$VHT presented their 4th quater 4C today, with the FY results to follow in a few weeks. Overall, a good result.

Their Highlights

Cash Highlights:

- Second straight positive net operating cash flow quarter– NZ$0.4M. Volpara has been net operating and investing cash flow positive since September 2022 – approx. NZ$1.0M.

- Net operating and investing cash outflow1 in Q4FY23 of NZ$0.2M, an improvement of 92% from a net outflow of NZ$2.9M in Q4FY22

- Record Q4 cash receipts from customers of NZ$10.0M+, up over 25% compared to Q4FY22 (or over 19% constant currency)

- Cash receipts from customers in FY23 are NZ$38.6M (unaudited), up over 35% compared to FY22 (or approx. 22% constant currency)

Software as a Service (SaaS) Highlights:

- Contracted Annual Recurring Revenue (CARR) now ~US$26.5M (~NZ$42.4M2), up approx. US$900k on the prior quarter (Q3FY23). A record net new CARR added in FY23 of US$4.3M (NZ$6.9M).

- Annual Recurring Revenue (ARR) now ~US$20.9M (~NZ$33.6M2), up from US$19.9M in the prior quarter (Q3FY23)

My Observations

This was the second consecutive quarter of operating cash flow positive. While receipts were down on the "bluebird" (Craig Hadfield's words) 3Q result, they were still up strongly over the PCP. This had been well-signalled last Q.

They reiterated that they will not be OpCF positive every quarter, and Terri made clear that with staff bonuses paid out in Q1, they expect Q1 to be OpCF negative. Craig Hadfield stated that they are about six months ahead of their goal of being CF positive by Q4FY24, and that they will be full CF positive in FY25. With good cost stability now established and good deal flow over the last year, this objective now looks very do-able.

Our good friend Claude Walker asked if they have a goal of generating positive net income. Craig pointed out that due to historical acquisitions, there will be a non-cash drag on financial performance that will take some years to work through as goodwill is amoritised. This doesn't bother me, as that is all sunk costs, even though it may put off into the future the day when $VHT can be rated on an earnings multiple.

With ARR, CARR and ARPA all trending in a positive direction, $VHT is headed in a direction where it will start making money. Thanks to FX, government grants, and exercise of options, cash on hand actually increased in the quarter. I think this is a first where this has not been due to capital raisings!

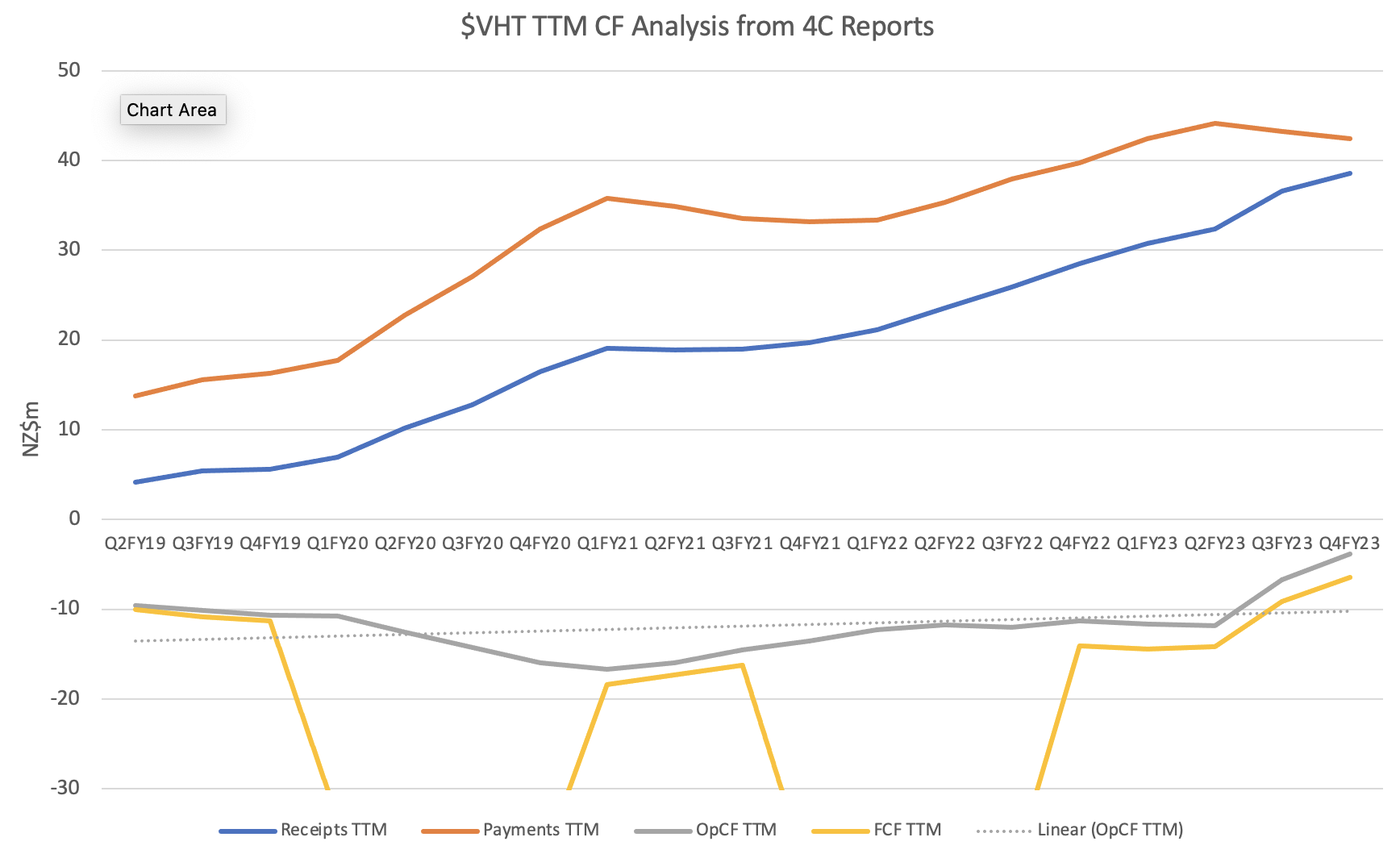

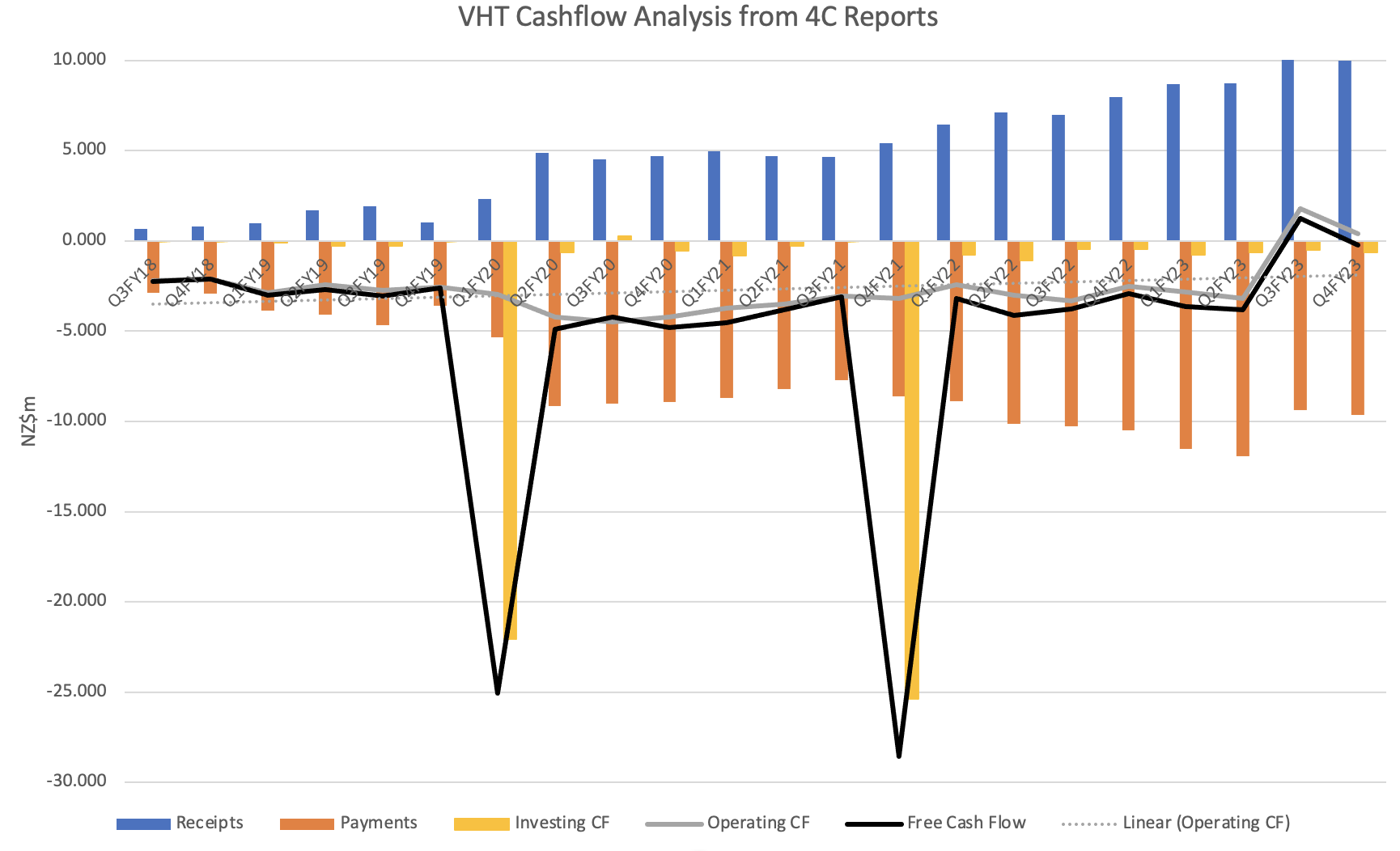

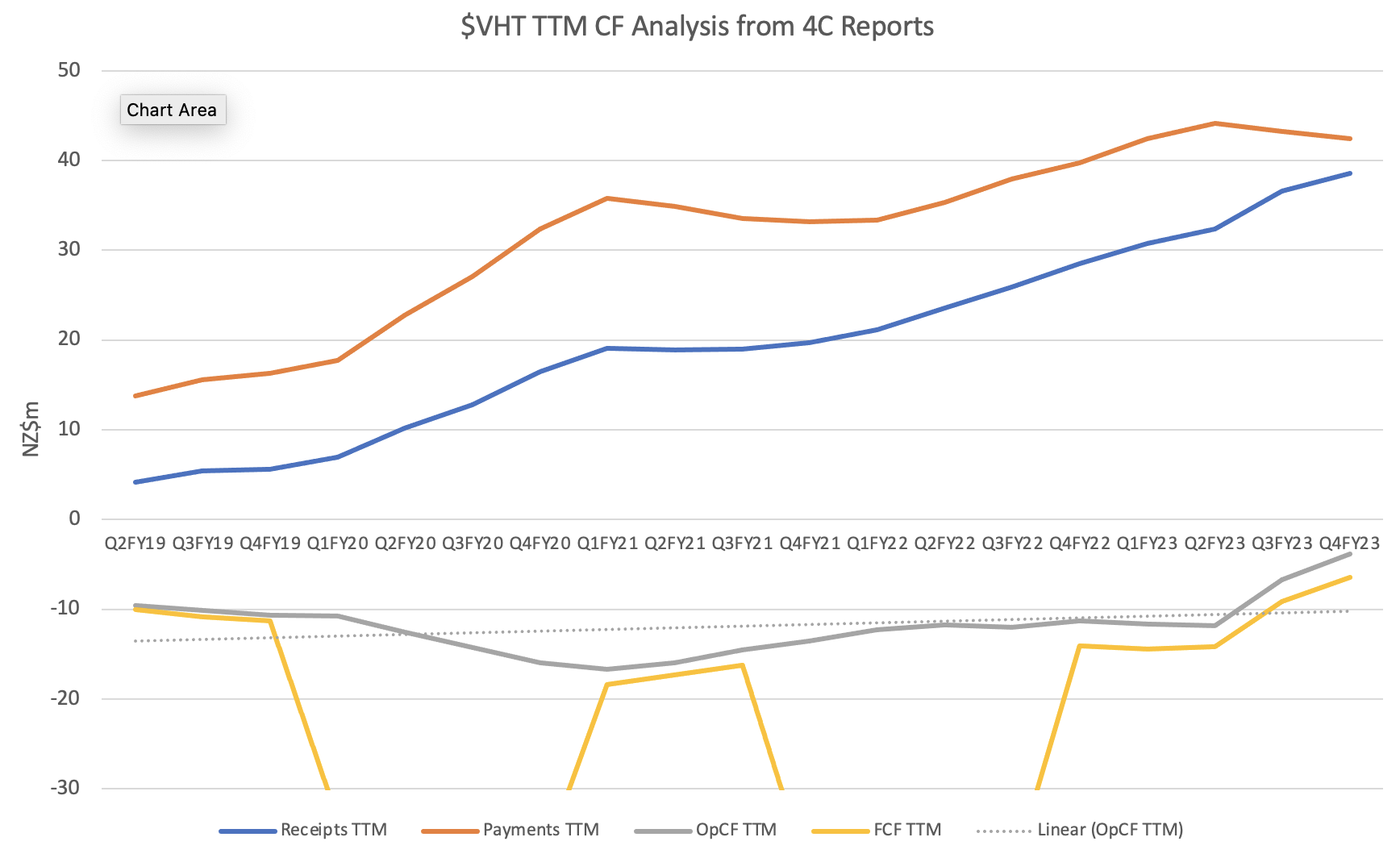

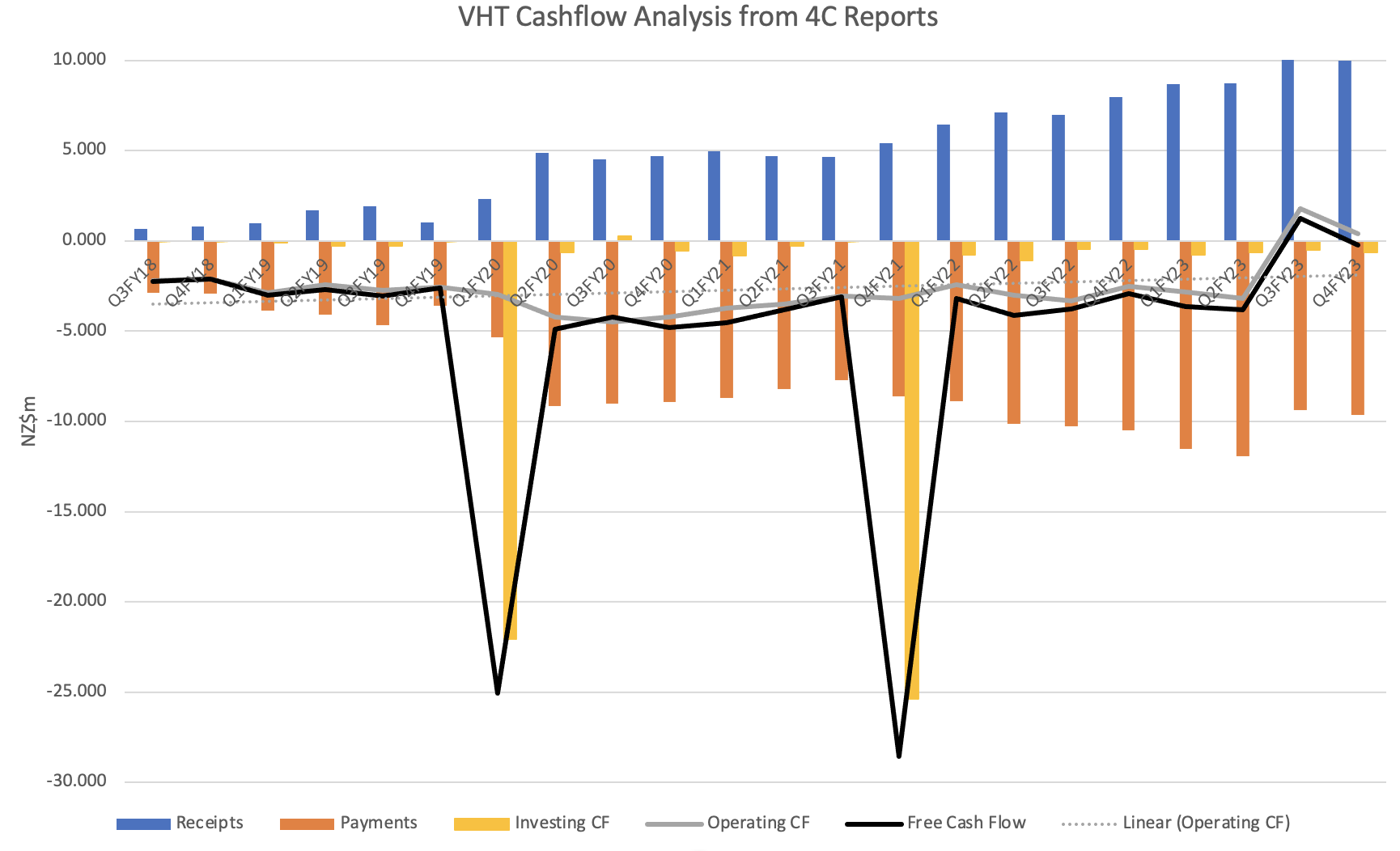

I have included the usual CF trend charts below, on quarterly and trailing 12 months (TTM) bases,

My Takeaways

A good result on all fronts. Quarters will continue to be lumpy, but overall $VHT is headed in the right direction under Terri's steady hand of focusing on customer value, large accounts, and tight cost control. My confidence is increasing and today I have increased my small position IRL and SM.

Figure 1

Figure 2

Figure 2

Note: Excludes Lease Payments in reported in Financing CF (most recently $143k)

Figure 2

Figure 2