Mader Group just released its Q4 FY23 quarterly update. Just yesterday we talked about the possibility of debt fuelling Mader’s consistent ROE of c. 30%. Well the surprise today is Mader has increased FY23 NPAT guidance to at least $37 million while reducing net debt to $42.7 million. That’s c. 43% net debt on equity, less than the average net debt over the last 5 years. Consensus analysts forecasts are for FY23 NPAT of $38 million. So, the earnings upgrade was anticipated.

Mader just keeps pulling out the surprises. It is reasonably capital light as @Bear77 eluded too. The model hasn’t changed much from when Luke Mader started the business with a ute, a toolbox and a competent diesel mechanic…the key expansion unit!

Disc: No longer held

EXECUTIVE SUMMARY:

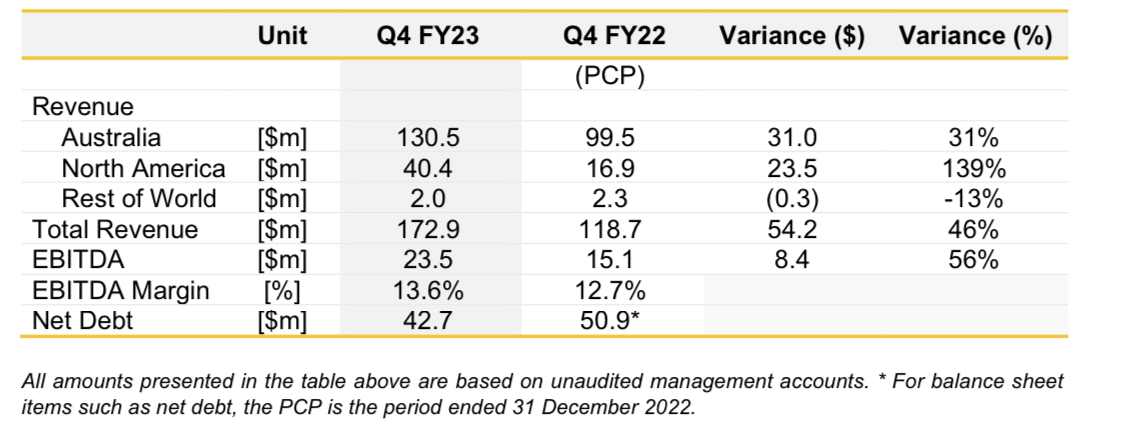

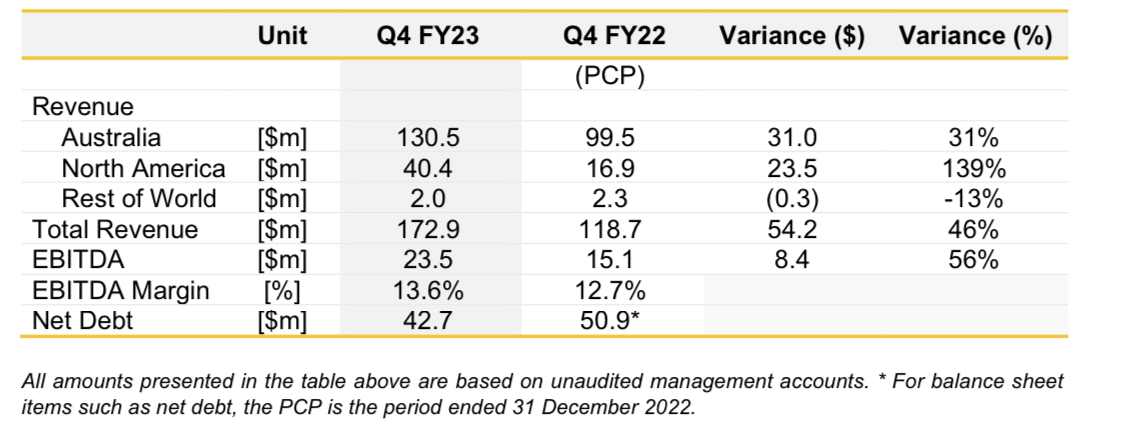

Generating revenue of $172.9m in Q4, Mader delivered another record quarterly performance, an increase of 46% versus the prior corresponding period (‘PCP’) and 11% growth quarter on quarter.

FY23 revenue closed at $608.8m (unaudited), exceeding Mader’s twice-upgraded market guidance of revenue of at least $580m (initially $510m+, upgraded in October 22 to $550m+ and further upgraded in February 23 to $580m+). This represents year on year growth of 51%.

Mader reaffirms its FY23 NPAT will be at least $37m (initially $33m+, upgraded in October 22 to $35.5m+ and further upgraded in February 23 to $37m+). Mader expects to release its audited NPAT results on Tuesday, 22 August 2023.

Customer demand for core services in Australia remained strong, delivering revenue of $130.5m, an increase of 31% vs PCP. Mader continues to experience success in the market penetration of new vertical service offerings.

The North American segment delivered $40.4m of revenue, a 139% increase vs PCP (123% on a constant currency basis). Continued momentum within North America was delivered through expansion into new regions and an expanded customer base.

Net debt closed the financial year at $42.7m (unaudited), a reduction of $8.2m since December 2022 reflecting strong operating cashflows in 2H FY23.