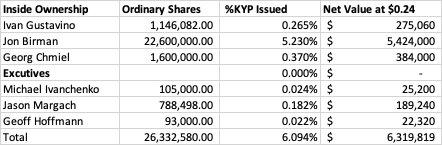

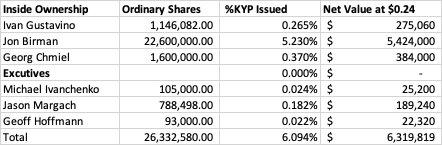

Market Cap $103.7m at share price $0.24

Board Bio's

Ivan Gustavino - Non-Executive Chair

Ivan Gustavino joined Kinatico (formerly CVCheck) as non-executive director and chair in August 2018. Ivan has over 25 years of history in technology companies, including vast experience in leading, advising and investing in high growth technology businesses.

Ivan brings extensive experience in deal making and advising technology investors and businesses at board level on a range of matters including business strategy, growth and M&A transactions. He is a recognised leader in software technology entrepreneurship in Australia and a highly regarded authority in business strategy, corporate transactions and in the marketing of emerging technologies.

Ivan has a Bachelor of Business (Information Processing) from Curtin University of Technology.

Jon Birman - Non-Executive Director

Jon Birman has a wealth of experience including previously having been the inaugural Chief Executive Officer of UGL Resources Pty Ltd. As CEO of UGL Resources, he helped grow the business from inception to $1 billion in revenues. Jon’s experience and entrepreneurship brings depth and complimentary skills to Kinatico’s current board members.

Jon has a Bachelor of Arts (Politics & Industrial Relations) from the University of Western Australia.

Georg Chmiel - Non-Executive Director

Mr. Chmiel brings three decades of experience in rapidly growing, disruptive online businesses and holds a unique combination of experience and skills in technology businesses, international enterprises, and boards of ASX-listed companies. Throughout his career, he has been instrumental in significantly growing shareholder value. Mr. Chmiel is currently co-founder and chair of Juwai-IQI, Asia’s leading PropTech group, and Chair of Spacetalk (ASX:SPA), a global technology provider of secure communication solutions for families. He is also a non-executive director of ASX-listed FinTech companies Butn and Centrepoint Alliance.

Mr. Chmiel is also a Senior Advisor to BrioHR, ASEAN’s leading HRTech platform, and a member of the advisory board to MadeComfy, a tech company in the Australian short-term rental market.