Well @McGhee I haven't looked into them previously, but we have their website and their company presentations to help us. Firstly, here are the industries they target: https://www.duratec.com.au/industries/

Here are some of their projects: https://www.duratec.com.au/projects/

Here is their latest update to the market: MINING--INDUSTRIAL-SEGMENT-UPDATE.PDF [8-Feb-2023]

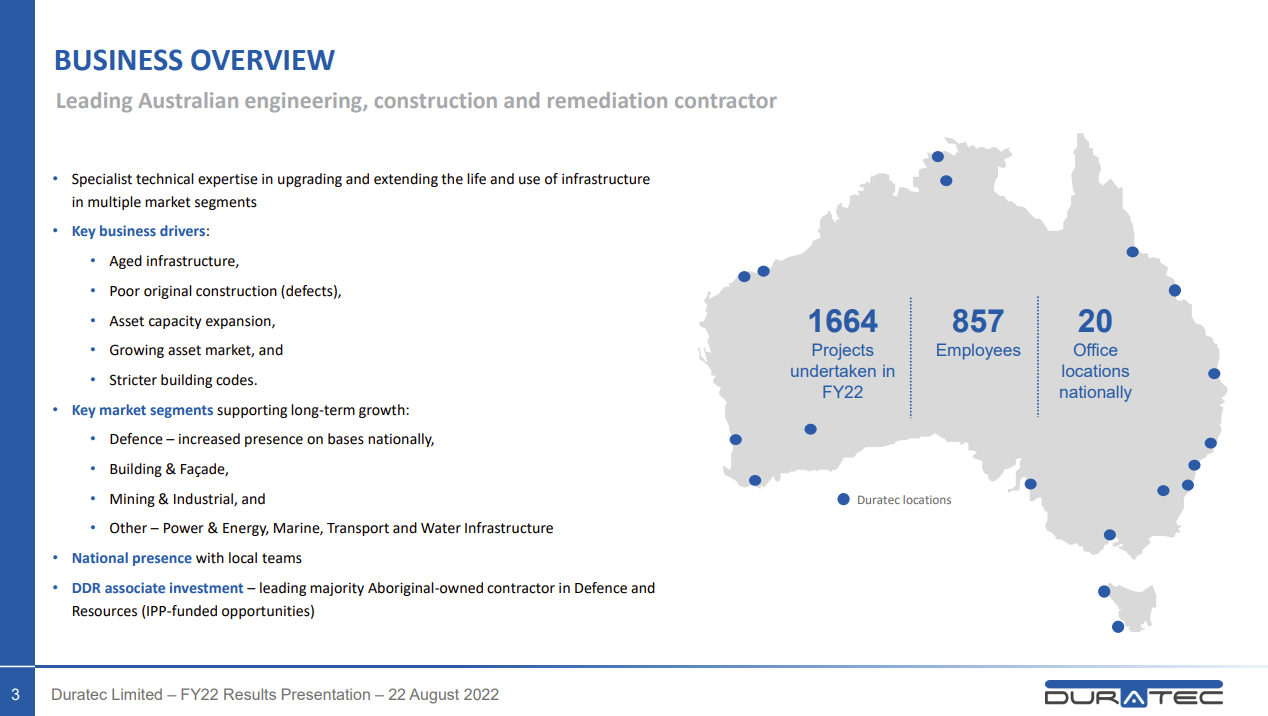

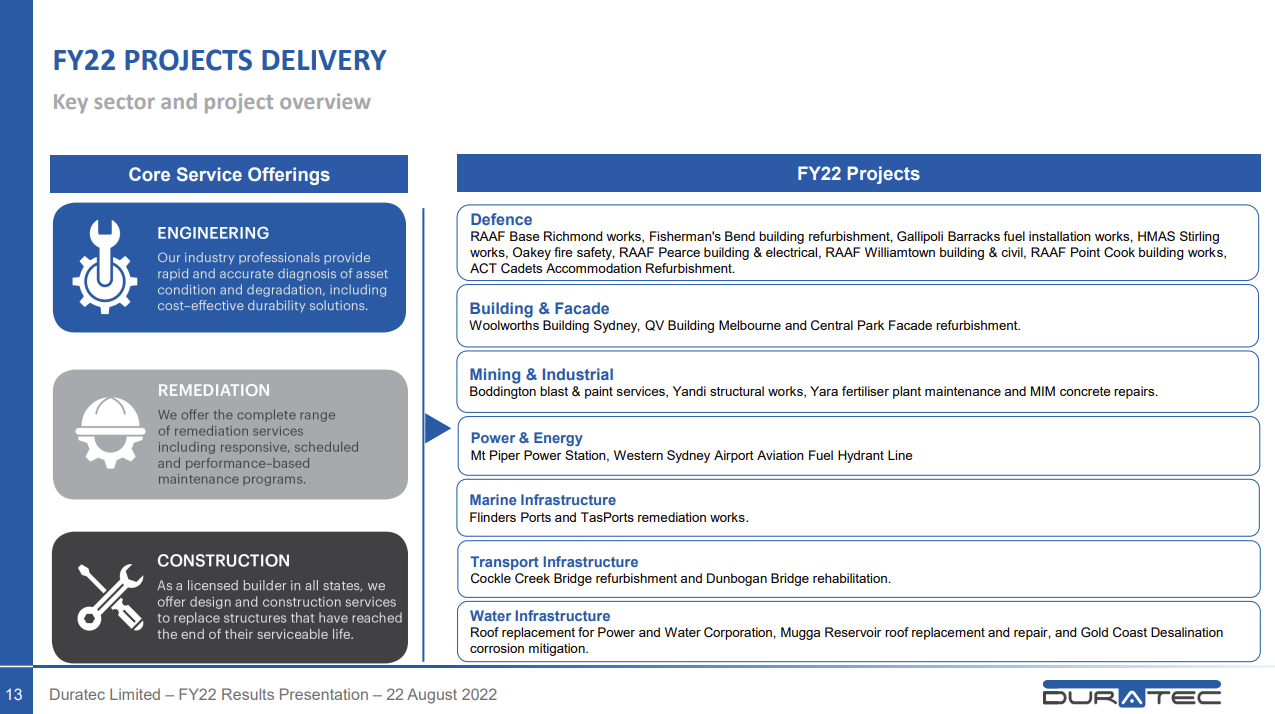

And the following slides are from their June 2022 Full-Year Results Presentation on 22-Aug-2022:

Hope that helps.

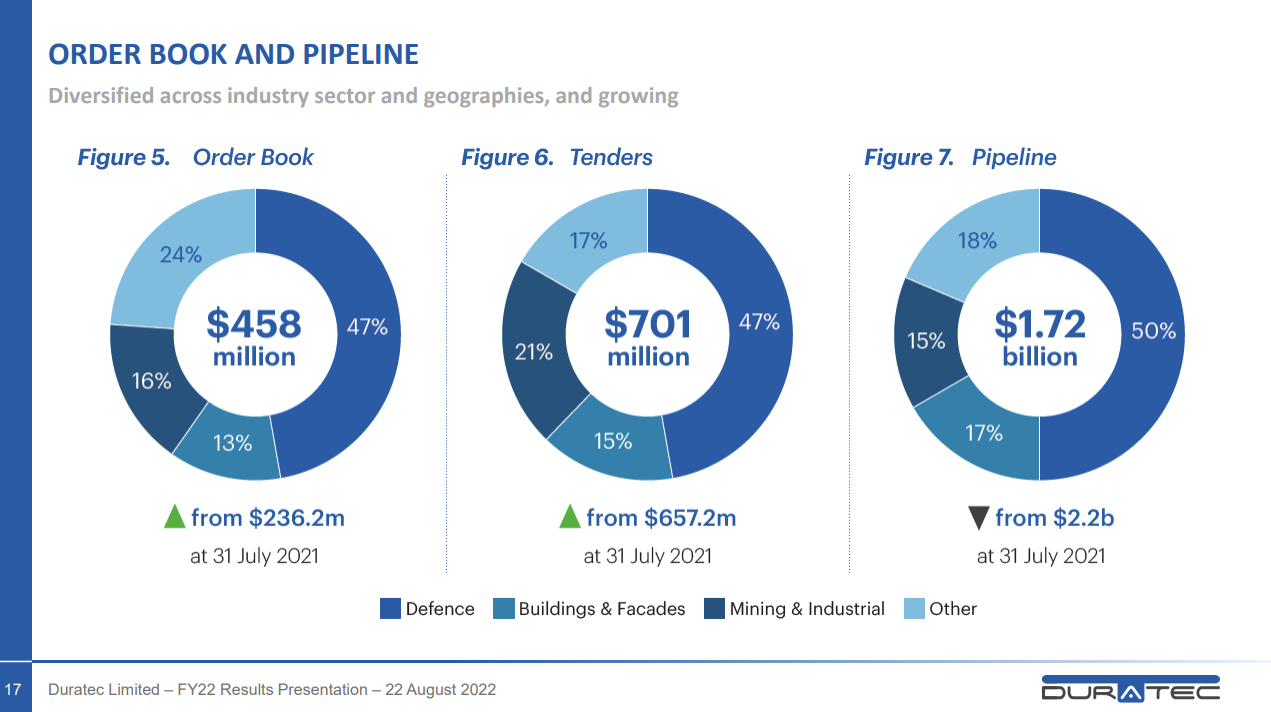

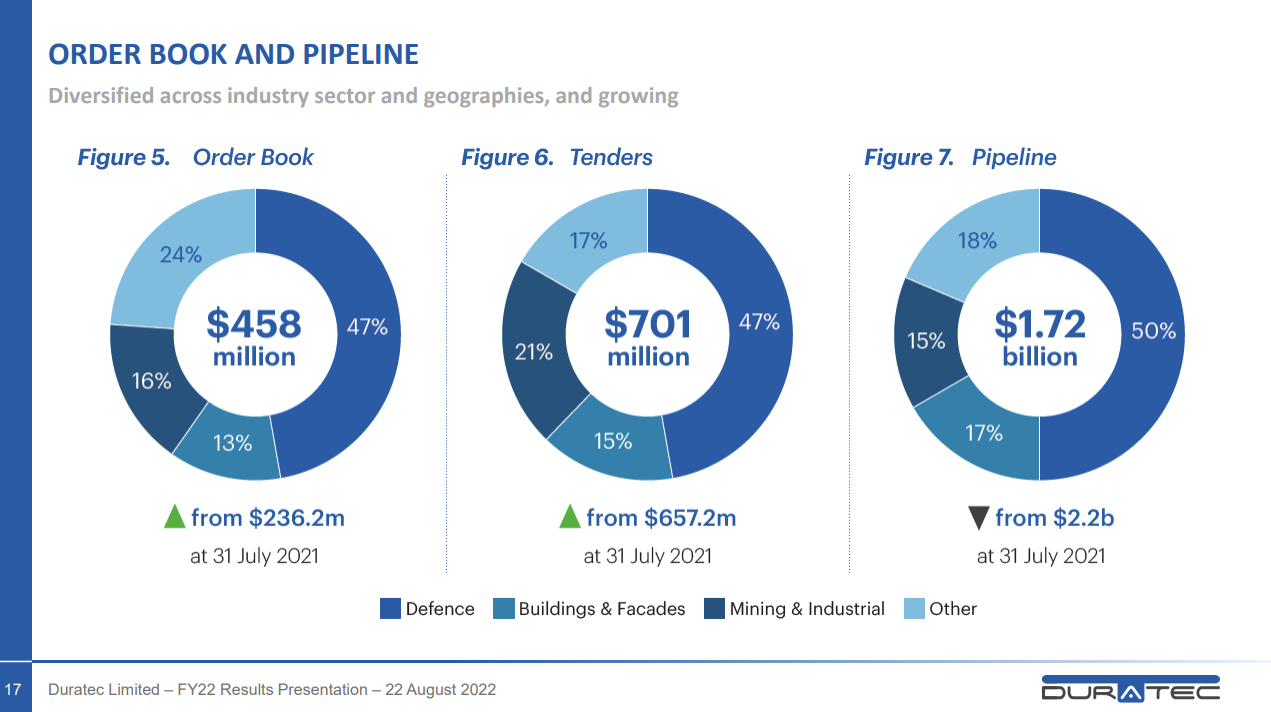

That last slide (above) shows that their order book (active work-in-hand, i.e. contracts already secured) was (at 30-June-2022) 47% Defence, 16% Mining and Industrial, 13% Buildings & Facades, and 24% "Other", with roughly half of their tender pipeline (and active tenders) being in the Defence Sector; Their tenders and tender pipeline looks to me to be same, same (in terms of the rough split between those sectors going forwards).

That presso (linked to above those slides) also discusses their FY22 full year results, so their revenue, their earnings, their outlook, etc. There is a typo on slide 18, which I've highlighted below. Rooky error. Surprised they didn't pick that up. They were reporting on FY22 in August 2022, so their outlook statements were clearly related to FY23 (this FY).

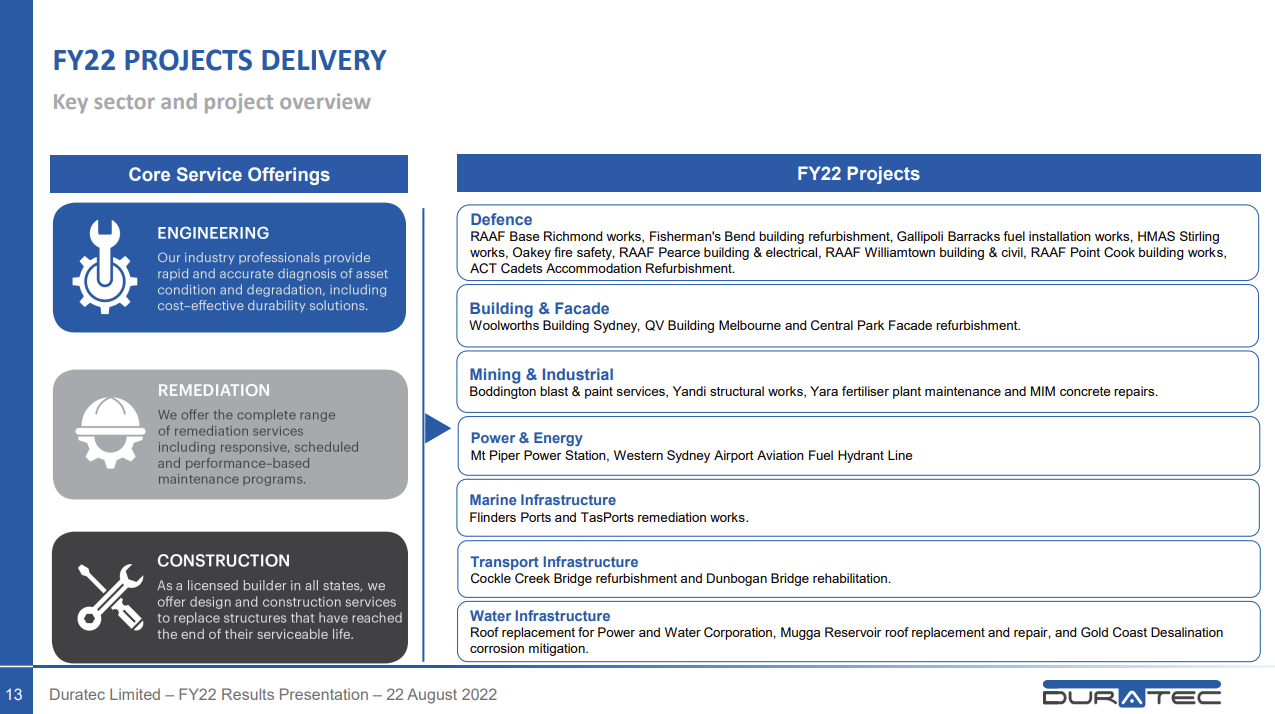

This company reminds me a little of one I used to hold shares in - called SRG Global - which was formed from the combination (merger) of SRG Limited and Global Construction Services (which used to trade under the ticker GCS). SRG plodded along for years with massive opportunities in front of them, but they never seemed to be able to take full advantage of those opportunities, i.e. they never won the number of contracts for the big dollars that were expected to flow through. They appear to have been coming good in the past 18 months or so however. Progress is still too slow for my liking (with SRG), and I don't hold them, but I think they'll do OK from here. SRG do specialise in a few niche areas, including ground anchors for dam walls and small footprint structures like overpasses and buildings, but they do share one niche area with Duratec, and that is building facades.

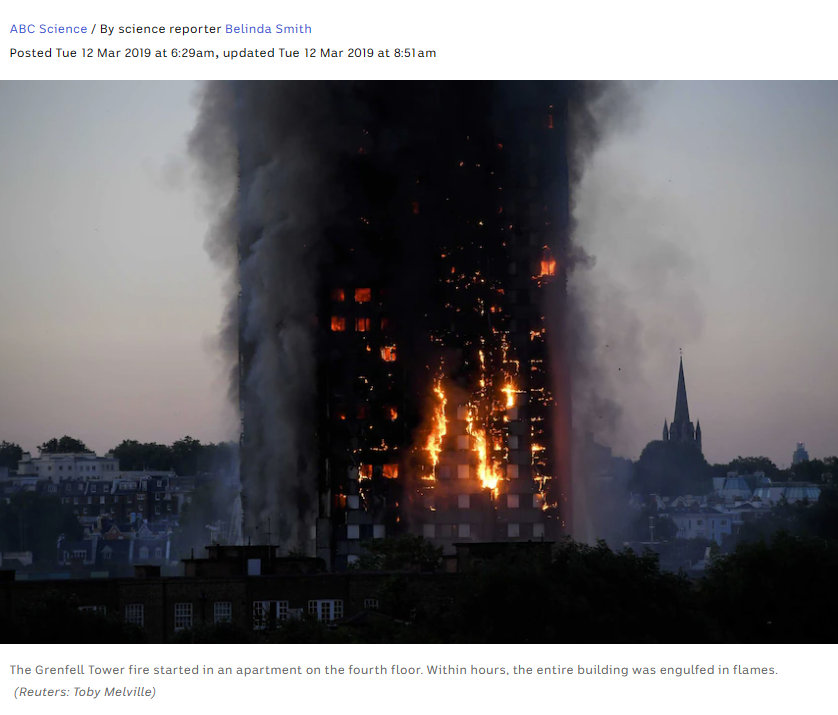

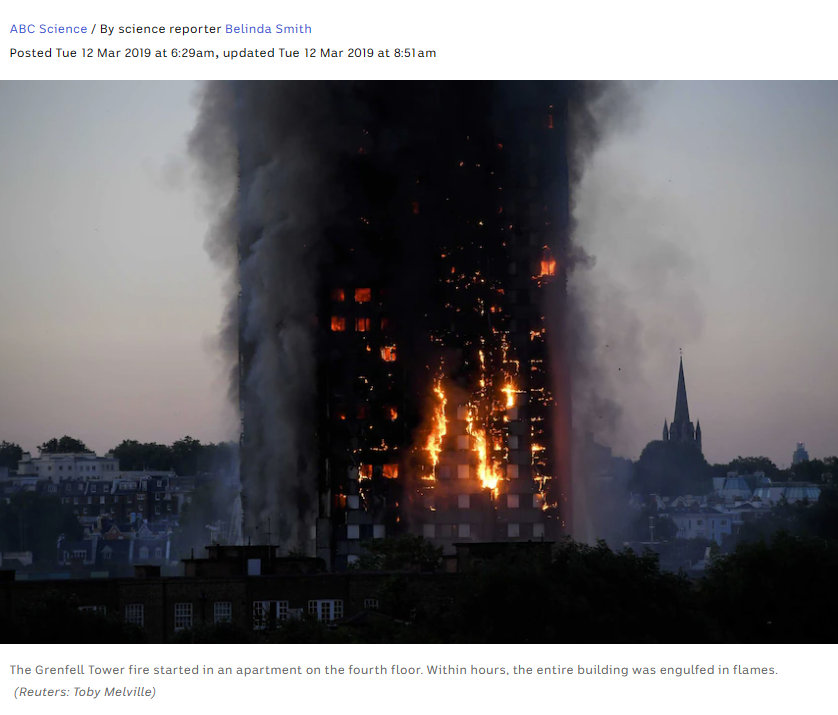

Many buildings have highly flammable aluminium composite cladding and there is a belief among some people that all such highly flammable panels will need to be replaced with non-flammable ones and that might occur via legislation (new laws, changes to building codes, etc.). Further Reading: https://www.abc.net.au/news/science/2019-03-12/aluminium-composite-cladding-polyethene-flammable-grenfell/10882316

Companies like SRG and DUR stand to gain work if those laws/changes are passed or enough pressure is otherwise applied on those building owners through other means, such as massively higher insurance premiums for buildings that are highly flammable due to their facade panels being highly flammable.

But there are no guarantees, and clearly there are other companies that can provide building facade installation and replacement services (beyond DUR and SRG).

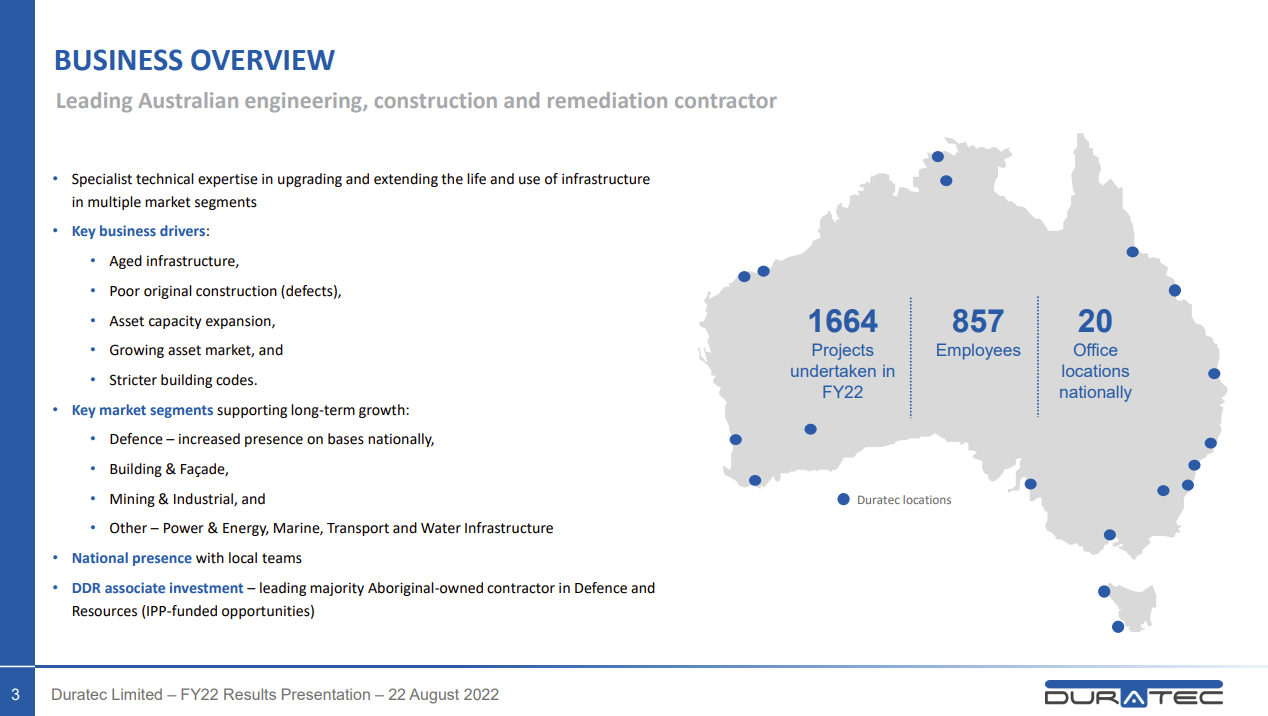

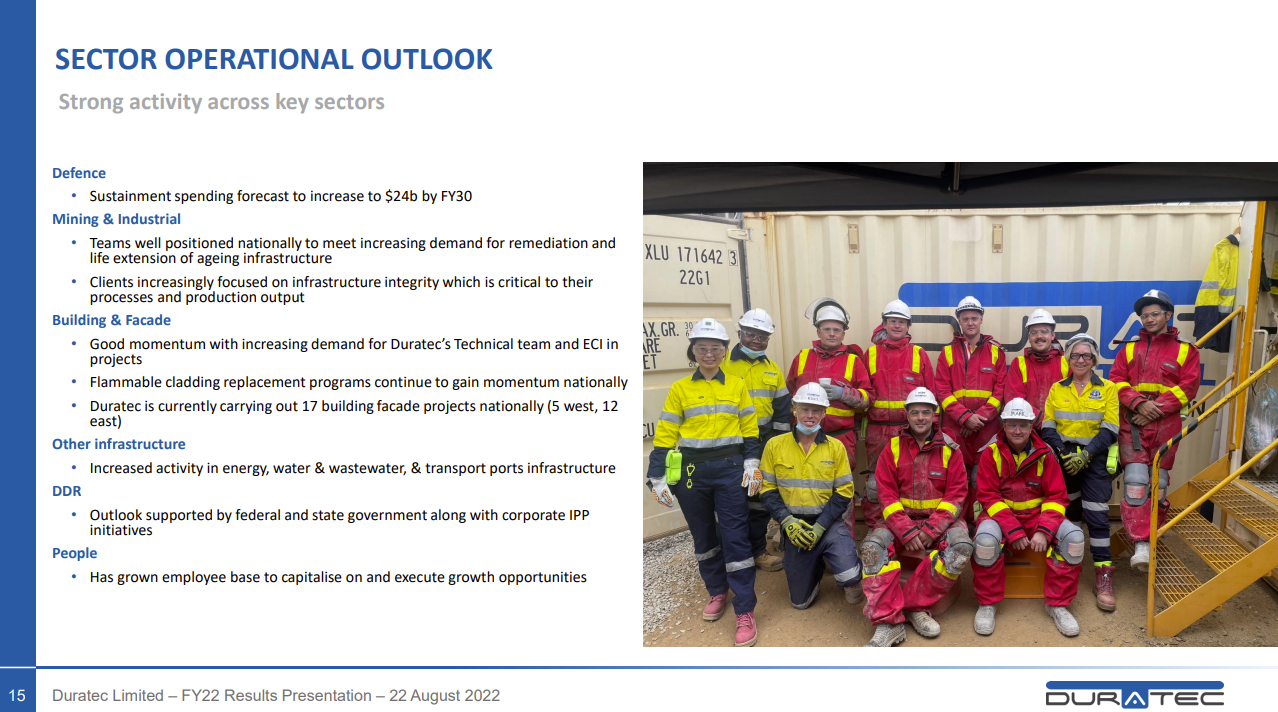

Having spent just 20 or so minutes on DUR, they seem to me to be a decent enough small Australian engineering and construction company that also do remediation work, and they seem to have a decent foot in door with the Australian Defence Force, which is positive. But beyond that I can't help too much more at this point.