@Bradbury - I have had some success in the Telco sector (not including Telstra) and have found that those smaller Telcos who have a technology bias, such as Macquarie Telecom (MAQ) and good insider ownership tend to outperform. The Tudehope Brothers who run MAQ own 51.2% of the company and MAQ do Cybersecurity and Data Centres as well as Telecommunications.

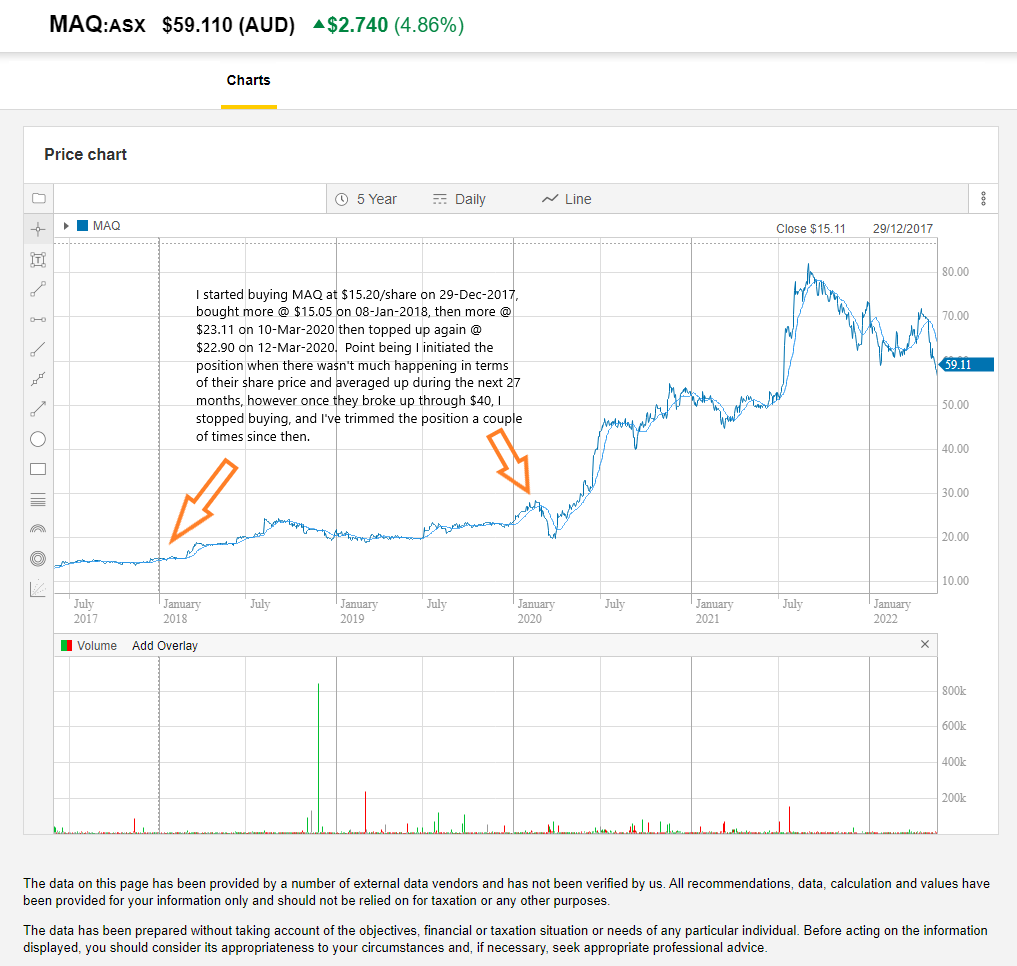

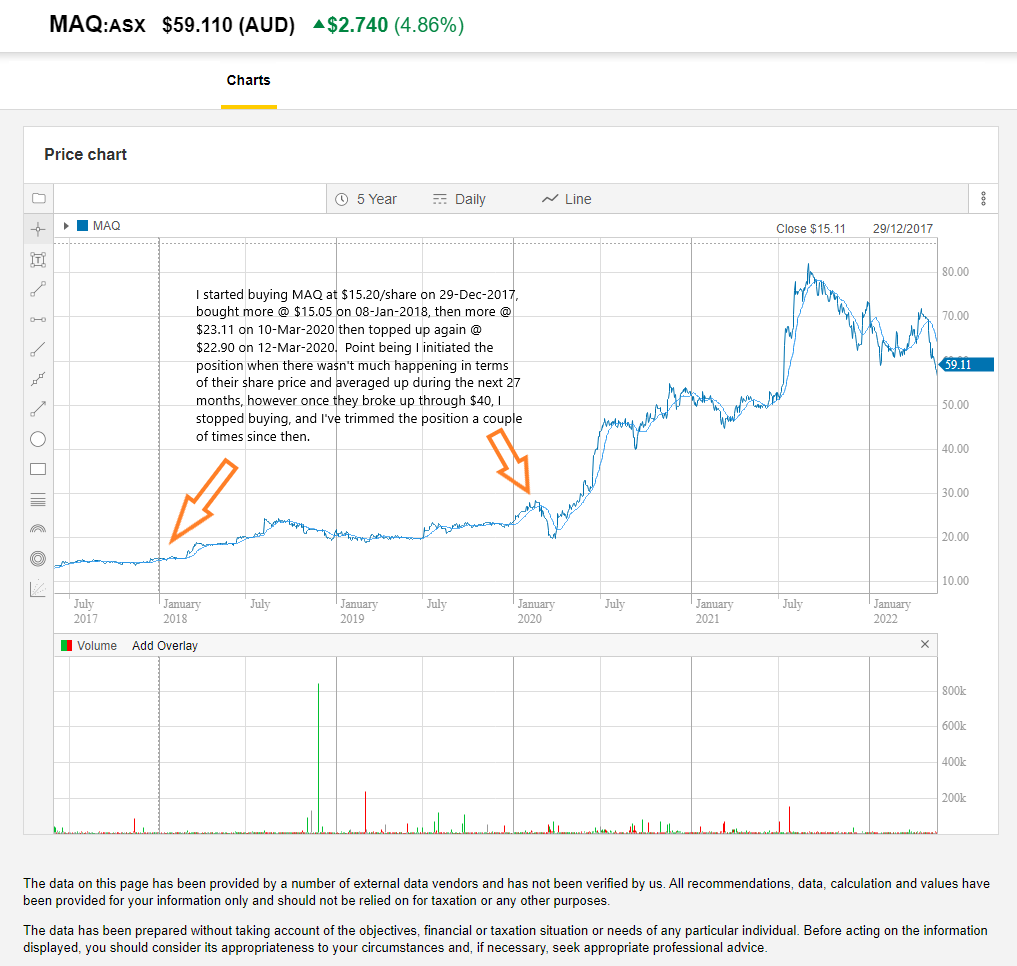

Source: Commsec (edited by me). Click on the chart to make it bigger. The orange arrows point to where I was buying - December 2017/January 2018 and March 2020.

So, as you can see above, I was buying (in the $15 to $23/share range) before they started seriously moving up. Based on management quality, skin in the game, and industry position - and because I liked the sectors they were playing in.

Here on Strawman.com, I added them to my Strawman portfolio in August 2019 @ $21.90/share and doubled down @ $20.76 on 17-Mar-2020.

That's one that worked out OK. Another one is Uniti (UWL), although I sold out before the takeover offer came through so I gave away some of the upside, but I still did pretty well out of my Uniti shareholdings.

Another one that has not turned out OK YET is Swoop (SWP). I started buying at $1.60 to $1.63/share here in August 2021, and they're now $0.64/share. IRL (in real life) I started buying a little later, and bought at prices between $1.27 and $1.30/share, but they're still around half of that level now. I still like Swoop - see here for my explanation on why. That's a thesis that just hasn't played out yet.

Which brings us to Pentanet (5GG). I like that they are concentrating on high speed wireless internet that bypasses the NBN. I like that they have formed WA's own eSports league, Pentanet.GG. I like that they are rolling out NVIDIA's GeForce NOW infrastructure here in Australia (and potentially NZ), starting with Perth and Sydney. I like that they are WA based and they are selling themselves as WA-based to their WA clients, who tend to be quite parochial in terms of supporting their own - they just tend to prefer to have their service providers based there in WA than interstate or overseas.

"GeForce NOW instantly transforms nearly any laptop, desktop, Mac, SHIELD TV, Android device, iPhone, or iPad into a high-performance PC gaming rig, allowing users to seamlessly play the most demanding PC games across their devices."

There's serious money in gaming, and this is a company that could potentially capture some of that market.

I see benefits in that agreement and partnership with NVIDIA - and also some risks. The first is the question of exclusivity - i.e. Pentanet do NOT appear to have an EXCLUSIVE agreement with NVIDIA for Australia (and NZ) - see here: 5GG-capital-raise-presso.pdf

So that's the capital raise presentation from June 2021 when they raised $20M only 5 months after IPO-ing (they floated on the ASX in January 2021). On page 3, under "Use of Funds" there is a line that says: "NVIDIA GeForce NOW expansion & exclusivity $5m". However the relevant slides - on pages 9 to 11 - do not discuss exclusivity, just that NVIDIA have chosen Pentanet to roll out NVIDIA's infrastructure to launch GeForce NOW cloud gaming in Australia. Furthermore, In the "Risks" section on page 14, point 7 says:

7. NVIDIA Pentanet has entered into the NVIDIA GeForce NOW Alliance Partner Agreement (NVIDIA Agreement) with NVIDIA Corporation (NVIDA) dated 25 November 2020 (as amended), pursuant to which Pentanet has the right to purchase up to 72 GeForce NOW(GFN) Game Servers from NVIDIA (or its approved third-party vendors), in a staggered approach. There can be no assurances that the commercialisation of the NVIDIA's gaming PC in the cloud service (GFN Service) will be successful. There is a risk that the GFN Service may not be fully understood by Pentanet’s target markets and that the cost and time required in penetrating these new markets are greater than estimated. These conditions may contribute to the risk that Pentanet is unable to successfully attract sufficient customers to commercialise the GFN Service. There is no guarantee that Pentanet will be granted exclusivity in Australia, for a period or at all. There is also no guarantee that the Company or NVIDIA will be in a position to enable the term of the NVIDIA Agreement to be renewed beyond the initial term of 3 years.

So it seems the agreement runs for 3 years from November 2020 to November 2023 and there is no guarantee it will be renewed. Nor is there a guarantee that Pentanet will be granted exclusivity in Australia, as stated in that paragraph.

It certainly appears that 5GG have NOT been granted exclusivity with regard to NVIDIA's tech, however they have been chosen to do the initial NVIDIA tech roll-out for NVIDIA's GeForce NOW platform and are planning to bundle the NVIDIA GeForce NOW service with their own internet (ISP) service.

The apparent lack of exclusivity does make a difference to the scope of the opportunity. However, I still feel they are in the right space with the right focus to capture a meaningful slice of the gaming market spend in Australia, even if NVIDIA subsequently choose to go with additional service providers in Australia and/or NZ. If NVIDIA was to NOT renew this agreement past that initial 3 year period (i.e. past Nov 2023) then that would be a game-changer, in a bad way. So they (5GG) should be closely monitored.

That slice does not have to be BIG - in terms of the overall gaming spend - to be meaningful and significant to 5GG in terms of revenue. It just has to give their revenue a significant boost and help move them into a profitable position over time.

I get the feeling - particularly from that third line under the "Use of Funds" heading on the right side of page 3 of that CR Presso from June last year that specifically mentions "exclusivity" - that 5GG would like to extend their agreement with NVIDIA and achieve exclusivity - but they don't appear to have achieved that as yet.

So there are big risks. They are very small company. They are not profitable. They operate in a highly competitive space. They do have a great partnership with NVIDIA but it does not appear to be an exclusive agreement for any particular region. It would be better if Pentanet had exclusive rights to roll out NVIDIA's "GeForce NOW" tech throughout Australia (and potentially NZ), and it might well pan out that way, but that is not guaranteed at this point.

So I'm keeping my position appropriately small at this stage, until they get some more runs on the board.

Another thing that attracts me to early stage companies like this is management and board quality and skin in the game - i.e. management's interests aligned with ordinary retail shareholders, so they are less likely to make dumb short-term decisions and more likely to make smart capital allocation decisions that will result in the company being worth more in future years. Here's a little about the Pentanet Board:

https://pentanet.com.au/investor-centre/

David Buckingham, their Non-Executive Chairman is a corporate leader with 30 years of experience in Telecommunications, media, technology, IT and education.

Former Roles:

Navitas Limited (ASX:NVT) – CEO/ CFO

iiNet (was ASX:IIN) – CEO/CFO (2008 to September 2015 when iiNet was acquired by TPG)

David Buckingham is also a Director of Nuheara Ltd, Hiremii Ltd and Openlearning Ltd. Has a Bachelor of Technology (Hons) (LUT) & ACA Chartered Accountant. Mr Buckingham owns 223,500 5GG shares and 3m options.

The MD, Stephen Cornish (left, above) founded Pentanet and Pentanet GG, Western Australia's own eSports league. His brother Tim Cornish (right, above) is also on the 5GG board. Tim is a Chartered Accountant with 20 years domestic and international business expertise in Asia-Pacific and South American engineering and mining service industries.

Stephen owns 50,458,137 shares, or 17.12% of the company, plus 9.9m options. Tim owns 13,471,137 5GG shares (4.57%) plus 6.6m options. Their parents, Peter and Susan Cornish, own 18,269,547 5GG shares (6.2%) – see here: Meet WA’s newest tech multi-millionaire, Pentanet founder Stephen Cornish | The West Australian

Between Stephen’s 17.2%, Tim’s 4.57% and their parents’ 6.2%, the Cornish family own 27.89% of Pentanet.

Another director, Ms Sian Whyte (above) has extensive experience across the legal, leadership, governance, startup and technology sectors. Admitted to the Supreme Court of Western Australia as a lawyer in 2012, she focused in commercial, corporate and taxation law before moving to online social gaming at VGW in 2017. She joined VGW as their first inhouse lawyer and is one of their foundational employees. From founding member of a legal department, Sian expanded into a range of functions and leading the teams in compliance, people and culture, and as a member of the senior executive as Chief of Staff. Ms Whyte does not hold any 5GG shares or options.

Another Director, Mr Dalton Gooding (above) has over 40 years' experience and is currently the senior partner (and a founding partner) of DFK Gooding Partners, where he advises on a range of businesses with emphasis relating to accounting issues, taxation, due diligence, feasibilities and general business advice. He was a Partner at Ernst & Young. He is the Chairman of Katana Capital (ASX:KAT) and a Board member of RAC WA. Mr Gooding holds 3,575,611 5GG shares (1.21% of the company) plus 2.4m options.

So - across the Pentanet Board - we have telco experience, gaming experience, and plenty of general business experience including in media, technology, education, legal, accounting, finance, taxation and governance.

So - upside/reasons to buy:

- New Telco that has carved out a niche in WA, mostly focused on gamers who are after dedicated high-speed internet that is not dependent on the NBN.

- Because they are high-speed wireless ISP, the potential margins are not as limited as they are when having to deal with “nbnCo”.

- No debt, just raised capital (middle of 2021), so well-funded at this point. In their 28-Apr-2022-released quarterly report for the March 2022 Qtr, Pentanet said, “The Company is in a strong financial position with cash reserves of $17 million available to dynamically scale the higher-margin on-net services offered by the Company as it continues to level up Australia’s internet and gaming sectors.”

- Very young company that few people have heard of or are following. I see that as a plus actually.

- The company’s founder, Stephen Cornish, is the MD of the company, and is their largest shareholder (owning 17.12%). If you include his parent’s and his brother’s shares, the Cornish family owns 27.89% of the company, so Pentanet is founder led with significant skin in the game.

- Just over 12 months ago, 5GG’s SP peaked at $1.10/share, and they’ve come right down to below 30cps now. So the hype has come out of the company, and they’ve also been sold down on the tech sell down, or “Growth to Value” shift where unprofitable companies that were previously priced based on potential are now trading at levels that make a lot more sense.

- I've had some success in the telco sector previously, and this one looks like a good opportunity to jump on one at an earlier stage with a significantly smaller position – due to the greater risks.

- This company is also exposed to the computer gaming sector, and e-sports, which are growing fast and becoming very significant, in terms of what serious gamers are willing to spend to improve their experience and performance, and the money involved in e-sports – see here: Global eSports market revenue 2024 | Statista Note: That's not their TAM (total addressable market), their TAM is a LOT smaller than that, that just helps to give a sense of the growth of the sector and the money being spent within it.

Downside/risks/reasons to avoid:

- Execution risk – including acquisition risks – The usual.

- Competition Risk – The usual.

- This is a young company with no solid track record of profitability yet, so…

- Valuation risk – hard to accurately value a company at such an early stage.

- Specific risk related to lack of exclusivity with NVIDIA within Australia.

- Not yet profitable and no clear timeline to achieve profitability.

Potential positive catalysts:

- Continued progress, growth and beating market expectations.

- Positive market updates (upgraded earnings forecasts), and announcements.

- The strengthening of the NVIDIA deal, such as being granted exclusive rights for Australia (and NZ potentially).

- M&A, positive strategic and earnings accretive acquisitions, or if a company like Uniti or Swoop try to acquire Pentanet, which is always a possibility.

- Increased Broker and Analyst coverage.

- Achieving profitability.

- Eventually, declaring and paying dividends.

Disclosure: I hold shares in SWP and 5GG currently both IRL and here, and I have exited UWL, however I reserve the right to sell out at any time, without notice, and without updating this forum thread (I will, if I remember, but I may forget to do so).

5GG-Company-Presentation.PDF

5GG-Quarterly-ActivitiesAppendix-4C-Cash-Flow-Report.PDF