Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Cettire has been progressively revealed to have one or two accounting irregularities, to say the least. It’s shares have dropped around 90% over the time Phil King at Regal Funds management has been a substantial holder. Currently Regal holds around 14% of Cettire. For Regal this resembles a likely permanent loss of around $200m.

In March of this year Opthea (ASX:OPT) revealed the drug they were developing for macular degeneration failed at Phase 3. Regal bet heavily OPT and ended up losing around $220m.

1992 was a notable year of self-inflicted calamity for the British Royal Family. Prince Charles and Diana separated, Prince Andrew separated from Sarah Ferguson and daughter Anne divorced. And Windsor Castle was ripped by fire. Plus, that year all the usual royal family scuttlebutt was particularly amped up in the media.

Come the end of the year the Queen was feeling at the end of her rope, and in her New Years message referred to 1992 as her “Annus Horribilis”. Latin for “a year of misfortune”. For Phil the 2025 financial year must be just anus.

A great read on this substack by Taxloss:

https://taxloss.substack.com/p/cettire-i-was-wrong

It all seems very suspect. Be careful shareholders.

Now here's a vote of confidence!!

Mr Dean Mintz, Founder and CEO, has acquired 11,436,790 shares in the Company, representing 3% of the shares outstanding, through on-market purchases.

The total consideration paid was approximately $15.8 million.

Following the purchase, Mr Mintz will have a ~33% shareholding in the Company and remain Cettire’s largest shareholder.

Mr Mintz commented: “We are relentlessly focussed on driving profitable revenue growth, expanding our global footprint, remaining self-funding and executing Cettire’s growth strategy.

I believe we are well placed to deliver profitable growth in FY25 and beyond.”

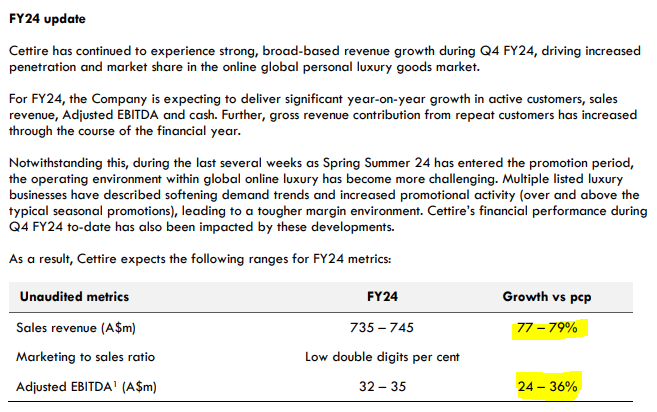

Quite the market reaction to Cettire's update today, with shares down ~40% at the time of writing.

Here's what they said (full announcement here)

Pretty good growth right? Well, it looks like the current Q4 is a shocker when you realize that Cettire was reporting EBITDA of $32.1m in April for the first 9 months of the year, and $545m in revenue.

So they are expecting a further ~$200m in revenue this quarter, but virtually no more operating profit. So they seem to be only able to move inventory by selling it for cost, and some impact from added costs perhaps associated with the China Launch.

Anyway, given today's drop shares are on a EV/EBITDA of ~12x

Doesnt seem too expensive, but only if you expect profit growth to return. Which maybe it will when competitors stop heavily discounting?

I dunno, but a reminder of how much and how quickly things can change in retail.

Will see if I can get the article content this evening

Presumably yesterday’s fall was around fears over the duty/tax concerns. I originally took Cettire’s response at face value but did hear Claude asking the question is this where their competitive edge came from (baby giants pod)? And is that going to go away now they’ve been called on it… I don’t think so but keen for thoughts

07-Feb-2024:

Rapid-profitable-growth-delivering-H1-Adj-EBITDA-of-$26.1m.PDF

CTT-H1-FY24-Appendix-4D-and-Financial-Report.PDF

CTT-H1-FY24-Results-Presentation.PDF

Market Like!

Tony Hansen at EGP would be relieved...

As you can see with his market capitalisation bands, over half of Tony's EGP CVF portfolio is invested in microcaps with market value of less than $200m. Of the 8 disclosed positions that made up his top 10 positions as at 31 December, 7 are ASX-listed (Tellus is unlisted), so here (below) are the share price performances of all 7 of those listed companies over the past 3 years:

Smartpay (orange line, +51.06% over 3 years) has come good in the past year, and BWF (Yellow, +16.25%) has a positive return, but Cettire (CTT) is the outstanding performer in the portfolio, having shot the lights out in Oct/Nov 2021, then fallen back to a negative return in the middle of 2022 before shooting up again over the past 12 months.

This only shows share price movement, so does not include dividends, so with dividends added the return on Dicker Data (black line, -3.78%) would become positive over the three year period, and the same is probably also true with Shriro (green line) because they do pay good dividends, but UOS (purple line) would remain a negative return and the PPK return over 3 years would absolutely remain negative, despite the spin-out of PPK Mining Equipment (PPKME) which is worth very little and is also very illiquid. Further Reading: PPK Group's difficult transition to be a technology company - Australian Manufacturing Forum (aumanufacturing.com.au) [31-Aug-2022]

The above graph may help explain why Tony's EGP Concentrated Value Fund (CVF) has underperformed their own benchmark index (the ASX200 Total Return Index):

Source: https://egpcapital.com.au/wp-content/uploads/2024/01/2023_12_1.pdf

Tony likes small companies, but his best performer, Cettire, has a $1.2 Billion market cap, so it's NOT small. Neither is DDR, at over $2 Billion. The second best performer of those 7 has been Smartpay (SMP) which has come back up over the past year, and their m/cap is now $353 million, however PPK, BWF and SHM all have m/caps of less than $90 million.

Life can be tough at the small end, even for a full time professional fund manager.

I don't know if Cettire fits this discription well because I don't follow the company closely, but I personally prefer to have a core of larger companies that are high quality in terms of their management, their business model, their industry position, and their total shareholder returns over 5 and 10 years - or longer when applicable, and then I can add some higher risk smaller companies in around the edges. Smaller companies are much more likely to triple or quadruple in price than larger companies are, but larger companies - as long as they are good quality larger companies - are also generally less likely to lose 80% of their market value over one, two or three years. You can make a living out of investing at the smaller end if you are very, very good at it (like @Wini clearly is!) but for us mere mortals, it can be difficult to do it consistently, year after year.

I like a mix of companies, but the majority of my larger portfolios are larger high quality companies - like CSL, TNE, ARB, NST, WES, FMG, NWH, MND, MIN, MAQ, ALU, AD8, ABB, CDA, JLG, NCK (mid-sized but still very high quality), and so on... and then I'm more comfortable having exposure to smaller companies with higher risk but potentially higher upside potential, like EGL, AVA, DVP, GNX, etc., understanding that they may trade sideways or even head south east for a while before they take off, if they take off, but I can afford to have a few that don't, and sell out of those at a loss at some point when I accept that my investment thesis for that particular company is busted, as I have done with ZNO (sold in early 2022), 5GG (April 2023) and EVS (July 2023). All small positions at the time I bought those three, and even smaller positions when I sold them, but they've dropped further since and even if they rebound I'm not going to be unhappy because I followed my process.

I should point out however that share price movement doesn't determine whether or not my investment thesis is on track or busted, unless it's share price movement over a LONG period of time that alerts me to the fact that I must be missing something important about this company and I need to do some more research to find out what it is. I have never invested in Cettire (CTT), but if I had, say three years ago, I would have been feeling fairly smug about that in October and November 2021, but I would sincerely hope I would NOT have sold out in the first half of 2022 just because the share price was heading the wrong way, unless I was trading the stock, and planned to buy back in when they were back in an uptrend, but as an investor rather than a trader I should have held, as long as the business was going OK. The reality is a little more cloudy however because if memory serves, Cettire did not live up to their own guidance during that period so it appeared they were not scaling as well as had been expected and the rapid topline sales growth wasn't there either, so the hype came out of the stock.

However, this latest report seems to prove that there was a decent business underneath all that and those were just teething problems rather than a house of cards collapsing. But like I say, I don't follow them too closely. Not really my sort of business. I've never really been into the new wave of online only retailers (Kogan, Temple & Webster, etc.) - I prefer Nick Scali (NCK), ARB & Wesfarmers (WES, who own Bunnings, Officeworks, and dozens of other brands) where they can sell online in addition to in-store. But each to their own.

I reckon they'd be some happy Cettire shareholders today. It would be nice if they can go on with it tomorrow like NCK did today (+5.93%) after their +16.57% rise yesterday on the back of their stellar report.

Full year results are in and this thing is still growing super fast… I’m back in IRL over the last month in the basis that it has a potentially long runway and worldwide customer base… of course it’s a little speculative but could be massive long term

Rapid, profitable growth, achieving FY23 Adjusted EBITDA of $29.3 million Melbourne, Australia: 10 August 2023 – Cettire Limited (ASX: CTT) (“Cettire” or the “Company”), a global

luxury online retailer, today released its results for the 12 months ended 30 June 2023 (FY23).

FY23 highlights (vs FY22):

● Gross revenue1 up 87% to $539.2 million

● Sales revenue up 98% to $416.2 million

● Active customers2 up 63% to ~423k, with year-on-year growth accelerating since Apr-23

● 58% of gross revenue from repeat customers (FY22: 50%)

● Delivered margin up 156% to $95.6 million

● Paid customer acquisition expenses 8.0% of sales revenue (FY22: 14.9%)

● Adj. EBITDA3 of $29.3 million (FY22: $(21.5) million)

● Statutory EBITDA of $25.8 million; Statutory NPAT of $16.0 million

● Ongoing localisation initiatives in progress, underpinning next wave of growth

● FY24 outlook:

o Operatingtomaximiseprofitablerevenuegrowth,whilstalsoself-funding

o PositivetradingmomentumcontinuesintoFY24ashealthydemandremains;growing

online luxury penetration provides supportive backdrop

o PositiveAdjustedEBITDAduringJul-23assalesrevenueincreasedbyapproximately

+120% 4 versus the pcp5

● The Company will host an investor webinar today, Thursday 10 August 2023 at 10.30 AEST. Click

here to register

Commenting on the FY23 results, Cettire’s Founder & CEO, Dean Mintz, said:

“FY23 has been another year of tremendous growth and transformation for Cettire. Through strong execution against our strategy to maximise profitable revenue growth, Cettire grew rapidly whilst also delivering significant profitability and cash generation.

Cettire is a highly nimble business, with a largely flexible cost base. This enables us to adjust quickly to market conditions and optimise performance. The pace at which we have been able to drive improved performance through FY23 is something I am particularly proud of.

1 Gross revenue is revenue net of GST/VAT/sales taxes but is exclusive of returns from customers; Sales revenue is gross revenues net of allowances and returns from customers

2 Active customers are unique customers who have made a purchase on the platform in the last 12 months

3 Cettire uses Adjusted EBITDA as a non-IFRS measure of business performance which excludes share-based payments, unrealised FX loss / (gain), loss/ (gain) on FX contracts and other items

4 Revenue growth in July is pre-accounting adjustments (deferred revenue and refund provisioning) 5 Prior corresponding period

Cettire Limited – ACN 645 474 166

1

Cettire stands out from other software and technology-enabled businesses globally for its ability to consistently grow rapidly, whilst achieving attractive levels of profitability and capital efficiency. We are very well positioned to continue to grow share of the personal luxury goods market.”

In FY23, active customers increased 63% to over 423,000. The Company has experienced a further acceleration in active customer growth since its April market update, achieving record quarterly net active customer additions in Q4 FY23. This was driven by continued strength in customer acquisitions and improvements in retention. Repeat customers accounted for 58% of gross revenues (FY22: 50%), with higher average spend per order and increased order frequency for this customer group.

The sustained strength in repeat customer purchasing behaviour continues to provide the Company with confidence to invest in pursuit of global growth. Paid acquisition of 8.0% of sales revenue during the year reflects more conservative operating settings as well as geographic and channel optimisation (FY22: 14.9%). Similarly, a moderation in brand investment to $3.3 million illustrates an increased focus on channels with nearer term payback (FY22 $11.8 million).

Delivered margin increased by 156% vs the pcp to $95.6 million, representing 23.0% of sales revenue (FY22: 17.8%). This demonstrates successful execution against several cost optimisation initiatives outlined at FY22 results, which reduced fulfilment cost per order, supplemented by a higher average order value.

Operating cash flow for the year was $36.5 million, driven by FY23 operating surplus (cash profit) and favourable working capital dynamics given Cettire’s capital light business model, which continues to provide a tail wind through this ongoing rapid growth phase. Year-end cash was $46.3 million, with zero financial debt.

A$m unless stated FY23 FY22 Growth vs pcp

Gross revenue1 539.2 287.8 87%

Sales revenue1 416.2 209.9 98%

Delivered margin 95.6 37.4 156%

Adjusted EBITDA3 29.3 (21.5) N/a

Adjusted EBITDA margin 7.0% (10.2)% +17.2pp

Average order value (A$) 747 702 6%

Active customers2 423,253 260,249 63%

Gross revenue from repeat customers 58% 50% +8.0pp

Cettire Limited – ACN 645 474 166

2

Business update

Localisation of Cettire’s platform remains a key strategic priority to drive penetration in its emerging markets. During FY23, the Company commenced deployment of multi-language features, including Chinese, Japanese and Spanish language sites. The localisation strategy has facilitated further rapid growth within its emerging markets, with FY23 gross revenues in these markets increasing by 140% vs the pcp. Emerging markets accounted for 27% of gross revenue during the period (FY22: 21%).

Much of Cettire’s localisation efforts have focused on the Chinese market launch. Due to the scale and significance of the opportunity, the Company has taken a disciplined approach to setting up its Chinese proposition, doing so in a way that affords Cettire the greatest optionality around channels to market.

The opportunity to grow penetration in Cettire’s top-three established markets (US, UK, Australia) also remains substantial. Established markets continued to perform strongly, increasing gross revenues by 77% vs the pcp, led by the US market which grew in-line with the Group.

Cettire expects the overall revenue base to continue to broaden as the Company further localises its proposition and grows its presence beyond established markets.

During the year, Cettire again achieved significant ongoing growth across its global supply chain, with the value of available inventory significantly expanding to approximately $2 billion. In line with Cettire’s strategy to provide a platform for all members of the supply chain, the Company added additional direct luxury brand supply relationships, including the commercial agreement with Zegna announced 15 December 2022, to directly integrate and sell its products on the Cettire platform.

Organisational capability continues to grow. In particular, Cettire has made several additional key engineering hires with world class pedigree during the period. The Company intends to continue to selectively build its technology talent where appropriate.

Cettire’s Founder & CEO, Dean Mintz, said:

"We have considerable momentum in the supply chain as our compelling supplier proposition gains traction. Our focus is on continuing to drive penetration across the supply chain, which in turn enables us to better serve our customers.”

FY24 Outlook and July trading update

In the coming year, Cettire will continue to focus on maximising profitable revenue growth, whilst also self- funding.

Cettire has continued to experience a healthy demand environment across its geographic footprint, illustrating the resilience of global luxury spend. The Company remains excited about the structural shift of luxury spend online, providing ongoing potential to expand its addressable market.

Cettire Limited – ACN 645 474 166

3

The Company is pleased to announce that positive trading momentum has continued into FY24, evidenced by the following observations through July 2023:

• Further acceleration in active customers growth rate to 67% versus the pcp;

• Sales revenue increased approximately 120% 6 versus the pcp; and

• Adjusted EBITDA profitability has been maintained.

Commenting on the Company’s sustained start to FY24 and outlook, Mr Mintz, said:

“We are pleased by the early trading in FY24, with all our key markets performing strongly. Cettire is well positioned for another strong year of growth and profitability. We are well advanced in our preparations for China market entry, which remains a very attractive market opportunity and offers significant incremental growth potential.”

Results webinar

Founder & CEO Dean Mintz and CFO Tim Hume will host an investor webinar at 10.30 am AEST on Thursday, 10 August 2023 to discuss the results. Register for the investor webinar via the link below:

https://us02web.zoom.us/webinar/register/WN_vkbJq5HvQg-xabfK2hCJTw

Questions can be pre-submitted to [email protected] or asked via the Q&A function during the webinar.

After registering, you will receive a confirmation email containing information about joining the webinar.

This document has been authorised for release by the Directors of Cettire Limited.

—ENDS

6 Revenue growth in July is pre-accounting adjustments (deferred revenue and refund provisioning)

Cettire Limited – ACN 645 474 166

4

For further information, please contact:

Investors

Tim Hume

Investors

Sam Wells

NWR Communications [email protected] +61 427 630 152

Media

Matt Wright

NWR Communications [email protected] +61 451 896 420

Launched in 2017, Cettire is a global online retailer, offering a large selection of in‐demand personal luxury goods via its website, cettire.com. Cettire has access to an extensive catalogue of more than 2,500 luxury brands and 500,000 products of clothing, shoes, bags, and accessories. Visit: www.cettireinvestors.com

About Cettire

Cettire Limited – ACN 645 474 166

5

Eureka Report published an article on 6th July titled "The Luxury Goods Market and LVMH" in which author Elizabeth Moran picks over some numbers from a recently released industry research report. A key excerpt from the article:

Apart from Cettire selling goods from a number of the named top brands as well as a boat load of other high end brands, the estimate of 33% of sales being online by 2030 combined with Cettire's growing global reach (including significant growth in Asian countries) and lower prices bodes well. Certainly better than I've been assuming to date.

I sold a smidge under 30% of my holding at $3.29 (only to watch the SP continue it's march up to above $3.50, doh!) but am more inclined than I was to just HODL and see where this ride takes me over the next few years...

CTT's SP rollercoaster rivals PNV's!

2 months on since my #3Q23 Trading Update straw and my conclusion that the valuation isn't yet what I would consider to be insane is being stretched... ok ok, heaved into a dumpster, doused in petrol and set on fire.

On it's upward march towards the $2.50 level, I saw a reference to CTT on a Livewire Markets "Charts of the Week" story which stated:

It’s the steady climb that we’re interested in and highlighted on the chart above. It’s a solid uptrend, where the dips have been met with support, whilst average volume has been picking up through the most recent part of the rally. The $2 round number has been tested and confirmed multiple times and it seems the bulls are now clear of this level.

I have devoted zero energy to learning about trading and charting (as opposed to valuation and the psychology of investing), but gee whiz do the traders move the SP, which today closed at $3.11 - more than double in 2 months. We're well into irrational SP territory to my mind, and the recent daily swings of typically double-digit percentage SP movement for a discretionary retail stock on no news defy belief to me as a non-trader.

Per my previous straw, I don't hold because of a high degree of conviction in the long term outlook and I'm most certainly not a fashionista who fully appreciates the range of products sold on the platform, yet the business metrics are all good so I don't think it makes sense to sell out entirely.

To my mind, the $3+ SP represents significant downside valuation risk, so I'm planning to trim somewhere between a quarter and a third of my position to recoup invested capital + some profit to reinvest in the wide range of interesting alternative options that exist currently after all the tax loss selling.

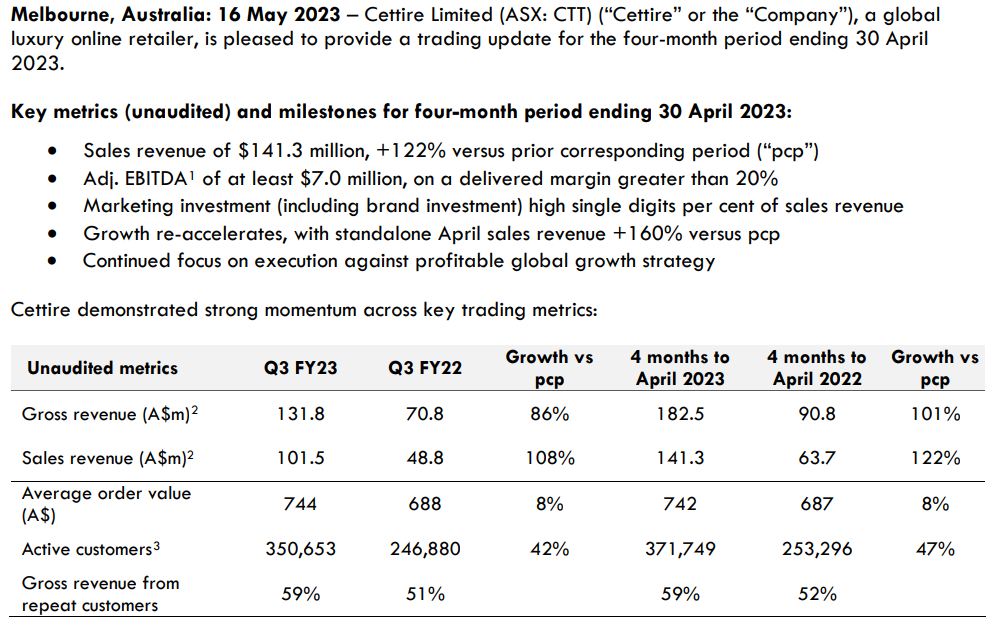

Cettire just dropped another impressive trading update. The headline numbers look great and continue to do everything I hoped they would (and then some):

I find myself in the extremely fortunate yet discombobulating situation of trying to decide what to do at this juncture.

For context, I started buying CTT while it was trading below $1 last year and my "investment thesis" was pretty flimsy at the time, consisting of a combination of mostly qualitative thoughts about the business and SP:

- Explosive revenue growth for luxury goods with an enormous global market

- Emerging global foothold

- Ability to easily control key costs as desired (or demanded), which has been demonstrated to great effect in recent quarters

- Founder selling (I considered to be entirely reasonable) turbocharged the sell off

- Any argy-bargy with brands not liking their goods being sold as grey market items would not come to a head in the near-medium term.

- My expectation that a luxury goods focus may weather an economic storm ok because the customer base tends to have a high degree of disposable income

My valuation "work" was equally flimsy and ultimately based on some digestion of forward estimates + peer comparison + simple multiples scenarios, at which point I concluded "it's probably going to be worth more than $1 soon" i.e. more of a "it's better to be approximately right than exactly wrong" type approach.

There is certainly a niggle that things are at, or close to being, as good as they'll get for a while which suggests it's time to aggressively trim. But then on the other shoulder is the voice saying to let your winners run, especially when the numbers say everything is going well and there's no significant deterioration yet i.e. don't box at shadows.

At current $2+ prices I won't be adding to my position, but any future excursions back below $1.50 territory which I've resisted over the past ~6 months may prove irresistible given today's update.

The valuation isn't yet what I would consider to be insane, so I'll probably continue to hold, but my finger is metaphorically getting itchy hovering over the sell button.

[Held IRL]

Been a while since I checked Google Trends:

It's unfortunate that China is a black hole to Google, but trend generally looks ok to me, some volatility + seasonality not withstanding, and there's clear evidence that they're expanding consumer awareness + geographic reach despite their pivot to moderating their marketing spend. Fashionistas are everywhere it seems!

[Held IRL]

Nice HY results from Cettire. Will their sales hold up over the next 1-2 years is the question on my mind though...

The sorts of consumers buying from them don't strike me as folk who will have to stop buying because interest rates have gone up a few percentage points or the price of their dream handbag went up 20% i.e. my current expectation is that even though Cettire's growth may moderate, perhaps quite substantially, I wouldn't expect them to start going backwards suddenly either.

Some more pondering to be done, but happy to hold for the moment...

CTT has been going for a little run of late, up strongly today, again. I had an interesting chat with a long-term shareholder on this. Obviously a big believer, but thought that the market had misunderstood the stock (partially CTT's management's fault who are notoriously light on detail/engagement with shareholders) and it is really starting to hit its straps. Not profitable yet, but getting close and as an earlier post pointed out a negative working cap cycle which is always attractive (i.e. it gets its money from customers before it pays it creditors - unusual in this world). Holding a good level of cash and worth watching - last update was pretty strong on turnover improvements and profitability.

I do not hold CTT either in IRL or SM.

Stable from November but expect that Nov bounce was due to Black Friday in US and pre-order for Christmas.

interested in other views.

Further to previous straw

New York Times article published 24 August 2021 explaining what Cettire does may have drawn attention

https://www.nytimes.com/2021/08/24/fashion/fashion-luxury-gray-market.html

Institutional investor substantial holder increase announced after close Friday.

However, caution as AFR article in June re various criticisms of sustainability of business model led to 20% drop in share price.

Very fast growth but investors beware

incentives for management which might give you a scare.

eCommerce is hot and the forecasts are high

it's hard to get comfortable with them, but perhaps worth a try.