Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Damn! $VHT the latest undervalued tech being taken out. I’ll be voting against, as my valuation is higher.

Disc. Held IRL and SM

$VHT reported their 1H FY24 results this morning.

Their Highlights

- Revenue from customers up 17.5% to NZ$19.8M

- Core subscription revenue up 26.5% to $14.9M

- Subscription revenue up 19.0% to NZ$19.3M

- Net loss for the period after tax improved 16.6% to NZ$4.4M

- Second consecutive free cash flow positive half-year

- Normalised non-GAAP EBITDA4 improved 67.9% to −NZ$1.4M

- Revenue guidance maintained at NZ$40.0M–NZ$42.0M for the full year

- EBITDA guidance maintained at +NZ$0.5M to -NZ$2.0M for the full year

My Analysis

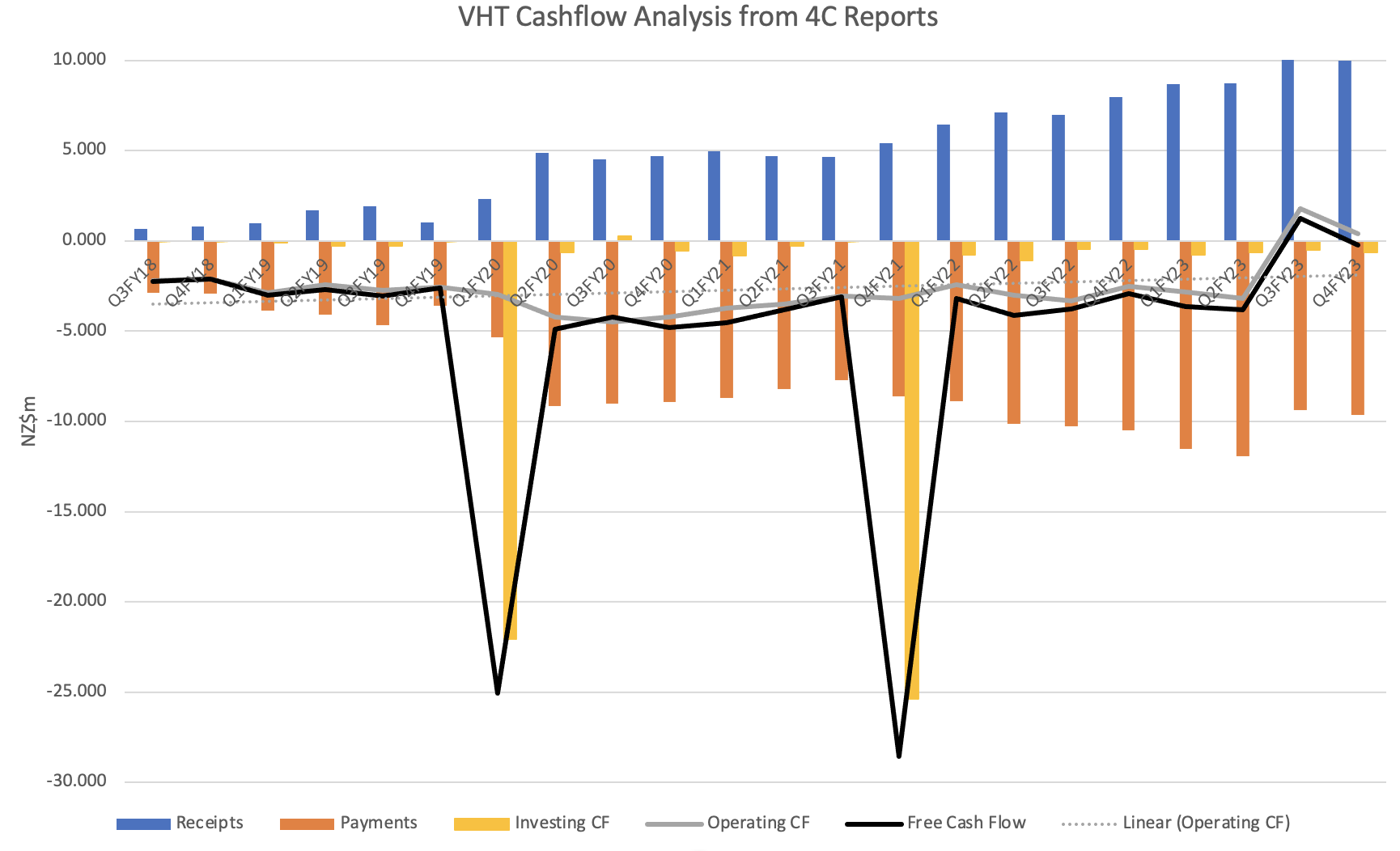

With the final 4C out several weeks ago there were no surprises. Revenue growth is broadly on track to achieve guidance for the year, which is maintained. 2H revenue tends to be stronger than 1H, so holding to guidance appears reasonable.

EBITDA continued to make progress, with $VHT's normalised non-GAAP measure improving 68%to -NZ$1.4m. EBITDA guidance also on track. I note GAAP EBITDA is -NZ$2.186m, a more modest improvements from -NZ$2.780 min the pcp.

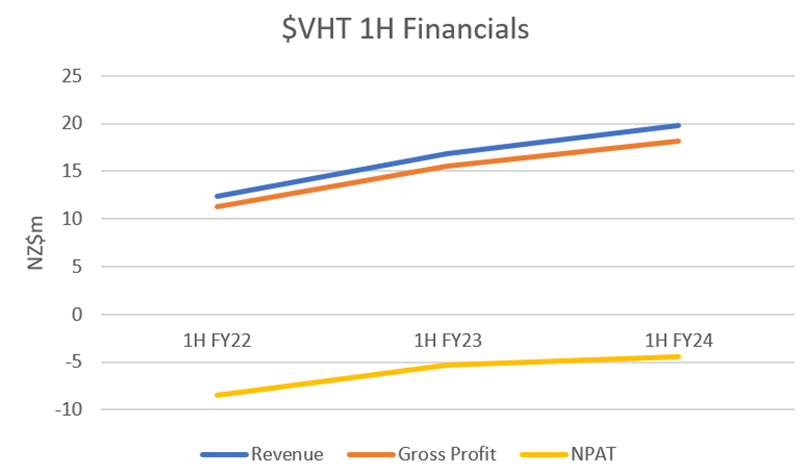

I have plotted some of the key financial trends for the 1H y-o-y comparisons. Its now about 18 months since Teri Thomas came onboard as CEO, bringing a much-needed cost discipline and a sales focus on larger customers (“elephants”). As a result, I am only showing a shorter time series on the financials, as it serves little purpose going further back in time.

Figure 1: 1H y-o-y Key Financials

The figure above shows the impact of the softer revenue growth this FY is having on the trajectory towards positive earnings. In short, while the trend is still up, its looking like hard work to get there.

Revenue

Softer revenue growth of 17% to pcp during the half is due to only one large customer going live, although the three core products of Analytics, Patient Hub and Risk Pathways achieved constant currency growth of 23%,

Revenue is only recognised once a customer contract goes live. Separately, CFO Craig Hadfield commented that $VHT are not making the progress they have aimed to in closing the gap between CARR US$28.4m and ARR US22.5m (the difference between the two being due to contracts that are closed but not yet implemented). To help close the gap, they will be adding a few headcount to accelerate implementations. Reading between the lines, it sounds like the recent cost control focus has meant that they have been running resourcing very tight in this area, adding some drag to having new customers going live.

Looking to H2, Craig noted that 4 customers with CARR of >US$250k are planned to give live. One has already gone live, with 3 more expected before end of March. Craig indicated that because of the strong second half, they remain confident of meeting guidance for the FY.

Other key metrics continue to be strong, with Net Revenue Retention at 112% (up 7% y-o-y) and APRA of $US40.4k up 25% y-o-y.

So the scene is set for a strong finish to the year.

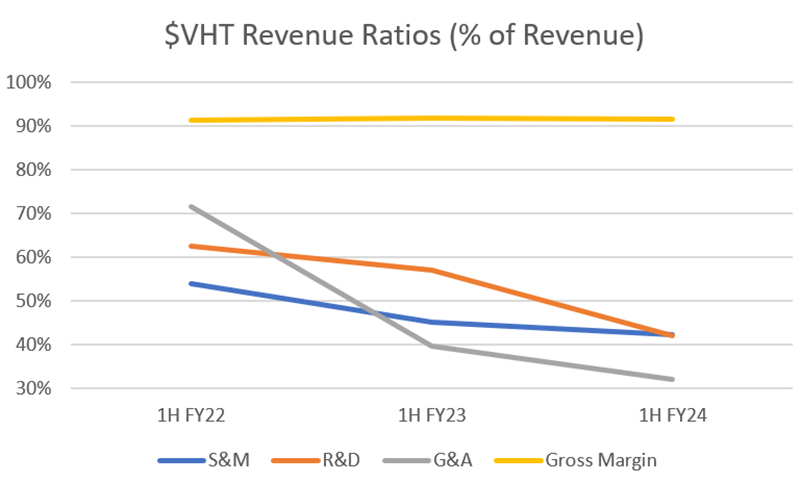

Costs

Figure 2 below shows that expense control continues to be $VHT’s saving grace, with R&D, S&M, and G&A all declining as a % of Revenue. In fact, Opex of NZ$23.055m is an actual reduction of 4% from NZ$23.952m, which is a great achievement given that revenue growth has been maintained, contracts have been expanded, new contracts signed, all in an inflationary environment.

Gross Margin is holding steady just under 92%, having held in the 91%-92% for several periods.

Having the cost base under control, $VHT are going to make targeted headcount increases, with a Sales Director in Europe (on which Terri sounded a bit more optimistic after having spent a month there over the summer), and adding clinically experienced people in the US who can help with customer success as well as sales (something she has learned from Epic days, and has mentioned previously that she is keen to push harder at $VHT).

Figure 2 1H y-o-y Margin and Expenses (% of Revenue)

Cash Flow

Net Operating Cashflow was NZ$1.3m compared with -NZ$6.0m in 1H23, demonstrating that positive impact of controlling costs while maintaining growth in receipts.

Overall, Free Cash Flow by my calculation was +NZ$0.443m (incl. lease payments), helped by the divestment of interest in Precision Medical Ventures.

My Key Takeaway

Overall, today’s result was solid if unexciting.

1H tends to be softer for revenue, as the key months of June to August include the summer in the US, which tends to be slower for the new customer “go-lives” that drive revenue.

I’ll not repeat ground covered in previous write-ups on $VHT, other than to say that I remain interested and the thesis requires a strong finished to maintain revenue growth in the realm of 20% p.a.

Disc: Held in RL and SM

Some decent numbers from Volpara -- top line growth remains strong, gross margins steady and business continuing to trend towards profitability. Company was net operating cash flow positive (albeit down a little from the preceding half) and breakeven on a FCF basis. Forecasting positive EBITDA over coming year.

Based on FY revenue guidance of NZ$40-42m, shares are on a forward P/S of about 4.8x

Results preo here

The Good:

- Fourth quarter of positive operating cash flow. As it is unlikely that VHT will increase operating expenses too much further in H2, Volpara should be able to maintain this for the remainder of the year and report a profit for FY24.

- Not in the report but @mikebrisy e reported NRR is at 112% which is up on 111% in Q1

- Increases to CARR (4.4% QoQ), ARR (4.7% QoQ) & APRA (3.5%)

- Cash levels now at $NZ 13.2m

The Not So Good:

- CARR to ARR gap is continuing to widen as go live looks to be limited by resources. Volpara may have to watch this as potential extended timelines may be negatives for some customers? The difference may also highlight potential money still sitting on the table.

Watch Status:

What To Watch:

- BreastScreen Australia position on density reporting

- Outcome of BreastScreen QLD density reporting trials. Looks like the trial will end around March 24 (Carried over).

- BAC detection model progress (Carried Over)

- Quiver update at RSNA in November (Carried Over). Due out in CY25.

- Estimating ~ NZ$40m of revenue for FY24 (My current forecast based on CARR). This would be a reduction to ~14% growth (constant currency) vs the 20% for FY23. (Carried Over)

$VHT announced their last 4C report today.

Their Highlights

Cash Highlights:

• Fourth consecutive positive net operating cash flow quarter, NZ$1.2M. A full year and a half ahead of guidance

• Volpara net operating cash flow positive for over 12 months since the start of October 2022 – approx. NZ$3.4M; and free cash flow positive for the same period – approx. NZ$730k1

• Record Q2 cash receipts from customers of NZ$11.5M+, up over 32% compared to NZ$8.8M in Q2FY23 (or over 31% constant currency) and first quarter over US$7.0M

• Volpara no longer required to provide Appendix 4C quarterly reporting updates

Software as a Service (SaaS) Highlights:

• Contracted Annual Recurring Revenue (CARR) now ~US$28.4M (~NZ$46.3M2 ), up over US$1.2M on the prior quarter (Q1FY24)

• Annual Recurring Revenue (ARR) now ~US$22.5M (~NZ$36.6M1 ), up from US$21.5M in the prior quarter (Q1FY24)

My analysis

A solid result, and an important milestone. $VHTs first 12 months period of postive cash flow. Closing cash of $13.19m is up from $11.62m a year ago.

The release details a list of significant contract renewals and expansions, as well as some new customers. $VHT also report expanding their rollout in the VHA, which provide heathcare to some 9 million veterans in the US.

There is also a further reference to the new product Quiver, which is intended to make radiologist work more productive (workflow and automation).

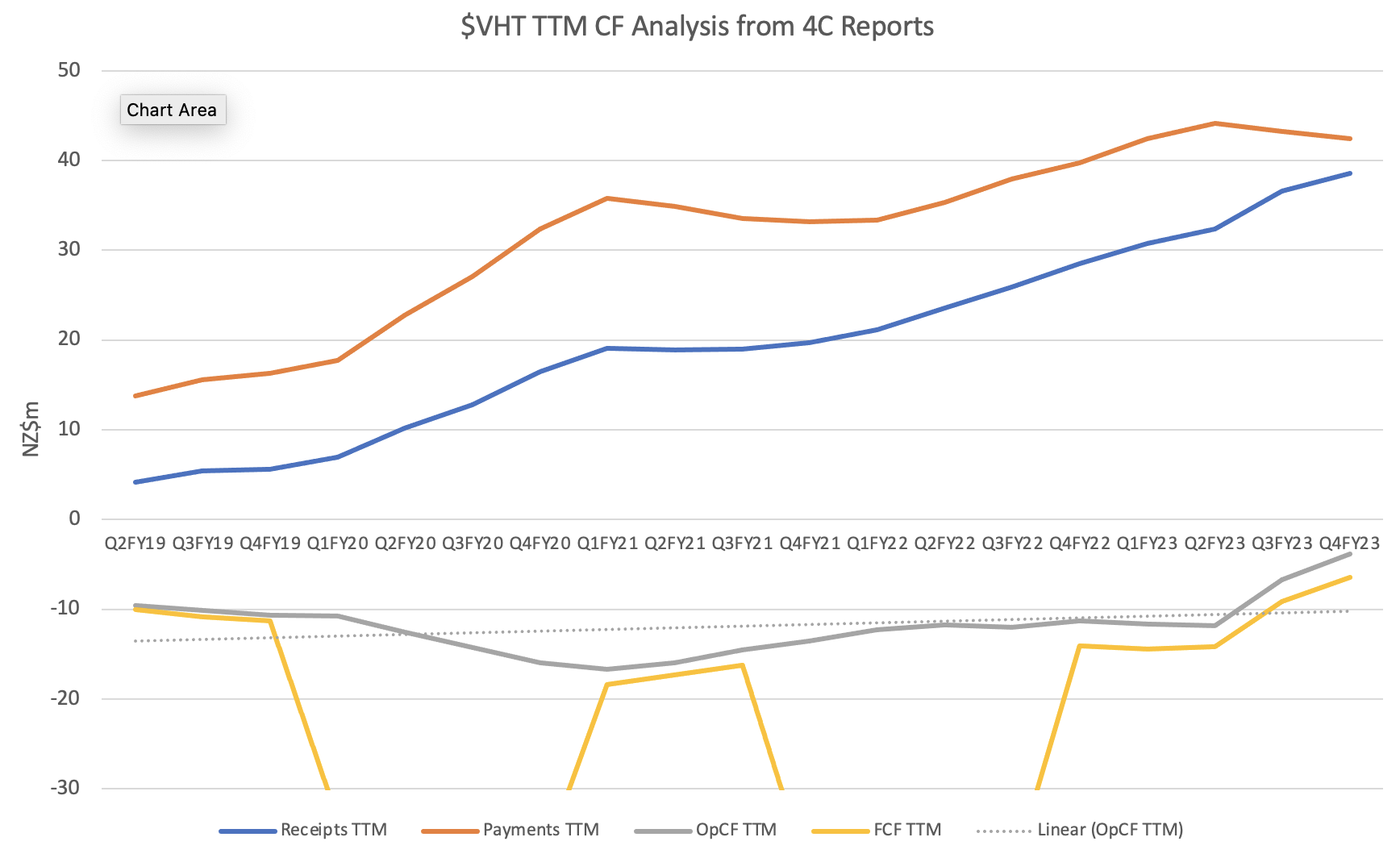

Below is my usual trend analysis, with trend lines based on the last 8Q. This shows just how effective Terri and Craig have been at managing costs which continuing to drive revenue.

The SP has fallen back again, presumably part of the general hit of "higher for longer" to microcaps but perhaps also reflecting a period of relative quiet on newsflow.

About to go on the call, but this looks on track to me.

Disc: Held in RL and SM

Another delayed update.

The Good:

- Third consecutive quarter of positive operating cash flow (just $9k), even after foreshadowing by management in Q4FY23 that Q1 would not be positive due to staff expenses. Staff expense did increase but were still below FY23. This has led management to bring forward the full year cash flow positive target to FY24.

- NRR up to 111% vs 107% at the end of FY23. This is a positive indicator of ongoing satisfaction with the Volpara product suite.

- ARR continues to grow, however it was only ~3% increase over the prior quarter

- APRA also is growing QoQ. t\This too has slowed, increasing ~4% over Q4FY23

The Not So Good:

- Slight decrease in cash position to $12.1m, mostly driven by IP expenses. These have remained fairly constant over the last 18+ months, however may start increasing with the new product lines in the works.

- From the CARR to ARR chart it looks as though it is taking around 18 months on average for contracts to become live, however this does provide a bit of an indication of future revenue forecasts. Note: Not new to this quarter. I've noted it to watch for improvements. While new customers are continued to be onboarded, this lag is likely to remain.

Watch Status:

What To Watch:

- Post update announced that VHT have sold down their interest in RevealDX, citing a focus on products with clearer synergies. Potentially this could lead to divestment of MRS Systems? Excerpt from the strategy update announcement.

- Outcome of BreastScreenQLD density reporting trials

- If NRR is announced regularly and where it is sitting.

- Ongoing reporting of the “Elephant” market segment

- Progress in growth strategy - new customer types,

- BAC detection model validation

- Quiver update at RSNA in November and any updates from Terri’s Europe trip over September (Thanks @mikebrisy)

- Progress towards my estimate of NZ$40m of revenue for FY24 (Forecast based on CARR). This would be a reduction to ~14% growth (constant currency) vs the 20% for FY23. Cash receipts of $11m for Q1 put them on target.

Updating my valuation for $VHT arriving at A$1.30/share expected value.

While this is not significantly different from my valuation a few months ago, this one is based on a full 10-year DCF modelling a range of scenarios detailed below, with ratios now derived from two full years of organic growth.

Revenue

While Teri is aiming for Revenue growth of >20%p.a., I consider at range of growth scenarios commencing in FY24 (25%, 22.5%, & 20%) and declining over the explicit period at rates ranging from -1.5% p.a. for the higher starting point down to -0.75% p.a. for the lower.

Expense Ratio

I assume operating leverage from expenses (incl. D&A) rising annually between 8% up to 15% (with the upper end in high revenue growth scenarios). I sense check the 2033 expense/revenue numbers and benchmark against other larger SaaS companies.

Capex

Capex/Revenue is currently low (8.3% and 7.3% last two years), which I think is because capability was acquired via business acquisitions in FY20 and FY21 and because most R&D is being expensed (FY23 Capex / R&D Expense = 15%).

I believe that to deliver the Risk Pathways beyond current diseases AND to leverage the image dataset (e.g. via AI), R&D and Capex will need to rise, so scenarios consider Capex/Revenue ranging from 8% up to 15%, with higher spend tied to higher revenue growth scenarios.

Common Assumptions

- WACC = 11%

- Terminal Growth Rate = 3%

- Tax = 30%

- Lease Payments rise in proportion with Operating Expenses

- AUD:NZD = 0.93

Results

Model outputs range from $0.67/share up to $2.16/share.

With some simple probabilistic modelling on the scenarios chosen I get a p(10)-p(90) spread of about $0.67-$1.75; p(50)=$1.30

The reason for the wide spread is that we don't have enough organic growth history to understand how well $VHT scales. It will be worth doing an update once FY24 gives another year of organic growth.

Limitations

$VHT will potentially grow faster in the early years at a lower rate of expense and capex growth than modelled (justification: 1) FY22 and FY23 revenue growth were 32% and 34%, respectively and 2) deadline for US FDA mandate on density).

As a result the modelling is probably pessimistic on NPAT and FCF generation in the first 2-3 years and are indeed below "consensus" of 2 analysts with target prices of $1.20).

Illustration of 1 Scenario (chosing one closest to Expected Value)

(Scenario: FY24 rev. growth=22.5%; -1.0% p.a.; FY33 rev. growth= 13.5%; expense growth =7.5% p.a.; capex/revenue = 10%)

Comment on Market Size (Quick triangulation)

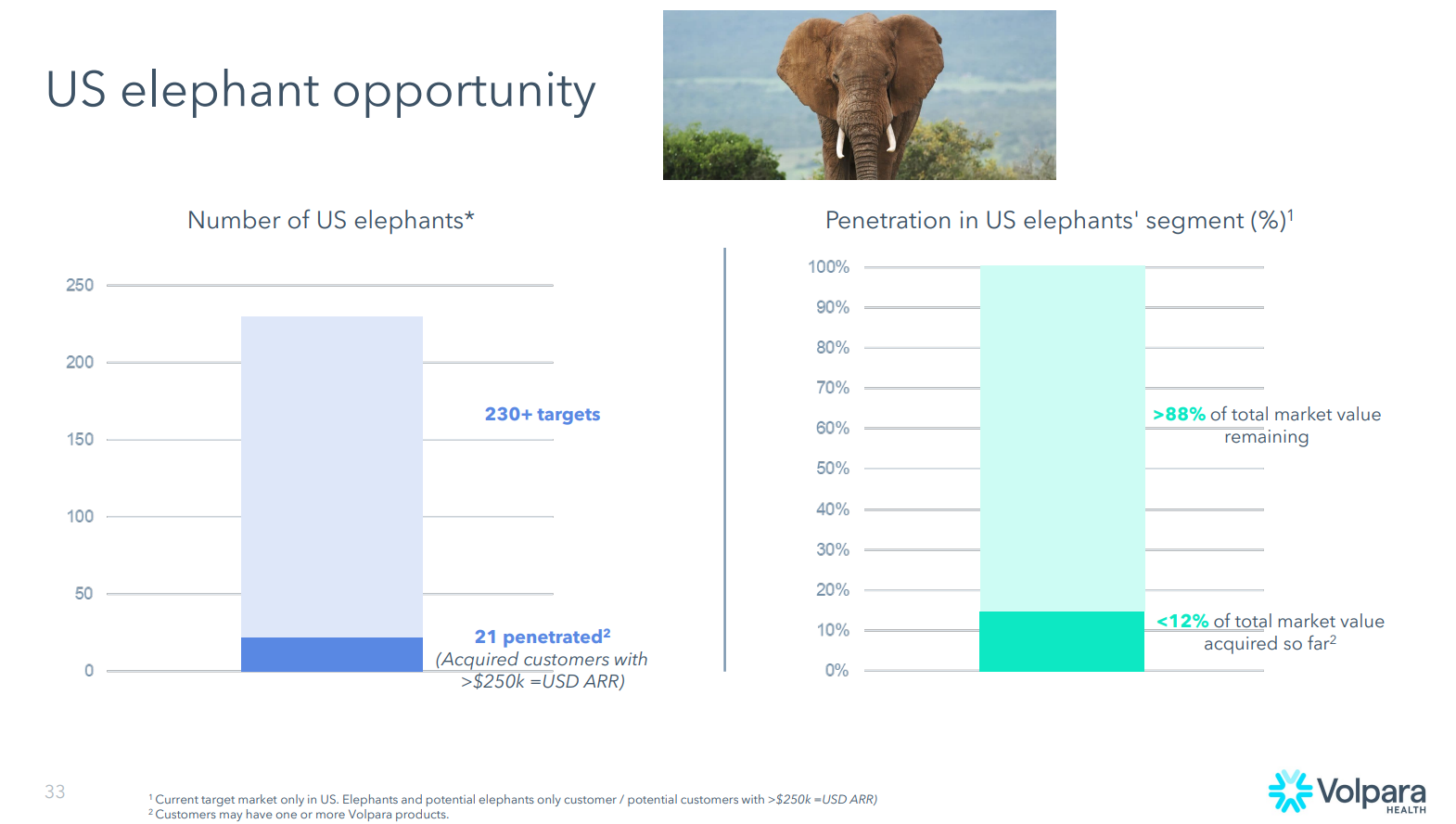

$VHT assess number of US Elephants as 230+. Elephant = ARR>US$0.25m

Assuming 50% elephants are $0.25-$0.50m ($0.375m) and 50% are $0.50-0.75 ($0.625m), US market size of elephants is US$115m. Assuming elephants make up 50% of the market, then US market is US$230 and assuming $US market is 40% of global market, then global market is US$0.6bn. Global radiology software market estimates range from US3-4bn up to as high as $7bn. This would make mammogram image analysis ranging from 8-20% of the total market. Note: mammography has a c, 10% share of the global radiology market, so numbers probably high, but OK for order of magnitude.

At a market CAGR of 6% for imaging software, global mammography software (imaging and analysis) market in 2033 is US1.1bn.

$VHT 20233 revenue in above scenario is NZ$185m = US$110, which is 10% share of global market for software relating to mammography. This is not unreasonable given the assumption that growth is also building out analystics for other diseases.

Conclusion: modelled revenue growth to 2033 should not be market-constrained and neither does it assume market dominance.

Further limitation: analysis has not considered market evolution where Autonomous Reading is widely implemented.

Disclaimer: For illustrative purposes only; not to be taken as advice.

After SA announced that they are reporting breast density, I contacted BreastScreen Victoria to ask when they are going to start reporting on breast density, given the evidence supporting density reporting.

This is their response:

“Thank you for getting in touch. We are currently scoping a project which will inform our approach to any future reporting of breast density. We encourage you to keep an eye on this page of our website as it will be updated with any news: https://www.breastscreen.org.au/breast-cancer-and-screening/screening-methods-and-diagnosis/what-are-dense-breasts/

We’d also like to invite your to join our Consumer Network where you will have the opportunity to contribute towards BreastScreen Victoria’s work: https://www.breastscreen.org.au/get-involved/consumer-network/ “

$VHT CEO Teri Thomas provided an update on the progress of the company, its market position, industry trends and priorities. While she flew through the material very quickly and at a high level, there was a lot of great content. It was a very content-rich presentation, I learned a lot, and if a recording is made available I definitely recommend that you catch it.

While there were no new material disclosures, there was some very good material. In this straw I pick out key points on:

- Financial highlights

- Product and Strategy

- Markets and Customers

- New Products

- Q&A - I discussed with Teri recent developments in Scandinavia and I've written her response virutally verbatim

Financial highlights achieved

- Revenue growth “up 61%” over the last two years***

- 15% reduction in the cost base

- FCF positive since September 2022

- $12m+ cash on hand to fund growth – no need to raise new capital

- “Elephants” up from 10 to 21, growing CARR by US$5m

*** I thought this was an odd statement, particularly since FY23 revenue of $35.01m is actually 77% higher than FY21 revenue of $19.75m. So I don’t know how it was derived (whether US$, NZ$ or A$, revenue added or something else. I cannot reconcile it).

Future Guidance – no change to previous messages

- Positive EBITDA forecast over next “12 to 18 months” (i.e. keeping wriggle room if they don't hit it this year?)

- 20% annual revenue growth

- High margins (%GM>90%)

- Low churn

- Stable cost base

- New product launch in <12months (see below)

- Major new products in innovation pipeline and growth outside of mammography (including to other cancers and beyond cancer, e.g., cardiovascular disease)

Product and Strategy

Teri emphasised the vision of the company “To become the global leader in software for the early detection and prevention of cancer and other devastating diseases.”

Upfront, she reminded everyone that $VHT is an analytics firm, neither competing with equipment vendors nor PACS vendors, but providing software that supports them.

She highlighted the growing incidence of cancer particularly in younger women (citing a recent article in JAMA) and recapped the recent shift by the US Government in recommending mammograms at age 40 instead of 50 as under-scoring the urgency of early detection, and how risk assessment can be used at even earlier ages. (In his introductory remarks Chair Paul Reid remarked that the risk product has been the fastest selling last year.)

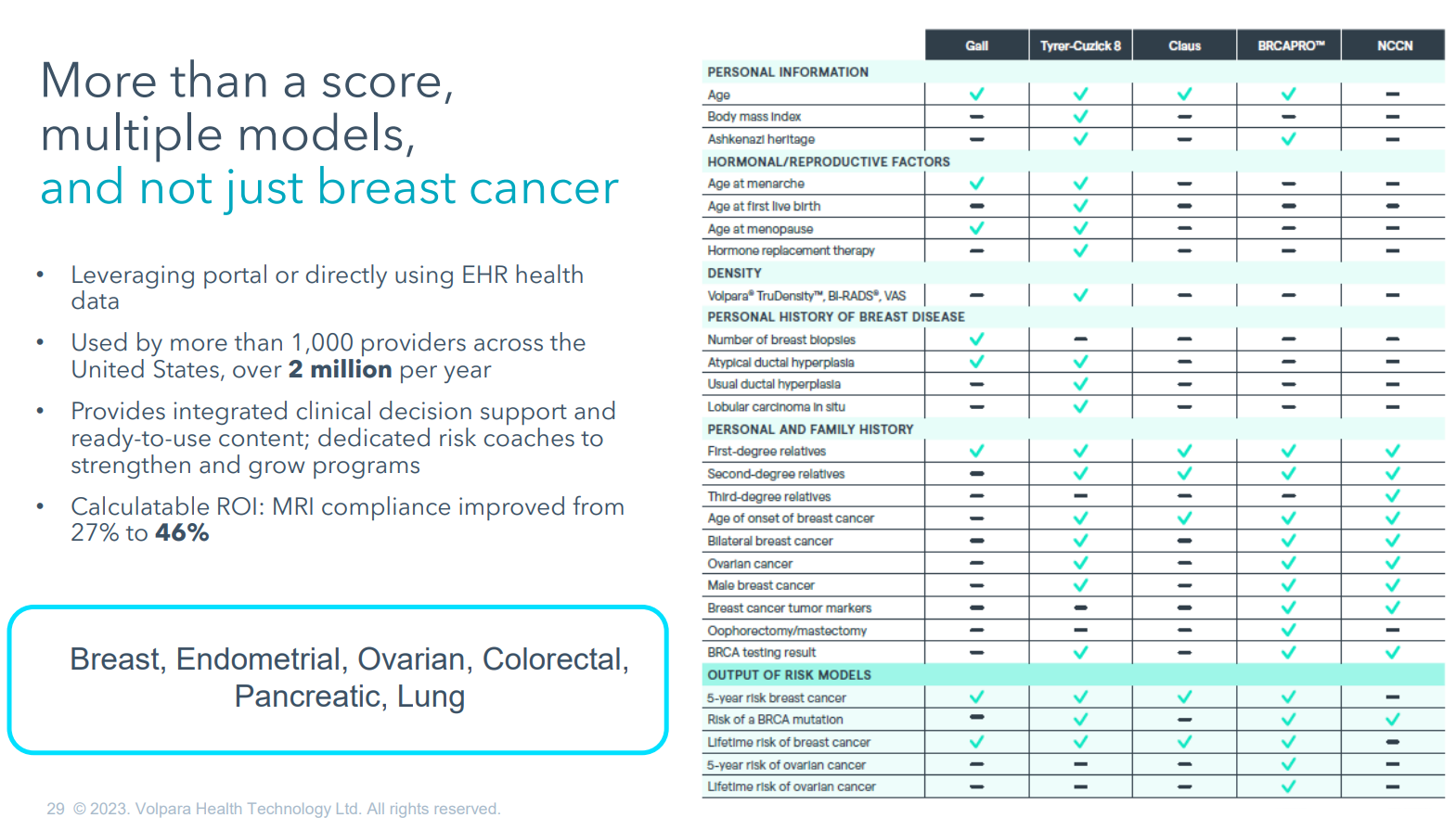

Teri noted that Risk PathwaysTM grew at its fastest rate last year. She linked this to the US government ruling that risk programs are to be required by the national accreditation program for breast centres.

Risk PathwayTM also provides a platform for extension of risk assessment beyond mammography. Teri noted that the competitive advantage of $VHT’s product is that it incorporates more risk models than the competition. She said the platform is “poised for expansion into other pathways as well” with the slide showing “breast, endometrial, ovarian, colorectal, pancreatic and lung.” Clearly, they are working to develop this platform to support the growing trend towards personalised healthcare pathways based on risk assessment beyond breast cancer. (see slide)

On Scorecard, Teri highlighted that $VHT’s proprietary algorithms deliver AI analysis within the workflow of the mammogram analysis, and that this differentiates it. (At the moment, I should add!) She again referenced the collaboration with $MSFT on AI.

She expects to see increased use of ScorecardTM and Analytics as $VHT supports organisations in complying with the new US FDA requirement mandating density reporting for all women undergoing mammograms. The presentation provided some data (I had not seen before) showing that 75% of women lie in the B and C density categories, where it is important to decide in which group they lie to assess their risk, and that two human experts will agree on this assessment around 65% of the time.

Market & Customers

Teri noted that the customer focus has broadened from hospitals and imaging centres/networks to include large screening programs (US and Australia). She indicated that they are also engaging insurers and primary care doctors, with the first primary care doctors already using $VHT products to screen women for risk at younger ages.

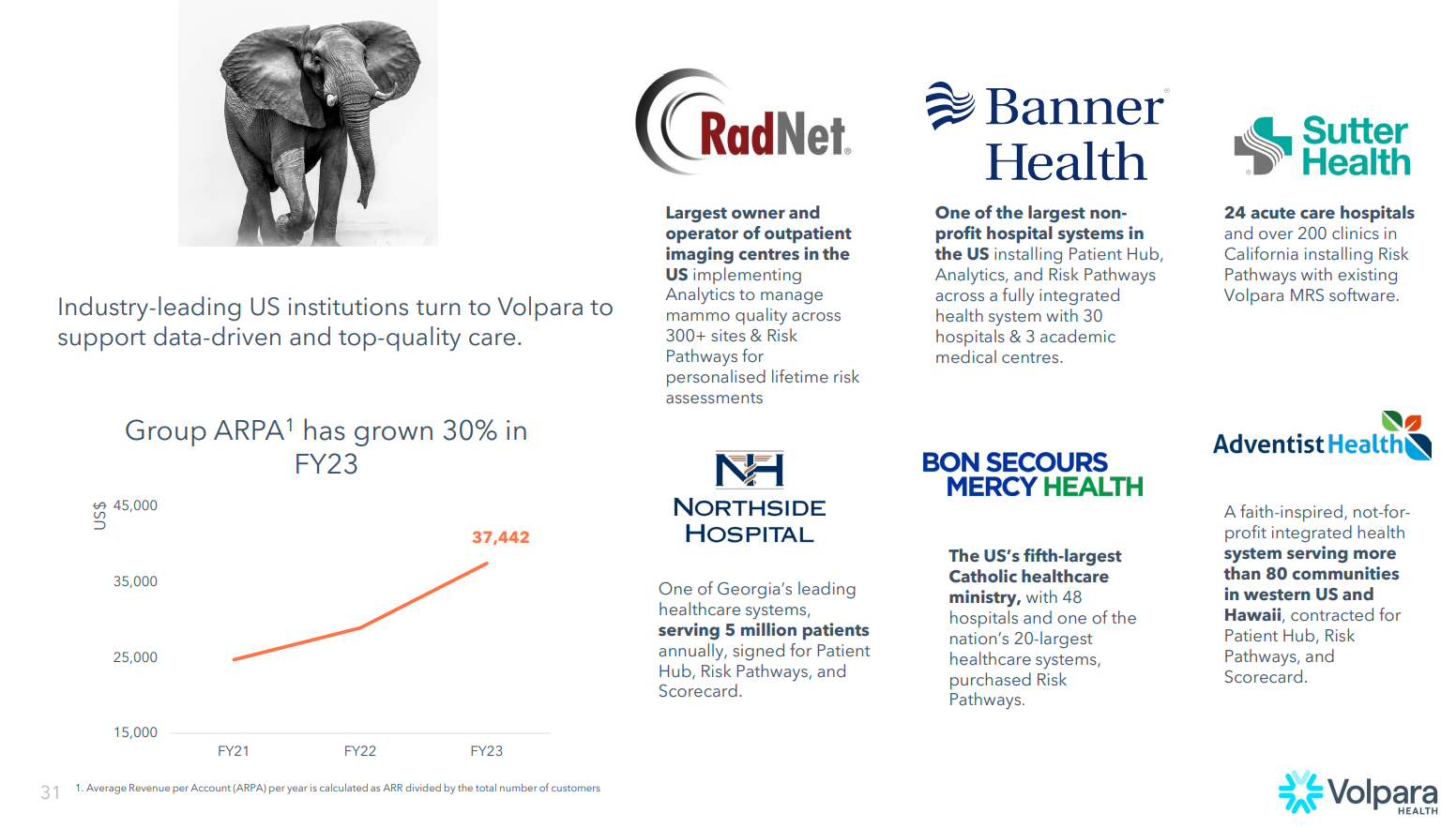

Under Teri, $VHT have shifted focus from ARPU (per user) to APRA (per account). ARPA increased 30% to US$37,442 in FY23, due to the focus on “Elephants”. Later, in the Q&A, CFO Craig commented that he saw this moving from $40k to $50k and even onwards to $100k.

Teri spent some time outlining the unique customer proposition of $VHT products, summarised in Slide 22 (“Uniqueness Defined”) much of which we have heard before, but it was good to see it pulled together.

$VHT estimate that their penetration into larger institutions is only 10-15%, with 21 “elephants” signed up out of a total of 230+ identifed targets. In her words “… a vast untapped market, with over 85% awaiting exploration”. She noted “a considerable proportion of these institutions” that lack comprehensive risk programs or analytics.

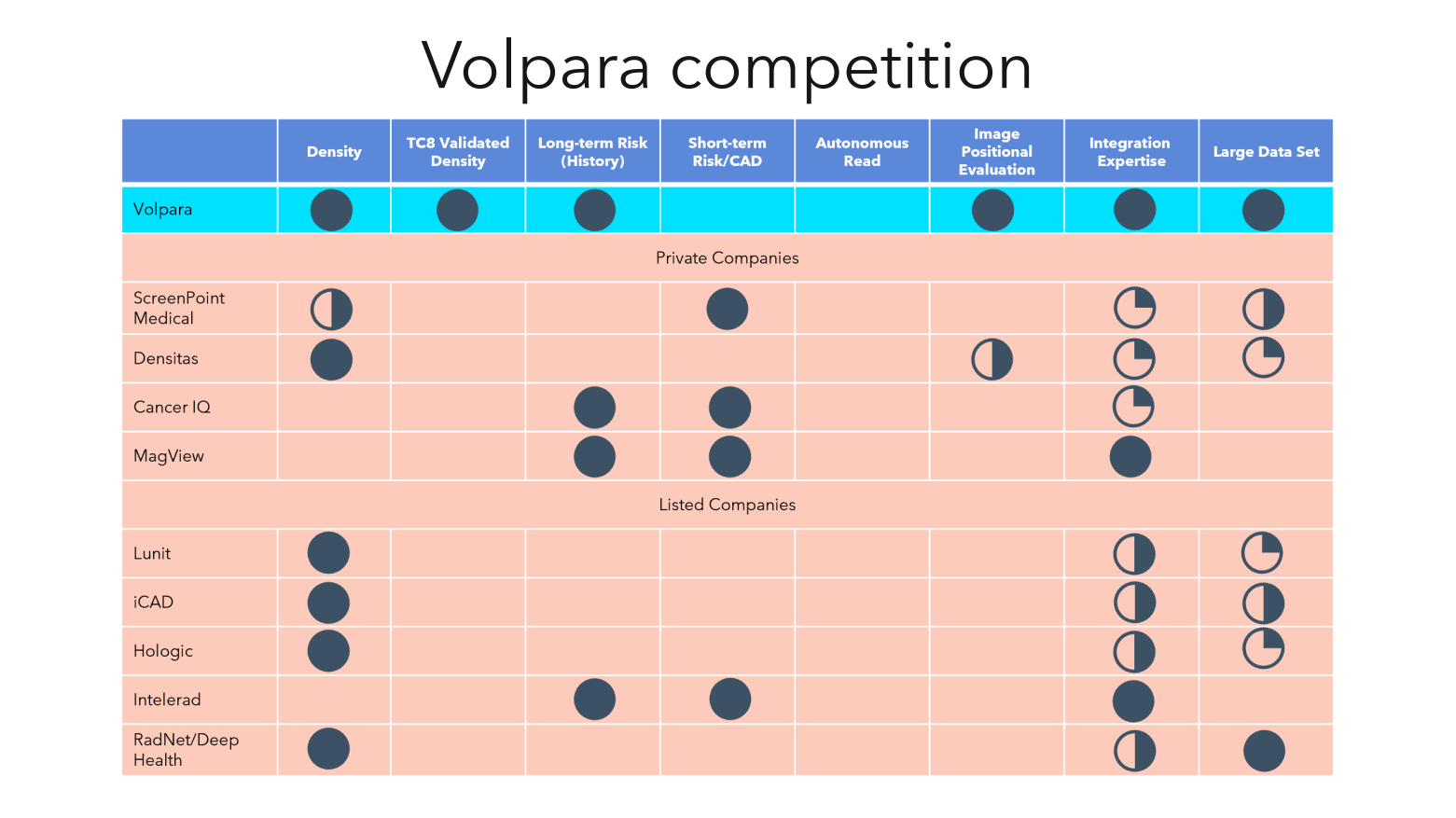

The competitive analysis (slide below- clearly, $VHT’s own view) was interesting. Teri did not discuss the significance of the gap in “Short Term Risk/CAD” and it was interesting to observe the currently blank “Autonomous Read” column. The latter is clearly the space that Transpera are working on. I missed the opportunity of asking Teri about the significance of these capability gaps, and what they mean for potential future $VHT technical (or commercial!) innovation. (I followed up with her on this after the meeting and will post the answer as a comment when I have digested it.)

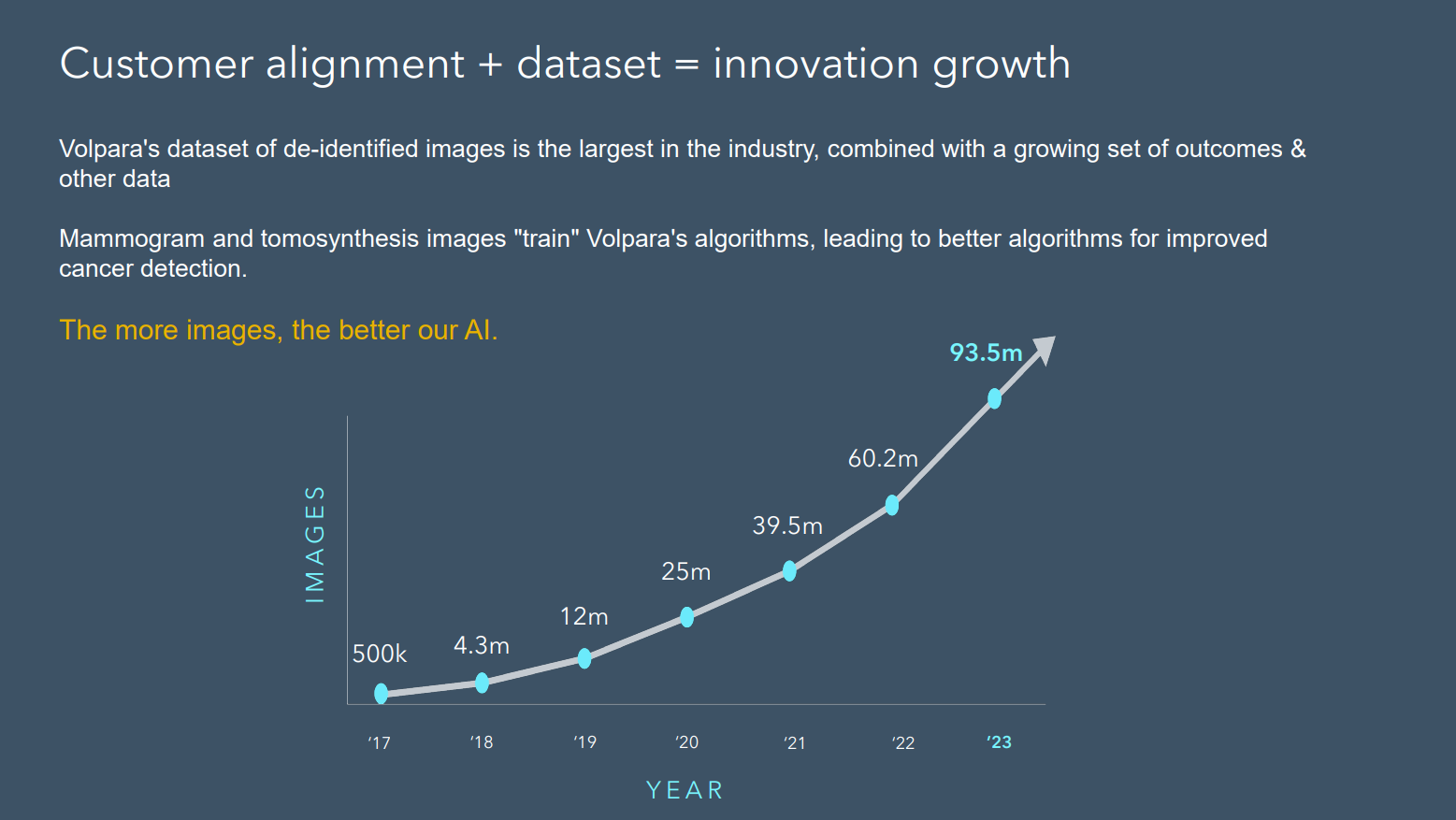

In addressing AI, Teri showed the following graph, highlighting the scale of the dataset on which $VHT’s algorithms are “trained” highlighting that some of the competitor efforts are training of dataset of hundreds or thousands of images. She was clear that this places $VHT at a strategic advantage, positioning them to improve the quality of their product offerings ahead of the competition.

New Products

Teri referred to the innovation pipeline, with efforts aligned closely with customers and key markets.

She gave a “sneak peak” of the next new product “Quiver”, which will be unveiled at RSNA (Radiology Society of North America Conference, November 2023). From the description, this appears to be a tool that streamlines mammography clinics operations (she says they refer to it internally as the “Binder Reduction Act” or BRA, ;-)), eliminating the need for "stacks of physical binders" and should save significant customer time. Teri says customers are “quite excited about this”. The product and other advanced modules are being incorporated into the overall code base, so it can be deployed across the existing customer base.

Quiver also has the advantage of “smoothing the onboarding of new customers to our analytics product”.

Teri summarised that not only are $VHT driving technical innovation, they are also focused on facilitating ease and efficiency for customers.

Overall, Volpara’s growth driver and product focus is aimed at mammography staff shortages, with some stats provided on this in the presentation.

On IP, the portfolio has 122 granted patents in 30+ countries with 26 applications in progress. There is copyright and 15 registered trademarks in addition. All this is a significant investment, if you peer into the accounts. All of this is in addition to the unparallel research validation in peer-reviewed journal citations.

An update was given on the public and private health screening in Australia, which is significant and growing, focusing on both density and risk. They plan to deploy the analytics capability they have been developing with $MSFT into Australia and NZ, so I expwect we will hear more about that in due course. Eventually, there will be a read-out from the QLD clinical trial, as well.

Q&A

There were few questions - nothing very insightful, apart from the one on ARPA, addressed above and ....

I asked my own question about the recent developments in Scandinavia (that we have been discussing here on SM), Teri replied:

"I'm gonna spend a lot of September in Europe and speak with some of the people that are running these programs. So we are in the research mode with the people that determine the standards in Scandinavia. It is a part of the world that everyone else is looking to as well, as they try to figure out some of the challenges with not enough radiologists and also not enough availability of MRIs for further scanning for people who have dense breasts. So the DENSE Trial and the SOBI recommendation was that for anyone who has dense breasts ought to get an MRI and that will save lives. But the next challenge was - OK, we don't have enought MRIs. So what we've been doing in Norway is studying what is the narrow band of density that is the most important for women to be able to go forward and get further testing including MRI. That will be concluding likely within the next year. So we will share publically when we can. But we are talking with some others about similar initiatives.

Part of the reason Teri is going to Europe is to figure out whether this is ready for a broader deployment versus still in the research phase. The key insight is that $VHT are directly involved with the actors at the cutting edge.

My Key Takeaways

I've seen every presentation since Teri took over as CEO, and this one deepened my understanding probably more than any.

I am encouraged that, in resetting the cost-base, Teri has maintained a strong innovation and product development engine, and that this is working hard at the cutting edge of research and AI exploitation. Both are essential if $VHT is to succeed in the long term.

Everything I heard today supports my investment thesis. I have a sense that patience here will be rewarded.

Held in RL (2.5%) and SM

$VHT AGM this morning at 10am AEST.

Presentation pack has some really great information that will be of interest to shareholders, including:

- Their assessment of the "Elephant" market potential ahead of them. It resets my understanding of US market penetration.

- Analysis of competitive positioning (which I think I have seen in another form in the past.

- Progress on the image dataset they have acquired (I won't mention 1st and 9th letters of the alphabet)

I'll be attending, but here are three interesting slides for those that cannot make it. It looks to be a really informative session.

Update on Australian breast density screening and reporting

Highlights:

• Following a successful trial, BreastScreen SA will use Volpara’s AI-based software to inform women of their breast density from 8 August 2023

• This is the first time in public breast screening in Australia that all women will be notified of their individual breast density regardless of the density category

• BreastScreen QLD is conducting a randomised controlled trial, using Volpara’s software, to assess the effect of notifying women participating in population-based breast screening of their breast density

My Assessment

Not material of itself, but a positive development. This is consistent with the annoucement earlier this year by the FDA of setting a deadline for including density reporting the US. As discussed earlier, there is a similar head of steam building in Scandinavian public screening (Norway &/or Sweden), and this is the first announcement for public screening in Australia.

The Volpara Density Score is the recognised gold standard and, so, if this tailwind keeps blowing, we may see more and more programs around the world adopting this approach, which overall will be good for $VHT. As public health programs apply it as the standard of care, I imagine it will also become the norm for private health as well.

I have no idea how material this is in the overall scale of things, but for sure, it is not a bad thing. Blow winds blow.

Are these related to the Scandinavian study Teri has spoken about? Are any StrawPeople across this?

AI offers huge promise on breast cancer screening: https://www.bbc.co.uk/news/health-66382168

And

https://doi.org/10.1016/j.breast.2023.03.010

Asking for a friend.

Dics: Held

Just off the call with Teri and Craig for the 1QFY24 4C results call. Teri was in her hotel room at Redmond WA, where she was the only partner speaker at the $MSFT Inspire Conference, speaking in the session ahead of Satya Nadella. $VHT picked up two $MSFT partner awards (Best Healthcare Partner and Best NZ Partner) and Teri was understandably proud of these achievements, and spoke about how $VHT continues to work with $MSFT to exploit AI technology with their vast dataset and the Azure AI platform, including outside of breast cancer, e.g., in cardiology.

To the results. Overall, I would describe them as a steady result, with the key point being that they came in just OpCF positive, which is a significant achievement given that Q1 is the heaviest cash outflow quarter of the year (staff incentives, annual contract payments). Given that in the past two presentation Craig had in particular guided us not to expect 1Q to be positive, it was a small positive surprise. To underscore the significance, the improvement in operating cashflow for 1Q vs PCP was +$3m and the FCF improvement slightly more.

Here are their Highlights from the 4C Report

Cash Highlights:

• Third straight net operating cash flow positive quarter, an improvement of 100% from a net outflow of NZ$2.8M in Q1FY23

• Volpara net operating cash flow positive since September 2022 – approx. NZ$2.4M

• Record Q1 cash receipts from customers of NZ$11.0M+, up over 27% compared to NZ$8.6M in Q1FY23 (or over 21% constant currency)

• Volpara heading towards being net operating cash flow positive in FY24 – a full year ahead of guidance

Software as a Service (SaaS) Highlights:

• Contracted Annual Recurring Revenue (CARR) now ~US$27.2M (~NZ$44.1M1 ), up US$700K on the prior quarter (Q4FY23)

• Annual Recurring Revenue (ARR) now ~US$21.5M (~NZ$34.9M1 ), up from US$20.9M in the prior quarter (Q4FY23)

My Analysis

This was a softer Q for new CARR added, up US$700k vs. what they normally expect to be around US$1m. Craig spoke about this being due to some changes in their revenue recognition, however, he went on to say that he expected to see an uptick in the 1H report which is audited. The was a somewhat opaque statement, from my perspective. They also spoke about some delays in new customer implementations, due to IT staff shortages at some customers. So, perhaps these items are related.

On new sales in the Q, the only "elephant" closed was VIC breast, althrough Teri noted that several others were "close to the gates" and that she expected them to close in the next Q. She cited the US heading into the summer period as a reason contributing to some deals not closing in line with their expectations.

Closing cash was down slightly to $12.1m from $12.7m, but as $VHT controls costs and progressively sees rising receipts, FCF should be expected to move more reliably into positive territory, unless there is investment in significant new capability, which I'd expect to be signalled to investors in advance. The stable cash balance underscores the recent decision to reduce the revolving credit facility, and Craig indicated that this should be reduced further over time.

Previously issued guidance was held to, both for FY24 ARR, EBITDA and to be operating cash flow positive for FY24, a year earlier than announced at their strategy refresh in July 22. On cashflow, Craig said that having been OpCF positive in 1Q - the toughest Q - they now expected to be reliably OpCF positive. That said, the lumpiness of cash flows from Q to Q means that a "surprise" negative quarter could not be ruled out.

On costs, Craig stated that cost would be flat at about $10-11m per quarter, albeit that there were a few positions to be filled with headcount expected to remain stable around 160. Teri added that the team are good at meeting their cost budgets!

On new business, Teri indicated that risk pathways is getting significant incoming enquiries. She noted that enquiries about density following the FDA ruling were not as strong as she had expected, although noting that this may be because there is still a significant time before the FDA deadline requiring density reporting.

My Key Takeways

A solid if unexciting result. It is good to see costs under control and management confident that they will stay under control.

Attention therefore can turn to the top line. It was a weaker quarter for growth with expectations set that 2Q will be stronger. I always pay close attention to this, as the proof of that pudding is always only 90-days away. A strong 2Q result would indicate that $VHT remains on track. A second weaker result might point to a lower overall revenue growth trajectory. That said, Teri and Craig has so far been true to their word, so I give them the benefit of any doubt.

The usual CF trend analyses are shown below, with the trends shown over the last 8Q only.

Overall, Teri and Craig are pleasingly consistent from quarter to quarter and continue to present as a good team.

Disc. Held in RL and SM

Volpara 3rd cash flow positive qrtr.

Guidance upgraded and expectation of net positive cash flow positive for FY24 - a full year ahead of previous expectation.

Technically speaking, Volpara shares recently broke out of a base between 65c and 85c which has been forming for all of this year (and some of the last, after the drop to the 40s during the October 2022 selloff into a bottom), and currently sits near 52w highs, though ideally we also see increased volumes to confirm demand.

Coupled with improving fundamentals, this is yet another healthcare name to watch.

A super solid announcement from VHT today. I am personally a massive fan of Craig and Teri’s tight reigns over the Volpara purse strings. Well done and a very positive announcement if planning to reduce debt facilities is a huge sign of faith that they will turn this business cash flow positive and soon.

The AI azure announcement about cardiovascular capability of Volpara’s data is pretty exciting. Speaking as someone who looks and retinal vessels all day the potential use case here is huge. Retinal images certainly can be incredibly good indicators for cardio issues. Using AI to power up and identify people at risk while having mammograms has the potential to save countless lives and the countless healthcare system dollars. This I predict will be the making of this company.

Microsoft partner of the year awards, 2023

Volpara was recognised as the winner of the Healthcare and Life sciences and the New Zealand award

I found 58 categories, so I’m not placing much importance on the result, other than finding it worth noting.

The finalists in their category were:

· Cognizant

· Emids

· RSM US LLP

https://partner.microsoft.com/en-US/inspire/awards/winners#tab-4

New contract announcement with BreastScreen Victorian, adding to major Australian customers.

Highlights:

• Five-year contract is for A$1.4M (NZ$1.53M1) in Total Contract Value (TCV)

• Contract includes Volpara® AnalyticsTM, artificial intelligence (AI) quality software that

assesses every mammogram image for appropriate positioning, compression, and radiation

dose

• BreastScreen Victoria, a public screening programme in Australia, diagnoses 37% of all

breast cancers in Victoria

I don’t recall $VHT’s threshold for an "elephant", but I’m pretty sure this counts as one. This adds to a good clip of significant contracts this year. Keep it up.

Note BreastScreen Australia is the national breast screening program, jointly funded by the Commonwealth and States and Territories. This adds to the SA and QLD parts of the program, so potentially there are still some other material jurisdictions that could potentially follow.

I also note Terri’s comment in the recent SM meeting about using the initiative in Norway to try and crack into the national screening programs in Europe. Good coverage in what is Australia’s national screening program would no doubt help credential that push. Good to see momentum here.

Disc: Held IRL and SM

Haven’t caught the meeting yet but I see Terri has picked up nearly 60k shares (although not on market - long term incentive plan).

Although I’d always like to see on market buys I don’t mind stock based incentives if they align management with shareholders…

Appendix 3Y Change of Director’s Interest Notice

Rule 3.19A.2

Appendix 3Y Change of Director’s Interest Notice

Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public.

Introduced 30/09/01 Amended 01/01/11

Name of entity Volpara Health Technologies Limited ABN 609 946 867

We (the entity) give ASX the following information under listing rule 3.19A.2 and as agent for the director for the purposes of section 205G of the Corporations Act.

Name of Director Teri Thomas Date of last notice 1 October 2022

Part 1 - Change of director’s relevant interests in securities

In the case of a trust, this includes interests in the trust made available by the responsible entity of the trust

Note: In the case of a company, interests which come within paragraph (i) of the definition of “notifiable interest of a director” should be disclosed in this part.

Direct or indirect interest

Date of change

Direct

1 June 2023

Nature of indirect interest

(including registered holder)

Note: Provide details of the circumstances giving rise to the relevant interest.

N/A

No. of securities held prior to change

110,000 Ordinary Shares

225,841 Restricted Stock Units (FY23 grant under Volpara long term incentive plan) vesting (subject to ongoing employment) as follows:

• 1 June 2023 – 75,280

• 1 June 2024 – 75,280

• 1 June 2025 – 75,281

Class

Number acquired Number disposed

+ See chapter 19 for defined terms. 01/01/2011 Appendix 3Y Page 1 3450-4190-1859, v. 1

Ordinary Shares

75,280 Ordinary Shares Nil

Appendix 3Y Change of Director’s Interest Notice

Value/Consideration

Note: If consideration is non-cash, provide details and estimated valuation

Nil consideration paid on exercise

(value - AUD$57,213 (based on VHT closing share price on 31 May 2023))

No. of securities held after change

185,580 – Ordinary Shares 150,561 RSUs

Nature of change

Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back

Exercise of 75,280 RSUs issued as part of FY23 RSU grant under Volpara long term incentive plan.

Part 2 – Change of director’s interests in contracts

Note: In the case of a company, interests which come within paragraph (ii) of the definition of “notifiable interest of a director” should be disclosed in this part.

Detail of contract N/A Nature of interest

Name of registered holder (if issued securities)

Date of change

Interest acquired

Interest disposed

Value/Consideration

Note: If consideration is non-cash, provide details and an estimated valuation

Interest after change Part 3 – +Closed period

Were the interests in the securities or contracts detailed No above traded during a +closed period where prior written clearance was required?

If so, was prior written clearance provided to allow the trade N/A to proceed during this period?

If prior written clearance was provided, on what date was this N/A provided?

+ See chapter 19 for defined terms. 01/01/2011 Appendix 3Y Page 2 3450-4190-1859, v. 1

No. and class of securities to which

interest related prior to change

Note: Details are only required for a contract in relation to which the interest has changed

Great meeting. So good to get deeper insights into Terri's strategic thinking and her experience. I find it so much more insightful when Execs talk about their business off script. We can always go to the investor calls for the scripted discussions. It makes the Strawman meeting process of much higher value especially when CEO's are back for repeat meetings. (Remember, SM Members can always view the recordings of the first meetings to get their 101s.)

I gained a much better understanding of the customer perspective and challenges in the buying decision."Understand the EMR context [at each customer]" and "mammography is not always the top of the priority list" and "you need a clinical champion" and "you have to show that adding Volpara doesn't increase the clinician workload". (This latter point was also a key theme at an $M7T webinar I attended recently, and post the link to on SM.)

Craig mde a great point: if you can control the cost base while delivering at least 20% revenue growth every single year, you'll do well.

Most of all, I was further encouraged by Terri's disciplined and focused approach to growth and the fact that she cited by EPIC and $PME as role models for growth. Terri and Craig seem to make a great team - so important for the CEO/CFO dynamic to work well.

The imaging software space is clearly going to be very dynamic for years to come, and this is even more reason to value Terri's disciplined approach to screening new opportunities.

Thanks for another great meeting. I'm glad I got back onboard last year.

Hi all,

I would be interested in every thoughts on analyst consensus for VHT from simply Wall Street.

Is this price target similar to your calculations. Interested in all thoughts and your @mikebrisy.

$VHT reported their FY23 Annual Results. Investor call at 10am.

Given the detail provided in the 4C quarterlies, there are no surprises, so I'll keep this brief. Continued strong revenue growth with effective cost control leading to a narrowing of the NPAT loss from (NZ$16.441m) in FY22 to (NZ$9.801m) in FY23. Confirming guidance to be EBITDA positive in FY24 with a range NZ$0.5 - NZ$2.0 m.

Their Highlights

• Volpara achieved record revenue from customer contracts, surpassing the guidance and reaching NZ$35.0M, up 34% (20% constant currency). Initial guidance ranged between NZ$33.5M and NZ$34.5M.

• Normalised non-GAAP EBITDA1 improved 57% to -NZ$6.1M

• Net loss for the year after tax showed significant improvement of 40% to -NZ$9.8M

• Volpara sets guidance for FY24 constant currency revenue of between NZ$40.0M and NZ$42.0M, up 15% to 20% on FY23

• Volpara guides to FY24 EBITDA1 range of between NZ$0.5M and -NZ$2.0M

My Observations

Closing cash at year end is NZ$9.711m, which is actually up on EOFY22 of NZ$9.676m, courtesy of NZ$1.125m exercise of share options. So not strictly cash flow positive, but with continued momentum and operating leverage into FY24, it looks like $VHT's cash burning days are behind it, i.e., bang on the cash flow inflection point.

From a quick scan of the accounts there is nothing unusual, i.e., no impairments on acquisition goodwill.

We are now at a position where over the next year we can see how revenue and costs scale from a stable base. I will look to increase my holding if this supports a strong valuation, so not before 1H FY24 result.

Disc: Held IRL (2.0%) and SM (2.9%)

I'll be increasing my SM holding today to reflect that my SM positions are usually 3-4x my RL weight.

$VHT presented their 4th quater 4C today, with the FY results to follow in a few weeks. Overall, a good result.

Their Highlights

Cash Highlights:

- Second straight positive net operating cash flow quarter– NZ$0.4M. Volpara has been net operating and investing cash flow positive since September 2022 – approx. NZ$1.0M.

- Net operating and investing cash outflow1 in Q4FY23 of NZ$0.2M, an improvement of 92% from a net outflow of NZ$2.9M in Q4FY22

- Record Q4 cash receipts from customers of NZ$10.0M+, up over 25% compared to Q4FY22 (or over 19% constant currency)

- Cash receipts from customers in FY23 are NZ$38.6M (unaudited), up over 35% compared to FY22 (or approx. 22% constant currency)

Software as a Service (SaaS) Highlights:

- Contracted Annual Recurring Revenue (CARR) now ~US$26.5M (~NZ$42.4M2), up approx. US$900k on the prior quarter (Q3FY23). A record net new CARR added in FY23 of US$4.3M (NZ$6.9M).

- Annual Recurring Revenue (ARR) now ~US$20.9M (~NZ$33.6M2), up from US$19.9M in the prior quarter (Q3FY23)

My Observations

This was the second consecutive quarter of operating cash flow positive. While receipts were down on the "bluebird" (Craig Hadfield's words) 3Q result, they were still up strongly over the PCP. This had been well-signalled last Q.

They reiterated that they will not be OpCF positive every quarter, and Terri made clear that with staff bonuses paid out in Q1, they expect Q1 to be OpCF negative. Craig Hadfield stated that they are about six months ahead of their goal of being CF positive by Q4FY24, and that they will be full CF positive in FY25. With good cost stability now established and good deal flow over the last year, this objective now looks very do-able.

Our good friend Claude Walker asked if they have a goal of generating positive net income. Craig pointed out that due to historical acquisitions, there will be a non-cash drag on financial performance that will take some years to work through as goodwill is amoritised. This doesn't bother me, as that is all sunk costs, even though it may put off into the future the day when $VHT can be rated on an earnings multiple.

With ARR, CARR and ARPA all trending in a positive direction, $VHT is headed in a direction where it will start making money. Thanks to FX, government grants, and exercise of options, cash on hand actually increased in the quarter. I think this is a first where this has not been due to capital raisings!

I have included the usual CF trend charts below, on quarterly and trailing 12 months (TTM) bases,

My Takeaways

A good result on all fronts. Quarters will continue to be lumpy, but overall $VHT is headed in the right direction under Terri's steady hand of focusing on customer value, large accounts, and tight cost control. My confidence is increasing and today I have increased my small position IRL and SM.

Figure 1

Figure 2

Figure 2

Note: Excludes Lease Payments in reported in Financing CF (most recently $143k)

Another contract expansion/extension.

An additional US$1.25m over 5 years, is an additional $0.25m CARR. Given that the total CARR is now reported as US$0.44m, then the original contract CARR appears to be US$0.20m. So, if I am interpreting this correctly, it is a sizeable expansion. (I'm not sure if the Banner contract had previously been broken out).

On the one hand it is great to see existing customers extending and expanding their use of $VHT's products, and buying more of the full suite of functionality, indictating that ARPU growth is likely to be a significant value driver (as Ralph Higham consistently asserted over the years).

On the other hand, this and the earlier annoucement last week, appear to indicate that $VHT are announcing every significant deal. I'm not sure that an incremental $0.25m of CARR is material in the context of the HY23 total CARR = US$24.1m (i.e., c. +1%). It is hard to see why this warrants a price sensitive ASX announcement. Does it draw attention to an absence of deal flow on new "elephants" since the five announced in early January ?

Overall, good news, but you can take both a glass half full and a glass half empty view. Let's see what the 4C looks like in a couple of weeks time and the FY in late May.

Disc: Held IRL and SM

Full text of the annoucement

Volpara expands agreement with Banner Health to a five-year, full system contract

Highlights:

• Five-year contract represents an additional US$1.25M (NZ$2.0M1 ) in Total Contract Value (TCV) over initial five-year period and expands existing Contracted Annual Recurring Revenue (CARR) to US$440K (NZ$705K1)

• Banner Health is one of the largest nonprofit hospital systems in the United States

• Initial five-year contract includes Volpara Patient Hub™, Risk Pathways™ and Analytics™ software

Wellington, NZ, 11 April 2023: (“Volpara,” “the Group,” or “the Company”; ASX:VHT), a global leader in software for the early detection of breast cancer, today announced that it has signed a five-year contract with Banner Health, one of the largest nonprofit hospital systems in the United States, representing an additional US$1.25M in TCV (NZ$2.0m1). CARR now totals US$440K (NZ$705K1).

The contract expansion includes upgrades and new installations of Patient Hub, Analytics and Risk Pathways software across the Banner Health network.

The fully integrated health system operates 30 hospitals, including three academic medical centers and other related health entities and services in six states: Arizona, California, Colorado, Nebraska, Nevada and Wyoming.

Volpara Group CEO Teri Thomas said: “We are proud to expand our relationship with Banner Health and extend Volpara software to all their locations. This standardisation of care and implementation of new capabilities will help deliver more personalized care, find more cancers and identify high risk patients sooner so they can receive recommended interventions. We look forward to working with Banner Health to help save more families from cancer.”

Installation is expected to be completed within the next 9 months. The contract includes annual payments and is expected to contribute to revenue growth in FY24. Consideration paid upon signing is not considered material.

Authorisation & Additional Information

This announcement was authorised by the Board of Directors of Volpara Health Technologies Limited.

@Seymourbutts gave the heads up earlier today on the $VHT contract extension/revision. In this straw, I aim to get into the details of what is means.

Today, the customer is revealed as Akumin - a leading US provider of outpatient (i.e. walk-in) radiology services. The original deal was announced on 5-Oct-2021, as a US$2.15m, 5-year deal with an ARR of $0.43m. At the time, it was $VHT's largest deal - one of their first "elephants". There was no mention of a volume component to that contract.

With approximately 3.5 years to run on that deal, the remaining TCV would be $1.5m if the contract is amortised on a linear basis from the annoucement date. (This is a finger in the air, as it is not clear what the effective date of the original contract was or the payment structure.)

That remaining $1.5m for 3.5 years is the same as the announced headline today, which is for a re-set 5 year term. So, at the headline level, the deal has shrunk!

However, what's new is this announcement is 1) the potential volume-related upside of $1.25m of value, via a revenue share arrangement and 2) the replacement of "Patient Hub" with "Analytics" - which according to the release delivers enhanced capability to support the breast density risk assessment, which will in future be mandated across all States via the recent FDA ruling.

If the maximum revenue is achieved, the new deal is worth $2.75m, an increase of 28% for a 5-year term. If no volume upside is achieved, then the deal is a reduction of 31%.

So that maybe explains the negative market response, after the initial positive response this morning.

What no-one knows, except Akumin and $VHT, are the historical and projected volumes. And maybe even they don't know for sure, given that demand for radiology services was hit during COVID, with the backlog still working through.

And so I think the market doesn't have the basis to make any judgement about this deal one way or the other, beyond the term extension of 1.5 years and indications that $VHT's advanced analytics are in demand, presumably as a result of the recent FDA ruling.

On balance, I see this development as mildly positive. But more important will be the forthcoming 4C update in a couple of weeks.

Interested if any other StrawPeople who follow $VHT closely have other views on this.

Disc: Held IRL and SM.

Volpara with another positive announcement to the market today regrading an amended (and extended) contract, you can find it here.

Small in the scheme of things but this is the second contract/win or extension in less than a month.

Keeping a closer eye on this in light of these recent announcements, and with the company pushing towards profitability.

Has been a good start to 2023 CY.

Held across SM and IRL.

Just watched Teri Thomas present at ASX Small and Cap-Caps.

Nothing significant to report.

Key Takeaways

- Reiterated that in remaining Q of FY23 and through FY24, lumpiness of some key payments means that they will fluctate either side of CF breakeven

- Expect to be cashflow positive for FY25 overall

- $12m cash + $10m undrawn debt facility. Teri doesn't expect to have to use the debt to get to sustainable cash generation

- Managing costs well, expecting only a gradual increase over time

- Expecting recent FDA ruling on breast density to have benefits internationally, beyond USA, including in ANZ

Overall - guidance on track.

(I was slightly annoyed that my question on the state of the "elephant hunting" pipeline went un-asked by the moderator. There, venting done.)

I enjoyed the presentation - one of the best explaining what $VHT does. Teri is a great comunicator. Worth watching the recording when it is up on the ASX site.

Where I stand on $VHT

As my SM history shows, after several years as a holder, I gave up on $VHT in the belief that it was a basket case. With already >33% of the massive US market and unable to make money and cash burn in the wrong direction. That was Aug 2021, and I'd given them 4+ years IRL and followed progress closely.

Late 2022, enter Teri, Ralph focused back on the science, costs quickly rebased, an "elephant hunting" strategy yielding good early results, and a maiden CF positive quarter, I re-entered at $0.82 on SM (RL tranches at $0.77 and $0.74).

At an EV/Revenue multiple of 6x, its not exactly cheap. However, I feel a <2% position for what is still in my view a high risk stock (in terms of delivering a material return) is the right place to be. Once it starts demonstrating progress towards consistent cash generation, it will re-rate and I have decided to position myself early for that eventuality because I have confidence in Teri.

$VHT will never be a $PME, Its economics just don't match up. But if it can continue to catch elephants, and benefit from the FDA density ruling, I believe it still has the potential to grow into a quality business. Remember - this usually takes time.

Disc: Held in RL (1.8%) and SM (1.5%)

AI and breast screening using Volpara algorithms showing exciting real life promise for early cancer detection. Presented at the latest ECR conference is pretty big news for the company. A standard of care for the future?

Breast density AI, risk and genetic testing discussions going mainstream. Always good that awareness is being raised.

Further to the straw by @Nnyck777 below is the release from $VHT.

Over the years, former CEO Ralph Higham was perpetually touting this as being around the corner. As with each reporting period it didn't materialise, I think many of us started to see this as a "crying wolf" scenario. It has finally arrived, with an 18 month implementation timeline.

This is potentially a very significant tailwind for $VHT, likely to result in new customers but also increasing the ARPU of existing customers as they expand their subscriptions to include density risk assessment and reporting capabilities.

Disc: Held IRL and SM.

ASX RELEASE

FDA Breast Density Reporting Rule Released

Volpara software is used to assess the breast density of more than 6 million US patients annually Wellington, NZ, 10 March 2023: Volpara Health Technologies (“Volpara,” “the Group,” or “the Company”; ASX:VHT), a global leader in software for the early detection of breast cancer, today announced that a new US federal regulation was finalised by the US Food and Drug Administration (FDA) requiring mammography facilities across the country to inform patients whether their breasts are composed of dense tissue. The regulation standardises language and expands the number of states with density disclosure laws nationwide.

National Notification Ruling Within the next 18 months—by 10 September 2024—all patient reports and summaries must include the following language about breast density:

• Non-dense breast notification states: “Breast tissue can be either dense or not dense. Dense tissue makes it harder to find breast cancer on a mammogram and also raises the risk of developing breast cancer. Your breast tissue is not dense. Talk to your healthcare provider about breast density, risks for breast cancer, and your individual situation.

• Dense breast notification states: “Breast tissue can be either dense or not dense. Dense tissue makes it harder to find breast cancer on a mammogram and also raises the risk of developing breast cancer. Your breast tissue is dense. In some people with dense tissue, other imaging tests in addition to a mammogram may help find cancers. Talk to your healthcare provider about breast density, risks for breast cancer, and your individual situation.”

The ruling also specifies the language about breast density in reports and summaries for healthcare providers is to match the BI-RADS® 5th Edition density categories.

“The FDA breast density notification language is a key step in equitably empowering all women in the United States to understand their breast density so they can take informed, actionable steps to monitor their own breast health,” said Teri Thomas, CEO of Volpara Health.

Opportunities for Further Accuracy & Empowerment

Nearly 40 million mammograms are performed each year in the US of which Volpara’s software today is used to assess the breast density of more than 6 million annually. The FDA ruling acknowledges advancements in density classification devices to help mitigate variability in assessment.

Volpara’s volumetric breast density assessment software to support physicians has long played an increasingly important role in making accurate, objective assessments of breast density possible. The Volpara® TruDensity™ physics-based AI algorithm is cleared by the FDA, Health Canada, and the TGA (Australia), is CE-marked, and has been validated in more than 400 articles and research abstracts.

“We’ve been working with leading clinicians and researchers around the world for more than a decade to make critical information about women's breast composition and its link to breast cancer more readily available," said Thomas. "The FDA regulation validates our focus, increases the industry’s attention on breast density, and propels us forward to improve both the patient and provider experience and understanding.”

Volpara’s Thumbnail™ module goes beyond simple notification to help providers go the extra mile to help patients. The module enhances patient mammography results letters with two images of the patient’s breasts and explains what breast density means in simple-to-understand terms and visuals.

About Breast Density

Dense breast tissue is common but has been linked to an increased risk for breast cancer and can also dramatically impact early detection. In the United States, nearly half of all women over 40 have dense breasts. As density increases, the accuracy of mammography decreases. According to a study published in Radiology, mammography misses almost half of breast cancers in women with the densest breasts. Because dense breast tissue and cancer appear white on a mammogram, tumours are often camouflaged on a mammogram. Studies confirm that early detection improves when women with very dense breasts receive an ultrasound or MRI exam in addition to mammography as part of their regular screening schedule.

Authorisation & Additional Information

This announcement was authorised by the Board of Directors of Volpara Health Technologies Limited.

ENDS

Finally FDA states women must be informed of there breast density score on breast screening. Hopefully this means more impending sign ups to Volpara Risk programs for breast screening companies in the US. The company is hopefully well placed to take advantage of this change.

$VHT issues a "Business Update" this morning, the main news being the expansion of an existing contract - always good.

Overall, it is good news, but I don't know why the announcement has been marked as price senstive. Individually and collectively, the content is not material IMO.

@Noddy74 - one of the items relates to what they are doing with AI (per your recent straw). Interesting in that there is also mention of $ALC and Microsoft.

Summary of highlights from the announcement:

• New contract with Sutter Health for Risk Pathways product represents an additional US$900k (>NZ$1.4M1) in Total Contract Value (TCV) over initial threeyear period and expands existing Contracted Annual Recurring Revenue (CARR) to US$374K

• Presentations and posters presented at the European Congress of Radiology (ECR) validate Volpara software

• Volpara participating in an AI in Healthcare panel discussion with Microsoft and Alcidion (ASX:ALC) in Sydney today

Disc: Held IRL (1.3%) SM (1.2%)

Q3FY23 Quarterly Report

The Good

- Positive free cash flow for the quarter of NZ$1.3m which is the first for the company which looks to be driven mostly from higher cash receipts as there hasn’t been any substantial operating cost reductions, more of a levelling out.

- I think the cash receipts are more of a product of the billing cycle and catch up of late payments from the wording in the update that suggests Q4 receipts won’t be as good, however the positive quarter shows signs that the profitability targets are within reach.

- Increase in cash balance to NZ$12m. Increase in cash position helps reduce the likelihood of a future capital raise at the reduced share price.

- CRA payments completed

- Starting the year with several large contracts as per previous announcement

The Bad

- No updates on wider product lines or future opportunities

What To Watch / Targets:

- Level of cash receipts for Q4 and if it falls back to the NZ$8m mark

- MQSA ruling still pending

Short reminder for those interested Volpara Quarterly Results and Investor Webinar is being held tomorrow as follows:

Wednesday 18th January 2023 at 9:00am AEDT (Sydney/Melbourne) to update shareholders on its Q3 financial results.

The call will be hosted by Teri Thomas, Managing Director, Craig Hadfield, Chief Financial Officer and Jill Spear, Executive Vice President of Sales and Marketing.

Webinar details Date:

Wednesday 18th January 2023 Time: 9:00am AEDT (Sydney/Melbourne)

To register: https://us02web.zoom.us/webinar/register/WN_WgrpDdEjSPWYt856kQ6SRA

Dial in details: Will be provided to you upon registration.

As noted by @Nnyck777, this is a solid win for Volpara.

At current FX rates, assuming even payments over the 5yr contract period and using FY22 as a baseline, these contracts represent a 9-10% annual lift in revenues.

Seems the market is impressed too -- shares up 17% today so far. That puts shares on about 5.2x forecast revenues for FY23 (which are expected to be about 24% above FY22). Company hoping to hit breakeven in the last quarter of FY24, and has around NZ$11m in cash to support it through to then.

Not held, but on my watchlist.

Inside Ownership

Very Brief Background History

In 1989,Professor Sir John Michael Brady mother-in-law dies from breast cancer. Professor Brady transitions to teaching medical imaging where he meets Dr Ralph Highnam. Together they laid out the basis for breast composition. In 2000s Dr Highnam, Professor Brady fellow scientists Professor Nico Karssemeijer and Professor Martin Yaffe began to make progress in the field and attract clinic interest. In 2009, Brady, Highnam, Karssemeijer and Yaffe met at a major medical imagine trade show in Chicago. They pool their talents and collective knowledge to create Volpara (Volumetric parameters).

Roger Allen is a current member of the board. He’s a entrepreneur and a venture capitalist he joined the board of Volpara back in 2010 and has the biggest inside ownership.

In April 2022, Dr Ralph Highnam steps down from CEO and transits to Chief Sciecne & Innovation Officer. Teri Thomas is appointed CEO.

Approx Inside Ownership End Dec 2022 – Percent of total shares issued. Value shares today using closing price of $0.52. 252,113,909

Ordinary Shares Percentage Net Value

Roger Allen (Patagorang Pty LTd) 18,467,848 Shares 7.32% $9.6m

Ralph Highnam 16,213,561 Shares 6.43% $8.43m

Professor Sir John Michael Brady 6,619,075 Shares 2.62% $3.44m

Prof Martin Yaffe 2,066,483 Shares 0.82% $1.07m

Prof Nico Karssemeijer 1,806,806 Shares 0.72% $0.94m

John Diddams (Board) 1,172,295 Shares 0.46% $0.61m

John Pavlidis (Board) 69,100 Shares 0.027% $0.03m

Total 46,415,168 Shares 18.41% $24.14m

Volpara Insiders Buying 2022

John Pavlidis - Independent, Non-Executive Director

Buying 29 June 2022 69,100 shares average cost $0.41 per share ($28,609.61)

John Diddams – Independent, Non-Executive Director (Retire since 2022 AGM)

22 June 2022 Buying 30,000 shares average cost $0.45 per share ($13,553.00)

16 June 2022 Buying 30,001 shares average cost $0.56 per share ($16,665.34)

At time of Retiring

Whitfield Investments Pty Ltd 1,060,768 Ordinary shares

Galdarn Pty Ltd 111,527 Ordinary shares

Total 1,172,295

Paul Reid – Chair, Independent, Non-Executive Director

15 June 2022 Buying 115,000 shares average cost $0.5822 ($66,958.91)

Volpara History Capital Raises/Acquisitions

Volpara Capital Raise – Raised $132.7m since listing April 2016 Current market cap 133.6m at 0.53.

· April 2020 – Raises $37m, $28m Institutional, $9m Retail at $1.30 per share

· June 2019 – Raises $55m, $45m Institutional, $10m Retail at $1.50 per share

· April 2018 – Raises $20m, $15m Institutional, $5.0 Retail at $0.60 per share

· November 2016 – Raises $10.7m, $7m Institutional, $3.7m Retail at $0.60 per share

· April 2016 -Raises $10m at IPO at $0.50 per share

Volpara Acquisitions

· February 2021 – CRA Health US$18.0m with a further US$4.0m payable upon meeting key performance and staff retention targets – industry leader in breast cancer risk assessment spun out from Massachusetts General Hospital

https://www.asx.com.au/asxpdf/20210202/pdf/44s8m0v7qkrzm1.pdf

· June 2019 – MRS Systems US$14.59m (~A$21.15m) – a medical software company that provides comprehensive patient track and communication and a radiology reporting platform, for sub-specialty radiology applications including breast and lung imaging.

https://www.asx.com.au/asxpdf/20190603/pdf/445k85khy2qchl.pdf

Volpara / Neuren /Promedicus all listed as likely 2023 winners.

Source you can take with a pinch of salt.

The last few years have been brutal for most Healthcare stocks on the ASX. Possible transition back to this area.

For those who couldn’t attend the investor call, there wasn’t much additional info, the presentation and doc’s cover it. Paraphrased by me, italics direct quotes.

Comments from presentation:

- Overall vibe was upbeat, but that is very much Terri’s style

- Reiterates focus on culture and purpose with an emphasis on staff being the secret sauce

- Upgraded guidance is a mix of organic growth and uplift from FX, (sounded like $US played a big part)

- RSNA, world’s biggest radiology conference starts this week, expect productive contacts with current and prospective customers

- “Unsolicited kudos” from Canadian Breast? VHT software allowed them to finish their data audit in 2 hours normally takes 2 weeks….I’m a bit fuzzy on exactly what process/product they were talking about.

- FDA mandate will be turning point in US and the rest of the world is watching

- This made me cringe; company mascot being launched at conference “goofy and fun”

Comments from Q&A:

- Revenue growth was a mix of new and existing customers, spilt evenly across the three products

- Can you maintain profitability timeline? A yes from Terri, firm on guidance

- Possible recessions expected to have negligible impact on revenue, healthcare immune

- Is upgraded guidance based on organic growth or $US? On current currency, organic rev growth 22% but bulk of upgrade is due to $US

- Cyber security, front of mind, top of the list for company risks, potential threats being constantly accessed across all parts of the business, training staff and testing systems regularly.

- FDA mandate, expected in the next couple of months, but have no idea on what the implementation timeline will be, it is not expected to be immediate/quick. VHT has time to scale accordingly, deployment of density software is not a “heavy lift”.

Conclusion:

- Terri, looking forward: profitability is in reach, it’s a “good year”. After profitability Volpara will look at company direction and options.

Volpara's half year to September 30 saw continued strong top-line growth, but continued to burn through the cash -- albeit at an improved rate.

The full presentation is here

Key details:

The business has culled its workforce by 18% or so since March and the cost base looks to have stablised. They expect NZ$7-8m in savings by FY24.

The company is guiding for about NZ$34m in FY23 revenue, which would be 30% growth and puts shares on a forward P/S of about 5.3.

There's a lot to like with Volpara, but like so many we need to see if they can continue to deliver strong revenue growth without increasing costs.

The Good

- Report maintains a strong focus on achieving cash flow positive position

The Bad

- Cash receipts levelling out on a quarterly basis which make the forecast cash break even looking difficult to achieve in the near term

What To Watch / Targets:

- Free cash flow for Q3 expected to be around -$2.3m. This is around 1 year of runway with cash and with $10m in credit facilities.

- MQSA ruling expected in the next 2 quarters, which would mandate a higher level of density reporting in the US.

- Noted strong pipeline of customers that were unsigned during Q2 that are likely to be awarded in H2FY23. Conversion of these will help to validate Terri's strategy.

VHT investor Call

Key points from the investor call this morning, following Q2 4C, summery in my words.

From the Presentation:

- B Corp certification, responsible, ethical business practice, was 18mths to get certification

- US legislation reintroduced to mandate breast density notifications, expected end CY22/earlyCY23

- Headcount: staff reduced from a high, mar 2022 of 189 to 155 currently. A few positions are outstanding,expect it to stabilise at 160. 41% of staff employed in R&D

- Reiterated taking care of current customers will drive sales, re referrals.

- Focus on most profitable markets US/Aust, CAN to a smaller extent

- Strategy based around growth

- New products in development, some collaboration with Microsoft, announcements expected next year

- Reiterated CF break even by 2024, profitable by FY2025

- Breast density focus is big news in the US, lots of recent media coverage.

- Product uptake is evenly split between 3 core products, with the breast scorecard slotting into the modules as needed. Funnel is growing organically based on customer demands.

- % of sales to new customers has increased to 73% in 2023 v 61% in 2022

- Comment from Jill, sales/marketing, “elephants on the horizon”

Q&A session:

- Sales pipeline in coming qtrs. has doubled.

- Targeting large customer called:

- Elephants 250K+

- Calves 100K+

- Cyber security discussed, actively administering/monitoring protocols etc

- First time this is mentioned according to Terri? Think I heard this right? Agreement with Epic, to work collaboratively with their customers, Epic has their own mammogram recording system, however the risk pathways and analytics adds value

- Meeting with Cerner, now Oracle, structural change is underway, not as strong in mammography, so opportunity to work together.

- Both Epic and Cerner were seen as collaborative opportunities for VHT

- Opex saving on reduced headcount expected to be min $NZ 1.5m. Noted Cash flow is lumpy, and investors should look at annual figures re payment cycles. CF up 8% in quarter considered low, expecting 20% Q3 as Oct is strong.

- Currency has helped results. Going forward incoming $US dollars, 20%, have been hedged to 2026 @ .64c

- Interest rate increases no impact, however, inflation is having an impact especially in salaries.

- Monetising image data base, 70m images. Working on combining with other data bases, the artery calcification's with Microsoft was used as an example. Some opportunities being looked at by “innovation” team, no product yet, further detail next year

- Jill on impact of FDA density legislation: 20% of states are not mandated and the existing legislation between states is also varied from a basic notification to a more details analysis for patients and at risks persons. Considered a positive for VHT as it offers an unbiased measurement for density and federal law will push reporting towards consistency

- Reiterated metric to watch going forward is ARPA not ARPU

General Impression:

The team presents well and appear direct in their communication and answers to questions.

Have I been sucked in by a good story? After selling out in the past, when the company was floundering to gain any traction, I have bought a small starter position this morning.

Perhaps this is my “hopium” stock, as I really hope they can succeed in their mission of “saving families from cancer”.

This is somewhat old news but don't follow Sonic usually but looks like they aquired AI screening tech. Not fully aware if they do breast cancer but they do chest screens to detect cancer so i imagine they might.

Quick look and looks like Goggle's Deep Mind is also working on it - DeepMind’s AI for Breast Cancer Screening | by Harrison Miller | Medium

Bye bye bye.

lol

that said, great interview and agree with comments of others, feel this business is ready to flourish.

the risk aspect seems like a huge market and the breast arterial calcification aspect could be quite significant in risk prediction too!

- Terri is what VHT needed a few years ago. Ralph is the classic boffin, all brains and no business. That is not a slight at Ralph, all great business's start with the idea and brains, but the Greats know when to transition to business, and it’s my observation that Terri is going about fixing all the business things, and that in itself will generate synergies (and more revenue). With Ralph still the brains, VHT seems a good investment.

-Terri's honesty is refreshing in general. To say what she doesn't like is a good sign. To know where she wants to go is an even better sign.

- Terri is forthright. You want that in a leader. Terri knows when to defer to her team. You want that in a leader. Terri has a vision for a business end state. You want that in a leader. I'm on team Terri.

- The M$ Heart product makes sense. I'm onboard. The deal seems incredible for VHT, and all M$ gets is the ‘feel goods’.

- I remain comfortable that VHTs moat still exists and is strong; clinically, dataset size, and volumetric data type.

- The change of APRU to APRA makes sense.

- The change of sales tactic makes sense.

- I continue to like the SaaS model.

- VHT is a software company, and caught up in the sell off, but as pointed out; has lots of revenue, and is debt free - two of the big requirements for actual success.

- Software companies need software engineers, and it sounds like Terri knows this and knows where to focus the efforts to achieve the outputs. (I consider AI ML to be software dev).

- The focus on “risk management” is a very smart move IMHO. Medical treatment is all about risk management, and I think her joke is deadly true – the doctor won’t be replaced by AI, but the doctor that doesn’t use AI as a decision support tool will be replaced! (by a doctor that will).

- My tolerance for software companies that are not cash flow positive is already high, which leads to one conclusion:

- A great investing quote is "sentimentality costs you money", but here I am, about to continue to HOLD and double down and BUY more. I normally leave ethics at the door with investing (spicy I know!) except in this instance, I think this company can do great good in the world AND make money in the process.

- Having said that, I think the wise move is to wait for the Strategic Review and buy from there. The risky money will move early... (I love the casino, that is me! Buy now!)

@Strawman A big thank you for pushing through and holding the meeting. Your platform continues to hold value for me (aka I’ll keep paying you money!)

Volpara #Cautiously Optimistic

Thank you to Strawman for organising this interview with Teri and bonus extra surprise of Craig.

My take aways (I have not read any other VHT straws on interview yet as we will all have our different perspectives and I am looking forward to doing so):

CEO Impressions:

-Teri is impressive and refreshingly honest. She understands Saas and medical technology from a practical perspective. I believe this was lacking and lead to lag in break even for the company. While Ralph is literally the brains of the operation sometimes academics can be lost in the details and minutia and fail to assess the macro factors for their own companies. I feel that Teri might be the answer to this gap.