Mader is very active in WA Rick, which is almost Covid-free compared to the rest of Australia. Their Facebook page does have a story about Troy, who spent six months in Western Australia (working for Mader Group presumably) due to border closures, and was able to get home and surprise his family right in time for Christmas. Lucky Troy! I'm guessing that there would be a few interstate heavy duty plant mechanics that would be a little bit wary of travelling to WA to work up in the mines for Mader and risk WA shutting their borders again - based on Troy's experience.

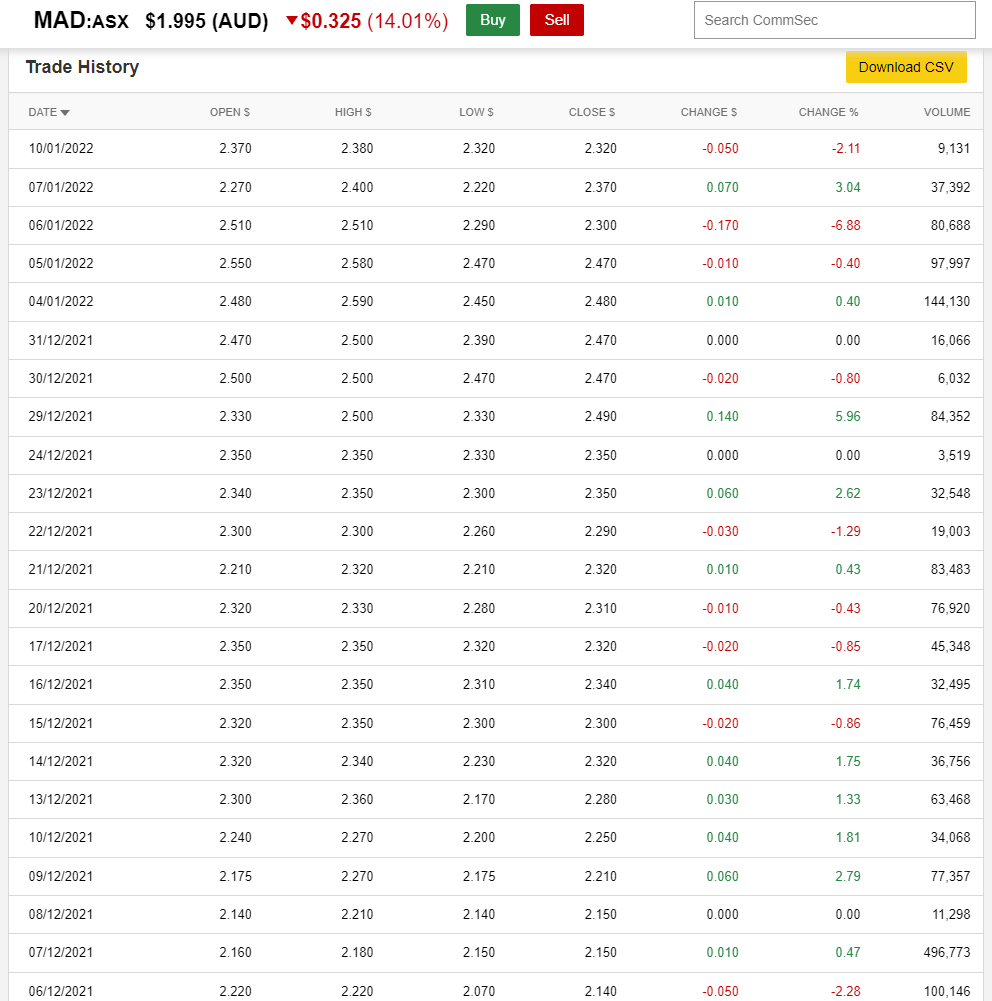

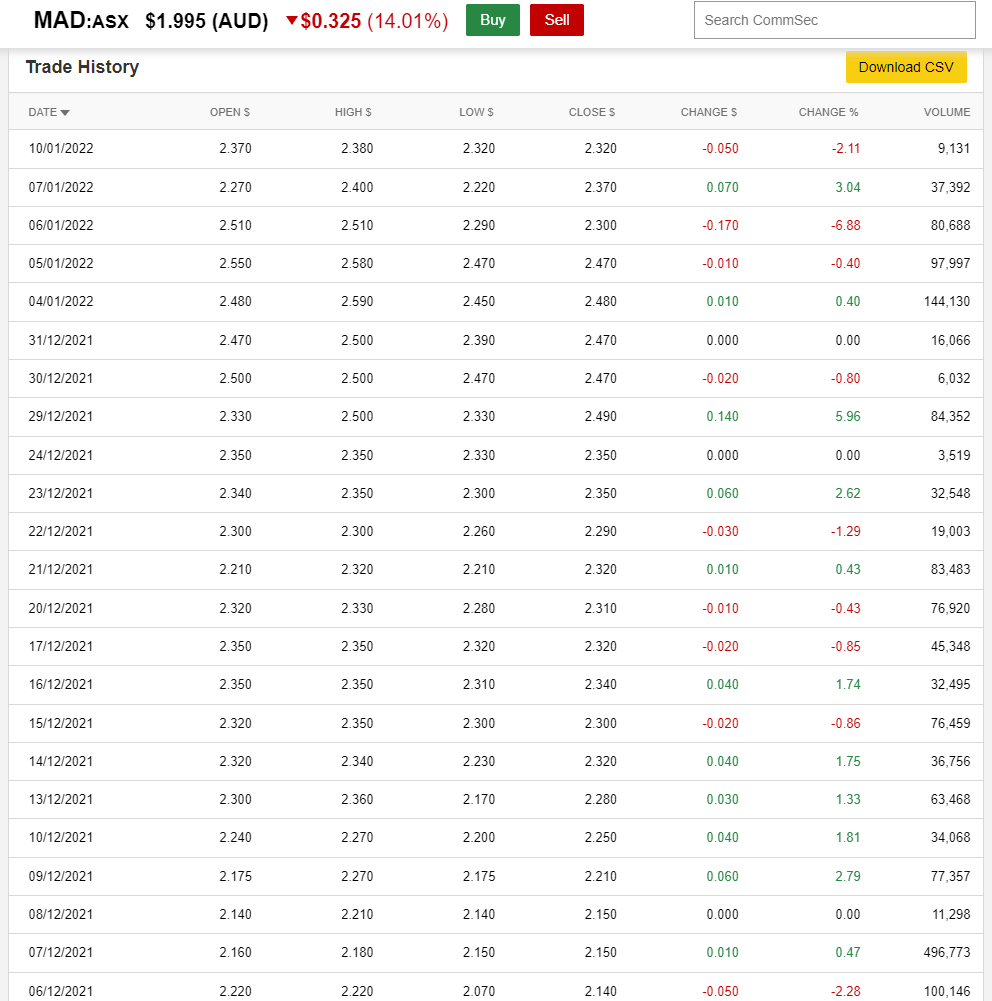

I think the most likely reason for the big share price moves is a fundy, or retail investor, or one of their KMP (key management personnel who have been issued with performance rights and share appreciation rights in addition to their Mader shares) is/are just reducing their exposure, i.e. selling down (or selling out). These moves have been on relatively low volume. Today's -14% fall (-32.5 cps) was a result of a total of only 107K shares (107,060 shares) changing hands worth a total of less than $227K, so less than a quarter of a million dollars worth of shares. The -6.9% fall last Thursday was on the back of only 80,688 shares being traded in the entire day. I'm thinking it's volatility based on low liquidity.

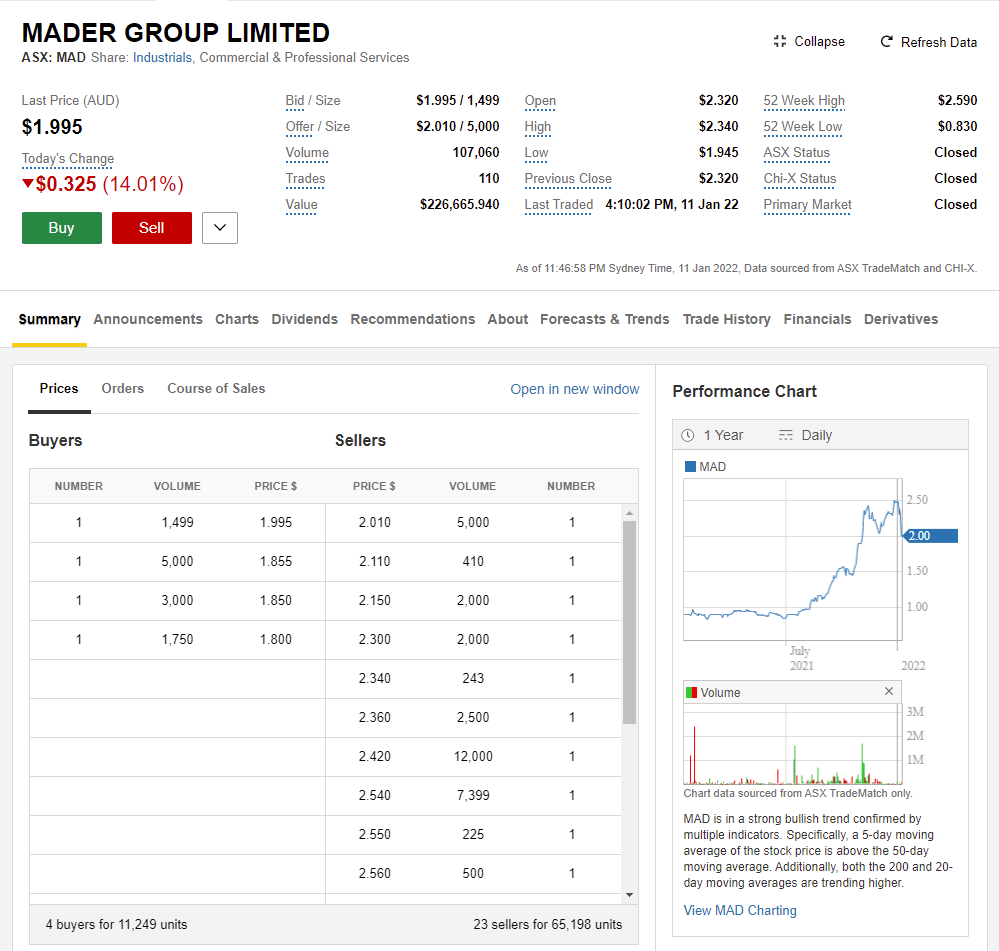

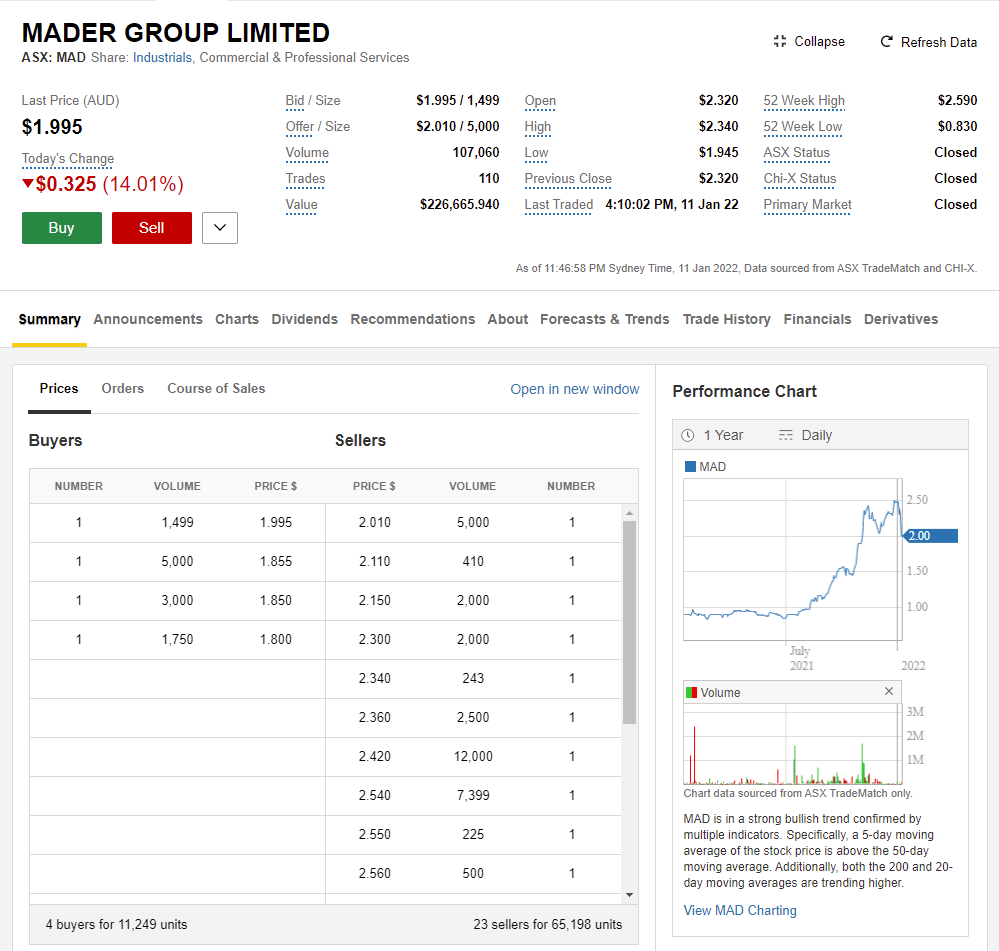

Actually - it is exactly that. Have a look at this:

So we have only 4 buyers listed there, and look at the prices between the top two, from $1.995 down to $1.855. If MAD opened tomorrow morning with that same spread (as above) and somebody sold 1,500 MAD shares "at market", that would move the price another -7% down (14 cps) because 1499 would sell at $1.995 and one share (the last share of the 1,500 sell order) would sell at $1.855. Just low liquidity. And they aren't heavily traded - here's some recent trading history:

The only half decent day from a volume perspective was December 7th, when almost half a million shares changed hands on the day, and the share price moved a whole 1 cent that day (+0.47%). The bigger moves have tended to be on lower volume, like 100,000 shares or less daily volume, suggesting that it's just a lack of buyers and sellers that is causing the moves up and down, with decent gaps between the price points, as shown above (above that trade history). Even though there are more sellers than buyers listed there, the gaps between their offers are quite large. If the market opened with no changes to that spread and somebody placed a BUY order "at market" for 10,000 MAD shares, it would move the share price up to $2.36, which would be a +18.3% rise on one trade worth less than $23 K.

To summarise, the evidence suggests it's a small amount of trades (small volume, not worth too much in dollar terms) that is moving the price a lot because there are very few buyers and sellers and the price points of their bids and offers are spaced apart with decent gaps between many of them. Because those bids and offers are generally for small volumes of shares, any half decent trades "at market" are going to take out a bunch of those bids or offers and would move the share price a heap. Hope that helps.

Disclosure: I do not currently hold MAD in RL, but they are in my Strawman.com virtual portfolio here.