Hi all, in light of the fact that Alcidion (ALC) is popular amongst members, I figured I would post a bear case for the business. Feel free to criticise and pick apart this argument – I have been a fan of ALC for over a year but am yet to bite the bullet. With any luck, we will generate some productive discussion around expectations and business prospects.

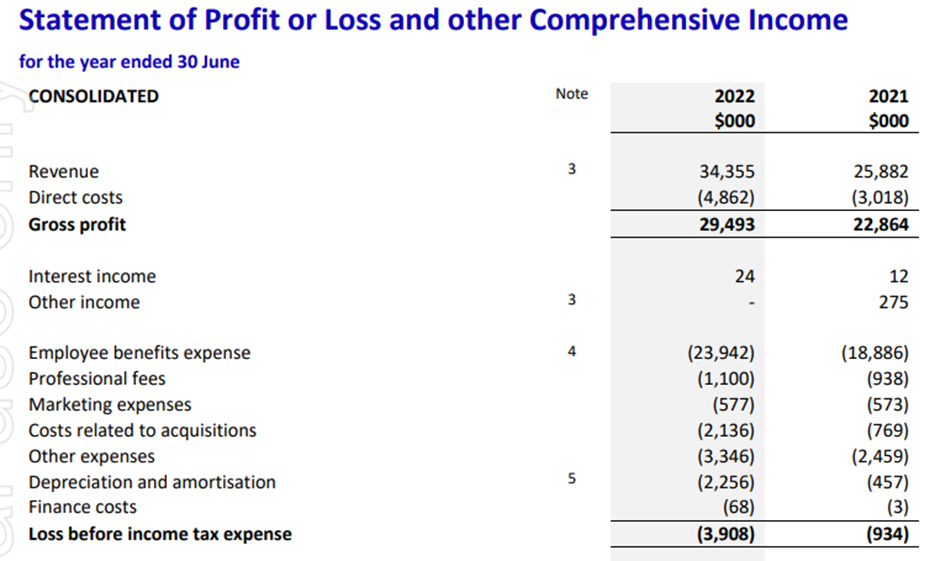

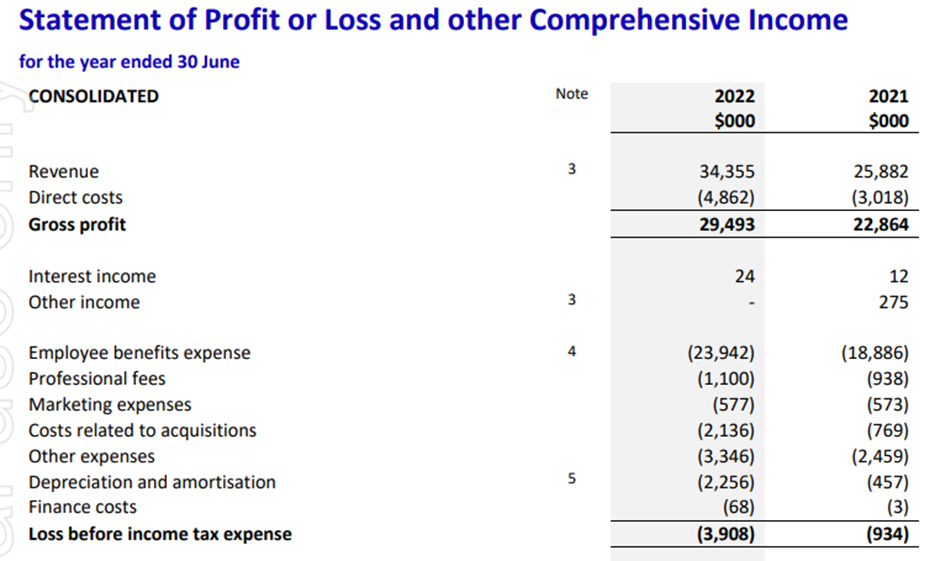

Since 2018, revenue has increased from 16m to 34m – both the result of both organic and acquisition growth. This growth is impressive, it has to be said. But ALC has struggled to demonstrate scalability during that time:

Let’s pretend the year is 2018. If we had the ability to skip forward to FY22 results, would you be happy with how the business has fared during that time?

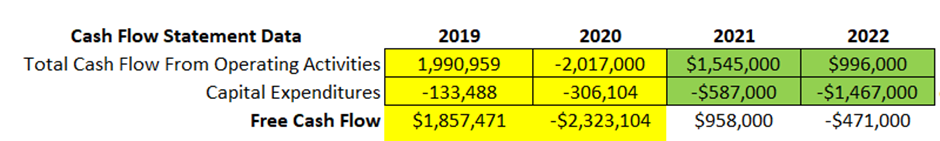

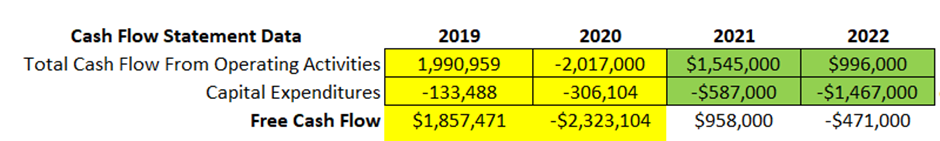

In fairness to ALC, the pandemic had a huge impact on business operations. But they have hardly demonstrated resilience during this time. Outstanding shares have risen from 805m to more than 1.2 billion (as of FY22). The business hasn’t been close to profitable and continues to tap shareholders on the shoulder for capital – to both sustain operations and continue their quest for growth.

Is this harsh? Perhaps. The business is trying to embed itself in an industry that is traditionally slow to innovate and adopt new ways of thinking. But they weren’t founded in 2015 or 16 – this is a business that was founded more than 20 years ago.

In FY22, revenue increased by 8.5m (since FY21). Direct costs only increased by 1.8m to achieve this, and the business reported a gross profit of 29m, up from 22m in FY21. That is darn impressive, no doubt about it. But here’s the catch – employee expenses increased by more than 5m, ‘other expenses’ increased by another 1m and D&A more than quadrupled. Correct me if I am wrong, but the business also raised capital twice during the year, raising more than 70m – primarily to fund acquisitions. Employee expenses alone is a red flag to me, consuming around 70% of current cash intake.

I am interested in what constitutes a success for this business. How long do we as investors give ALC to make their mark and start funding their own growth? Is there an expectation amongst members that shareholders will continue to see their shares diluted for another five years while the business grows? Is this acceptable?

On the valuation front, I don’t think the current price is particularly attractive, nor ridiculous. They are currently trading at 5x P/S. My DCF returned a valuation of 0.5c, and this is assuming that Alcidion can steadily grow free cash flow over the course of the next four years. Based on their past history, they haven’t demonstrated an ability to do this so I am cautious about making these assumptions.

Happy for all thoughts/comments.

Disc - not held.