Thanks to @Madwinemaker for helping to arrange the meeting with EchoIQ

It takes oodles of R&D to make it to commercialisation (it looks like EIQ has >$27m in accumulated losses) and they've been working on this tech for years. That's par for the course for this kind of business, but it appears they've passed some key milestones and are at an interesting juncture.

It all depends on how well the commercialisation goes. Even under a best case, it will likely take a few years to build any material sales momentum. As Philip said, you are dealing with very slow moving sales cycles and very conservative customers.

And I do think a cap raise is a certainty at some stage -- even if commercialisation goes well. A growing business usually takes more resources, and they're also continuing to develop new products. (But that's not a bad thing if they're able to get a good ROI on any fresh funds raised.)

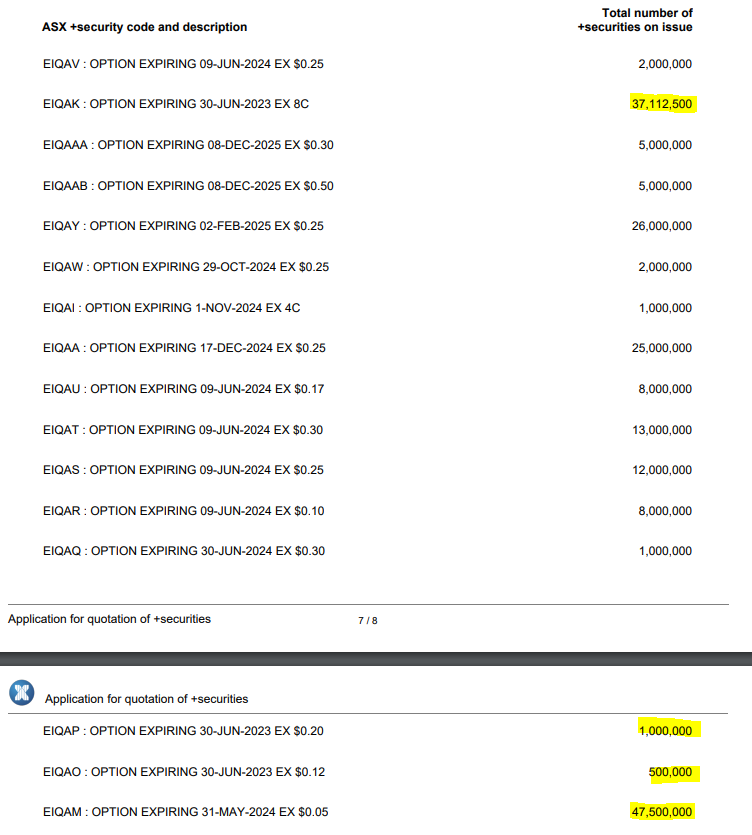

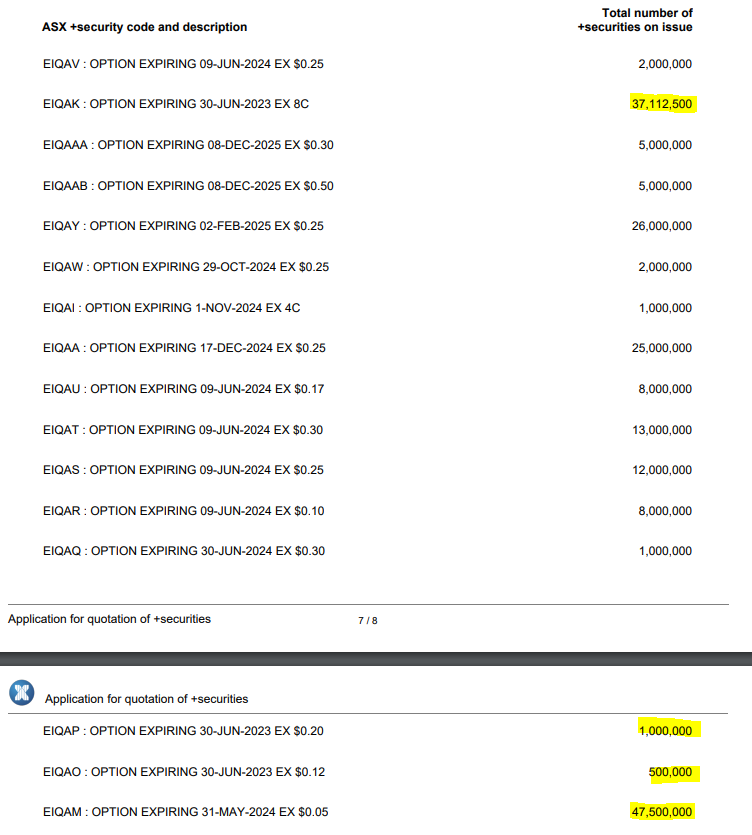

It looks like there are around 85m options due to expire this year that are in the money. That could raise a further $5m or so, but with 455m shares currently on issue (300k of which just came out of voluntary escrow), you're looking at some decent dilution.

Of course, there's undoubtedly a huge potential market, and as a software product it has the potential for high margins and good operating leverage. They seem to have a strong bench in terms of the C-suite and Board too.

Definitely worth keeping an eye on, but i'll be waiting to see some good adoption of their EchoSolv product before buying.