Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

EGL results released on the 20th Aug has provided me with concern and optimism.

Concern.

As @Slideup , @mikebrisy , @Bear77 eluded to there are question marks on the transparency of the cost overruns in Singapore and the notion that they are one off. Adding the acquisitions undertaken over Jason Dixon's reign and questions of competency are fair to ask.

I would also add the renumeration and focus on EBITDA as the financial metric in which is featured heavily throughout the rem report / annual report and it puts into question how shareholders are being prioritised ?

A good current comparison to EGL is Stealth Group under the leadership of Mike Arnold . The transparency and alignment from Chairman to Mike and the leadership team is evident and consistent with the reports produced. The focus on profitability is consistent and thus the EPS and FCF have improved markedly. Its little wonder the share price performance has 5-6x over the past 18months.

Based on what EGL released and guided for i am holding my position with a positive frame of mind.

Optimism looking forward.

Guidance by Jason for FY26 is EBITDA to come in at 15-20% higher than 2025 or in a range of 12.76m to 13.32m. Allowing for a 6% increase in SOI to 396m this would translate to a EPS of between 1.38c - 1.44c or 12%-17% increase.

Scenario 1.

Examining the FY25 results they were mixed but what stood out was the H2 improvement versus H1.

H1 saw revenue of 54.2m and a EBITDA of 3.9m or 7.19%

H2 saw revenue of 57.7m or 6.4% higher however EBITDA was 7.2m or 12.47%.

If i reading the commentary correctly this is a 73.5% uplift in H2 EBITDA compared with H1.

If this was simply replicated for the FY 2026 assuming a 10% lift in revenue to $123m EBITDA would be 15.33m or 38% higher than 2025.

Allowing for a 6% increase in SOI to 396m (which has been the average increase over the past 3 years) EPS would increase 1.66c or 32%.

If these results were to flow through the current SP reflecting 21x 2025 EPS is attractive. A 21 PE multiple on a 1.66c EPS = 35-36c SP.

Scenario 2.

Looking divisionally on how EGL 2025 results unfolded and what we can be reasonably be expected for 2026 based on the guidance and trend underway this scenario also dwarfs the EBITDA guidance Jason Dixon provided.

EGL Air - revenue to remain flat at 19.4m for FY26 and EBITDA to come in at 9% = $1.74m.

EGL Energy - revenue to climb 15% to 56.5m and EBITDA margins to equal 2025 @ 13.7% = $7.74m

EGL Baltic - revenue to rise 10% to 38.6m and EBITDA to rise to 15% from 10.8% in FY25 reflecting the cost overruns in Singapore . EBITDA to come in at $5.79m

EGL waste - revenue to rise 20% on 2025 to 4.16m and EBITDA margins to hold at 45% = $1.87m

Group results would see revenue rise to $118.66m or 6% (which is modest) and EBITDA rise to $17.14m or 54%. This reflects the operating leverage obtained in scaling up and anticipated sound executing on any implementation work .

(this is optimistic but not out of the realm of realistic)

Translating this to NPAT at past three years margins equates to 7.37m and EPS of 1.86c which is a 51% increase.

At a 21 PE = 39c.

Disc : Held IRL & SM

25-Nov-2022: I'll make this one brief. 37 cents per share within 5 years (i.e. by November 2027), but ideally I'd like to see them trading at those levels or above within three (so by November 2025). I think they can, and I think they probably will. I am an EGL shareholder both here on SM and in real life as well.

I've articulated some of what I like about the company (and part of the investment thesis) in various straws I have posted here.

Friday 09-June-2023: Update: "Stale" is it?!? Well, OK then. Nah, Yeah! All good. Reactivated. Still holding this one. Still like it a lot. 37 cps by November 2027 - Sure! Yep! ...and then some!

Wednesday 21st February 2024: Update: Marked as stale. All good. No change to my target price. They reported today: Half-Yearly-Report-and-Accounts.PDF and released the following two days ago: EGL-Kadant-PAAL-Agency-Agreement.PDF - no problems with any of that. All good. Onwards and upwards. Still Holding.

Thursday 29th August 2024: Update: FY24 Report All good. I've posted a straw here about there their Full Year (FY2024) results. No change to investment thesis except I can now raise my price target because they've reached my previous one (of 37 cps). Now 42 cps. Onwards and upwards.

Wednesday 26th March 2025: Update: Marked as stale again. No change to 42 cps PT, and that's still for November 2027, as before.

They've been sold down on a single project cost blow-out which they said was due to a failed internal process to keep track of project modifications, and they've since addressed that issue so it can't happen again. Not wonderful, but also not a thesis breaker. Also their H1 results for FY25 underwhelmed, including their full year guidance, so they were sold down again. Volatility presents opportunity.

I do hold EGL and I have high conviction on this one, based on what Jason and Paul did at Tox Free prior to selling that business to Cleanaway in 2018. Cleanaway paid $3.425 per Tox Free share in cash which valued Tox Free's fully diluted equity at approximately $671 million. The total value including Tox Free's net debt was $831 million.

What Jason has done as CEO of EGL is bring much-needed cost discipline and a strong focus on both upselling and cross-selling, along with a laser focus on profitability which means they don't lower their prices just to keep busy - they maintain margins and build safety margins into their tenders. This has been most evident in EGL's improved margins over the past couple of years.

In terms of that laser focus on profitability and good margins, the laser strayed somewhat on that one project over in Singapore where there were delays and cost blowouts in the delivery and installation of two gas turbine silencers and an exhaust gas system for a client. EGL said that much of the additional costs related to modifications that became necessary to allow these large units to be transported from the port to the client's site in Singapore, rather than the installation itself, however EGL's internal systems failed to keep track of those additional costs and pass them through to the client. All fixed now apparently, but it was a big job, and they did lose money on it, so lessons have been learned through that experience clearly.

This was EGL's Baltec Inlet & Exhaust Systems (Baltec IES) division, and there were no such issues across any of EGL's other divisions, and I have reason to believe that the issues they experienced in Singapore are unlikely to be repeated with Baltec IES in the future, so my view is that my investment thesis is still solid, despite this hiccup.

As far as their future growth possibly slowing, I think I need to give them another year or two to see if that is indeed the case or whether FY25 is just an aberration in an otherwise stellar growth trajectory. I'm leaning towards the latter right now.

Interesting move today:

They were up +8.89% today, but that's just 2 cents/share up, and there's a 2 cent gap between the highest bid and the lowest offer so they could have gone either way in the CSPA at 4:10pm.

The more interesting thing for me is that the heavy selling volume appears to have moved up to 26 cents. In fact the 4 sell offers @ 26 cents account for 83.8% of ALL of the volume on the sell side. That's significant!

Of course, that will likely all change when trading resumes in the morning, but when you combine the short term uptrend shown on the right of that graph (19 to 24.5 cps) with that large sell volume moving up and away from the last traded price, it certainly suggests that sentiment towards EGL might be swinging from negative to a bit more positive now.

Time will tell. I'm not buying here. I have enough. 22.5 cps and below was the time to be loading up IMO.

Disclosure: Holding, both here and IRL.

21st August 2025: Updating Price Target post FY25 Results:

I'm lowering my price target to below EGL's current price. I've lost conviction in this company based on their latest reported numbers.

I sold my EGL & 27c/share yesterday - it was only a small position - and I sold my larger position here on SM at today's 26c/share closing price, so I no longer hold any EGL. I shared my reasons in a straw last night, which I'll copy in here below now:

20-Aug-2025: Having been through EGL's FY25 results (Appendix 4E, 20/08/2025 – Annual Report to Shareholders, FY25 Financial Results Presentation) - I saw a few orange flags there, particularly the precipitous drop-off of their Clean Air division EBITDA (-50.9% yoy) which they are blaming on challenging lithium markets - I would hope that division has a much broader addressable market than just the lithium sector.

We know about their cost blow-out with Baltec IES, but a -19.1% EBITDA decline on the back of a +31.9% increase in revenue in Baltec means a major margin compression there.

EGL Energy was good, and EGL Waste was terrific to finally see some traction there after bugger all happening there in prior years, however I also took note of @Wini's comments about their declining cash balance (they have no cash now) and 20% of their revenue sitting as work in progress not aligning with what management are saying: that over 50% of revenue is now recurring maintenance.

"This feels like aggressive revenue recognition to me, overstating earnings through the P&L."

See Wini's post on EGL here: https://strawman.com/forums/topic/10752#post-37413

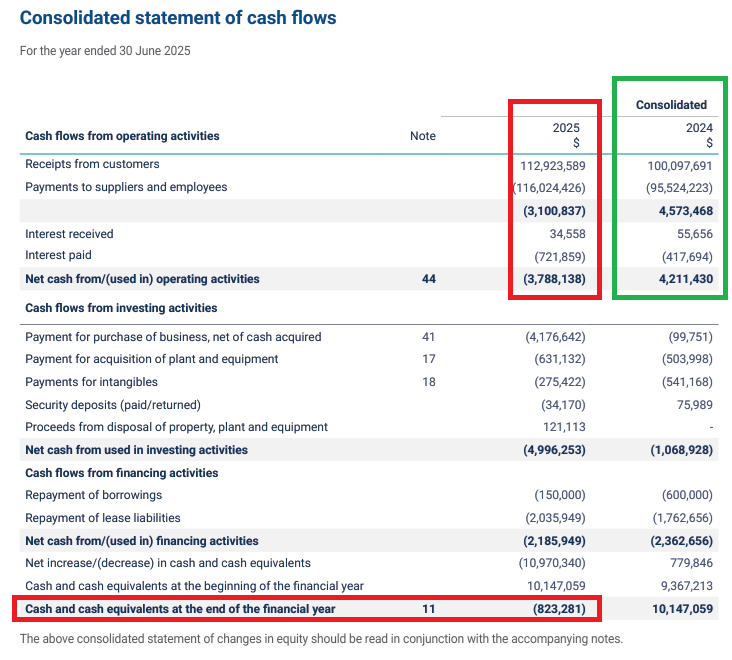

This looks interesting to me:

Revenue growth but payments to suppliers and employees was greater than total receipts from customers resulting in a $3.8m loss from operating activities vs a $4.2m profit the previous year.

Also they had a negative cash position at June 30 vs over $10m in the bank the previous year. So they will likely need to raise money to shore up their balance sheet. Or at least that's how it looks to me.

I prefer companies of this small size to be in a net cash position and EGL are no longer in that position.

I sold all of my remaining EGL @ $0.27 this arvo (Wednesday) and was considering doing the same here, but would have only got $0.255 here because that's where they closed. [Have now sold them here also - on Thursday].

I think EGL has a good story and will likely be worth substantially more in future years, but my faith in their management has diminished today, so I moved to the sidelines IRL and will likely do the same here this week also. I think there are better opportunities out there for that capital at this point in time, and too many unknowns and eventualities that could drive the EGL SP back down in the near term, in my opinion.

Perhaps teething problems, but also perhaps aggressive revenue recognition to inflate yoy comps, and while I do see over $4m spent on a business purchase (in the table above), I think it was a mistake to rely on the use of an overdraft to do that rather than to raise capital including via issuing new shares. I can only think they thought their share price was too low and they wanted a higher share price before announcing a CR.

Anyway, sidelines for me with EGL and my real money portfolios, and likely also here on SM shortly.

And the margin compression in some sectors is a concern too for a business that was apparently so focused on maintaining margins and not taking on any work that might rely in losses or low profit margins. Thats what Jason Dixon was saying in his meetings with us here but I don't see that in these results across their various divisions.

That said, now that I'm out of EGL, their EGL Waste business will probably shoot the company to the moon.

Additional:

P.S. They appear to have rolled EGL Water into EGL Waste now. I think EGL Energy is their main baseline ARR business - won't shoot the lights out but decent margins and dependable. EGL Waste (inc. EGL Water, inc. their PFAS removal tech) is the exciting part, but I feel the revenue and earnings are going to be lumpy, certainly not straight line growth. I have real questions around EGL Clean Air and Baltec IES in terms of maintaining margins and discipline, remembering that the owners of that IES business that got rolled into EGL are still there and are still major shareholders of the company.

Ellis and Denise Richardson sold Baltec IES to The Environmental Group (EGL) in October 2013 alongside others, and post-acquisition Ellis was appointed as Managing Director at EGL as well as their Board Chairman, and while his roles changed over the years (as detailed below), he remained an EGL director until he resigned in March 2021. He is also EGL's largest shareholder, currently holding 10.38% of the company's shares. Denise owns another 8.71%.

Their daughter - I believe, although I haven't been able to confirm that relationship - Ms Lynn Richardson, remains a Non-Executive Director (NED) and EGL's Non-Executive Chairperson. Lynn formerly served on the executive committee of Baltec IES, contributing strategically to its growth before the acquisition of Baltec by EGL. Lynn holds EGL shares via Richmarsh Investments Pty Ltd (which she controls) —approximately 3.57 million voting shares. Ellis owns more than 10x that many, 38,016,832 EGL shares (10.38% of the company, EGL's largest shareholder).

According to ChatGPT, in 2020, Lynn issued a notification stating she no longer acts "in concert" with Ellis or Denise Richardson.

In terms of the timeline:

- EGL acquired Baltec IES in late 2013 from Ellis and Denise Richardson, and others; Lynn Richardson also worked at Baltec IES prior to the acquisition;

- Ellis Richardson became EGL's Managing Director and their Executive Chairman at the same time (in Nov 2013);

- Lynn Richardson became an EGL Director on May 21st 2015, and was elected their Board Chair on November 23rd 2017;

- Ellis as EGL's Chair then replaced himself as MD with Dean Dowie as EGL's new Managing Director effective 1 July 2019, however Deano only lasted 7 months in the top job - until 24th February 2020 when EGL announced they had appointed Mr Andrew Arapakis as their new CEO & MD, but then on March 26th 2020, one month later, EGL announced, "...that as a result of the COVID-19 pandemic Mr Andrew Arapakis will no longer be joining the Company as CEO. Given the present COVID-19 pandemic and resultant economic environment the Company has moved to elect Mr Ellis Richardson as interim Managing Director. Mr Dean Dowie will revert to an executive director role as previously advised, effective immediately." Deano quit the Board later that year, in November 2020;

- Ellis Richardson was therefore re-elected to the MD position at EGL for the second time on March 26th 2020;

- Lynn Richardson issued that "no longer acting in concert with Ellis and Denise Richardson" notification or letter in 2020; and

- Jason Dixon (ex-Tox Free) took over as EGL's new CEO in Feb, 2021, with Ellis Richardson stepping down as MD at that time (Feb '21), then quitting the Board in March, 2021, however Ellis remains EGL's largest shareholder today (with 10.38%). Denise Richardson is EGL's third largest shareholder with 8.71%, and EGL's Chairwoman, Lynn Richardson (shown below) owns about 0.94% of the company through Richmarsh Investments.

So, my point is that as the original Baltec IES vendors AND as EGL's largest shareholders, the Richardson's hold a fair bit of sway within the company, so I'm not overly convinced that Jason Dixon's management (as EGL's CEO) fully extends to their Baltec IES division.

And I'm therefore questioning just how "quality" the management team really is at EGL when I look at that massive cost blowout in the past FY with Baltec, and Baltec's big profit (EBITDA) reduction despite earning significantly more revenue during the year, resulting in a significant margin compression.

I also question the rationale behind the acquisition of Airtight Pty Ltd, "a leading Australian air pollution services provider focused on mid-tier customers" for $12m in April 2023 (upfront consideration of $7.0m cash plus up to $5.0m earnout based on FY24 earnings) when EGL's Clean Air division produced this result in FY25:

They have used the current downturn in the lithium market as the main reason for that huge drop in EGL Clean Air revenue, but they never made it clear when they were bolstering their "Air" division via acquisition that it was so dependent on the lithium sector. The impression they gave me at that time was that the Clean Air division provided cross-selling opps across their other divisions and their gear was in high demand across numerous sectors. Apparently not.

So, yeah, there are a number of things - orange flags if you like - that have caused me to review my investment thesis on EGL and then sell out of EGL, for now.

The main ones are less trust in management in terms of what they say, and also doing what they say they are going to do, and honest reporting without fudging the numbers, with leads directly to the question of just how "quality" is this management team really? - Quality management being a "must" for my high conviction investee companies.

So, I reckon I'll bench EGL for now and watch them for a while, like a couple of years, and I might put them back on my playing field at some point in the future. For now, they're on the bench. And I'm on the sidelines. Just to mix up some metaphors.

Disc: Not holding.

20-Aug-2025: Having been through EGL's FY25 results (Appendix 4E, 20/08/2025 – Annual Report to Shareholders, FY25 Financial Results Presentation) - I saw a few orange flags there, particularly the precipitous drop-off of their Clean Air division EBITDA (-50.9% yoy) which they are blaming on challenging lithium markets - I would hope that division has a much broader addressable market than just the lithium sector.

We know about their cost blow-out with Baltec IES, but a -19.1% EBITDA decline on the back of a +31.9% increase in revenue in Baltec means a major margin compression there.

EGL Energy was good, and EGL Waste was terrific to finally see some traction there after bugger all happening there in prior years, however I also took note of @Wini's comments about their declining cash balance (they have no cash now) and 20% of their revenue sitting as work in progress not aligning with what management are saying: that over 50% of revenue is now recurring maintenance.

"This feels like aggressive revenue recognition to me, overstating earnings through the P&L."

See Wini's post on EGL here: https://strawman.com/forums/topic/10752#post-37413

This looks interesting to me:

Revenue growth but payments to suppliers and employees was greater than total receipts from customers resulting in a $3.8m loss from operating activities vs a $4.2m profit the previous year.

Also they had a negative cash position at June 30 vs over $10m in the bank the previous year. So they will likely need to raise money to shore up their balance sheet. Or at least that's how it looks to me.

I prefer companies of this small size to be in a net cash position and EGL are no longer in that position.

I sold all of my remaining EGL @ $0.27 this arvo and was considering doing the same here, but would have only got $0.255 here because that's where they closed. I think EGL has a good story and will likely be worth substantially more in future years, but my faith in their management has diminished today, so I moved to the sidelines IRL and will likely do the same here this week also. I think there are better opportunities out there for that capital at this point in time, and too many unknowns and eventualities that could drive the EGL SP back down in the near term, in my opinion.

Perhaps teething problems, but also perhaps aggressive revenue recognition to inflate yoy comps, and while I do see over $4m spent on a business purchase (in the table above), I think it was a mistake to rely on the use of an overdraft to do that rather than to raise capital including via issuing new shares. I can only think they thought their share price was too low and they wanted a higher share price before announcing a CR.

Anyway, sidelines for me with EGL and my real money portfolios, and likely also here on SM shortly.

And the margin compression in some sectors is a concern too for a business that was apparently so focused on maintaining margins and not taking on any work that might rely in losses or low profit margins. Thats what Jason Dixon was saying in his meetings with us here but I don't see that in these results across their various divisions.

That said, now that I'm out of EGL, their EGL Waste business will probably shoot the compnay to the moon.

12th May 2025:

It looks to me like EGL have broken their downtrend, however...

- They're a low liquidity microcap company - so today's +4% SP move was on less than $80K worth of shares (total traded all day was 313,500 EGL shares at a total value of $79,298.69);

- There is a single buy order at 25 cps (in the green) which is skewing the numbers (in the orange) to suggest that there are more buyers than sellers when in reality if that one trade was cancelled or filled, that takes out more than half of the total volume on the "Buy" side; and

- That one buy order looks huge compared to the other numbers there, however it's only worth $96.5 K ($96,485), so under $100K, not exactly a massive buy if it was to go through.

Still, on the plus side, if a microcap fundie was building a position or increasing an existing position, they'd probably choose to do it like that, in smallish buys (in $ terms) because of the low liquidity.

And we're now half way between their H1 report in February which disappointed the market and their next report in August which may yet prove that all is not lost and that there's still growth in this little company yet.

I had mixed feelings in Feb because the single project cost blowout (in Singapore) in their Baltec division was already disclosed to us before they reported, which is what ended their prior SP uptrend in mid November (EGL-Trading-Update-13-Nov-2024.PDF) however the actual H1 results in Feb suggested that there was perhaps a little more going on than just a single project having significant cost overuns due to a failed internal cost tracking procedure. I wondered if EGL's prior growth expectations (i.e. before November) may have been a tad overblown or exaggerated and I don't think I was Robinson Crusoe in that regard based on their continuing downtrend that only seems to have been broken in the past couple of days.

Still, I did load up on EGL in the past few months both here and in my larger real money portfolio outside of my super (due my SMSF being restricted to ASX300 companies - and EGL being way too small to be in that index), because while we clearly don't see the full picture from where we are, it seemed to me that my investment thesis was still intact. In short, balancing the risk vs the potential reward, I estimated that there was probably limited downside compared to the likely significant upside, so I'm still in.

But I am aware of the risks. If they release any further bad news, the SP will likely get smashed, and that SP fall will be turbocharged by the low liquidity where there will only be a few buyers for a lot of shares trying to be sold. I'm just betting that the news is more likely to be good than bad for the next little while, like 18 months or so.

Disclosure: EGL, as of today, is my largest position here (21.6% of my SM portfolio) and is one of the smaller-to-medium positions in my real life portfolio, which has much larger positions in LYL, GNG and WGB - WAM Global is almost up to their NTA/NAV now so they've staged a great comeback on the back of pre-announcing their next two dividends, one of them being a special dividend. I sold out of Southern Cross Electrical Engineering (SXE) last week to free up some cash (now that they're back up close to all-time highs). I still hold a medium-sized position in NRW (NWH) in that portfolio (as well as in my SMSF and here), plus I have three early stage gold companies (explorers / developers) in there, being Meeka (MEK), New Murchison Gold (NMG) and Medallion Metals (MM8) - MM8 being a new addition to that real money portfolio last week and a company I've probably never (or rarely) talked about here but one I reckon has probably got a rosy future based on the land / tenements they own, their drilling results so far, the location of their projects, the people running the company, and their substantial shareholders, plus a couple of resources funds that I respect that are also apparently (allegedly) shareholders of MM8. There are two more companies I'm also looking at with a view to putting some play money into them. EGL however, while still a bit of a punt (due to the risk), is more of an investment, and the EGL position in that portfolio is multiples larger than the much smaller positions I have in those speculative early-stage goldies.

Further Reading: https://environmental.com.au/

14-April-2025: EGL-Water-PFAS-Separation-Plant-EPA-Approval.PDF

More positive news for EGL, which I hold both here and in my largest real money portfolio.

Excerpt:

The EPA license for Reclaim Waste has been approved for the treatment of PFAS.

Key Highlights:

The Environmental Group, in collaboration with Reclaim Waste, is pleased to announce that Reclaim Waste’s liquid waste facility has received approval from the Environmental Protection Agency (EPA) to treat PFAS (Per- and Polyfluoroalkyl Substances) at its Laverton facility through The Environmental Group’s PFAS separation plant. This approval signifies a significant milestone in their shared commitment to the environment and innovative waste management practices.

The EPA approval is a testament to the effectiveness and safety of the PFAS separation technology developed by The Environmental Group together with site support from Reclaim Waste. Rigorous testing and evaluation have demonstrated the plant's capability to treat PFAS-contaminated waste streams safely and sustainably. This PFAS plant provides Reclaim Waste with commercial opportunities to accept PFAS-contaminated liquid waste while ensuring compliance with the new EPA waste disposal categories, characteristics and thresholds released in March 2025, meeting all PFAS discharge limits.

Mr Jason Dixon, CEO of The Environmental Group, stated, "We are pleased that Reclaim Waste has received EPA approval and that our PFAS treatment plant will enable them to process and treat PFAS contaminated waste streams. Further to the liquid waste treatment, we have also performed trials on soils and biosolids which have provided extremely promising results. This achievement underscores our dedication to environmental responsibility and innovation."

The Environmental Group’s treatment technology is a low operating and capital cost process, that has proven to be highly effective whilst remaining a safe and sustainable method for treating PFAS.

As previously advised on 13 November 2024, The Environmental Group was granted an Australian patent 2021338584, which covers the Company’s processes and apparatus for reducing the concentration of PFAS contamination in wastewater, soil and biosolids. This patent is valid for a term of 20 years from the date of filing, ensuring that the Company holds exclusive rights to their innovative technology in Australia for the duration of the patent term. This highlights the Company’s commitment to addressing environmental contamination and its contributions to advancements in environmental protection technologies.

EGL’S PFAS Opportunity

Per- and Polyfluoroalkyl Substances (PFAS) are a group of man-made chemicals that includes PFOA, PFOS, GenX and many other chemicals. PFAS have been manufactured and used in a variety of industries around the globe, including in the United States since the 1940s. PFOA and PFOS have been the most extensively produced and studied of these chemicals. Both chemicals are very persistent in the environment and in the human body meaning they don’t break down and can accumulate over time. There is evidence that exposure to PFAS can lead to adverse human health effects (https://www.epa.gov/pfas/pfas-explained).

Historically PFAS has been widely used in food packaging, commercial household products, including stain and water-repellent fabrics, non-stick products (e.g. Teflon), polishes, waxes, paints, cleaning products and fire fighting foams (a major source of groundwater contamination at airports and military bases where fire-fighting training occurs). PFAS has also been used by industries such as chrome plating, electronics manufacturing and oil recovery, hence the prevalence in the environment.

The PFAS treatment market is a rapidly growing area driven by increasing environmental regulation as evidence emerges of the extent and toxic nature of PFAS substances in the environment and on human health. EGL believes that these regulations are driving a market need to remediate legacy sites ahead of redevelopment, as well as for the rehabilitation of active sites and those that impact human use such as agricultural applications, water ways, residential developments, nature reserves and recreational areas.

The separation of PFAS from both water and soil is a key step in removing the substance from contaminated areas and preventing further risks to health of the environment and community.

--- end of excerpt ---

Disc: I hold EGL, however my IT (investment thesis) does not include EGL Water - which is all about their PFAS removal tech - as a core component, but rather as a sort-of powerball type upside, well beyond my solid base-case thesis. My IT is based on continued growth of EGL's already successful divisions and their growing distribution agreements with international players for exclusive Australian distribution of those products and technologies. And Jason continuing to drive profitability higher through margin increases and continued focus on cross-selling across their divisions, plus some disciplined M&A (inorganic growth) mixed in with their continued organic growth.

The PFAS opportunity, if it pans out to be profitable and they capture significant market share, could be some nice icing on an already great-looking cake, but my IT is not reliant on that. EGL Water is going to take time, because it's so early-stage, UNLESS they get taken out (acquired) earlier by a larger player at a decent premium, which is what happened to Jason Dixon's and Paul Gaskett's last business, Tox Free Solutions, which Cleanaway acquired for approximately $671 million.

Jason is EGL's CEO and Paul is EGL's CCO (Chief Commercial Officer) and previously their Head of Sales, and they have other people there at EGL who they also worked with at TOX, including one of EGL's non-executive Directors, Michael Constable, who previously held senior executive finance roles within Nylex and Programmed Maintenance Group and was CFO of Millennium Services Group for 4 years and CFO of Tox Free Solutions for over 10 years.

EGL's current market cap, based on Friday's closing price of just 22 cents/share was around $88 million, so my view is that EGL is an early stage opportunity (a small microcap) that is not well known or well understood, but with superb management (now) and key metrics all heading in the right direction except for that hiccup in H1 of FY25 with one Singapore project having a significant cost blowout which EGL blamed on a flawed internal project-cost-tracking procedure which they say they have now rectified (so that issue can not reoccur). These types of situations have usually proved to be significantly profitable investment opportunities for me over the years.

EGL Water (the PFAS tech) is higher risk, because it's new tech trying to establish a presence in a competitive and evolving market, so it might work, or it might fizzle out by not capturing enough market share to be profitable and become a significant contributor to the overall EGL earnings mix. It's too early stage for me to have a high level of confidence in it. While I am confident that their tech works, I don't have visibility or a good understanding of their PFAS-removal competitors or the state of that niche sector in terms of what's available and what the costs are, or what new products and services are currently in development by other players, and how all of that is likely to play out. That's why my IT does not rely on it. If EGL Water pans out really well for EGL, that's great, but if it never amounts to anything much, that's also OK because the rest of EGL is enough to provide excellent returns, IMO.

31-March-2025: EGL-to-Acquire-Advanced-Boilers-and-Combustion-Pty-Ltd.PDF

Plus Investor Presentation.PDF

This looks like a great bolt-on acquisition to me, paying just $5.5 million using existing cash resources, and very complimentary to EGL's Tomlinson Energy business which already installs and services boilers.

Other points:

- Advanced has expertise in fabrication, boiler fit out, economisers, pipe welding, skid manufacture and control panels, broadening EGL current capability;

- Advanced own exclusive intellectual property rights to Maxitherm boiler technology which is particularly relevant to larger industrial uses and complement EGL’s existing range of boilers;

- Advanced reported FY24 revenue of $16.0 million and normalised EBITDA of $1.6 million;

- Approximately 60% of Advanced’s revenue is service revenue, which is recurring in nature aligning with EGL’s strategic growth plans; and

- Fast execution: Expected completion date is 5 April 2025 (five days after today's announcement).

Disc: Holding, both here and IRL.

P.S. Market likes it.

EGL H1 2025 revealed the impacts of the project overruns in Baltec Division which were called out to be 1.2mill.

This is a orange flag going forward and happy to provide a pass to CEO and Management especially in light of so many of their divisions are in sweet spot and they are positioned to benefit .

Jason Dixon since taking the helm in Feb 8th 2021 has delivered immense shareholder returns. SP at this time was 3.5c.

Fair to say the size of the organisation was a fraction of what it is today.

It has also presented a great opportunity to top up at now 20c.

In deriving to 30c valuation the following assumptions are at play over the next 4 years to 2028

Revenue

FY25 up 15% to 112.5m

FY26 up 12% to 126m

FY27 up 10% to 138.7m

FY28 up 10% to 152.6m

EBITDA

Through the 2025 and 2026 period EBITDA margins of 10 & 12% respectively rising to 14% in the years 2027-2028 14% to 21.36m

NPAT to grow to 12.97m in 2028 from 4.4m 2024.

SOI over the four year period to grow up 3% per year to 420m shares on issue

From a Valuation standpoint applying a EBITDA multiple applied is 9x brings MC to 192m and in turn discounted back by 10% per year provides a SP of 30c today.

If a 7x EBITDA valuation was to transpire MC would reduce to 149.5m in 2028 and following discounting back by 10% pa would see a fair SP today of 23.6c

What are the positives in play ?

- EGL Baltec division in strong demand with move to renewables. Growth in H1 was 84% on H1 2024.

- EGL Energy have invested in necessary personnel to ensure demand is met eg qualified boiler technicians.

- EGL waste and water positives taiwinds in terms of draft approval for PFAS treatment at Laverton Melbourne Victoria and USA patent being granted . There are many tenders set to be announced in H2.

What are the risks or factors to look out for ?

- Acquisitions to further dilute shareholders. Past 5 years share count has increased 78.6% to 373m. Per share returns have been impacted.

- Execution risk as per FY 25 with Baltec division reflecting quality to key personnel to assess risk when scoping projects

- EBITDA and NPAT do not grow faster than revenue growth.

- Need to watch if sentiment re renewables push changes with Trump administration questioning the science.

Disc ; Held on SM and IRL

My EGL Valuation update is based on the company's February Investor Update which included 1H FY25 Results and 2H FY25 Outlook commentary

EGL Interim Report - 31 December 2024

Revenues from ordinary activities up 16.1% to $ 54,232,766

EBITDA down 13.4% to $ 3,726,756

Earnings Before Interest and Tax (EBIT) down 27.8% to $ 2,309,954

Profit from ordinary activities after tax down 30.5% to $ 1,443,907

Profit for the half-year down 30.5% to $ 1,443,907

As announced in the November 2024 Trading Update, one project within EGL’s Baltec IES business unit incurred a material cost overrun of approximately $1.2M

EGL Outlook statements for 2H 2025 given during 1H FY25 Results Presentation

• EGL Baltec is set to have strong performance with a large sales pipeline supporting the transition to increased renewable energy.

• EGL Air conditions remain difficult in the mining sector, introducing strategies to grow, dust extraction showing green shoots on improving market.

• EGL Waste & Water is expected to have an exciting half with tenders due to be awarded.

• EGL Energy’s Fulton distribution agreement is exceeding expectations in demand, with additional service staff hired to grow recurring revenue.

• Extended product offering to drive growth, with new opportunities in the pipeline.

• ERP implementation over the next 12 months to improve efficiency and accuracy.

• Underlying FY25 EBITDA expected to increase approximately 10-15%

The Moelis report for EGL via the ASX Equity research scheme. Solid info, target price of 35c. Add it too the extensive info Strawman members have reported recently.

Nessy

Not held yet

$EGL closed down 15% today, and I think at some point they were down as much as 25%.

I attended the call today (but haven't written up my notes, as it has been somewhat of a deluge of results on my Watchlist today, and I wanted to focus my effort on analysing $DUR, which I've just written some overall comments on.)

$EGL's SP got whacked big time for the Baltec Project Execution stuff-up when it was announced last November, and today it was as if it got whacked all over again, largely for the same information - albeit the $1.2m cost blowout impact was made clear.

In terms of other bad things in the results, Clean Air segment has been hit hard by the down turn in lithium - again, hardly news. Quite wisely CEO Jason Dixon said they weren't waiting for lithium to recover and are exploring other areas to focus deploying this technology to. So, I guess that's the same as saying "don't expect much from Clean Air for a while".

And, yes, there was reduced margins in energy because they've brought on 10 people to support the large volume of service work they see coming over the horizon as they perform regular statutory checks on every boiler rated at over 2MW, in perpetuity.

But despite the downbeat report, the company is holding to the November issued guidance of FY25 EBITDA to grow by 10-15%.

At one point Jason said he was perplexed by the market reaction, because he thinks the business is doing pretty well.

So I think this is perhaps an issue of credibility. I believe Jason was a bit too relaxed is his words around the Baltec screw-up. At one point saying "someone made a mistake" ... "won't happen again".

But as I have said before, project execution is a world full of mistakes, a multitude of "unique mistakes that won't happen again". (If I had a $ for every project-screw-up-lesson-learned workshop or post-mortem I've run in my career,... well, I'd have even more to invest ;-) I once had a boss who was Deputy CEO of a global enegy company who vented at me once after a post-investment appraisal saying "I don't want to hear about learning lessons, I want the f****** our there to earn their wages and APPLY the lessons.".)

Most capital projects run significantly over budget and over schedule - there's no shortage of studies and stats. to bear this out. But unlike yesterday's call with Peter De Leo at $LYL where I came away with high confidence that the management team there knows who to assess and price project risk, Jason didn't give me the same confidence today. But all that said, I still feel like $EGL have been whacked twice for largely the same information.

I do consider that today's closing price givign a FY25 forward P/E of 16.5 makes the stock well-priced given the industry tailwinds (strong energy sector; water and waste - blue sky upsides essentially valued at $0). It is by no means cheap for an engineering and projects company, but it does have a strong component of recurring, maintenance-type revenue, which looks set to increase. And so I think this can easily justify a P/E in the 15-20 range.

So, I've added to my position in RL and SM.

How do I reconclile my concerns about project execution at $EGL and buying more? Easy. Most of $EGL projects involve deploying standard packages and solutions into client infrastructure. While of course every project is unique (witness the road transport loading miss in the Singapore Blatec project), the projects have more in common with prior projects than they are unique. And again, the research shows that repeat projects tend to do better on cost and schedule blowouts, because they are more amenable to learning. So EGL's technical project risk profile should be lower than a run-of-the-mill-engineering-and-construction-firm. Anyway, that's what I convinced myself of today before I hit the "BUY" button.

Keen to hear other holder views? And I need to look at the results more closely to see what I've missed.

Disc: Held in RL and SM

$EGL’s project execution mis-step has provided me with the entry opportunity I’ve been waiting for.

The market has to understand that every now and then every engineer is going to have a project delivery stuff up.

But I’m pleased to have been handed this entry opportunity this morning through a massive over-reaction. I was getting concerned that this one had gotten away from me.

Disc; Held RL 3.5% initial position

Stumbled on this article while doing a bit of research on PFAS testing labs in the US.

Not sure why the US does not have any lab testing like ALS and SGS (Swiss firm), but they have all these technology firms that sell lab testing equipment to them.

Anyway it is a large market in the US, but then the US has nearly zero tolerance on forever chemicals compared to Australia.

Seems the stricter regulations is benefiting the US players more than anyone else.

Also there is mention of a private listed company Aclarity that has a technology that uses low energy electricity to break down the chemicals

I do hold Xylem in my Moomoo papertrade account

Base case using guidance: $0.45/sh

Base case with an upgrade. Have mapped a likely beat with 1 or 2 waster deals driving a target of $14m EBITDA ($12m on cash basis): $0.51/sh

High case: $0.56/sj

Low case: $0.26/sh

All predicated on FY24 results and FY25 guidance.

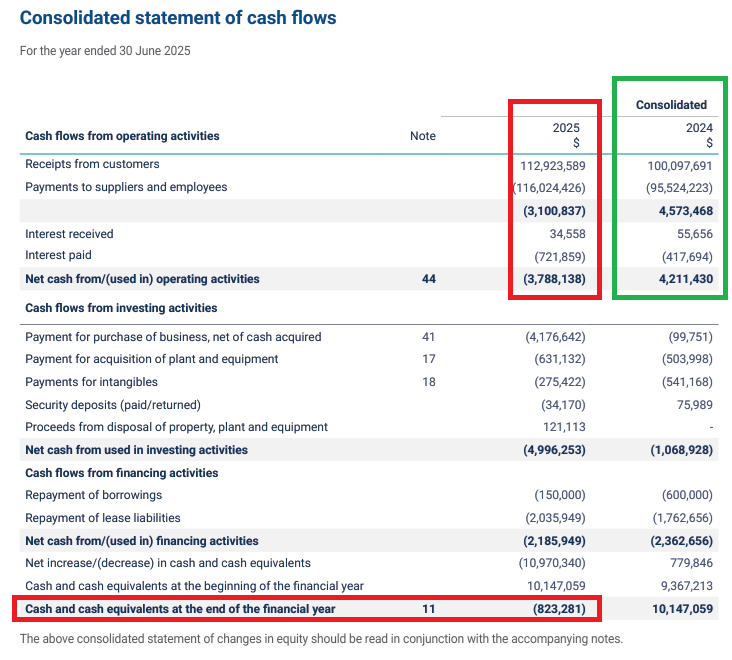

The Environmental Group (EGL) reported today, and the market seems to like it, with good reason.

EGL closed yesterday at 34.5 cps, and are currently up 1 cent at 35.5 cps (+2.9%), but they've traded as high as 36.5 cps (+5.8%) today on the back of this report.

It was a good one, as expected:

Margins improved even further as evidenced by their much higher growth in EBIT (+52.8%) and NPAT (+68%) compared to their +18.8% revenue growth.

Source: EGL Results Presentation.PDF Note: Their presso is too large to upload here, and their website investors' page (https://environmental.com.au/investors/) hasn't been updated yet today to include today's announcements and presentation, so I had to link to the ASX site version with its "r personal use only" watermark up the left edge of every slide. - A clean version should be uploaded to EGL's website shortly (hopefully).

I hold EGL here, but not currently in any real money portfolios - it is a company I like however, a lot!

No certainly EGL can capitalize on recent news articles regarding PFAS contamination in Sydney's water supply but this must certainly present a great opportunity especially to increase EGL's profile....we'll see but I added in RL today regardless.

Assume $6m in EBT for 2024 off of $96m in Revenue.

Let revenue CAGR at 10% while Opex only grows 5% a year with gross margins at 25%

=>

2029 Revenue: $154m

2029 Opex: $23m

2029 EBT: $16m

Assuming a P/EBT of 15 and 390 million shares

=> 2029 share price: $0.60

Discount at 10%

=> 2024 SP: $0.37

Given there recent growth rate I'd suggest this is pretty conservative. I'm really expecting a greater growth in revenue than this, especially if there is any success with the PFAS water treatment, however I'd also expect the operating cost to be grow faster in that case too. I consider this a reasonable base case - I'll be keen to see how far out I am in the future, and will maybe get more bullish as we go.

I really like Jason -- seems to have a clear idea of where the key strengths of the business lie, and has really helped drive profitable growth since he took over 3 years ago. A no-nonsense guy and a straight talker.

Honestly, I think I'm going to add some EGL to my portfolio on that basis alone.

Here are some highlights from today's meeting:

- EGL has transitioned from a traditional engineering company to one focused on maintenance and services, with over 50% of revenue now coming from recurring service work.

- The different divisions of EGL, including Baltec (gas turbines), Tomlinson (boilers), TAPC (air pollution control), and EGL Waste, are highly complementary and provide integrated solutions for clients. There really do seem to be genuine cross-sell opportunities. For example, EGL Waste brings together service lines like recycling plants, dust extraction, odour control, boilers, and combustion technologies, allowing EGL to offer end-to-end solutions in the waste industry.

- The waste industry in Australia is undergoing significant change, with a ban on waste exports and a requirement to increase recycling rates by 17% in the next 6 years. This is driving $5 billion in spending on new waste treatment plants, presenting a major opportunity for EGL (the largest player in this space)

- Baltec has developed world-leading IP for gas turbine silencers suitable for peaking load operation, as the energy market shifts towards renewables supported by gas peaking plants. This positions Baltec for strong growth over the next 20-30 years.

- The exclusive distribution agreement with Fulton, a global leader in boilers, is expected to drive significant growth in the Tomlinson division without adding fixed costs, directly benefiting the bottom line. Jason really hit this point several times -- it sounded like a very significant opportunity.

- The PFAS water treatment technology is seen as a potential game-changer, with strong interest from clients and a large addressable market, particularly in the treatment of contaminated biosolids.

- Jason emphasized the importance of balancing engineering excellence with commercial discipline, focusing on margin expansion rather than just top-line growth (love it!!)

- EGL has significantly improved margins across its divisions by instilling a strong commercial mindset and implementing rigorous project review processes.

- The company is taking a disciplined approach to growth, focusing on organic opportunities and strategic partnerships that enhance existing capabilities, rather than pursuing acquisitions simply for the sake of growth.

- He mentioned the growth they had achieved without "one red cent" of capex:

- Turmec, Kadant PAAL, and Fulton - were secured without EGL putting in any capital, yet they hve been instrumental in growing the business from $35 million in turnover to nearly $100 million.

- He also pointed out that they are still in the early stages of realizing the benefits from the Kadant PAAL and Fulton deals, suggesting significant growth potential ahead without the need for capital investment.

That last part alone gave me a sense he is a very savvy operator. And, to cap it all off, he's a massive shareholder and has a base salary of $270k (pretty ordinary for the CEO of a $100m listed company.)

13-May-2024: EGL-Secures-New-National-Distribution-Agreement.PDF

Bottom left to top right. Tick.

Solid company, good management, profitable, growing, small enough to be underappreciated and underpriced by the market. Tick.

Disclosure: I hold EGL shares both here and in my largest real money portfolio.

Their website: Home - The Environmental Group Limited

Their website has had an overdue makeover. Not bad.

02-May-2024: Two new "Subs" notices today, from Challenger and Greencape Capital, but Greencape is considered a controlled entity of Challenger (which is why Greencape Capital appears on the second page of Appendix 2 of Challenger's notice - the first link below) so it's the same 5.01% position, not two different ones:

Becoming-a-substantial-holder-for-EGL-from-Challenger.PDF

Becoming-a-substantial-holder-of-EGL-from-Greencape-Capital.PDF

They have been moving above and below 5% of EGL for a while now...

They became Subs (with 5.53%) last year at the end of August then sold down to either 0% or close to 0% by my calculations (as 20,253,269 EGL shares was around 5.42% of EGL's shares on issue at that time) in March (12th) this year and now they're back in with 5.01% (18,724,807 EGL shares) as from 30-April-2024.

The other subs there are Jason Dixon (JALIE 2), their CEO, and Ellis & Denise Richardson who were the founders and vendors of Baltec IES which was acquired by EGL some years back, and the Richardsons received EGL shares as part of that acquisition. Harley Grosser's Capital H Management is the largest shareholder there with 10.4%, just ahead of the 10.38% held by the Richardsons, which I'm assuming is the same 10.38%, not two lots of 10.38%, as it is common for mirror notices to be lodged for the same holding, such as the mirror notice lodged today by Challenger because Greencape is considered a controlled entity of Challenger.

EGL was down half a cent (or -1.82%) today however that was on just 12 trades which all together added up to just under $11.3K - only 42,014 EGL shares changed hands today. So not a lot of liquidity with this one. Market cap of just $102m, so a real microcap. However, I'm an EGL shareholder both here and in my largest real money portfolio, and doing well with EGL so far. I'm happy with the company's progress - Jason and Paul have certainly turned it around and got everyone focused on locking in recurring revenue maintenance contracts with everything they sell, whenever they can, and they also appear to be focusing on maintaining decent margins so being more choosy with targeting certain types of work to chase and avoiding low margin or zero-margin work. One of the reasons this business performed so poorly in prior years (before Jason Dixon and Paul Gaskett came over to run it) is that they weren't sufficiently focused on margins and they often lost money on contracts.

The Turmec agency doesn't seem to have generated much work for them since they took it on, but it is relatively low margin work anyway - I think the Turmec agency is a 2% clip-the-ticket on all Turmec sales into Australia, but there are supposed to be cross-selling opportunities that come with these state-of-the-art recycling plants that Turmec specialises in. When they sell some.

Meanwhile most of the other divisions appear to be firing for EGL, except for EGL Water, which is just passed the proof-of-concept stage really, in terms of PFAS removal, well, it's been commercialised but people aren't exactly bashing their door down to get hold of that tech just yet. I regard EGL Water as the Powerball upside - nice if it happens but my investment thesis isn't factoring it in. Yet. The rest of the divisions are travelling OK, and showing margin improvements for the most part, as we've commented on here before when analysing their H1 results. This is one where I'm backing the management, based on what they achieved at TOX (Tox-Free Solutions, bought by Cleanaway), and on the interview that Andrew had with Jason a couple of years back where he impressed me in terms of knowing the business well even though he had only been there a relatively short time. He was also saying the things I wanted to hear in terms of his focus and priorities, so I paid attention and then did further research and then bought some.

Anyway, gone past midnight, got to grab some ZZZs now.

21-Feb-2024: EGL Reported today after the market had closed - no presentation yet - just this: Half-Yearly-Report-and-Accounts.PDF

Here's page 1:

I've added the green and blue bits - it was all strictly black and white. Nice to see margin improvement as they scale.

You can see some revenue splits between their various divisions on pages 17 and 18 (note 3, "Operating Segments") - good to see that level of detail actually. [link to EGL's H1 FY24 report is at the top of this straw]

They are still a young and small company but so far, so good. They also released the following announcement two days ago (19-Feb-2024): EGL-Kadant-PAAL-Agency-Agreement.PDF

If you hold them (I do) or follow them, you'd know they have the Australian agency agreement with Irish company Turmec, the global leaders in large scale waste recycling plant technology (conveyors, sorting machines, etc). EGL have now added a similar agency agreement with Kadant PAAL for the sale of world leading Baling solutions in Australia and New Zealand.

Kadant PAAL has 150 years of experience, designing and installing more than 32,000 machines, and their reputation is built on robust construction combined with cutting design and technology.

EGL's CEO, Jason Dixon, sees the collaboration as a tremendous opportunity to partner with the leading European baler manufacturer, a region long acknowledged for its technological prowess in the Australian waste market. The exclusive agreement not only enables Kadant PAAL to enhance its global sales, but also solidifies EGL's position in the waste industry. Offering a complete range of services and technologies, including waste processing, air and odour control, servicing and spares, along with PFAS separation, EGL is well-equipped to provide environmental benefits to the community and deliver strong returns for its shareholders.

The Agency Agreement provides for:

- Territory exclusivity across Australia and New Zealand

- Success based sales commission.

- Sale of spare parts.

- Servicing and repairs of equipment.

The initial period of the agreement is for two years with the intention of the parties to build a long-term partnership. The agreement commenced on 19 February 2024.

Here's an interesting observation from the last page of that announcement - they state they have 4 business units, and then they describe 5:

Somebody must have had their mittens on that day. I think it may have been like that since they spun EGL Water out into a separate business unit. EGL's website suggests they have 6 business units or subsidiaries:

However that would have been updated just after the "Airtight Solutions" acquisition, and Airtight is now part of TAPC (Total Air Pollution Control), so that's back to 5 business units again. Their final page "About EGL" section in their announcements does need to be updated to reflect "five" not "four" business units. (As shown above, second image up), but you can get these little omissions or small errors with regard to minor details with microcap companies.

The main thing is they have a decent business that provides solutions to problems that need to be solved, and they are kicking goals. Steady progress, profitable, growing, good management. All ticks. Minor details like the number of business units or subsidiaries they have isn't a thesis-breaker.

So yeah, happy to be holding this one. EGL closed today (Wednesday) at 28 cps, up +2 cents or +7.69%, so not a bad day. And then they released this report at 8:03pm. Let's see if they hold on to today's gains tomorrow (Thursday). I reckon they should, and might even go up a bit more.

05-Nov-2023:

The Environmental Group (EGL) is a top 10 position for me both here on Strawman.com and in real life. EGL did move higher within my top 10 list during recent months (in August and September) because their share price got up to between 26 and 28 cps, and while it did drop back to 22 cps at the end of October (and finished Friday at 21.5 cps) - they’re still in my top 10 (both here and IRL) in terms of market value of the respective positions.

EGL are a microcap company – their market cap is currently just $82 million – so their SP will move up on positive announcements and drift lower when there’s no news coz some people will sell out and move on, looking for the next hot stock. They had a very good FY23 full year report in August, hence their SP rise, and there hasn’t been any price sensitive news from them since then, so they’ve retraced as a number of people who jumped on them in August have jumped back off again.

I first became interested in EGL when they appointed Jason Dixon as their new CEO in Feb, 2021. Jason and EGL’s National Sales and Marketing Manager, Paul Gaskett, were instrumental in building up Tox Free Solutions which was acquired by Cleanaway (CWY) in 2018 for an Enterprise Value of $831m. Tox Free was at that time one of Australia’s leading Waste Management and Environmental Solutions companies with over 1,500 staff and an annual turnover of approximately $500m. You can read more about Jason here: EGL: 08-Feb-2021: Appointment of CEO – Mr Jason Dixon.

And more on both of them here: https://www.environmental.com.au/about-egl/executive-team

Also, Jason Dixon has done two interviews with Andrew here on Strawman.com, which you can find here: Strawman: Meetings with company CEO's

[Those meeting dates were 19th of June, 2023, and way back on October 8th, 2021, about the fourth meeting in, when the whole "CEO Meetings" idea first kicked off here.]

Jason and Paul had the Australian agency agreement for Turmec, an Irish company that is the global leader in state-of-the-art waste recycling plants, and they bought that agency with them and incorporated it into the EGL Business when they joined EGL. This came about because Turmec repatriated all of their Irish employees who were working in Australia back to Ireland when Covid-19 started to become a serious issue in 2020, and Turmec wanted people they could trust to be their Australian agents for all new Turmec business and also for ongoing consumables sales and service to their existing Australian customers. My understanding is that Turmec knew Jason and Paul from Tox Free and were happy to award that agency agreement to them (to be their agents here in Australia). However, while the Turmec agency is an important part, it is only one part of the EGL Business.

Turmec sits within EGL Waste Services, referred to in their recent presentations as EGL Waste, whose main activities involve the design, construction, commissioning, and maintenance of waste treatment plants, specialising in waste recycling plants where Turmec are the world leaders. EGL Waste also do a lot of Air Control systems, especially dust control, which is where TAPC and Airtight Solutions get involved (see below).

EGL also have Baltec IES (Inlet & Exhaust Systems) which provides a broad range of products and services to the gas turbine power industry to reduce emissions and noise, and to improve efficiency, such as gas turbine inlet filtration systems (filter houses), inlet cooling/fogging systems, acoustical components, expansion joints and complete exhaust systems with guillotine and diverter dampers.

Then there is Total Air Pollution Control (TAPC), Australia’s largest full-service air pollution control company, headquartered in Wollongong, NSW, with branches in Perth, Sydney, Melbourne, Brisbane, Singapore and Manila. TAPC supplies a complete range of products and services for the removal of pollutants from industrial gas and air streams, installing, maintaining and repairing a vast range of industrial air pollution control devices. TAPC serves more than 100 industry groups across Australia, New Zealand, South-East Asia and the Pacific.

EGL’s most recent acquisition was a company called Airtight Solutions, which has now been combined with TAPC (see above) to form EGL Clean Air, but is currently listed on their website as a separate business unit. This acquisition has expanded their market share, added new customers (which allows for cross-selling of their other services), and enhanced their product range in Air Filtration, Purification and Air Pollution Control systems.

Next is Tomlinson Energy Service, which EGL are now calling EGL Energy (in their latest presentations), which was the old Tomlinson business that was part of RCR Tomlinson before Paul Dalgleish blew up RCR by driving it in a new direction they knew very little (or clearly not enough) about – Solar Farm Construction. EGL bought the Tomlinson business very cheaply from the RCR Administrators and it has been providing baseline recurring revenue for EGL ever since via regular scheduled maintenance of industrial Steam Boilers, large commercial Hot Water Heaters and Boilers, Thermal Oil Heaters, Package Burners and Biomass Steam and Hot Water Generators – throughout Australia – which they also supply, install and commission.

One thing that Jason and Paul have brought to EGL is a focus on parcelling ongoing maintenance contracts with their design, supply and install contracts wherever they can, across all of their business units, because they understand the value of baseline recurring revenue. Tomlinson were always doing this, but EGL now do this across their other divisions also.

Finally, there is EGL Water, which is about removing dangerous and/or harmful contaminants from water, and their main focus has been on PFAS removal. PFAS, or per- and polyfluoroalkyl substances, is a group of over 4000 chemicals. Some PFAS are very effective at resisting heat, stains, grease and water, making them useful chemicals for a range of applications including:

- Stain and water protection for carpets, fabric, furniture and apparel;

- Paper coating (including for some food packaging);

- Metal plating (including Teflon coatings on frypans, saucepans and other cookware);

- Photographic materials;

- Aviation hydraulic fluid;

- Cosmetics and sunscreens; and

- Medical devices.

Because they are heat resistant and film-forming in water, some PFAS have also been used as very effective ingredients in fire-fighting foams.

In Australia, the historical use of PFAS in fire-fighting foams has resulted in increased levels being detected at sites like airports, Defence bases, and other sites where fire-fighting training has been conducted (which has prompted some recent payouts and also money has been allocated by the government for future payments to people who were exposed to PFAS through fire-fighting foam use on Australian Defence Force bases), or where fire suppression systems are installed for extinguishing liquid-fuel fires. Increased environmental levels of PFAS have also been found near some industrial areas, effluent outfalls and landfill sites.

Unfortunately, the properties that make some PFAS useful in many industrial applications and particularly in fire-fighting foams, also make them problematic in the environment. The PFAS of greatest concern are highly mobile in water, which means they travel long distances from their source-point; they do not fully break down naturally in the environment; and they are toxic to a range of animals.

While understanding about the human health effects of long-term PFAS exposure is still developing, there is global concern about the persistence and mobility of these chemicals in the environment. Many countries have discontinued, or are progressively phasing out, their use. The Australian Government has worked since 2002 to reduce the use of certain PFAS.

Source: https://www.pfas.gov.au/about-pfas/substances

See also: https://www.pfas.gov.au/about-pfas/affects and: https://www.pfas.gov.au/

EGL have their own dedicated website for their EGL Water division: https://eglwater.com.au/

That site provides links to other sites (such as the Australian government site linked to above) where you can find more information about PFAS and what is being done to try to phase out its use, reduce exposure to it, and remove it from contaminated water and soil.

EGL Water have partnered with Victoria University’s Institute for Sustainability and Innovation, which has spent months testing the efficacy of their new pioneering technology. Researchers have found an 87% reliable reduction in PFAS-contaminated water. This ground-breaking result signals the technology’s major potential for cost-effectively removing PFAS from the environment.

Source: https://eglwater.com.au/

Here are some links to announcements from EGL this year regarding their EGL Water division:

14-Feb-2023: MOU with 374Water Systems, Inc.

23-Feb-2023: EGL Water - Successful Commercial PFAS Results

08-Jun-2023: EGL Water PFAS Separation Plant Sale

And here’s a link to their August presentation that accompanied their FY23 Full Year Results:

24-Aug-2023: EGL Results Presentation

In that August Presentation (on slide 28) they mention that recent successful class action law suits have highlighted increased awareness and the urgent need to find solutions to remove PFAS contamination in water, soil, landfills, farmland and housing estates.

So there you have it - in no particular order - the 5 businesses within (or divisions of) The Environmental Group (EGL):

EGL is still a relatively small company that the Australian sharemarket is currently valuing as being worth less than $100m in total (currently $82m based on a 21.5 cps SP), and most investors either haven’t heard of them or do not follow them, so they have a long runway of growth ahead of them in my opinion, and the true value of the company is not yet being adequately reflected in their share price - again, in my opinion.

Also, as their name suggests, what they do is generally positive for our environment.

I bought our initial (real life) tranche of EGL at 14.5 cps in October 2021, not long after that first CEO meeting that Andrew had here with Jason Dixon, then I added more at 18 cps in December 2021, then more at 20 cps in May this year. Our average price paid has been 16.7 cps. They’ve been as high as 34 cps in Jan, 2022, got back up to 28 cps in September this year, and they finished October at 22 cps. It is my view that even when they were up at 34 cps very briefly in January of last year, they were still not trading anywhere near fair value due to the years of growth they have ahead of them, if they are not acquired (at a decent premium) by a bigger player before then.

And that's without factoring in the "Powerball" nature of their PFAS removal tech within EGL Water, which has an addressable market in the billions. I am currently not expecting too much from that business because I am aware that there are multiple players in that space, and there are no guarantees that EGL's PFAS-removal tech is going to win out and earn them significant market share compared to the other (mostly much bigger) players in that space. EGL have only made one commercial sale of a PFAS-Separation Plant - so far (link above). So I'm certainly hoping for a lot of success from EGL in PFAS removal in future years, but I'm not counting on it.

My bullishness on EGL is really just based on their other 4 divisions - and if EGL Water hits it out of the park then that will be plenty of welcome icing on the cake.

I'm not going to do a heap of graphs of revenue, profits, margins, etc., because this is a business that has relatively new management that is turning the business around (the business had NOT performed well before Jason and Paul joined the company in 2021), and it's still relatively early days in that turnaround, however based on what Jason and Paul did at Tox Free and what I have seen so far with EGL, I'm definitely onboard with this one.

Source: https://www.environmental.com.au/egl-subsidiaries/egl-waste-services

Disclosure: Yes, I do hold EGL shares.

17-July-2023: FY23-Trading-Update.PDF

Nice!!

Good work guys!! Keep it up!!!

Disclosure: I hold EGL shares both here and IRL.

30-June-2023: Strategic-Partnership-Agreement-with-374Water-Systems,-Inc.PDF

Strategic Partnership Agreement with 374Water Systems, Inc.

The Environmental Group Limited (ASX:EGL) is pleased to announce that it has executed a Strategic Partnership Agreement (SPA) with 374Water Systems, Inc. (NASDAQ: SCWO) for the exclusive distribution of the AirSCWO technology in Australia and New Zealand.

374Water Systems (374Water) is a global cleantech and social impact company founded in 2018. 374Water has developed and commercialised the novel AirSCWO™ system – a modular waste slurry destruction technology which destroys all organic compounds including PFAS and other persistent organic compounds. The technology utilises a physical-thermal process powered by water above its critical point (374°C and 221 bar) and air, that yields a highly effective oxidation reaction that completely eliminates organic compounds. At scale, the process generates energy and safe by-products which can be recovered and reused.

The technology has a broad range of applications including the processing of organic waste streams including:

- Biosolids & biosolid digestate

- Landfill leachates

- Commercial & domestic wastes (oils, fats, grease, plastic and food wastes)

- Liquids, sludges, and slurries contaminated with PFAS, 1,4-Dioxane

- Spent adsorption media like granulated activated carbon & ion exchange resins

- Animal and animal processing wastes

- Persistent organic pollutants.

EGL’s established network in the waste, utilities and industrial sectors provides the opportunity for the rapid uptake of the 374Water technology which will be complimented by EGL’s existing broad service network to provide effective after sales service and support.

The AirSCWO™ technology successfully processes waste streams in a standalone manner or can be combined with EGL’s PFAS Concentration technology, making it possible to treat vast volumes of PFAS contaminated liquid waste streams and destroy PFAS – Removing the contaminant entirely from the environment.

EGL Chief Executive Officer Jason Dixon said, “We are delighted to announce our strategic partnership with 374Water, marking a significant milestone for EGL. This collaboration allows us to bring the world-class AirSCWO technology to Australia and New Zealand, revolutionising the destruction of organic compounds and addressing critical environmental challenges. With our own PFAS concentration technology, extensive customer base and robust service network, we are confident in the success and positive impact this partnership will achieve.”

374Water Chief Executive Officer Kobe Nagar adds, "Through our strategic partnership with EGL, we're excited to expand AirSCWO technology's reach to Australia and New Zealand, revolutionizing their waste treatment landscape with our innovative solution."

They key terms of the SPA include:

- EGL is granted the exclusive distribution rights of 374Water’s AirSCWO™ technology within Australia and New Zealand.

- Provisions for comprehensive training of EGL service technicians in the USA for installing, commissioning, and servicing AirSCWO™ systems operating in Australia and New Zealand by EGL.

- Opportunities to implement AirSCWO™ technology into EGL PFAS Concentration projects for PFAS destruction.

- Where requested by 374Water, the provision of Project Services which include project management, design, procurement, construction, installation, commissioning, and maintenance of AirSCWO™ systems within the territories of Australia, New Zealand and Association of Southeast Asian Nations (ASEAN) as well as Pacific Ocean island countries and territories located west of the international date line.

- 2 years validity with an option to extend by a further 3 years.

Comment: I think this is another smart Strategic Partnership Agreement (SPA) that makes a heap of sense for EGL. And it's well within their wheelhouse, as usual.

Disclosure: I do hold EGL shares, both here and IRL. I note that the EGL SP rose +7.5% (or +1.5 cps) yesterday, and was up another half cent earlier today - although currently flat - at $0.215. Great potential! Looks signifcantly undervalued to me, based on regulatory and other tailwinds, and their market position. Also, as Jason Dixon said here recently (see Company Meetings page), they are virtually recession-proof. Most of their recurring revenue generating business units are anyway. Lots to like. Right place(/space), right time!

Now I wait for the market to catch up...

I dont know this company but in reading their reports was struck by a certain deja vu, then i found this on wikipedia...lets hope history doesnt repeat for s/h's

By 2018 the RCR brand had a reputation for delivering high quality mining technologies, innovation and services to both national and international markets and by the end of Financial year 2018 the company had grown to $2Billion in Revenue and was net cash at June 30 2018, having paid down all debt facilities.[31][32][33]

In late July 2018, cost overruns were discovered on a project. At the time the cost overruns were significant however, the company remained in profit and net cash. The Chairman, Roderick Brown, directed RCR into a protracted voluntary suspension for a period of 30 days which was had long term ramifications.[33] The company completed a capital raising of $100 million by Macquarie Bank, paying $12.1M in fees, according to the 2018 Annual Report, and the company resumed normal activities.[34] The Chairman, Roderick Brown and Directors called in Administrators when the Secured Creditors withdrew support for them on November 21, 2018.[34][35] In the final report of the Liquidator, it was determined that the protracted Suspension and the loss of confidence in the Chairman, Roderick Brown and new CEO, Bruce James “had a significant adverse impact on the group and its ability to successfully tender for new projects”.[35]

According to the Administrator's Report, McGrathNicol oversaw “a sale process that involved more than 300 interested parties on an 'accelerated sale process' timeline, seeking bids with minimal conditionality”.[35] The Administrators admitted failure to sell the business as a whole “Ultimately, each bidder who had initially engaged in the 'whole of business' sale process concluded they would not submit final bids”.[35] This was expected due to the accelerated due diligence process that was unsuitable for sale of such a large complex conglomerate as identified by KPMG in “Navigating Complex M&A”.[36]

The Sell Off[edit]

In 2018, RCR Boilers was sold to The Environmental Group Limited

08-June-2023: EGL-Water-PFAS-Separation-Plant-Sale.PDF

Positive. I hold EGL shares both here and IRL.

I have regarded their EGL Water division as the "powerball" upside that would be great if it happens, but I didn't factor the successful commercialisation of their PFAS separation and removal tech (i.e. EGL Water) as part of my investment thesis. I believed they were a good investment without it. And if it works, at scale, and in an economically viable way, then great! For clarity, they knew what they had worked; the tricky part was getting it to work at scale for a price that would be marketable. Their PFAS tech is good, and unique, however there are alternative PFAS removal technologies being worked on by other companies, so it's far from clear who is going to end up with the lion's share of the market.

The market is of course huge. Here is a recent news article which demonstrates what a problem PFAS has been just on Australian defence sites: Commonwealth settles $132.7 million class action over PFAS contamination across Australia - ABC News [15 May 2023]

See also: Mick Tisbury's 12-year fight to protect firefighters from PFAS toxic foam contamination - ABC News [04 Oct 2022]

Like I said, EGL has plenty of upside aside from their EGL Water division, but this announcement of their first commercial sale of a PFAS Separation Plant (which is what EGL Water is all about) is very positive news.

18-April-2023: EGL-Acquisition-of-Airtight-and-Capital-Raising.PDF

Plus: EGL-Investor-Presentation---Acquisition-of-Airtight--Raise.PDF

EGL to acquire Airtight Solutions funded through a $8.0 million institutional placement

Highlights:

- EGL to acquire leading Australian air pollution services provider Airtight Pty Ltd (“Airtight”) for $7.0 million plus up to $5.0 million earnout based on FY24 earnings [The earnout payable will be equal to the amount by which Airtight’s FY24; EBITDA (calculated on a pre-AASB 16 basis, noting that cash rent is expected to be $0.3 million) exceeds $1.35 million, multiplied by 5, up to a maximum of $5.0 million];

- Acquisition represents a major expansion of EGL’s presence in the air pollution control market;

- Airtight focuses on smaller low-risk projects with recurring cash flow in the light industrials sector, diversifying EGL’s revenue and expanding EGL’s client base;

- Revenue synergies from cross-selling with EGL’s TAPC and Waste Services divisions, and the opportunity to grow service revenue through Tomlinson personnel and experience;

- Highly experienced and capable leadership team and excellent cultural fit;