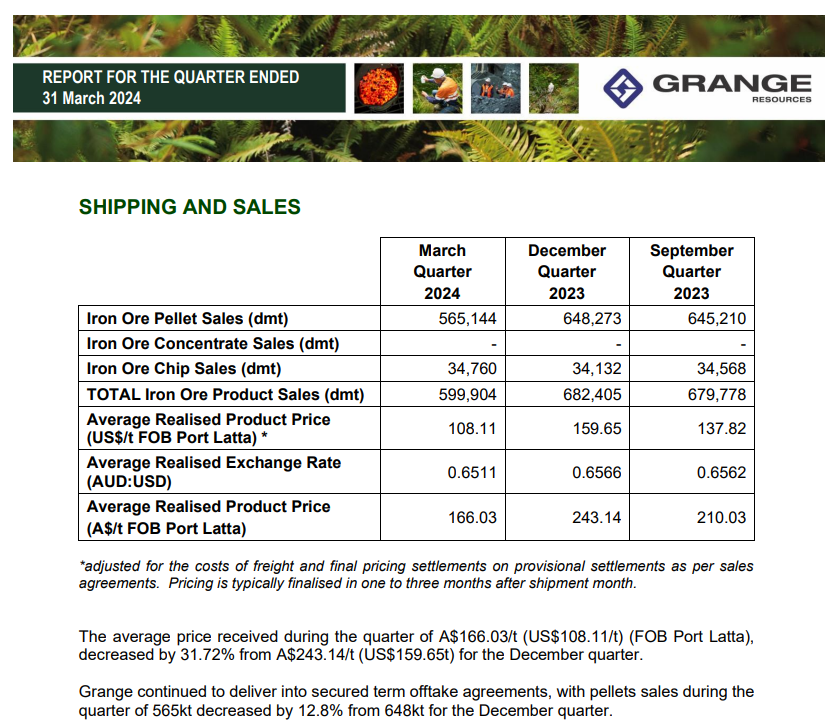

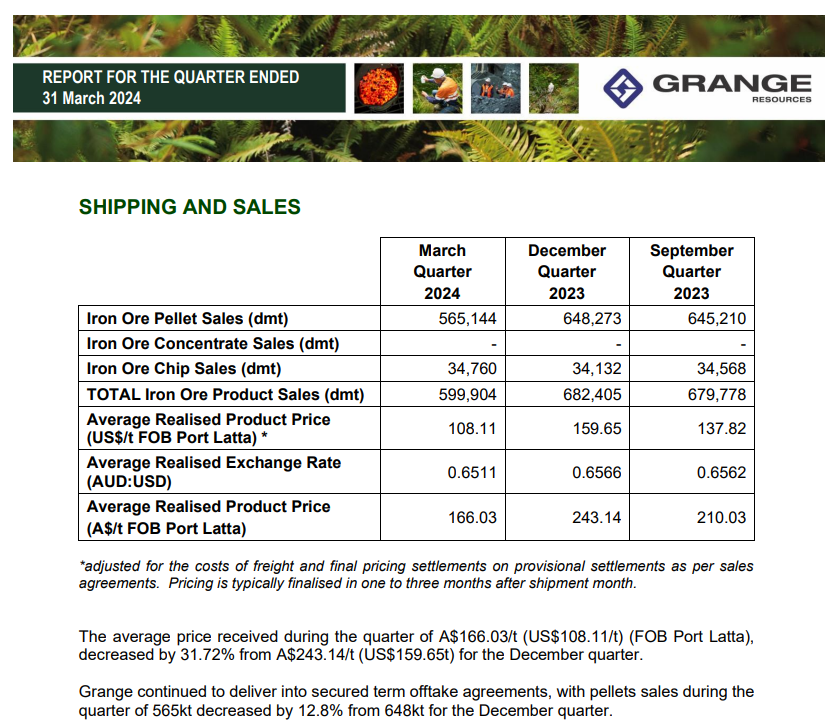

Price Taker! = Average received prices for the quarter dropped to US$108.11/t (A$166.03/t)* (FOB Port Latta) compared with US$159.65/t (A$243.14/t for the December quarter).

Cash and liquid investments of A$271.96 million and trade receivables of A$30.37* million compared with cash and liquid investments of A$282.61 million and trade payables of A$57.73* million for the December quarter. A dividend of $23.47 million was paid during the March quarter.

Iron Ore - Price - Chart - Historical Data - News (tradingeconomics.com)

Iron turned up to USD $109. Look for the SMA50 to Break up through the SMA 200

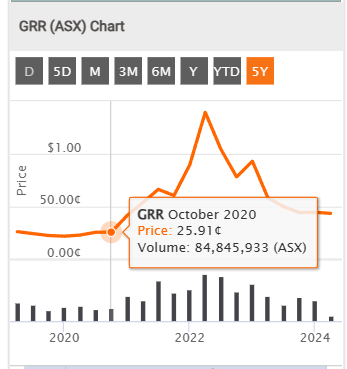

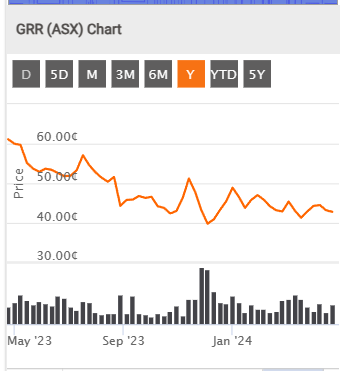

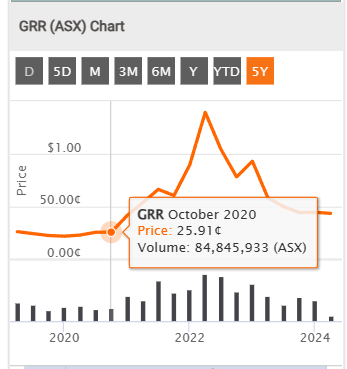

Return (inc div) 1yr: -33.65% 3yr: 4.03% pa 5yr: 21.33% pa

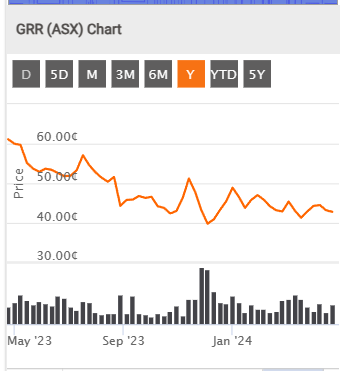

Chart 1yr look

5Year below:

Watching Developments. The Fe market is very cyclical.

Not Held.