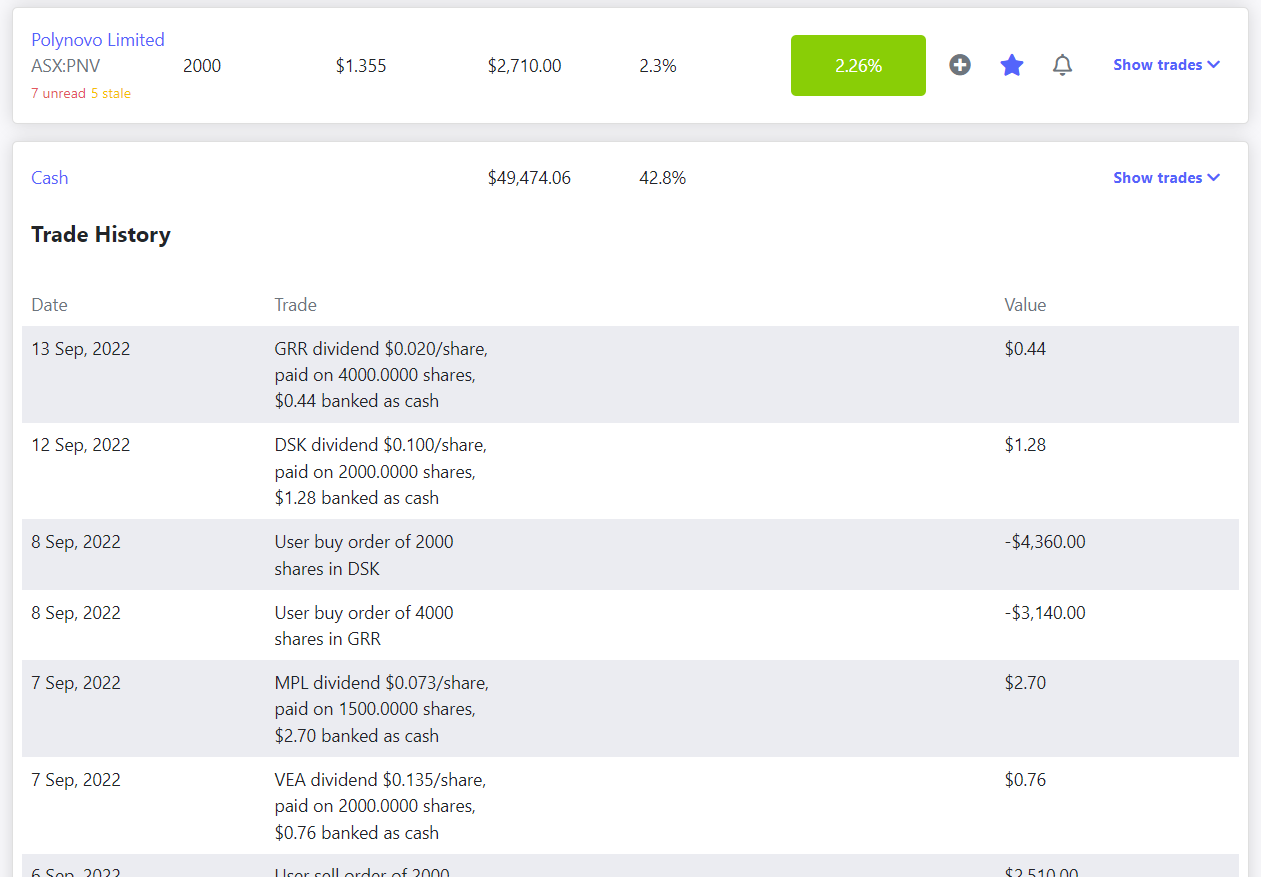

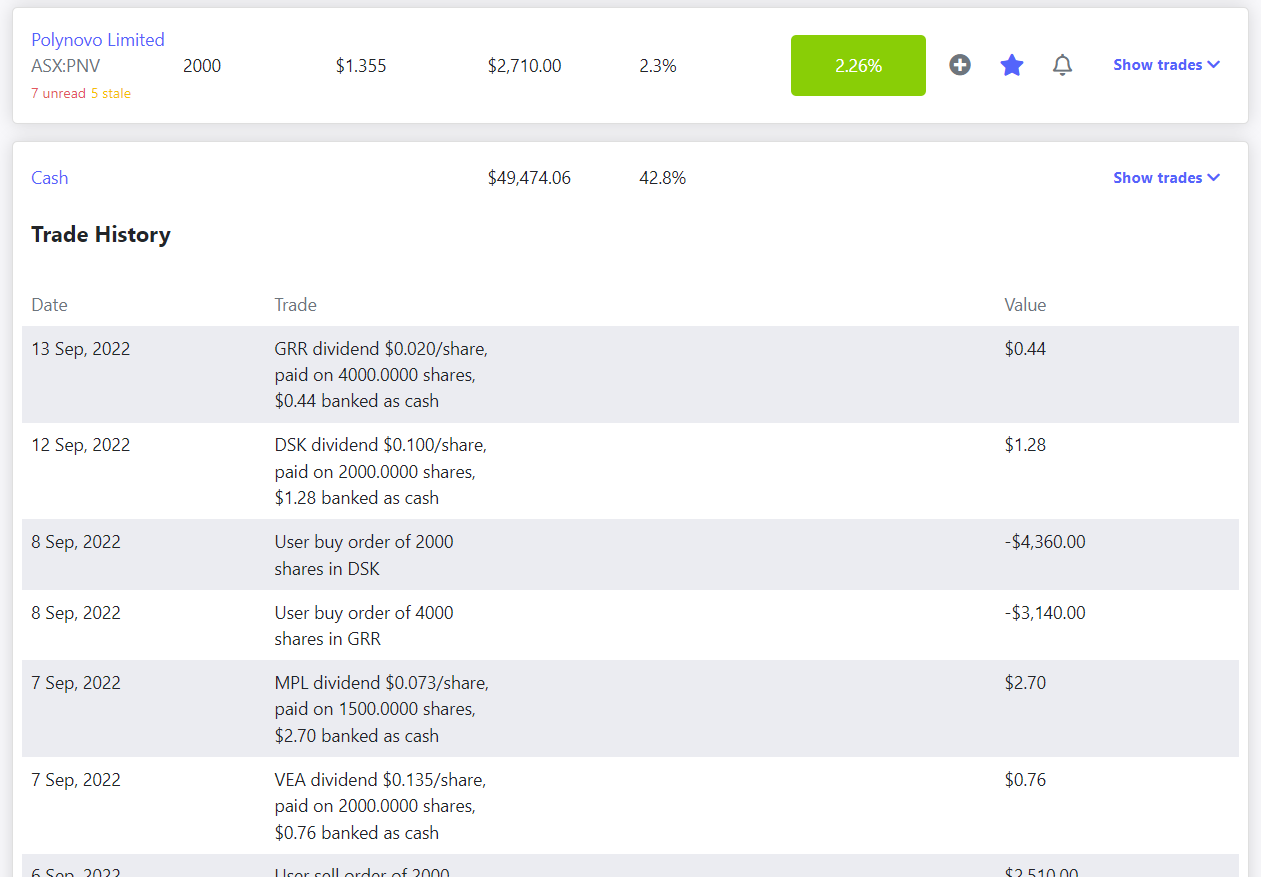

It can be easy to miss these dividends when they are automatically reinvested (as they always are here on SM) @raymon68 however, if you scroll down to the bottom of your portfolio and click on "Show trades" besides "Cash" (which is always the last line of everyone's portfolio), you'll see this:

You can see there that there was 44 cents cash added to your cash balance on the same date (13 Sep, when they went ex-div; i.e. the divs are always calculated and added to your account on the day they go ex-div, so much faster than in real life). That 44c was the balance of the $80 div (4000 x 2c) after the maximum shares had been bought with that $80 (i.e. 102 new GRR shares @ 78c/share = $79.56, left 44c change, added to your cash balance).

I find that looking through my Cash "Show Trades" list is a good way to check that all the dividends have been paid on the right days here. The only time that doesn't work would be when the amount paid is exactly divisable by the closing share price on the ex-div day in which case there would be NO cash left over and no transaction would appear in your "Cash Trades" list - you would instead just get the extra shares added to the respective shareholding. That rarely happens however, so over 95% of dividends can be tracked through "Show Trades" alongside "Cash".

I would personally much prefer just to receive cash, as I do in real life, or at least have the option of choosing either all DRP or all cash, whether for the entire portfolio or for each position. In real life, the extra capital gains calculations that are usually involved when you finally sell a holding in which there has been a lot of reinvested dividends is a total pain, plus I much prefer to generate income from my holdings and choose when I want to invest that income, where I want to invest it, and at what price, rather than have the market choose a price at which my dividends are automatically reinvested, but it is what it is.

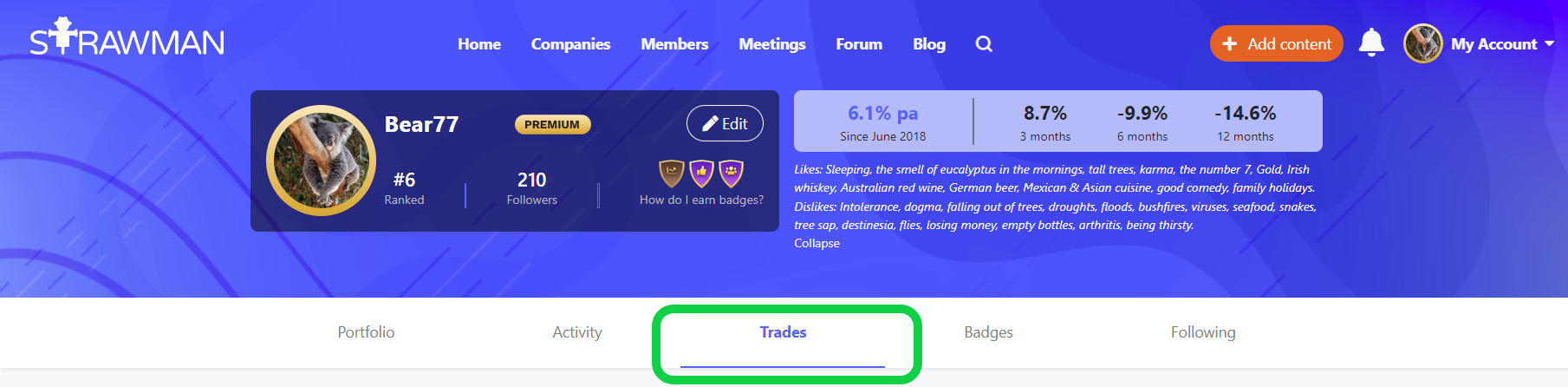

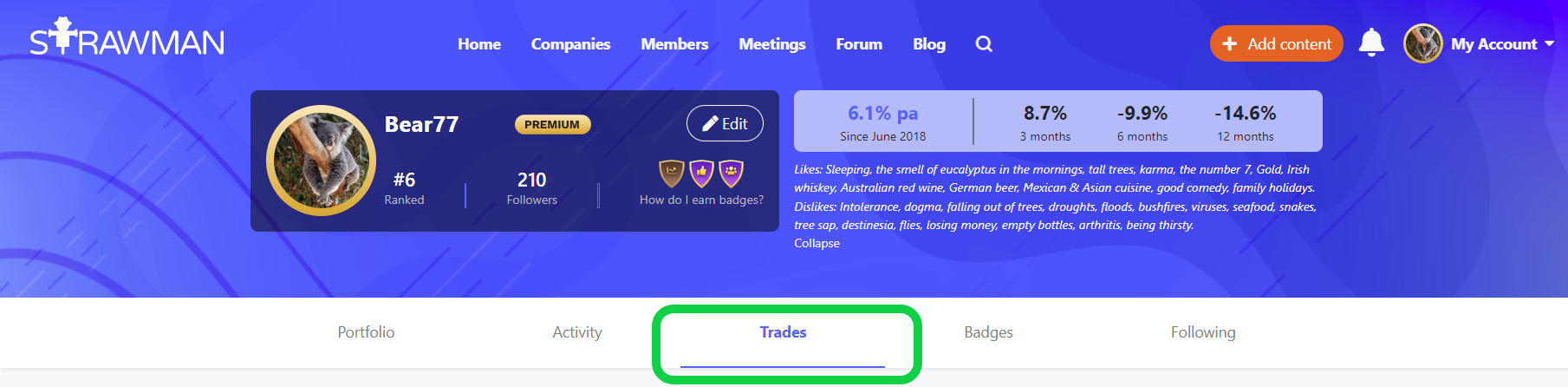

Edit: Additional: Of course, if you click on the "Trades" button above your portfolio in your "My Profile" page of the site, you'll get the full list of ALL trades including all dividends that have been reinvested for you.

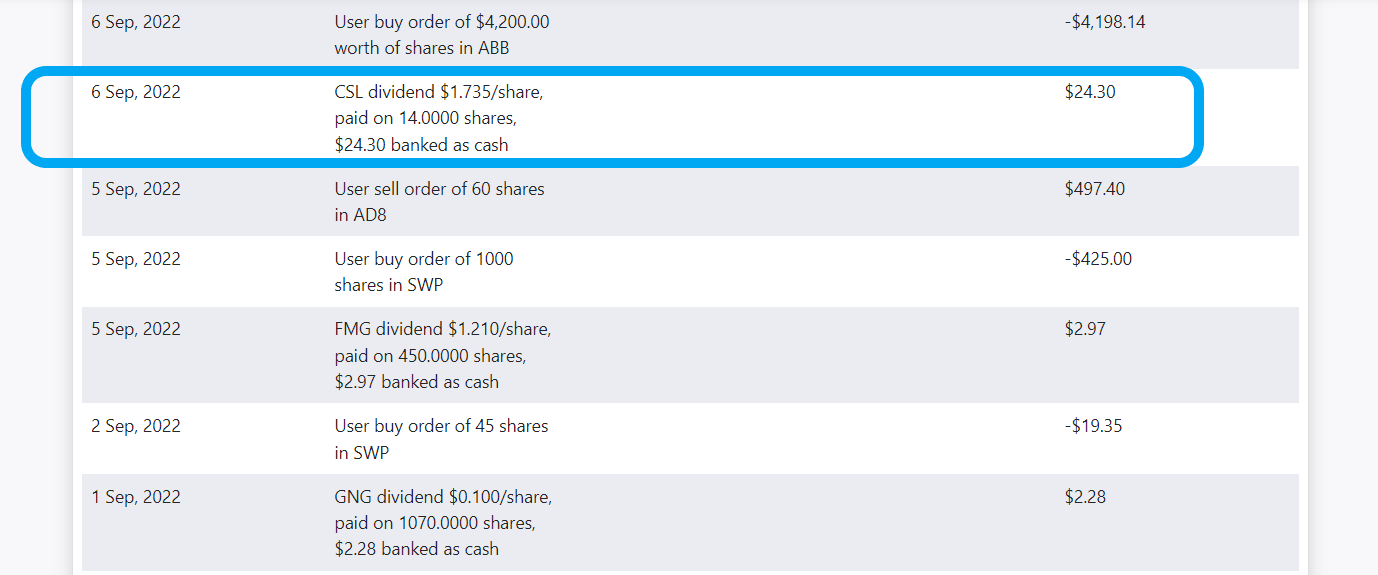

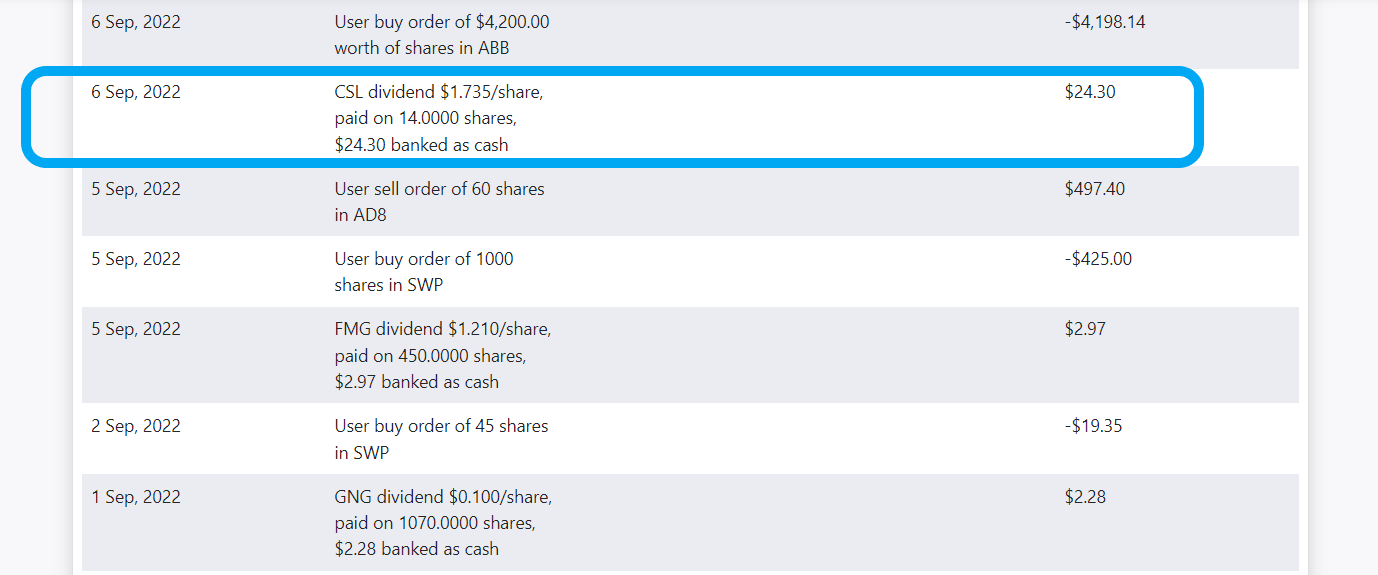

The only time THAT won't list a dividend would be if the total value of the dividend paid is less than the value of a single share of the company. That actually DOES happen by the way. It happened to me recently with CSL.

So I only hold 14 CSL shares here, so the whopping $24.30 that earned me in dividends this month wasn't enough to buy any CSL shares (they closed at $294/share that afternoon), so that one only shows up in the "Cash" transaction list, not in my "Trades" list. So I guess what I'm saying is that if you check your "Trades" list AND your "Cash" transaction list, you'll get to see ALL dividends paid to your virtual Strawman.com account.

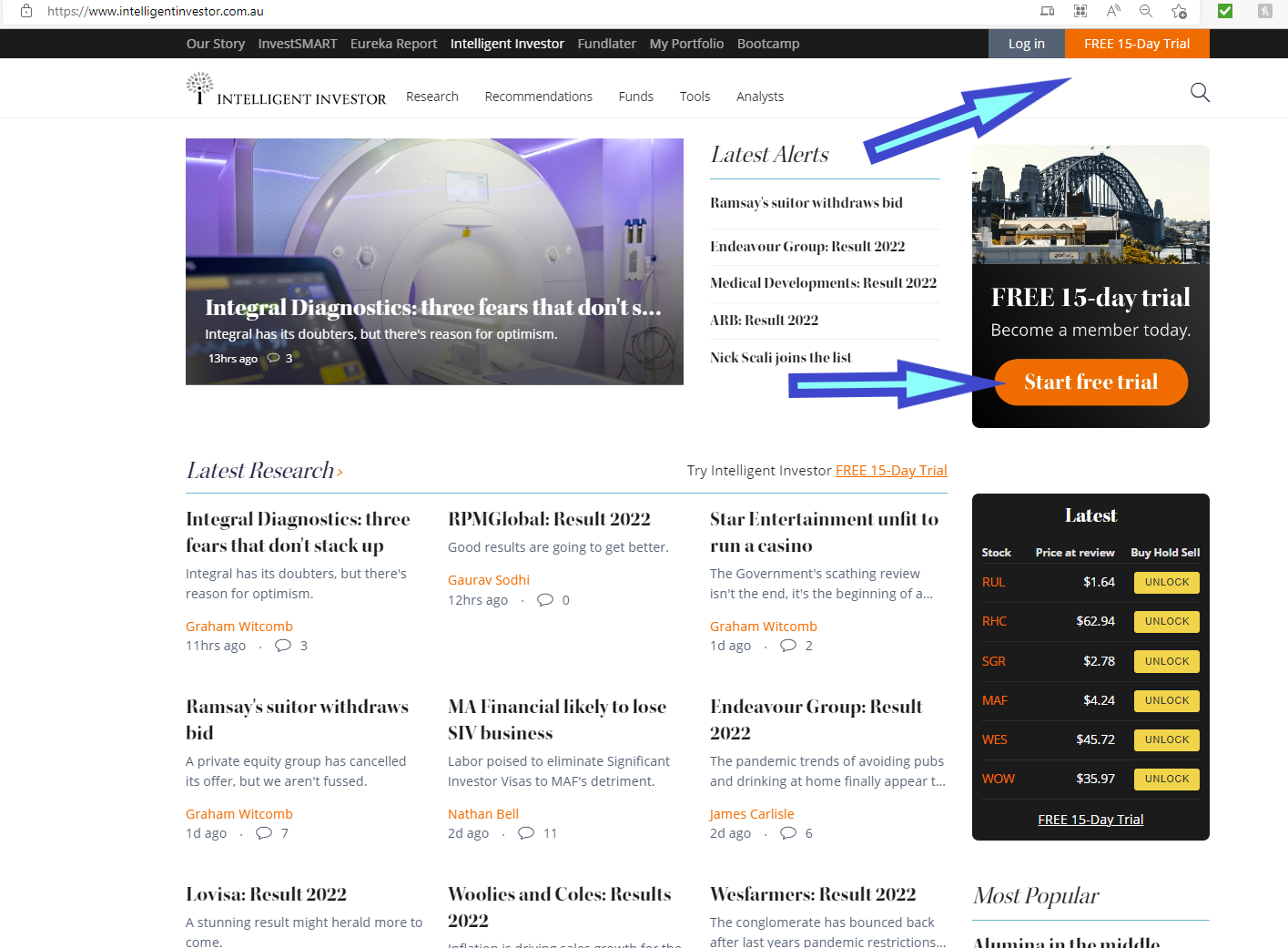

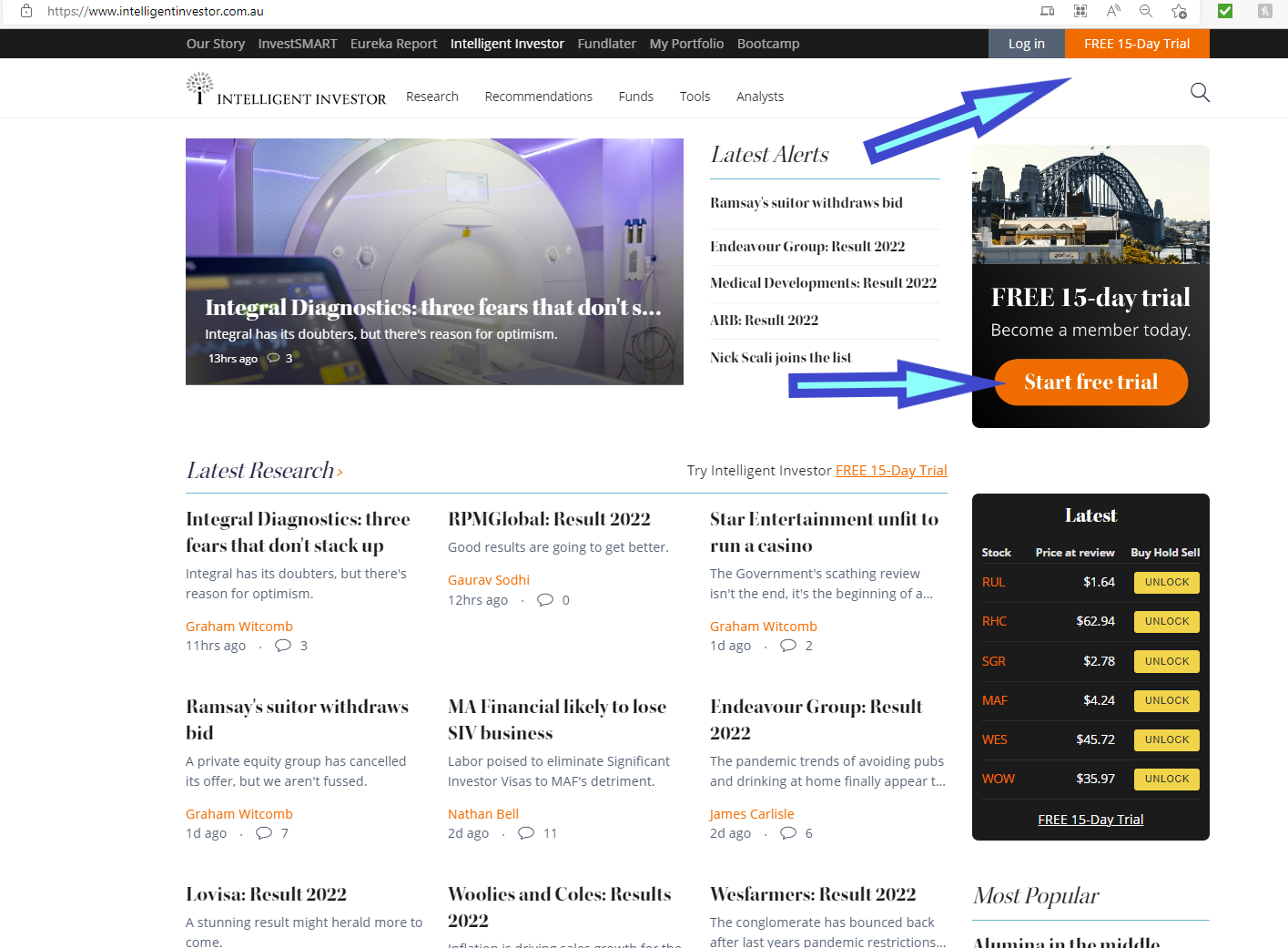

By the way, on a totally unrelated topic, I watched the recording of Andrew's talk with Gaurav earlier today, and have just recently (in the past half hour) converted my Intelligent Investor (II) free trial into a paid 12 month subscription (with an extra month added by the site for free) for $880. Money well spent I believe. I know we get quite a few ideas off Gaurav when he's on "The Call", but the quality of the reports available through II are excellent, particularly Gaurav's work. For those who feel they could benefit from it, I would encourage you to at least give the free trial a go - here: Intelligent Investor

Plain Text Link: https://www.intelligentinvestor.com.au/

There's an orange "Free 15-Day Trial" button that's unmissable. In fact there's TWO of them:

And they don't ask you for any credit card details at all unless you later decide to join as a paid subscriber as I did earlier this evening.

I was previously a subscriber in 2016, but the quality of the analysis looks even better to me now.

You can get a rough idea from that screen shot of part of their home page - of what they cover - but if you sign up for the free 15-day trial you get to see the actual reports - which I definitely found useful. These subscription services aren't for everybody, like perhaps less suitable for those who are very time-poor I guess, but the good thing about II is that they email you when they release a new report so if you're interested you click on the link and view the report, or you can ignore it if you're not interested, which suits me, as I don't tend to have enough time to wade through a lot of stuff looking for stuff that interests me, and I'm finding as I get older that more and more companies - and sectors - just don't interest me any more, or at least I guess I'm getting more choosy about where I spend my research time, and on what. There just don't seem to be the hours in each day that there used to be.

So, yeah, I think this one will provide me with value. As Strawman.com does, of course.