I have been a bit annoyed by not having transparent information from Alcidion lately.

Case 1: No explanation of revenue going backward.

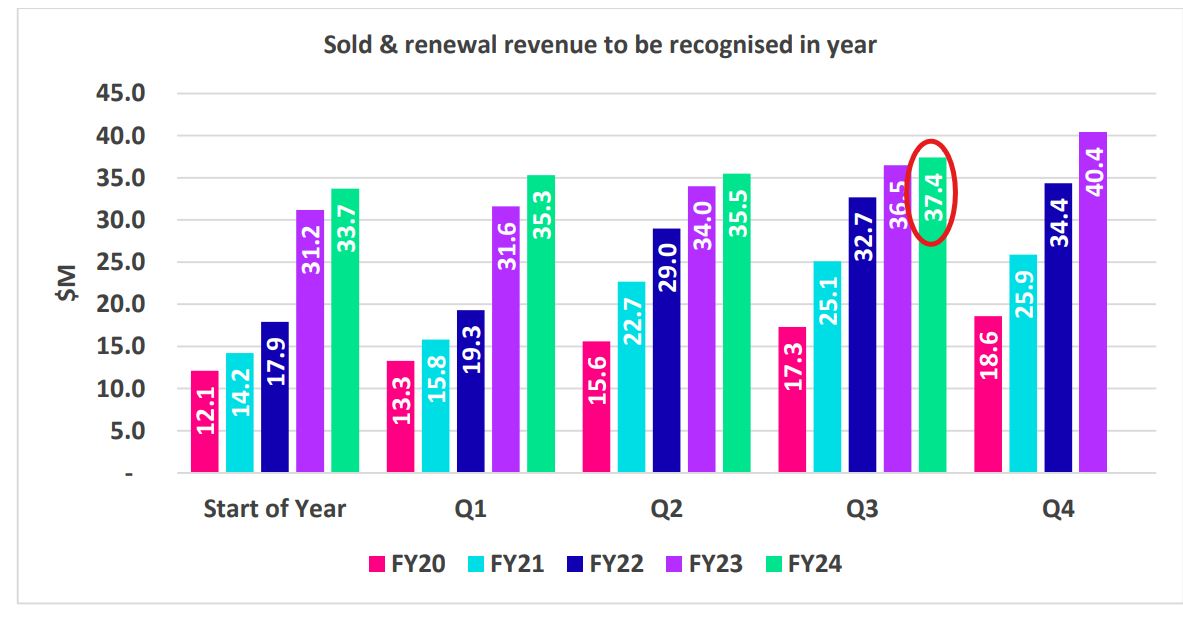

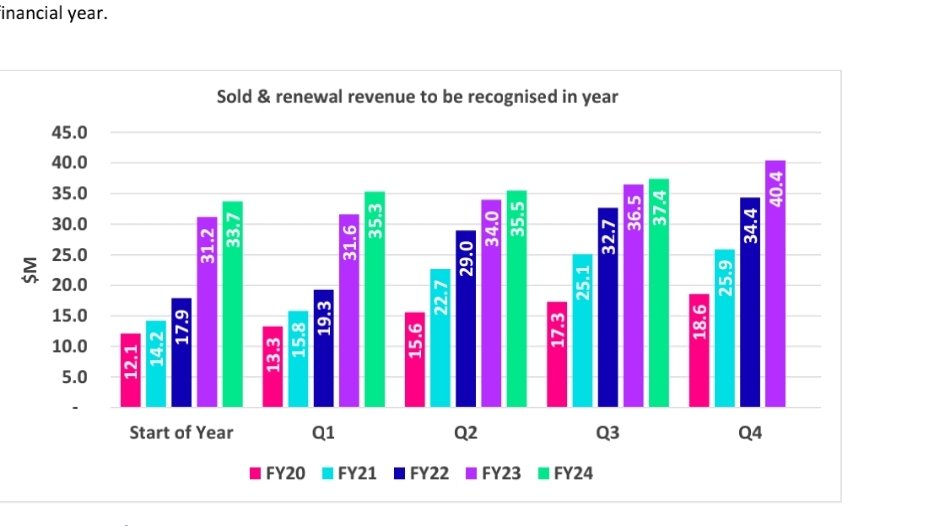

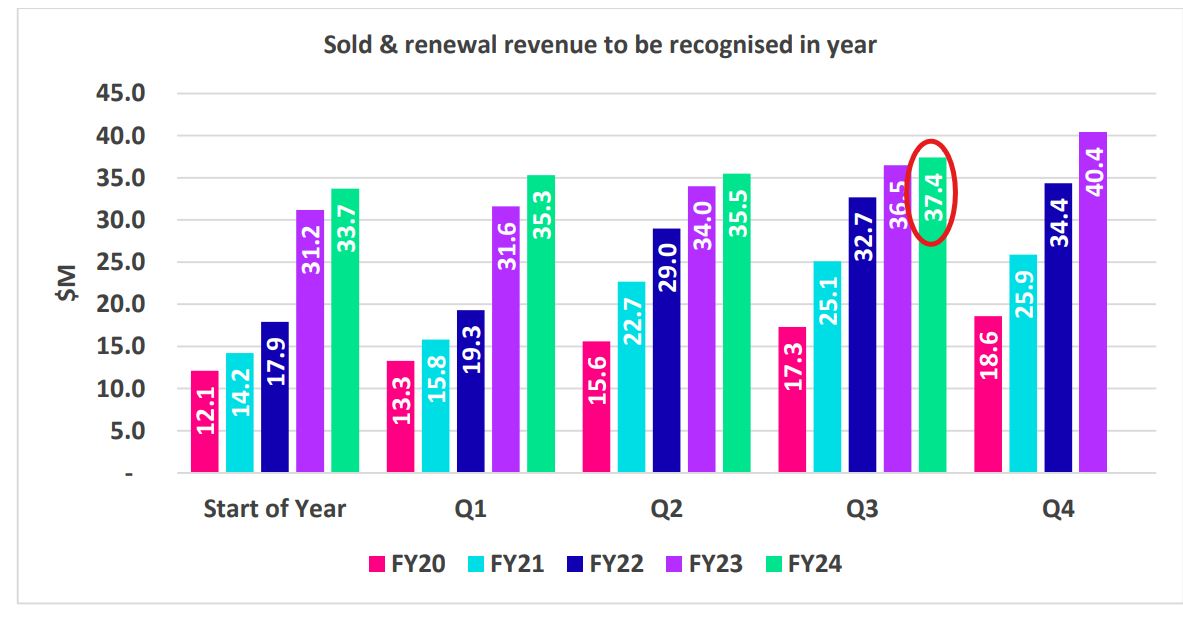

So at the end of Q3 FY24 they had sold & renewal revenue to be recognized in year = 37.4m

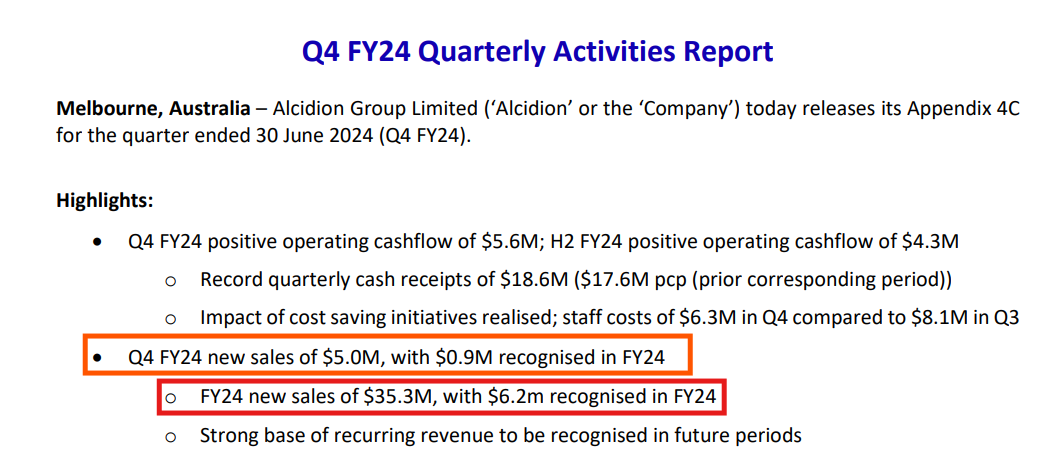

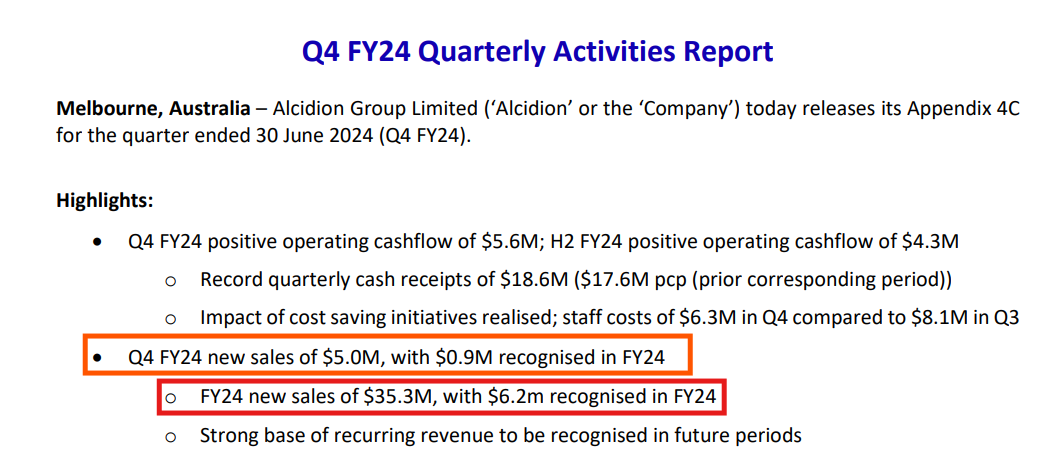

and then in Q4 they announced, new sales of $5m and 0.9m recognised in FY24 so that brings 37.4+0.9 = $38.3

At the start of FY24 they had $33.7m to be recoginsed and in FY24 they said they added total $6.2m in sales to be recognised in FY24, so technically, revenue should be $39.9m

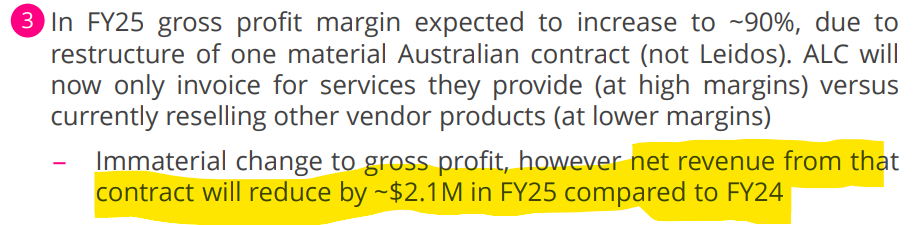

I can understand if there is some issue and the customer is pulling back or delaying but I couldn't find any explanation in the report - What is the meaning of starting the number of $28m for FY25 that they have given - How can I confidently say that it will be recognised in this year? No idea

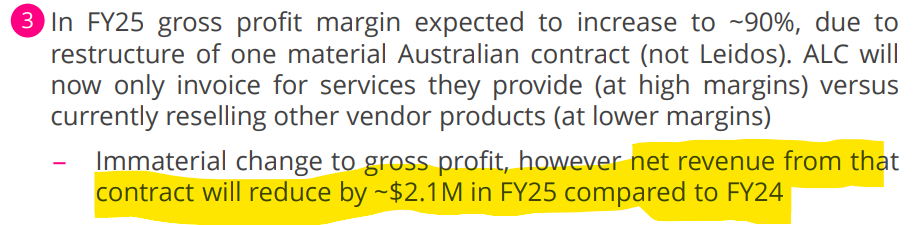

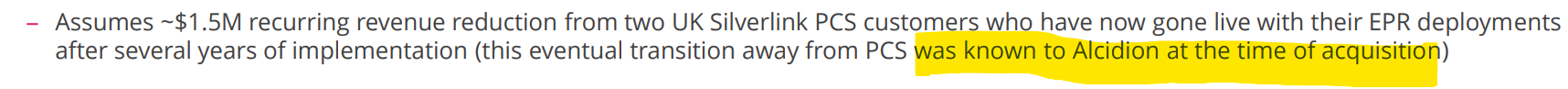

So I can only assume that, this reduction in revenue is on top of the things we can see slipped in FY24

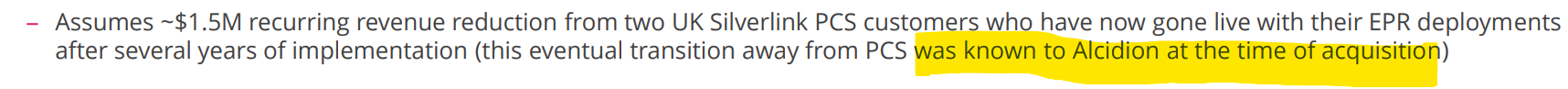

On top of all this, the following - They didn't mention during acquisition capital raising - Just cherry-picking information to present to Investors I feel

Bit annoyed.