Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Today, Duratec shares closed up 8.8% on no company announcements. I’m guessing this might be a reaction to President Trump’s “full steam ahead” comment on the major nuclear-powered submarine pact, ending months of uncertainty over whether his administration would keep the alliance with Australia and the U.K.

The Australian Government made an initial investment of A$127 million ($84 million) last year to upgrade facilities at the Henderson shipyard near Perth, saying billions of dollars would be spent over the next 20 years to transform it into the maintenance hub for its AUKUS submarine fleet.

Last month it said it would spend A$12 billion ($8 billion) to establish defence facilities in Western Australia to help deliver submarines under the AUKUS nuclear submarine deal. At that stage AUKUS deal was still “under review” by the Trump administration. Now it seems the doubt over the AUKUS deal is over.

Duratec is in an ideal position to benefit from AUKUS, as explained in this Duratec news article from January 2025:

“Following the successful delivery of the Parkes Wharf restoration project, Duratec, in a joint venture with Ertech (DEJV), has been awarded two more Defence contracts at HMAS Stirling. Both are for the early contractor involvement (ECI) phase of projects that are part of the base’s preparation for the Submarine Rotational Force – West (SRF-West).

SRF-West refers to the rotational presence of AUKUS partners at HMAS Stirling, beginning 2027. The base will host one UK and up to four US conventionally armed, nuclear-powered submarines on a rotational basis.

The first contract is for the planning phase of maritime infrastructure upgrades to accommodate visiting submarines. The works will involve piling and dredging. It is the fourth such project secured by the DEJV at HMAS Stirling over the last five years and a continuation of works for local teams that have been on site since 2017.

The second contract is for the planning phase of a new, fit-for purpose controlled industrial facility to support the maintenance of submarines.

These contracts demonstrate Duratec’s marine infrastructure capabilities and recognise its ability to deliver large-scale Defence projects. Duratec looks forward to collaborating with all stakeholders on these and other upcoming projects at HMAS Stirling.

https://www.duratec.com.au/news/duratec-completes-remediation-works-to-wharf-at-hmas-stirling/

Held IRL

An important Item to note, is that Duratec, during their earnings update conference call, guided for contract wins being anticipated by August, noting that contract awards were held up by the Federal Govt elections. With that in mind, I think the graph below is telling, given the open tenders pipeline.

Despite the earnings downgrade for FY2025 due to contact delays, there should be some positive catalysts in the short term:

DISC - HELD.

Friday 29th March 2024: My price target for DUR is $1.45 during the next 12 to 18 months, with a longer price target somewhat north of that if they can keep growing their order book, as explained in my Bull Case, which is buried in a forum thread as a post here, which attempts to wrap up a fair chunk of the content that others have contributed here recently with regard to Duratec.

I have just added to the end of that post, with another of the excellent graphs from @mikebrisy that I had forgotten to include earlier, and links to all of the DUR forums here, and also a link to DUR's own website:

Extend the Life of Your Assets | Duratec Australia

I bought DUR shares this week @ $1.135 (on Wednesday 27th March 2024) in one of my real money portfolios, and I plan to add them into my Strawman.com virtual portfolio also once I sell some shares to free up some cash here.

I do like these sort of companies, they're unlikely to shoot the lights out super quickly, like a speccy tech or biotech company might do, but IMO they have a high probability of grinding higher over time - as long as the investment thesis stays intact - and that investment thesis revolves around them winning more work and margins either remaining stable or improving, but NOT declining in a meaningful way.

I tend to give such E&C contracting companies a bit of latitude (i.e. time) due to the lumpy nature of much of their contract work, but I also like to keep a close eye on them for orange and red flags, because when these companies do unravel, which does happen sometimes, the decline can happen very quickly, so I give them a long leash in relation to some things, but a short leash in relation to other things like cost blow-outs on projects, missing milestones on projects, having to make penalty payments for missing milestone targets, clients calling in completion bonds or other penalty or insurance payments. That's trouble for companies like this.

However, what I have found is that often companies get into that sort of trouble by straying away from what they do best, so venturing into new areas, like Forge group into power station construction, and RCR into solar farm construction; both of those companies started off their new forays into those new areas by acquiring a company already active in the space but without a decent track record of success in the space, and then ploughing into the sector at speed and with fixed price contracts that undercut the incumbent players in the space.

So I have learned some of the things to look out for. The successful E&C companies are those who (1) ideally or mostly stick to what they know and do well, (2) are prepared to expand their offering, but in a very measured and risk-averse way, (3) are choosy with contracts and clients, so don't just grab any work they can get, but tender sensibly so as to maintain margins and reduce risk, (4) carve out a decent niche for themselves, so they are highly regarded in their industry(/industries) and can therefore maintain decent margins, (5) have competent management who make good capital allocation decisions that include (5a) using debt prudently, so either avoiding debt whenever possible, or using it sensibly and paying it off quickly, (5b) reinvest their capital back into growing the business whenever they can at good rates of return, only returning capital to shareholders (as dividends, capital returns, or share buybacks) when they clearly have more cash than they need, and (5c) being strategic and sensible with M&A, meaning not overpaying for acquisitions, not just buying things for the sake of becoming bigger, but buying companies or assets that make clear strategic sense, and structuring the acquisition payments strategically well.

What I mean by that last bit is that they use shares when their share price is flying, and cash/debt when their share price is clearly undervaluing the company - as long as the debt they use is quickly and easily repaid - and when acquiring other companies that bring in complementary skills and service offerings, trying to bring existing management across with the acquisition and ensuring that they are appropriately incentivised to keep performing and make the acquisition a successful one.

A great way to do this is to structure it so that part of the price paid is in the form of earn-out payments that will only be paid if the acquisition meets predetermined hurdles in the future, such as 1 or 2 years in the future. This incentivises the management of the company being acquired to both stick around for that period of time and to do their best to see that the business they run (now a division of the larger business that has acquired them) does meet those hurdles so they do get those payments.

That's just one example, and there are many ways to do it, but in this E&C sector I do not generally like acquisitions where everything is paid upfront unless it's a really straightforward bolt-on acquisition that simply adds scale and clients and is well within the current competencies of the acquirer, and then it needs to be at a good (preferably cheap) price.

Other things I like to see are things I generally like to see with all of the companies I choose to invest in, including (a) management underpromising and then regularly overdelivering, (b) setting very realistic goals rather than aspirational ones that are unlikely to be met, (c) having a very good position within the industries that they operate in, and (c) being well-regarded by their peers, clients, and their TAM, and (d) growing at a decent clip over time. There are plenty of others, but I won't waffle on any further on that.

And then, after all of that, once a company is on the shopping list, we look at price, and what we are prepared to pay, and what sort of return we expect to achieve, and over what timeframe.

You can start with a price/value filter, but then you're going to be looking at a lot of rubbish companies that are cheap for good reasons, so I tend to start at the "quality" end, in terms of filtering, and look at price once a company makes the list of companies that I'd like to have direct exposure to.

Generally.

I did talk about M&A (acquisitions) there a bit, and I don't mind a company growing inorganically if they are making good M&A calls and being strategic and disciplined (especially in relation to prices and timing), but there also needs to be organic growth, and I'm also fine with companies that either never make acquisitions or rarely make acquisitions, as long as the organic growth is there.

Some of the worst outcomes seem to be from companies that get involved in M&A for the wrong reasons, such as to satisfy management remuneration incentive hurdles. One quick example is that if management are incentivised to grow revenue and earnings rather than grow EPS or TSR (total shareholder returns), then they may well grow revenue and earnings by buying other companies to increase their own size, without adequate consideration and analysis of the real benefits and risk of the acquisitions, and also without the necessary discipline to NOT overpay. This can result in poor outcomes through bad acquisitions that result in large write-downs (impairments) in subsequent years, and/or a worse company overall.

One example of that was Australia's largest gold producer back in the day, Newcrest Mining (NCM when they were still listed here), who were actually a very reasonable and profitable gold miner with a high ROE - until they bought Lihir Gold for $8.5 Billion in 2010. Actually, the Lihir acquisition was weighted heavily to shares that were trading above $40 at the time, so it valued Lihir at more than $10.5 billion at the time the deal settled.

Less than 4 years later, on 10-Dec-2013, they (NCM) were trading at $7/share, so their SP was down by more than 80% (from over $40 to a low of $6.99).

In June 2013, Newcrest had announced write downs of more than $6 billion, and became engulfed in a disclosure debacle that resulted in the company paying penalties of $1.2 million to ASIC. One year later, in mid-2014 they reported a further $2.6bn write down on Lihir and a FY2014 loss of $2.2bn.

I won't go on - there were more write-downs and Newcrest had shocking management during that period. The Newcrest Board also ensured that they and their management team were all paid very well while destroying all of that shareholder value.

Good Riddance! was my reaction last year to the news that NYSE-listed Newmont GoldCorp were acquiring Newcrest, and I don't miss the company at all. They were one of the worst run gold producers Australia has ever seen.

And the rot all started with one really bad acquisition that was made for the wrong reasons.

So, that's my example. M&A can be good, certainly, and often is, but not always. And in terms of large acquisitions, most of them are either bad decisions or the price paid ends up being too high, with the benefit of hindsight. Smaller acquisitions do not tend to have as bad a track record overall, but there can still be some poor decisions made, even by quality management teams. Even Xero, a high quality company, have had a chequered M&A record. I would like to see Xero really concentrate on organic growth going forwards.

But back to Duratec. So far, so good, they've only been ASX-listed for a little over 3 years, despite operating for much longer than that, so we only have those 3 years of public records plus their IPO prospectus to go on for now, and there are good signs there for sure - see here for more.

Friday 8th November 2024: Update:

(DUR SP = $1.57)

I'm no longer holding DUR, as I see better opportunities elsewhere at the share price levels DUR have risen to, even though I do think they are going higher from here.

Raising my PT to $1.74, which is probably fair value or a little under. It all comes down to execution and how much work they convert from their pipeline into active tenders and from there into their order book (or WIH: Work In Hand, meaning contracted work). Good company. If I had more money to invest I would hold them.

Saturday 24th May 2025: Update:

(DUR SP = $1.47)

So, from my last update on 8th November, when DUR were $1.57/share, they fell to $1.34, then have been up and down since, getting as high as $1.78 and looking like they wanted to break through $1.80 on two occasions, but they retraced both times to around $1.50 ($1.52, then $1.48), and they then got back up to $1.72 recently (30th April) before starting another downtrend in May (this month).

I note that they tagged my previous price target of $1.74 on three occasions since November:

But that was then, and this is now. Yesterday (Friday 23rd May 2025), they released this: REVISED-GUIDANCE-FOR-FY25-AND-BUSINESS-UPDATE.PDF and finished the day down -5.47% @ $1.47.

I haven't been invested in this company since before my last update in November because I figured I had better opportunities with more potential upside, however there's nothing wrong with a company like Duratec for what they are, if you don't mind lumpy revenue and earnings but are happy with everything moving in the right direction over a rolling five year period, which I find is a suitable barometer for engineering companies who do have a considerable percentage of one-off type contracts in their mix of work - in addition to the multi-year recurring revenue work.

Except Duratec have only been listed on the ASX for 4.5 years, since November 2020, so we have limited data to work with.

There are always reasons for guidance downgrades, and they are usually temporary setbacks, not structural issues. In this case, DUR said (yesterday) that they had revised their FY25 full year revenue and EBITDA guidance range downwards due to delays in expected project awards and weather disruptions.

They said, "Importantly, following a slow start to the calendar year due to late unseasonal weather, May and June are showing strong performance and provide confidence into FY26", and "Duratec expects the delayed projects to be awarded in coming months, supporting positive momentum into 1H FY26."

Swings and roundabouts. While their DDR (the Duratec and Dundee Rock JV), Energy (including WPF Engineering Services), and Building & Facade sector work were all still at record levels of activity, and they say that their gross margins are still strong in all sectors, they noted that Defence and Mining sectors were experiencing lower than expected revenues.

This is worth noting because their overweight exposure to the Australian Defence industry was a major drawcard in my view, as it differentiated them from many of their competitors, and while clearly the work from Defence does ebb and flow, it isn't as cyclical as mining as it's not exposed to things like commodity price movements.

Duratec continues to talk up their large tender pipeline and their record-level active tenders, saying "Strong tender activity continues with tenders at an all-time high level of $1.7bn."

We've had this discussion before here, but it pays to remember that not all companies' tender pipelines and active tenders are reliable predictors of future revenue, as it clearly depends on their win rate and whether or not that win rate is steady and reliable, or at least fairly consistent.

Contracts can be included in their tender pipeline and they may have even tendered for those contracts already - so they are active tenders - but those contracts can ultimately be awarded to another company and some of those projects may not even proceed - for any number of reasons - so the contracts may never awarded to anybody.

That's why we (here) last year looked at the correlation between Duratec's tender pipeline/active tenders and their revenue in subsequent years to see if the tender pipeline and active tenders could be viewed as useful forward indicators of future revenues. It seemed that all were growing at a reasonable clip and there seemed to be a decent correlation between them.

You could therefore be forgiven for assuming that Duratec's current $1.7 billion all-time high tender level means they should be a lot busier and earning more money in the next few years as they win a good percentage of those tenders and get stuck in to that new work.

And that could well be the case, however I'm a little concerned about their growth trajectory, remembering that they've only been listed on the ASX for four and a half years - since November 2020, so depite the fact that the company has been operating much longer than that, the level of disclosure that we get from them now as a listed company only goes back 4.5 years.

This is what concerns me (the graph below) - from yesterday's announcement with the blue trendline added by me:

Based on this new guidance, that earnings (EBITDA) growth trajectory is flattening, and it started flattening in FY24 and has flattened further in FY25, so while it could pick up nicely in FY26 if they don't encounter similar issues to those disclosed yesterday for FY25 (poor weather and delayed project awards plus lower levels of work in mining and defence) or new issues, it's a leap of faith really to assume that they won't encounter similar headwinds in FY26 to those they have encountered in the current year.

If you compare that to a company like SRG Global (SRG), who are similar but not exactly the same - they have different areas of speciality but there is some overlap, especially in building facades and NDT/equipment and structural scanning and testing, SRG is maintaining their growth:

That (above) was from their AGM Presentation last year (green trend lines added by me) and shows their Earnings and Dividend growth from FY21 to FY24. Below is a similar graph from their February 2025 Presentation that accompanied their H1 (of 2025) results, this time showing only H1 numbers for the past 4 years:

Again, the green trend lines were added by me.

Remember that SRG also have to put up with similar weather across Australia and they also have to deal with contracts sometimes not being awarded within the timeframe they might have expected, but the difference is that SRG are more conservative in their forecasting so they can meet or exceed their guidance even with a few setbacks along the way if they encounter them, and, importantly, despite two decent acquisitions over the past 4 years, SRG are growing their earnings per share at a good clip, and maintaining that growth.

So, yeah, there are always reasons, but results matter.

And SRG's results are better than DUR's results in FY24 and FY25 IMO, and that included maintaining their earnings per share growth, which will drive up their valuation over time, so while DUR will probably give me a decent return over the next 5 years, I'm thinking that SRG is likely to do even better than that.

Another thing that is always in the back of my mind is: The first downgrade is never the last downgrade; they often come in threes. Meaning three in a row. Or more.

I'm not saying that's the case here with Duratec, but it might be.

I'm betting that it's not going to be three downgrades with EGL (The Environmental Group, who had a single project cost blowout in FY24), because I reckon they explained the major reason for the first downgrade and fixed the issue, so I remain invested in EGL, however I don't have the same confidence in Duratec's management.

My confidence in EGL's management comes from following them when they were running a different company, Tox Free Solutions, before they sold that to Cleanaway (CWY) in May 2018 for approximately $670 million, and then from watching what Jason Dixon has done at EGL after that - so far.

I may in time come to appreciate Duratec's management as well, but I'm not there yet. I think they need to get their growth trajectory back on track first and start giving guidance that they know they can easily hit, rather than guidance that they should hit if nothing goes wrong.

I am therefore downgrading my price target for DUR to $1.42 today, and I remain on the sidelines with them.

Revenue guidance has been revised downward to a range of $570m - $585m from $600m - $640m. EBITDA guidance has been adjusted to a range of $50m - $53m from $52m to $56m previously.

The guidance is based upon the earnings from year-to-date work delivered plus the Company’s forward forecast assumptions of the earnings from current works expected to be delivered by the end of the financial year. In FY24, the Company reported revenue of $555.8m and EBITDA of $47.6m.

Last

$1.47

Change

-0.085(5.47%)

Mkt cap !

$371.0M

Disc - not held

A link to the Duratec results call and Q and A here.

https://openbriefing.com/OB/Duratec-Limited/2025/2/20/Duratec-1H-FY25-Results-Webinar/5806.aspx

On the downside revenue was down 2% YOY however they did a good job managing costs etc, so still recorded a 6% lift in NPAT and a 12% increase in normalised EBITDA.

They also lifted the dividend by 15% YOY, plus the order book was up $5 million from the AGM and the tenders and pipeline buckets were up a couple of hundred million. They reconfirmed current full year guidance of $600 million + in revenue and $52 million plus in EBITDA.

So, it's not as strong a result as the last few years however still good numbers overall in my view, given the current multiple is around 20. The market seems fairly neutral on it so far today, given the share price has had a good run over the past few months.

Interestingly they did lift their debt facilities by $120 million or 70%, which they said was to give them plenty of room to convert more of the tenders plus any really compelling acquisition opportunities that come along. On that note the joint venture in DDR from 2018 and the recent acquisition of Wilsons Pipework in 2023 both had excellent halves, up more than 100% on the previous year.

Mostly business as usual and happy to let them keep compounding away from here hopefully...

Duratec Management Ownership

Current Market Cap At $1.49 is $370.8m

DUR Management Bio

*Note Not included Krista Bates who was Non-executiive director of DUR board until her passing announced 14 November 2024.

Martin Brydon - Non-Executive Chair

Mr Brydon is currently a Non-Executive Director of the Building Limited and resides in Perth. Mr Brydon has more than 30 years’ experience in the Australian construction materials and building product industries, commencing as an electrical engineer at Cockburn Cement Limited (CCL) in WA before moving into roles in operations management, sales & marketing and general management before ultimately becoming Chief Executive Limited (ABL) in 1999, Mr Brydon became Executive General Manager - Strategy and Business Development and worked closely with the Managing Director in formulating and executing strategy. This included ABL entering the downstream businesses of concrete and concrete aggregates and masonry products through a series of acquisitions. Mr Brydon was appointed Chief to the ABL Board as Managing Director in November 2015. He retired from ABL in January 2019. During his tenure, ABL grew to have a market capitalisation of over $4 billion and was included in the S&P ASX100 index. Mr Brydon is an independent Director as, in the Board’s view, he is free from any business or other relationship that could materially interfere with, or reasonably be perceived to materially interfere with, the independent exercise of his judgement.

Christopher Oates - Executive Director – Managing Director

Mr Oates holds a Bachelor of Science in Construction Management and Economics and has over 25 years’ experience in the construction and remediation industries. Mr Oates is a registered builder across the business in several states and territories. Prior to assuming his role as Managing Director, Mr Oates was a General Manager and Executive Director of Duratec responsible for the general management of the Company in Western Australia and the Northern Territory where he was involved in securing and delivering a wide range of projects across numerous sectors, including mining & resources, oil & gas, water & wastewater, transport infrastructure, marine as well as direct engagement with projects on Department of Defence bases across Australia. In his role as Managing Director, Mr Oates is responsible for the overall management of the Company, Health, Safety, Environment and Quality, strategic planning, new business opportunities and risks and business development.

Robert (Phil) Harcourt - Non-Executive Director

Mr Harcourt has over 45 years of experience in the civil and structural engineering industry. During this time Mr Harcourt has held numerous roles including; Senior Project Engineer and CEO of Savcor Finn Pty company Savcor Group. Mr Harcourt along with two trusted colleagues established Duratec in 2010 and led the Company as Managing Director through a period of rapid growth to become a highly recognised and reputable specialist civil remediation contracting company. He resigned as Managing Director on 24 November 2023 and was appointed as a Non-Executive Director on that date.

Gavin Miller - Non-Executive Director

Secretary and graduate of the Australian Institute of and commercial management experience in various industries, including manufacturing, utilities and civil construction.

While I didn't attend the $DUR AGM today, I've noted they have issued guidance as follows:

- Revenue: $600-$640m (FY24= $555.8m), so +11.6% at midpoint

- EBITDA: $52-$56m (FY24 47.6m), so +13.4% at midpoint

Updates on portfolio (compared with FY24): are Orderbook $409m ($405m), Tenders $1500m ($1400m), and Pipeline $4.1bn ($3.8bn).

Note the Orderbook excludes annuity-style MSA work, which is becoming more important over time.

My graph below showing as % of revenue, with "AGM" based on the FY25 Revenue Guidance midpoint.

My Assessment: Steady as she goes.

Disc: Held in RL and SM

It wasn't deemed announcement worthy (even as non-price sensitive) but $21.8 million is not a bad day's work.

[Hold a bit IRL only]

DUR-Inititation-Taylor-Collison-07-Nov-2024.pdf

Here's the first page (below) - click on the link above for the full broker report.

18-Oct-2024

My previous valuation was just a posting of the only broker report I had, so this is a quick update, given recent discussions here, with my view,

Quick Estimate: Valuation $1.88 ($1.50 - $2.23)

Method:

3-year projection of financials, discounting 2027 NPAT at 10% using a range of P/Es 16, 18, 20.

Assumptions:

Set revenue growth % Gross margin and expenses growth based on analysis of recent results, allowing for some maturation of the business.

Revenue growth: 12% to 18% p,a,

Gross Margin %: 17.0% to 18.0%

Expense Growth: Set below revenue growth ranging from 10% to 14% p.a.

Other key variables: Equity-accounted income, D&A, interest income and costs set to constant ratios of revenue based on assessment of historical results over last 6 years.

Tax: 30%

Comparison to Analysts

4 analysts have TP's with average of $1.618 with a range of ($1.43 - $1.90), so I am well ahead of the market on this one. The reason is that while analysts seem to assume strong growth in FY25, the rate of growth falls quite rapidly through FY26 and FY27, and I see no basis for this given the track record and the size of the prospect inventory.

Furthermore, with a focus on converting more of the revenue base to MSAs, and continuing to push for ECI opportunities, there is more robustness to this business than I first thought. The push into mining and energy is also welcome.

The analysis below isn't a high conviction set of scenarios and more a set of sensitivities.

Howver, given my view on this business and everything I know today, I wouldn't take a harder look at valuation with a view to selling unless the SP should get up over $2.20 in the next year. So I'm not concerned that I am up +60% on purchase price in 6 months.

Disc: Held in RL and SM

24-May-2024

Based on Moelis valuation, which pretty much aligns with my own view.

17-Oct-2024: Duratec's newsletter, InSpec, their Spring edition has been emailed to me today - here's a link to the online version: The spring edition of InSpec is here!

It's interesting, and gives some insight into some of the things they do. I sold my DUR here earlier this week and no longer hold them IRL either - not because I'm bearish on them, just because they no longer look like one of the best opportunities across the market for me to make money at current levels.

I bought DUR in April at between 99 cps and $1.23, then sold some in August at $1.30, then sold the dividend shares at $1.415 last month, and the rest at $1.64 two days ago - I see better upside in LYL right now. DUR is still good, but they were a lot better at around $1/share to $1.25/share. DUR has been rising, and they look relatively fully valued to me here for where they are and their current order book, and if they can keep growing that revenue and their earnings, I may well jump back onboard in the future.

Meanwhile, Lycopodium (LYL) has been dropping, as they often do when they go ex-div and don't release any news, and that's something that LYL shareholders need to expect - they do not have promotional management - they do not blow their own trumpet, to the point of not even providing percentage increases on their increased revenue and earnings every report - we have to calculate that ourselves - as you can see I have done in my "valuation" for LYL.

Anyway - this may explain my thinking at this point:

Same sector; not exactly, they are very different companies, but generally these engineering & construction and mining services contractors get lumped in the same basket despite their significant differences. Point being, DUR has been in an uptrend since May when they briefly dipped below $1/share, and LYL is in a downtrend that started in late July and accelerated after they went ex-div on September 19th for their 40 cps fully franked dividend, as I expected would happen.

This is fine.

No really, it is. Lycopodium has no debt, and they have a reduced free float due to high insider ownership.

That was their insider ownership a year ago - in November 2023 when I last broke it all down. 36% of the company owned by their Board and Management and another 25% held by insto's, so their free float is less than 40% of the company, being the only reason they haven't been added to the ASX300 index yet.

Anyway, what am I doing, this straw isn't even about them - it's about Duratec - DUR - a good company, but... in my humble... NOT the best use of my investment dollars at this exact moment in time, particularly when I have LYL as an option.

So, yeah, nothing wrong with DUR, just not one I'm holding right now.

$DUR announced the award of two ECI Defence contracts at HMAS Stirling to its 50:50 JV with Ertec, with values of $10m ($1.9m and $8.1m).

While immaterial for FY25, the deliverie phases will be in FY26 and FY27, and will be more material for the ultimate winner.

Judging by the muted market reaction, I'd highlight a few points:

- For engineering and construction infrastructure projects, the design and planning phase is typically 5%-10% of the ultimate project cost. (Can be lower, can be higher, depending on scope and scale, and how detailed the design deliverables are.)

- So, in the success case we are talking about projects probably worth order of magnitude $100-$200m, or $50m-$100m net to $DUR.

- ECI involvement in design and planning gives the contractor a strong inside edge leading up to the bidding for the execution phase. Essentially, they are advantaged in being able to more precisely determine execution risk, leading to a better bid. This isn't always true, as a competitor could misprice risk on the downside (particularly if they were desperate for work!) However, with the market still pretty tight in infrastructure contractiing, that is less likely. Given this knowledge assymetry, clients often don't take ECI contracts to market, and instead have an independent advisor review the project proposal.

- To quantify, this potentially moves $DUR from a 25-30% CoS (without ECI) to a >70-80% CoS on ultimate award, with more certainty on the project margin ultimately achieved.

- $DUR are increasingly using their MEND capability to get better scope definition in early design. They'll no doubt be using it here, and it is a real edge over competitors who don't yet have the capability.

So, while not material for FY25, it is leading up to a potentially nice piece of work for 2026 and 2027.

$DUR has had a very strong SP run over the last 6 months, so anything other than a very material project award (>$100m) is probably unlikely to move the dial.

But good news, nonetheless.

Disc: Held

Duratec has just won two significant contracts. One in its own right and the other through its 49% owned business, DDR Australia. The DDR Australia project which is with the Department of Defence is the largest project ever awarded to DDR. To get these contract wins in perspective, the Duratec component represents about 12% of the order book and 9% of the revenue reported for FY24. That’s a decent win!

Held IRL (2.9%)

Highlights

- Duratec secures $21.8m Energy sector project for the King Bay Supply Base (KBSB) Wharf Refurbishment, its first direct contract with Woodside Energy Ltd (Woodside)

- DDR secures $54.7m contract forming part of the Project Phoenix portfolio of work for Department of Defence (Defence) in the Northern Territory (NT)

Duratec Limited (ASX: DUR) and DDR Australia (DDR), Duratec’s 49% owned associate business, have been awarded two new significant contracts across the Energy and Defence sectors. Duratec has secured the KBSB Wharf Refurbishment Project on behalf of Woodside, while DDR has been awarded a contract with Defence to deliver a critical portfolio of work across the NT as part of the Project Phoenix portfolio of work.

• KBSB Wharf Refurbishment – Located within the Port of Dampier in Western Australia, the KBSB Project is a $21.8 million Onshore Services Contract with Woodside, that aims to extend the service life, maintain the operational efficiency, and enhance the safety and resilience of the existing wharf facility. Pre-work is anticipated to start in November 2024, with commencement on site scheduled for February 2025, and expected completion by end of 2025.

• DDR Defence Contract Award – At an overall contract value of $54.7 million, this is the largest contract awarded to DDR to date. The project’s key objectives within the portfolio of work includes, refurbishment of existing buildings, upgrade of engineering services at transmit and receive sites, construction of a new receive site, installation of new fibre optic link cables connecting transmit and receive sites, and decommissioning of high-frequency communications infrastructure. Early civil works are targeted to commence in October 2024.

The combined duration of the current works is anticipated to be 30 months. This opportunity will be delivered with regional delivery partners ensuring that local businesses benefit from the contracted works.

Asset remediation and maintenance specialist $DUR announced their FY24 results.

Their Headlines

- Record Revenue of $555.8m (up 13%)

- EBITDA of $47.6m (up 22.6%)

- NPAT of $21.4m

- Gross profit 17.3%, up from 16.7% in FY23

- Strong cash on hand of $65.2m, with a cash conversion of 84% in FY24

- Annuity style contracts of $145.8m, making up ~26% of revenue

- Improved order book with quality tender opportunities continuing to grow

- Early Contractor Involvement (ECI) presenting significant opportunities across the business

My Analysis

The result was well-guided to at the end of May.

NPAT growth of 11.6% is well below what we've seen in recent years/underwhelming, but meeting expectation. Note: the analyst TP is about +21% ahead of the market, so room for SP to continue to advance (if you believe that means anything!)

Net Margin % of 3.9% the same as FY23 - so managing costs and commercial exposures well. (And better than FY21 3.0% and FY22 2.5%)

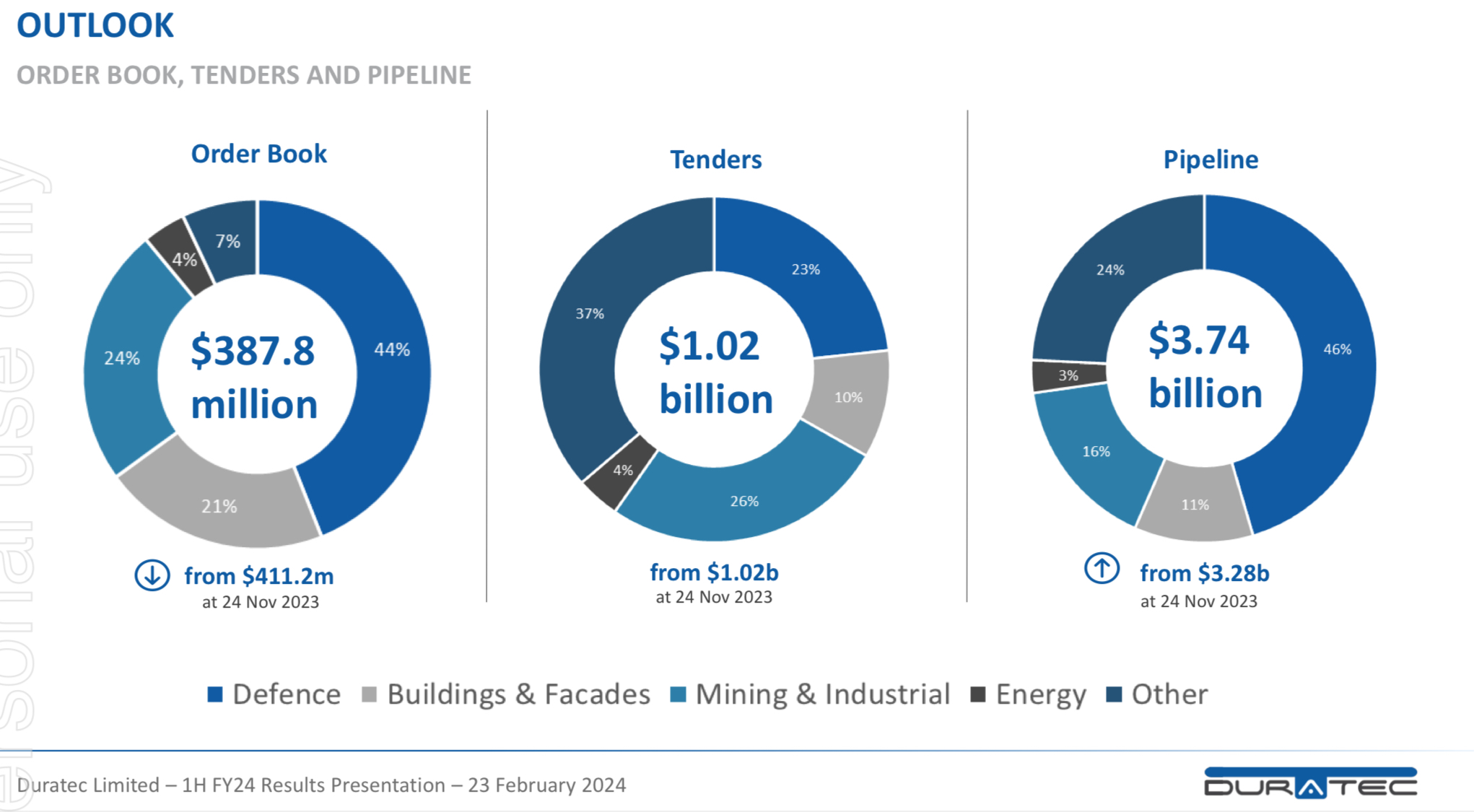

I include the updated picture on pipeline - slight increase in order book. The continuing build in Tenders bodes well for the year ahead. "Pipeline" is more a "whatever you want number" - but being high means they have line of sight to lots of work, and therefore can be selective in bidding for jobs that play to their strengths.

Joining the call at 11am.

Overall looks good.

Disc: Held in RL and SM

Sometimes (actually often!) when screening companies and then doing the deep dive prior to initiating a position, important details don't really sink in properly.

Shareholders of $DUR will today have received the latest edition of the company magazine, and one aspect of it really made me sit up and pay attention (turn to pages 20-21.)

While I understood that $DUR was extending its core focus of asset remediation and extension to the energy sector, via the acquistion of WPF (Wilson's Pipe Fabrication), its passed me by how significant this move is in the context of the challenge over the next 2-3 decades of decommissioning Australia's offshore oil and gas facitilies. (This is actually embarassing, because I have been involved for 25+ years in the energy sector!!) By this I mean that I noted the scope potential, but didn't fully grasp the materiality or the opportunity or the broader strategic fit for $DUR.

"There are more than 1,000 oil and gas structures in Austrlian water. The Australian Petroleum Product and Exaplorations Association (APPEA) estimates that decommissioning these facilities could cost $50 billion over the next 30 years."

So the penny dropped: a deep core corporate capability in existing asset remediation and extension + an acquired oil and gas industry construction capability + innovative tech in remote asset mapping (MEND) - which will be hugely applicable in the offshore environment.

There are also multiple barriers to entry in this sector: Offshore + Oil & Gas.

This is a major potential multi-decadal growth driver for $DUR and I didn't properly consider this in my investment thesis. Some oversights are fortuitous!

Disc: Held in RL and SM

Great new video here showing more on the MEnD Division and why this is a moat for Duratec. This seems to be one of the key reasons Duratec has been so profitable and has had no serious losses on projects over the years.

https://www.youtube.com/watch?app=desktop&v=heJcULrrCgc

Good interview with the CEO

https://youtu.be/HBWdKvs--II?si=gGzyiLXEYBWXobqh

Talks about the big contracts around the 17:30 mark.

01-May-2024: Some relatively minor buying by the Chairman and another director of Duratec on April 24th at $1.05, announced today:

Change-of-Director's-Interest-Notice-M-Brydon.PDF (25,000 @ $1.05, Martin Brydon is the non-exec Chairman of DUR)

Change-of-Director's-Interest-Notice-K-Bates.PDF (transferred 14,150 from one account to another and also purchased another 19,000 on-market at $1.05, non-exec director)

At this point in time, DUR is the only company in my largest portfolio that is in the green TODAY (for the day), up half a cent to $1.03 today. In my SMSF, the only one in the green today is NEU, up 5 cents/share at this point in the day.

[Edit: Both DUR and NEU ended up in the red by the end of the day]

Lots of red across all of the sectors today, with gold underperforming (worst sector):

Not too fussed about that however, we've had a good run, and we do get these days every now and then.

Came across this chart in the past couple of days from that Microequities Asset Management Presso that somebody here linked to, and it shows that we should expect 1 negative year out of every 5 years on average, based on historic returns of the All Ords Index:

As long as we have a reasonably decent process of good stock selection, we should do well over time, but a minimum target investing period (or time horizon) of 5 years is helpful in achieving that.

Here's a link to that point in their presso if you want to hear the context around the chart inclusion: https://youtu.be/HPNn-M5_kcQ?t=999

Duratec is one of those companies where I wouldn't be too surprised if they fall further or trade sideways for a while until the market is once again convinced that they are growing their WIH/Order Book at a good clip as well as increasing their profits, so it might take 5 years, hopefully not, but it might. We shouldn't always expect companies to shoot northeast as soon as we buy some of them, it's a game of waiting - having a good process and then letting time do its thing. Company management teams can make all the right moves, but it often takes a while for the results to show up in the share price, and the best company management teams are thinking longer term anyway, as co-owners of the business (because the best management teams have skin in the game like these directors do) so they are looking to build stronger, more resilient companies that are best placed within their industry in future years.

One example is with these contracting companies - either engineering and construction or mining services or infrastructure services - all relatively low margin businesses, so good management teams choose to chase relatively higher margin work and turn down work where there is a higher chance that they could lose money if things don't go to plan, and that can show up as lumpy revenue that can fluctuate significantly from year to year. That lumpiness can be simply due to the nature of the industry or the workflow within the industry, but it can also be impacted by management decisions relating to the type of work that they want to chase. We don't have total visability of this of course, so that's where we want to back competent management with skin in the game and a decent track record of making sensible and strategic decisions that should move the company in the right direction over future years.

Sometimes that involves some pain first before gain in subsequent years. Sometimes...

Not saying that there's pain in store for DUR shareholders (I am one) however it's something to be aware of as a possible eventuality and not something that would necessarily indicate the investment thesis was busted. Sometimes things get worse before they get better. As long as they DO get better.

DUR has retraced from just over $1.70/share in January to below $1/share - they closed at 99 cps on Monday (29-Apr-2024), and it seems that some of the Board members (half of them as there are only 4 on the DUR Board) either see value down here or else are trying to signal to the market that there is value down here.

The old saying is there are many reasons for management (including Board members) to sell their shares but only one reason to buy.

Well there's clearly at least 2 reasons to buy - (1) Because you see value, and (2) Because you want to signal to the market that there is value in the share price (the shares have been oversold). They are similar but not exactly the same, and it's usually impossible to know which one applies. One thing that would sway my thinking there would be the SIZE of the purchases, and these purchases are NOT huge, they are modest, but then this is only a $254m microcap company, so perhaps these purchases are significant in that context.

Here's what the Duratec directors' owned prior to last week's buys:

Chris Oates is their MD by the way, so the boss man, and he has over $24m worth of DUR shares, which is 9.68% of the company. Here are their Substantial Shareholders:

Phil Harcourt, Chris Oates and Deane Diprose are three founding directors of Duratec, and together they sold down 8.5 million DUR shares in September (2023) which represented 3.4% of the company’s issued capital at that time and they said the sale "enables increased liquidity and free float as well as greater personal diversification for the vendors."

The sale was undertaken at a price of $1.35 per share by way of an underwritten block trade. Following the sale, founders Phil Harcourt, Chris Oates and Deane Diprose each retained a 9.7% shareholding in Duratec. "Mr. Harcourt, Mr. Oates, and Mr. Diprose remain committed long-term shareholders of the Company and have no intention to sell any further shares in the medium term."

Source: Partial-Share-Sale.PDF [08-Sep-2023]

- Dencort Pty Ltd is the corporate trustee for the Harcourt Family Account, for Robert (Phil) & Denise Harcourt. (See: Change-in-substantial-holding-Dencort-08-Sep-2023.PDF

- Kent Colony Ventures Pty Ltd is the corporate trustee for the Diprose Richards Family Trust (Deane Diprose and Esme Richards). (See: Change-in-substantial-holding-Kent-Colony-08-Sep-2023.PDF

That's the bottom three taken care of in the above table:

- Chris Oates, 9.68% (that 10.88% listed in the table appears to be incorrect based on all of the forms lodged by DUR); Chris is the current MD of Duratec.

- Phil Harcourt (Dencort), 9.68%; Phil was the MD of Duratec until 03-Dec-2023.

- Deane Diprose (Kent Colony Ventures), 9.67%; Deane is an executive manager at Duratec and was a founding director - see here: (24) Deane Diprose | LinkedIn

And then we have the top 3, which appear to total 47.75m shares worth 19.57% of DUR which are held by Ertech Holdings, a private company controlled by founder Jim Giumelli and his nephew James Giumelli, and one of them holds 400,000 DUR shares in addition to the 47,348,514 held by Ertech, hence speaking for 19.57% instead of 19.40%.

Ertech is an Australian and employee-owned civil and electrical construction business, delivering services to the private sector, and local, state and federal governments across Australia. Their head office is at 118 Motivation Drive, Wangara WA 6065, and they also have a Queensland division.

James Giumelli is Ertech's CEO and he was a director of Duratec from Nov 2014 to Aug 2020 (for 5 yrs & 10 months) when Duratec was still part of Ertech - see here: (24) Experience | James Giumelli | LinkedIn

His uncle is Jim Giumelli, the founder of Ertech. Duratec was the name of Ertech's Maintenance Business which was spun out of Ertech (floated on the ASX) in 2020, and Ertech retained a 19.4% stake, which is why Ertech's founder Jim Giumelli and his nephew James are listed as "Subs" for DUR because it is considered that they control Ertech.

See here: Ertech workers enriched by dividend windfall | The West Australian

Ertech workers enriched by dividend windfall

by Sean Smith, The West Australian, Thu, 26 August 2021, 7:24PM

Ertech founder Jim Giumelli in 2017.

A dividend windfall has catapulted a handful of long-serving workers at the privately-owned civil construction and engineering group Ertech into the ranks of the State’s millionaires.

The workers are amongst 35 employees who are also shareholders of Wangara-based Ertech, which banked $24 million from the sharemarket float of its Duratec maintenance business late last year.

Ertech has now returned about $19m of the surplus cash to its shareholders, including senior management, taking total payouts to about half a dozen veteran employees over their time with the group past $1m each.

“There’s some long-serving employees who have become millionaires from holding the stock,” Ertech executive chairman Gavin Miller said.

Mr Miller said the employee ownership had worked well, with the participants “truly invested” in the success of Ertech’s clients. The group has about 350 employees in WA and NSW.

“People who have been with us for a while understand (the scheme), and they’re easier to encourage in,” Mr Miller said.

“New employees often just want to wait and see. But I think after this, we should be able to encourage a few more to buy in.”

Ertech will also spend $7m on a selective buyback and cancellation of up to 415,000 shares from founder and former chief Jim Giumelli and other shareholders.

The buyback will further reduce Mr Giumelli’s holding in Ertech from about 52 per cent to near 32 per cent.

The former EY Entrepreneur of the Year award winner owned about 66 per cent before selling into a 2017 buyback that coincided with him stepping down from executive duties with Ertech in the final leg of a staged retirement from the group he founded in 1981.

“In our 40th year of operation, I am proud that the business is in a strong and stable financial and leadership position to enable a successful transition of majority ownership of the company from myself to our valued employee shareholders,” Mr Giumelli said.

Mr Giumelli said he had no intention of reducing his shareholding further “for the foreseeable future”.

--- ends ---

See also: Ertech to look east for its earnings | The West Australian

Ertech to look east for its earnings

by Peter Williams, The West Australian, Wed, 9 November 2016, 12:06PM

[i.e. well before they spun Duratec out of Ertech]

Private contractor Ertech Holdings is putting more of its eggs in the east-coast basket after buying Queensland’s Moggill Constructions.

The move comes in the wake of founder and majority shareholder Jim Giumelli stepping down from his executive role after 35 years.

Describing business conditions in WA as “absolutely woeful”, Mr Giumelli said the board took the view a couple of years ago that it had to expand interstate.

“We weren’t flogging a dead horse here but the opportunities existed over east,” he said.

Moggill is a 43-year-old business involved in civil engineering construction, mainly in public infrastructure.

The deal follows Ertech setting up in Sydney over the past year. It has had a presence in Melbourne for about a decade, while subsidiary Duratec also operates in the east.

Managing director James Giumelli, the founder’s nephew, said about 80 per cent of Ertech’s $292 million revenue came from WA in fiscal 2016. Net profit was $9.6 million.

“It’s still very competitive in WA,” he said. “There are some good opportunities but you have to be quite selective about the ones you target.”

Director Gavin Miller has taken over the executive chairman role.

“I’m still a director on the board and give my tuppence worth on probably more things than I should,” Jim Giumelli said.

A beef cattle producer, the 69-year-old plans to gradually sell down his stake in Ertech, whose shares are held by about 50 employees.

--- ends ---

In summary, this appears to me to be about people who can succesfully build good businesses and think like business owners rather than just managers, because they ARE part-owners of the business.

Ertech remains a privately owned business.

Duratec is ASX-listed, and I hold Duratec shares both here and in my largest real money portfolio. Duratec's largest shareholder is Ertech (with 19.4%), and Duratec was part of Ertech before they were spun Duratec (their Maintenance business) out into a separate company. Both Ertech and Duratec have management with significant skin in the game.

In February this year 44% of Duratec’s order book consisted of Defence projects, and management believes this represents only 1.3% of the total addressable market (TAM) of $17 billion. This was before the Labour government announced additional defence spending over the next decade.

On the 24 November 2023 Duratec’s order book was down 6% pcp. The weaker order book appears to be the main reason for the share price weakness since Duratec announced a record 1H24 result on the 23rd February 2024.

The defence budget is about to receive an additional $5.7 billion per year from this year, and $50 billion more over the next decade, compared with the funding trajectory of the previous Coalition government.

By 2034, annual defence spending will be about $100 billion, hitting 2.4 per cent as a share of the economy. This year’s defence budget is about $53 billion, just over 2 per cent of GDP.

As part of the Defence budget review an additional $1.4 billion will be directed towards upgrading northern bases instead of defence buildings in Canberra.

In the 1H24 presentation Duratec said they were well positioned to capitalise on accelerated defence spend in key regions such as NT and WA. While we haven’t heard any news of project wins from Duratec yet, the stars are starting to align for more defence projects in the NT.

Held IRL (2.6%)

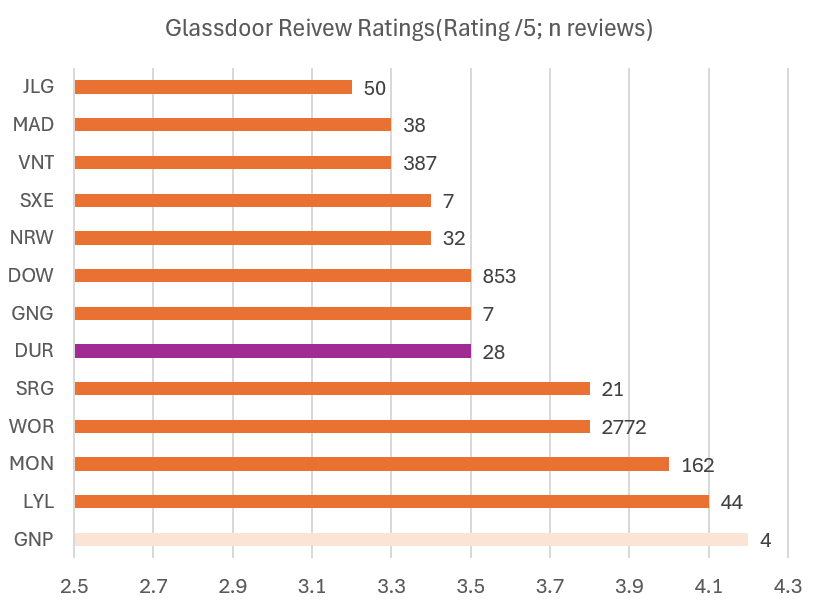

Part of my potential investment thesis for $DUR is a belief (or rather a question) that its more stable business compared with sector peers allows for better talent management and, as a result, industry outperformance.

** I've referred to this analysis in previous posts. It didn't clearly indicate what I though it might, but as I know several StrawPeople are interested in $DUR (and other firms referenced), so I have gone ahead and written it up. **

$DUR performs less cyclical work (compared with sector peers) due to its focus on asset refurbishment and life extension. This should enable better workforce management and career development, which in turn should drive higher performance than sector peers. If the firm is well-managed, this should lead to it retaining a cadre of key project management and engineering personnel, who understand its systems, processes, scope types and clients. This part of the potential thesis derives from my career exposure over 30 years to capital projects, where a common (universal!) factor in project underperformance is the capability of the project management team. A key capability and performance driver is staff turnover. High staff turnover leads to "hiring risk" including misalignment with company culture and processes, in addtion to performance/capability factors. These are major contributors of project underperformance, which can be very material.

I conducted an analysis, via data-mining LinkedIn profiles, of staff at $DUR in the key populations of:

- Project Management: including Project Managers (PM), Senior Project Managers and Site Managers. These are the key roles responsible for delivery of contracted scopes of work.

- Operations Managers and Area Managers: roles which oversee multiple project teams within a geographical area and/or industry vertical.

As well as measuring tenure at the firm, the analysis looked for evidence of career progression and development of individuals, e.g., project engineer-to-project manager-to-operations manager.

For the PM population, I conducted a parallel analysis at industry peer $LYL – a known high performer in the sector (covered extensively here by @Bear77 and @Rick ). $LYL faces the additional challenges of being more exposed to the commodity cycle, delivering more work through contractors, and having a more diverse international portfolio of mining projects.

Key Findings

Far from showing stable workforce tenure at the Project Manager (PM) level, if anything, $DUR tends to show a high level of PM turnover (avg. tenure = 3.2 yrs), even after making some allowance for portfolio growth (adjusted avg. tenure 3.5yrs). (This compares with an average tenure of 7.7 yrs of the equivalent population at $LYL)

In the PM population, staff at $DUR have held on average held 1.5 roles (1.8 at $LYL) at the firm.

However, $DUR appears to compensate for high PM turnover via the management layer of Operations Managers (OM) and Area Managers (AM). Holders of these positions demonstrate both longer average tenure and there is a strong propensity to appoint people to these roles who have developed through the ranks at $DUR. OMs and AMs have nearly always previously held one or more Project Management roles. For staff in these roles, average tenure at $DUR is 6.3 years, with staff having held on average 2.5 positions at $DUR. Importantly, of the 23 staff in this population, only 2 have been hired externally at this level in the last 3 years, with all others have been developed internally.

Finally, from an analysis of Employee Reviews at Glassdoor.com, the average $DUR rating = 3.5 is in line with the Industry Average (3.5-3.6 - see note at end of Straw), indicating $DUR is not distinctive in people management. (See graph at end of Straw)

Conclusion

There is no evidence, based on this analysis, that $DUR is distinctive in the management of its cohort of key project management professionals. Therefore, there is no evidence to indicate that better project management capability will drive industry outperformance in this area. The differentiated people management part of the potential investment thesis is not supported.

Limitations

The methodology was based on measuring the time employees have remained employed with the firm. While high turnover in the engineering and construction industry is one indicator of management capability and company culture, it is not a perfect indicator. Indeed, it is perfectly arguable that an underperforming firm and management team may have long tenured staff, e.g., by failing to manage performance effectively.

Secondly, Glassdoor reviews are susceptible to manipulation by management. (e.g., Management/HR teams encouraging managers and targeted high performers to submit reviews). Some of the firms also have a small population of reviews, and the scores can be disproportionately skewed by a small number of “outliers” for whatever reason.

Figure 1: Glassdoor Reviews Analysis

Analysis of data in graph:

Review-weighted Industry Average = 3.69

Review-weighted Industry Average (ex-WOR) = 3.51

Unweigthed Industry Average = 3.61

I have cited 3.5-3.6 as a better Industry Average for small/mid cap firms due to the dominant impact of the number of $WOR reviews in the dataset.

Interesting Unintended Finding

$LYL comes out looking pretty good in this analysis, so I've definitely put it on my watchlist!

27-March-2024: See here: https://strawman.com/forums/topic/8686#post-24873 DUR SP = $1.135.

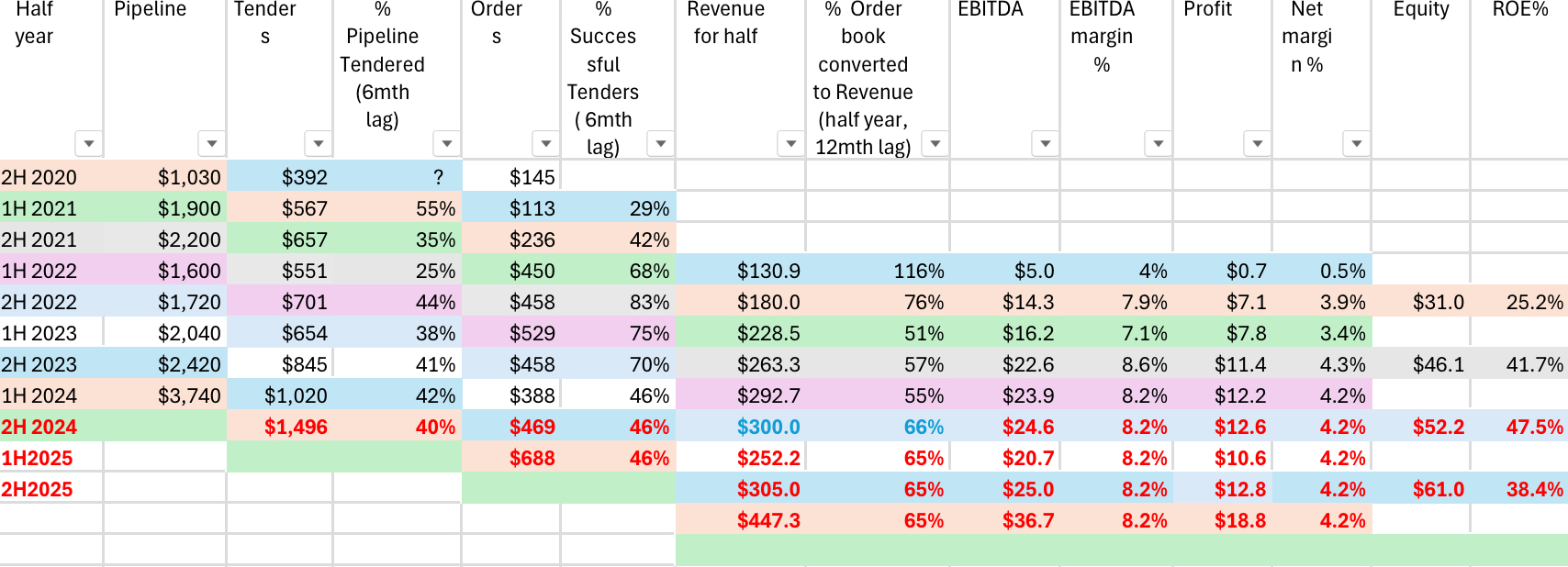

We now have a RL holding in Duratec (2.4%). I probably rushed into this a bit too early given the $388 million order book at 1H24. However, I’m here now, so it’s in my best interests to keep an eye on the pipeline of work. I am hoping to get some insight into what lies ahead to help with decisions for our holding. To help with this I’ve developed a Pipeline to Profit Model (another spreadsheet of course!).

Since listing, Duratec has consistently reported the dollar values for the pipeline of work, tenders and the order book for each half year. They have also reported EBITDA, NPAT and the margins for each. This comprehensive data makes it possible to model the historical dollar flows from pipeline to profit, and to see if there are any relationships that might be useful in forecasting profits. If they were to stop providing this data I think that could be an orange flag.

In the spreadsheet below I’ve modelled the dollars flowing from pipeline to profit assuming average lag times between each stage, noted in the column headers. I’ve assumed lag times of 6 months from pipeline to tenders, 6 months from tenders to order book, and 12 months from order book to revenue. This assumes an average lag time of 2 years from pipeline to profit, which sounds too short, but it will serve to test the model. I think the model could be very rubbery at this stage, but it’s somewhere to start and the aim is to update and improve the assumptions over time.

I’ve colour coded the dollar flows across different stages of the pipeline, and used black text for actual data, blue text for guidance, and red text for forecasts.

Analysing the conversion percentage for each stage in the pipeline, there appears to be some relationships that might be useful in forecasting profit. The conversion from pipeline to tenders ranged from 25% to 55%, narrowing from 38% to 44% over the last 2 years. For forecasting purposes I’ve assumed 40% of the 1H24 pipeline could result in tenders, ie c. $1.5 billion in tenders for 2H2024. Of course the lag times might be out of whack, and that won’t be very useful. Time will tell!

There seems to be more variability in the conversion of tenders to order book (contract wins). The conversion rate increased from 29% to 83% between 1H2021 and 2H2022, and then fell each half to 46% for 1H24. That means less than half of the projects tendered for resulted in a contract. It would appear that Duratec has become more focused on maintaining margins than in winning additional contracts, which is a good thing. Assuming 46% of the tenders would result in contracts, the 2H2024 order book could be c. $470 million.

Conversion of the order book to revenue has ranged from 51% to 66% for each half year. This makes sense as you might expect more than half of the order book would be converted to revenue each half year in the year/s of delivery due to the order book growing (not shrinking?). I’ve assumed 65% of the $388 million 1H2024 order book would be converted to revenue in 1H2025, resulting in 1H2025 revenue falling to c. $250 million. NPAT might be c. $10.6 million using a net margin of 4.2%. Based on this model NPAT could fall from c. $24.8 million in FY2024 to $23.4 million in FY2025 (5.6% lower).

The next update to look out for will be Duratec’s guidance for FY24. Last year this was released on 24 April 2023. We should have an update on the order book within a month, and hopefully it’s up on the $388 million at the 24 November 2023, or that could spell trouble!

Last year the FY23 results all came in at the top end of the upgraded guidance provided in April 23. I like to see this with guidance. I think Duratec is in for a record profit this year, but it’s the order book, the pipeline of profits, the margins and the ROE that we need to be watching.

Click on the photo to view the Duratec 3D model of a Main Roads Timber Bridge. Drag and expand with two fingers. The detail is incredible!

@mikebrisy, I’ve been exploring the Duratec website trying to better understand the services they provide. The whole-of-life asset management service is really interesting.

On the Duratec website I found some interesting information about one of Duratec’s unique services. I can see how these services would be sought after by government and big industry to manage and maintain infrastructure to avoid costly and unnecessary premature deterioration of assets. The following is from their sustainably page on the Duratec website. The detail in the 3D models developed by their engineers is incredible (I wonder if they are client of Pointerra?) Here’s an example of a 3D Model of a Main Roads Timber Bridge. Click on the link and explore the structure. There are other examples in the 3D models link below.

Duratec is a solutions-driven contractor, providing whole-of-life engineering, construction and remediation services.

We work to extend the life of existing assets and infrastructure. In doing so, we help to reduce reliance on the development of new infrastructure. In partnership with our clients, we work to provide long-term, sustainable and intergenerational outcomes whilst considering harsh environmental factors.

With an in-house technical team, one of our unique offerings is our ability to provide condition assessments to determine the level of deterioration and decline, and then develop 3D models of these assets to assess and monitor changes over time.

As a national contractor working across a range of industries, we understand the potential environmental impacts of our work are varied. With this in mind, we work in strict accordance with our Environmental Management System, certified to ISO 14001.

Claude held Duratec until its peak in February 2023, then sold. Perfect timing Claude! What a master!

The reason Claude sold is behind the paywall, so I’m none the wiser. This is one opinion I would hold in very high regard. I’ve joined the waiting list to be a subscriber to “A Rich Life”. I guess I’ll just have to wait until Claude lets me in!

After Claude sold (well I assume he sold) another article appeared in May 2023 regarding upgraded guidance. That’s behind the paywall also. :(

If you’re looking for a “very well researched”, DEEP DATA BEAR CASE (cough, cough…excuse me!) on Duratec you should tune in to Mathan Somasundaram on “the Call” (37:47 into the podcast) https://podcasts.apple.com/au/podcast/the-call-from-ausbiz/id1506523664?i=1000648704155

For those who don’t have time to listen (or simply prefer not to) I’ve jotted down some “deep data” notes. This is value investing at its absolute best! I couldn’t help myself from adding in a few comments in brackets throughout! Sorry, it’s a bit cheeky! :)

Duratec…GET OUT!

- They make machines last longer, and do some concrete manufacturing (that’s an interesting interpretation!)

- They’ve had a huge run, now they’re petering out (that’s Deep Data for you!)

- its not expensive which is always a worry after you’ve had a big run (I didn’t know that?)

- The multiple is not high and the market knows it (Mr market is so clever? Why are we wasting time trying to value businesses?)

- Brokers upgrading, which is a worry (mmm..I hadn’t thought about that)

- The market is pulling back, which tells me brokers were over optimistic (I’ll have to take that on board)

- share price has gone sideways for 4-5 months (deep data at its best)

- the last result wasn’t great (I must have read the wrong report?), so we’ve had a number of disappointments (I must have missed those too)

- Brokers haven’t downgraded which is interesting (Very interesting!)

- the stock is not expensive (We can agree on that one!), so I think high expectations are already built in (Huh?)

- You’ve got to play the growth (how much growth are we looking for? I thought 34% CAGR since starting was OK) so it’s not for me. If it were a successful growth story and the market were willing to pay for it, you’d have a high multiple (Of course. Why didn’t I think of that! Much easier than reading reports)

- It looks too cheap! (We can agree on that!)

- The risk is high here (there’s always a risk). I would not be jumping in because I think the downgrades are going to build (Really? I wish I had access to deep data like that). You’ve had a couple of good years (not me unfortunately, but early investors have)

- once you’ve had the first downgrade, GET OUT! (OK! Still waiting though)

- The risk is high here, the brokers are not doing any more research (first I knew about it) which kinda tells me there’s stuff that’s not going great (Of course! A great indicator. Much easier than combing through reports) and there’s too high expectation (I’m expecting a 15.8% return. Does that mean my expectations are too high then? I’ll have to adjust those down!)

Disc: Do your own Research! This is for educational purposes only, and it doesn’t consider your personal circumstances. Nor does it consider anything related to the reports, company financials, or future prospects of the business.

Sorry! I couldn’t help it!

In the quarterly rebalance effective prior to the Open on March 18, 2024, Duratec will be added to the S&P All Ordinaries Index (ASX: XAO). This will not affect the valuation of the business, but could lift the demand for the stock from fund managers.

https://www.duratec.com.au/investors/financial-reports-presentations/

Duratec announced to the market it has changed the date of its AGM today for the third time time in the last two weeks.

This and the three founders selling down about 10% each of their holding (they have gone from 11.18% to 9.68% ownership) seems to have spooked the market over the past 3 weeks.

There was nothing in the annual report that I could see suggesting a change in momentum of the business although it is not expected the defence segment will grow as quickly as it did in FY23.

An item of business at the meeting will be the re-election and appointment of directors.

Is it uncommon for a company to change the date of its AGM like this?

Transparency and integrity have always been a strength of the management.

sell down 8.5 million shares in the Company.

Staedy Left to right chart Here:

DUR:

Duratec Limited is an Australian contractor providing assessment, protection, remediation, and refurbishment services to a range of assets and infrastructure. Headquartered in Wangara, Western Australia, the company has fifteen branches around the country in capital cities and regional centres, delivering services across multiple sectors including Defence, Commercial Buildings & Facades, Infrastructure (Water, Transport & Marine), Mining & Industrial, Power and Energy.

Defence:

Dedicated to the delivery of capital facilities, infrastructure and estate works program projects.

Mining & Industrial:

Provision of tailored preventative maintenance programmes.

Buildings & Facades:

Completion of facade condition assessments and facade restorations.

The Board - Greys n Blond

Overview

-Duratec came in at the top end of their twice upgraded revenue and EBITDA guidance:

-They had a total of 1944 projects (compaired with 1664 in FY22)

-Their workforce increased by 20%

-Wilson Pipe Fabrication (WPF), the first substantial acquisition for the company, has been a sucess and has the highest margins within the business (gross margins about 30%)

-The Mining & Industrial, Energy and WPF segments have the highest margins and are growing quickly on a forward looking basis

-NPAT margin increased from 2.5% in FY22 to 3.9%

-The orderbook has $458.2m ($458m FY22) however this excludes $60-70m of master services agreement

-One legacy heritage structure remediation project impacted the FY23 results due to scope/access/location. This was still completed to a high quality

Business Segments

Defence

-Significant increased revenue of $229m ($135 FY22) with $252m in the orderbook

-This is the lowest margin segment about 13% gross margins

-Recent slowing of estate works due to cancellation/reprioritisation of projects that no longer suit the national defence strategic review (released May 2023)

- New priorites are: fuel reserves, maritime infrastructure, bases, ports and accommodation building

Mining and Industrial

-Revenue of $86m (up from $65m in FY22) with $105m in the orderbook

-This is a higher margin segment about 21% gross margins

-Second half of the year significant increase in award of iron ore industry upgrades comencing with BHP Berth wharf at Port Headland

- This followed an Early Contractor Involvement of 3D capture of the entire Wharf

- This had led to further additional awards in the Pilbra region of WA

Buildings and Facades

-Revenue of $78m (up from $65m in FY22) with $82m in the orderbook

-This segment has a gross margin of about 15%

-TAM $12b

Energy

-Revenue of $47m (up from $12m in FY22) with about $60m in tenders

-Higher margin segement about 21% gross margins

-Significant fuel security and upgrade works upside

Wilson Pipe Fabrication

-Highly motivated management team

-A key vertical acquisition for the energy segment

-About 30% gross margins

-Voted contractor of the year (Santos 2023 Directors awards)

-TAM $60b from decommissioning of offshore oil and gas infrastructure as the economy decarbonises

Mend Consulting (ECI - early contractor involvement)

-Full in-house solution

- Survey data/ laser scanning/ thermal

- Annoview labeling

- In-house sampling/ testing

- commercial options

-Asset management council innovation award 2023

-Since BHP win (discussed above) new enquires from an international gold miner with a variety of assets

DDR Australia

-Duratec has 49% ownership

-Revenue of $33m (down from $72m in FY22)

-A delay in tender award decisions has reduced the work over FY23

The 6 key projects

The pipeline of work

Remuneration

-Executive directors

- Phil Harcourt $1m (including a $450,000 cash bonus)

- Chris Oates $908,000 (including a $400,000 cash bonus)

-Employee expenses increased to $35.8m (from $27.8m in FY22)

Conclusions

-FY23 had a big increase in revenue driven by the Defence segment

-This flowed through to the bottom line and the NPAT margin and cash position improved

-The new WPF acquisition is earnings accretive and provides an important vertical for the Energy segment

-Management demonstrated excellent capital allocation with the acquisition of WPF

-The decommissioning of offshore oil and gas projects as we decarbonise has a TAM of $60b with WPF/Energy segment well placed to win this work

-Managements ability to risk manage project selection is a moat

-Mend consulting (Unique 3D modeling) is gaining traction and leading to commercial work

-It is unlikely that the Defence segment will continue at the same rate as it did in FY23

Disclosure held irl

Key Points:

-A high quality national engineering, construction and remediation company with some vertical integration, listed in 2021, current market cap $298m

-Run by the 3 founders with strong shareholder alignment owning over 30% of the company

-High quality, conservative management: average annual growth rate over 12 years of 32%

-Management recently upgraded guidance for FY23: revenue $465-495m (up from $310m FY22), EBIDA $36-39m (up from $11.7m FY22)

Key Business Drivers:

-aging infrastructure eg. wharfs/ bridges

-poor original construction eg water proofing

-expansion of existing assets

-stricter building codes eg fire proof cladding

Key Markets:

-Defence: about 50% of revenue. DUR has a presence on 52 defence bases in Australia. Bipartisan approved 10 year spend. Over 25,000 defence buildings that will need something done. Current big project RAAF Base Tindal aviation refuelling works

-Mining and Industrial: about 25% of revenue. Current big project is Western Sydney International Airport fuel infrastructure

-Building and façade: about 15% of revenue. Current big project is recladding Central Park Building in Perth

-Energy/ Transport and water: about 10% of revenue. Recently purchased Wilson’s Pipes Fabrication which supply materials to DUR

Business Model:

-Quality rather than a quick fix ie. solid repair solutions

-DUR will do a 3D model conditions survey to tag the engineering problems (they are the only company in Australia doing this), then DUR suggest solutions, sometimes it is put out to tender or they are given the work to complete

-DUR are usually 1 of 2 or 3 competing for this work

-1500 projects in the past year (out of 4000 project they were offered): “It’s the jobs we knock back that make us successful”, Chris Oates GM/Executive director/Founder

Outlook:

-Since mid-may DUR has secured $30m in Mining and Industrial segment work

-Recently upgraded guidance for FY23 (management have a history of upgrading guidance):

*Revenue $465-495m for FY23 up from $310 FY22 (increase 50-60%)

*EBIDA $36-39m for FY23 up from $11.7m FY22 (increase 208-233%)

-Using data from the half yearly accounts net margin likely to be about 4% on a NPAT of $18-20m

-More than double last year's profit result

(I got here by using EBDITA guidance of $36-39m. 1HFY23 NPAT conversion was 7.85/15.6 = 50%. Therefore expected NPAT for FY23 of about $18-20m. This is a net margin of 18/465 = 3.9%)

Issues:

-A low margin business. FY22 net margin was 2.5%

-It is a high cap ex business

-A competitive sector keeps margins down. Their biggest competitor Monadelphous had a net margin of 2.9% in FY22 on a market cap of $1.15Bn. Monadelphous has had flat revenues and EPS for several years and is not showing any growth

Conclusion:

-A quality business performing quality engineering work with highly aligned and quality management

-Growing rapidly

-50% of business comes from defence which is not cyclical and very sticky

-Has a strong national footprint and some vertical integration and is the only one of its competitors doing 3D model generation

-FY23 DUR should earn 8.2c/share. That is based on their guidance which they have a track record of being conservative on. On their current PE of 19.4 the market is assuming EPS of 6.1c. Should be about $1.59 based on the current PE. This is assuming the market wants to keep DUR at a PE of 19.4

I've been looking at Duratec and I like what i see. An excellent company doing excellent engineering run by excellent management.

My major concern is the low net margins of the business. These margins have fallen from a pre-COVID 5.5% in FY18 down to 2.5% in FY22.

This is a question for @Karmast who seems to know this company well. What is your take on this? Is this COVID effecting costs? Do you think these margins will rebound for FY23?