31/01/23

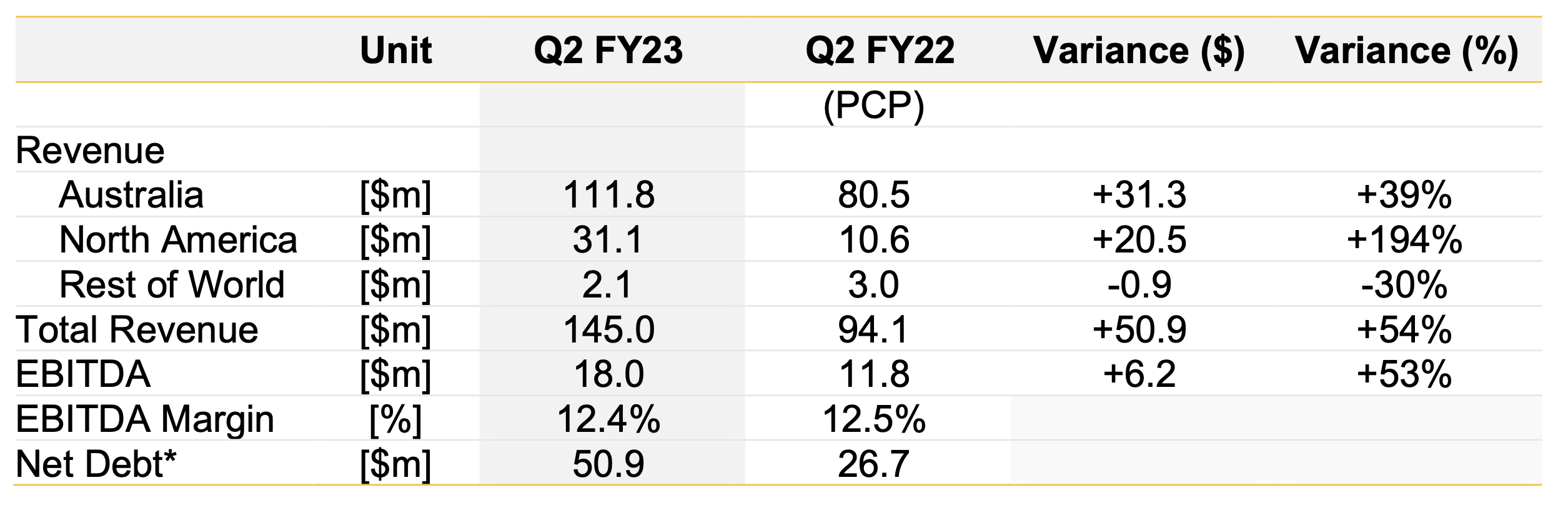

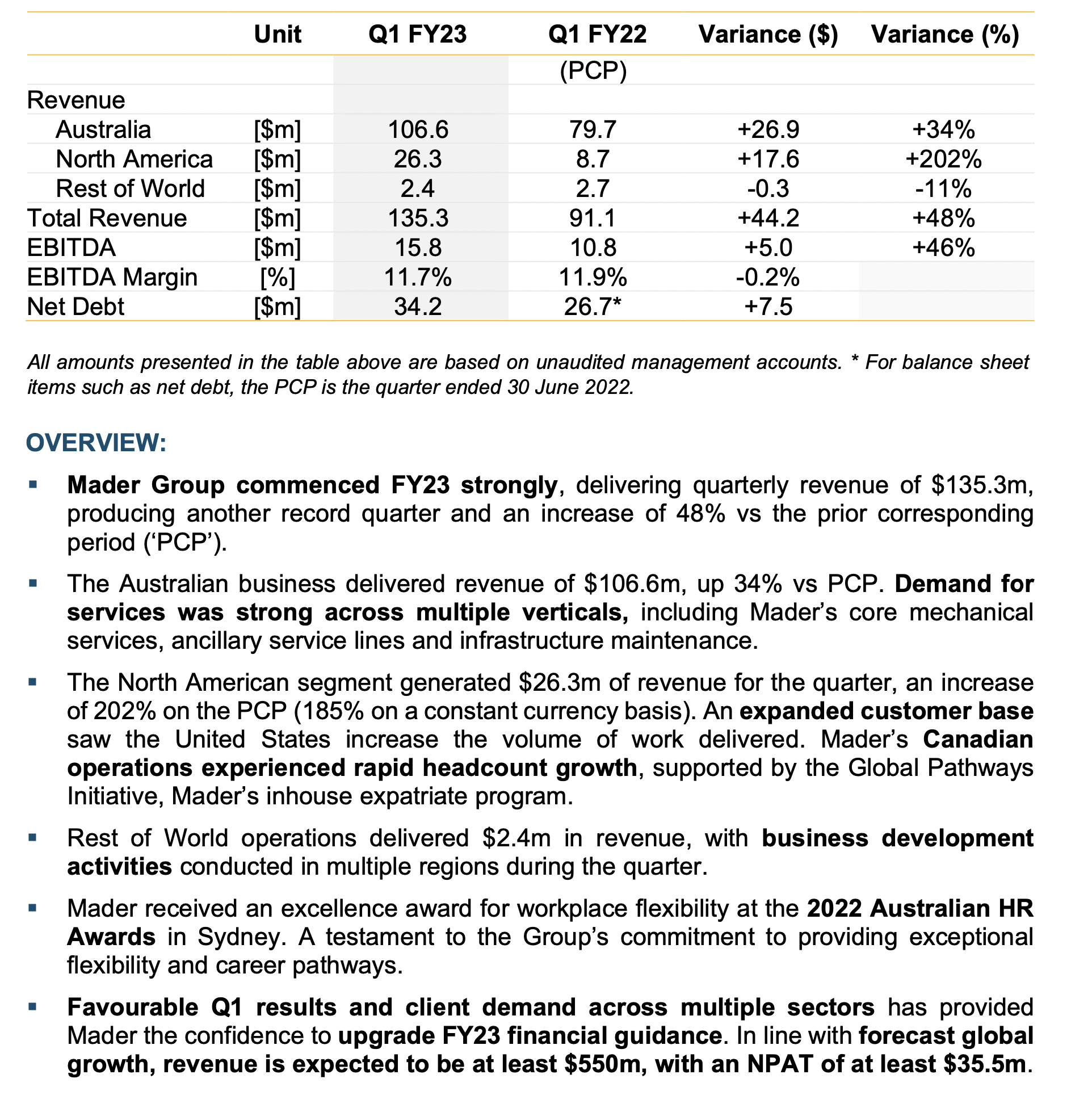

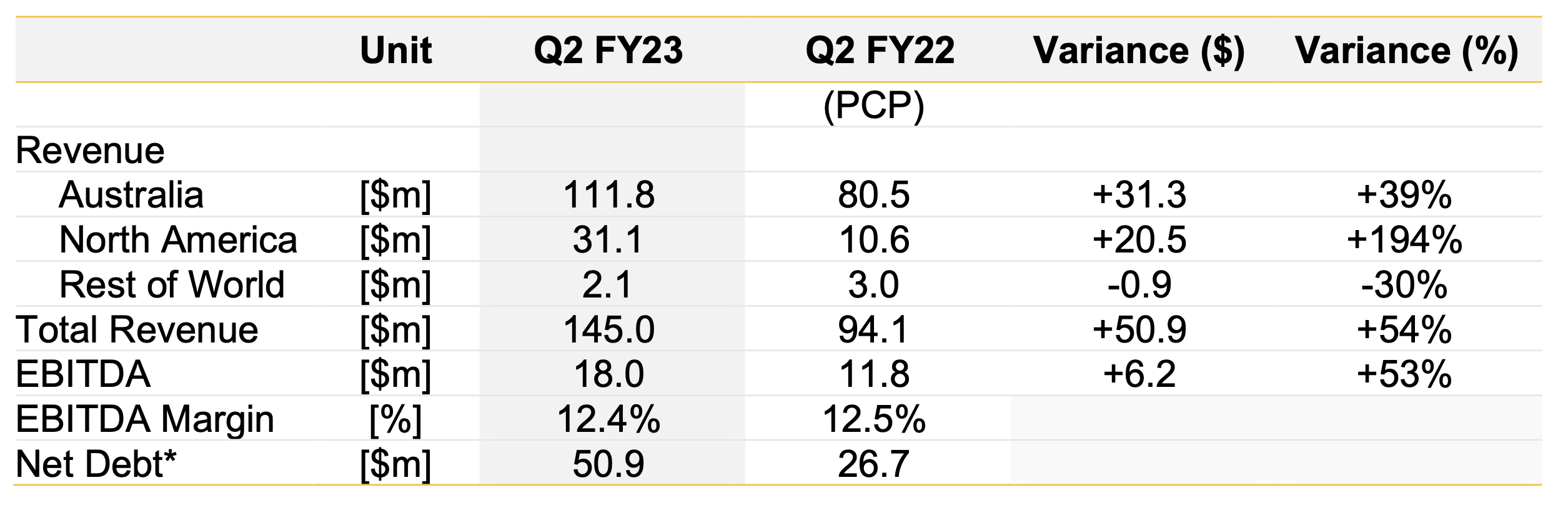

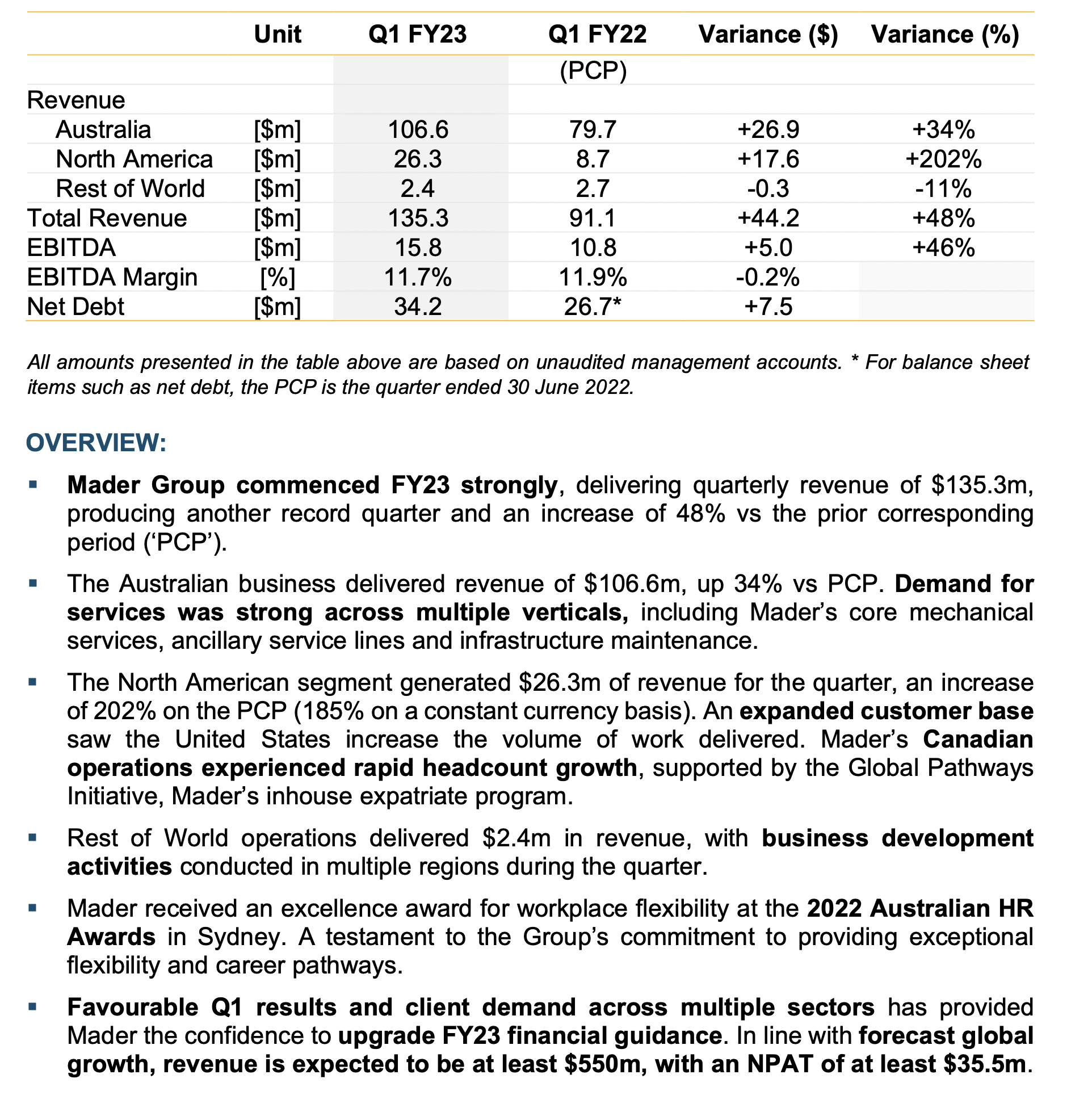

Mader has reported huge increases in revenue:

The NA result has been flagged earlier but really is a very bullish sign that their expansion into a new, and much, much larger Geography shows early signs of delivering outsized future returns.Impressively the Australian business which is much more mature still managed to increase revenue by 39% vs PCP.

Less exciting is the huge increase in debt over the last 12 months.

The explains this in part by the costs from the re-development of the Mader Maintenance Centre which allows them to now chase larger contracts. Also timing of receipts stuff which I take to be a bunch of fluff.

Clearly they are investing for growth and growing very successfully.

With time we should be able to tell how cost effective that is. Hopefully they will disclose a ROIC in the HY summary. If anyone can work it out please let me know!

The share price had run up considerably over the preceding weeks (a bit of a pattern, and has dropped off a few percent following this release)

Held

--------------------------------------------------------------------------------------------------------------------------------------------------------------------

Strong update from Mader here and SP has ticked up in last few days in anticipation.

The standout was the exceptional growth in NA, now representing ~20% of Total Revenue, from ~10% in PCP.

The bull thesis for Mader is that they can reproduce their home-market advantages oversees in the much larger NA market. This update would provide a strong vindication of this thesis. Held IRL (but not enough...

Full report here:

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02587249-6A1117523?access_token=83ff96335c2d45a094df02a206a39ff4

Edit: spelling, Maths