Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Discl: Held IRL 1.27% and in SM

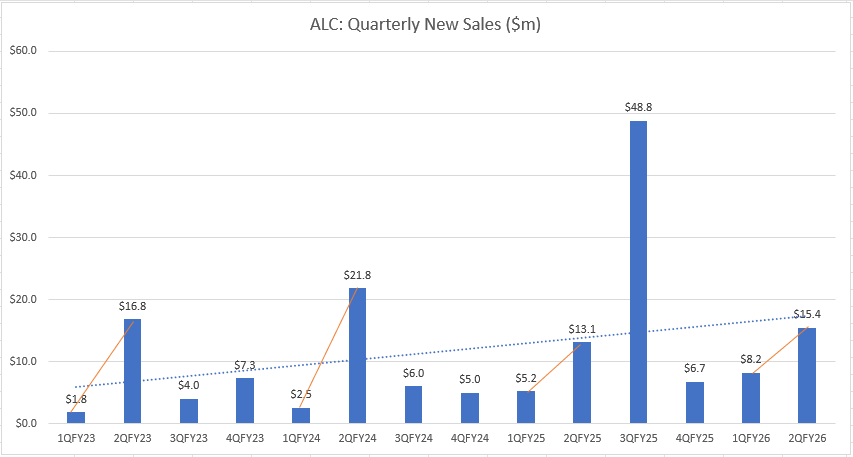

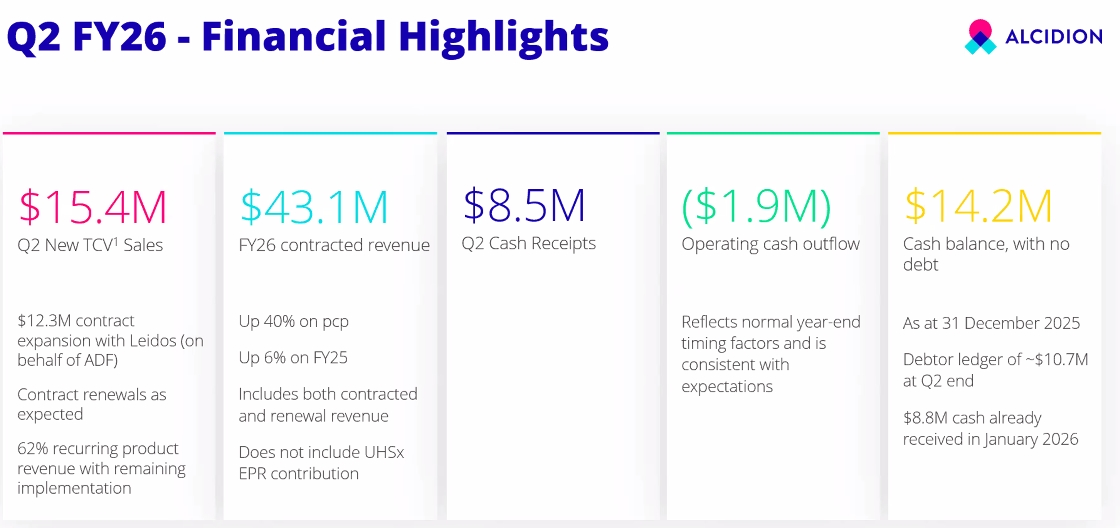

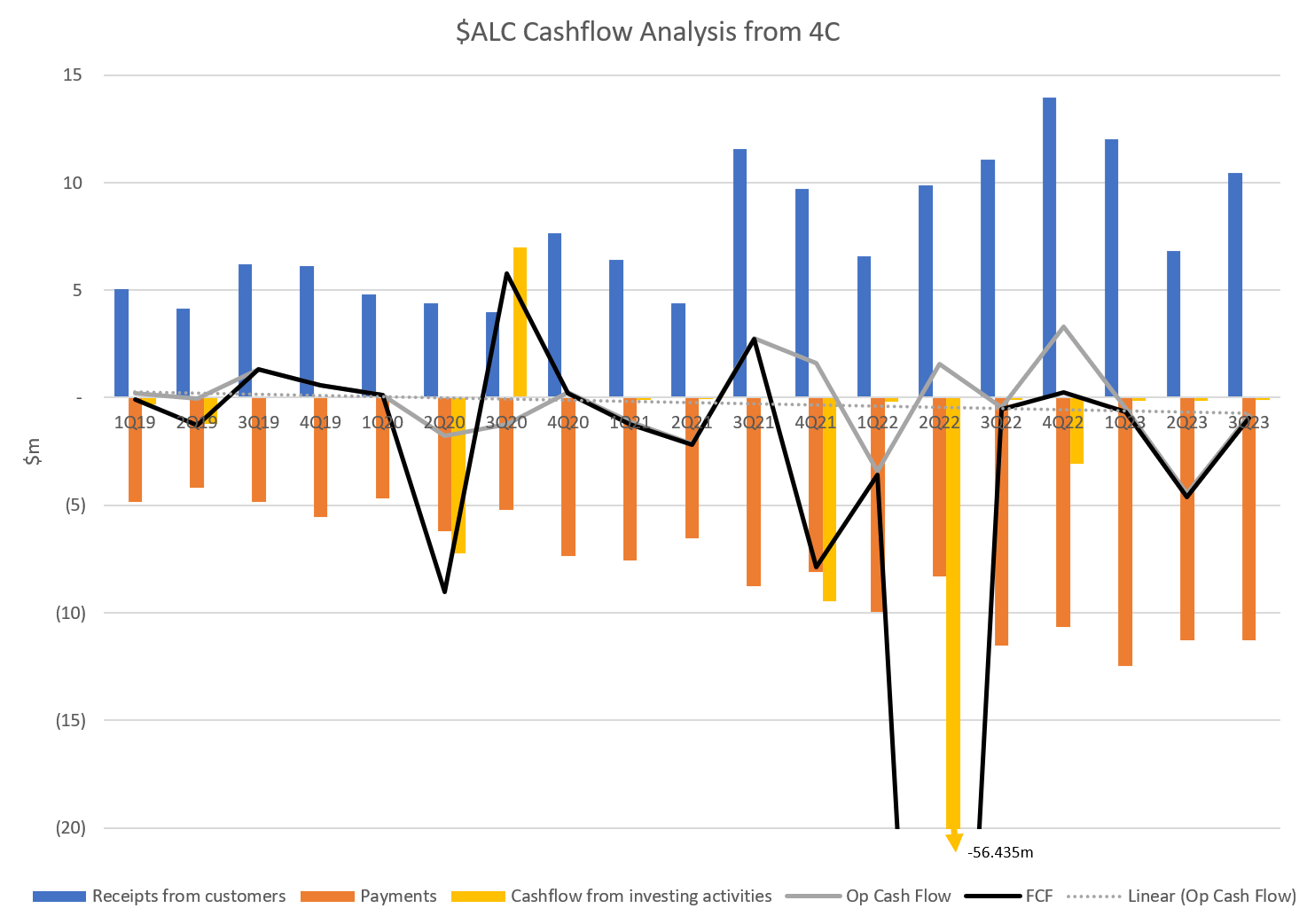

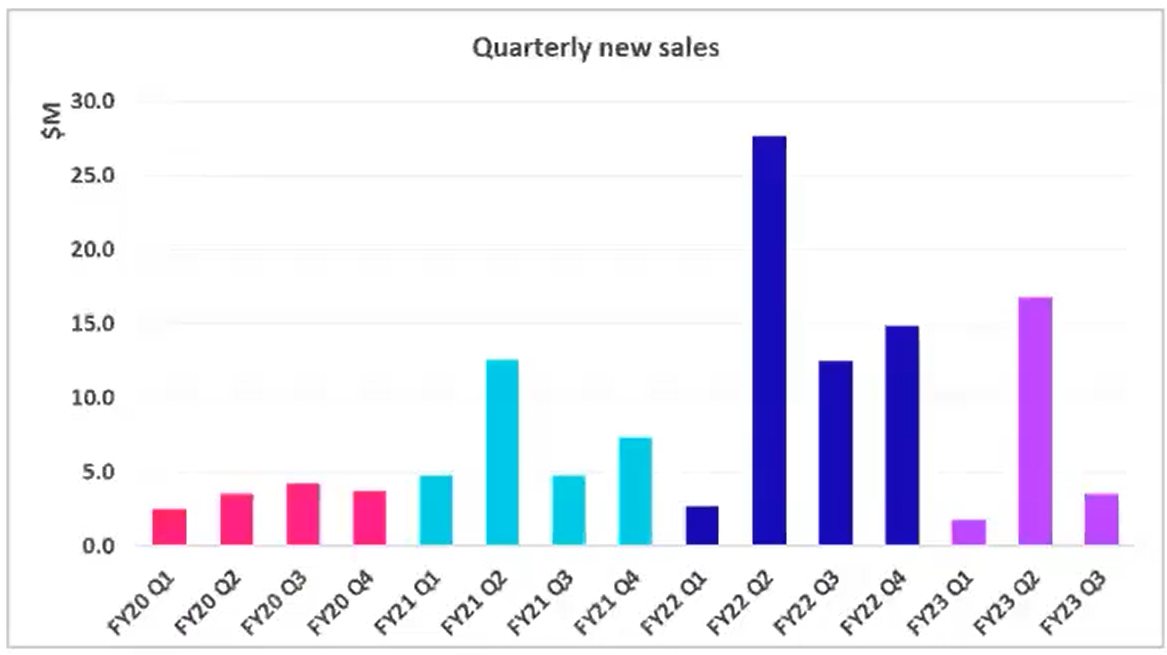

Not a bad 4C from ALC today, mindful that 1H is seasonally flatter than 2H. In reviewing the results, I took the approach of comparing 1H-2H trends in the past 3 years to put this 2QFY26 results in better perspective.

QUARTERLY SALES

- New TCV sales of $15.4m, $12.3m of which is Leidos JP20260 project related which was previously announced

- Excludes the sales from the whopper UHSussex deal, where the contract is currently being negotiated

- The sharp rise in 2Q Sales vs 1Q in FY26 is consistent with that of the past 3 years, but is that little bit more impressive given the higher 1QFY26 sales vs the past 3 years, so no concerns here

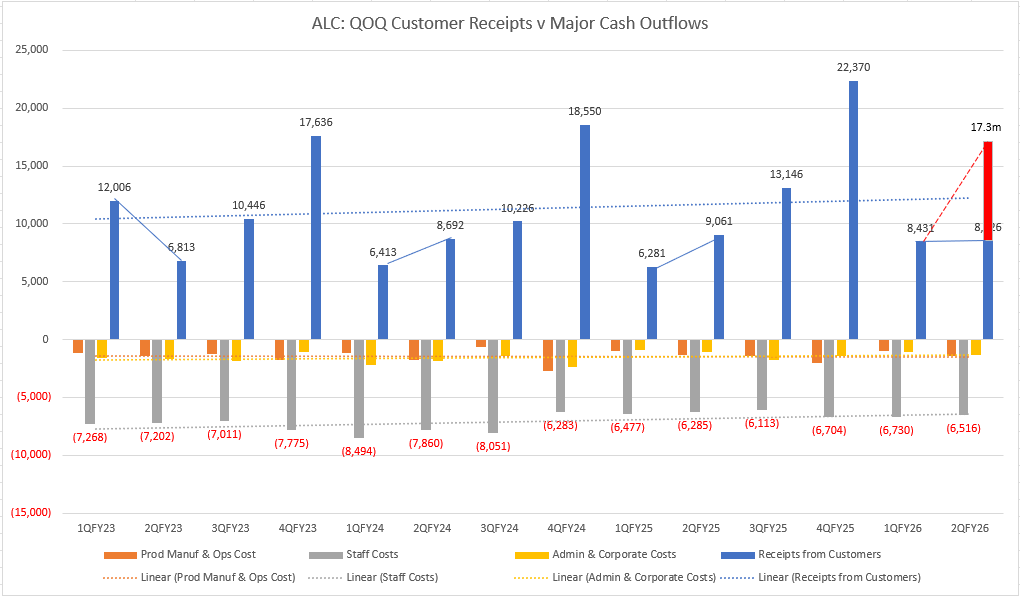

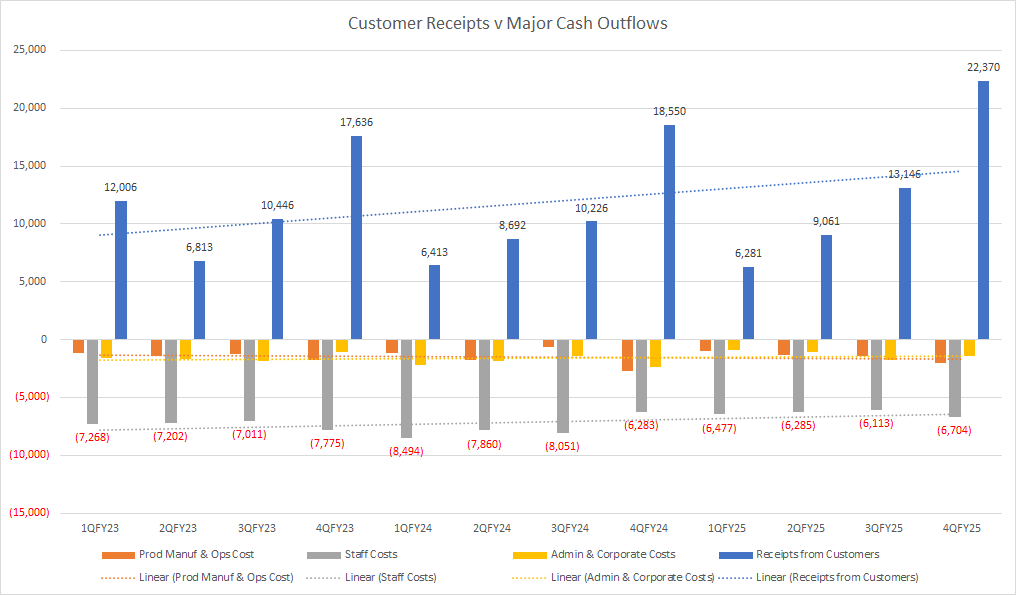

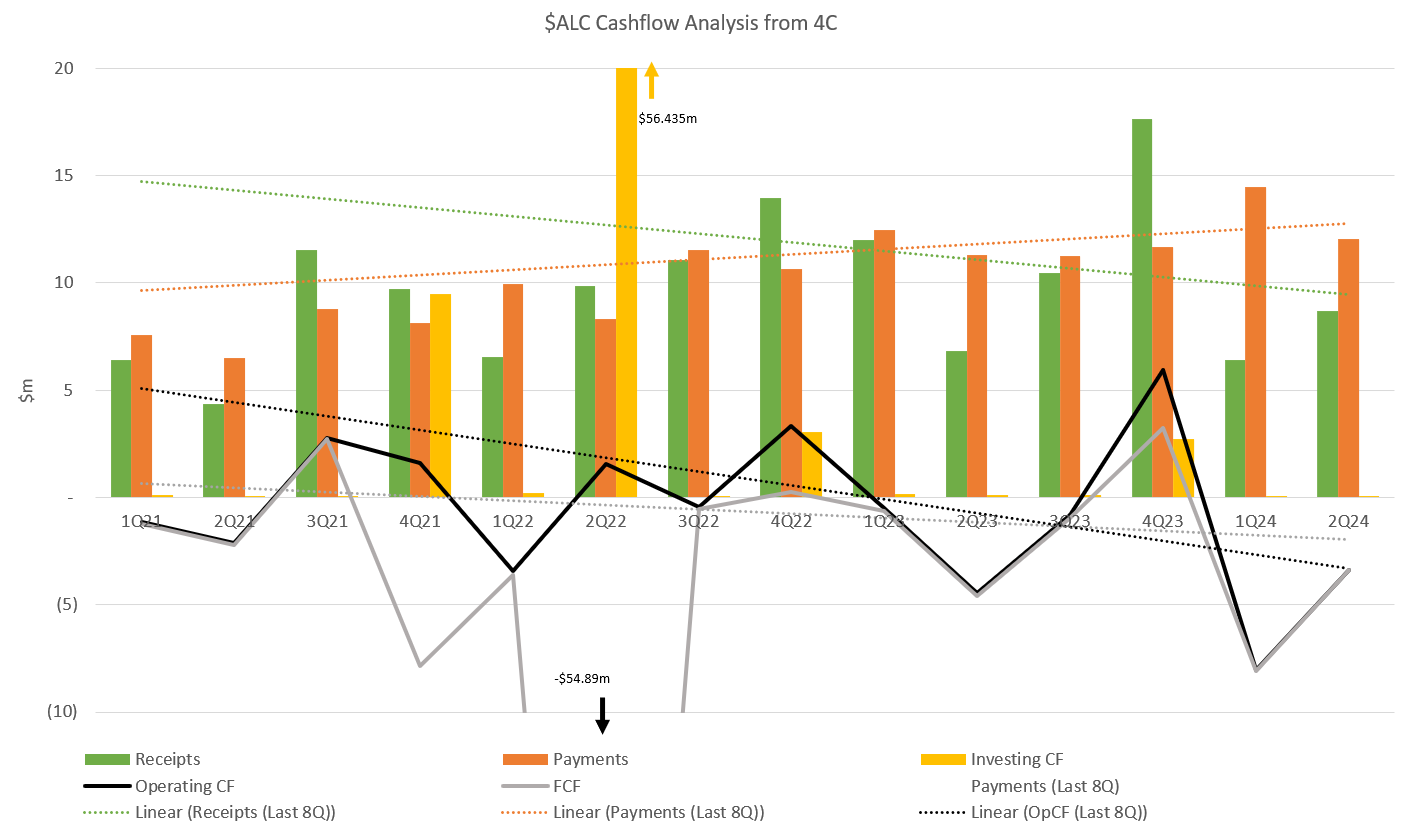

CASH FLOW - No Concerns

- ($1.9m) operating cash flow, $8.5m cash receipts was noticeably flat QoQ vs the past 2 years, but this is purely timing-related

- When adding the $8.8m cash that was collected in early Jan that tipped past 2Q, the cash receipts position (and by extension, the Operating cashflow position) is actually a marked improvement from the past 2 years

- Cash outflows are in line with seasonal 1Q-2Q trends:

- Ops Cost - jump QoQ is consistent with previous 1Q-2Q

- Staff Costs are on trend and generally declining - increased 3.7%, salary increases at ~inflation rate

OTHER KEY FINANCIAL POINTS

FY26 Contracted Revenue is up 40% on pcp but is already up 6% on FY25 at 1H, with a sesonally stronger 2H and the UHSussex deal yet to be accounted for - that is impressive

Cash balance $14.2m, no debt.

NEW SALES

- New sale not previously reported - 3 year Patientrack renewal with NHS Lanarkshire, about ~$1m

- Further info on UHSussex deal:

- 3rd EPR contract for ALC

- UHSussex was a Patientrack customer, with limited existing stakeholders - the EPR deal was won with significantly more stakeholders having to select ALC, reinforcing the significance of ALC winning this deal via a competitive tender in an existing customer

- Kate provided heavily caveated high-level guidance that UHSusex would likely be structured similar to the North Cumbria deal ie (1) ~$2m implementation cost over 24M (2) payment of 7 year licenses upfront (3) the rest being ARR

- The deployment of UHSussex will use existing resources coming off other deployments, may add 1-2 FTE in the UK for deployment, and ~1 FTE for ongoing support, marginal incremental cost is expected

- The UK is now reaching the end of the current 4-year NHS funding cycle, with the new funding cycle kicking in the new UK FY - Trusts are working out the funding possibilities

NEW MARKETS UPDATE

No real updates (1) Middle East - confirmed that there is at least a Patient Flow market, progressing conversation with potential partners (2) Canada - understanding market opportunity and targetting EPR customers

Alcidion selected as preferred EPR supplier

Alcidion (ASX:ALC) out with some good news today to advise the market that they have been selected as the preferred EPR supplier by University Hospitals Essex.

- Total contract value is still being finalised but expected to be "in excess" of A$35m over a 7-year period. this is pending the modules utilised

- Target deployment Q4 FY26 - so we should see this in the FY27 numbers

- Competitive tender process for this one

Kate's said "We are excited to have been selected by UHSx as their preferred EPR supplier. This builds on a long-standing relationship Alcidion have with UHSx where they have been using Miya Observations and Assessments(Patientrack) for many years. UHSx’s purpose for the EPR procurement is to implement a single, integrated digital platform that improves patient care, supports regional integration, drives operational efficiency, and delivers long-term social and research benefits. Miya Precision is ideally placed to deliver on this vision working alongside the implementation teams and clinical staff at UHSx to ensure there is long term benefit to the people of this region.”

My thoughts: Good addition/win, let's now wait for execution of this and the roll out to be finalised. Will be interesting to see what the final value of this is. Won't have a material impact on FY26 numbers so won't contribute to FCF for this year (see prior straw). But a good, solid win nonetheless. Let's have some more.

Disc: Held.

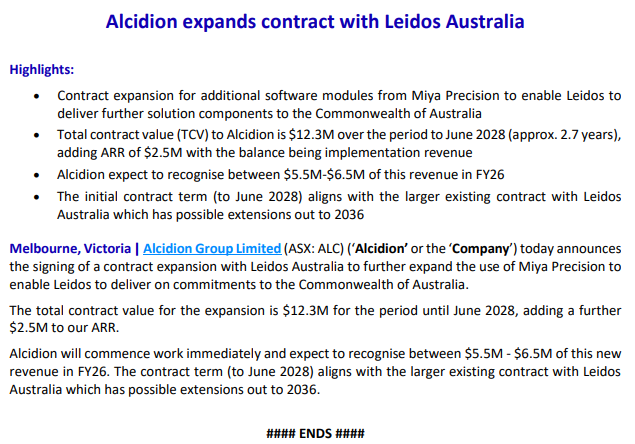

Alcidion out with a short and sweet announcement today (see below).

With the addition of the $5.5 - $6.5m revenue being recognised in FY26 - this should nudge them over the magic number of $40m in revenue which is what they have needed to hit FCF. Still circa 7+ months in the FY, so barring any cancellations they should now be at the FCF inflection point...

Disc: Held IRL and SM.

ALC out with their quarterly update ths morning.

Here's my summary of their summary:

- 8.2 million in new contracts signed for Q1 FY26, mostly recurring revenue (92%).

- Operating cash outflow reduced to $0.6 million (from $3.9 million last year) - big tick.

- Cash receipts rose to $8.4 million, ending the quarter with $16.4 million cash and no debt.

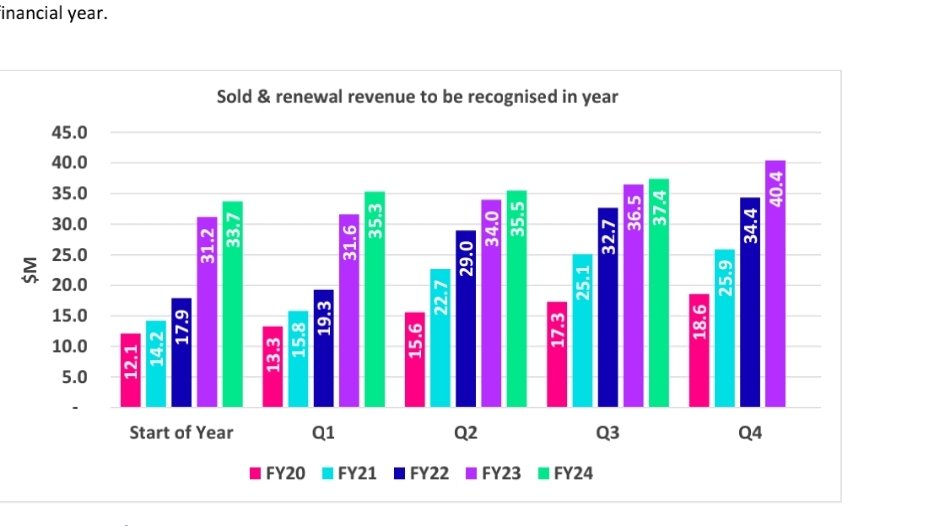

- Contracted FY26 revenue reached $36.3 million — Alcidion’s strongest Q1 on record.

- Company reaffirmed guidance for positive EBITDA and operating cash flow for FY26

Q1 cash receipts are typically a slow start for ALC, however this is a circa 30% increase on both FY24 & FY25 Q1s. Kate has noted this in her comments that this strong start has set the company up for the remainder of the FY. Language suggests that they are focusing on expanding existing contracts through additional product offerings, sounds simple but you'd be surprised how difficult this is to acheive.

Still a holder of ALC - next couple of updates are make or break for my thesis. In saying that, I've probably already succumb to thesis creep on this.

Discl: Held IRL and in SM

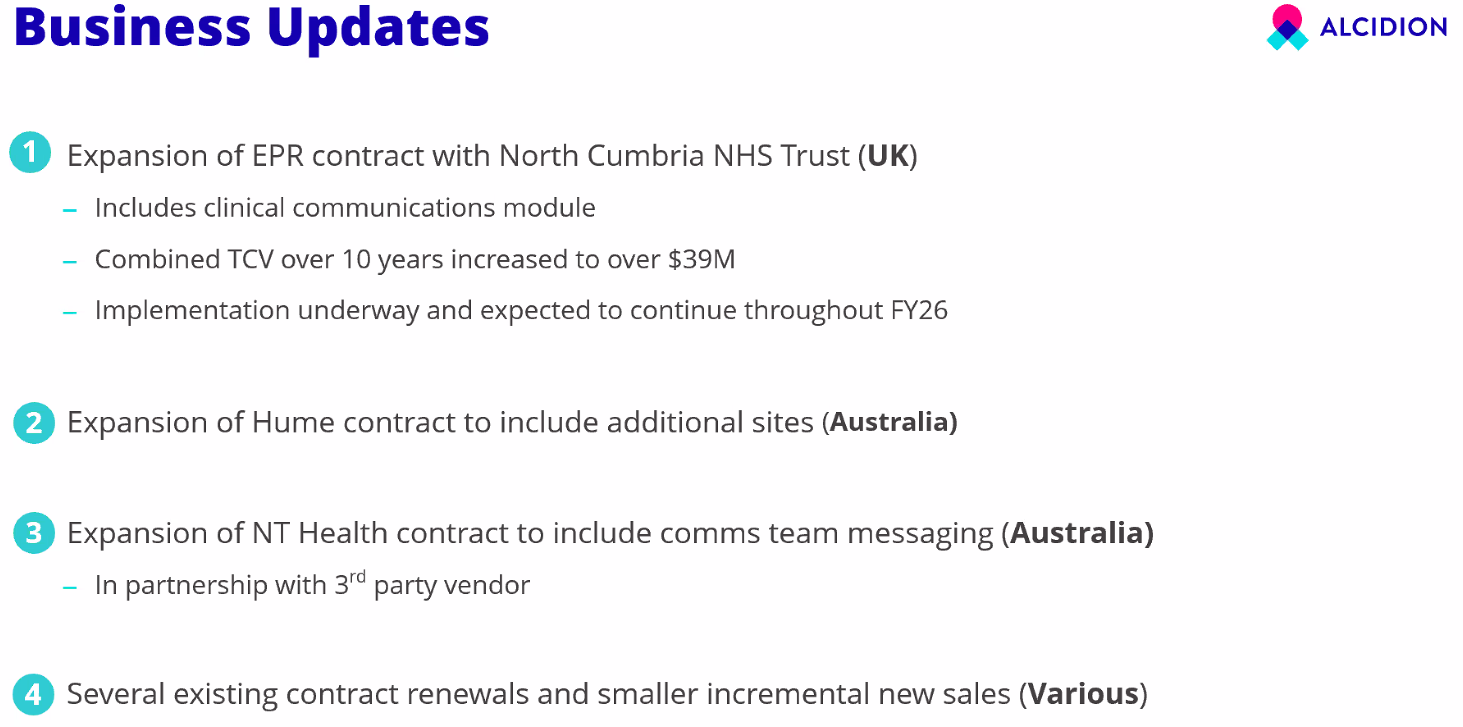

Appears to be a nice win from ALC:

- Very decent 18% TCV uplift from the original NCIC deal of $37.5m in Feb 2025

- Is a great data point that the NCIC deployment should be going OK - companies almost never uplift an IT contract pre-go-live, if the deployment is not going well

- Adds Electronic Document Management System (EDMS) capability into the Miya Precision ecosystem

- Provides another data point on the interoperability of Miya with 3rd party vendors - a good thing

What I am not fully clear with is:

- ALC’s net revenue from the uplift given that Mizaic is a partner with the solution, so a larger chunk of that uplift should logically go to Mizaic

- Margins thereof - should be high as the cost should mostly be around the development work to integrate to/from MediViewer

- Contract upsell opportunities arising - the para below says MediViewer is in 20 trusts today, but it does not say which of the 20 are existing ALC customers - if none are, then MediViewer interoperability could open some new doors or open smaller contract uplifts, if they are existing customers

But any win is a nice win!

Discl: Held IRL and in SM

Had a flick through of the ALC Investor Roadshow Presentation issued by ALC today. I don't normally expect to find anything new but this time, found a few new slides on the Medium Term Growth Strategy and Outlook, slides 27 to slide 32.

It puts a bit more flesh on themes Kate presented at the FY25 results, and looks like the Growth Strategy dry run that is due to be presented at the AGM.

As Phil Collins would sing “I can feel it (M&A) coming in the air tonight, Oh Lord .... "

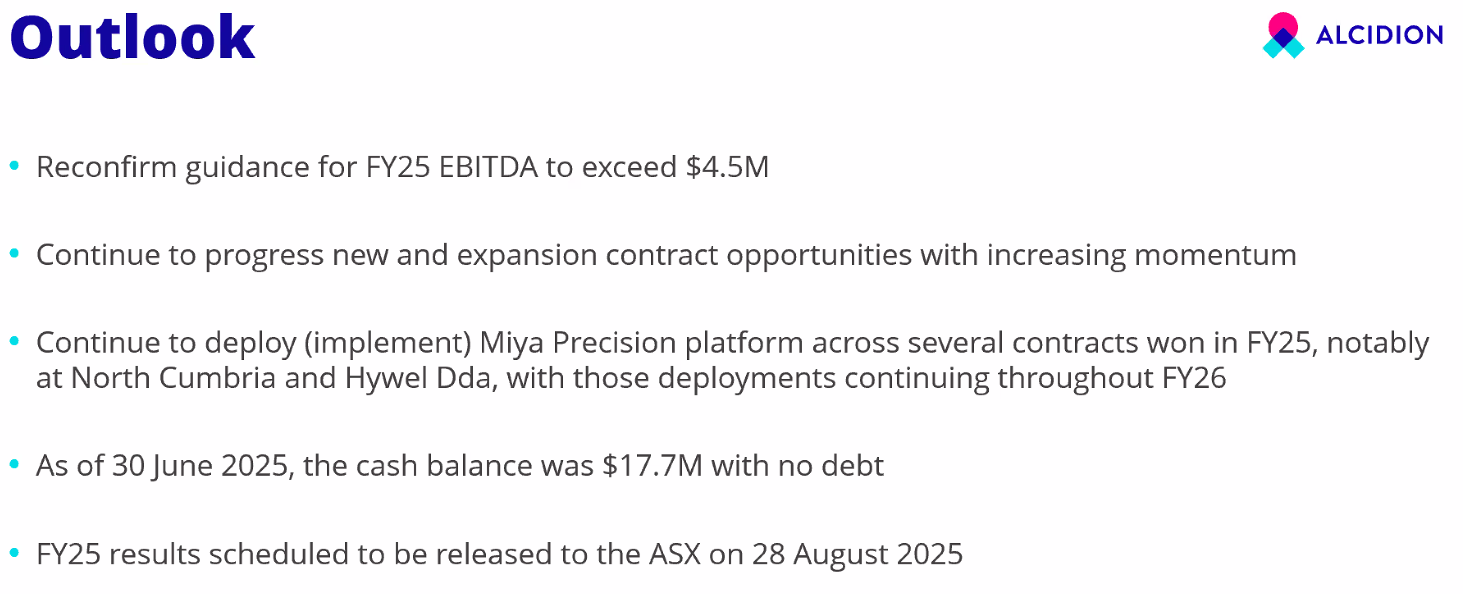

Finally got a chance to have a closer look at ALC's FY25 results.

Discl: Held IRL and in SM

SUMMARY

There were significant positives in the ALC FY25 results, easily the most positive in quite a few half’s.

- A steady cadence of new contracts were signed in FY25, including the huge North Cumbria 10-year $39m deal - revenue grew 10% to $40.8m, ARR, which excludes capital license revenue, has risen 31% to $28.5m,

- Maiden full-year NPAT 1.65m, maiden full-year EBITDA positive $4.84m, positive EPS of $0.12 - this included a tailwind of $0.9m of forex gains, without which, both NPAT and EBITDA would still have been positive for FY25

- YoY Gross Margin expanded from FY24 86.1% to FY25 88.2% - driven by strong margin of 89.1% in 2HFY25 - given how operating leverage is kicking in, these appear sustainable

- Record year for (1) TCV (2) 2HFY25 highest revenue

- Balance sheet is strong - $17.7m cash, no debt - no concerns other than it might give rise to “M&A ideas”

- Record positive operating cashflow for FY25 of $5.8m, Net positive cashflow for FY25 of $4.9m - driven by record 2HFY25 collection, No capitalisation of R&D spend

- From my own calculations of Rule of 40 - it was big YoY jump of 17.2% from FY24 (6.2%) to FY25 11.0%

- With each new contract win and successful deployments, the Miya Platforms referenceability improves, improving the win probabilities

- Market tailwinds around the increasing urgency for healthcare to move to digitalisation to enhance efficiency remain intact

- Expansion has been flagged (1) Geographically to Canada, Saudi Arabia and the UAE and (2) Adjacent verticals into Aged Care and Community Care

If I had to point out a negative, it would be that the revenue now includes clearer visibility of “lumpy recurring” capital licenses. As these do not recur annually in a linear manner, only when contracts are renewed, and then not for all contracts necessarily, it does add a degree of lumpiness and unpredictability to the revenue stream. This is the same challenge with HSN’s earnings. But all revenue is good, so will just need to adjust expectations to this new reality.

HOWEVER, I have to admit being less excited about ALC turning this corner vs my other holdings. I think this is because ALC growth is now more “steady” than “fast”. It does feel that ALC is now on the cusp of scaling, although it will be more paced/steady and new-contract dependent, rather then rocket-like.

Investment Thesis Is Intact

Having turned the corner and now turning profitability, it does feel like the troubles in the past few years are behind ALC.

Kate summed it up nicely: “ALC has been right-sized and scaled to enable a matured, repeatable model to (1) add new capabilities (2) add new geographies”

This slide is a good summary of why my thesis of ALC is very much intact and I do want to remain invested.

ALC is current a shy of 1% holding in my portfolio, which reflects my excitement and expectations.

Will wait for Kate to reveal the ALC Growth Strategy towards the end of Sept and work out if I should increase exposure thereafter. Am particularly keen to better understand ALC’s expansion plans in term of geographies (Canada, Saudi Arabia & UAE have been flagged) and adjacent verticals (Aged Care, Community Care).

Detail is per below:

------------------------

Revenue and Profitability

The HoH and YoY charts show the following trends:

- Total revenue rose sharply in FY25 with the $8.4m of North Cumbria capital licenses

- Maint & Support revenue was flat HoH and YoY - the contracted revenue from the new sales wins in FY26 have not yet fully kicked in given the timing of when the contracts were executed - only the Hume contract contributed in full in FY25

- ARR has increased 31% to $28.5m - this is before any contribution from FY26 sales - this will underpin the higher proportion of recurring revenue for future periods

- Capital license revenue was broken out for the first time this FY - a good thing from a transparency perspective, but this is “lumpy recurring”, it will recur at contract renewal, rather than annually - this “lumpy recurring” is what the market is still trying to work through with HSN’s results

- The fall in Product Implementation revenue was expected with the winding down of the Leidos Implementation Phase in 1HFY25 - this will pick up in FY26 from the full-year services contributions from the North Cumbria deployment

- Technical Services revenue will remain flat - this is for annual services contracts

- Direct costs have remained very flat

- This has contributed to gross margins increasing to 88.2%

Costs have gone down (1) Fixed costs by 10% (2) Direct costs by 7% as a result of the change in ANZ contracts - this is on a nice flat/downward trajectory

Staffing levels are expected to be similar in FY26, with employee spend mostly focused on Sales & Marketing this year to drive further revenue growth

Which enable ALC to achieve its maiden full-year NPAT and EBITDA.

- 2HFY25 was another half-year record for revenue at $23.1m

- First FY that UK income contribution is higher than ANZ at 63% UK: 37% AU

- Capital Licenses are excluded from Recurring Revenue and Recurring Revenue %

Rule of 40

Used EBITDA and Maintenance & Support, Annual Licenses recurring revenue, in line with how ALC defines recurring revenue, to calculate the Rule of 40

Rule of 40 - big jump of 17.2% from FY24 (6.2%) to FY25 11.0%

Given the current trajectory on Direct Costs, Total Expenses and Total Revenue, expect the Rule of 40 to steadily rise

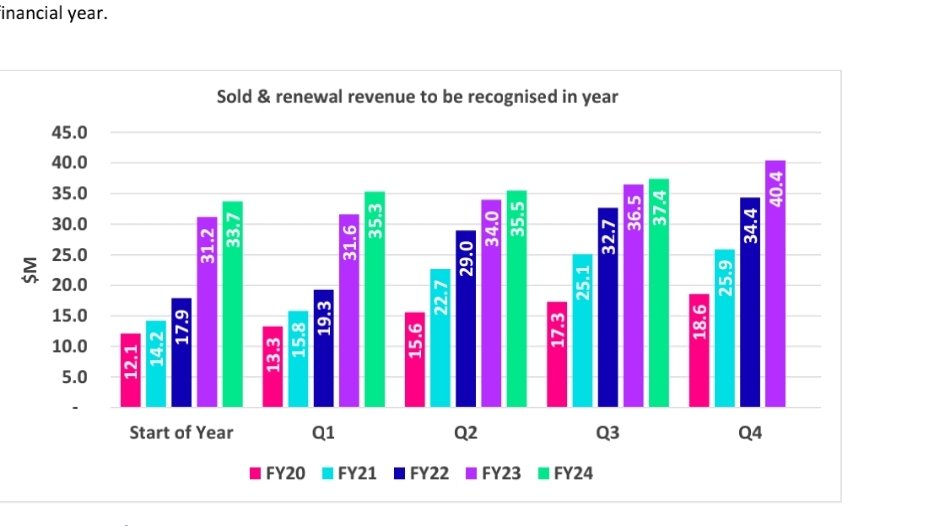

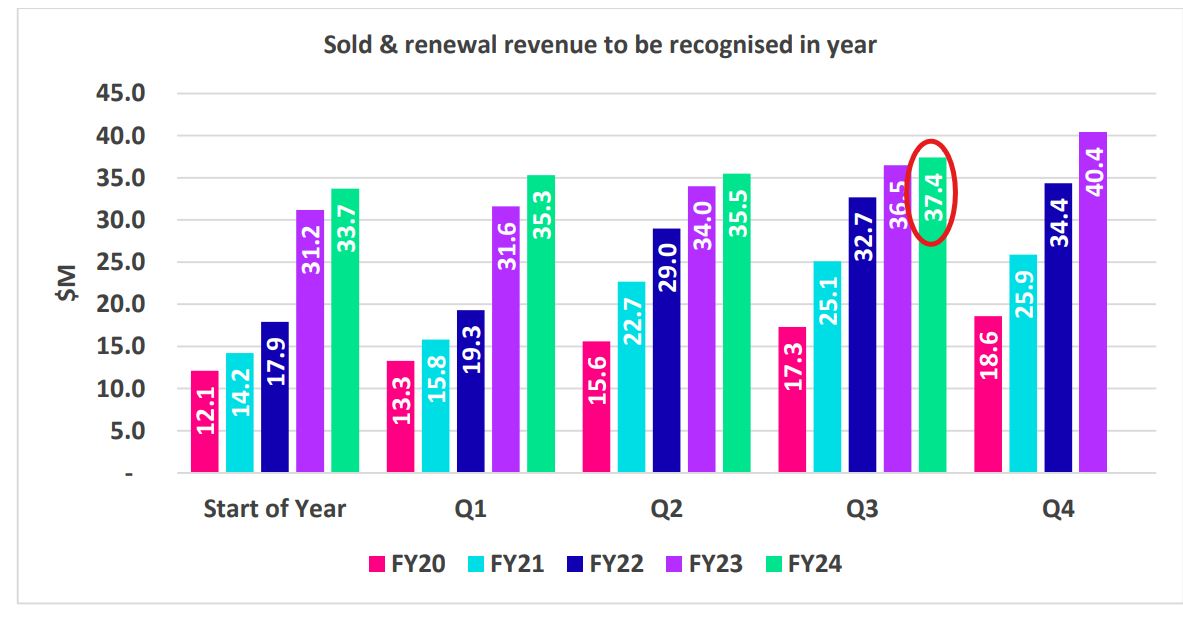

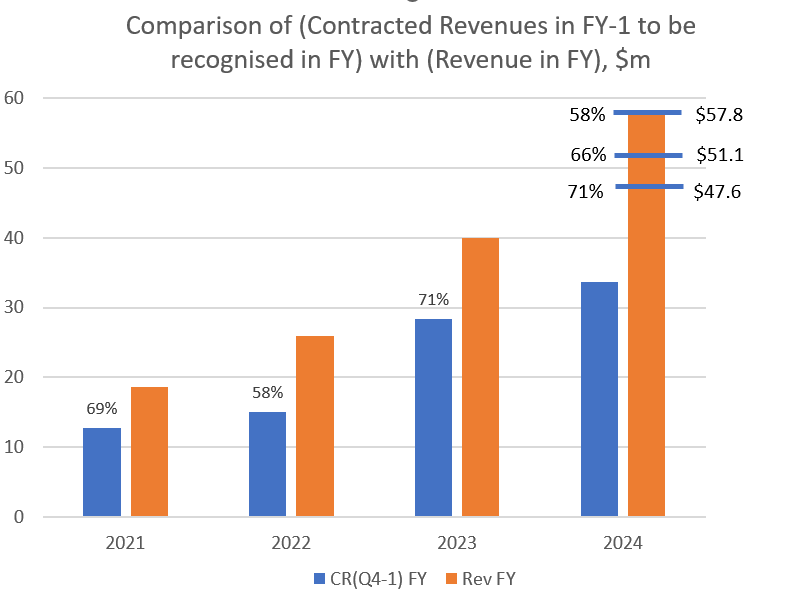

Contracted and renewal revenue to be recognised in FY26 is $34.0m, representing 83.3% of FY25 Total revenue

- Exploring new geographies - Canada (similar maturity to the UK), Saudi Arabia, UAE (similar maturity to ANZ)

- Exploring applicability of Miya platform applicability to adjacent platform verticals - Aged Care, Community Care

- The UK is moving out of an EPR focus - last major tenders expected in the next 1-2 years

- One of the 3 pillars of the NHS 10 year plan is to move from analogue to digital - this is a key tailwind for ALC, hence the investment in the UK leadership to position for this

- Unclear what funding is to be allocated to this pillar and over what timeframe

- Focus is very much on Patient Flow - ALC well placed for this with constantly increasing referencebility

Hopefully, Management has learned the lesson to not spend before contracts too much..

I don't hold ALC, but I note 51 Strawpeople do, and ALC has previously been quite a followed company, so am slightly surprised by the lack of commentary.

It seemed like a reasonable result today. Not superb, but they have tipped into profitability.

As a lazy way of assessing its investment case, I ran a "rule of 40" which has improved significantly but still only scores ~22%.

valuation ratios are a bit mixed:

P/E ratio of 97.4

EV/EBITDA multiple of 28.1

EV/Revenue multiple of 3.5

ASX:ALC could get interesting once again if they continue to win contracts. It would be helpful to know LTV:CAC and NRR but these arent reported. Any thoughts from others?

I'm not sure why but I can't seem to attach screenshots or pdf files currently so the link to the full report is here:

2026 Guidance will be released tomorrow along with the 2025 financials.

I feel the guidance provided tomorrow will be a major catalyst for the share price in the short term.

I am keen to hear if anyone has any thoughts on what the 2026 guidance might look like??

Dean Fergie of Cyan covers Alcidion here -

https://ausbiz.com.au/media/deans-three-small-caps-to-watch-ahead-of-reporting-season-?videoId=43329§ionId=1885

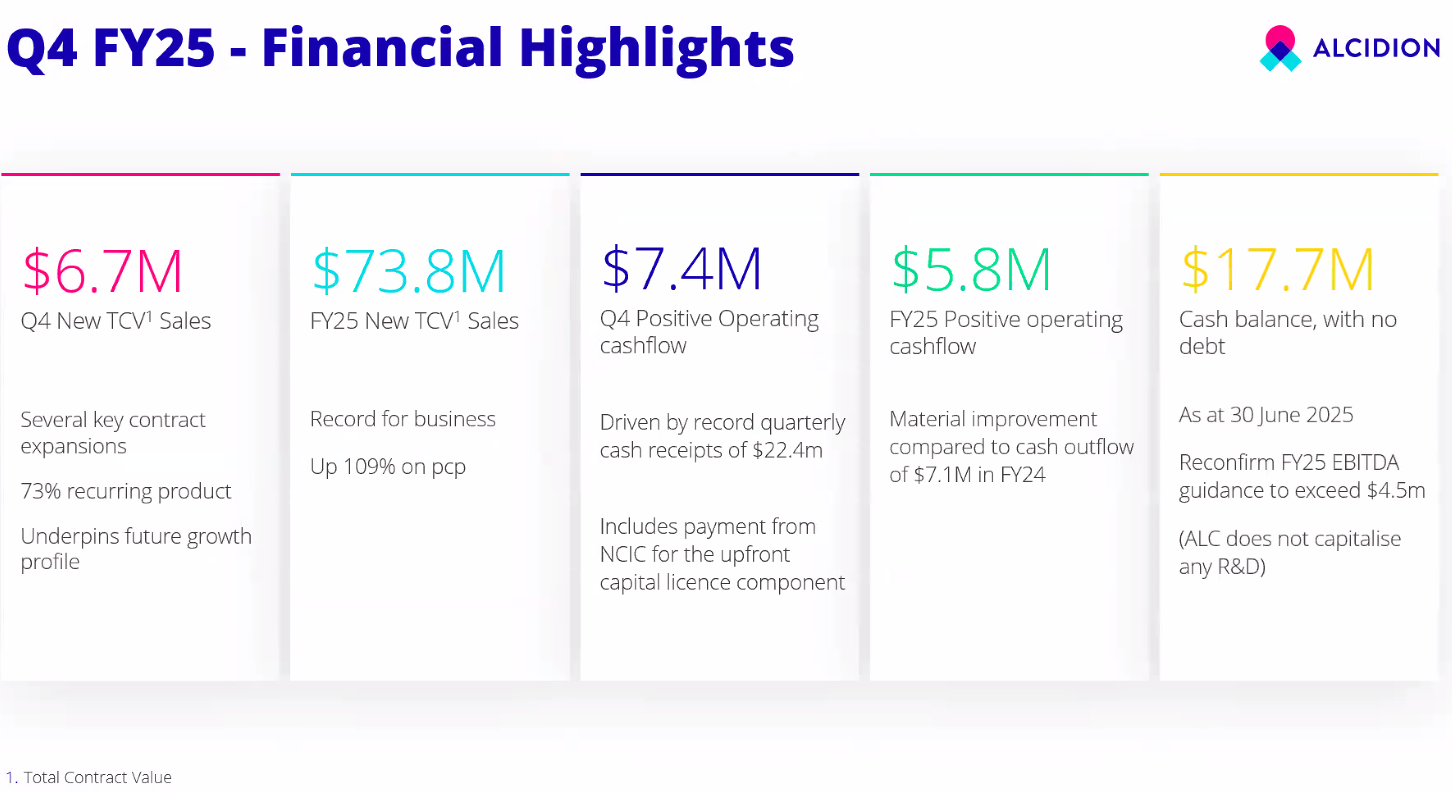

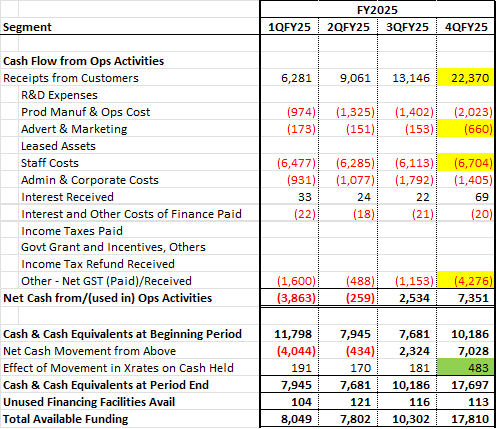

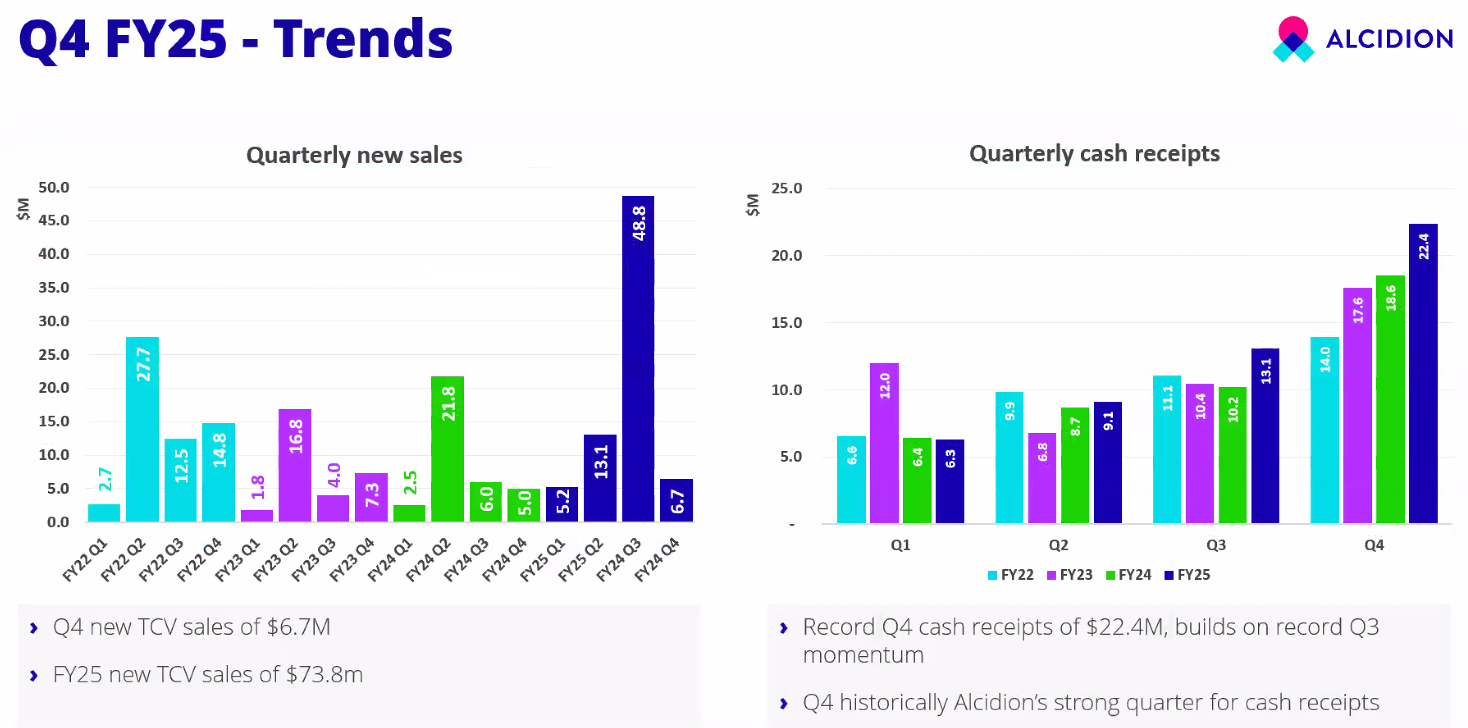

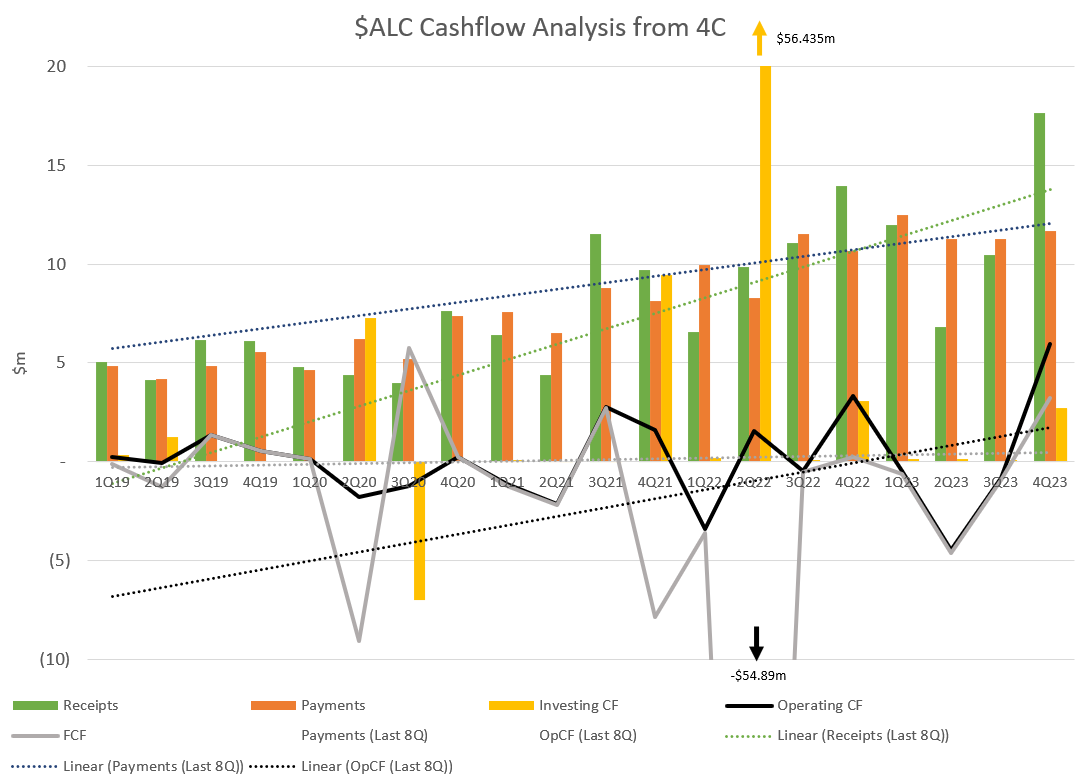

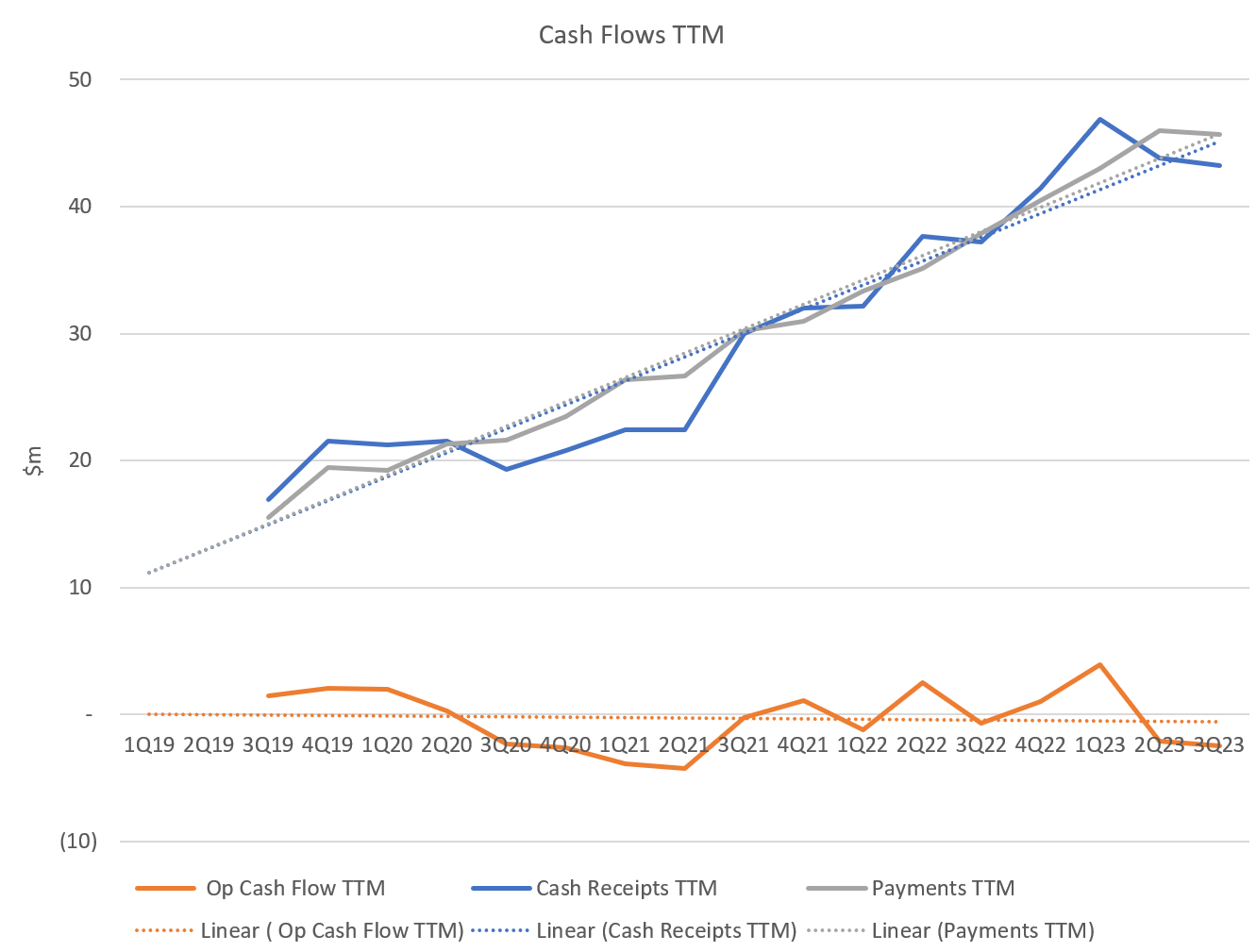

Nice positive 4C update from ALC today. Key takeaways from me:

- Good feeling that ALC is increasingly gaining momentum - steady flow of contract announcements, changing of language to “expansion” is translating to cash flow and should translate to EBITDA

- Really good to see the positive trend and inflection into FY25 positive operating cashflow

- Major expenses appear to remain on-trend, and thus look like they are under good control

Onward and upward, it would seem!

Discl: Held IRL and in SM

Kate provided good context around the Q4 cashflow which included acceleration of (1) payment of 50% of short term incentives for staff and (2) payment of VAT/GST, both typically paid in Q1. Noticeable Q4 spikes in these cash lines vs previous quarters which should start 1QFY26 cashflows in a good position.

One to watch out for is that ~$8m of the cash receipts for the Quarter were for NCIC capital licenses - this will not recur in Q4FY26 for NCIC, will need to factor this when analysing Q4FY26 cashflows. This caused a bit of distortion with HSN’s 1QFY25 results, so am more weary of these 1-off capital licence sugar hits.

Not inconceivable that ALC used the capital license sugar hit to make earlier payments against STI’s and the VAT, so net, net, the Q4 cash flow result is still a pretty good one. All 3 lines should normalise in the coming quarters.

We had chatter on the forums around the impact of forex on ALC’s revised guidance a month or so back - there is a $0.3m positive FX movement this Quarter, not unexpected given the fall in the AUD in recent months.

While high Q4 cash receipts is expected, seasonally, what was nice to see is all of FY25 cash receipts swing upwards from FY24.

A sharp above trend uptick in cash receipts which is very nice

No concerns from the key expense lines (1) Prod Manuf/Ops Cost rose to support increasing revenue/cash receipts (2) Staff costs increased as noted above, but is mostly in line with the decreasing/flat trajectory - this feels under control and (3) Admin & Corporate costs fell QoQ - this has also remained flat, on trend

“Expansion” of contracts - a clear positive change this Quarter, indicating that the upselling strategy is gaining traction.

Good mix of expansion and new contracts across FY25 - modular platform is providing the flexibility to tailor solutions for digital health deployment across different customer budgets, readiness.

In response to a question, Kate confirmed that the materiality threshold for contract announcements is around $4m.

There was some mention of implementation delays in UHS and 2 other contracts, but Kate reported that ALC was ready to go, customer-end readiness/issues mostly - given the magnitude of change the ALC implementations will introduce, it is absolutely better to get it right late, than to get it wrong early, both from ALC and the customer’s perspective. Nothing worse than bad rap from a problematic deployment from both.

Nothing new with Guidance as this was telegraphed earlier, but always good to see the re-affirmation.

Cash balance of $17.7m with no debt is not shabby at all.

Other Points from Questions

- 27% non-recurring revenue, one-off implementation costs, in the first slide is from Q4 TCV wins only - does not reflect the full-year recurring revenue %

- 15% of the ALC staff base work on delivery projects - a good data point

- Seeing continued NHS commitment to digitalisation - waiting for Phase 2, which focuses on implementation, which is due in Sep 2025

- NCIC upfront license capex $8m, billed in Qtr

- Regional expansion - currently, revenue is roughly half UK, half ANZ - looking at Canada, Middle East as the 2 markets for expansion, South East Asia remains on the radar on a opportunistic basis

- Kate made the point that healthcare organisations are struggling worldwide, ALC is well placed, but they need to manage the balance and focus on upsell opportunities at existing clients, current UK/ANZ focus vs new customers in new regions - makes sense to me, given where things are at presently

Short and sweet guidance upgrade from ALC this morning.

- Fairly decent increase in EBITDA guidance of circa 50%

- Smaller contract upgrades always nice - but will take it with a grain of salt

- Interested to see what costs continue to be cut - there is a happy medium here.

Disc: HELD SM IRL

Up nearly 10% on no news today did I miss a trick?

Ok this is long, almost 4 hours, if you are big on ALC, it may be worth a listen. i do it while jogging or ironing etc

although mainly US-based this is the monster in med records. interesting, the podcast highlights the pinch points and dynamics in the industry, since software was not a "thing" in my equity analyst heyday im always interested in learning more about it.

i think it is probably bearish if you think ALC will dominate the industry, maybe ok if they find a niche and maybe engineer a good exit in time. thats what i cam away with anyway. disc no holding in ALC

https://open.spotify.com/episode/6ParBTxIbofsV5DDZxA4y9?si=e2807723ed3446a0

Decent quarterly update from Alcidion today.

Highlights:

- Upgraded guidance for FY25 EBITDA expected to be >$3m and deliver positive cashflow

- Q3 cash receipts of $13.1M with a positive operating cashflow of $2.5M (compared to a cash outflow of $1.4M in Q3 FY24) and includes no receipts from North Cumbria Integrated Care (NCIC) NHS Trust

- Q3 new TCV sales of $48.8M with $11.5M expected to be recognised in FY25 o Signed new $37.5M, 10-year milestone contract with NCIC NHS Trust to deliver new Electronic Patient Record (EPR) platform o Signed new 5 year, $5.5M contract with Hywel Dda University Health Board, our first customer in Wales o Renewed several PCS (PAS) customers

- FY25 contracted (sold and renewal) revenue stands at $40.2M at end of Q3

- Cash balance of $10.2M and no debt as of 31 March 2025 o Expecting a strong Q4 of receipts with a debtor ledger of $17.7M at the end of Q3

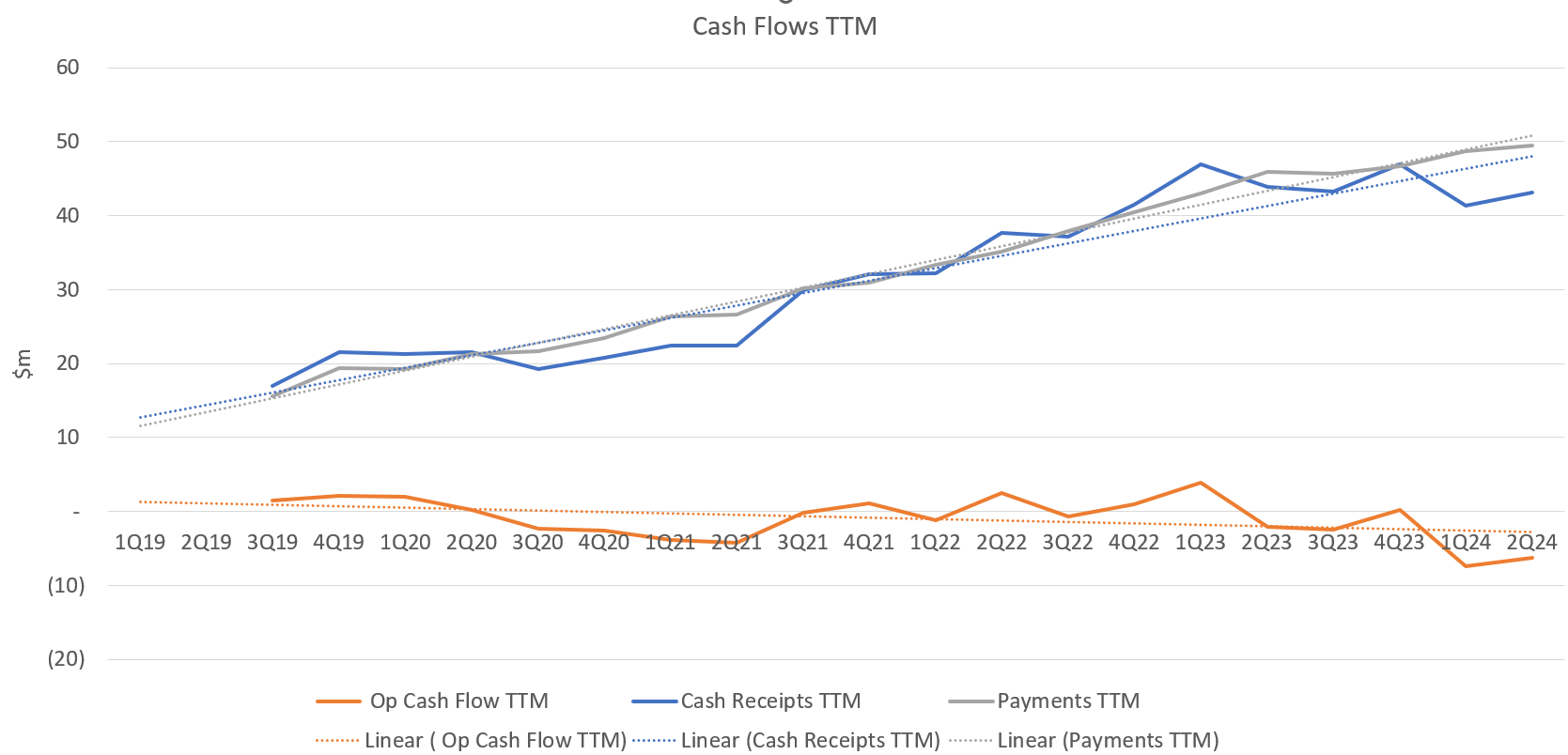

As illustrated by the graph of cash receipts (refer above), Q4 is historically the strongest period for customer receipts, a trend that we expect will continue in Q4 FY25, underpinned by a debtor ledger of $17.7M at the end of Q3.

Overall a pretty rosy update, are they rebuilding our confidence and trust?

Disc: Held IRL and SM.

Kate sold 5.0m shares from her holdings of 43.6m shares at $0.085, about 10% of her holdings. She still holds 3.2% of ALC, so still good skin in the game.

Not ideal but after 6+ years, she is perhaps entitled to reap some reward for the toil ... this (and Trump) could improve my top up price!

Held: IRL and in SM

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02918351-3A662768

ALC is starting to look better with those new contracts rolling in. I have been underwater in this position for what feels like an eternity, and it's nice to see the SP nudged back from the edge recently (still underwater however).

Hopefully, things will continue to move in a positive direction.

Held in IRL & SM.

· February 2024 - $5.5m over a term of five years with an option to extend to seven years. secured a contract with Hywel Dda University Health Board in Wales for the provision of its Miya Precision Platform – inclusive of Miya Precision for Patient Flow, Observations and Assessments and Smartpage for clinical communications and tasking. https://announcements.asx.com.au/asxpdf/20250211/pdf/06fcz73kdz7hyn.pdf

· November 2024 - $3.7m over a total term of five years. An agreement with Peninsula Health for use of its Miya Precision platform. https://announcements.asx.com.au/asxpdf/20241121/pdf/06bp6jspdglw74.pdf

· November 2024 - $4.5m over a five year period, contract with Northern Adelaide Local Health Network (NALHN), a portfolio of the South Australian Department for Health and Wellbeing, for use of its Miya Precision and mobile clinical task management solutions. https://announcements.asx.com.au/asxpdf/20241114/pdf/06bcql6pv6y3tj.pdf

· July 2024 - $4m over a 5 year period, agreement with Hume Rural Health Alliance (“HRHA”) for the use of Miya Precision as an enterprise digital platform with a focus on patient flow and virtual care https://announcements.asx.com.au/asxpdf/20240717/pdf/065npcgq6y2gzj.pdf

· March 2024 - $3.4m extends contract with Dartford and Gravesham NHS Trust for an additional 3 years for Miya Precision and associated modules to deliver electronic observations and assessments, manage patient flow and support electronic documentation https://announcements.asx.com.au/asxpdf/20240306/pdf/0616b9q5fr4hrt.pdf

· December 2023 - extends contract with South Tees Hospital NHS Foundation Trust for an additional 8 years for Miya Precision Electronic Patient Record (EPR). The minimum contract value is $23.3M (£12.2M) over the new contract period of 10 years. https://announcements.asx.com.au/asxpdf/20231211/pdf/05ydqw8l1dq7j1.pdf

· May 2023 – renewal agreement $3.3m with Royal Wolverhampton NHS Trust for two years, and third contract renewal with University Hospitals Dorset NHS Foundation Trust for 3 years for the use of its Silverlink Patient Care System (PCS) solution https://announcements.asx.com.au/asxpdf/20230530/pdf/05q55rgbkn713z.pdf

*Previous Contract/Agreements look at my previous straw from couple years ago

Held: IRL and in SM

SUMMARY

With a positive overall quarter, while growth is no longer at eye-watering levels, it does feel like there is steady positive revenue and contract momentum, mostly around Miya Precision/Patient Flow, amidst a relatively stable cost base.

- 2 new 5-year Miya Precision Patient Flow contract wins, 2 renewals, $13.1m sales

- $0.26m net cash outflow from operations, significant $3.0m improvement on cash outflow YoY ($3.37m) and QoQ ($3.86m)

- FY25 contracted revenue $30.8m, exceeding the $28.0m indicated contracted revenue outlined at the FY2024 results announcement - excluding North Cumbria, in final stages of contract

- Confident of a stronger 2HFY25, maintaining FY25 guidance of EBITDA breakeven and cashflow positive

- Cash balance of $7.7m, no debt

OPERATIONS

- $13.1M of new and renewal sales, with the majority being from new customers, with approximately $4.5M expected to be recognised as revenue in FY25.

- Q2 new sales comprised 88% recurring product revenue and 12% non-recurring services (primarily product implementation) revenue

- 2 new 5-Year contracts for Miya Precision via competitive tender:

- Five-year partnership with Northern Adelaide Local Health Network (NALHN) for use of Miya Precision platform to assist with patient flow and clinical operations including messaging, $4.5m TCV over 5 Years

- Peninsula Health in Victoria, which will see our technology help to improve patient flow throughout the hospital whilst assisting clinicians with mobile access to patient records, $3.7m TCV over 5 years

- Won all competitive tenders in Patient Flow in the last 12 months

- These new partnerships continue to validate the strength of our patient flow offering where we now have a material presence across the Australian acute healthcare market.

- 2 renewals:

- Extended ongoing relationship with Sydney LHD, which utilises Alcidion’s Miya Precision virtual care and remote patient monitoring offering

- Signed a two-year renewal for our PCS PAS module with Northumbria NHS Foundation Trust.”

- North Cumbria contract in final stages - this will be a material contract, once signed

FINANCIALS

Modest operating cash outflow of $0.26M, a material improvement on the same quarter last year (outflow of $3.4m), driven by an uplift in cash receipts from new business coupled with continued strong cost management disciplines.

Cash receipts in H1 FY25 were $15.3M with an operating cash outflow of $4.1M, an improvement of $7.3M over the H1 FY24.

Heading into the second half of the financial year, FY25 contracted revenue stands at approximately $30.8M, which does not include any contribution from the North Cumbria contract or other new deals that may occur before the financial year end.

- Exceeds the $28.0m of contracted revenue excl North Cumbria indicated in the FY2024 results announcement

The increased rate of larger contract signings has been the result of the execution of evolving and maturing pipeline opportunities, several of which are still progressing through the tender stage and into the selection stage of the procurement cycle.

We maintain our position of EBITDA breakeven occurring upon achieving revenue of approximately $36.0M and as result of our continued sales progress we expect to be EBITDA and cashflow positive for FY25

Just announced, I'll take this as well!

Would have been better if this was a Trust in the UK, but this looks like a reasonable sized deal to add to the North Adelaide deal last week.

This might warrant taking ALC out of the doghouse, at least for a bit of walkabout ...!

Discl: Held IRL and in SM

RBC quick take on ALC 1Q25 Activities Report

1Q25 Activities Report - 1Q cash typically weak, positive FY25 EBITDA guidance reaffirmed

ASX: ALC | AUD 0.05 | Sector Perform | Speculative Risk | Price Target AUD 0.09

Sentiment: Neutral

ALC reported negative operating CF of -$3.9m (vs -$14.5m in 1Q24 and RBCe $1.1m). While we had been expecting ALC to deliver positive operating CF, we acknowledge our forecasts did not properly consider the typical seasonality of low cash receipts in 1Q. Therefore we do not view the negative operating CF in 1Q25 as a negative for ALC. Management said the 1Q25 cash receipts and operating CFs were in line with their expectations. The company announced new TCV sales of $5.2m in 1Q25 which exceeded our expectation of $2.9m, however we note the value of unannounced New TCV sales of $1.2m is below historical levels. Total contracted and scheduled renewal revenue for FY25 has increased slightly to $28.5m at Sep 24 (vs $28.0m at Aug 24) and management reaffirmed its target of being positive EBITDA in FY25 target. Overall, we view the 1Q25 activities report as neutral for ALC

DISC: Held in RL & SM

I have been a bit annoyed by not having transparent information from Alcidion lately.

Case 1: No explanation of revenue going backward.

So at the end of Q3 FY24 they had sold & renewal revenue to be recognized in year = 37.4m

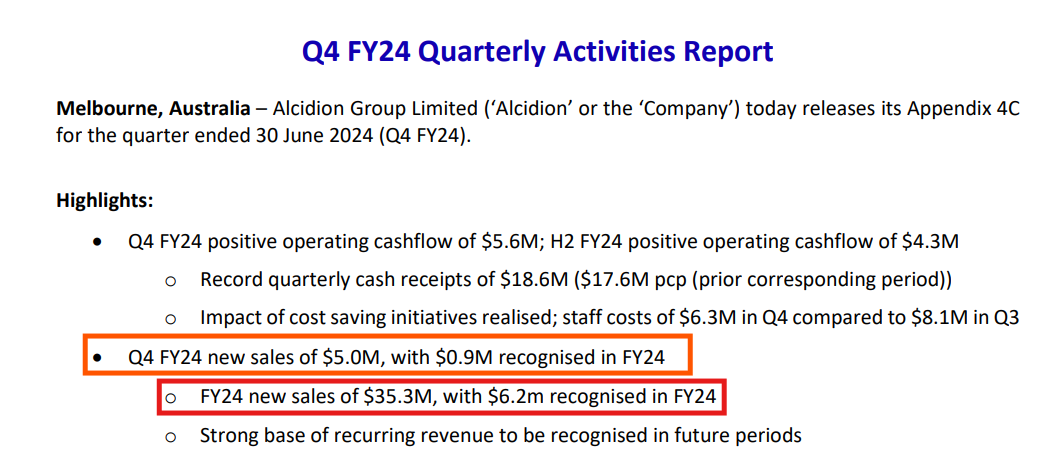

and then in Q4 they announced, new sales of $5m and 0.9m recognised in FY24 so that brings 37.4+0.9 = $38.3

At the start of FY24 they had $33.7m to be recoginsed and in FY24 they said they added total $6.2m in sales to be recognised in FY24, so technically, revenue should be $39.9m

I can understand if there is some issue and the customer is pulling back or delaying but I couldn't find any explanation in the report - What is the meaning of starting the number of $28m for FY25 that they have given - How can I confidently say that it will be recognised in this year? No idea

So I can only assume that, this reduction in revenue is on top of the things we can see slipped in FY24

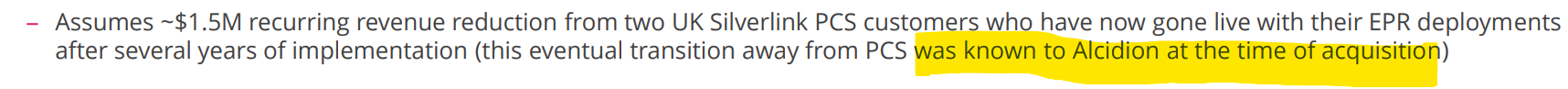

On top of all this, the following - They didn't mention during acquisition capital raising - Just cherry-picking information to present to Investors I feel

Bit annoyed.

Alcidion (ALC) reported this morning, and I did think this one would've made it onto SM by now given the following - that bloody firehose is almost about to be turned off.

There's a bit to digest with this one.

For those that want a quick glance, highlights are as follows:

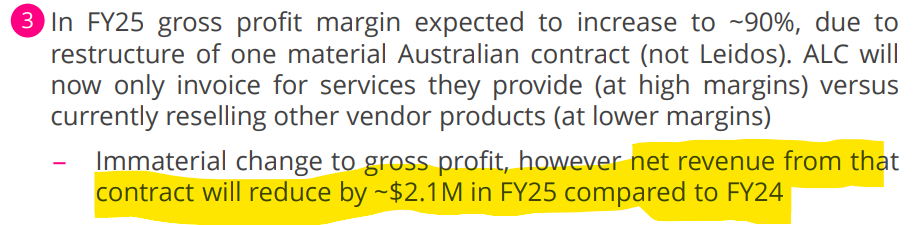

- FY24 revenue of $37.1M and Underlying EBITDA loss of ($3.4M);

- H2 Underlying EBITDA loss of ($0.6M), assisted by reduced staff costs in H2

- Q2/Q3 reset of cost base now delivering annualised cost savings of $6.4M

- FY24 operating cash outflow of ($7.1M), with a H2 positive operating cashflow of $4.3M

- FY24 new sales of $35.3M, with $6.2M recognised in FY24

- Milestone new contracts and extensions further validating Alcidion’s long term value proposition

- As of August 2024, $28.0M of contracted and renewal revenue able to be recognised in FY25, excluding any revenue contribution from North Cumbria contract once finalised

- Run-rate EBITDA breakeven at ~$36M1 of revenue; targeting EBITDA positive in FY25

- Continued increase in market activity with opportunities progressing into the selection stage of the procurement cycle

- ~$130M of contract and renewal revenue able to be recognised from FY25 to FY29, excluding upside expansion from existing contracts or impact of North Cumbria contract

- Cash balance of $11.8m and no debt as of 30 June 2024

Media Release can be found here, for those that like big text and numbers (like me) - preso is here.

Biggest surprise is Revenue has reversed about 8%, largely attributed to a reduction in Capital Licenses and Product implementation. This probably also explains why Gross Margins are up (marginally) - they had to put one positive on the Exec summary.

Good to see Operating Cash Flow positive for H2 (FY24), however, doesn't appear this is sustainable, yet...

We knew costs had blown out prior to contract wins - appears they've addressed this: "Responding to the delays in customer procurement cycles, we reduced the cost base resulting in approximately $6.4m of annualised cost being removed in late Q2 and Q3. The reduced cost base, combined with winning new contracts, resulted in a material improvement to our cashflow in Q4 with the reduced Q4 cost base expected to be maintained heading into FY25."

I'm going to jump to the juicy stuff (IMO) and lets take a look at the outlook. There is (already) $28m contracted and renewal revenue able to be recognised in FY25, this does have a few assumptions baked in regarding current and newly issued contracts. Based on current cost run rate for the end of FY24, the EBITDA breakeven is $36m of revenue - which they appear to be expecting.

Would love for them to be targeting to be cashflow positive, but there is some trust to win back here, so maybe that's why the bar is a little lower.

They've also wet your appetite by advising market activity is increasing, which may also explain their 10% increase in marketing spend.

Takes a bit more to build my confidence and trust back with ALC, so I'm hoping to see some more contract wins and extensions in the near term (3-6 months). If they do get some of these coming through and pick up in H2 next year then who knows, maybe they will exceed expectations, which at present are quite low.

Held.

Chart Update 20th Aug 24

I think we are going to see a drop soon down to between 0.44 - 0.50. While they had some good news recently, it will still take some time before it turns into contracts. They should be releasing their books full year soon and I feel the news of Alcidion being HNS prefered software has already been priced in.

FWIW this from RBC (Royal Bank of Canada)

Alcidion Group Limited

4Q24 Activities Report - Softer FY24 Revenue Guidance, Subdued 4Q New Sales

ASX: ALC | AUD 0.08 | Sector Perform | Speculative Risk | Price Target AUD 0.10

Sentiment: Negative

Our view: ALC's 4Q24 new TCV sales was slightly below our forecasts, albeit the company achieved a record high in customer cash receipts which was above our expectations. Net operating cashflow turned positive from last quarter, but was below our forecasts due to higher than historical R&D costs. Management guided FY24 revenues to be slightly below RBCe and Consensus forecasts, with higher recurring revenues than we were expecting. Overall, a weaker result comprising a few misses across the top-line, new sales and operating cashflow

Key points from the 4Q24 activities report:

- ALC achieved 4Q24 new sales with TCV of $5.0m (vs RBCe $7.0m) with $0.9m to be recognised in FY24 (~18% of 4Q24 TCV vs ~48% in 3Q24)

- Operating cashflow was $5.6m (vs RBCe of $8.2m, and -$1.3m in 3Q24). This was supported by record high customer cash receipts of $18.6m (vs RBCe of $12.6m) which was up 5% vs pcp, combined with the realisation of cost savings initiatives which reduced staff costs to $6.3m (vs $8.1m in 3Q24). However, this was offset by increased R&D costs to $2.7m which sits above previous average R&D spend ~$1.1m

- FY24 revenue is expected to be $37m-$37.5m (vs RBCe $38.4m, Consensus $38.9m), comprising ~74%/26% recurring/services revenues (vs 70%/30% in FY23)

- With the UK elections now over, management are starting to see FY24 tender activity move through the selection processes and are pleased with the progress of several opportunities in both the UK and ANZ. Management is also optimistic for FY25

- ALC's cash balance was $11.8m (vs RBCe $14.2m, and $6.5m in 3Q24)

DISC: Held in RL & SM

Alcidion released 4th Q update this morning, My initial thoughts

- Staff cost is looking much better now. ( Good for the upcoming period with lower cost base)

- Management reported new sales for FY24 at $35.3m but chose not to highlight them in the graph like in every 4Cs so far doesn't sit well with me. ( It would be better to show the graph as it is rather than hiding it)

Bull case? Well its playing exactly how it should be so far. Im in the whole on this one from way back. To be honest Im pretty disappointed on this stock. So if Im to start working it again it will just be a token stake at the moment. I just dont trust it. Anyway heres the chart.

Chart Update Wed 17th July

Interesting Talking Healthtech podcast with Alcidion: https://www.youtube.com/watch?v=HsifU_PsSXY&t=53s

Chart Update Mon 1st July

Another words, I dont know. News seems ok however I need to see the market jump on board before I add to my devalued share holding. My Av. holding is way above here as I enetered this stock green (not with envy either) and plan on digging myself out of the hole this position is in. Over all I think the company has a future or a take over (not so good).

Note wave 4 down. It went way lower than my rules allow. This next wave could technically be a wave 5 to finish off however Im also in favour of it starting a wave 1 again after the 5 waves down it just took for my so called w4. This is why I dont enter anything until I see the larger waves 1/2 and how they play out. I usually say "take this with a grain of salt" however this time I'll give it a "bucket of salt".

Bull Case? We'll see.

Up 20% today on 6x average volume with no news.

Have any subscription/stock picking services made a recommendation?

If it's a sign of an impending announcement, this is most welcome.

Daniel Sharp, ALC Director bought 250,000 shares.

Sounds like a lot but outlay was ~$13k, didly squat, similar to Kate's outlay.

On the back of Kate buying, has this been a Board-wide action to shore up confidence by having each director purchase SOME shares, I wonder?

This feels like another half-hearted, no conviction purchase. Better than zero, thats for sure, but doesnt quite move the dial for me.

Discl: Held IRL and in SM

CEO Buying

CEO Kate Quirke

· On market trade 1,000,000 Shares ($46,671) 23 April 2024

- $28,600 ($0.047)

- $18,071 ($0.045)

Giving Kate Quirke Total 48,561,285 share. At today’s price of $0.048 her shareholding is valued at $2.33m. Giving her total of 3.6% ownership of Alcidion.

Ok, so there's some cause for optimism in these results.

You can read the ASX announcement here, but the key points are:

- ALC has $37.4 in contracted and scheduled renewal revenue for the first 9 months of the year -- up 2% on pcp. And there's almost $3m in additional revenue to be recognised this year from new sales made during the quarter. Ok, so the revenue growth will look tame compared to previous years, but it should be positive and it should also deliver improved margins now they've reduced expenses by about $6.4m annually (hopefully not at the expense of future growth).

- Q4 (historically the best quarter, which is a pattern ALC expects to continue) will enjoy the full benefits of cost cuts, and the business is expecting to be cf +'ve in the second half.

- They have $6.5m in cash and said they have "adequate funds"

- Cash receipts down a little on pcp, but up 17% on the preceding quarter and there's $12.9m due from debtors (last year it was $7.3m)

- Basically cash flow b/e on an underlying basis, when you remove redundancy costs.

- Continued to sign up new trusts, which as Kate says help build their "referencability"

Despite the drop in the pace of growth -- which seems more to do with the industry environment, rather than the business itself -- the company is still moving forward. Maybe they lose some marks for ramping costs up too fast (although that's always easier to know in hindsight), and maybe they'll handicap themselves with less resources going forward, but the bigger picture thesis doesn't seem broken to me. Although i'd rethink that if they couldn't get back to higher rates of growth, or they lag on a relative basis next to other players in the NHS.

Last year shares were on ~4x sales, now they're on 1.5x. So i'm happy to keep my holding for now (about a 1.7% weighting).

This may have been commented on before but something I overheard in the hospital today….

Hunter New England health district is upgrading their current paper based system (not a typo, yes it’s paper in 2024) to an emr provided by Epic. Not necessarily news worthy to alcidion other than that alcidion provide a services within Sydney LHD and from what I heard today, this new system from epic will be trialled in HNE prior to a state rollout.

Just an observation really. And I’m not sure if the service alcidion provide to Sydney LHD is an emr or a patient flow portal/ eHealth as it was introduced for the COVID virtual care center they operated

Following @mikebrisy 's notes, I did a bit of googling to try to get my head around ALC's NHS opportunity. Some notes to add to the pot which was interesting for me, but may be old news for others:

- There are currently 215 NHS Trusts (googled "number of nhs trusts in england")

- A total of 189 trusts have now introduced new EPR systems, meeting the UK Govt's 90% target by end 2023 (189/215 = 87.9% but lets ignore the % for a moment!)

- Therefore 26 Trusts have yet to introduce new EPR systems

- The next target is for 95% of trusts to have an EPR in place by March 2025. The remaining hospitals are expected to go live the following year. https://www.ukauthority.com/articles/nhs-england-hits-national-target-for-epr-roll-out/ (there are many articles, carrying plus minus the same story, stats etc)

- "NHS England is investing £1.9 billion to support hospital trusts to either adopt a new or improve their existing systems. Last year it spent over £400 million to support 150 NHS trusts, and a further £500 million is due to reach trusts this year" (which @mikebrisy has pointed out, there HAS BEEN spend activity)

- To hit the 95% March 2025 target, 204 of the 215 Trusts must have an EPR in place by Mar 2025, so 15 more to go-live in the next 12 months, then 11 Trusts from Mar 2025/2026

- Because the budget is both for new and improvement of existing systems, that STG500m must fund 15 new Trust implementations and presumably, improvements to EPR systems in some portion of the189 trusts that already have EPR's

- There was a STG700m budget cut in 2023 which is presumably the driver to push out the end date to 2026 (and possibly beyond) . HSJ had the following article July 2023 which I could not access, other than the headline:https://www.hsj.co.uk/technology-and-innovation/digitising-all-trusts-by-2025-unachievable-after-700m-cut-government-admits/7035234.article

May 2022 Article below - behind a paywall, managed to dump this out before the super-quick free trial cut me out. While dated, of interest is the list of 27 Trusts, who at May 2022 do not have an EPR. This number coincidentally lines up with the 26 Trusts which need to implement an EPR in 2024-2026 from above, which we can infer from the Nov 2023 announcement.

Essentially, the list of 27 Trusts below, plus minus, is the remaining universe for ALC to implement an EPR in the next 1-2 years. We do not know which of these Trusts ALC are bidding for/chasing and we do not know the contract size of each Trust.

I think I am going to use the list of Trusts below and work out where each Trust is in the procurement process. Kate mentioned that there is quite a lot of transparency in the NHS Procurement process, so theoretically, we should be able to find out the procurement status of each trust that has at least started the procurement process. Each of the 27 Trust which awards to someone other than ALC in the coming months means there is one less Trust for ALC to win. This then puts a bit of a boundary around trying to define the NHS universe that ALC is chasing and how big the remaining opportunity is likely to be.

Would be good if everyone could post any EPR-related updates to the 27 Trusts below as the list must narrow in the coming months.

For me, this extra bit of information more or less lines up with what Kate has been saying, but I previously had no numbers against which to evaluate the extent of the opportunity/ies, the procurement and budget issues and ALC traction.

In summary:

- There has been budget cuts which has impacted the procurement processes and pushed out the overall Govt EPR timeline to 2026

- 26-27 Trusts need new EPRs, 15 by Mar 2025, 11 by "sometime 2026" - this is ALC's maximum possible uiverse

- Each award of these remaining 26-27 Trusts to anyone other than ALC, reduces ALC's maximum universe - this gives us a reasonably finite boundary against which to monitor ALC's contract success and momentum over the next 12-18M

- If 15 Trusts need to go-live by Mar 2025, the fastest EPR implementation that I can google was 5-6 months and the STG500M budget unlocks soon, ALC contract wins need to be rolling in by 4QFY24/1QFY25 and implementation must start 1QFY25, 2QFY25 at the very latest

- If ALC's contract traction remains muted in the next 3-4 or so months, it would mean that ALC's opportunity shrinks to the last remaining 11, by which time, the show could well be over ...

-----------

Almost 30 NHS trusts do not have comprehensive electronic patient records amid a renewed push by government to get electronic systems into all NHS hospitals, according to HSJ research. A total of 27 trusts - across 20 integrated care systems - reported not having EPRs in place when asked by HSJ (see box below). While some of these may use smaller-scale electronic systems in individual departments, several trusts continue to rely on largely paper-based patient records.

NHS England is also pushing for ICSs to reduce the number of EPRs within an ICS to help data flow more freely between organisations when needed and saving time for clinicians who do not need to learn how to use different EPR systems.

Miriam Deakin, director of policy and strategy at NHS Providers, said getting EPRs into trusts was a “significant task” and added it will be “challenging” for the NHS to meet the government’s target.

HSJ asked every NHS trust in England if they have an EPR, and – if not – whether it was currently procuring an EPR.

Although 28 trusts told HSJ they did not have an EPR — representing around 14 per cent of all trusts (excluding ambulance trusts) — HSJ understands that NHSE believes the number of trusts without adequate EPRs is between 35-40.

The regulator is thought to be aiming for trusts to be using EPRs which would achieve a level 5 HIMSS rating, which is an international standard for hospital IT. It is not known how many trusts’ EPRs would achieve a level 5 rating currently.

Several major teaching hospitals are among the 28 trusts which told HSJ they do not yet have an EPR.

This includes Liverpool University Hospitals Foundation Trust, Nottingham University Hospitals Trust, and Norfolk and Norwich University Hospitals FT.

LUHFT said it was currently procuring an EPR as part of a national programme launched last year to improve EPR procurement. In 2019-20, the trust pulled out of its EPR procurement after naming Intersystems as preferred provider.

NUHT said it was using “elements” of one EPR and had “plans to purchase the remaining elements in the next two years”, while NNUH is working on an joint EPR procurement with Queen Elizabeth Hospitals

All the trusts are outside London except Barking, Havering and Redbridge University Hospitals Trust and the Royal National Orthopaedic Hospital Trust.

Rory Deighton, acute lead at NHS Confederation, said trusts’ efforts to roll out EPRs quickly and effectively have often been “hampered by inadequate levels of available capital funding”.

He said the upcoming NHS digital health plan should “commit to providing leaders with the necessary support to roll out comprehensive EPR systems”.

Every trust which responded to HSJ’s questions said they were either in the process of procuring one, or developing a business case to secure funding in order to launch a procurement.

Several trusts indicated plans to run joint procurements for EPRs or align themselves with other trusts in their ICSs.

For example, University Hospitals Plymouth Trust said it was “working with our ICS colleagues, and under the leadership of the ICS, to set out our case for a future EPR for UHP and the wider system”.

Another trust, Stockport FT, said it had “started activities to progress with this key digital ambition for the organisation, working with our ICS, regional and national colleagues”.

Two trusts in Cheshire, Mid Cheshire Hospitals FT and East Cheshire Trust, said they had run a joint electronic patient record procurement and had chosen Meditech as their preferred provider.

The government has sought to get trusts to use electronic patient records since the early noughties, but its flagship programme to deliver this in the 2000s — the National Programme for IT — failed to incentivise trusts to adopt EPRs amid questions over their quality.

Ms Deakin, NHS Providers’ policy director, said procuring and implementing an EPR is “expensive and time consuming, but trusts know it carried real potential benefits for patient care and safety”.

She added: “Trust leaders know that it’s vital to get EPRs right but they are delivering this while overstretched staff are working flat out to tackle backlogs and deliver care to patients as quickly as they can.”

An NHSE spokesman said: “The NHS is focused on supporting local care systems so that 90 per cent of trusts have an EPR in place by December 2023 in line with the long-term plan ambition.”

Earlier this week staff raised patient safety concerns after four hospitals in Manchester suffered a “total IT failure”.

The trusts which told HSJ they lacked an EPR

- Doncaster and Bassetlaw Teaching Hospitals FT

- Worcestershire Acute Hospitals Trust

- Mid and South Essex FT

- Royal Orthopaedic Hospital FT

- Northumbria Healthcare FT

- South Tees Hospitals FT

- Torbay and South Devon FT

- University Hospitals Plymouth Trust

- United Lincolnshire Hospitals Trust

- Dartford and Gravesham Trust

- Barking Havering and Redbridge University Hospitals Trust

- Royal National Orthopaedic Hospital Trust

- Queen Elizabeth Hospital King’s Lynn FT

- James Paget University Hospitals FT

- Norfolk and Norwich University Hospitals FT

- Queen Victoria Hospital FT

- Robert Jones and Agnes Hunt Orthopaedic Hospital FT

- Stockport FT

- Northampton General Hospital Trust

- Sherwood Forest Hospitals FT

- Nottingham University Hospitals Trust

- Royal Cornwall Hospitals Trust

- North West Anglia FT

- Airedale FT

- Mid Cheshire Hospitals FT

- Liverpool University Hospitals FT

- East Cheshire Trust

Source: Information obtained by HSJ

Source Date: April and May 2022

From <https://www.hsj.co.uk/technology-and-innovation/revealed-the-27-trusts-still-without-an-electronic-patient-record/7032511.article>

My notes from this arvo's chat with Kate Quirke, ALC CEO. Have rearranged the notes into logical headers as a lot of ground was covered in the call.

My Thoughts Reflecting on the Call

- Institutions are still backing ALC - Aust Super and new Substantial Holder, Salter Brothers Emerging Companies took a 5.11% stake 2 days ago.

- Walked away from the meeting not feeling that there has been permanent or structural change and that today’s challenges appear “transitional” (for 12-18M) rather than permanent.

@nerdag 's bullish thinking is increasingly resonating. Salter Brothers clearly acted on this.

The only way forward is up (by how much is another question altogether), with a base revenue position of ~$120m over the next 5 years anchoring the viability of ALC. This does not feel like a $0.00 company at all, which is the max loss from here.

Might actually be a very good time to average down - buy when everyone else is fearful. It feels like we are in peak pessimism mode now on what FEELS like a transitonary problematic period.

Discl: Held IRL and in SM

-------------

Summary of Meeting

- A mixed feeling of “defiance” and “resignation” is the feeling I walked away with

- Defiant - ALC is clearly going through a rough patch, as is every other competitor, but Kate remained clear and had high conviction that there is a lot of growth ahead once ALC gets past the current NHS challenges - she flagged another year

- Resignation - doing all they can within what is controllable, will need to be patient for the NHS spend to be unlocked, resigned to the negativity in the meantime, weathering it as best as it can

Overall Challenges

- Confluence of micro and macros issues, compounding each other

- Challenge is acknowledged and FY2024 will not be a good year

- All competitors face the same pressures as everyone is impacted

- Another year to run, after which ALC’s focus will move from Tier 0 hospitals to the more matured Tier 2 hospitals

Downsizing

- Taken $6m out of the cost base

- Comfortable with executing the downsizing now as the focus in the last 18M was on developing repeatable processes as ALC scales, which is bearing fruit with the downsizing

R&D

- R&D has not been sacrificed with the downsizing as - resources to support the ADF contract reached end-of-delivery, creating capacity post downsizing

Cash Position & Cash Forecasting

- $120m of contracted revenue in the next 5 years, business is now rightsized

- Have the ability to forecast cash flow pretty well, very little bad debts

- Expect to sign more contracts

- Capital raise was an “insurance policy” prior to downsizing

- Cashflow positive target will be met after incorporating the cost of downsizing redundancies

UK NHS Activity

- Significant uptick in tender activity

- Budget is severely constrained this year to recover from Covid spend, budget for the next year is looking to be in catch-up mode

- As ALC’s buyers are government buyers, they are driven by/guided by what spend is permitted

- Buying cycle is long as ALC is focused on meeting the needs of Doctor’s and Nurses to increase their efficiency as their primary objective, not the Patient’s needs (who benefit from better service from the NHS)

- The NHS is still a key ALC revenue stream:

- Very significant growth opportunity in a sizeable market funded by the government

- Sale of additional modules to existing NHS customers

- Largest employer in the UK

- Good launch pad to other countries eg. Canada

ALC Platform Competitive Advantage

- ALC’s platform & modular approach allows it to position against the current “moment in time EPR focus” as well as the changing NHS focus over the years - ability to mix and match modules to solve healthcare problems

- ALC has, and will continue to detect emerging trends in healthcare challenges and build the platform response early - the Silverlink acquisition and integration into Miya precision allowed ALC to position itself to solve the current EPR challenges that the NHS is facing

- Have already built in AI into the ALC platform for many years and will continue to incorporate elements of AI

M&A

- A lot of increased M&A activities/opportunities, but is not ALC’s focus at the moment, still very much focused on organic growth and demonstrating the value from the ALC platform

- ALC is at a reasonable level of scale already, presently

Competition

Nerve Centre in the UK

- Main ALC competitor in the NHS, a small company based in the Midlands and is doing well in the UK

- ALC is more focused in the North of the UK

- Nerve Center is only now just building a Patient Admin module - need a proven reference case in NHS tenders

- ALC has the advantage of a ready-to-go platform and has modules in areas where Nerve Center does not

Telstra Health in Australia

- “Copying” ALC

- Is trying to be all things to all people - still trying to work out its unique proposition

- Acquired a lot of companies, has a different architecture, different technology stack

Other Opportunities Discussed

- Management of Medications - lots of localisation and legislative requirements required, EPR players in Australia already have a module for the large hospitals, remain open to this

- Aged Care - very poor state of IT, but profit margins in the sector are too thin to make investing worthwhile

On Hindsight

- Would have executed downsizing earlier but they had to find the right balance against the then-reality of NHS moving at pace - classic IT company conundrum

- Would have combined Silverlink and Miya solutions earlier

- Better marketing of the business and value proposition and would have spent more time in marketing to counter the massive marketing teams that ALC’s competitors have (their competitors are also laying off people)

Qualifier: Bull case from these levels.

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02778239-3A637559

No real surprises in this announcment. Staff cost cuts were already in the pipeline, and there is "4m pa of additional cost savings" to come - I'll be very interested to see what these costs are and no doubt more will be said today.

At 1x sales, costs now coming under control, and arguably sector tailwinds with cashstrapped public health services in the Western world being reluctant to commit to a full EMR replacement, and the very not implausible chance of acquisition by one of the bigger players at these prices, the only thing pushing the price down now is sentiment.

A few contract wins, the timing of which is unpredictable, and Alcidion will be back above 10c soon enough.

Biggest sign to watch for is whether management put their money where their mouths are and start buying substantially on-market once the blockout period expires on 1 March, then I think we'll have found a floor for the price. If they don't, then that will be a red flag.

I was nursing a 75% paper loss IRL at these levels, and am confident enough to risk a bit more averaging down my buy-in price, with the upside outweighing the downside risk at the current price.

Beleaguered $ALC reported their 4C this morning, with the investor call later this morning (I won't be able to attend so will have to catch up with the recording)

Their Highlights

- Q2 new TCV sales of $21.8M; $0.7M expected to be recognised in FY24

- Signed $23.3M South Tees contract extension for an additional 8 years (to 2033 with 2 years remaining on current contract) for Miya Precision Electronic Patient Record (EPR). Further options to extend out to 2038 and add further Alcidion modules which if taken would result in a total TCV of up to $54M over the next 15 years

- FY24 contracted revenue at end of Q2 of $35.5M, up 4% on pcp

- Sold & renewal revenue over the next 5 years (excluding FY24) of $126M

- Q2 cash receipts of $8.7M; up 28% on pcp, resulting in an operating cash outflow of $3.4M. Debtor balance at end of Q2 of $7.3M (PCP: $5.6M) which included $3.9M from a major customer which was collected in the first week of January 2024

- During Q2, raised $5.4M via Placement and SPP to ensure maximum flexibility and maintain a strong balance sheet to execute on market opportunities and drive revenue growth

- Cash balance of $7.9M and no debt at 31 December 2023, strengthened further following receipt of $3.9m in early January 2024

My Analysis

2023 was a horrible year for the company, and investors voted with their feet with the SP down almost 2/3rds and the SPP component of the capital raising towards the end of the year essentially shunned by investors.

My usual 4C Cashflow picture below tells the story - no discernible growth trends, a growth stock currently becalmed with the sails flapping in the breeze. I've added the TTM picture for operating CF over a longer timeframe, so you can more clearly see the adverse inflection over the last 12-18 months.

Within all the bad news there is the good news of the South Tees renewal - previosuly announced. We don't know the full terms of the deal in terms of margin; however, this is a high gross margin business, and such a long term contract with the potential to deliver average annual revenue of $3.6m over 15 years and act as a flagship reference case. The South Tees procurement team will have struck a good deal, you can be sure.

The blame on slow procurement is placed squarely on the customers, which I am not sure is totally justified. I have previously published a sample list of recent NHS deal announcements. Product and Sales Capability are two other factors in the mix, and there has to be question-marks on both.

Kate is turning her attention to managing costs, which she has to do. Taking direct control of the UK team by not replacing the MD is a significant step, and she'll have a tough year directly running a microcap operating on two sides of the globe. But that is the work to do, as it is a fight for survival now.

My thesis is broken, and I should exit. However, with the SP on about 1.2x expected FY24 sales there is every chance that some wind might be blown back into the sales. One or more material sales deals, which are as ever said to be in prospect, even a decent upsell to an existing customer would be positive catalysts. There is also the prospect of M&A - not a reason to hold on its own - but $ALC has to be on someone's shopping list at this level.

So, I am not going to shoot myself in the foot by exiting today. My position is small (RL now only 0.5%) and the damage is done. I'm a grumpy HOLD.

From Fintel & Nasdaq

Alcidion Group (ASX:ALC) Price Target Decreased by 31.25% to 0.11

The average one-year price target for Alcidion Group (ASX:ALC) has been revised to 0.11 / share. This is an decrease of 31.25% from the prior estimate of 0.16 dated October 31, 2023

The price target is an average of many targets provided by analysts. The latest targets range from a low of 0.08 to a high of 0.14 / share. The average price target represents an increase of 53.70% from the latest reported closing price of 0.07 / share

What is the Fund Sentiment?

There are 6 funds or institutions reporting positions in Alcidion Group. This is a decrease of 1 owner(s) or 14.29% in the last quarter. Average portfolio weight of all funds dedicated to ALC is 0.00%, a decrease of 30.59%. Total shares owned by institutions decreased in the last three months by 18.66% to 922K shares

DISC: Held in SM & RL

Ok going have rough stab at this, finding hard to forecast revenue growth too far in future. Take this valuation with grain of salt.

Assume no growth Revenue $40m

I used a share count of 138,851,125 which includes $6m capital raise dilution plus I have included an extra 3%.

Revenue per share 0.03 Cents

Revenue multiple of something similar to VHT of 4 gives me 0.12

Probably review once more information comes to light

Well the details of the SPP were released ...

https://www.marketindex.com.au/asx/alc/announcements/share-purchase-plan-announcement-3A629872

The SPP aims to raise up to $1.0M via the issue of up to approximately 13.33 million fully paid ordinary shares (‘SPP Shares’). The SPP is not underwritten

Alcidion’s existing eligible shareholders will be the given opportunity to subscribe for a maximum of $30,000 per shareholder in SPP Shares at the same offer price as the Placement of $0.075 per SPP Share

Given that you can currently buy the shares on market for less than the SPP price ...

I wanted to have a look at how the NHS is progressing in its digitalisation stratgy.

So I teamed up with my new buddy Bing Chat Enterprise to generate this list of 40+ accouncements for EMR systems from over the last two years. These are much bigger investments that for $ALC's products. The contract sizes range from about GBP8m right up to GBP50m. (I have not personally verified the whole list, however, a sample do check out.)

I note that the 2023 list is shorter (pro rata) than 2022.

I wondered though, with so many decsions being taken on big EMR platforms, whether that may be one issue for $ALC for the following reasons:

- The EMR is a big financial commitment, In the run up to making it and in the aftermath, spending on other systems many be squeezed

- In the run up to an EMR procurement decision, it may be hard to get management to take decision on patient flow and other solutions. This could be for reasons including: attention focused on EMR bundles of functionality (which may obviate the need for $ALC investment) and questions of inter-operability

- Both in the run-up to and aftermath from an EMR decision, human capacity in the NHS Trust will likely be focused on the success of the EMR. $ALC may be struggling for attention, in some cases.

So, an alternative hypothesis is: "$ALC is reporting slow decsion-making on new contracts, because the systems attention is elsewhere?"

Here is the AI-facilitated list (enjoy)

- September 2023: Bradford Teaching Hospitals NHS Foundation Trust selected Cerner as its preferred supplier for its new EMR system.

- August 2023: Alder Hey Children’s NHS Foundation Trust awarded a contract to DXC Technology to deliver its Lorenzo EMR system.

- July 2023: Nottingham University Hospitals NHS Trust signed a contract with System C to implement its CareFlow EMR system.

- June 2023: University College London Hospitals NHS Foundation Trust selected Epic as its preferred supplier for its new EMR system.

- May 2023: The Royal Marsden NHS Foundation Trust signed a contract with Civica to implement its Cito EMR system.

- May 2023: Lancashire Teaching Hospitals NHS Foundation Trust selected Cerner as its preferred supplier for its new EMR system.

- April 2023: Surrey and Sussex Healthcare NHS Trust selected Cerner as its preferred supplier for its new EMR system.

- April 2023: Imperial College Healthcare NHS Trust extended its contract with Cerner to implement its Millennium EMR system across its five hospitals.

- March 2023: Barnsley Hospital NHS Foundation Trust awarded a contract to DXC Technology to deliver its Lorenzo EMR system.

- March 2023: Manchester University NHS Foundation Trust awarded a contract to Allscripts to deliver its Sunrise EMR system.

- February 2023: The Hillingdon Hospitals NHS Foundation Trust signed a contract with InterSystems to implement its TrakCare EMR system.

- February 2023: Oxford University Hospitals NHS Foundation Trust signed a contract with Epic to implement its EMR system across its four hospitals.

- January 2023: St George’s University Hospitals NHS Foundation Trust selected Epic as its preferred supplier for its new EMR system.

- January 2023: Liverpool University Hospitals NHS Foundation Trust selected Cerner as its preferred supplier for its new EMR system.

- December 2022: Royal Berkshire NHS Foundation Trust awarded a contract to System C to deliver its CareFlow EMR system.

- December 2022: Guy’s and St Thomas’ NHS Foundation Trust extended its contract with Cerner to implement its Millennium EMR system across its three hospitals.

- November 2022: North Bristol NHS Trust signed a contract with Allscripts to implement its Sunrise EMR system.

- November 2022: Sheffield Teaching Hospitals NHS Foundation Trust awarded a contract to InterSystems to deliver its TrakCare EMR system.

- October 2022: Barking, Havering and Redbridge University Hospitals NHS Trust extended its contract with Cerner to implement its Millennium EMR system across its three hospitals.

- October 2022: King’s College Hospital NHS Foundation Trust signed a contract with Epic to implement its EMR system across its four hospitals.

- September 2022: Luton and Dunstable University Hospital NHS Foundation Trust awarded a contract to Epic to implement its EMR system across its two hospitals.

- September 2022: Mid Yorkshire Hospitals NHS Trust selected Cerner as its preferred supplier for its new EMR system.

- August 2022: East Sussex Healthcare NHS Trust signed a contract with Civica to implement its Cito EMR system.

- August 2022: Great Ormond Street Hospital for Children NHS Foundation Trust awarded a contract to DXC Technology to deliver its Lorenzo EMR system.

- July 2022: Dorset County Hospital NHS Foundation Trust selected Cerner as its preferred supplier for its new EMR system.

- July 2022: Birmingham Women’s and Children’s NHS Foundation Trust signed a contract with System C to implement its CareFlow EMR system.

- June 2022: Chelsea and Westminster Hospital NHS Foundation Trust awarded a contract to DXC Technology to deliver its Lorenzo EMR system.

- June 2022: East Lancashire Hospitals NHS Trust selected Cerner as its preferred supplier for its new EMR system.

- May 2022: Portsmouth Hospitals University NHS Trust signed a contract with InterSystems to implement their TrakCare EMR system.

- May 2022: Royal Free London NHS Foundation Trust extended their contract with Cerner to implement their Millennium EMR system across their three hospitals.

- April 2022: Cambridge University Hospitals NHS Foundation Trust selected Epic as their preferred supplier for their new EMR system.

- April 2022: Leeds Teaching Hospitals NHS Trust awarded a contract to Allscripts to deliver their Sunrise EMR system.

- March 2022: University Hospitals Bristol and Weston NHS Foundation Trust signed a contract with Epic to implement their EMR system across their two hospitals.

- March 2022: The Newcastle Upon Tyne Hospitals NHS Foundation Trust extended their contract with Cerner to implement their Millennium EMR system.

- February 2022: South Tees Hospitals NHS Foundation Trust awarded a contract to System C to deliver their CareFlow EMR system.

- February 2022: Northumbria Healthcare NHS Foundation Trust selected Allscripts as their preferred supplier for their new EMR system.

- January 2022: The Royal Wolverhampton NHS Trust signed a contract with Allscripts to implement their Sunrise EMR system.

- January 2022: Royal Cornwall Hospitals NHS Trust awarded a contract to System C to deliver their CareFlow EMR system.

- November 2021: University Hospitals Birmingham NHS Foundation Trust signed a contract with Cerner to implement their Millennium EMR system across their four hospitals.

- November 2021: Norfolk and Norwich University Hospitals NHS Foundation Trust awarded a contract to DXC Technology to deliver their Lorenzo EMR system.

- October 2021: County Durham and Darlington NHS Foundation Trust signed a contract with Civica to implement their Cito EMR system.

- October 2021: Barts Health NHS Trust secured £12m of funding from NHS England and NHS Improvement to invest in a new EMR system and selected Cerner as its preferred supplier.

Note: I don't have an up to date number, but there of the order of 200-250 NHS Trust in the UK, so this is a minor but significant fractoin of the whole.

There are multiple risks i see fundamentally and sentiment vise.

1. Management ability and willingness to reduce cost of business is minimum- and happy to raise capital at distress price to fund delayed contracts

2. Kate mentioned that procurement approach has changed for EMR and it went into tender process and not every NHS trust going in FY24.

3. Risks are two fold now, probability of them winning the contracts x probability of them winning in required timeframes till balancesheet allow to fund employees.

4. Management and Boards ability to navigate potential difficult macro environment.

5. There were no high hopes for Q2 and Q3 results - sentiments isn't going to turn anytime soon

I would have preferred them to reduce the cost base somehow instead of dilution. History of dilution is very poor...makes it difficult to increase any KPI per share

I just sold my shares at loss and will come back at higher prices once i have confidence that it is self funded.

Wow! This has become wealth transfer machine from shareholders to employees.

Management decision not to reduce staff cost even after delayed contracts is costing balance sheet and shareholders.

$ALC in a Tading Halt pending annoucement of the Capital Raise.

There is a call later this morning on the 4C Quarterly, which is yet to be released.

I can't attend, so hoping to read reports from other StrawPeople.

Not sure why a CR is required, as they had $14m at end of June, and cash flow generative. It's hardly an opportunistic raise given the SP!

So presumably there is an acquisition on the horizon?

Interesting.

Disc: Held in RL and SM

ALC commentary: 9:00-11:31

Claude Walker gives some handy commentary in the lead-up to ALC releasing its Appendix 4C Cash Flow Quarterly Report on Oct. 31st.

I agree with: ALC needs to become profitable and the UK contracts need to come through for the share price to start climbing out of the doldrums.

Disc: Held IRL & SM

Alcidion Wins HTN's Communication Tool of the Year Award

Dear Shareholders,

We are delighted to share the exciting news that Alcidion has been honored with the prestigious "Communication Tool of the Year" award by HTN (Health Tech News). This recognition showcases our commitment to innovation and the transformative impact our solutions have had on healthcare communication and patient care. This award is a testament to the outstanding collaborative efforts of our teams at Guy's and St Thomas' NHS Foundation Trust and Lancashire Teaching Hospitals NHS Foundation Trust.

Before Smartpage's introduction, healthcare institutions, like Guy's and St Thomas' NHS Foundation Trust, relied on paper-based processes and pagers. These antiquated methods led to inefficiencies, a lack of accountability, and ultimately poorer patient care outcomes. With the implementation of Smartpage, our technology has empowered healthcare professionals by providing them with a fast, reliable, and contextual messaging system, complete with two-way closed-loop communication and comprehensive task management capabilities.

The impact of Smartpage has been profound, with benefits that include:

- Full visibility of activity, enabling staff to prioritize and respond quickly to deteriorating patients.

- Reduction of unnecessary interruptions, leading to improved patient care.

- Easier clinical collaboration and real-time data insight.

- Better integration and operational efficiency.

Lancashire Teaching Hospitals, another esteemed partner, adopted Smartpage across both clinical and non-clinical services and witnessed an average of 60 percent of daily jobs activated within five minutes, showcasing its effectiveness in a real-world healthcare environment.

Smartpage is currently live within nine NHS organizations, with plans to expand to other trusts and develop their time-saving software.

We are immensely proud of this recognition and grateful for the unwavering support of our shareholders. This award reaffirms our mission to drive positive change in healthcare through innovative technology, and we look forward to the continued journey of improving patient care.

Thank you for your ongoing trust and support.

Sincerely,

Team Alcidion

In the episode of Talking HealthTech, Kate and Martin ( Founder of Olinqua) discuss how their partnership can reduce hospital wait times and overall make things more efficient and Why this is the right time for this partnership.

Doing research to figure out Alcidion's chances of winning NHS contracts for EPR. ( Putting all the info that I can find here and then will see how it all relates and figure out chances - That's the idea anyway!!)

https://www.digitalhealth.net/2023/07/epr-frontline-digitisation-target-declared-unachievable/

https://www.digitalhealth.net/2023/04/what-to-expect-from-epr-transitions-in-2023-and-beyond/

https://www.digitalhealth.net/2018/10/hancock-tech-revolution-mandatory-open-standards/

Alcidion reported its FY23 report

Revenue:

Receipt from Customers

Expense

Operating Cash

No. of Shares

My view:

In the absence of an NHS contract, Alcidion currently looks like a slow growth company. However, I get a sense that Alcidion has significantly hired in anticipation of NHS contracts and because of those contract delays, expense has grown fast compared to revenue.

In one of the calls, Kate mentioned that it would be very shortsighted of her if she started cutting costs and suddenly had NHS contracts and struggled to find the resources to fulfill them.

Although Alcidion hasn't performed that poorly in the absence of NHS contacts - However, I anticipate there will be significant pressure on Alcidion's share price for some time because one of the co-founders ( Ray Blight) seems to be selling his portion after his resignation. He resigned on 30 June 2021 and also Alcidion's previous CFO Collin MacKinnon who retired last year is selling down his portion. ( Highlighted yellow in the screenshot below).