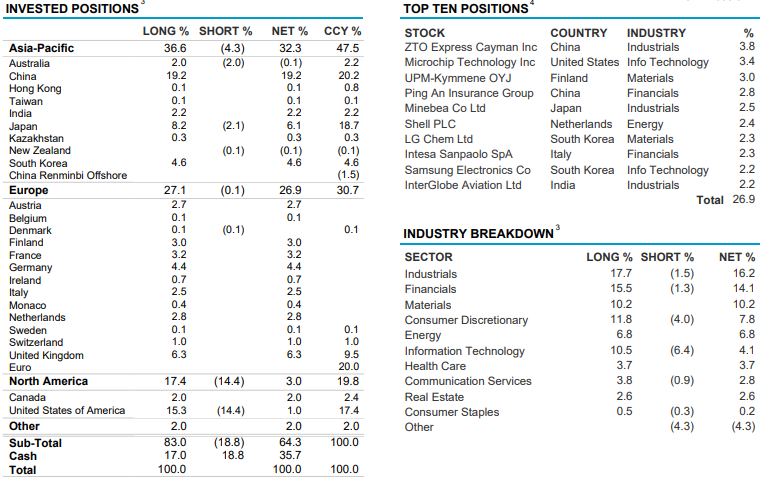

I hold some Platinum international fund. Currently have a large cash weighting, along with decent sized short book, mostly against US tech.

Whilst they could be considered 'defensive', their track record show's historically they have beat the market pretty handily when the US market has underperformed. I agree with their investing philosophy, the way they see markets & it is not something I can replicate easily via ETF's or my brokerage account.

To be contrarian:

Perhaps you should have done this 16-12 months ago when defensive assets were cheaply valued. No everyone is thinking of this, it might be the worst time to move into defensive assets.

Perhaps you should consider looking for an actively managed growth fund that you could DCA into over the next 6-12 moths, as these assets will be unattractive to the market, over that timeframe, but may outperform over the medium term?

Usual caveats re timeframes, personal situations et etc DYOR etc etc.

Just something to think about.

Hey folks,

Giving the current market conditions (potential recession + inflation + likely deleveraging), I'm thinking it might be worth looking at finding a defensive asset manager. Returns are good, but probably more important is not losing capital, preferably after inflation.

What options are people aware of? The ones I am aware of are:

Oaktree Capital (Howard Marks)

Bridgewater Associates (Think this is Ray Dalio)

Platinum (I don't know much about these guys)

Koda Capital (I don't know much about these guys either, except they have sounded like a good defensive manager on podcasts).