Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Update Aug 2025

Valuation in Aug 2025 based on 28 cents EPS in FY25 and 13% growth rate for next 5 years (less than half historical average) with PE of 25 (bottom quartile of historical average).

The long term growth is slowing and so far North America isn't ramping up quickly enough to compensate, so have trimmed my growth expectations for the next 5 years. That said want them to keep pushing into America at this point and also sensibly expand into some adjacencies as announced, like infrastructure and marine, when their teams can add that work in a location.

They also believe ASX300 index inclusion is a possibility in FY26 but they will need to do some work on Board composition and rem structures etc if that happens.

Valuation in Aug 2024 based on 24 cents EPS for FY24 and 15% growth rate for next 5 years (half historical average) with PE of 18 (bottom decile of historical average).

Why do I own it?

# Market leader in Australia with 40% market share of the repairs and servicing of mining equipment such as trucks, graders, conveyors etc. Basically 3900 mechanics and technicians heading to 70% of Australia's mine sites to repair vital equipment that is no longer under warranty. And they usually do it faster and cheaper than the original equipment manufacturers. Unlike other mining services companies though it's "asset light" as it's mostly people producing the revenue rather than capital intensive equipment. This also means they have some flexibility to scale the business costs up or down based on demand. The next biggest player only has about 10% of the staff that Mader currently has.

# For those who have had a car or a fridge break down, when it's really important to your job or your business, you can appreciate why Mader is the "go to" when they can get the equipment working again faster and cheaper than waiting for the manufacturer to come fix it...

# Business is somewhat diversified with 79% in Australia, 19% US and Canada, 2% Rest of the World. The North America business has been growing well and they only have 2% market share so far, which means there is still plenty of room for growth.

# Has a strong and entrepreneurial founder in Luke Mader who is now the Executive Chair and he still holds 51% of the shares. They hired an outside CEO about 3 years ago who seems to be running the business well under Luke's oversight. Another founder is also on the Board and holds 20% of the shares. So a LOT of skin in the game.

# It's quite a simple business to understand, isn't likely to be easily disrupted and also has a simple balance sheet.

# They seem to have a strong culture which a great program of international exchanges for staff. Mechanics can travel the world within the company and with 3900 staff, there are lot's of career progression options. They also run a fun sounding program called Three Gears, which provides lots of local experiences for staff and families like hikes, rides, ziplines, BBQ's etc to break up some of the monotony of remote work. This is their single biggest MOAT.

# Debt to equity ratio of around 15% and expected to go net cash in FY26. ROE / ROC is consistently over 30% and 20% respectively. Net margins have consistently been around 6.5%.

# Solid MOS at current price of $5.25 in Aug 2024 at less than half the historical growth rate. The business has compounded revenue at over 30% p.a. for more than a decade.

# They can deliver double digit revenue and earnings growth for 5 + years so the return should exceed my 15% p.a. + target.

What to watch

# Some key person risk if something was to happen to Luke Mader - need to watch how CEO Justin progresses in the next couple of years.

# It's a small and "executive" Board so there is some risk of "group think" and also easier remuneration plans. Need to call this out and would be good to see an independent thinker or two added over time that also brings some new skills. This will have to happen with index inclusion.

# While it doesn't show up historically they could be impacted by mining downturns, so need to be prepared to look through that cyclicality.

# Any Regulatory changes to labour hire laws

Edit: Include today Justin Nuich Buy announce today.

Mix Bag buying and Selling from Management.

Justin Nuich

· 7 March 2025

Buying 3,460 Shares at price $5.75 per share ($19,895)

Luke Mader

· 6 March 2025

Buying 83,500 Shares at price $5.97 per share ($498,495)

Craig Burton

· 27 February 2025

Selling 1,000,000 Shares at price $6.15 per share ($6,150,000)

Mader's AGM was in Perth today. Sadly no online version and I couldn't make it in person so not sure what happened in Q&A.

However they reaffirmed the sales and profit plans for this year and next, that would see around 15% p.a. growth in both.

And I thought both the Chair Luke Mader and the CEO's addresses were clear, focused and covered what makes Mader the leader in the industry.

Presentation and speeches below -

https://clients3.weblink.com.au/pdf/MAD/02865322.pdf

https://clients3.weblink.com.au/pdf/MAD/02865315.pdf

https://clients3.weblink.com.au/pdf/MAD/02865310.pdf

Happy holder IRL and on Strawman.

27-June-2024: 27 month Price Target of $7.77, so by September 2026. Mader have been up above that already at the end of August last year, but some of the hype came out of the stock in September last year. The US market can be a hard nut to crack, but Luke Mader and his team are doing a reasonably job of replicating their very successful Australian business model over there.

I do not hold MAD shares with real money at this point, they look too fully priced to be buying up here, but I was saying that at lower levels a couple of years ago also.

They've done alright for me here in my Strawman.com portfolio however. And I have no reason to think they're not going to keep growing, just possibly not as fast as some punters were speculating on when MAD's SP was heading North East at a good clip last year.

https://www.facebook.com/MaderNorthAmerica/?locale2=ms_MY&_rdr

https://www.madergroup.com.au/news/2019/07/the-fix-is-in/

https://www.madergroup.com.au/

Mader Group founder Luke Mader has sold 4% of his stake and put a nice little ~$62mil into his back pocket. Don't worry, he still retains about 51% of the business.

They have also come out this morning and reaffirmed guidance, and disclosing that they've welcomed a strategic investor to their register.

Don't hold, has always been "too expensive", yet it shows what execution can do to price over time. EPS has consistently increased, as has the multiple.

Partial to a WA and Perth-based company, so will take a closer look over the coming days. Maybe as Luke lightens his load further I'll take some of his share.

Assuming reach managements target of Revenue $1 billion in FY26. Based on Net Margin of 6.5% giving EPS of 30 cent with share count increases 3% per year till FY26. PE35 Discounted back for today giving me $7.82

Link fixed. Have owned this for yrs. Hasnt let me down yet

OK, we’ve talked about what a great business Mader is, but what is it worth? What can you afford to pay for Mader and still make a reasonable return? The market price is no guide, as you can clearly see over the past few years. When Mader was trading on a PE of 9 in 2021 it was too cheap. Now Mader is trading on a PE of 32 times earnings (guidance $million / 200 million shares x 32 = $5.90), is that a reasonable price to pay? The market thinks so, but the market is not always right. It was wrong when Mader was on a PE of 9, so it could be wrong now.

Let’s assume Mader consistently returns 30% on share holder equity for 10 years. If the share price equaled shareholder equity value and all earnings were reinvested into growth your return would be 30% per year.

That’s not the case. You are currently paying $6 for 50 cps of equity in the business (PB 12). So, in effect your return is 30% per year on 50 cps, and 74% of earnings are reinvested at the 30% rate. The remaining 26% of earnings are paid out as dividends returning you c. 1% fully franked.

One way of working out the intrinsic value of Mader shares is to consider future returns based on current shareholder equity, future ROE, the percentage reinvested, your dividends and your franking credits. You also need to consider what total return you would be happy with investing in Mader, accounting for the risks. The higher the cost price the lower your returns will be.

Currently a government backed term deposit is returning 5%, so you would require a decent premium over this to compensate for additional risks in owning a cyclical mining services business, perhaps a premium of 3% to 5% for Mader.

McNiven’s StockVal Formula considers all these things and works out a valuation based on your required return. Alternately, you can use the formula to arrive at an estimated return based on the current share price. I do this in Excel.

At the current share price of $6, forward ROE of 30%, equity of 50 cps, 74% of earnings reinvested, and including 100% franking credits, I get a return of 7.9% per year. If you are happy with a premium of 3% over a term deposit for the additional risk, and you can’t find a higher return elsewhere, than you could pay $6 today.

Personally, I would prefer a higher premium to take on the additional risk, say 5%. Using McNiven’s StockVal formula and a required return of 10%, the valuation is $4.00. I’m not saying this is the value, but you get the idea.

I can see why the market is paying $6 per share for Mader. So, that’s the valuation I’ll give it.

Disc: Not held

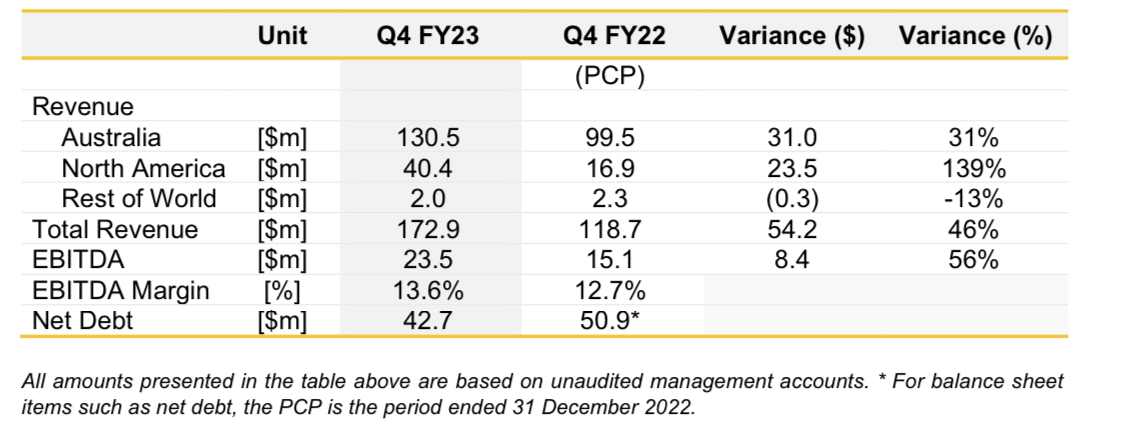

Mader Group just released its Q4 FY23 quarterly update. Just yesterday we talked about the possibility of debt fuelling Mader’s consistent ROE of c. 30%. Well the surprise today is Mader has increased FY23 NPAT guidance to at least $37 million while reducing net debt to $42.7 million. That’s c. 43% net debt on equity, less than the average net debt over the last 5 years. Consensus analysts forecasts are for FY23 NPAT of $38 million. So, the earnings upgrade was anticipated.

Mader just keeps pulling out the surprises. It is reasonably capital light as @Bear77 eluded too. The model hasn’t changed much from when Luke Mader started the business with a ute, a toolbox and a competent diesel mechanic…the key expansion unit!

Disc: No longer held

EXECUTIVE SUMMARY:

Generating revenue of $172.9m in Q4, Mader delivered another record quarterly performance, an increase of 46% versus the prior corresponding period (‘PCP’) and 11% growth quarter on quarter.

FY23 revenue closed at $608.8m (unaudited), exceeding Mader’s twice-upgraded market guidance of revenue of at least $580m (initially $510m+, upgraded in October 22 to $550m+ and further upgraded in February 23 to $580m+). This represents year on year growth of 51%.

Mader reaffirms its FY23 NPAT will be at least $37m (initially $33m+, upgraded in October 22 to $35.5m+ and further upgraded in February 23 to $37m+). Mader expects to release its audited NPAT results on Tuesday, 22 August 2023.

Customer demand for core services in Australia remained strong, delivering revenue of $130.5m, an increase of 31% vs PCP. Mader continues to experience success in the market penetration of new vertical service offerings.

The North American segment delivered $40.4m of revenue, a 139% increase vs PCP (123% on a constant currency basis). Continued momentum within North America was delivered through expansion into new regions and an expanded customer base.

Net debt closed the financial year at $42.7m (unaudited), a reduction of $8.2m since December 2022 reflecting strong operating cashflows in 2H FY23.

27 April 2023: MA Moelis Australia: Mader Group Ltd (Buy): "Another record quarter, strong growth continues, reaffirmed guidance"

That's the first page - click here to access the full report.

Disclosure: I hold MAD here in my Strawman.com virtual portfolio.

Hi Andrew,

Sounds like you have been busy and might have missed my request for an interview with someone from Mader (ASX:MAD)

https://strawman.com/reports/MAD/all

Thanks in advance!

UW

Just listened to the latest episode of Baby Giants and surprise, surprise Matt Joass spoke about Mader at length. Should have listened to it sooner.

Hi Andrew, I don’t recall an interview with someone from Mader Group (ASX: MAD) but I could be wrong.

It would be good to hear from Justin Nuich or the man himself, Luke Mader.

On the Strawman company page I note some of our Straw People took positions in MAD a while back and have done very well for themselves.

Also, Matt Joass, Founder of Maven Funds Management, presented at the MicroCap Leadership Summit on September 15th, 2022. Here’s his presentation

https://www.youtube.com/watch?v=WfNEFhoO5ks

Thanks always to @Bear77 for posting each weeks ASX Equity Research Reports, this week Mader makes the list with a report from MA Moelis Australia

https://strawman.com/forums/topic/5543#post-17164

Mader seems to be kicking plenty of goals at the moment but is it too late?

I’m not sure why more Straw people including myself don’t own this one.

Any thoughts?

31/01/23

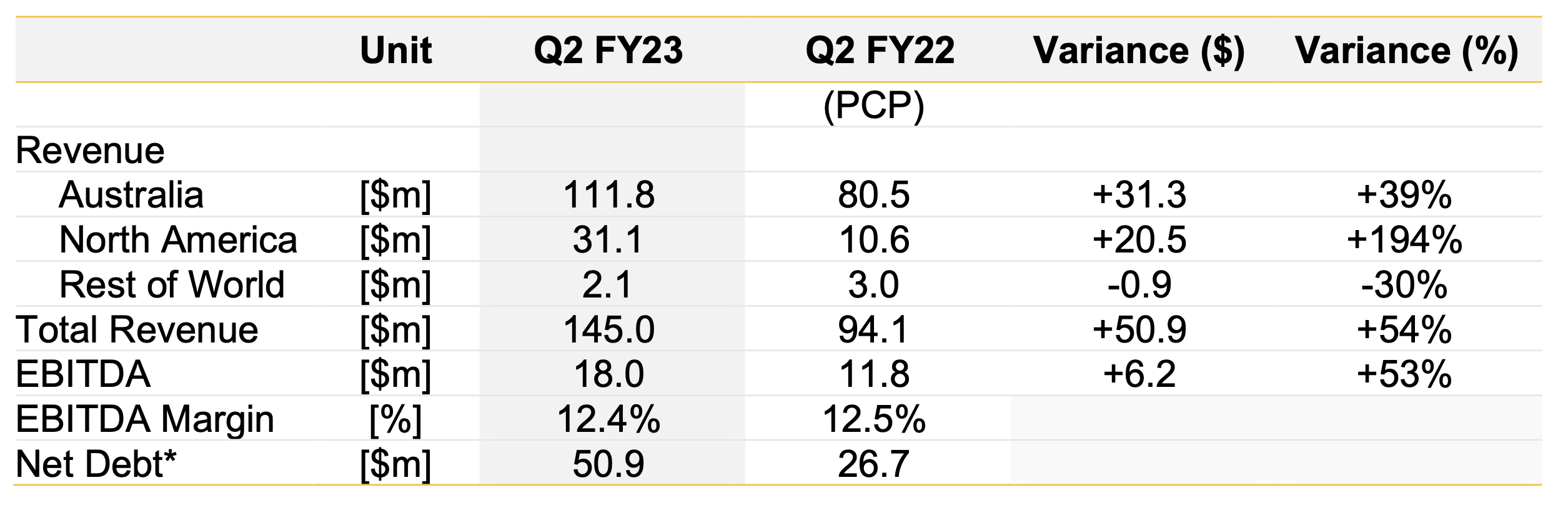

Mader has reported huge increases in revenue:

The NA result has been flagged earlier but really is a very bullish sign that their expansion into a new, and much, much larger Geography shows early signs of delivering outsized future returns.Impressively the Australian business which is much more mature still managed to increase revenue by 39% vs PCP.

Less exciting is the huge increase in debt over the last 12 months.

The explains this in part by the costs from the re-development of the Mader Maintenance Centre which allows them to now chase larger contracts. Also timing of receipts stuff which I take to be a bunch of fluff.

Clearly they are investing for growth and growing very successfully.

With time we should be able to tell how cost effective that is. Hopefully they will disclose a ROIC in the HY summary. If anyone can work it out please let me know!

The share price had run up considerably over the preceding weeks (a bit of a pattern, and has dropped off a few percent following this release)

Held

--------------------------------------------------------------------------------------------------------------------------------------------------------------------

Strong update from Mader here and SP has ticked up in last few days in anticipation.

The standout was the exceptional growth in NA, now representing ~20% of Total Revenue, from ~10% in PCP.

The bull thesis for Mader is that they can reproduce their home-market advantages oversees in the much larger NA market. This update would provide a strong vindication of this thesis. Held IRL (but not enough...

Full report here:

Edit: spelling, Maths

Matt Joass Presents at MicroCap Leadership Summit 2022

Business review starts at 5:30

CEO and Director -- Justin Nuich -- bought 10k worth of shares on market today, at a price of $2.34.

Perhaps only a small parcel, but a good sign nonetheless.

Disc: MAD remains on the watchlist.

1:48pm, 01-Feb-2022: There have been some isolated cases of Covid-19 in WA's mining industry, and BHP is one of the companies that has been affected.

COVID cases isolate dozens of WA mine staff - Australian Mining

At this stage, the management of all of the affected mines are saying there have been no material impacts to production. It does however feed into the skilled worker shortage that WA is experiencing. There are now even ads on Adelaide buses spruiking WA as a place with PLENTY of work, so worth considering a move over there. Seems out of step with their refusal to open their border and allow people in though.

I'm thinking that these conditions are very positive for a company like Mader Group (ASX: MAD) as long as they can keep their own workers Covid-free. Mader provide fitters and other skilled workers - especially heavy duty mobile and fixed plant mechanics - to various industries, but the mining industry is their bread and butter, with earth-moving/construction also providing MAD with plenty of work. My brother is one of those (HD plant mechanic) and he's working at S32's Worsley Alumina refinery (which was majority owned by BHP before the South32 spin-out/demerger). He doesn't work for Mader - he works for another labour hire company that also provides workers to the mining and minerals processing industries. Those labour hire companies are doing very well at the moment, especially in WA, and remember that WA only has a small fraction of people with Covid-19 compared to the eastern states and SA. If the Covid problem gets worse there, I reckon the labour hire companies are only going to get busier. They already have rising metals/materials prices as a tailwind, which is resulting in further activity in the sectors they operate in. I think Mader provides the purest exposure to that and I do hold Mader shares, and S32 shares - but not BHP at this point.

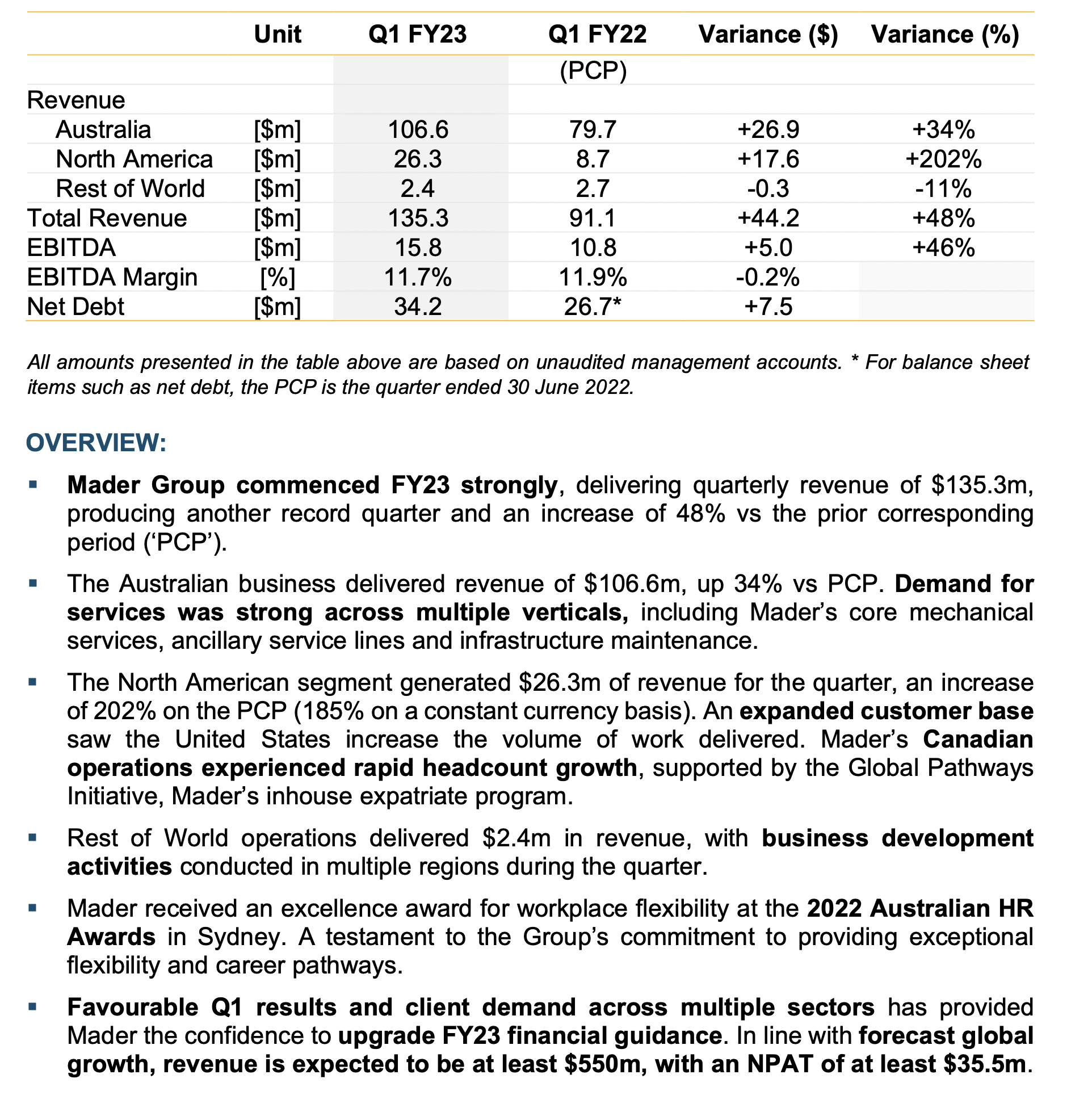

Mader's quarterly update ticks a lot of boxes. They've slightly upgraded revenue guidance and refined forecast profit to "at least $24 million" - previously $23-25 million. If anything that still seems low given management's tendency to be conservative and the fact they'd have to slow significantly in the second half to merely reach $370m.

A now regretful sell for me last year. I participated in much of their run up and never saw this as a long term play, but I was too quick to pull the trigger and should of hastened my sell more slowly...

24-Aug-2021: Euroz Hartleys Analyst Gavin Allen has maintained his "Buy" recommendation on MAD (Mader Group) and has raised his PT from $1.21/share to $1.55/share. MAD closed on Friday (03-Sep-2021) at $1.16. I added them to my SM portfolio at 98c/share three weeks ago, and have made three small top-ups to that position since with some loose change. I'm probably going to also buy some in RL but I should have done that before they reported, as they've popped quite a bit now. I'd rather buy on a pullback, but I'm not sure that I'm going to get that opportunity in the near-term because they are flying at the moment.

I've attached Gavin's analysis. Here's a brief extract:

Event:

MAD has reported solid full year 2021 numbers and issued very robust market guidance for 2022.

Impact:

MAD has reported full year 2021 numbers and issued 2022 guidance as follows:

- Revenue of $304.3m up 11% on the pcp (EH $298.8m)

- EBITDA of $35.7m up from $32.7m pcp and in line with our expectations.

- NPAT of $19.3m up from $17.5m and above our $18.6m expectation.

- Net debt is at $27.5m (including leases), up modestly on 2020, reflecting working capital build consistent with the revenue increase.

- The above is consistent with a 4th quarter operational update provided late July.

- Final dividend of 1.5c declared for 3.0c full year.

- 2022 guidance has however been provided, which is new:

- Revenue between $355m and $365m, up from $304.4m in 2021

- NPAT forecast between $23m and $25m, up from $19.3m in 2021

- Midpoint NPAT forecast is a 24.5% increase on 2021, representing a significant upgrade on consensus expectations.

Action

Buy, PT increased to $1.55/sh

Key Catalysts

- This robust 2022 guidance issued is a catalyst in isolation.

- Quarterly updates consistent with this ambition will see further re-rate as objectives are de-risked.

- MAD is pursuing well understood strategic ambitions, the outcomes from which are likely further catalysts.

--- end of extract ---

Disclosure: I hold MAD in my virtual SM portfolio, and I'm looking seriously at adding them in RL if I can make the numbers work at these levels - still working through that. They're not cheap compared to where they were 2 months ago, but they might be cheap compared to where they'll be in 12 months from now. There is plenty of content on Mader Group here.

[Following on from my forum post in relation to good investor relations at Mader I'm posting this separately as a straw so it can be found when searching for Mader on the companies tab].

So, if you accept that Mader's receivables balance is of a high quality how can we use that to our advantage as investors? On the investor call Paul said their receivables balance typically sits at 45 days. Doing eight turns of receivables (365/45=8.1) gets you to $543m of revenue in FY22 i.e. 79% growth YoY! But Paul did allude to the fact it can blow out to 60 days (and some things he said to me verbally make me think it was closer to 60 as at 30 Jun). So six turns of receivables gets you to $407m of revenue i.e. 34% growth YoY.

Put another way, they guided revenue to be around 20% higher in FY21 but on back of the napkin calcs business would have to slow from current levels in order to hit their forecast. It's just one data point but every little bit helps....

I’ve had a bit of a deep dive into Mader following its result this week. The headline numbers were strong and the growth will accelerate if their forecast is to be believed. Others have laid out what they do and where their growth will come from so I’ll let their words stand and really focus on the bits of the result I like and the bits I don’t (HINT: There’s no cash here. Here, there’s no cash. Cash! NO.)

The good stuff

- They provided guidance - and they weren’t shy about shooting for the moon either. Mostly it’s just good to see they feel they know their business well enough to provide a relatively tight guidance range.

- Expanding their service offerings and this is generating meaningful top and bottom line expansion.

- Their Short Term Incentive program seems to be well aligned with shareholder returns (NPBT, TRIFR and staff retention) and should assist longer term performance as well.

- Earnings per Share increasing each year

- Margins should improve as they move into higher margin markets like the U.S and Canada. Management stated they expect Canadian margins halfway between Australian and the U.S.

- They responded to retail investor queries at the investor briefing. I know this because they answered mine (partially – I’ve followed up and we’ll see what they come back with).

The not so good stuff

- Where’s the money? Their cash conversion seems consistently really low. Since 2017 (including prospectus figures) they have generated about $87m in NPAT. Adding back depreciation gives a figure around $117m. However, in the same time period they’ve disclosed operating cashflow of just $72m. Partly it’s explained by their growth and a corresponding increase in their receivables balance. Not sure that explains it all though…

- The lack of cash is why the dividend hasn’t changed since they listed and the payout ratio is low. I don’t really care about dividends per se but I do care that they’re forced into that position.

- Related to the points above debt is rising (so they’re really paying dividends out of debt). The whole message is just a bit disjointed. They describe themselves as a profitable, fast-growing and capital light business. Yet cash is down, borrowings are up, dividends are flat and they’re forecasting spending the equivalent of more than 80% of this year’s NPAT on capex in FY22.

- No Long Term Incentive program. I’m not so worried about that because I think the STI program measures factors in the long term interests of the company but it’s a bit odd.

- So I mentioned receivables; it’s the biggest number on their balance sheet by miles. It’s the main reason their cash is low. They also disclosed it’s critical in how they look at debt because they view their debt capacity as approximately 50% of their receivables balance (that only makes sense if they mean their net debt capacity, i.e. after subtracting cash, so I’ll give them the benefit of the doubt and assume that’s what they meant). All of this means that if you care at all about risk it’s a figure that matters. I would expect much better disclosure than they’ve provided. Where’s the ageing profile for starters? They don’t disclose a provision for doubtful debt or bad debt write off expense. Some of their peers go further than that even and include a table showing risk exposure i.e. this much is against AAA customers, that much against AA customers etc.

- ROE has steadily been declining since they listed. It’s still in the 30s though so still pretty strong - just a watch on that one.

- Where are the women? I’ll tell you one place they are – pictured all over their promo material and in the annual report. But the photographer has done well to find them. There’s no women on the board, no representation at a SMP level and only 7% representation among employees. It’s a sausage factory. Now I get it – given the industry it’s not going to be 50%. But they can do better than that. Start with at least token representation on the board and senior staff and work down.

- Only 1 independent director

- On the investor call they stated the depreciable life of their assets is significantly shorter than their useful life i.e. there will come a time when they’re getting benefit from their assets still and they’re fully depreciated so no expense in the P&L. Now that’s well and good but it’s contrary to the accounting standards and the opposite of what they state in their annual report. So I hope their auditors weren’t on the call.

It sounds like I really don’t like this business. I actually own it in RL and SM. The founder is still active in the business and owns a heap of it. It’s headline results speak for themselves. But there’s some questions here around governance and messaging that are flashing a deep amber to me. It was a bit of an impulse buy nearly 12 months ago now and I think it’s good to reflect on your holdings with a critical eye. I’ve emailed them with a few questions I have and I’ll be really interested to see what they come back with.

[Holding…]

24/08/2021 - Today Mader Group announced a pleasing FY21 result, ahead of expectations - Results Presentation

FY21 HIGHLIGHTS:

- Record revenue of $304.3m delivered, up 11.2% from $273.5m in FY20

- EBITDA of $35.7m delivered, up 8.2% from $33.0m in FY20

- NPAT of $19.3m delivered, up 10.5% from $17.5m in FY20

- 3.4m hours of specialised equipment maintenance delivered to over 240 customers across 370 sites, up from 2.7m hours in FY20

- Net debt of $23.9m, equating to net leverage of ~0.7x

- A final full franked dividend of 1.5 cents per share, taking the total dividend relating to FY21 to 3.0 cents per share.

FY22 OUTLOOK:

- Continued growth in activity levels across the global mining industry underpin a positive outlook for the business in all markets and geographies in FY22

- Expecting strong growth in FY22, with forecast revenue of between $355m - $365m delivering a forecast NPAT of between $23m - $25m.

Executive Director & Chief Executive Officer, Justin Nuich said the company had a solid balance sheet, strong cashflow, low capital intensity and significant global and local growth opportunities.

My Take

Revenue was 13% higher than what analysts were expecting, and NAPT was in line with expectations.

Mader is bullish about 2022 growth forecasting revenue to be up 17% - 20% and NPAT to be up 20% -30%. Earnings growth is higher than what analysts have been forecasting forecasting prior to the announcement.

Organic growth is driven by penetrating into new markets with a proven business model.

Revenue in North America grew by $10.3 million (75%) contributing about 1/3rd of the revenue growth for Mader in 2021.

Mader Group is expanding its fleet and plans to enter Canada in the near term.

Due to COVID Mader has scaled back in other parts of the world where revenue was down 47%. Mader is intending to scale up again as the situation improves. By the close of FY21, Mader ramped up its international services in five countries including Papua New Guinea, Mongolia, Laos, Zambia and Mauritania.

Mader have an enormous potential for organic growth over several years. Mader has identified $6 billion in addressable markets in Canada and South America alone (see attached map).

Given the potential to rapidly expand into new markets using a proven business model with a return on shareholders equity of 30%, I am happy to maintain my valuation for Mader of approx $1.60.

Disc: Held SM and IRL

Mader has just announced a pleasing result with a record quarter and FY21 revenue above consensus forecast. I think the businesses is currently 30% undervalued.

Full ASX Announcement

OVERVIEW:

- Record quarterly revenue of $86.4m, up 24% on the prior corresponding period (PCP), and up 14% on the previous quarter. Second consecutive quarter of record quarterly revenue.

- FY21 revenue of $304m, above consensus forecasts, and up 11% vs FY20.

- Revenue generated in Australia increased to $77.0m, up 21% vs PCP, driven by high levels of customer demand. Revenue up $8.7m, up 13% vs Q3 FY21 indicating growing momentum throughout the business.

- In North America, quarterly revenue increased to A$6.8m, up 45% vs PCP excluding foreign exchange movements (30% on an A$ basis). Preparations for operational delivery into Canada now complete with customer negotiations well advanced.

- Rest of World operations generated A$2.6m in revenue, up 568% vs PCP. Growth across active regions has continued to be impressive despite mobility and health restrictions.

- Revenue growth delivered and sustainable profit margins maintained due to the unique Mader business model which is broadly protected from labour market conditions due to our in-house skilled labour and flexible pricing terms on which it is engaged by customers.

- Continued growth in activity levels across the global mining industry and improving personnel mobility levels continue to underpin a positive growth outlook for the business into FY22.

Disc: Held

Mader is on Sale Today!

Mader are on sale today (18/06/21), at 85c shares were down over 7% during intraday trading. What happened? No announcements...I have no idea!

Is this a good opportunity to back up the truck?

What's to like about Mader?

- Forecast earnings growth 18% over next 3 years

- Track record of consistent earnings growth since 2017

- Current PE 9.64

- ROCE 39%

- Future ROE 30%

- PEG 0.6 (cheap!)

- Excellent founder management

- Recent strong insider buying (over 700,000k shares between 85 - 96c) latest by CEO at 96c on 30 April

- Debt/Equity 45%

- Dividend 3.4% fully franked (conservative 34% payout ratio)

What is Mader Worth?

2021 earnings: $19 million/200 million shares x 10.9 (average PE) = $1.04

2022 earnings: $23.7 million/200 million shares x 10.9 = $1.29 ($1.16, discounted at 10% per annum)

2023 earnings: $27.3 million/200 million shares x 10.9 = $1.49 ($1.20, discounted at 10% per annum).

Simply Wall Street DCF valuation = $1.85

Conservative valuation, $1.20/share

Disc: added more shares today (RL)