Part of my potential investment thesis for $DUR is a belief (or rather a question) that its more stable business compared with sector peers allows for better talent management and, as a result, industry outperformance.

** I've referred to this analysis in previous posts. It didn't clearly indicate what I though it might, but as I know several StrawPeople are interested in $DUR (and other firms referenced), so I have gone ahead and written it up. **

$DUR performs less cyclical work (compared with sector peers) due to its focus on asset refurbishment and life extension. This should enable better workforce management and career development, which in turn should drive higher performance than sector peers. If the firm is well-managed, this should lead to it retaining a cadre of key project management and engineering personnel, who understand its systems, processes, scope types and clients. This part of the potential thesis derives from my career exposure over 30 years to capital projects, where a common (universal!) factor in project underperformance is the capability of the project management team. A key capability and performance driver is staff turnover. High staff turnover leads to "hiring risk" including misalignment with company culture and processes, in addtion to performance/capability factors. These are major contributors of project underperformance, which can be very material.

I conducted an analysis, via data-mining LinkedIn profiles, of staff at $DUR in the key populations of:

- Project Management: including Project Managers (PM), Senior Project Managers and Site Managers. These are the key roles responsible for delivery of contracted scopes of work.

- Operations Managers and Area Managers: roles which oversee multiple project teams within a geographical area and/or industry vertical.

As well as measuring tenure at the firm, the analysis looked for evidence of career progression and development of individuals, e.g., project engineer-to-project manager-to-operations manager.

For the PM population, I conducted a parallel analysis at industry peer $LYL – a known high performer in the sector (covered extensively here by @Bear77 and @Rick ). $LYL faces the additional challenges of being more exposed to the commodity cycle, delivering more work through contractors, and having a more diverse international portfolio of mining projects.

Key Findings

Far from showing stable workforce tenure at the Project Manager (PM) level, if anything, $DUR tends to show a high level of PM turnover (avg. tenure = 3.2 yrs), even after making some allowance for portfolio growth (adjusted avg. tenure 3.5yrs). (This compares with an average tenure of 7.7 yrs of the equivalent population at $LYL)

In the PM population, staff at $DUR have held on average held 1.5 roles (1.8 at $LYL) at the firm.

However, $DUR appears to compensate for high PM turnover via the management layer of Operations Managers (OM) and Area Managers (AM). Holders of these positions demonstrate both longer average tenure and there is a strong propensity to appoint people to these roles who have developed through the ranks at $DUR. OMs and AMs have nearly always previously held one or more Project Management roles. For staff in these roles, average tenure at $DUR is 6.3 years, with staff having held on average 2.5 positions at $DUR. Importantly, of the 23 staff in this population, only 2 have been hired externally at this level in the last 3 years, with all others have been developed internally.

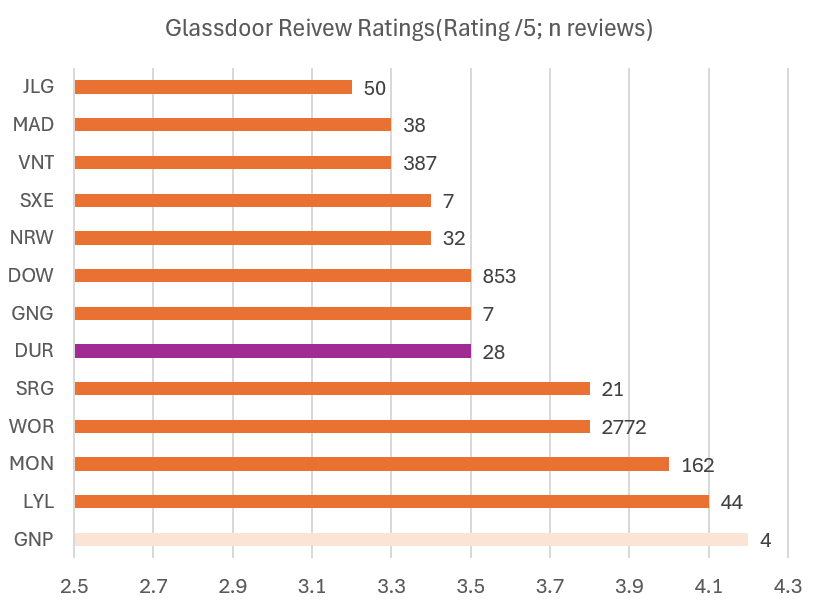

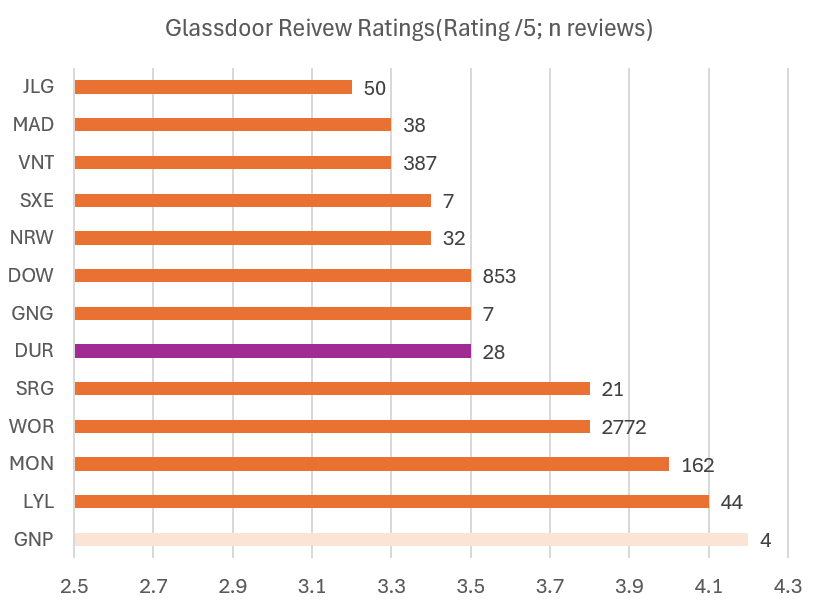

Finally, from an analysis of Employee Reviews at Glassdoor.com, the average $DUR rating = 3.5 is in line with the Industry Average (3.5-3.6 - see note at end of Straw), indicating $DUR is not distinctive in people management. (See graph at end of Straw)

Conclusion

There is no evidence, based on this analysis, that $DUR is distinctive in the management of its cohort of key project management professionals. Therefore, there is no evidence to indicate that better project management capability will drive industry outperformance in this area. The differentiated people management part of the potential investment thesis is not supported.

Limitations

The methodology was based on measuring the time employees have remained employed with the firm. While high turnover in the engineering and construction industry is one indicator of management capability and company culture, it is not a perfect indicator. Indeed, it is perfectly arguable that an underperforming firm and management team may have long tenured staff, e.g., by failing to manage performance effectively.

Secondly, Glassdoor reviews are susceptible to manipulation by management. (e.g., Management/HR teams encouraging managers and targeted high performers to submit reviews). Some of the firms also have a small population of reviews, and the scores can be disproportionately skewed by a small number of “outliers” for whatever reason.

Figure 1: Glassdoor Reviews Analysis

Analysis of data in graph:

Review-weighted Industry Average = 3.69

Review-weighted Industry Average (ex-WOR) = 3.51

Unweigthed Industry Average = 3.61

I have cited 3.5-3.6 as a better Industry Average for small/mid cap firms due to the dominant impact of the number of $WOR reviews in the dataset.

Interesting Unintended Finding

$LYL comes out looking pretty good in this analysis, so I've definitely put it on my watchlist!