Gotta love that visible gold, eh?!

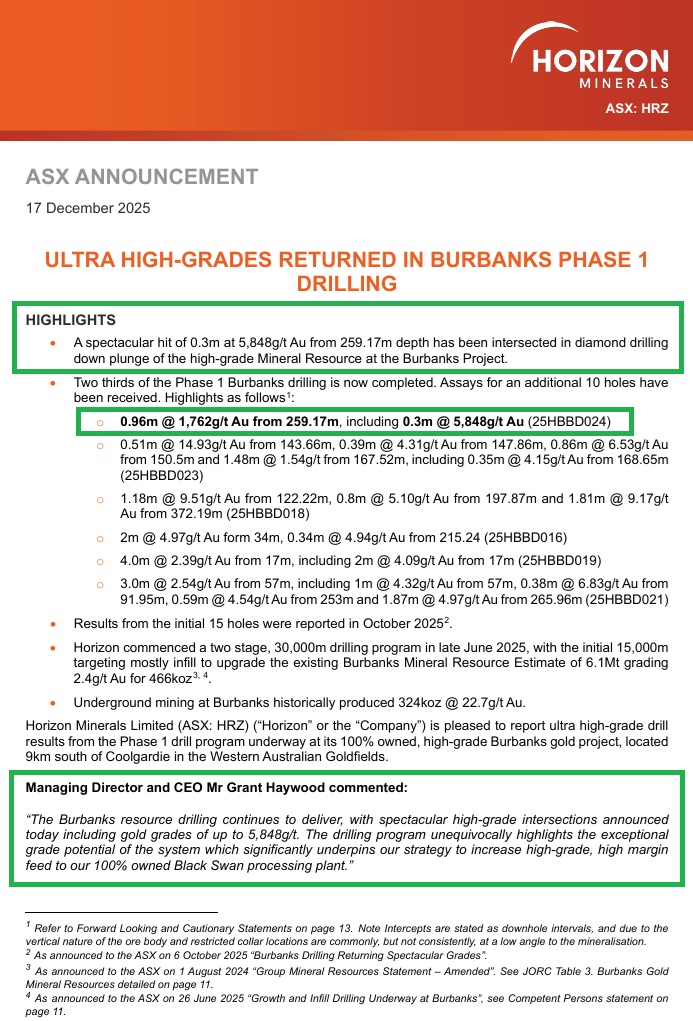

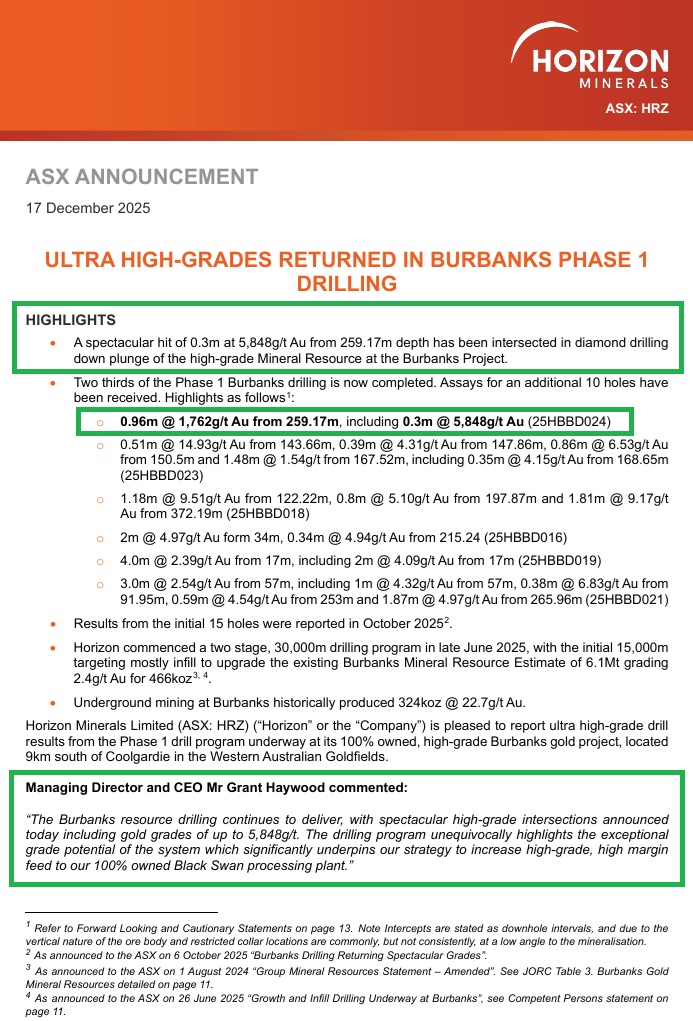

Excerpt:

Sure it's only a foot long (0.3 metres), but 5,848 grams per tonne of gold... There's Bonanza grades, and then... well, they've called it "Ultra High-Grades". That'll do.

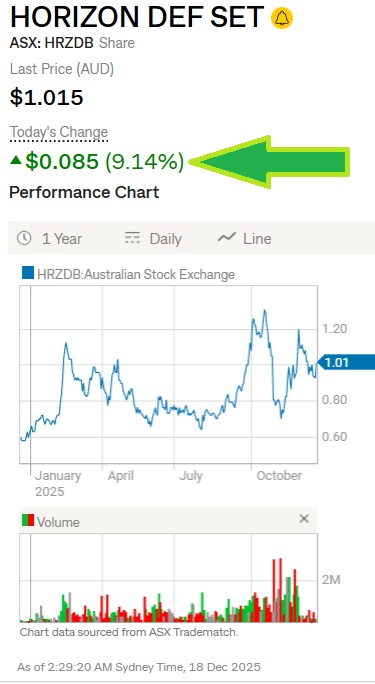

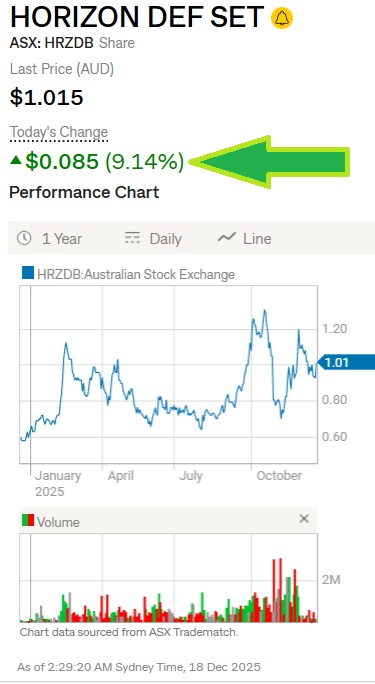

Market liked it - they were bid up +9.14% today, but the SP has been very choppy lately and they're still well below their highs.

They've just done a capital consolidation on a fifteen (15) to one (1) basis, so they're currently trading under HRZDB instead of the usual HRZ ticker code, because they are trading on a deferred settlement basis. Interestingly, Strawman.com (this website) accepted my buy trade for HRZ today even though HRZ isn't trading as HRZ and it did not recognise HRZDB, and my buy trade here did not go through despite my buy price being higher than their closing price, but they'll be trading as HRZ again soon and the trade may go through at that point, perhaps... if they haven't closed higher than my buy price in the meantime.

So while Horizon Minerals' share price is still well below recent all-time highs (as shown on that graph above), the same can't be said about the US$ gold price which is now within spitting distance of setting a new all-time high (as shown below, right side):

The uptrend continues.

Here's a sample of some of the best performers across the Aussie Gold Sector on Wednesday:

And those are just the 21 gold companies that closed up by over +5% today. Lots of project developers near the top of that list. There's money flowing into companies that are lower quality and higher risk because the major producers look fully priced to many. It doesn't stop those producers from making new highs, but the argument is that the smaller companies could have greater gains, so people are thinking they could get more bang for their bucks with project developers and emerging producers now.

HRZ is one of those, and I do hold them with a position that has a current weighting of 0.93% of my total sharemarket investments; they are a small position held in my speccy portfolio only. I've trimmed the position to lock in some profits already - when their SP was higher than where they closed today. My average buy price was 76.5 cps (adjusted for their recent 15:1 share consolidation).

Nice gold hits reported today but it's all about Black Swan with HRZ - getting that mill converted from nickel to gold and then getting it commissioned and running at nameplate capacity is what is going to substantially derisk HRZ from here, and that is going to take some time, but they've got GNG on the case and they're moving forward at a good rate I reckon. I may tip more into this one when they get close to producing their own gold instead of getting it toll treated at other companies' mills.