Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Damn! $VHT the latest undervalued tech being taken out. I’ll be voting against, as my valuation is higher.

Disc. Held IRL and SM

$VHT reported their 1H FY24 results this morning.

Their Highlights

- Revenue from customers up 17.5% to NZ$19.8M

- Core subscription revenue up 26.5% to $14.9M

- Subscription revenue up 19.0% to NZ$19.3M

- Net loss for the period after tax improved 16.6% to NZ$4.4M

- Second consecutive free cash flow positive half-year

- Normalised non-GAAP EBITDA4 improved 67.9% to −NZ$1.4M

- Revenue guidance maintained at NZ$40.0M–NZ$42.0M for the full year

- EBITDA guidance maintained at +NZ$0.5M to -NZ$2.0M for the full year

My Analysis

With the final 4C out several weeks ago there were no surprises. Revenue growth is broadly on track to achieve guidance for the year, which is maintained. 2H revenue tends to be stronger than 1H, so holding to guidance appears reasonable.

EBITDA continued to make progress, with $VHT's normalised non-GAAP measure improving 68%to -NZ$1.4m. EBITDA guidance also on track. I note GAAP EBITDA is -NZ$2.186m, a more modest improvements from -NZ$2.780 min the pcp.

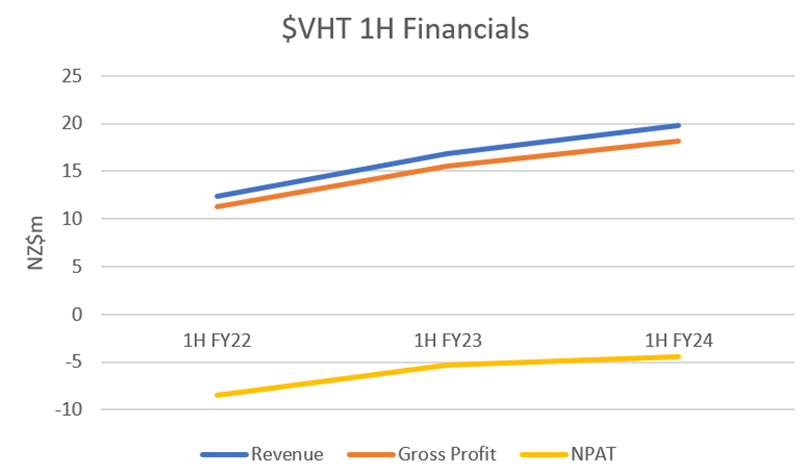

I have plotted some of the key financial trends for the 1H y-o-y comparisons. Its now about 18 months since Teri Thomas came onboard as CEO, bringing a much-needed cost discipline and a sales focus on larger customers (“elephants”). As a result, I am only showing a shorter time series on the financials, as it serves little purpose going further back in time.

Figure 1: 1H y-o-y Key Financials

The figure above shows the impact of the softer revenue growth this FY is having on the trajectory towards positive earnings. In short, while the trend is still up, its looking like hard work to get there.

Revenue

Softer revenue growth of 17% to pcp during the half is due to only one large customer going live, although the three core products of Analytics, Patient Hub and Risk Pathways achieved constant currency growth of 23%,

Revenue is only recognised once a customer contract goes live. Separately, CFO Craig Hadfield commented that $VHT are not making the progress they have aimed to in closing the gap between CARR US$28.4m and ARR US22.5m (the difference between the two being due to contracts that are closed but not yet implemented). To help close the gap, they will be adding a few headcount to accelerate implementations. Reading between the lines, it sounds like the recent cost control focus has meant that they have been running resourcing very tight in this area, adding some drag to having new customers going live.

Looking to H2, Craig noted that 4 customers with CARR of >US$250k are planned to give live. One has already gone live, with 3 more expected before end of March. Craig indicated that because of the strong second half, they remain confident of meeting guidance for the FY.

Other key metrics continue to be strong, with Net Revenue Retention at 112% (up 7% y-o-y) and APRA of $US40.4k up 25% y-o-y.

So the scene is set for a strong finish to the year.

Costs

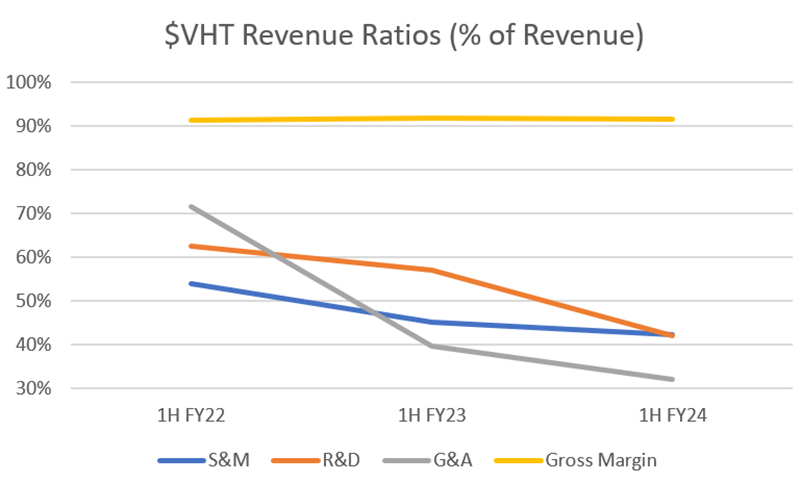

Figure 2 below shows that expense control continues to be $VHT’s saving grace, with R&D, S&M, and G&A all declining as a % of Revenue. In fact, Opex of NZ$23.055m is an actual reduction of 4% from NZ$23.952m, which is a great achievement given that revenue growth has been maintained, contracts have been expanded, new contracts signed, all in an inflationary environment.

Gross Margin is holding steady just under 92%, having held in the 91%-92% for several periods.

Having the cost base under control, $VHT are going to make targeted headcount increases, with a Sales Director in Europe (on which Terri sounded a bit more optimistic after having spent a month there over the summer), and adding clinically experienced people in the US who can help with customer success as well as sales (something she has learned from Epic days, and has mentioned previously that she is keen to push harder at $VHT).

Figure 2 1H y-o-y Margin and Expenses (% of Revenue)

Cash Flow

Net Operating Cashflow was NZ$1.3m compared with -NZ$6.0m in 1H23, demonstrating that positive impact of controlling costs while maintaining growth in receipts.

Overall, Free Cash Flow by my calculation was +NZ$0.443m (incl. lease payments), helped by the divestment of interest in Precision Medical Ventures.

My Key Takeaway

Overall, today’s result was solid if unexciting.

1H tends to be softer for revenue, as the key months of June to August include the summer in the US, which tends to be slower for the new customer “go-lives” that drive revenue.

I’ll not repeat ground covered in previous write-ups on $VHT, other than to say that I remain interested and the thesis requires a strong finished to maintain revenue growth in the realm of 20% p.a.

Disc: Held in RL and SM

$VHT announced their last 4C report today.

Their Highlights

Cash Highlights:

• Fourth consecutive positive net operating cash flow quarter, NZ$1.2M. A full year and a half ahead of guidance

• Volpara net operating cash flow positive for over 12 months since the start of October 2022 – approx. NZ$3.4M; and free cash flow positive for the same period – approx. NZ$730k1

• Record Q2 cash receipts from customers of NZ$11.5M+, up over 32% compared to NZ$8.8M in Q2FY23 (or over 31% constant currency) and first quarter over US$7.0M

• Volpara no longer required to provide Appendix 4C quarterly reporting updates

Software as a Service (SaaS) Highlights:

• Contracted Annual Recurring Revenue (CARR) now ~US$28.4M (~NZ$46.3M2 ), up over US$1.2M on the prior quarter (Q1FY24)

• Annual Recurring Revenue (ARR) now ~US$22.5M (~NZ$36.6M1 ), up from US$21.5M in the prior quarter (Q1FY24)

My analysis

A solid result, and an important milestone. $VHTs first 12 months period of postive cash flow. Closing cash of $13.19m is up from $11.62m a year ago.

The release details a list of significant contract renewals and expansions, as well as some new customers. $VHT also report expanding their rollout in the VHA, which provide heathcare to some 9 million veterans in the US.

There is also a further reference to the new product Quiver, which is intended to make radiologist work more productive (workflow and automation).

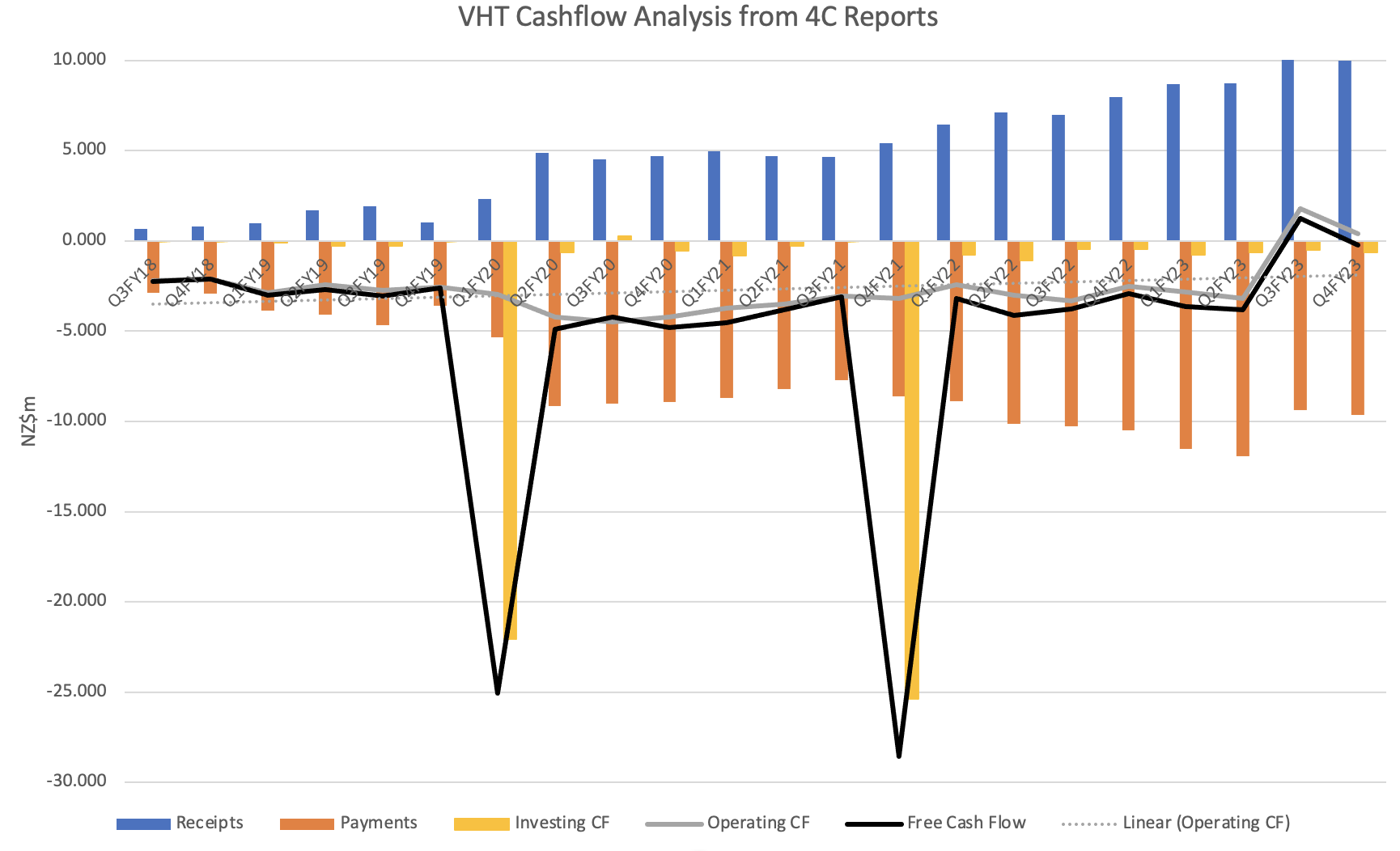

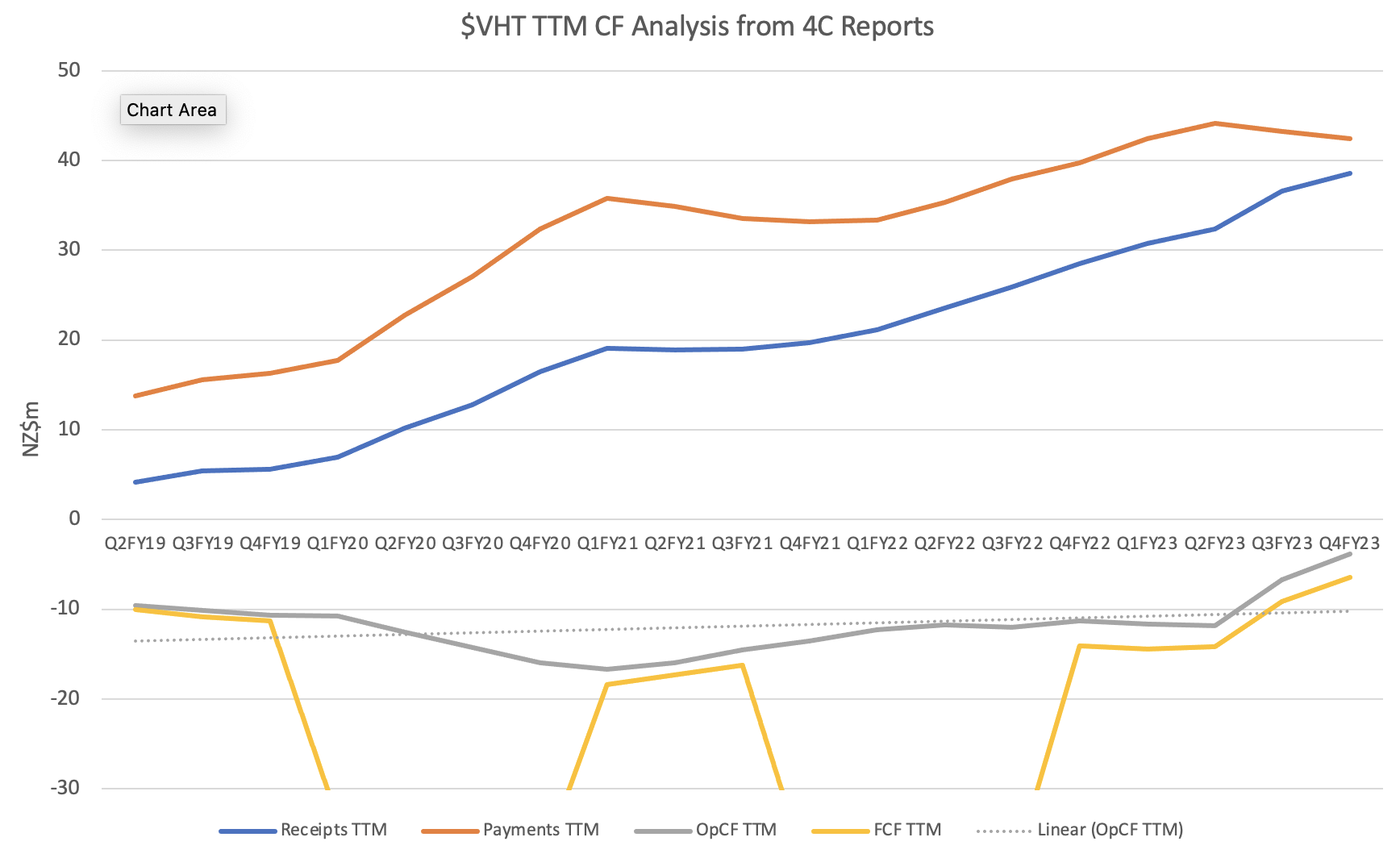

Below is my usual trend analysis, with trend lines based on the last 8Q. This shows just how effective Terri and Craig have been at managing costs which continuing to drive revenue.

The SP has fallen back again, presumably part of the general hit of "higher for longer" to microcaps but perhaps also reflecting a period of relative quiet on newsflow.

About to go on the call, but this looks on track to me.

Disc: Held in RL and SM

$VHT CEO Teri Thomas provided an update on the progress of the company, its market position, industry trends and priorities. While she flew through the material very quickly and at a high level, there was a lot of great content. It was a very content-rich presentation, I learned a lot, and if a recording is made available I definitely recommend that you catch it.

While there were no new material disclosures, there was some very good material. In this straw I pick out key points on:

- Financial highlights

- Product and Strategy

- Markets and Customers

- New Products

- Q&A - I discussed with Teri recent developments in Scandinavia and I've written her response virutally verbatim

Financial highlights achieved

- Revenue growth “up 61%” over the last two years***

- 15% reduction in the cost base

- FCF positive since September 2022

- $12m+ cash on hand to fund growth – no need to raise new capital

- “Elephants” up from 10 to 21, growing CARR by US$5m

*** I thought this was an odd statement, particularly since FY23 revenue of $35.01m is actually 77% higher than FY21 revenue of $19.75m. So I don’t know how it was derived (whether US$, NZ$ or A$, revenue added or something else. I cannot reconcile it).

Future Guidance – no change to previous messages

- Positive EBITDA forecast over next “12 to 18 months” (i.e. keeping wriggle room if they don't hit it this year?)

- 20% annual revenue growth

- High margins (%GM>90%)

- Low churn

- Stable cost base

- New product launch in <12months (see below)

- Major new products in innovation pipeline and growth outside of mammography (including to other cancers and beyond cancer, e.g., cardiovascular disease)

Product and Strategy

Teri emphasised the vision of the company “To become the global leader in software for the early detection and prevention of cancer and other devastating diseases.”

Upfront, she reminded everyone that $VHT is an analytics firm, neither competing with equipment vendors nor PACS vendors, but providing software that supports them.

She highlighted the growing incidence of cancer particularly in younger women (citing a recent article in JAMA) and recapped the recent shift by the US Government in recommending mammograms at age 40 instead of 50 as under-scoring the urgency of early detection, and how risk assessment can be used at even earlier ages. (In his introductory remarks Chair Paul Reid remarked that the risk product has been the fastest selling last year.)

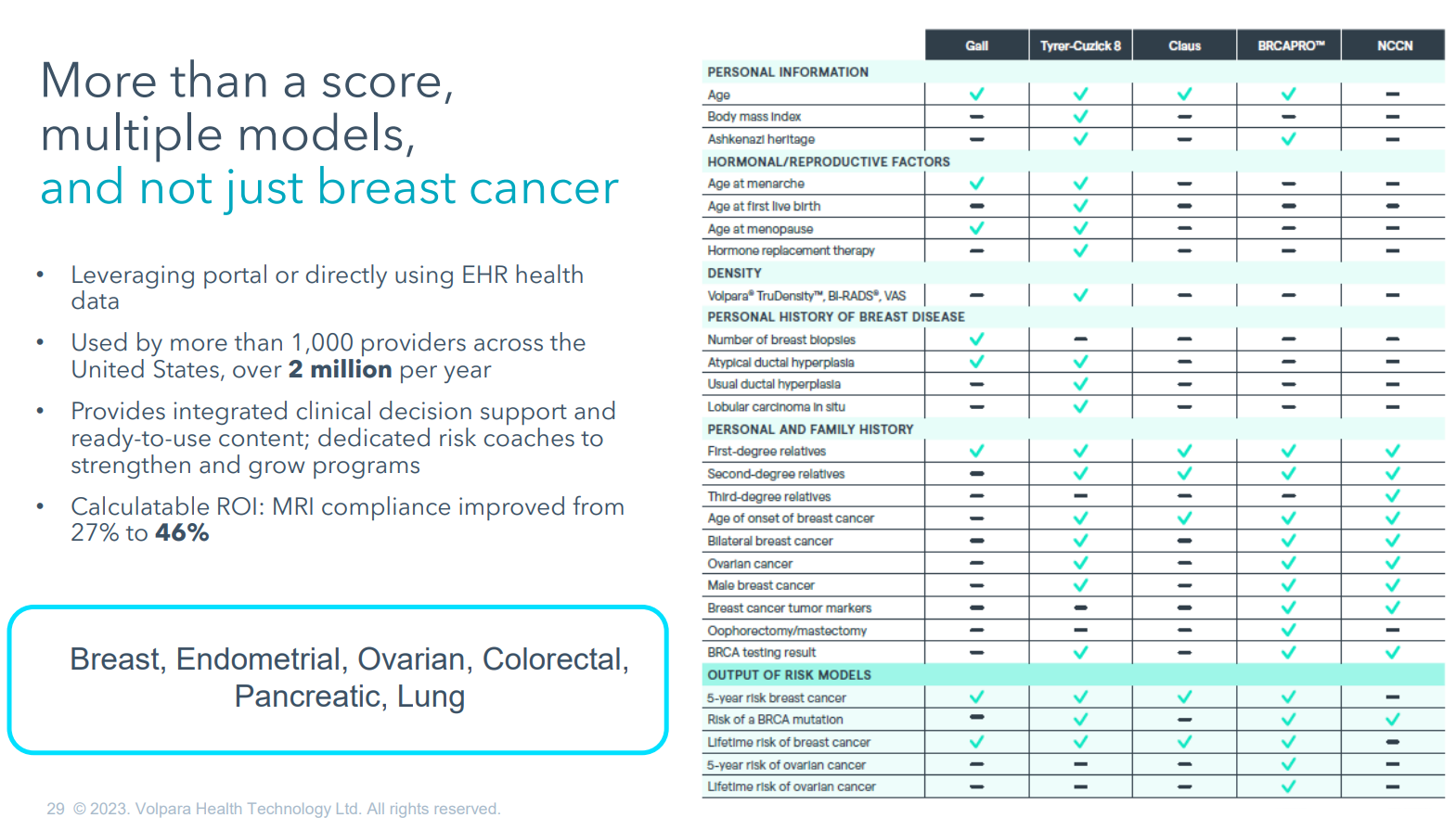

Teri noted that Risk PathwaysTM grew at its fastest rate last year. She linked this to the US government ruling that risk programs are to be required by the national accreditation program for breast centres.

Risk PathwayTM also provides a platform for extension of risk assessment beyond mammography. Teri noted that the competitive advantage of $VHT’s product is that it incorporates more risk models than the competition. She said the platform is “poised for expansion into other pathways as well” with the slide showing “breast, endometrial, ovarian, colorectal, pancreatic and lung.” Clearly, they are working to develop this platform to support the growing trend towards personalised healthcare pathways based on risk assessment beyond breast cancer. (see slide)

On Scorecard, Teri highlighted that $VHT’s proprietary algorithms deliver AI analysis within the workflow of the mammogram analysis, and that this differentiates it. (At the moment, I should add!) She again referenced the collaboration with $MSFT on AI.

She expects to see increased use of ScorecardTM and Analytics as $VHT supports organisations in complying with the new US FDA requirement mandating density reporting for all women undergoing mammograms. The presentation provided some data (I had not seen before) showing that 75% of women lie in the B and C density categories, where it is important to decide in which group they lie to assess their risk, and that two human experts will agree on this assessment around 65% of the time.

Market & Customers

Teri noted that the customer focus has broadened from hospitals and imaging centres/networks to include large screening programs (US and Australia). She indicated that they are also engaging insurers and primary care doctors, with the first primary care doctors already using $VHT products to screen women for risk at younger ages.

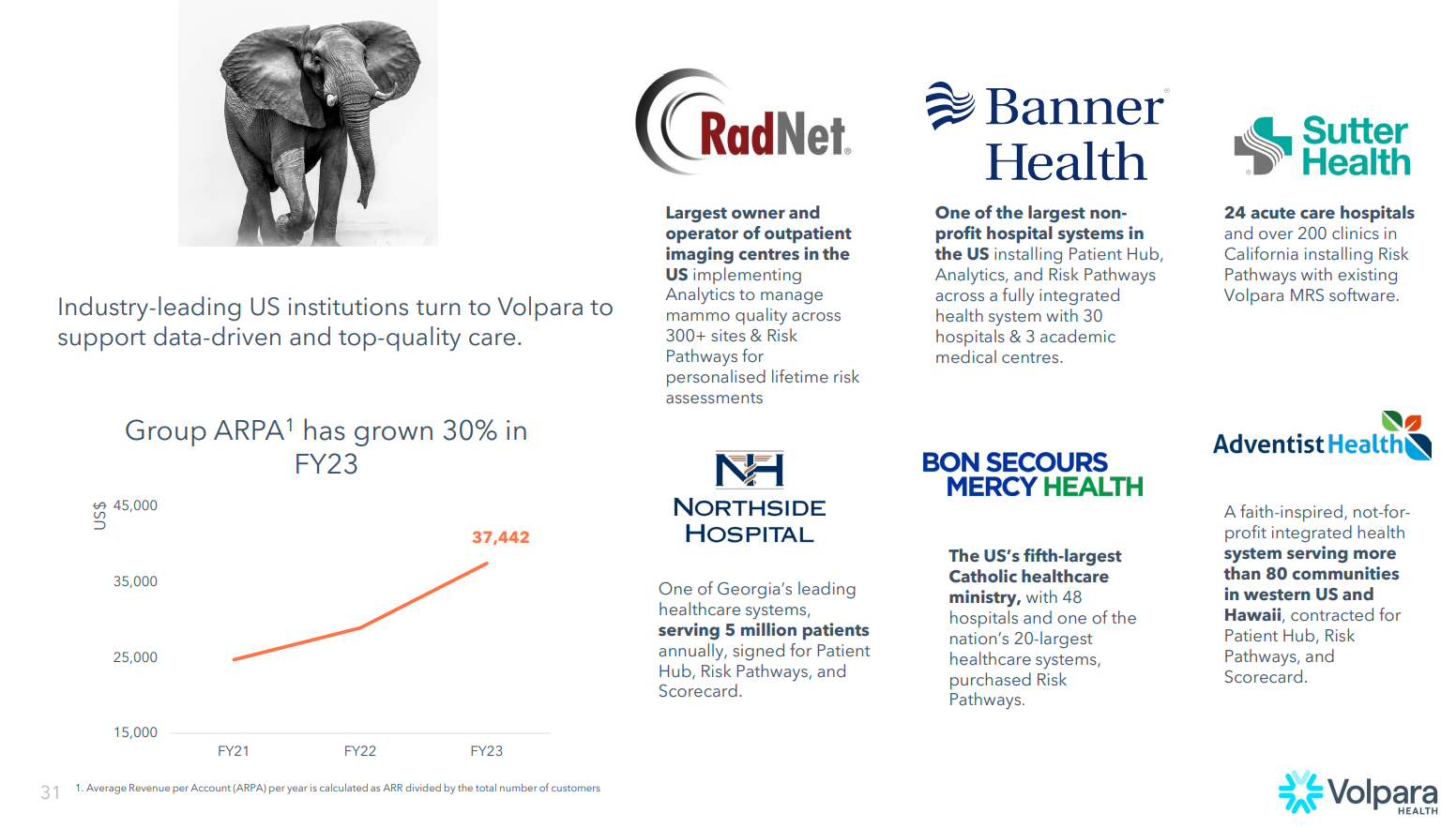

Under Teri, $VHT have shifted focus from ARPU (per user) to APRA (per account). ARPA increased 30% to US$37,442 in FY23, due to the focus on “Elephants”. Later, in the Q&A, CFO Craig commented that he saw this moving from $40k to $50k and even onwards to $100k.

Teri spent some time outlining the unique customer proposition of $VHT products, summarised in Slide 22 (“Uniqueness Defined”) much of which we have heard before, but it was good to see it pulled together.

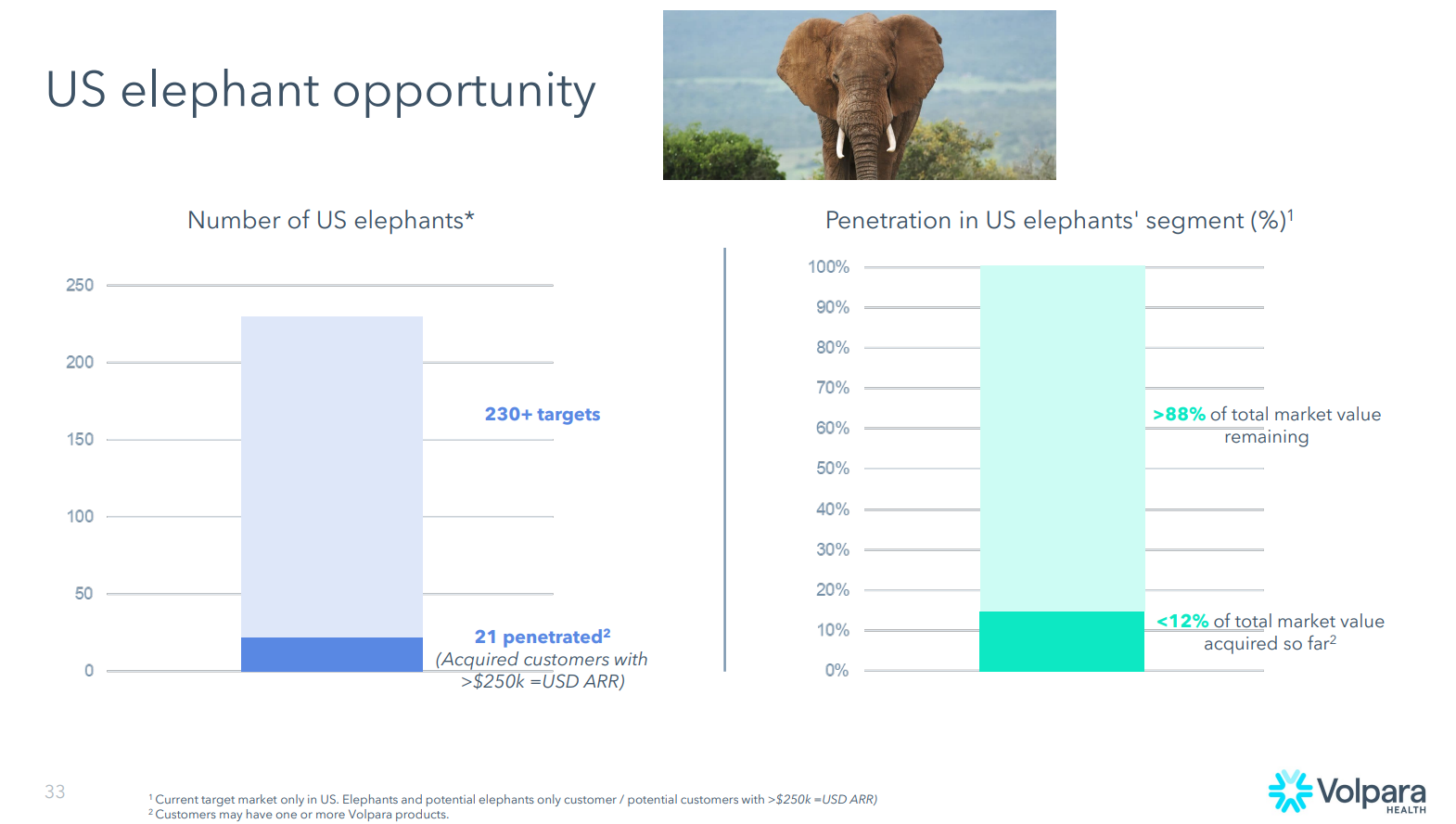

$VHT estimate that their penetration into larger institutions is only 10-15%, with 21 “elephants” signed up out of a total of 230+ identifed targets. In her words “… a vast untapped market, with over 85% awaiting exploration”. She noted “a considerable proportion of these institutions” that lack comprehensive risk programs or analytics.

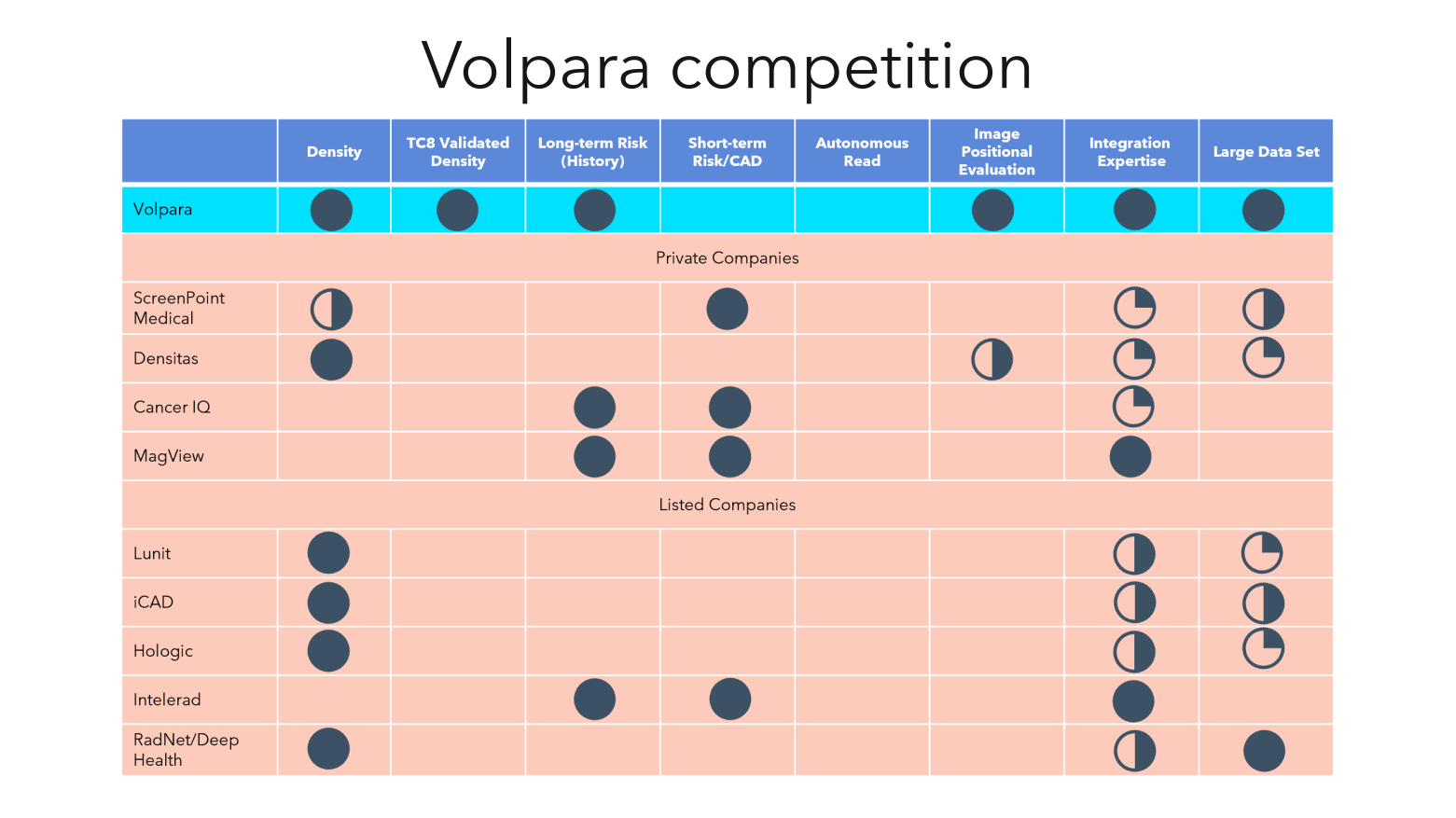

The competitive analysis (slide below- clearly, $VHT’s own view) was interesting. Teri did not discuss the significance of the gap in “Short Term Risk/CAD” and it was interesting to observe the currently blank “Autonomous Read” column. The latter is clearly the space that Transpera are working on. I missed the opportunity of asking Teri about the significance of these capability gaps, and what they mean for potential future $VHT technical (or commercial!) innovation. (I followed up with her on this after the meeting and will post the answer as a comment when I have digested it.)

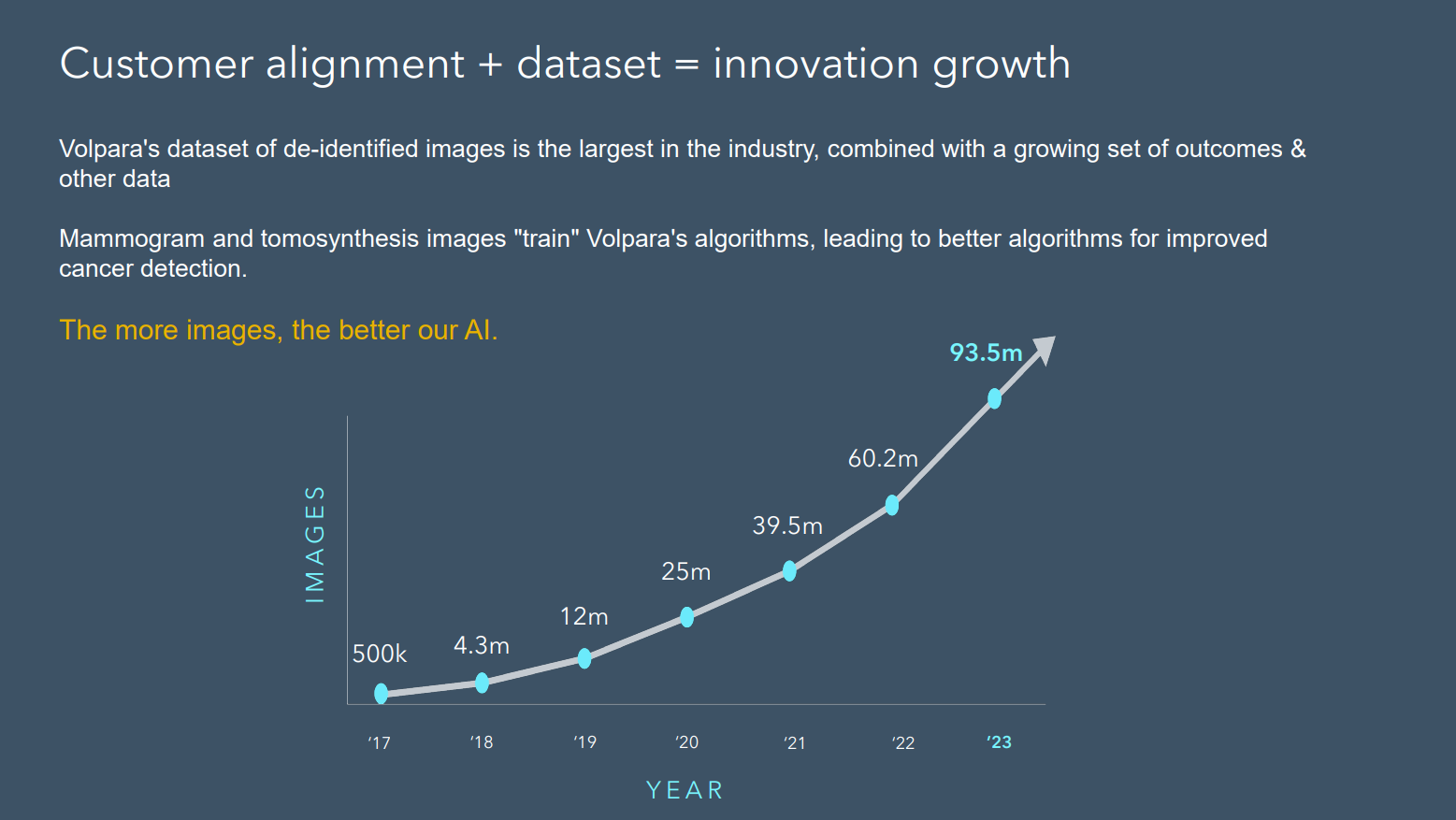

In addressing AI, Teri showed the following graph, highlighting the scale of the dataset on which $VHT’s algorithms are “trained” highlighting that some of the competitor efforts are training of dataset of hundreds or thousands of images. She was clear that this places $VHT at a strategic advantage, positioning them to improve the quality of their product offerings ahead of the competition.

New Products

Teri referred to the innovation pipeline, with efforts aligned closely with customers and key markets.

She gave a “sneak peak” of the next new product “Quiver”, which will be unveiled at RSNA (Radiology Society of North America Conference, November 2023). From the description, this appears to be a tool that streamlines mammography clinics operations (she says they refer to it internally as the “Binder Reduction Act” or BRA, ;-)), eliminating the need for "stacks of physical binders" and should save significant customer time. Teri says customers are “quite excited about this”. The product and other advanced modules are being incorporated into the overall code base, so it can be deployed across the existing customer base.

Quiver also has the advantage of “smoothing the onboarding of new customers to our analytics product”.

Teri summarised that not only are $VHT driving technical innovation, they are also focused on facilitating ease and efficiency for customers.

Overall, Volpara’s growth driver and product focus is aimed at mammography staff shortages, with some stats provided on this in the presentation.

On IP, the portfolio has 122 granted patents in 30+ countries with 26 applications in progress. There is copyright and 15 registered trademarks in addition. All this is a significant investment, if you peer into the accounts. All of this is in addition to the unparallel research validation in peer-reviewed journal citations.

An update was given on the public and private health screening in Australia, which is significant and growing, focusing on both density and risk. They plan to deploy the analytics capability they have been developing with $MSFT into Australia and NZ, so I expwect we will hear more about that in due course. Eventually, there will be a read-out from the QLD clinical trial, as well.

Q&A

There were few questions - nothing very insightful, apart from the one on ARPA, addressed above and ....

I asked my own question about the recent developments in Scandinavia (that we have been discussing here on SM), Teri replied:

"I'm gonna spend a lot of September in Europe and speak with some of the people that are running these programs. So we are in the research mode with the people that determine the standards in Scandinavia. It is a part of the world that everyone else is looking to as well, as they try to figure out some of the challenges with not enough radiologists and also not enough availability of MRIs for further scanning for people who have dense breasts. So the DENSE Trial and the SOBI recommendation was that for anyone who has dense breasts ought to get an MRI and that will save lives. But the next challenge was - OK, we don't have enought MRIs. So what we've been doing in Norway is studying what is the narrow band of density that is the most important for women to be able to go forward and get further testing including MRI. That will be concluding likely within the next year. So we will share publically when we can. But we are talking with some others about similar initiatives.

Part of the reason Teri is going to Europe is to figure out whether this is ready for a broader deployment versus still in the research phase. The key insight is that $VHT are directly involved with the actors at the cutting edge.

My Key Takeaways

I've seen every presentation since Teri took over as CEO, and this one deepened my understanding probably more than any.

I am encouraged that, in resetting the cost-base, Teri has maintained a strong innovation and product development engine, and that this is working hard at the cutting edge of research and AI exploitation. Both are essential if $VHT is to succeed in the long term.

Everything I heard today supports my investment thesis. I have a sense that patience here will be rewarded.

Held in RL (2.5%) and SM

$VHT AGM this morning at 10am AEST.

Presentation pack has some really great information that will be of interest to shareholders, including:

- Their assessment of the "Elephant" market potential ahead of them. It resets my understanding of US market penetration.

- Analysis of competitive positioning (which I think I have seen in another form in the past.

- Progress on the image dataset they have acquired (I won't mention 1st and 9th letters of the alphabet)

I'll be attending, but here are three interesting slides for those that cannot make it. It looks to be a really informative session.

Update on Australian breast density screening and reporting

Highlights:

• Following a successful trial, BreastScreen SA will use Volpara’s AI-based software to inform women of their breast density from 8 August 2023

• This is the first time in public breast screening in Australia that all women will be notified of their individual breast density regardless of the density category

• BreastScreen QLD is conducting a randomised controlled trial, using Volpara’s software, to assess the effect of notifying women participating in population-based breast screening of their breast density

My Assessment

Not material of itself, but a positive development. This is consistent with the annoucement earlier this year by the FDA of setting a deadline for including density reporting the US. As discussed earlier, there is a similar head of steam building in Scandinavian public screening (Norway &/or Sweden), and this is the first announcement for public screening in Australia.

The Volpara Density Score is the recognised gold standard and, so, if this tailwind keeps blowing, we may see more and more programs around the world adopting this approach, which overall will be good for $VHT. As public health programs apply it as the standard of care, I imagine it will also become the norm for private health as well.

I have no idea how material this is in the overall scale of things, but for sure, it is not a bad thing. Blow winds blow.

Are these related to the Scandinavian study Teri has spoken about? Are any StrawPeople across this?

AI offers huge promise on breast cancer screening: https://www.bbc.co.uk/news/health-66382168

And

https://doi.org/10.1016/j.breast.2023.03.010

Asking for a friend.

Dics: Held

Just off the call with Teri and Craig for the 1QFY24 4C results call. Teri was in her hotel room at Redmond WA, where she was the only partner speaker at the $MSFT Inspire Conference, speaking in the session ahead of Satya Nadella. $VHT picked up two $MSFT partner awards (Best Healthcare Partner and Best NZ Partner) and Teri was understandably proud of these achievements, and spoke about how $VHT continues to work with $MSFT to exploit AI technology with their vast dataset and the Azure AI platform, including outside of breast cancer, e.g., in cardiology.

To the results. Overall, I would describe them as a steady result, with the key point being that they came in just OpCF positive, which is a significant achievement given that Q1 is the heaviest cash outflow quarter of the year (staff incentives, annual contract payments). Given that in the past two presentation Craig had in particular guided us not to expect 1Q to be positive, it was a small positive surprise. To underscore the significance, the improvement in operating cashflow for 1Q vs PCP was +$3m and the FCF improvement slightly more.

Here are their Highlights from the 4C Report

Cash Highlights:

• Third straight net operating cash flow positive quarter, an improvement of 100% from a net outflow of NZ$2.8M in Q1FY23

• Volpara net operating cash flow positive since September 2022 – approx. NZ$2.4M

• Record Q1 cash receipts from customers of NZ$11.0M+, up over 27% compared to NZ$8.6M in Q1FY23 (or over 21% constant currency)

• Volpara heading towards being net operating cash flow positive in FY24 – a full year ahead of guidance

Software as a Service (SaaS) Highlights:

• Contracted Annual Recurring Revenue (CARR) now ~US$27.2M (~NZ$44.1M1 ), up US$700K on the prior quarter (Q4FY23)

• Annual Recurring Revenue (ARR) now ~US$21.5M (~NZ$34.9M1 ), up from US$20.9M in the prior quarter (Q4FY23)

My Analysis

This was a softer Q for new CARR added, up US$700k vs. what they normally expect to be around US$1m. Craig spoke about this being due to some changes in their revenue recognition, however, he went on to say that he expected to see an uptick in the 1H report which is audited. The was a somewhat opaque statement, from my perspective. They also spoke about some delays in new customer implementations, due to IT staff shortages at some customers. So, perhaps these items are related.

On new sales in the Q, the only "elephant" closed was VIC breast, althrough Teri noted that several others were "close to the gates" and that she expected them to close in the next Q. She cited the US heading into the summer period as a reason contributing to some deals not closing in line with their expectations.

Closing cash was down slightly to $12.1m from $12.7m, but as $VHT controls costs and progressively sees rising receipts, FCF should be expected to move more reliably into positive territory, unless there is investment in significant new capability, which I'd expect to be signalled to investors in advance. The stable cash balance underscores the recent decision to reduce the revolving credit facility, and Craig indicated that this should be reduced further over time.

Previously issued guidance was held to, both for FY24 ARR, EBITDA and to be operating cash flow positive for FY24, a year earlier than announced at their strategy refresh in July 22. On cashflow, Craig said that having been OpCF positive in 1Q - the toughest Q - they now expected to be reliably OpCF positive. That said, the lumpiness of cash flows from Q to Q means that a "surprise" negative quarter could not be ruled out.

On costs, Craig stated that cost would be flat at about $10-11m per quarter, albeit that there were a few positions to be filled with headcount expected to remain stable around 160. Teri added that the team are good at meeting their cost budgets!

On new business, Teri indicated that risk pathways is getting significant incoming enquiries. She noted that enquiries about density following the FDA ruling were not as strong as she had expected, although noting that this may be because there is still a significant time before the FDA deadline requiring density reporting.

My Key Takeways

A solid if unexciting result. It is good to see costs under control and management confident that they will stay under control.

Attention therefore can turn to the top line. It was a weaker quarter for growth with expectations set that 2Q will be stronger. I always pay close attention to this, as the proof of that pudding is always only 90-days away. A strong 2Q result would indicate that $VHT remains on track. A second weaker result might point to a lower overall revenue growth trajectory. That said, Teri and Craig has so far been true to their word, so I give them the benefit of any doubt.

The usual CF trend analyses are shown below, with the trends shown over the last 8Q only.

Overall, Teri and Craig are pleasingly consistent from quarter to quarter and continue to present as a good team.

Disc. Held in RL and SM

New contract announcement with BreastScreen Victorian, adding to major Australian customers.

Highlights:

• Five-year contract is for A$1.4M (NZ$1.53M1) in Total Contract Value (TCV)

• Contract includes Volpara® AnalyticsTM, artificial intelligence (AI) quality software that

assesses every mammogram image for appropriate positioning, compression, and radiation

dose

• BreastScreen Victoria, a public screening programme in Australia, diagnoses 37% of all

breast cancers in Victoria

I don’t recall $VHT’s threshold for an "elephant", but I’m pretty sure this counts as one. This adds to a good clip of significant contracts this year. Keep it up.

Note BreastScreen Australia is the national breast screening program, jointly funded by the Commonwealth and States and Territories. This adds to the SA and QLD parts of the program, so potentially there are still some other material jurisdictions that could potentially follow.

I also note Terri’s comment in the recent SM meeting about using the initiative in Norway to try and crack into the national screening programs in Europe. Good coverage in what is Australia’s national screening program would no doubt help credential that push. Good to see momentum here.

Disc: Held IRL and SM

Great meeting. So good to get deeper insights into Terri's strategic thinking and her experience. I find it so much more insightful when Execs talk about their business off script. We can always go to the investor calls for the scripted discussions. It makes the Strawman meeting process of much higher value especially when CEO's are back for repeat meetings. (Remember, SM Members can always view the recordings of the first meetings to get their 101s.)

I gained a much better understanding of the customer perspective and challenges in the buying decision."Understand the EMR context [at each customer]" and "mammography is not always the top of the priority list" and "you need a clinical champion" and "you have to show that adding Volpara doesn't increase the clinician workload". (This latter point was also a key theme at an $M7T webinar I attended recently, and post the link to on SM.)

Craig mde a great point: if you can control the cost base while delivering at least 20% revenue growth every single year, you'll do well.

Most of all, I was further encouraged by Terri's disciplined and focused approach to growth and the fact that she cited by EPIC and $PME as role models for growth. Terri and Craig seem to make a great team - so important for the CEO/CFO dynamic to work well.

The imaging software space is clearly going to be very dynamic for years to come, and this is even more reason to value Terri's disciplined approach to screening new opportunities.

Thanks for another great meeting. I'm glad I got back onboard last year.

$VHT reported their FY23 Annual Results. Investor call at 10am.

Given the detail provided in the 4C quarterlies, there are no surprises, so I'll keep this brief. Continued strong revenue growth with effective cost control leading to a narrowing of the NPAT loss from (NZ$16.441m) in FY22 to (NZ$9.801m) in FY23. Confirming guidance to be EBITDA positive in FY24 with a range NZ$0.5 - NZ$2.0 m.

Their Highlights

• Volpara achieved record revenue from customer contracts, surpassing the guidance and reaching NZ$35.0M, up 34% (20% constant currency). Initial guidance ranged between NZ$33.5M and NZ$34.5M.

• Normalised non-GAAP EBITDA1 improved 57% to -NZ$6.1M

• Net loss for the year after tax showed significant improvement of 40% to -NZ$9.8M

• Volpara sets guidance for FY24 constant currency revenue of between NZ$40.0M and NZ$42.0M, up 15% to 20% on FY23

• Volpara guides to FY24 EBITDA1 range of between NZ$0.5M and -NZ$2.0M

My Observations

Closing cash at year end is NZ$9.711m, which is actually up on EOFY22 of NZ$9.676m, courtesy of NZ$1.125m exercise of share options. So not strictly cash flow positive, but with continued momentum and operating leverage into FY24, it looks like $VHT's cash burning days are behind it, i.e., bang on the cash flow inflection point.

From a quick scan of the accounts there is nothing unusual, i.e., no impairments on acquisition goodwill.

We are now at a position where over the next year we can see how revenue and costs scale from a stable base. I will look to increase my holding if this supports a strong valuation, so not before 1H FY24 result.

Disc: Held IRL (2.0%) and SM (2.9%)

I'll be increasing my SM holding today to reflect that my SM positions are usually 3-4x my RL weight.

$VHT presented their 4th quater 4C today, with the FY results to follow in a few weeks. Overall, a good result.

Their Highlights

Cash Highlights:

- Second straight positive net operating cash flow quarter– NZ$0.4M. Volpara has been net operating and investing cash flow positive since September 2022 – approx. NZ$1.0M.

- Net operating and investing cash outflow1 in Q4FY23 of NZ$0.2M, an improvement of 92% from a net outflow of NZ$2.9M in Q4FY22

- Record Q4 cash receipts from customers of NZ$10.0M+, up over 25% compared to Q4FY22 (or over 19% constant currency)

- Cash receipts from customers in FY23 are NZ$38.6M (unaudited), up over 35% compared to FY22 (or approx. 22% constant currency)

Software as a Service (SaaS) Highlights:

- Contracted Annual Recurring Revenue (CARR) now ~US$26.5M (~NZ$42.4M2), up approx. US$900k on the prior quarter (Q3FY23). A record net new CARR added in FY23 of US$4.3M (NZ$6.9M).

- Annual Recurring Revenue (ARR) now ~US$20.9M (~NZ$33.6M2), up from US$19.9M in the prior quarter (Q3FY23)

My Observations

This was the second consecutive quarter of operating cash flow positive. While receipts were down on the "bluebird" (Craig Hadfield's words) 3Q result, they were still up strongly over the PCP. This had been well-signalled last Q.

They reiterated that they will not be OpCF positive every quarter, and Terri made clear that with staff bonuses paid out in Q1, they expect Q1 to be OpCF negative. Craig Hadfield stated that they are about six months ahead of their goal of being CF positive by Q4FY24, and that they will be full CF positive in FY25. With good cost stability now established and good deal flow over the last year, this objective now looks very do-able.

Our good friend Claude Walker asked if they have a goal of generating positive net income. Craig pointed out that due to historical acquisitions, there will be a non-cash drag on financial performance that will take some years to work through as goodwill is amoritised. This doesn't bother me, as that is all sunk costs, even though it may put off into the future the day when $VHT can be rated on an earnings multiple.

With ARR, CARR and ARPA all trending in a positive direction, $VHT is headed in a direction where it will start making money. Thanks to FX, government grants, and exercise of options, cash on hand actually increased in the quarter. I think this is a first where this has not been due to capital raisings!

I have included the usual CF trend charts below, on quarterly and trailing 12 months (TTM) bases,

My Takeaways

A good result on all fronts. Quarters will continue to be lumpy, but overall $VHT is headed in the right direction under Terri's steady hand of focusing on customer value, large accounts, and tight cost control. My confidence is increasing and today I have increased my small position IRL and SM.

Figure 1

Figure 2

Figure 2

Note: Excludes Lease Payments in reported in Financing CF (most recently $143k)

Another contract expansion/extension.

An additional US$1.25m over 5 years, is an additional $0.25m CARR. Given that the total CARR is now reported as US$0.44m, then the original contract CARR appears to be US$0.20m. So, if I am interpreting this correctly, it is a sizeable expansion. (I'm not sure if the Banner contract had previously been broken out).

On the one hand it is great to see existing customers extending and expanding their use of $VHT's products, and buying more of the full suite of functionality, indictating that ARPU growth is likely to be a significant value driver (as Ralph Higham consistently asserted over the years).

On the other hand, this and the earlier annoucement last week, appear to indicate that $VHT are announcing every significant deal. I'm not sure that an incremental $0.25m of CARR is material in the context of the HY23 total CARR = US$24.1m (i.e., c. +1%). It is hard to see why this warrants a price sensitive ASX announcement. Does it draw attention to an absence of deal flow on new "elephants" since the five announced in early January ?

Overall, good news, but you can take both a glass half full and a glass half empty view. Let's see what the 4C looks like in a couple of weeks time and the FY in late May.

Disc: Held IRL and SM

Full text of the annoucement

Volpara expands agreement with Banner Health to a five-year, full system contract

Highlights:

• Five-year contract represents an additional US$1.25M (NZ$2.0M1 ) in Total Contract Value (TCV) over initial five-year period and expands existing Contracted Annual Recurring Revenue (CARR) to US$440K (NZ$705K1)

• Banner Health is one of the largest nonprofit hospital systems in the United States

• Initial five-year contract includes Volpara Patient Hub™, Risk Pathways™ and Analytics™ software

Wellington, NZ, 11 April 2023: (“Volpara,” “the Group,” or “the Company”; ASX:VHT), a global leader in software for the early detection of breast cancer, today announced that it has signed a five-year contract with Banner Health, one of the largest nonprofit hospital systems in the United States, representing an additional US$1.25M in TCV (NZ$2.0m1). CARR now totals US$440K (NZ$705K1).

The contract expansion includes upgrades and new installations of Patient Hub, Analytics and Risk Pathways software across the Banner Health network.

The fully integrated health system operates 30 hospitals, including three academic medical centers and other related health entities and services in six states: Arizona, California, Colorado, Nebraska, Nevada and Wyoming.

Volpara Group CEO Teri Thomas said: “We are proud to expand our relationship with Banner Health and extend Volpara software to all their locations. This standardisation of care and implementation of new capabilities will help deliver more personalized care, find more cancers and identify high risk patients sooner so they can receive recommended interventions. We look forward to working with Banner Health to help save more families from cancer.”

Installation is expected to be completed within the next 9 months. The contract includes annual payments and is expected to contribute to revenue growth in FY24. Consideration paid upon signing is not considered material.

Authorisation & Additional Information

This announcement was authorised by the Board of Directors of Volpara Health Technologies Limited.

@Seymourbutts gave the heads up earlier today on the $VHT contract extension/revision. In this straw, I aim to get into the details of what is means.

Today, the customer is revealed as Akumin - a leading US provider of outpatient (i.e. walk-in) radiology services. The original deal was announced on 5-Oct-2021, as a US$2.15m, 5-year deal with an ARR of $0.43m. At the time, it was $VHT's largest deal - one of their first "elephants". There was no mention of a volume component to that contract.

With approximately 3.5 years to run on that deal, the remaining TCV would be $1.5m if the contract is amortised on a linear basis from the annoucement date. (This is a finger in the air, as it is not clear what the effective date of the original contract was or the payment structure.)

That remaining $1.5m for 3.5 years is the same as the announced headline today, which is for a re-set 5 year term. So, at the headline level, the deal has shrunk!

However, what's new is this announcement is 1) the potential volume-related upside of $1.25m of value, via a revenue share arrangement and 2) the replacement of "Patient Hub" with "Analytics" - which according to the release delivers enhanced capability to support the breast density risk assessment, which will in future be mandated across all States via the recent FDA ruling.

If the maximum revenue is achieved, the new deal is worth $2.75m, an increase of 28% for a 5-year term. If no volume upside is achieved, then the deal is a reduction of 31%.

So that maybe explains the negative market response, after the initial positive response this morning.

What no-one knows, except Akumin and $VHT, are the historical and projected volumes. And maybe even they don't know for sure, given that demand for radiology services was hit during COVID, with the backlog still working through.

And so I think the market doesn't have the basis to make any judgement about this deal one way or the other, beyond the term extension of 1.5 years and indications that $VHT's advanced analytics are in demand, presumably as a result of the recent FDA ruling.

On balance, I see this development as mildly positive. But more important will be the forthcoming 4C update in a couple of weeks.

Interested if any other StrawPeople who follow $VHT closely have other views on this.

Disc: Held IRL and SM.

Just watched Teri Thomas present at ASX Small and Cap-Caps.

Nothing significant to report.

Key Takeaways

- Reiterated that in remaining Q of FY23 and through FY24, lumpiness of some key payments means that they will fluctate either side of CF breakeven

- Expect to be cashflow positive for FY25 overall

- $12m cash + $10m undrawn debt facility. Teri doesn't expect to have to use the debt to get to sustainable cash generation

- Managing costs well, expecting only a gradual increase over time

- Expecting recent FDA ruling on breast density to have benefits internationally, beyond USA, including in ANZ

Overall - guidance on track.

(I was slightly annoyed that my question on the state of the "elephant hunting" pipeline went un-asked by the moderator. There, venting done.)

I enjoyed the presentation - one of the best explaining what $VHT does. Teri is a great comunicator. Worth watching the recording when it is up on the ASX site.

Where I stand on $VHT

As my SM history shows, after several years as a holder, I gave up on $VHT in the belief that it was a basket case. With already >33% of the massive US market and unable to make money and cash burn in the wrong direction. That was Aug 2021, and I'd given them 4+ years IRL and followed progress closely.

Late 2022, enter Teri, Ralph focused back on the science, costs quickly rebased, an "elephant hunting" strategy yielding good early results, and a maiden CF positive quarter, I re-entered at $0.82 on SM (RL tranches at $0.77 and $0.74).

At an EV/Revenue multiple of 6x, its not exactly cheap. However, I feel a <2% position for what is still in my view a high risk stock (in terms of delivering a material return) is the right place to be. Once it starts demonstrating progress towards consistent cash generation, it will re-rate and I have decided to position myself early for that eventuality because I have confidence in Teri.

$VHT will never be a $PME, Its economics just don't match up. But if it can continue to catch elephants, and benefit from the FDA density ruling, I believe it still has the potential to grow into a quality business. Remember - this usually takes time.

Disc: Held in RL (1.8%) and SM (1.5%)

Further to the straw by @Nnyck777 below is the release from $VHT.

Over the years, former CEO Ralph Higham was perpetually touting this as being around the corner. As with each reporting period it didn't materialise, I think many of us started to see this as a "crying wolf" scenario. It has finally arrived, with an 18 month implementation timeline.

This is potentially a very significant tailwind for $VHT, likely to result in new customers but also increasing the ARPU of existing customers as they expand their subscriptions to include density risk assessment and reporting capabilities.

Disc: Held IRL and SM.

ASX RELEASE

FDA Breast Density Reporting Rule Released

Volpara software is used to assess the breast density of more than 6 million US patients annually Wellington, NZ, 10 March 2023: Volpara Health Technologies (“Volpara,” “the Group,” or “the Company”; ASX:VHT), a global leader in software for the early detection of breast cancer, today announced that a new US federal regulation was finalised by the US Food and Drug Administration (FDA) requiring mammography facilities across the country to inform patients whether their breasts are composed of dense tissue. The regulation standardises language and expands the number of states with density disclosure laws nationwide.

National Notification Ruling Within the next 18 months—by 10 September 2024—all patient reports and summaries must include the following language about breast density:

• Non-dense breast notification states: “Breast tissue can be either dense or not dense. Dense tissue makes it harder to find breast cancer on a mammogram and also raises the risk of developing breast cancer. Your breast tissue is not dense. Talk to your healthcare provider about breast density, risks for breast cancer, and your individual situation.

• Dense breast notification states: “Breast tissue can be either dense or not dense. Dense tissue makes it harder to find breast cancer on a mammogram and also raises the risk of developing breast cancer. Your breast tissue is dense. In some people with dense tissue, other imaging tests in addition to a mammogram may help find cancers. Talk to your healthcare provider about breast density, risks for breast cancer, and your individual situation.”

The ruling also specifies the language about breast density in reports and summaries for healthcare providers is to match the BI-RADS® 5th Edition density categories.

“The FDA breast density notification language is a key step in equitably empowering all women in the United States to understand their breast density so they can take informed, actionable steps to monitor their own breast health,” said Teri Thomas, CEO of Volpara Health.

Opportunities for Further Accuracy & Empowerment

Nearly 40 million mammograms are performed each year in the US of which Volpara’s software today is used to assess the breast density of more than 6 million annually. The FDA ruling acknowledges advancements in density classification devices to help mitigate variability in assessment.

Volpara’s volumetric breast density assessment software to support physicians has long played an increasingly important role in making accurate, objective assessments of breast density possible. The Volpara® TruDensity™ physics-based AI algorithm is cleared by the FDA, Health Canada, and the TGA (Australia), is CE-marked, and has been validated in more than 400 articles and research abstracts.

“We’ve been working with leading clinicians and researchers around the world for more than a decade to make critical information about women's breast composition and its link to breast cancer more readily available," said Thomas. "The FDA regulation validates our focus, increases the industry’s attention on breast density, and propels us forward to improve both the patient and provider experience and understanding.”

Volpara’s Thumbnail™ module goes beyond simple notification to help providers go the extra mile to help patients. The module enhances patient mammography results letters with two images of the patient’s breasts and explains what breast density means in simple-to-understand terms and visuals.

About Breast Density

Dense breast tissue is common but has been linked to an increased risk for breast cancer and can also dramatically impact early detection. In the United States, nearly half of all women over 40 have dense breasts. As density increases, the accuracy of mammography decreases. According to a study published in Radiology, mammography misses almost half of breast cancers in women with the densest breasts. Because dense breast tissue and cancer appear white on a mammogram, tumours are often camouflaged on a mammogram. Studies confirm that early detection improves when women with very dense breasts receive an ultrasound or MRI exam in addition to mammography as part of their regular screening schedule.

Authorisation & Additional Information

This announcement was authorised by the Board of Directors of Volpara Health Technologies Limited.

ENDS

$VHT issues a "Business Update" this morning, the main news being the expansion of an existing contract - always good.

Overall, it is good news, but I don't know why the announcement has been marked as price senstive. Individually and collectively, the content is not material IMO.

@Noddy74 - one of the items relates to what they are doing with AI (per your recent straw). Interesting in that there is also mention of $ALC and Microsoft.

Summary of highlights from the announcement:

• New contract with Sutter Health for Risk Pathways product represents an additional US$900k (>NZ$1.4M1) in Total Contract Value (TCV) over initial threeyear period and expands existing Contracted Annual Recurring Revenue (CARR) to US$374K

• Presentations and posters presented at the European Congress of Radiology (ECR) validate Volpara software

• Volpara participating in an AI in Healthcare panel discussion with Microsoft and Alcidion (ASX:ALC) in Sydney today

Disc: Held IRL (1.3%) SM (1.2%)

See @Slew 's straw for all the relevant details on $VHTs quarterly results call.

As I have been tracking it for so long, and was a former shareholder, I'm posting my updated 4C analysis.

Bottom line - the new CEO and elephant strategy not yet flowing through to cash results - albeit recognise it might take a while.

While the 4C says they have almost 7 quarters of cash, as you can see, they have significant ongoing development spend of $0.4-0.7m per Q, say $2m per year.

We've now had a run of 5Qs clean from acquisition costs. Still no trend towards making money any time soon.

Like @Slew, I hope they suceed given their service to helthcare, but I wonder if this was better taken out by a larger player in the space, wipe the management and board costs, get some sales and marketing synergies and become part of a profitable business.

Otherwise, I fear another capital raising within a year.

Disc: Not held.

Some takeaways from the Meeting ... just a few key ones.

- New CEO appears to have in-depth experience in the space, and understands the clinical workflow well, as well as the positioning of competitor products (hardware, software etc.) She is also a very personable and charasmatic individual.

- The two acquisitions have not been fully integrated; so there is a cost-out opportunity to be addressed. This will could be tricky to manage well, given need to retain top talent in the breast space.

- Terri perceives that "customer success" is a gap. Customer success being helping your customers to get the most out of the product after going live, and thereby maximising revenue growth from existing customers. (Picked out the "go live" mentality as an endpoint versus the beginning. Current culture driven by new customer acquisition).

- Terri sees a more strategic focus on the "elephant accounts" ... the finds of entities that $PME does deals with, I think

- Both Terri and Craig sound confident about the strategic moat around the company's breast IP

- Craig CFO clearly understands that attempting to raise capital at the current SP would be a disaster in the current market. With the contingency credit facility, it sounds like they have 2.5 years to really turn things around. Should be doable if Terri is right in her assessment of the oppotunity in customer success.

- Heart and MicroSoft collaboration sounds like some nice "blue sky" opportunity

I was encourage by what I heard; it confirms my hypothesis that new CEO will bring a sharper commercial focus to the business.

If successful, then $VHT is worth something and likely a lot more than today's SP. But even if I miss the first 30% of the recovery, I want to see some evidence of delivery. So, I remain on the sidelines, and will eagerly await 1) result of strategic review in July and 2) next 6 months result in November.

Disc: Not held in SM and IRL

Further to the results (posted by @Learner) I have updated the quarterly cashflow trend chart.

Unfortunately, there is still no sign of operating leverage, with costs growing broadly in line with revenue, meaning that operating cash burn remains in the middle of its long run range of -$2 to -$4m per quarter. i.e. no line of sight to cash breakeven.

New ARPU of $2.04 appears to be sitting at about the average of the last year, indicating no serious trend towards the vision of $10.

I remain on the sidelines for VHT, as I don't see it on track to become a cash generative business.

DIsc: Not held in SM or IRL

Post a valuation or endorse another member's valuation.