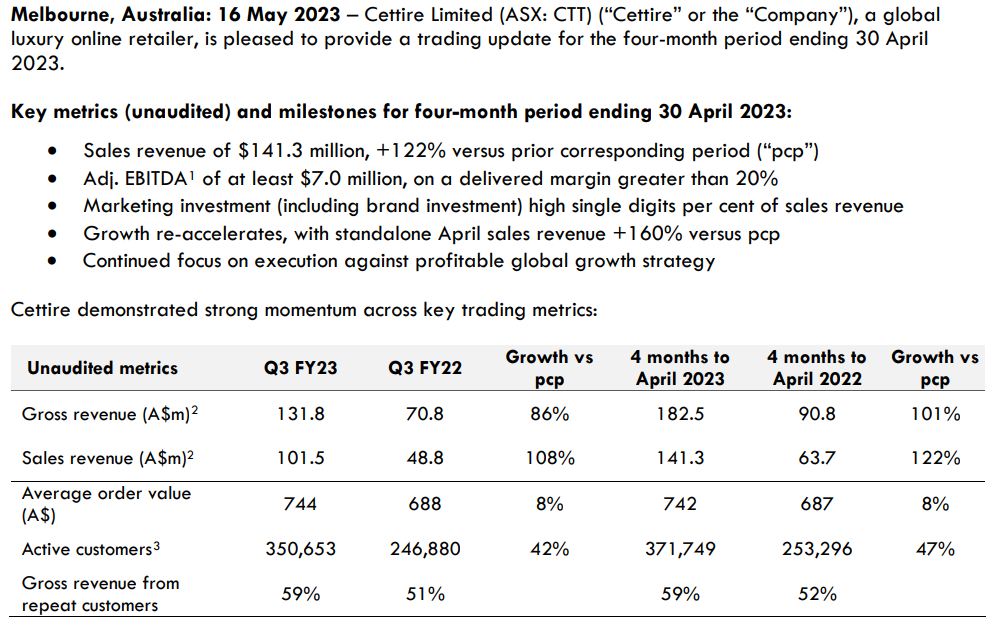

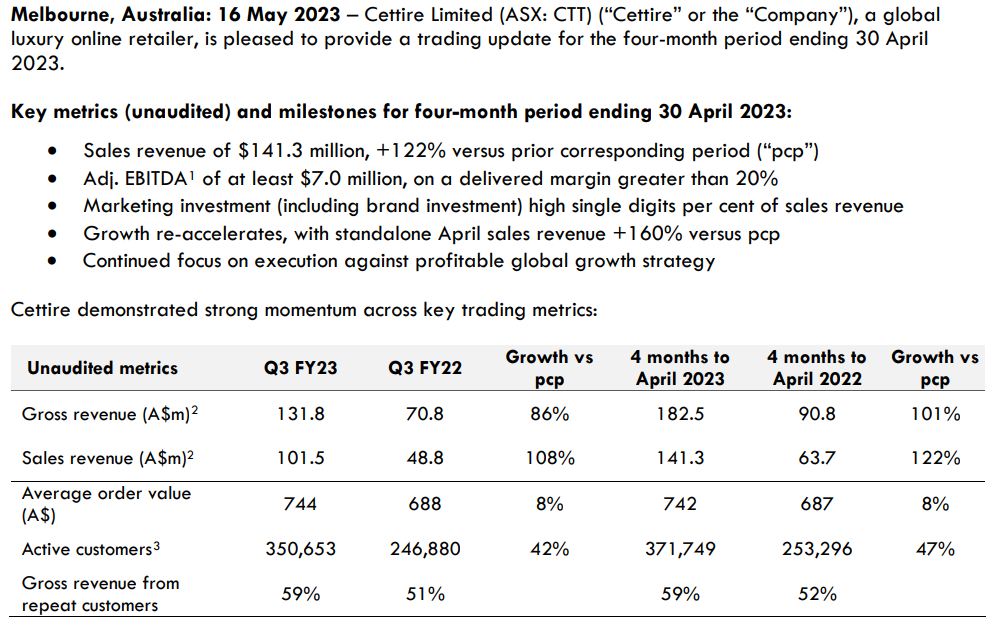

Cettire just dropped another impressive trading update. The headline numbers look great and continue to do everything I hoped they would (and then some):

I find myself in the extremely fortunate yet discombobulating situation of trying to decide what to do at this juncture.

For context, I started buying CTT while it was trading below $1 last year and my "investment thesis" was pretty flimsy at the time, consisting of a combination of mostly qualitative thoughts about the business and SP:

- Explosive revenue growth for luxury goods with an enormous global market

- Emerging global foothold

- Ability to easily control key costs as desired (or demanded), which has been demonstrated to great effect in recent quarters

- Founder selling (I considered to be entirely reasonable) turbocharged the sell off

- Any argy-bargy with brands not liking their goods being sold as grey market items would not come to a head in the near-medium term.

- My expectation that a luxury goods focus may weather an economic storm ok because the customer base tends to have a high degree of disposable income

My valuation "work" was equally flimsy and ultimately based on some digestion of forward estimates + peer comparison + simple multiples scenarios, at which point I concluded "it's probably going to be worth more than $1 soon" i.e. more of a "it's better to be approximately right than exactly wrong" type approach.

There is certainly a niggle that things are at, or close to being, as good as they'll get for a while which suggests it's time to aggressively trim. But then on the other shoulder is the voice saying to let your winners run, especially when the numbers say everything is going well and there's no significant deterioration yet i.e. don't box at shadows.

At current $2+ prices I won't be adding to my position, but any future excursions back below $1.50 territory which I've resisted over the past ~6 months may prove irresistible given today's update.

The valuation isn't yet what I would consider to be insane, so I'll probably continue to hold, but my finger is metaphorically getting itchy hovering over the sell button.