Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Market Cap $103.7m at share price $0.24

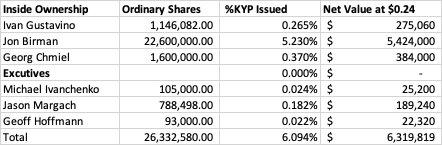

Board Bio's

Ivan Gustavino - Non-Executive Chair

Ivan Gustavino joined Kinatico (formerly CVCheck) as non-executive director and chair in August 2018. Ivan has over 25 years of history in technology companies, including vast experience in leading, advising and investing in high growth technology businesses.

Ivan brings extensive experience in deal making and advising technology investors and businesses at board level on a range of matters including business strategy, growth and M&A transactions. He is a recognised leader in software technology entrepreneurship in Australia and a highly regarded authority in business strategy, corporate transactions and in the marketing of emerging technologies.

Ivan has a Bachelor of Business (Information Processing) from Curtin University of Technology.

Jon Birman - Non-Executive Director

Jon Birman has a wealth of experience including previously having been the inaugural Chief Executive Officer of UGL Resources Pty Ltd. As CEO of UGL Resources, he helped grow the business from inception to $1 billion in revenues. Jon’s experience and entrepreneurship brings depth and complimentary skills to Kinatico’s current board members.

Jon has a Bachelor of Arts (Politics & Industrial Relations) from the University of Western Australia.

Georg Chmiel - Non-Executive Director

Mr. Chmiel brings three decades of experience in rapidly growing, disruptive online businesses and holds a unique combination of experience and skills in technology businesses, international enterprises, and boards of ASX-listed companies. Throughout his career, he has been instrumental in significantly growing shareholder value. Mr. Chmiel is currently co-founder and chair of Juwai-IQI, Asia’s leading PropTech group, and Chair of Spacetalk (ASX:SPA), a global technology provider of secure communication solutions for families. He is also a non-executive director of ASX-listed FinTech companies Butn and Centrepoint Alliance.

Mr. Chmiel is also a Senior Advisor to BrioHR, ASEAN’s leading HRTech platform, and a member of the advisory board to MadeComfy, a tech company in the Australian short-term rental market.

Kinatico looks like an interesting, fast growing SaaS business and the 1H26 results look impressive. However, it appears the market was expecting more with the share price down 9% today (14/01/26). This looks like a good business to own, but at what price? It currently trades on 100 times FY25 earnings and 45 times analyst earnings forecasts for FY26. It stays on my watchlist until I can work out what it’s worth.

Highlights

- Q2FY26 SaaS revenue of $4.9m (up $1.5m or 42% on prior corresponding period (pcp)), representing 58% of total revenue (46% pcp) with annualised SaaS revenue of $19.7m on the basis of Q2FY26 run rate

- H1FY26 total revenue of $17.6m (up $2.0m or 13% on pcp)

- Kinatico’s H1FY26 closing cash and cash equivalents balance was $10.4m (up $0.6m on pcp)

- H1FY26 SaaS revenue of $9.7m (up $3.2m or 49% on (pcp)

Leading Australian “Know Your People” RegTech company, Kinatico Limited (ASX: KYP) (Company or Kinatico) is pleased to provide the following unaudited flash results for the first half of the 2026 financial year.

Kinatico CEO Michael Ivanchenko said: "Annualised SaaS revenue has grown 42% to $19.7m, with SaaS now representing 58% of quarterly revenue. This is clear evidence of the success of our strategy.

At the same time, we have launched our new solution, Kinatico Compliance continues to resonate with SMEs and also large enterprise. The combination of the ongoing operational performance and the addition of our new solution gives confidence that we are well positioned for continued momentum. Disciplined execution, while remaining cash accretive reflects the operational leverage emerging in the business. To the Kinatico team—thank you for your continued commitment to our customers and delivery of our common goals. These results are yours."

Not held

Much like Stakk yesterday, the Kinatico story is about a business pivoting away from its original model to leverage its tech investment in a new way. The key difference is that Kinatico is further along in this journey and has already demonstrated early success.

Michael appeared to have a very level-headed approach, ranging from making tough decisions and applying sensible capital allocation frameworks to envisioning the business's long-term future. He frankly admitted to early missteps and acknowledged (unprompted) past errors regarding over-promising and under-delivering. It was also clear that the focus is squarely on solving customer pain points in the most user-friendly manner possible.

He also offered a very practical perspective on AI and its specific application to the business, devoid of the usual fluff or hype.

The business seems to be in a strong position, with a right-sized cost base capable of significant scaling; Michael believes the current cost structure could sustain double the current revenue. They boast a healthy balance sheet, positive operating cash flow, and extremely sticky customers. While it is early days for the SaaS model, churn sits at 0% so far.

He used the phrase "the overnight success that's been 18 years in the making," which I liked (I use a version of it regularly!), but the point was that they seem to have reached a stage where they possess a commercially ready product set, are self-sustaining with plenty of runway, and now simply need to execute on the operational front.

Shares are trading at ~7x recurring revenue, which isn't excessive provided they can sustain recurring revenue growth and further unlock their operating leverage.

I'm going to add a small watching position.

You can interrogate the transcript here: Kinetico Transcript.pdf

Here are some AI generated notes from the meeting:

Corporate Evolution and Strategic Pivot

- Transformation from CV Check: The company has successfully evolved from "CV Check" (a transactional background screening provider) to Kinatico, a broader RegTech SaaS platform. This move was driven by customer feedback requesting easier compliance management rather than just raw data.

- Solving the "Excel" Problem: Their primary competitor remains the spreadsheet. Kinatico’s value proposition is replacing manual, error-prone Excel processes used by companies to track workforce compliance.

- Focus on Usability: Unlike competitors who focus strictly on the regulatory requirements, Kinatico focuses on the user experience of the staff managing compliance. The goal is to minimize distraction and overhead for the client.

Business Model and Sales

- Frictionless Onboarding: They have removed barriers to entry by offering month-to-month contracts (no lock-ins), a free tier for up to five users, and unlimited free admin seats. The pricing model is a simple "per worker per month" fee.

- Zero Churn: Since launching the SaaS product, the company reports zero churn, attributing this stickiness to the product's daily utility and the lack of restrictive contracts.

- "When Harry Met Sally" Effect: Sales are seeing a network effect where winning a client in a specific sector or suburb (e.g., aged care) leads to inbound inquiries from neighboring businesses due to word-of-mouth.

- Self-Serve Focus: While enterprise pipelines are strong, current growth is heavily driven by self-serve signups, which lowers the cost of sales.

Operational Efficiency and Financials

- Massive Operating Leverage: The company has reduced headcount from ~134 to 70 while simultaneously doubling revenue. Management believes they can double revenue again without increasing the current headcount.

- Capital Management: The business is profitable, debt-free, and cash-flow positive. They do not capitalize operational spend; normalized CapEx is expected to be between $3m–$3.5m annually.

- Transactional vs. SaaS: The traditional transactional revenue (background checks) is expected to decline as a standalone product but is being integrated into the SaaS offering, reducing the need to constantly "re-win" customers.

Technology and AI

- "AI First" Philosophy: The company has adopted a practical AI strategy. This includes using AI to enhance internal staff productivity (Ivanchenko uses AI for 30-40% of his day) and upcoming product features, such as allowing clients to query compliance data using natural language prompts.

- Digital Identity Stance: Management views the inevitable government rollout of digital identity as a positive tailwind. It would remove the cost and security burden of biometric identity verification from Kinatico’s platform, allowing them to focus on higher-value workflow automation.

- Moat: The competitive moat consists of 18 years of accumulated domain knowledge, deep integrations with government databases, and the difficult-to-replicate nuance of making complex software feel easy to use.

Growth Targets and Expansion

- Revenue Goals: The medium-term target (3-5 years) is to reach $75m–$90m in revenue, with 80% derived from SaaS.

- International Strategy: The US is not a priority target due to the complexity of state-by-state regulations. The focus is on Southeast Asia, utilizing a partnership/JV model rather than opening physical offices.

- M&A Criteria: The company is open to inorganic growth but remains disciplined. Targets must be accretive (no "basket cases") and provide either access to a new customer segment or product acceleration.

- Future Vision: While currently focused on workforce compliance, the platform is effectively a digital workflow engine that could eventually be applied to any form of compliance beyond just people.

Thanks Andrew - good interview. Appreciated you doing that. I hold IRL and here, and that confirmed my thesis - I think there is a lot of operating leverage to come and if he can keep Capex to that number - it could get pretty interesting returns wise. Given we're only talking $130m market cap and with no borrowings, cash in the bank and growing topline with (hopefully) widening margins, I think it's one to watch. Thanks again for doing that...what a great platform this is!

Discl: Not Held.

Following my deep dive, this is a first crack at a preliminary valuation for KYP ahead of next week's SM meeting.

Rather than get more excited during my deep dive, I grew significantly more hesitant.

This valuation helped validate my growing uneasy feeling that there is probably quite a bit of froth built into KYP's price vs a less than assured path forward to sustain the current growth.

Fully agree with @Wini 's comments in the Ausbiz chat on 24 Oct that KYP is not one that I will chase at current levels.

Discl: Not Held

SUMMARY

Financial position is very impressive

TAKEAWAYS

The key questions for me now are (1) how is this growth going to be sustained to justify the current PE multiple (2) how long will the current growth run for before it plateaus

The current 124x PE feels very expensive against the backdrop of (1) not a clear monopoly/semi-monopoly (2) uncertain longer-term growth opportunities (3) sterling growth in the last 3 years

REVENUE

Revenue is growing

The legacy transactional Criminal History check is flatlining, Other Checks are in decline

Exponential Growth has come from the Workforce Compliance SAAS products since the BPT acquisition and its subsequent enhancement/re-branding - the market is clearly rewarding KYP for this

Growth is exclusively in Australia - NZ has been completely flat in the last 5 years, despite the workforce compliance products

PROFITABILITY

Nice inflection to profitability, EBITDA, NPAT and EPS

BALANCE SHEET AND CASH

- Balance sheet is clean - $10.2m cash, no debt

- Increasingly positive cashflow from operations - $5.3m in FY25

- Overall cash flow also rose to $0.4m in FY25 from $0.13m in FY24

Discl: Not Held

Went through KYP’s major announcements going back to FY2021 to get a better understanding of how the company, and its strategy and execution thereof has evolved since.

SUMMARY

- Prior to FY2021, CV1 (as it was then known) was mostly focused on pre-employment background screening

- A step change occurred in Feb 2021 when CV1 acquire Bright People Technologies (BPT) which added “credentials-based workforce management capability”, via BPT’s 2 SAAS software modules - Enable Enterprise and Cited moving CV1 from a wholly “pre-employment background screening” provider to a “full-employment lifecyle” provider

- International expansion has been flagged since early 2021

- “Growth into North America and Europe in 6-24 months” was flagged in Sept 2022, then silence on this until Oct 2025

- Between 2023 to 2025, focus has been on maturing the workforce compliance product culminating in the announcement of Kinatico Compliance, its next gen product in Oct 2024, which was subsequently branded as “Compliance X”

- The Growth Strategy playbook was announced in Oct 2025 - continue to focus on small businesses in ANZ with 2 parallel tracks of (1) targeting mid-market & Enterprise and (2) Initial International expansion to South East Asia

MY TAKEAWAYS

- Confirms my sense that international expansion is still some time away and the footprint is unlikely to be big

- It does feel that there has been some sort of reality check as to KYP’s capabilities vs global incumbents in the US/Europe which resulted in the updated focus on South East Asia

- This pivot to SEA does not quite make sense to me given that (1) workforce regulatory requirements are fundamentally quite diverse and different across each SEA country (vs a mostly-similar Australia and NZ scenario today) (2) is not a natural extension from the current ANZ base (3) it does not feel that there is much in the CV1 legacy check and BPT modules that addresses non-ANZ requirements (4) other than Singapore and the Philippines, the language for regulatory compliance is the respective national language, not English.

- This is adding to my concern that KYP is going to struggle to expand beyond ANZ in a meaningful manner. The flat lining of NZ revenue amidst the strength in the SAAS revenue is a bit glaring - need to peel the reason for this.

- If KYP is “constrained” to a mostly ANZ scenario, taking the XRO experience, there will come a point where growth will plateau - I can’t see where the long term growth will come from to justify the ~124x PE it is trading at today

- The other thought is whether (1) the easy runs have already been gotten with small businesses where ComplianceX is pretty much a no-brainer for the problems that it solves and (2) the pitch is likely to become harder to bat on from here, going after mid-sized and large enterprises where it is harder to penetrate and gain traction.

DETAIL

This diagram from the FY2022 AGM Presentation was helpful.

Feb 2021 - Bright People Technologies Acquisition

2 modules:

- Enable Enterprise - allows operators and contractors to run workforce compliance end-to-end:

- Identity and verification

- Onboarding and induction

- Deployment and re-deployment (logistics such as booking flights and accommodation

- Ongoing compliance monitoring and management

- Cited - next gen digital compliance and credentials management via a cloud-bases system, integrated within the customer supply chain, to create a digital credentials eco-system for whole-of-life management and portability

- This marked the start of KYP’s pivot to SAAS revenue

Nov 2021 -CGI Strategy

The “CGI Strategy” was presented by the then-new CEO Michael Ivanchenko in Nov 2021.

Mid CY 2022 - Thinking on Growth

I can see how this is valuable in an ANZ scenario - these are basic requirements that would mostly be done manually or not at all for smaller business.

The "unique advantages" did not inspire any confidence of KYP's ability to expand overseas, particularly against stong global incumbents in the US, UK and Europe. I felt the exact opposite ie. that overseas expansion in these markets were really a non-starter, with current capability.

FY23 and FY24

Silence on international expansion, heavy focus on building out and maturing the workforce compliance solution and adding value to KYP's SAAS product.

25 Oct 2024 - Kinatico Compliance announced

6 Mar 2025 - Compliance X is announced, focus is back on ANZ

6 Oct 2025 - FY25 AGM

- International Expansion returns, but ambitions have clearly been scaled down to SEA countries vs Europe/US 3-4 years ago

- Focus on larger enterprises instead

Discl: Not Held IRL and in SM

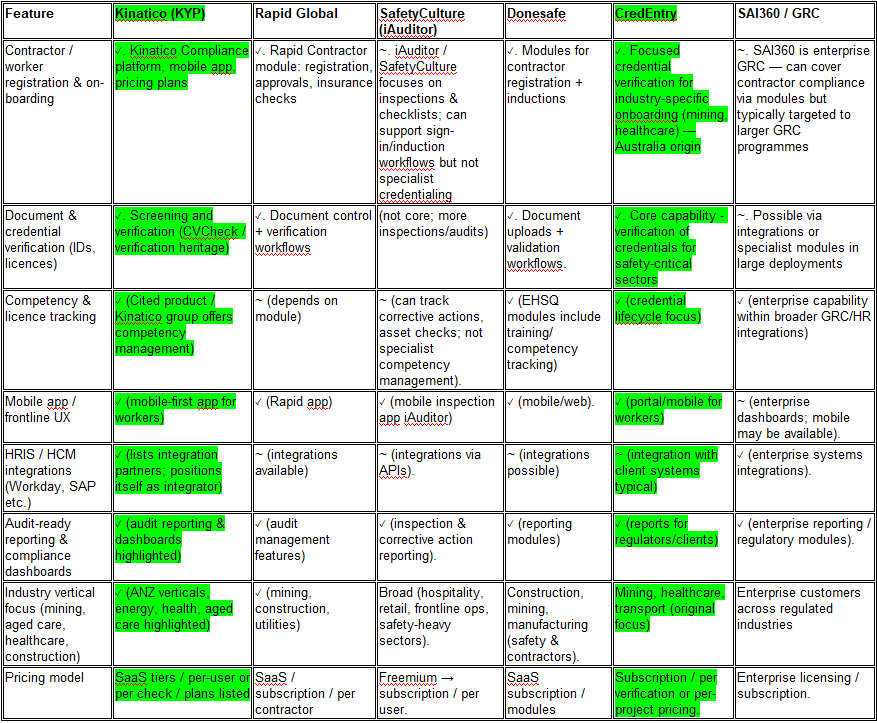

Part 3 - Competitors, Domestically and Globally

In summary, at this point, my thinking on KYP:

- Not an obvious monopoly/semi-monopoly in the workforce compliance space - it looks like it has direct competitors. Its acknowledgement that their “Serviceable Obtainable Market” of 60-70% of TAM might be explicit admission of this.

- Has clear and largish global competitors with their own international reach

- Appears small, size-wise, vs its global peers

- Not seeing an immediately obvious path to international expansion - is KYP merely an ANZ play, despite the noises it is making on “international expansion”.

- The $10m cash on hand does not seem like much to work with at all, given the on-paper scale of the global players - I would expect a capital raise to accompany any M&A

Need to peel the KYP announcements to confirm or debunk this continued scepticism.

Would appreciate any input/feedback from anyone who has followed KYP more closey and for longer as I am unsure if I am off course with my thinking thus far ...

DOMESTIC COMPETITORS

Kinatico sits in the workforce-compliance / compliance-management / RegTech niche. competitors fall into three groups: specialist workforce/credentialing platforms; broader compliance/GRC vendors; and general workforce/HR platforms with compliance modules. Representative competitors (examples with sources):

- Rapid Global — safety & compliance / contractor management solutions

- SafetyCulture (iAuditor) — operations & compliance inspections widely used across industries (competes on operational compliance)

- Donesafe / SAI360 / Donesafe-like GRC vendors — broader compliance and risk platforms used by enterprises.

- CredEntry / other credentialing vendors — focused on credential verification / visitor & contractor credentialing (very direct overlap).

- Large HRIS / HCM vendors (Workday, SAP SuccessFactors, ADP, Oracle) — not direct substitutes for deep compliance workflows but important competitors/partners because many customers rely on HRIS vendors’ modules or integrations. Kinatico lists many of them as integration partners.

(Industry listings and competitor aggregates also show Kinatico compared to Rapid Global, Nakisa, Redzone and others in third-party directories.)

COMPETITOR FEATURE MATRIX (TOP 6)

Takeaway from Matrix

- Kinatico’s strengths: integrated screening history (CVCheck heritage), mobile worker UX and explicit HRIS integrations — good fit for regulated industries in ANZ

- Kinatico competes most directly with specialised ANZ credentialing/worker-compliance vendors (CredEntry, Cited within Kinatico group, Rapid Global, Donesafe)

- SafetyCulture and SAI360 compete on adjacent functionality (inspections, enterprise compliance) and may win customers via broader operational or GRC footprints

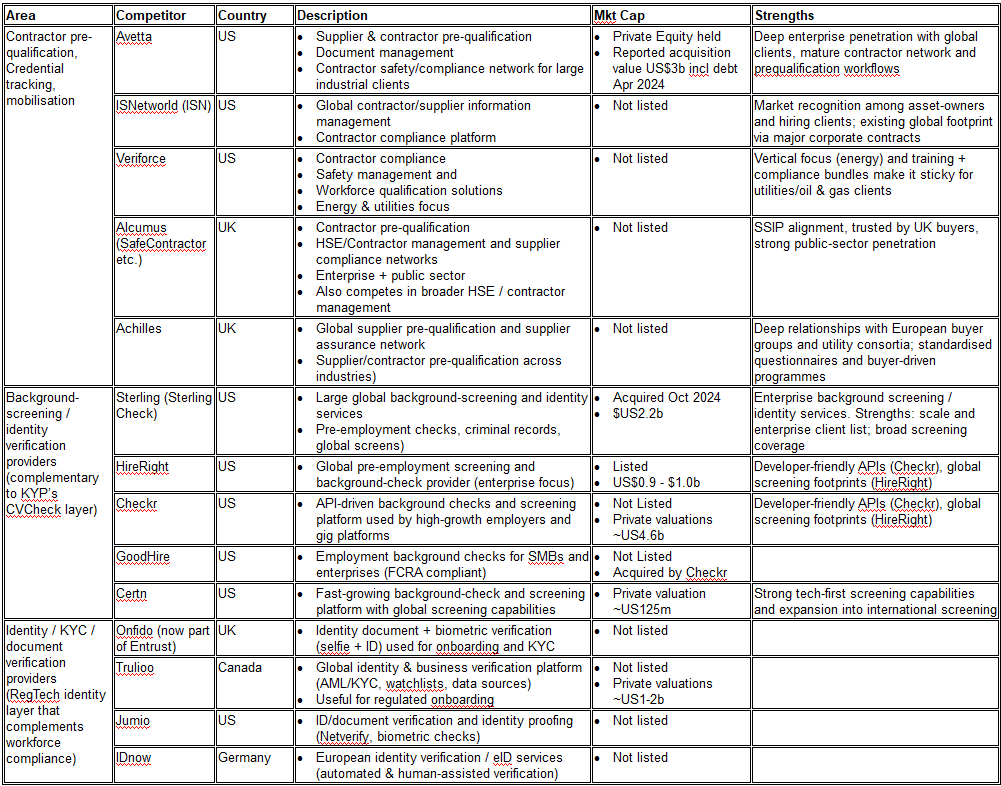

CLOSE OVERSEAS COMPETITORS

Below is a focused list of non-Australia / New Zealand companies that offer products comparable to Kinatico (workforce compliance, contractor pre-qualification, credential verification, ID/KYC, background screening, mobilisation/logistics). For each I give the primary country (HQ) and a one-line note on the comparable product area.

Key Notes

- Region matters: Avetta / ISN / Veriforce / Alcumus / Achilles already operate in many countries and have strong relationships with large corporates and asset-owners — they’re the firms a global miner/utility will ask about first.

- Partnership vs direct competition: Some identity and screening providers (Onfido, Jumio, Sterling, Trulioo) often partner with contractor management platforms rather than compete directly on full workforce-compliance stacks. Kinatico could integrate with (or white-label) these providers when entering new markets.

- Regulatory & data localisation: entering EU/UK/North American markets typically requires local data-handling, chain-of-custody and compliance with local background-check laws — existing local players have operational advantage

- Africa & Middle East - higher barrier to entry due to local rules - must partner locally or buy licences; direct entry without local partnerships is high friction

- India - large TAM, but regulatory and fragmentation challenges

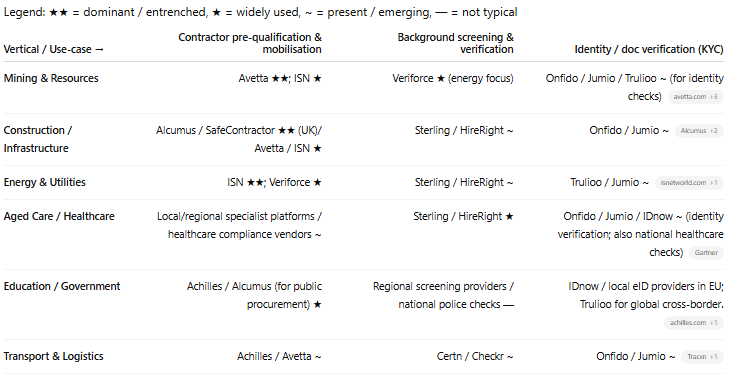

COMPETITOR MAP BY VERTICAL

Go-to-market competitor map by vertical and who dominates which vertical.

Vertical Competitor Map Takeaways

- Large asset-owners in mining, energy and infrastructure typically contract with Avetta/ISN/Veriforce/Achilles/Alcumus — these players are entrenched because they operate buyer-led networks or are aligned with procurement standards

- Background screening for hires and contractors is dominated by specialist screening firms (Sterling / HireRight / Checkr / Certn) that focus on speed, global data sources and API integrations. They are complementary to (and sometimes partners of) contractor-management platforms

- Identity/KYC providers (Onfido, Trulioo, Jumio, IDnow) dominate the document + biometric verification layer — often integrated into contractor platforms rather than replaced by them.

CHAT’s “ADVICE” ON WHERE KYP CAN REALISTICALLY WIN INTERNATIONALLY

Adding this for completeness - not placing any reliance on these “suggestions”

- Target mid-market and regional subsidiaries of global firms first. Large miners/utilities typically use Avetta/ISN — but their regional operations and subcontractors can be won with faster onboarding, lower cost and better local integrations. (e.g., KYP’s ANZ vertical templates are a selling point)

- Partner rather than compete on screening / identity in new markets. Integrate with global screening (Sterling/HireRight/Certn) and KYC (Onfido/Trulioo/Jumio) instead of building local screening networks from scratch — this substantially lowers time-to-market and regulatory burden

- Focus on niche verticals where buyers value local/regulatory fit. Aged care, healthcare and regulated education environments prize local compliance fit (national police checks, healthcare registers) — win these by pre-baking local checks and workflows.

- Use a two-track approach: (A) land-and-expand with mid-market clients via fast deployments and modern UX, (B) pursue 1–2 strategic global anchor customers (regional units of multinationals) to build credibility and integrations.

MY TAKEAWAYS

Domestically

- Appears KYP has direct competition, with various companies dealing with some or all aspects of the workforce compliance management space - need to peel what KYP’s market share is and KYP’s differentiator from its competitors

- KYP’s own Serviceable Obtainable Market of ~60-70% of TAM also suggests that KYP’s is not quite in a monopolistic/semi-monopolistic situation

International

- There are big international players in KYP’s space in the US, UK, Europe and Canada with seemingly huge valuations in the US$b, and “relatively entrenched” positions, most of which sound like they have a global offering - prima facie, these look completely out of KYP’s reach to acquire given KYP’s market cap of ~A$164m. If anything, it raises the risk of KYP being acquired for the globals to geographically expand to ANZ - with those valuations, acquiring KYP would appear to be well within reach

- The smaller non-English speaking countries could be white space for KYP’s international expansion but these will come with its significant operational challenges - language, lack of standardisation, need for deep local knowledge etc

- I can’t quite see an immediately obvious and viable pathway to KYP’s international expansion - this was my very first risks when looking at KYP for the very first time. The evidence in this superficial dive seems to confirm this thinking rather than debunk it

QUESTIONS TO ASK

Q6. What is KYP’s thinking and plans around international expansion? In what space, region?

Part 2 on TAM. Trickier to assess!

PRACTICAL TAM (1st PASS OF CHAT)

Estimates vary by how you define the market (pure workforce-credentialing vs. compliance software vs. whole RegTech market). authoritative market research firms provide different figures; below I list a clean, sourced range and how to interpret it:

1) Workforce / workforce-compliance software (narrow segment) — one specialist estimate puts the global Workforce Compliance Management Software market at ~US$2.4–2.5 billion (2024) with double-digit growth (CAGR ~12%+). This is the most directly comparable segment to Kinatico’s product. Dataintelo

2) Compliance management software (wider category) — multiple sources show a broader Compliance Software market in the tens of billions (USD) range: e.g. Mordor / Verified Market Research / The Business Research Company report values spanning ~US$33–60 billion depending on the exact scope and year. These figures cover GRC, regulatory reporting, policy management and other enterprise compliance functions — larger than Kinatico’s immediate niche but addressable over time if the company expands features.

3) RegTech (largest umbrella) — RegTech market estimates commonly range from ~US$17B (2023) up to >US$70B by 2030 depending on the research house and definitions (RegTech includes identity, KYC/AML, regulatory reporting, compliance automation). If Kinatico expands into adjacent RegTech services (identity verification, screening, automated regulatory checks), it could target a slice of that broader RegTech TAM.

Bottom line (practical TAM for Kinatico right now):

- If you map Kinatico to the workforce compliance / credentialing sub-segment, a defensible global TAM today is in the low single-digit billions USD (~US$2–4B) and growing at double-digit CAGR.

- Kinatico is a SaaS RegTech / workforce-compliance vendor with measurable scale in ANZ (claimed ~1M people, 30k organisations). That makes its immediate market the workforce compliance niche (smaller TAM but faster path to revenue).

- The company faces competition from both specialist credentialing vendors (CredEntry, Cited-style platforms, Rapid Global) and broader compliance/GRC or HRIS vendors. Competitive differentiation will come from domain expertise, integrations, scale, verification capabilities and vertical focus (healthcare, mining, aged care, construction etc.)

If you stretch to all compliance software / RegTech opportunities (adjacent services, vertical expansion), the addressable market expands to tens of billions USD over the next 5–10 years. (Use the larger RegTech / compliance software reports for strategic upside.)

CHAT’S GDP-BASED METHOLODLOGY TO CALCULATE KYP’s ANZ TAM (2nd PASS)

Including this for completeness and a data point - can’t say I am bought into it as I expect TAM’s to be a bit more specific, generally

Data Points

Global workforce compliance management software market (narrow segment): US$2.47 billion (2024), projected high double-digit growth (DataIntelo market estimate). Dataintelo

Australia GDP (2023) ≈ US$1.728 trillion. Macrotrends

New Zealand GDP (2024) ≈ US$260.2 billion. Trading Economics

World GDP (2023) ~ US$100 trillion (used to compute country share). Macrotrends

Baseline Approach (Proportional to GDP)

A simple, commonly used, way to estimate a country/region slice of a global software market is to allocate by economic size (GDP), adjusted for adoption intensity. Using that:

Australia + NZ combined GDP ≈ 1.728T + 0.260T = ~US$1.99 trillion. Macrotrends+1

Share of world GDP ≈ 1.99T / 100T ≈ 1.99%. Macrotrends

Apply that share to the global workforce compliance market (US$2.47B):

ANZ TAM ≈ US$2.47B × 1.99% ≈ US$49.1 million.

Result (baseline): ~US$49M for the specific workforce-compliance / credentialing software market in Australia + New Zealand today.

Adjusted Baseline

Higher per-capita digital adoption in ANZ: Australia and NZ are mature, high-tech adopters with strong regulatory compliance needs in mining/healthcare/construction, so per-GDP spend on RegTech could be above global average. Adjusting up (×1.5–2.5) gives an upper practical TAM of roughly US$75–125M. (This captures higher software penetration, industry concentration and local demand for workforce credentialing.)

Lower bound: if you instead use the broader compliance software market (tens of billions), and then narrow by the fraction that is workforce credentialing, the ANZ slice of that could be larger — but that drifts away from Kinatico’s immediate product set into adjacent markets. See VerifiedMarketResearch / Mordor for larger compliance market context.

Final GDP-Based TAM

Conservative / baseline (GDP share): ~US$49M (approx).

Practical / adoption-adjusted upper bound: ~US$75–125M (to reflect higher per-capita software spend and industry concentration in ANZ).

KYP’S VIEW ON TAM FROM FEB 25 RESULTS PRESENTATION

- KYP’s $2.7b TAM aligns more closely with the Global Workforce/Workforce Compliance Software, but is a a fraction of the global RegTech TAM of US70b by 2030

- The Estimated Serviceable Market of $200-$300m within 10 years is on the higher side of the GDP-based TAM from Chat of US75m-US$125m

- Boils down to what the agreed definition of “RegTech” is, as may not be comparing like-for-like at all

- Agree with the SME’s positioning, which is taking on a more XRO-like focus

Customers / scale: Kinatico states it serves ~1 million individuals and >30,000 businesses across Australia & New Zealand (public investor content)

TAKEAWAYS

- Am not clear what makes up the KYP TAM as “RegTech Solutions” is very broad - KYP’s $2.7b TAM is more aligned to the narrower “Workforce compliance software” TAM (US24-25b) above vs Global RegTech (up to US$70b by 2030)

- Also unclear if the KYP TAM is global, semi-global (in the countries KYP is targeting only) or pure ANZ

QUESTIONS

Q5: What does the KYP TAM comprise off? Reg Tech (broader) or Workforce Compliance (narrower). Is that a global or ANZ only TAM, and the Serviceable Obtainable Market of ~60-70% of TAM is thus against the ANZ market only?

Started a deep dive on KYP ahead of next week's meeting. I found doing this deep dive ahead of a SM meeting extremely helpful with RTH. Pre-meeting, I was clear what I needed to see/hear before I decisively entered (as was the case with RTH) or I pull the pin and move on. I also found doing this deep dive in logical chunks, over a few days, very helpful, to gradually build understanding of the story which in turns builds (or kills) conviction.

I used inputs from my buddy, Chat, but have asked the questions in multiple ways to see if I get the same answers. I then synthesised and summarised the inputs. Questions that I had, I have/will add to the KYP Slido.

Further context is that in my past life, I had to work out how to deal with the issue of managing Reg Tech compliance within a SAP SuccessFactors/SAP HR back end, so I do have some appreciation of the technical integration challenges of bolting on something like KYP to an existing ERP. This is key to point out as most of my doubts/commentary centre around the robustness of the KYP product and how ready/capable/scalable it truly is, outside of ANZ.

With that context, here is Part 1: KYP's Products.

1. KINATICO COMPLIANCE (SaaS)

This is the core SaaS workforce-compliance / credential-management platform. Key features:

- Real-time dashboard of workforce compliance status and visibility across people, roles and tasks

- End-to-end lifecycle: hiring → onboarding → ongoing compliance tracking → off-boarding

- Mobile app access for workers: upload documents/photos, complete forms, receive alerts

- HRIS / HCM / ATS integrations: supports a wide list of systems (Workday, SAP SuccessFactors, BambooHR etc) for sync of user/role data

- Verifications & checks included as part of plans (and add-ons available): e.g., working rights, police checks, driver’s licence, qualification verification, AML screening, etc

- Configurability: organisations can create custom workflows, digital forms, assign activities by role/location, set up alerts/renewals

- Data security / compliance credentials: e.g., ISO 27001 certification, accreditation for national police checks, document verification service

- Tiered pricing: Starter (free up to 5 users), Core (~US$15/user/month), Premium (~US$24/user/month) with more features/verification inclusions

So in short: a platform to manage workforce credentialing, compliance, verification, ongoing monitoring, with dashboards, mobile app and integrations.

2. COMPLIANCEX

Although less fully detailed, this is described as the “new platform” version / upgraded workflow engine for Kinatico. Key notes:

- Launched during 2025

- Designed to simplify people-management workflows by synchronising disparate screening, validation, compliance and procedural systems into one real-time, secure, self-serve solution

- Positioned as an evolution of their compliance platform — likely the next-gen version/underlying tech of Kinatico Compliance.

- According to a broker note: “the company’s new compliance SaaS solution … underlying real-time workforce compliance management”

Here’s a timeline-style table summarising what Kinatico Ltd (ASX: KYP) has publicly disclosed about the development and rollout of their “ComplianceX” platform — what features they plan, when they said they’ll deliver them, and how that maps to what we know so far. Some dates are exact, others are inferred from announcements.

- Development for ComplianceX appears to have been ongoing through 2023 and into 2024, with roadmap features clearly defined by Sept 2024.

- Various news articles in April 2025 describe the “launch” of the ComplianceX workflow platform. For example, one: “the latest version of Kinatico’s platform … ComplianceX … synchronises disparate screening, validation, compliance and procedural systems.”

- In their FY25 full year results announcement they said they “invested in excess of $3.5m of operating cash flow into new compliance technology” while focusing on building their new solution

- The formal launch of the platform was scheduled for 6 March 2025.

- The product is already in market (Q3 FY25 ended March 2025) with revenue impact. Q3 FY25 (quarter ended March 2025) results show SaaS revenue of US $4 m (or AU$4 m) for that quarter, up 60% YoY, with mention that “while simultaneously focusing on the launch of its new platform

- They stated that the platform was built with international markets in mind: one source notes “Compliance X was developed with international markets in mind. The company aims to achieve international revenue within the next calendar year, potentially through partnerships or acquisitions in other jurisdictions

- The roadmap features (self-service config, predictive tasks, geolocation triggers) are still being delivered — implying a phased feature rollout over 2025 and beyond.

- The company also mentions international rollout ambitions as part of the ComplianceX strategy.

Deployment Plans

- 2025 (Calendar Year): Full commercial availability of core ComplianceX platform in ANZ; customer onboarding; feature enhancements and module rollouts (predictive tasks, geo-triggers, dynamic dashboards).

- 2026 and beyond: Expansion into international markets using ComplianceX as the core platform, possibly via partnerships/acquisitions, localised integrations and new modules for global compliance. (Inferred from roadmap & strategy commentary)

3. CVCHECK SCREENING & Verification Services

This is the legacy / foundational business of Kinatico. Highlights:

- Pre-employment screening, background checks, verification of credentials, references, police checks, etc

- Understood to serve many thousands of clients in Australia & NZ across enterprise and SMB

- It remains part of the group and provides the “screening & verification” layer which complements the compliance/credential-management SaaS.

- The re-branding from CVCheck Ltd to Kinatico took effect October 2022, reflecting an expanded product offering including broader RegTech / compliance workflows.

4. Additional modules / vertical-specific offerings

- While less fully detailed in public documentation, some other product/solution names and modules are indicated:

- Cited – referenced as part of their suite (pre-existing product under the group) which provides compliance management

- OnCite – mentioned in context of mobile application enabling workers to manage daily compliance and credentials

- Industry/vertical-specific modules: though not always branded with unique names, Kinatico notes they serve sectors like aged care, mining, healthcare, government, education and have configurable workflows for regulated industries. (From “Who We Serve” pages)

Notes/Caveats

- While the “Kinatico Compliance” and “ComplianceX” names are quite prominent, the exact modular breakdown (e.g., “contractor-management”, “visitor-credentialing”, “asset-based compliance”) is not always separately itemised in the public site.

- Some older products (e.g., Cited, OnCite) seem to be being folded into the broader “Kinatico Compliance / ComplianceX” stack — so there may be overlap or rebranding underway.

- Pricing and feature-inclusion vary by plan; some verification checks are add-ons

- The company is in a transition phase (from more transactional screening business to recurring SaaS) which means product road-map and packaging may evolve rapidly

TARGET INDUSTRIES

As mentioned above, Kinatico clearly targets multiple industry verticals and offers tailored compliance workflows for them. Based on “Who We Serve” on their website:

- Aged Care – organisations dealing with mounting regulation and credential verification burdens

- Education – staff vetting, credentialing of teaching/support roles, cyber-incident tracking etc

- Financial Services – high trust/credential regimes, data security, regulatory compliance

- Disability Care – compliance paperwork, verification, streamlined workflows

- Energy & Resources – contractor management, site compliance, credential tracking across locations

- Critical Infrastructure – regulatory obligations (e.g., SOCI Act), credential oversight across roles and supply chain.

- Utilities – workforce of contractors, internal employees, supply chain – manage credentials and compliance across roles/locations.

- Healthcare – staff credentialing, audits, compliance-heavy environment.

USE CASES

- Mining & Resources / Mobile Workforces: Validate + Logistics modules are explicitly designed for asset-owners, multiple sites, mobile workforce, travel/accommodation management

- Regulated Sectors (Health, Aged Care, Education, Financial Services): Modules tailor workflows for credential/licence tracking, working-with-children, AML, cyber policy acknowledgement etc. (via core Compliance product)

- Small/Mid-Sized Organisations: Starter plan for up to 5 users; self-service model emphasised to capture smaller organisations. Kinatico+1

KEY TAKEAWAYS

- Think KYP has evolved from the old CVCheck company which existed years ago

- Kinatico Compliance appears to have morphed into “ComplianceX”, positioned as the “next generation” of Kinatico Compliance - this will likely encompass “everything” into a single, seamless platform

- ComplianceX was launched on 6 March 2025, and as at Q3FY25, appears to be revenue generating

- There are intentions on international rollout as part of the ComplianceX strategy - 2026 and beyond: Expansion into international markets using ComplianceX as the core platform, possibly via partnerships/acquisitions, localised integrations and new modules for global compliance. (Inferred from roadmap & strategy commentary)

AREAS TO FOCUS ON/QUESTIONS AT THIS POINT

Q1. International expansion - what is KYP’s capability to achieve this and plans thereof? Ambition is one thing, capability is quite another, especially when there are existing RegTech providers overseas (subject of next deep dive part).

The commentary says ComplianceX was built with international expansion in mind - this may be nothing more than ensuring that there is country code field to enable the adding of diferent countries to either a module or an industry vertical sub-module, or both. I think of how XRO has struggled to gain significant traction outside of ANZ.

Q2. What edge does KYP bring that other RegTech in foreign jurisdictions not have for customers to switchover to KYP such that KYP can "rule the RegTech" world? I ask this thinking about my other holdings: RTH in horse racing data, SDR in small hotels/revenue management AIM in enterprise captioning/translating, C79 in PhotonAssay, EOS in kinetic anti-drone - these are all companies with a product that is global. I do not include XRO in this list because, like KYP, XRO needs very specific tailoring of its product for each jurisdiction that it enters.

Q3. Does KYP have the financial ability to undertake foreign M&A, balance sheet-wise? Have not looked at the financials yet, but there was commentary about $10m cash, no debt - that does not feel like much of a war chest for any M&A without an associated capital raising, which given how far the price has come, looks like a distinct possibility. Given RegTech complexities, rather than focused on the revenue opportunity an M&A presents, I would be more focused on investment requirements, why and how customers will transition over to a KYP bolt-on.

Q4. Spend of $3.5m to develop ComplianceX (number needs to be validated), feels very, very light for a "strategic asset" - raises questions on the extent of this product - was it a platform rebuild (ala CAT, which revamped its platform for scale) or was it a quick cosmetic integration/makeover of the hodge podge of solutions, to make it look seamless. Goes back to the "what is the moat" question as well.

Have opened a position in Kinatico (KYP) - IRL and here. Another company converting from traditional software to SaaS. They do compliance software for workplaces - think certification checking when onboarding staff and ongoing monitoring. Eg mining drivers, aged care, etc. “RegTech” is a growing area with compliance requirements only getting more complex - their product integrates with most HR systems and handles this complexity for clients. Some nice enterprise clients and adding more as time goes by.

My theory is that they are at an inflection point and with moderate growth and a lower R&D / development bill in FY26 and ongoing they could start a much more profitable trajectory as the operating leverage starts to kick in.

Balance sheet is solid with $10m cash, positive cash flow and no debt. About $120m market cap and at current numbers a very high PE (just over $1m profit this year) but expecting that PE to drop to the 20s on FY26 results and more beyond.

I’ve not met management but the 3 key execs have good pedigree and skin in the game. I really like the chief revenue officer - seems to know his product very well (and gets more airtime than the CEO at briefings!)

In summary my thesis is:

- growing SaaS revenue into a market that is growing - they say TAM is $2.8b and growing

- pricing is ok if you look forward (and squint back :-)

- solid balance sheet

- Should get lots of leverage from growth and capex bill has peaked (at least CEO thinks so) - just turning NPAT profitable in FY25

- product is sticky and gaining in acceptance / child care is a interesting opportunity off the back of the inquiry also

- shares on issue have stabilised and even a little buyback last year - there’s no major dilutive options or like out there

- management have good pedigree and are well aligned

Downsides/question marks/risks:

- that money burns a hole in their pocket and they do something stupid like M&A

- management take increases - it’s been big as a %age of profits but my theory is it’s front ended and will fall as a percentage of earnings

- The big ERP players figure out reg tech and start doing it for themselves

- it’s scalable here but limited / costly if you go overseas

- liquidity of the stock isn’t ideal

Thats about it - would be interested in other straw folks views…@Strawman - would be great to get them on for a meeting too…

Rich

CVCHECK – Q3 FLASH – REVENUE RECORDS, BRIGHT UPDATE

- A record $4.2m revenue was booked in Q3FY21 (26% up on PCP), $3.2m from B2B and $1.0m B2C

- A record $11.1m ARR was booked for the 12 months ended 31 March 2021

- A record month of $1.65m revenue was booked in March

- Integrations revenue of $0.5m is 231% up on PCP and up 152% for the 9-months to end March

- Strong balance sheet, cash at bank $14.8m as at end March and no external financing

- Bright People Technologies acquisition approved at General Meeting on 31 March

Disc:I hold

CVCheck – best sales on record, Bright acquisition on schedule

Highlights

- Strong trading conditions during February resulted in a new all-time record month of sales and the 12-month booked ARR

- New wins and order strength from pre-existing customers are driving strong sales growth

- March sales continue strong

- Bright People Technologies acquisition on schedule to close in April

Disc: I hold

CV1 to acquire Bright People Technologies and completes $10.5 million placement to institutional and sophisticated investors

Highlights

~ CV1 to acquire Bright People Technologies (“Bright”), a cloud-based workforce credentials and compliance software company, operating under a Software as a Service (“SaaS”) business model

~ Acquisition Enterprise Value of $15.3m1 , with $12.0m in scrip issued at completion and to be held in voluntary escrow until 31 December 2022

~ The combination of CV1 and Bright will create a credentials-based workforce management capability built on Bright’s workforce compliance strength and the CVCheck platform’s highly automated verification workflows and HRIS integrations

~ In FY202 , Bright generated revenues of $4.9m, 85% gross margin and EBITDA of $1.7m

~ Bright’s clients include BHP, Roy Hill, Woodside, Atlas Iron, WaterCorp and the NT Government

~ Bright’s Chairman and largest shareholder, Mr Jon Birman, will be appointed to the CV1 board as a Non-Executive Director and Bright Executives, Petra Nelson and Declan Hoare, will join the CV1 Executive Management Team

~ The transaction is conditional on CV1 shareholder approval, certain conditions precedent and customary closing conditions

~ CV1’s largest shareholder, the Carolan Family (~16%3 ), have given a statement that they currently intend to vote in favour of the acquisition

~ $10.5m (before costs) raised through a strongly supported share placement to institutional and sophisticated investors (“Placement”)

DISC: I hold

CVCHECK – Q2 FLASH FINANCIALS - REVENUE RECORDS, CASH POSITIVE

? A record $3.5m revenue booked in Q2FY21 (12% up on PCP), $2.7m from B2B and $0.8m B2C

? A record $7.0m revenue booked for H1FY21

? A record of over $10.2m booked ARR for the 12 months ended 31 December 2020

? Cash positive Q2, strong balance sheet with cash at bank $5.2m as at end December, no debt

DISC: I have small holding