Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

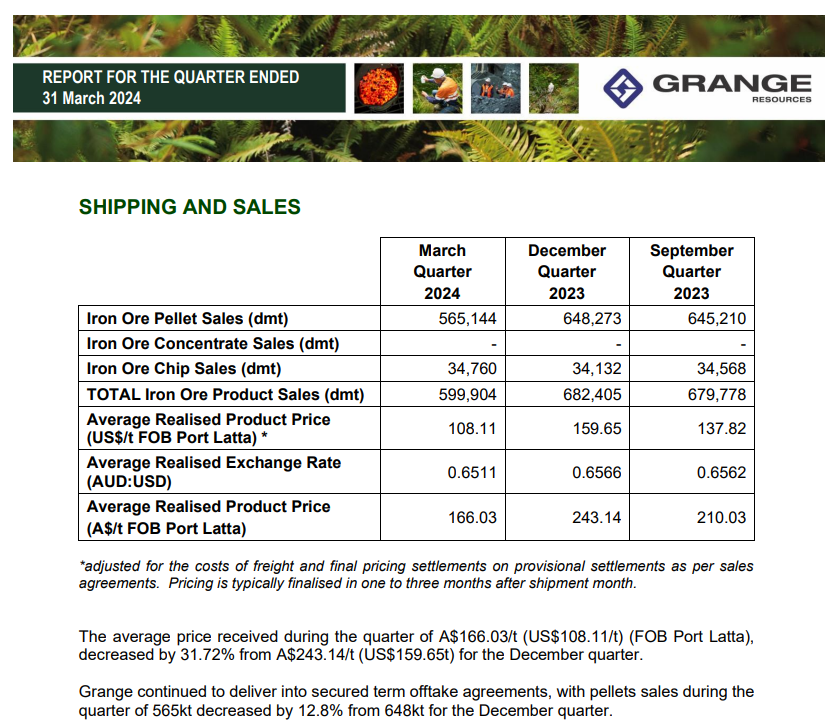

Price Taker! = Average received prices for the quarter dropped to US$108.11/t (A$166.03/t)* (FOB Port Latta) compared with US$159.65/t (A$243.14/t for the December quarter).

Cash and liquid investments of A$271.96 million and trade receivables of A$30.37* million compared with cash and liquid investments of A$282.61 million and trade payables of A$57.73* million for the December quarter. A dividend of $23.47 million was paid during the March quarter.

Iron Ore - Price - Chart - Historical Data - News (tradingeconomics.com)

Iron turned up to USD $109. Look for the SMA50 to Break up through the SMA 200

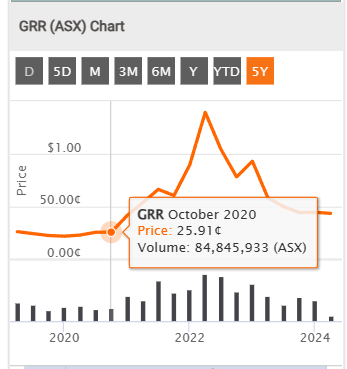

Return (inc div) 1yr: -33.65% 3yr: 4.03% pa 5yr: 21.33% pa

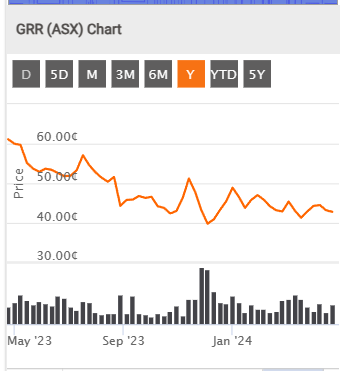

Chart 1yr look

5Year below:

Watching Developments. The Fe market is very cyclical.

Not Held.

Cash and liquid investments of A$242.34 million and trade receivables of A$43.20* million compared with cash and liquid investments of A$279.29 million and trade payables of A$66.69* million for the March quarter.

Cash and liquid investments decrease was largely due to negative final settlement adjustments due to decreased iron ore prices in April and income tax instalment paid in June.

The average A$ price received during the quarter of A$160.62/t (US$108.12t) (FOB Port Latta), decreased by 29.53% from A$227.93/t (US$156.21/t) for the March quarter.

History of Dividends..

Director: Mike Dontschuk. He / Director could see some value here

Number acquired 10,000 Fully Paid Ordinary Shares.

consideration details and estimated valuation: $5,700

GRR published its annual Mineral Resources and Reserves update for Savage River, with little a 6.4Mt decrease in Ore Reserves the only notable change, of which about 2.5Mt would be attributed to mining, the balance resource modelling. Not good, but not materially value impacting.

The Definitive Feasibility Study for underground mining also due out this month and of more interest is still on going (in progress). The delay is also a bit of a disappointment but the current price doesn’t factor anything in for this potential project yet so again, not value impacting.

No change on valuation

Disc: Hold in RL + SM

Time to review my investment thesis and value Grangere Resources (GRR) having held for 20 months and seen a price range of 60c to $1.75. Also, the annual resource update and feasibility study for the Southdown Magnetite Project are due out at the end of the month, both price sensitive information. Note I assume an FX rate of $0.75 AUD:USD for all that follows (it’s my base case long term ave for FX).

Investment Thesis

GRR produces 2.5mtpa of Magnetite which is high grade iron ore (65%+ Fe fines) attracting a premium for it’s quality, so despite relatively high production cost of around A$100-120/t it is cash positive when index iron ore prices are US$61+ and generates US$2.5m in positive cash from current operations for each $1 over that price (which is currently US$120). Prices are unlikely to maintain an average at current levels but are likely to be above GRR’s break even. Hence low downside risk with strong upside return potential if prices spike or remain elevated. In addition, A$300m ($0.26/share) of cash on hand also provides a nice safety net.

On top of this are the opportunities yet to be developed which are currently undergoing further feasibility studies (ie back of the envelope they look good, but they need some hard numbers to confirm it). First there is the North Pit Underground Development – same site but instead of open cut like current operations, this would be a tunnel (no costly overburden to remove, but technically more complicated than just digging a hole). There are no indications of cost to extract only that it offers 6mtpa for 10 years+ potential output. Second there is the Southdown Magnetite Project in Albany WA which they have just secured 100% control of (note a cash consideration is mentioned for the 30% they are buying but I couldn’t find an amount – TBA???) and which offers 5mtpa of 69.5% Fe Fines for a very long time (28+50yrs).

So, we have current profitable operations that under pin cash flows, a heap of cash and opportunities to grow production to 5x current levels… sounds good, but at what price?

Value and Valuation

The current price of A$0.70 a share would be about fair value for just the current operations if GRR received an average price of US$100/t for it’s 65%+ Fe Fines, which would occur when the benchmark iron ore price (62% Fe Fines) is around US$80/t. Given commodity price volatility it is reasonable that the market needs a margin of safety. But this is just on current operations which produce 2.5mtpa, so indicates the market has no value for operations under development.

Unfortunately, we have not been provided any details on the likely economics of either the North Pit Underground Development or the Southdown Magnetite Project. However, I expect the cash cost per tonne will be similar if not better than current operations (A$100-A$120) because of scale benefits in both cases. Cost to develop is unlikely to large for the North Pit Underground Development (existing site & no overburden), but may be for setting up a new sit of operation for the Southdown Magnetite Project. However the long life of this second project will provide more opportunity to defuse these costs over the life of the operations to provide economic extraction values.

So in estimating a value we have a big invested capital unknown, also start dates for production are unknown, on top of production costs… Little wonder the market provides no value for these projects, but it’s unlikely they are worthless.

What could it be worth? If we assume some production starts in FY24 (2mtpa) building to FY28 (10mtpa) and allow similar operating cash and non-cash costs plus 25m in other costs a year and only take half the terminal value in FY31 we get a base case value of $0.85/share (US$100 65% Fe Fine ore price), which is more than the current share price.

Bold assumptions possibly, but here are a range of outcomes for different iron ore prices:

Things that may or may not be important:

· China connection: There is strong Chinese ownership and control elements, which may help or hinder if issues arise. All iron ore miners have either direct or indirect geopolitical risk when it comes to China, so it’s an unavoidable exposure for this industry.

· Leadership: I would describe the board as quite insular and tight, shareholder communication is light, board remuneration is “healthy” but not unreasonable given results but I would prefer to see more skin in the game. Experience seems good, but may be tested as they move into new underground operations and the development of a new site.

· Jiangsu Shagang Group: “China’s largest private steel company” owns 48% of the company (aka above mentioned China based control) and is a related party with a long term off-take agreement for 1mtpa until 2032 (40% of production). It maybe good to have a customer locked in, but the use of market pricing and the timing of that pricing may be a bit selective in volatile markets… They will also have an off-take agreement on the Southdown Magnetite project of 30% of it’s production (12 Dec 2022 media release).

I have been far to passive on my GRR holding, missing a chance to cash out, but despite buying at higher prices, dividends have netted positive returns. It will move violently with the iron ore price so I believe there will be more opportunities to top up at lower prices and sell at higher. I am just trying to decide if I top up prior to announcements due at the end of March, the current price looks good but a few bad days for iron ore prices may drop the price to 60c…

Disc: Hold in RL + SM

Hi Strawman team,

The GRR went Ex- Dividend on the 13th Sept 2022:

My GRR holding hasn't been updated yet. The 0.02cps dividend?

Regards.

9/9/22 - Fe has ticked up above the $100 to $100.1 ( range $86 to $100 M to M )

Supply vs Demand

Ex-dividend 13/9/22

Got some shares here ..will see how these trade. Risk is the Fe market price is below $100 and could trend lower.