Hi Wakem,

DigitalX is a company I've been looking at as well. I'm not a Bitcoin bull but the thought of a software company with strong tailwinds and plenty of potential caught my eye. The fact they provide exposure to digital currency provides diversification to an equity portfolio as well. I'm still very early stages of my research and haven't put my thoughts together concisely but here are some rough notes; as a result there may be errors.

DigitalX was showing a lot of promise in FY2018 with $8.2M in revenue and $1.7M in appreciation of their digital assets. This resulted in a $2.4M profit for the year compared to a $3.6M loss in FY2016. Revenue was entirely from initial coin offering (ICO) consulting revenue - think IPOs for digital currencies. My understanding is that DigitalX were to ICOs what the investment banks are to IPOs. As investment banks need to generate interest in a company listing publicly, so to would DigitalX for an initial coin offering. As a result, management was very promotional during this period pumping out announcement after announcement. Was the over promotion justified? Probably, but you can make your own judgement.

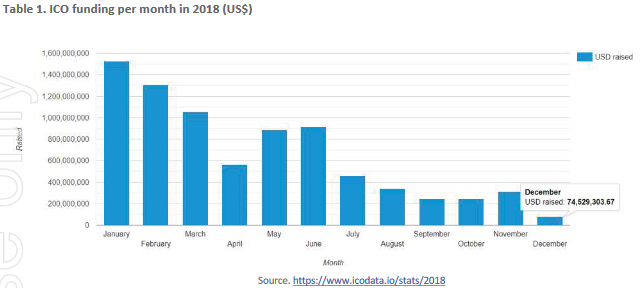

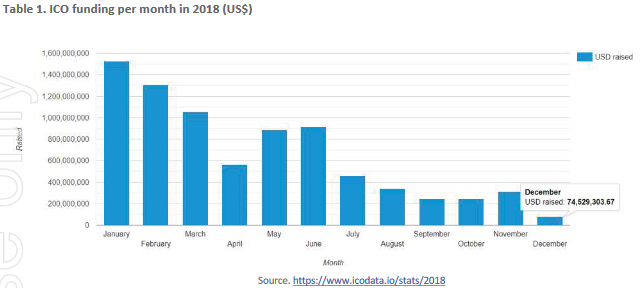

From an $2.4M profit and positive free cash flow of ~$600,000 in 2018, DigitalX took a dive the following year. Revenue from operations (essentially ICO & STO consulting revenue) was $0.927M and free cash flow negative at ~$3.6M in FY2019. In hindsight this provides a great learning opportunity as to whether an investor understood the key drivers of the company. As revenue was entirely derived from ICOs and STOs, tracking these, both the number and money going into them, provided a strong leading indicator to where the company was headed. As seen below, it also explains the downfall of the company - the ICO market essentially dried up.

According to icodata.io, there were the following number of ICOs by year:

2017 = 252

2018 = 1602

2019 = 474

2020 = 121

2021 = 136

And money going into ICOs:

DigitalX swung big during the ICO euphoria of 2018, taking gambles on some highly speculative offerings. However, just as investment banks tend to do well off IPOs so too did DCC with ICOs. They received favourable equity terms in these ventures and tended to sell out some or all of their holdings early enough to make off with considerable gains. As a company betting everything on ICOs and STOs, their lack of revenue diversification and a highly speculative new market would be their eventual downfall. As the ICO market dried up, so did DigitalX's prospects.

In April 2018 DCC opened up their funds under management division. FUM was permitted to invest in the following 5 areas:

Crypto

ICOs

Cash

Derivatives of cryptocurrencies

Managed investment schemes

The FUM division appears to have kept the company alive during this time. In addition to the new FUM division, DigitalX is focused on:

ICO management and corporate advisory

Blockchain consulting and development

Blockchain investor education and crypto news

It's the Blockchain consulting and development division that I'm most excited about. The ASX is revamping the settlement system for share trades. The new system will be based off of Blockchain technology and Digital Asset Modelling Language (DAML) and do away with the current CHESS process. This provides validation to the thesis behind strong tailwinds for the company. In addition, DCC has an app called Drawbridge to work with this new blockchain-based clearing and settlement system. Drawbridge is a digital compliance tool to allow the "orderly acquisition and disposal of securities" - essentially it tells people within the company when they can and cannot trade shares. DigitalX's management team is looking to build off the tailwinds blockchain provides to financial markets by building more products in this area.

While the software and Blockchain side of the company excite me, I'm disappointed in the unit economics. They currently charge $500 per year + an initial $950 setup fee for Drawbridge. If they somehow manage to sign up all 2,000 ASX listed companies, that's an annual recurring revenue of only $1M. That's not to suggest they could not target global share markets; however, at the current price it's hard to get excited about this. You could argue they could increase their price; however, as recently discussed on a Baby Giants Podcast episode (if I remember correctly) it's hard to increase your price past a certain point. The low cost is disappointing as an annual charge of $500 per year would show up when rounded as a $1 on a company's financial statements - hardly an expense anyone is going to bat an eye at. If I get the chance to talk to management I'll be asking what their thoughts are on this and whether they see the current version of Drawbridge as a minimum viable product.

This really only scratches the surface and I still haven't caught up to the ASX announcements from 2019 on wards. While I started out quite excited about this company, and still am, I'm starting to lean towards it being a no from a risk-reward perspective; however, that's ignoring their FUM division.