I agree with @NewbieHK and @Remorhaz that the $ALC result today was a postive.

I'll skip the usual summary of results and analysis and focus instead on an assessment of my usual CF trend analysis and take a look at contracted revenues. The common thought process I am bringing to all of my small caps that are approaching inflection is: "now that costs are under control and also now that we are seeing the organic growth engine exposed, is the revenue growth and operating leverage strong enough to make this an interesting investment?"

First some general observations:

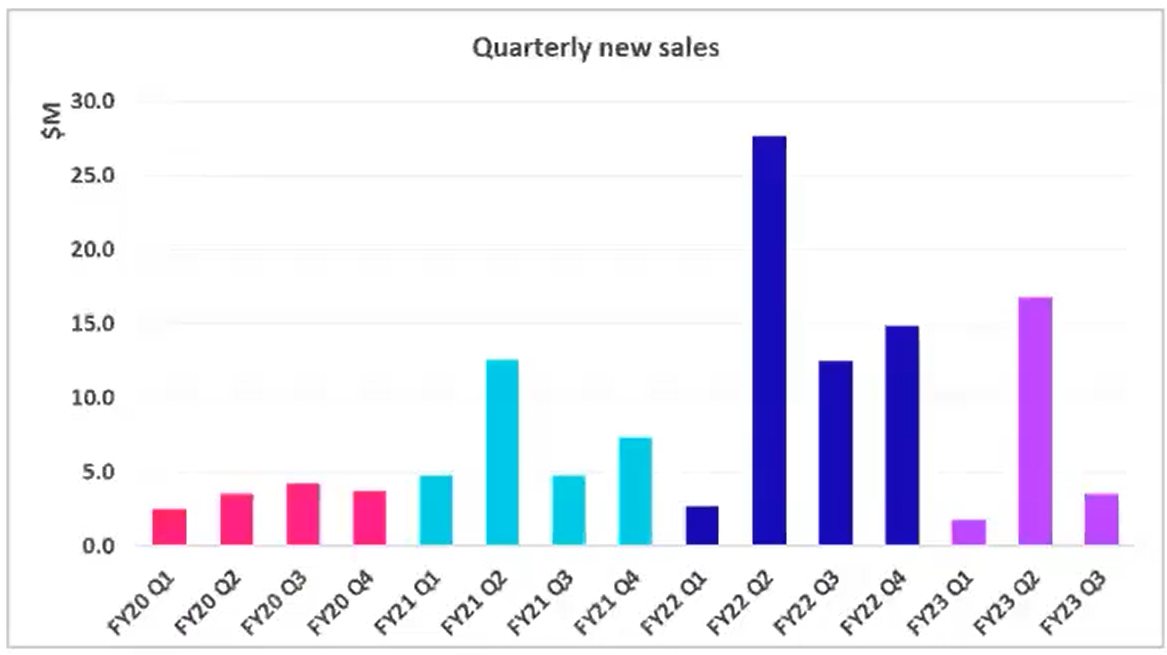

- The selling of incremental modules approach appears to be working.

- The mix of renewals and new contracts is good.

- NZ appears to have reached a possible turning point. No point writing too much, as it is the size of an Aussie State, but worth a mention. Kate has commented before on the slow progress in NZ, because they have been impacted by the consolidation of District Health Boards into a consolidated structure. This kind of reorganisation plays havoc with IT procurement decisions because of all the energy that is consumed in the internal reorganisation. So I am sure they will be focused on trying to get a roll out of the module that is in place in one of the former DHBs. And after that more modules? Eventually, the new organisation will kick into action and start making decisions. (I have three members of my extended family working in the NZ health service, and the staffing pressures are as real there as in Aus and UK.)

- The key message of "we're saving clinicians time", be it doctors, nurses, or orderlies will resonate strongly with decision-makers, given the perennial staffing pressures in all markets.

- They are building strong "reference cases". This is important because public health services are not in competition with each other and openly share good practices, and coalesce around common solutuions. $ALC are doing a good job on social media with this, as others here have observed.

- Costs appear to be reasonably under control, with Kate setting clear expectations for FY24.

Now to the analyses.

1. CF Trend Analysis

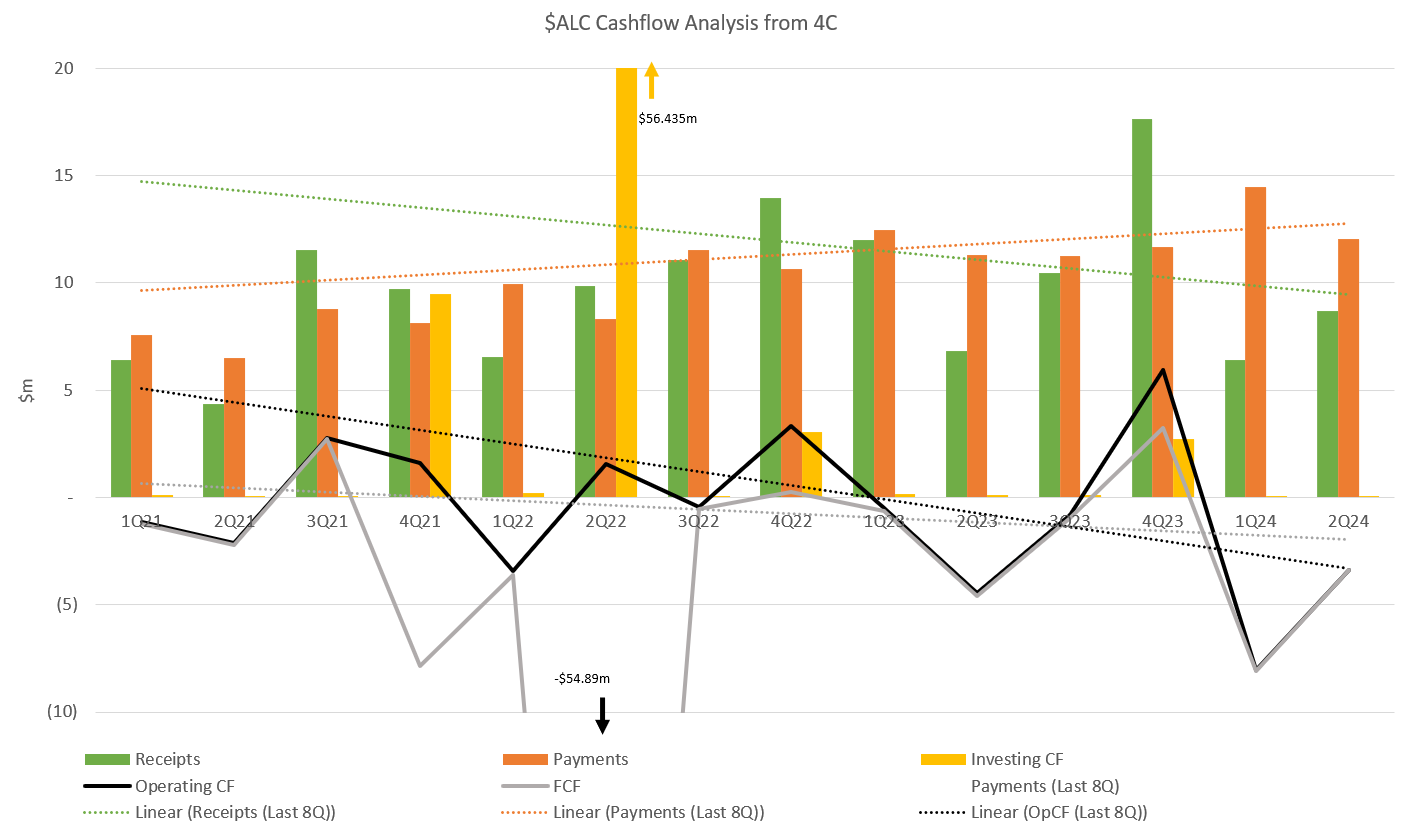

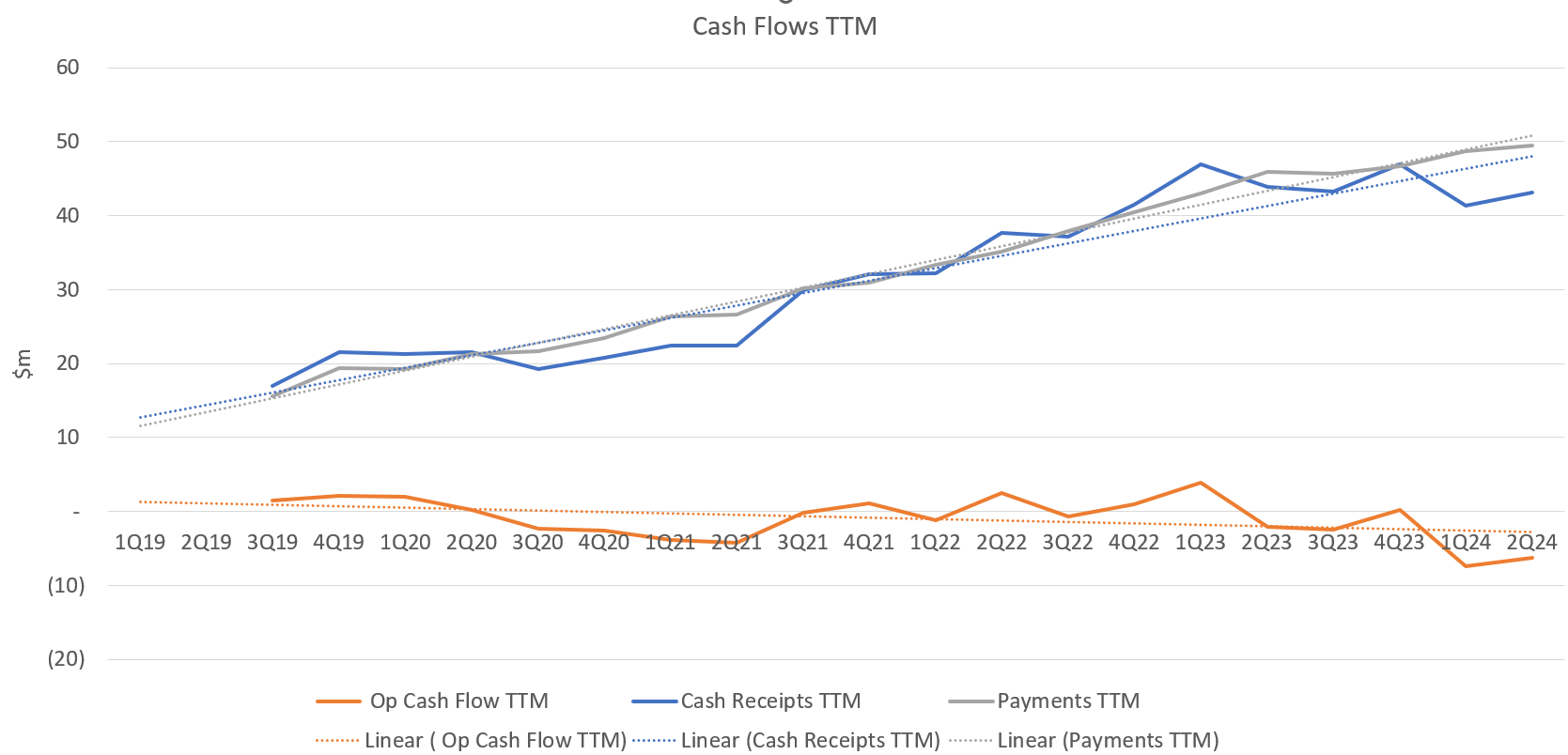

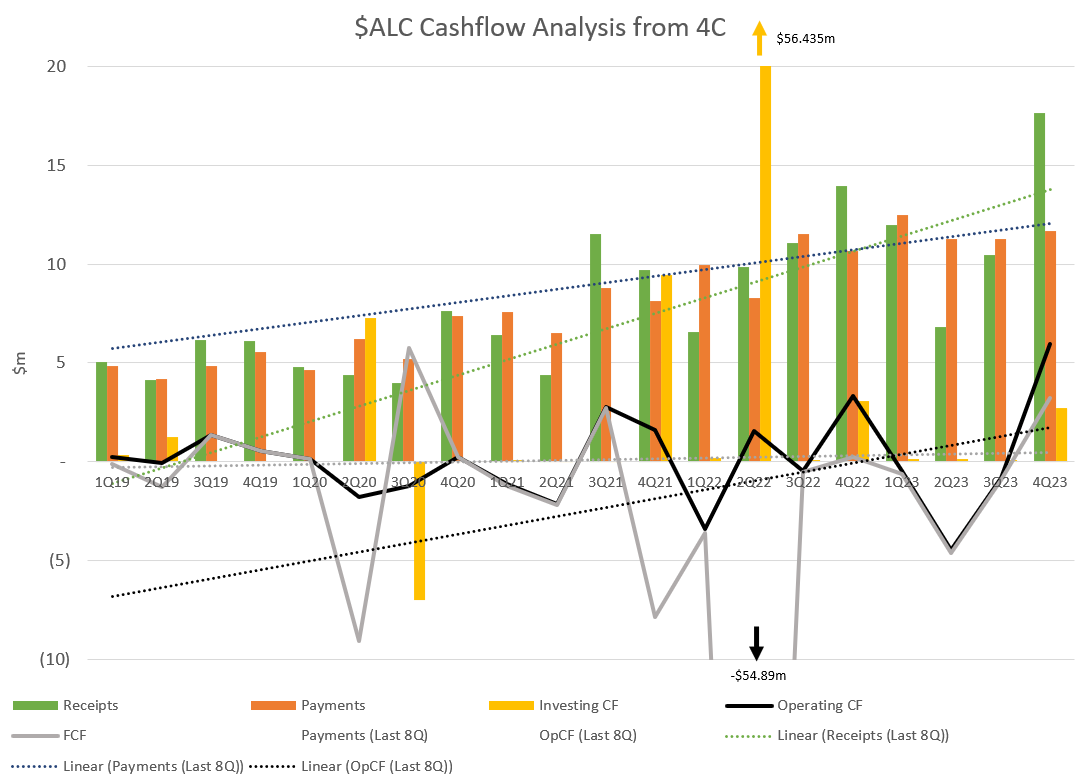

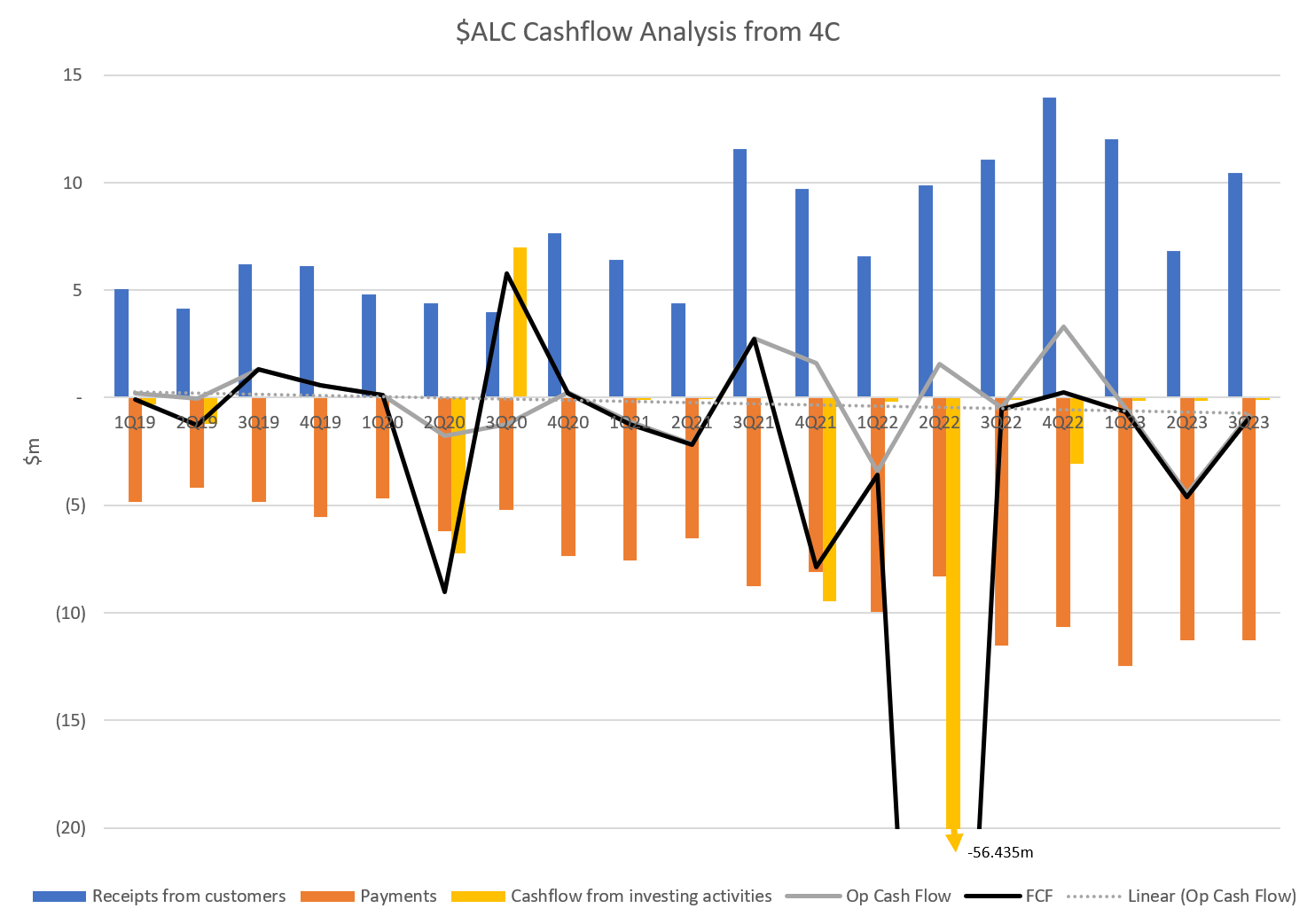

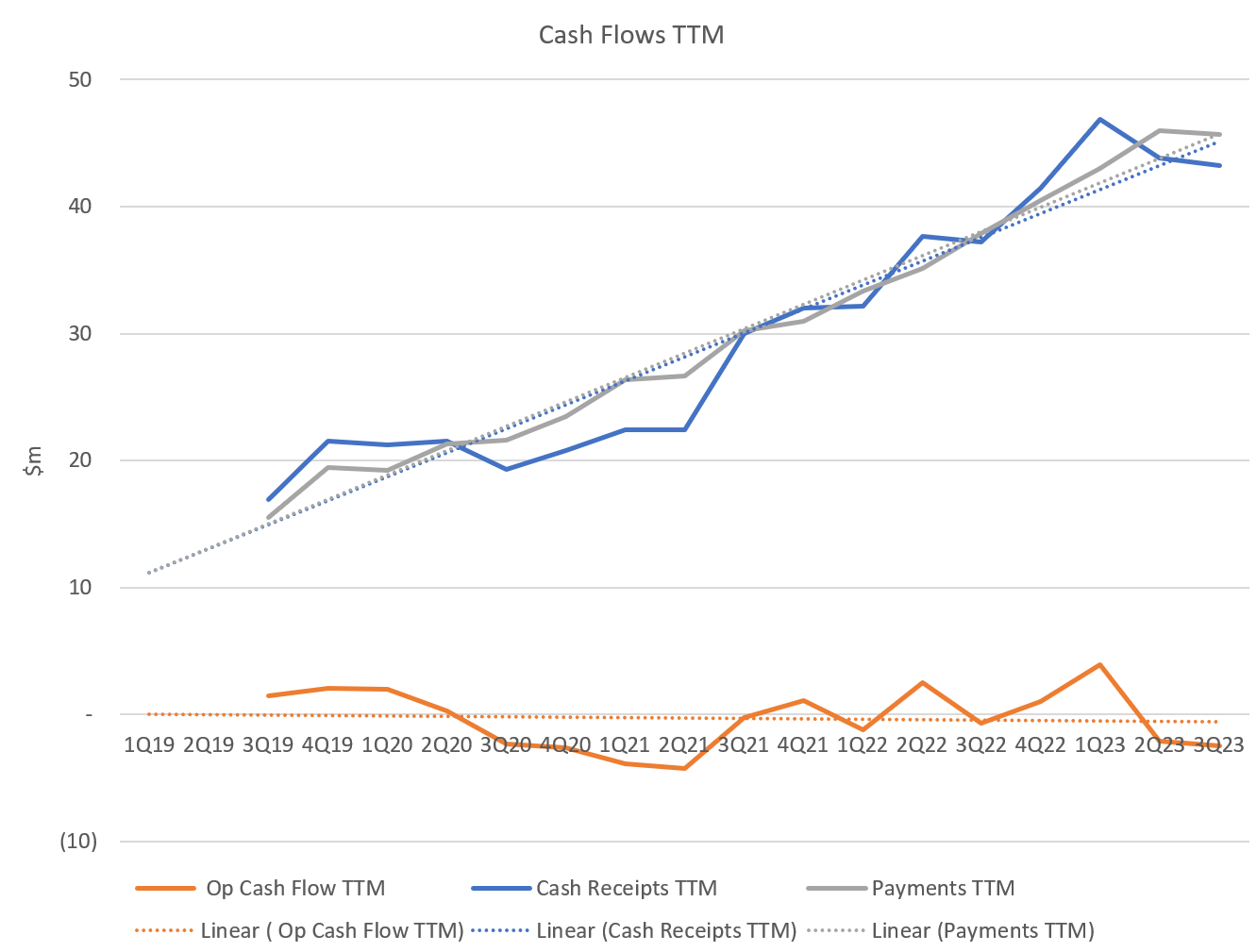

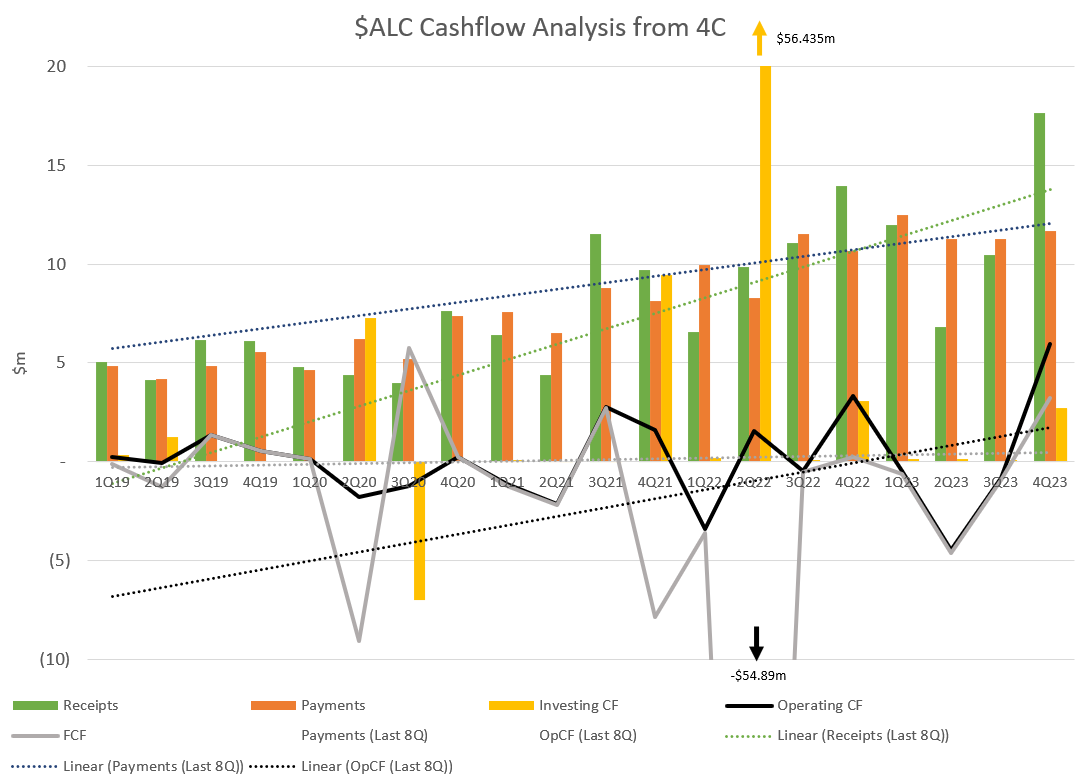

Above is the usual CF analysis. I usually prefer to focus on FCF, but because of the acquisitions within the 8Q window I am going to focus on OpCF. (Although, you can see that absent the Silverlink earnout, $ALC is solidly in the exploitation phase with minimal capex.)

Previously, I have shown the trend lines over the entire dataset, but I am increasingly using the last 8Q, as above, because I think that is a better reflection of the impact of management efforts in the more recent capital constrained environment.

If you compare the above chart, with earlier editions, the good news is that the slope of the OpCF line is increasing significantly. Obviously, the very strong most recent Q helps a lot.

Given the high Q-on-Q volatility it would be wrong to say that the last 3Qs shows a positive trend. So, I won't say that! But the longer term trend is there. Again, I'm not going to show the FCF trend line, as the one-off Silverlink impact renders this meaningless.

2. Analysis of Contracted Sales and Revenue

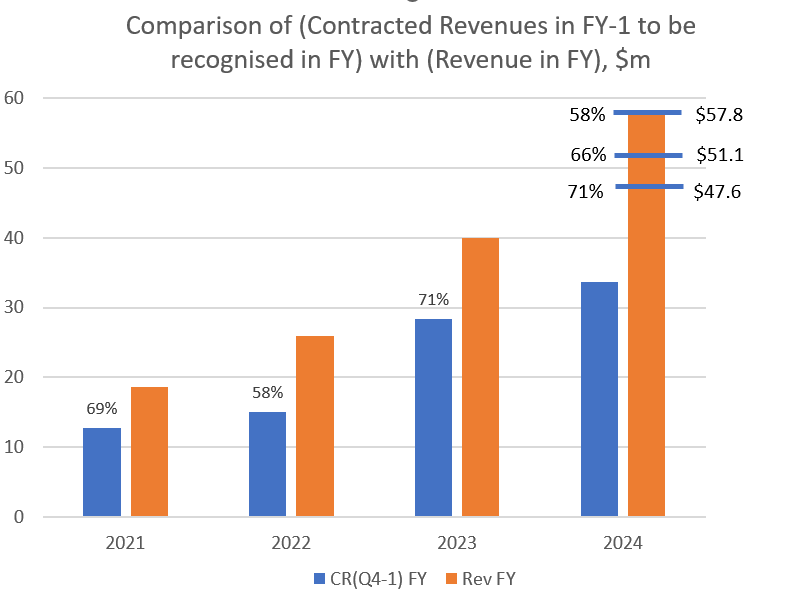

In lieu of an explicit outlook, I've noticed that in each Q4 report, Kate gives a statement of how much of the contracted revenue is expected to be realised as revenue in the following FY.

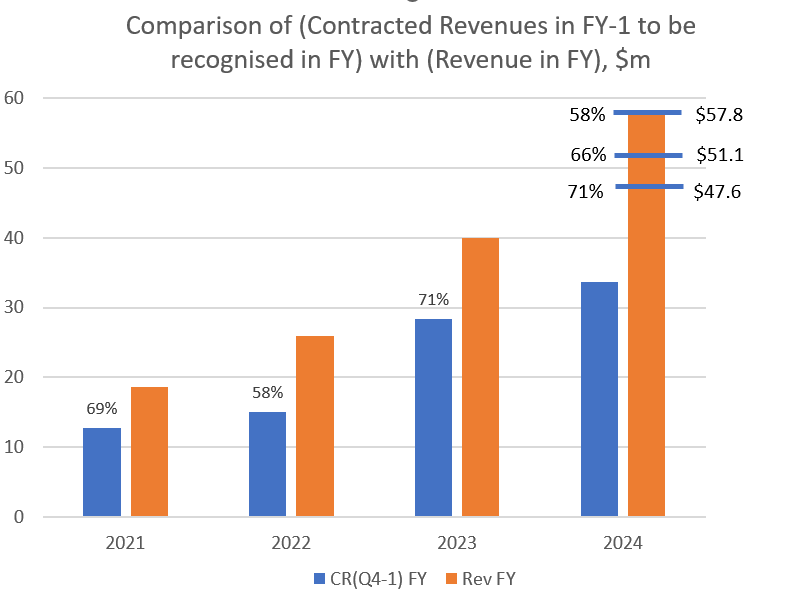

So, in the graph below I compare that component of the CR (denoted as "CR(Q4-1)FY") with the revenue or the forecasted revenue from the FY (denoted as "Rev FY").

Above each blue bar (the CR), I plot the % of how much of the next year's revenue is already contracted.

You can see that over the last 3 years, it has been 69% (2021), 58% (2022) and 71% (2023), yielding and an average of 66%.

For FY24, I have used these %'s from the previous years with $33.7m of CR to be recognised as revenue in FY24 to project a range of forecast revenue outcomes for the FY24.

These revenue projections equate to FY23-FY24 revenue growth rates ranging from 19% in the low case to 45% in the high case, with a mean of 28% revenue growth.

This is where I have to write "past performance is no guarantee of future performance" and indeed, with a constant sales force going in to FY24, you might expect being at the lower end of the range to be more likely. It might even be lower (all things being equal) because a constant level of incremental sales represents a progressively declining % increase of each year's base.

However, if $ALC lies anywhere on that range, and provided costs can controlled as Kate has indicated, then we should expect FY24 to be both significantly cash generative at the OpCF and FCF levels.

(OK. I'll stop there and put my inner analyst back in the box).

My Key Takeaways

Overall, the $ALC analysis indicates that the company is passing through the CF inflection point. Given the very large Q-on-Q variations, it is important to take today's positive result in its wider context, and I think Kate's measured and qualified delivery did justice to that.

However, in the UK (and to a lesser extent in NZ), the health systems face particular head winds. In the UK the NHS is widely perceived to be in crisis. I have lived in the UK for 20 years and much of my business network and extended family live there today. At a personal level, I am aware of stories that show the system to be under stress, subject to industrial unrest and suffering from political interference. Kate made reference to these headwinds, and again to her great credit was very balanced in how she tells the story.

$ALC's continued progress despite these headwinds is encouraging. My only issue, is in the case of the UK, there is no end in sight.

I am considering increasing my position in $ALC. With the SP at 25 x EV/EBITDA(FY25), it is sitting between $M7T (12) and $VHT (38), and my current position size indicates a higher risk rating than it deserves. One to mull over, and I will likely wait until Monday, when $M7T reports. There's enough data now that it might even be time to build a DCF. Now there's a cheery thought.

Disc: Held in RL (0.9%)