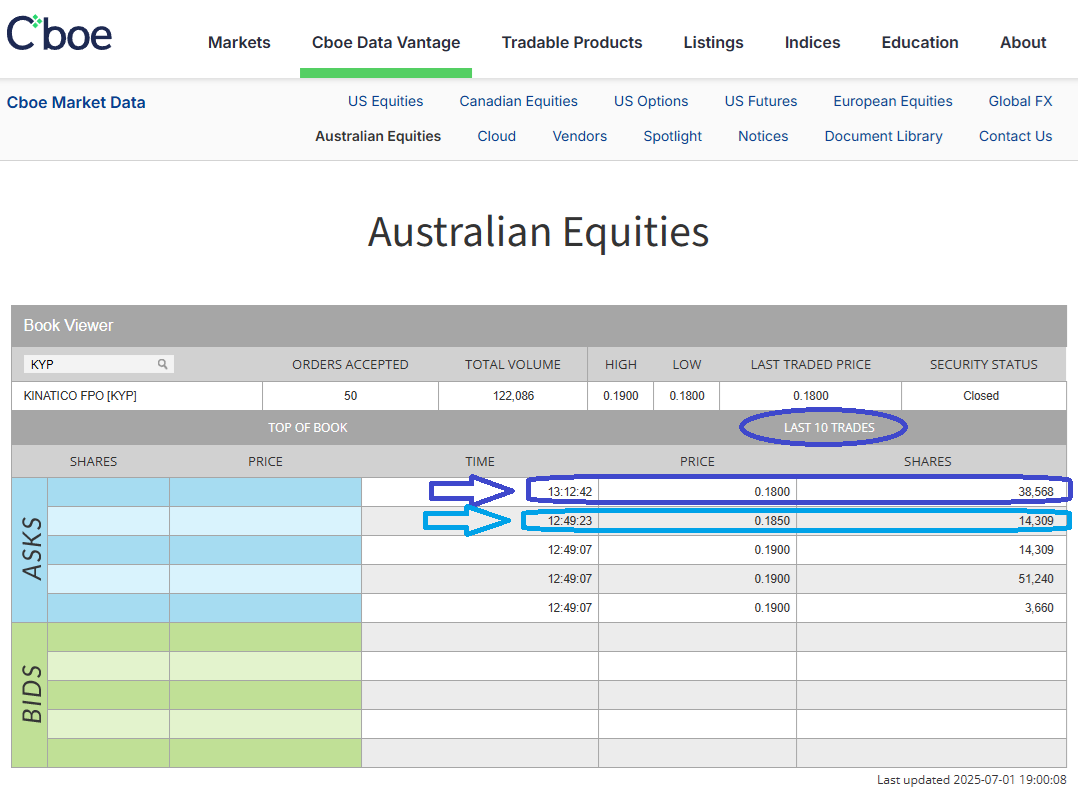

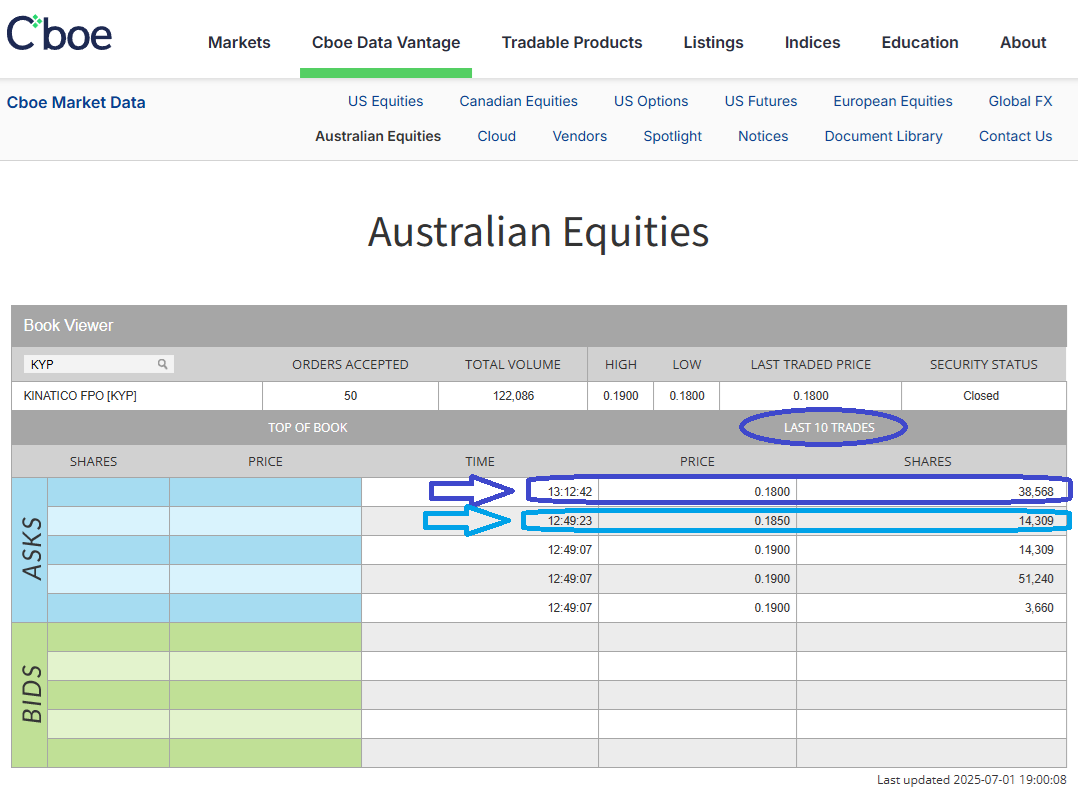

Got me stumped @RogueTrader - it was nothing to do with Chi-X, now known as Cboe because Cboe list their last 10 trades like this:

Source: https://www.cboe.com/market_data_services/au/equities/

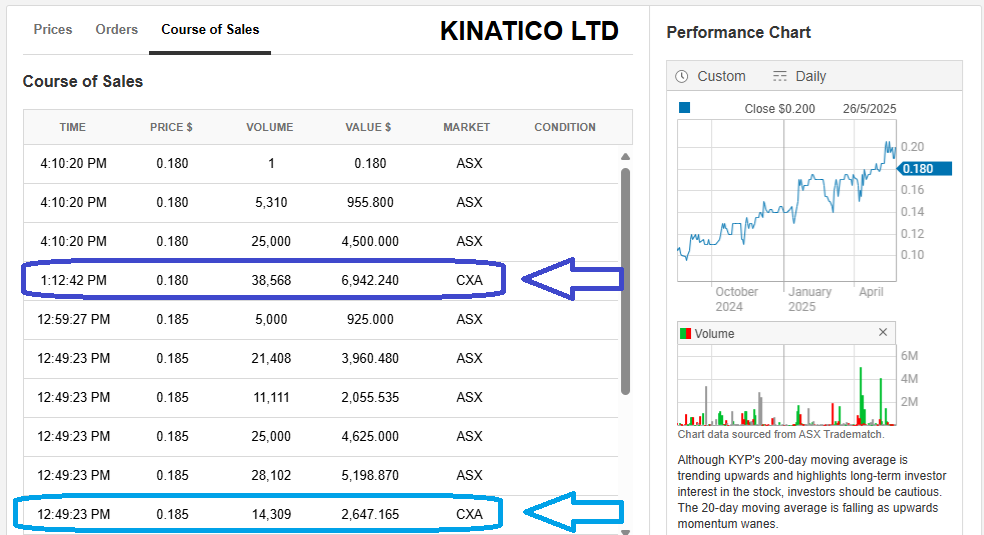

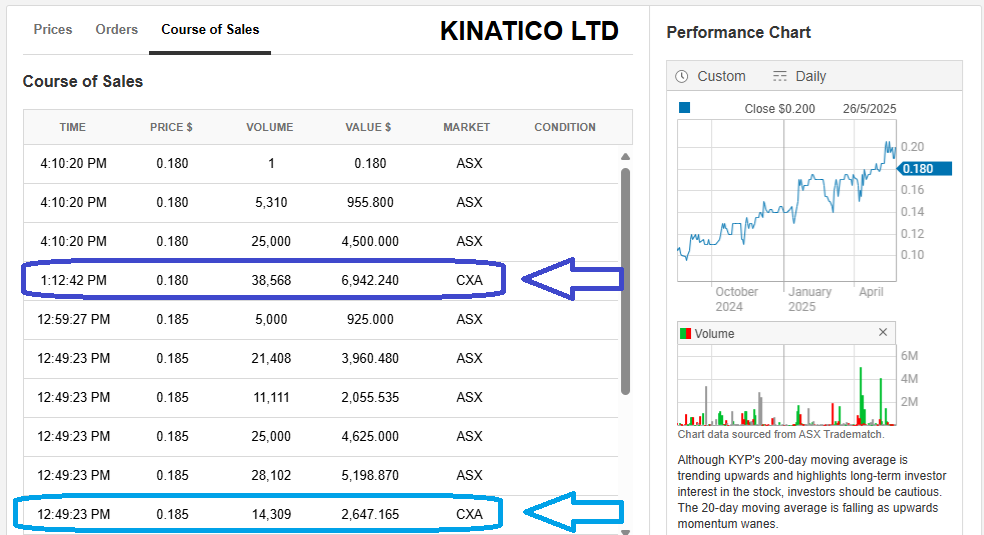

i.e. Cboe only had five KYP trades go through all day, and the most recent two - which I've highlighted there in blue (above and below) - match up to the ones labelled CXA in the ASX summary below:

Source: ASX: https://www2.commsec.com.au/quotes/summary

So we can rule out funny business involving Cboe (formerly Chi-X).

I asked ChatGPT: if my buy order is at 18 cents on the ASX and is at the top of the queue, how is it possible for other orders to go through at that price during the CSPA on the ASX and only 1 of my shares gets bought?

ChatGPT said:

Great question — this kind of situation often puzzles traders during the Closing Single Price Auction (CSPA) on the ASX.

Here's a breakdown of what likely happened and why only one of your shares was bought, despite you having the top buy order at 18 cents:

Key Concepts in the CSPA:

- CSPA (Closing Single Price Auction) occurs between 4:10 pm and ~4:12 pm (randomized end).

- During this time, the ASX matches buy and sell orders to determine a single closing price.

- Matching is based on:

- Price priority (higher buys/lower sells first),

- Then time priority (earlier orders at the same price),

- But most importantly in the CSPA: orders are matched at a single price, not sequentially.

Likely Reasons Only 1 of Your Shares Got Filled:

1. Insufficient volume available at the matched price

Even though 18 cents ended up being the closing price, the total quantity matched at that price may have been small. If only a few shares were offered at 18c (or lower), then only a few buyers (based on price-time priority) would get filled.

You got 1 share likely because that’s all that could be matched from available sellers at that price.

2. Other buy orders also existed at 18c — earlier than yours

Even though you say you're “at the top of the queue,” that might only refer to visible order depth during live trading.

However, CSPA can include orders entered after 4:00 pm (when the match starts) or hidden orders like Icebergs or large brokers using algorithms — they might have earlier time priority or larger sizes at the same price.

3. Matching logic is “pro-rata” during CSPA

The ASX matching engine during the auction might use a pro-rata allocation when many orders compete for limited volume at the same price.

For example:

- 1,000 shares for sale at 18c

- 10,000 shares trying to buy at 18c

Each buyer might get a small percentage of the available 1,000 — potentially just 1 share in your case.

4. CSPA includes hidden or off-market activity

There could be:

- Crossed trades (e.g., a broker matching client buy/sell internally),

- Iceberg orders (where only part of the order is shown),

- Or Conditional orders that triggered right at the close.

These would not appear in pre-close depth, but still affect what gets matched.

✅ TL;DR Summary

You were at the top of the visible queue at 18c, but during the CSPA:

- The matched price was 18c.

- Very little volume may have been available at that price.

- Other orders may have had time priority or hidden order types.

- You only got 1 share because matching is pro-rata, and demand at that price likely far exceeded supply.

--- ends ---

Not sure about the pro-rata stuff - I've never heard of that before - it's done in order of the queue, that's why people sometimes put in rediculously high prices during the CSPA so that they get above you in the queue.

My own best guess is that something like this happened:

- During the pre-CSPA period that runs from 4pm to 4:10pm, probably very close to 4:10 (the cut-off), two sell orders were placed on the ASX - one for 25,000 shares and the other for 5,310 shares, both at $0.185 (18.5 cents/share) which moved them above you in the queue (because of the higher buy price); then

- Just before 4:10pm, somebody placed a sell order for 30,311 shares @ $0.18 each, and because the sell volume exceeded the buy volume (by one share) on the overlap (18 to 18.5 cents), they were all settled at 18 cents, with yours being third in the queue and only one share being sold to fill out the sell volume.

The thing about that is that it makes little sense - why wouldn't the sellers have nominated the same price as the buyers, i.e. 18.5 cents? They dudded themselves if that's what happened.

The other possibility is that there was a fair bit of action during the pre-CSPA (after 4pm but before 4:10pm) and it ended with two sell orders above yours because they were set at a price higher than 18 cents, and there were also enough sellers for 30,311 shares at 18 cents or less, and the last change that was made a few seconds before 4:10 was that somebody reduced their buy order so that there was more volume (one extra share) on the sell side at 18 cents or less than on the buy side at 18 cents or more, so the CSPA settled those shares at 18 cents with your order being 3rd in the queue at that point. That seems far more likely - that sellers emerged during the pre-CSPA and that the price was then manipulated by buyers who went over the top of you at a higher price but then reduced their order volume to force a closing price of 18 cents.

That's all I've got @RogueTrader - hope that helps.