18-April-2023: EGL-Acquisition-of-Airtight-and-Capital-Raising.PDF

Plus: EGL-Investor-Presentation---Acquisition-of-Airtight--Raise.PDF

EGL to acquire Airtight Solutions funded through a $8.0 million institutional placement

Highlights:

- EGL to acquire leading Australian air pollution services provider Airtight Pty Ltd (“Airtight”) for $7.0 million plus up to $5.0 million earnout based on FY24 earnings [The earnout payable will be equal to the amount by which Airtight’s FY24; EBITDA (calculated on a pre-AASB 16 basis, noting that cash rent is expected to be $0.3 million) exceeds $1.35 million, multiplied by 5, up to a maximum of $5.0 million];

- Acquisition represents a major expansion of EGL’s presence in the air pollution control market;

- Airtight focuses on smaller low-risk projects with recurring cash flow in the light industrials sector, diversifying EGL’s revenue and expanding EGL’s client base;

- Revenue synergies from cross-selling with EGL’s TAPC and Waste Services divisions, and the opportunity to grow service revenue through Tomlinson personnel and experience;

- Highly experienced and capable leadership team and excellent cultural fit;

- Acquisition of Airtight is expected to be more than 15% EPS accretive to EGL shareholders on forecast FY24 pro forma earnings (before any synergies);

- EGL will undertake an equity capital raising of up to $9.0 million, comprising a placement to raise $8.0 million (“Placement”) and a subsequent Share Purchase Plan to raise up to a further $1.0 million (“SPP”); and

- Proceeds from the Placement and SPP will be used to support the acquisition and growth of Airtight.

Strategic Acquisition and Capital Raising

The Environmental Group Limited (ASX: EGL) today announced that it has signed a binding agreement to acquire 100% of the shares in Airtight for $7.0 million plus earnout. Airtight is a leading Australian air pollution services provider in the mid-tier market. Airtight was established in 2002 and operates under the name Airtight Solutions.

Background on Airtight

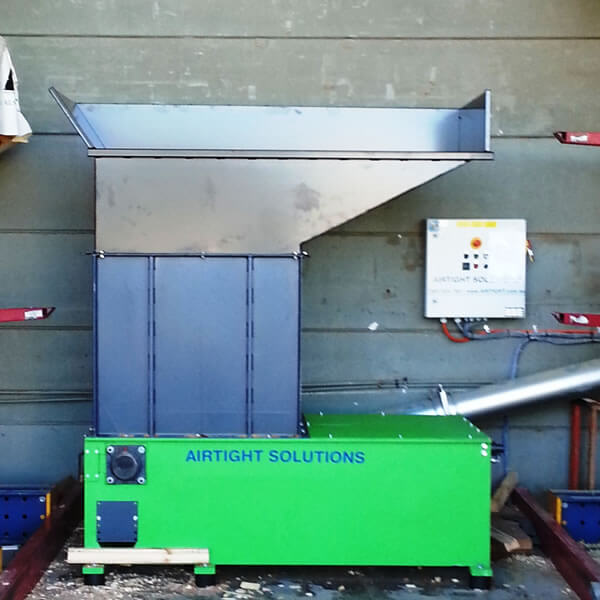

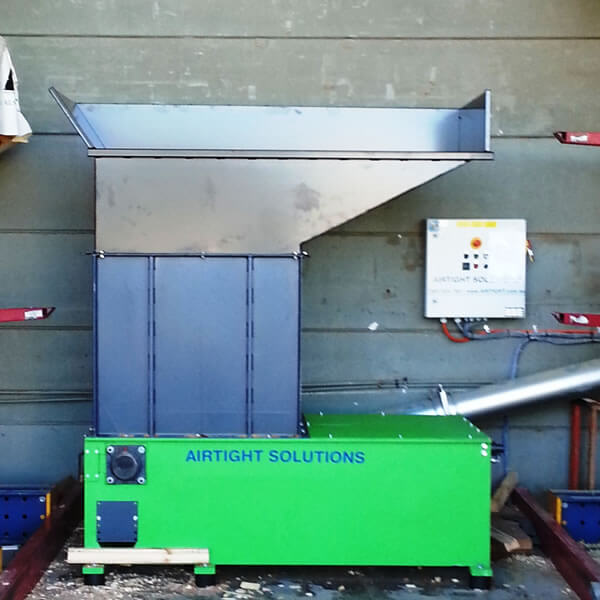

Airtight is one of the largest specialist air pollution control companies operating in Australia, with an extensive track record and a focus on reliability, premium service and safety. Established in 2002, Airtight was formed by senior air pollution control engineers who recognised a gap in the mid-tier market for air pollution control in Australia.

The key divisions include:

- Dust & Fume Control – specialises in designing, installing and maintaining air pollution control equipment;

- Engineered Solutions – offers engineering resources required to deliver pollution control projects;

- Aftercare Servicing – offers preventative maintenance & servicing packages; and

- Waste-to-Energy – offers extensive range of waste reduction technologies.

Airtight serves several key client industries including automotive, agriculture, manufacturing, joinery, metal & polishing, food & pharmaceutical, paper & printing and recycling & waste recovery.

Airtight is headquartered in Wetherill Park, NSW and operates in Sydney, Melbourne and Brisbane. Airtight has approximately 40 staff across these offices.

Strategic rationale

The acquisition represents a major expansion of EGL’s presence in the air pollution control market.

- The acquisition expands EGL’s solutions offering to include small and medium size airborne dust collection solutions and associated services and products;

- The acquisition captures sections of the market outside of TAPC’s existing target network, as well as providing industry diversification;

- Significant cross-sell opportunities with EGL’s TAPC and Waste Services divisions, plus opportunity to leverage Tomlinson personnel/experience to grow EGL’s service offering; and

- Airtight’s management team is highly experienced and culturally aligned to EGL, and is expected to add significant depth to EGL’s operations.

EGL’s Chief Executive Officer Jason Dixon (who has been interviewed here on Strawman by Andrew - see Meetings and scroll all the way down to Friday October 8, 2021, 12-2pm AEST) said: “Airtight represents a unique opportunity for EGL to expand significantly in the air pollution control market. Having high quality staff with great reputation in the market, Airtight’s strength lies within its focus on the lighter industrials market, which complements TAPC’s heavy industrials sector focus.”

“The acquisition will provide EGL with greater diversity in its business and service offerings, broadening our customer base and further improve the consistency of cash flow.”

See EGL-Acquisition-of-Airtight-and-Capital-Raising.PDF for the remainder of this announcement, which includes the Transaction Summary, Financial Impact, Placement details, SPP details, and the indicative timetable for all of that.

Sounds like a good fit to me. I hold EGL shares both here on SM and IRL, since shortly after that 2021 interview with Jason Dixon here.