Straw significantly edited as there were some errors in the earlier cash flow figures, now corrected.

Text also updated following the presentation Q&A and some observations added. Apologies for what is now a very messy straw ... but accuracy is important!

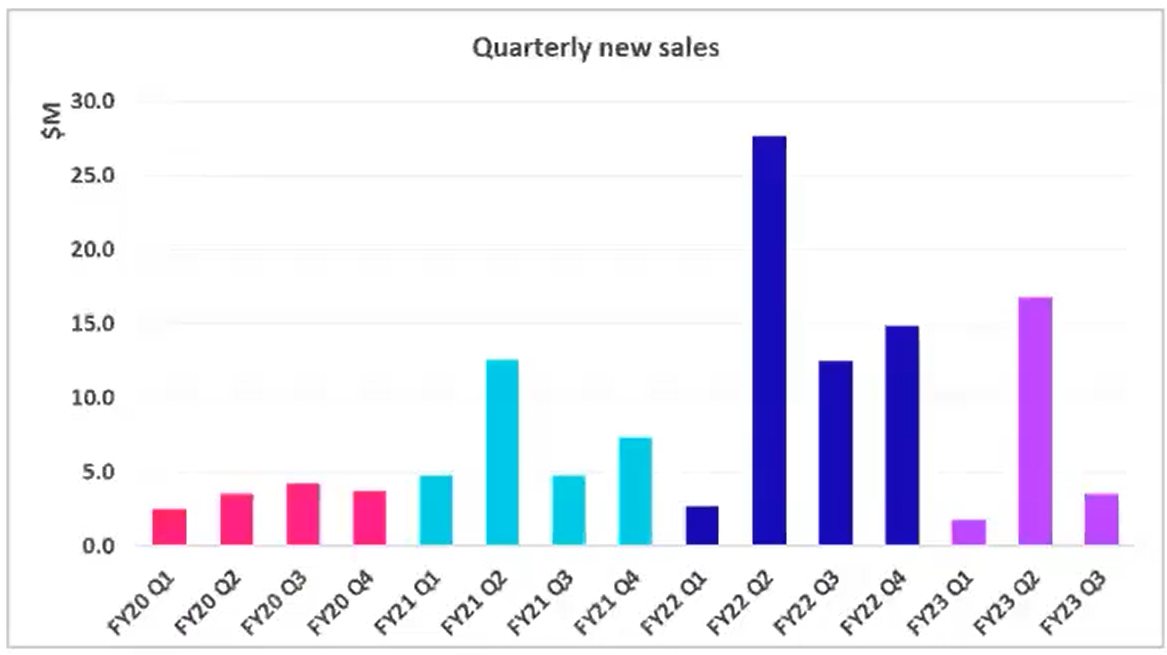

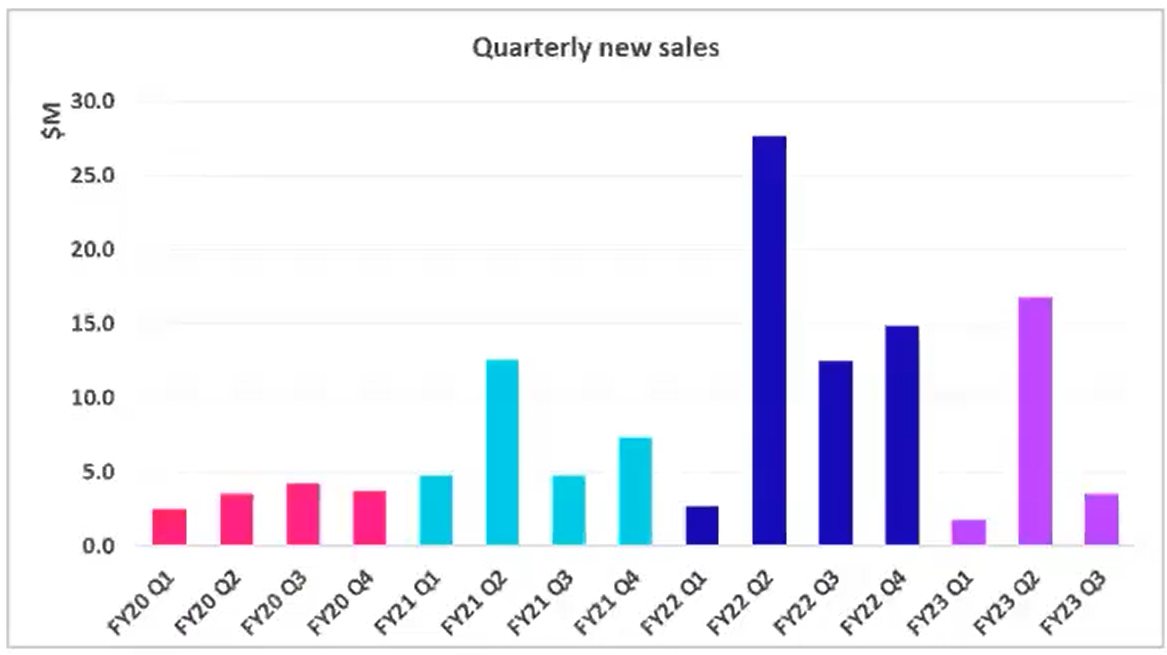

Figure 3 added to show the quarterly new sales from the presentation.

@Valueinvestor0909 has picked out the key issues.

Based on Q2 FY23 report we were all expecting at least $2m (edited from $3m) of the cash receipts (** see below comment) to be due to the late payments in the previous quarter. So the reported receipts of $10.446m are really only c. $8.5m (edited from $7m) from the quarter, so meh.

Also, Q3 Sales are unimpressive, - the graph wasn't in the 4C release, but is included in the presentation. (Edited out my earlier comment, throwing shade at Kate for not reporting this metric!) I've included it in Figure 3, below.

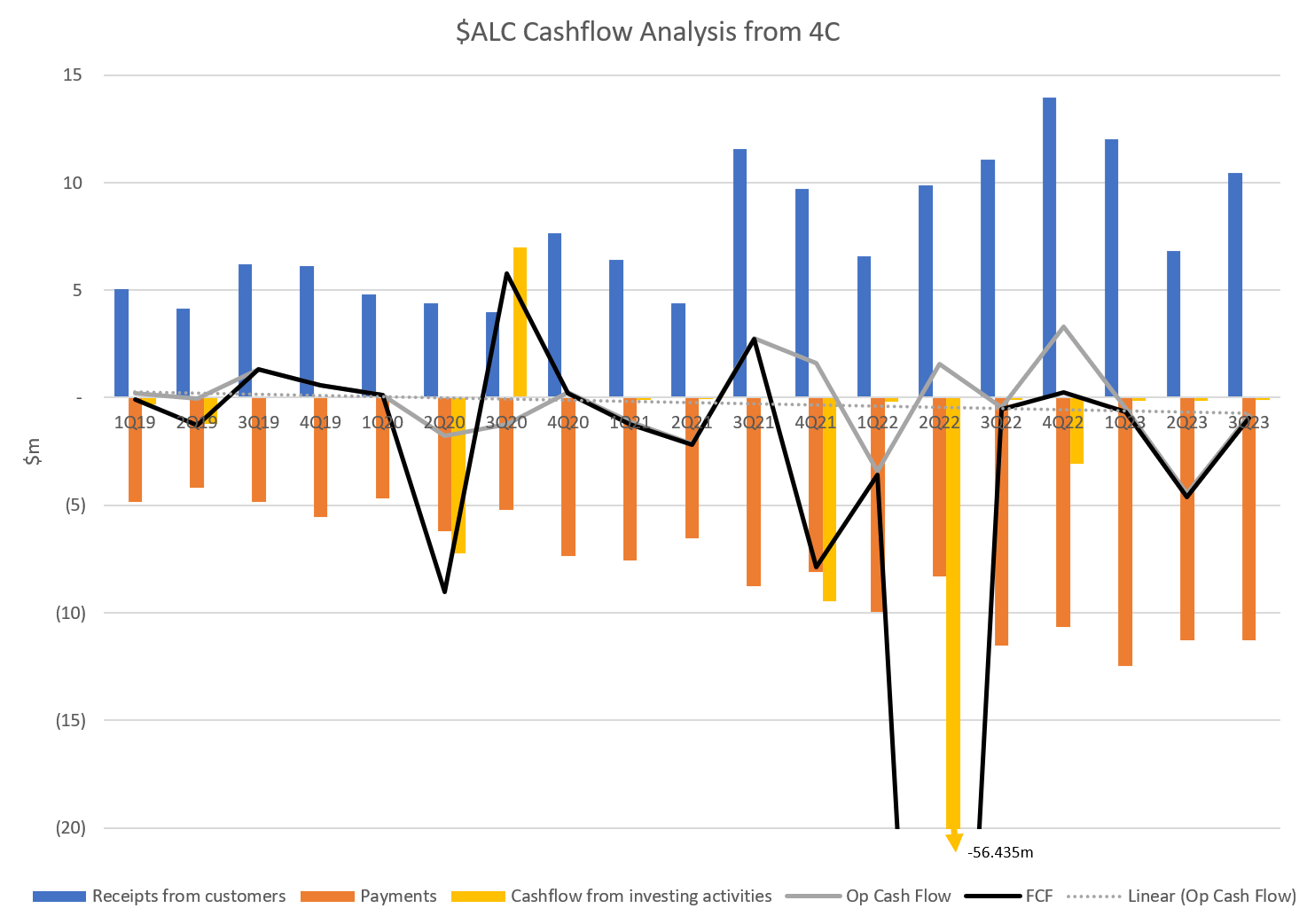

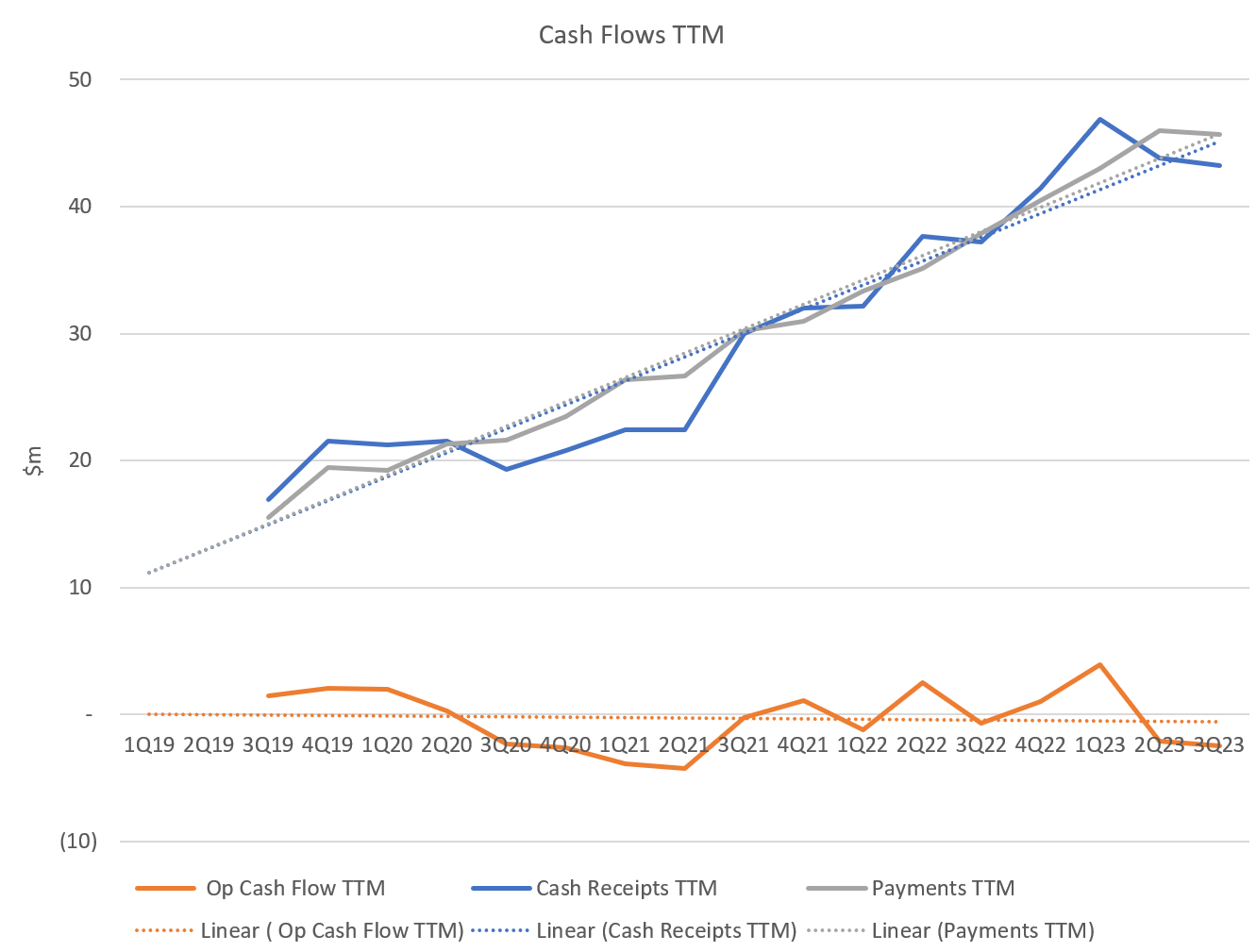

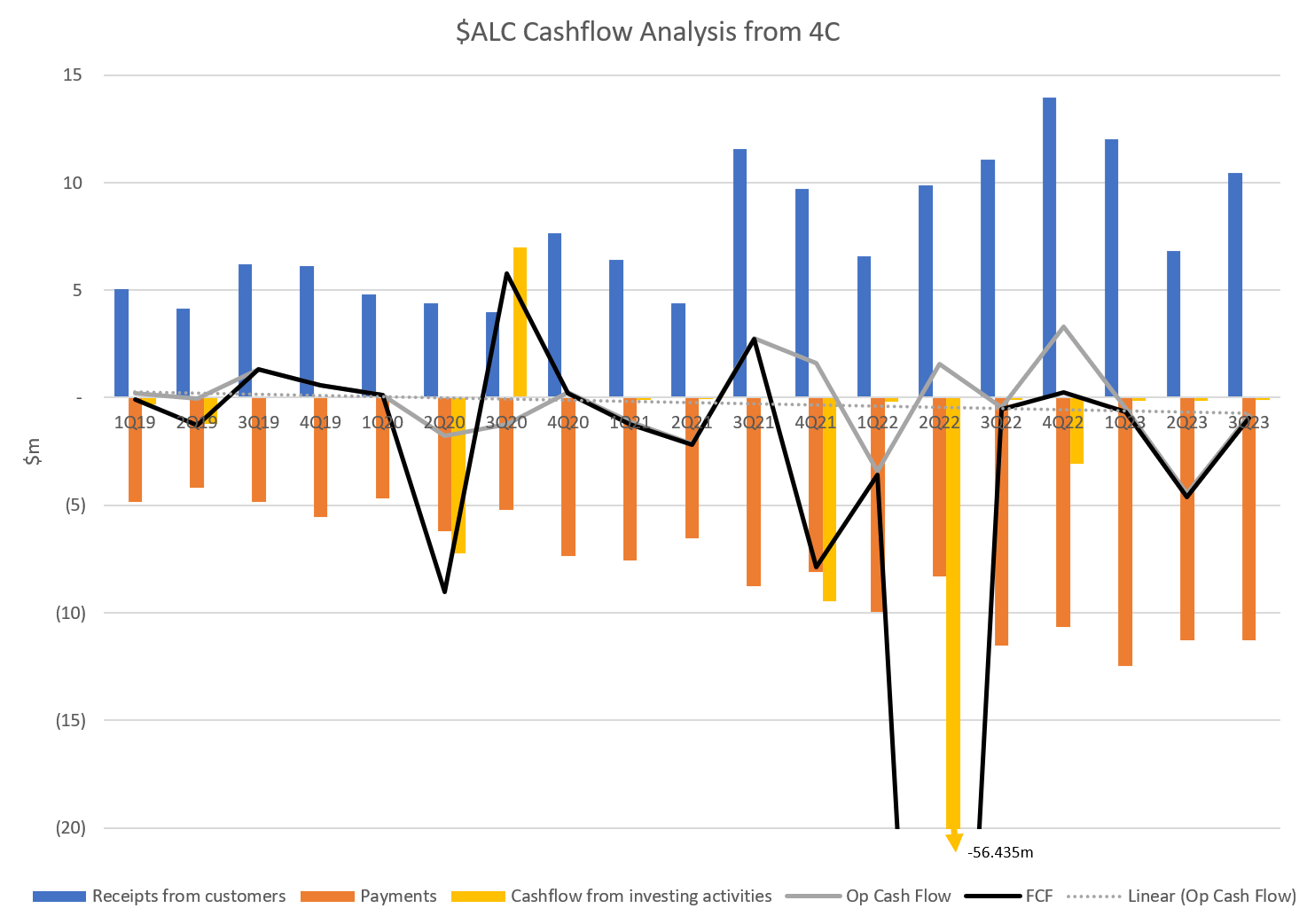

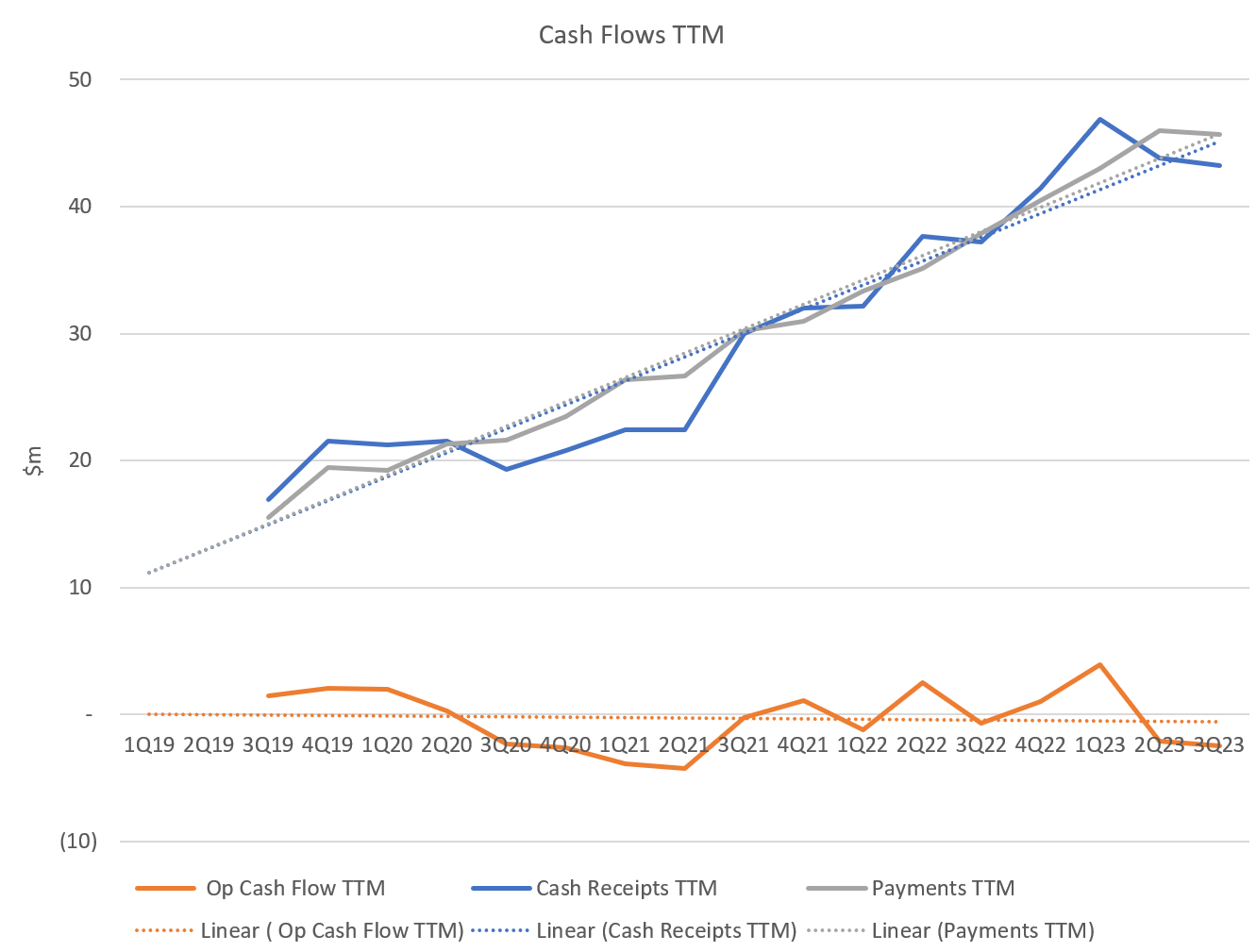

Taking a step back, I've updated my usual 4C Cashflow plot (Figure 1). And because $ALC is lumpy from Q to Q, I have plotted the same data in a trailing 12 months (TTM) format.

Basically, $ALC is running hard to stand still - there being no significant trend now in OpCF since the Silverlink acquisition.

I'm hanging on because Kate appears to be controlling costs well, and the UK implementations are providing reference sites. It should be expected for these implementations to take time, given the long sales cycle. So I am holding for now, but I think another year or so, and the strategy needs to start delivering operating cash flow growth.

** Comment:

During the Q&A today, one investor asked about the "late $5.6m receipt", to which the CFO (correctly) replied that the questionner was mistaken. He then clarified that there was a late payment of $2m in Q2 and, because some payments in Q3 were also received late, that Q3 receipts could be considered "normal" (swings and roundabouts argument). This confused me, because if this is true, why did they make a song and dance about it in Q2. Doesn't it just mean that a portion of payments falling due towards the end of the Q will always risk falling into the next Q?

CFO was adamant that Q4 will be the strongest receipts of the year. This is also in the release, so that indicates to me that >$13m Q4 receipt is in the bag. Given that the cost base is stable and investments are dialed right back, this means they will likely have a final Q that is OpCF and FCF positive.... provided they get paid ;-)

Key Takeaway

Management are trying very hard to get the most out of each quarterly report, for example, to achieve the (now abandoned) promise of being EBITDA positive this year. Personally, I think they are trying too hard to put a positive gloss on their communications. Now I don't believe Kate and her team would mis-state the facts, but they need to be careful with the spin, as it is easy to trip yourself up over time. For example, it is fine to talk about NHS staff shortages and strikes. But we all watch the news, and that is a characteristic of the market they are playing in. It is a fair headwind countering the tailwind of the drive to digitally emable the NHS.

I am observing a pattern in several tech holdings that, when sales and receipts in the quarter fall off the growth trend, there is a tendancy to talk about timing of payments, slow sales cycles, delays in renewals, and the strength/growth/record nature of the pipeline. (Examples from $3DP, $EVS and $ALC). As investors, we only have to wait 13 weeks to see if the story plays out so, thank goodness for the 4C and quarterly reporting! Equally, it is important to recognise that 13 weeks is a short period of time and the lumpiness from quarter to quarter can be very significant, as Figure 1 shows. It is as important not to over-react to one bad quarter as it is to over-react to one good quarter. Whatever the fair value of $ALC, I don't believe that today's result warrants a 10% markdown. Of course, using a cricket analogy, for every over that you don't hit the target run rate, it means more boundaries are needed in subsequent overs to stay on target overall.

Figure 1

Figure 2

Figure 3

Disc: Held IRL and SM