Quite the market reaction to Cettire's update today, with shares down ~40% at the time of writing.

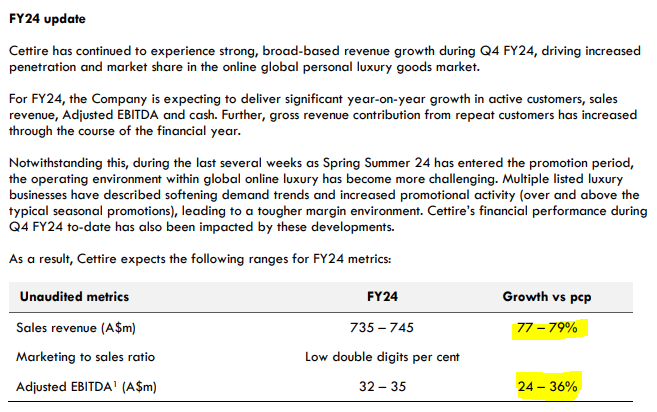

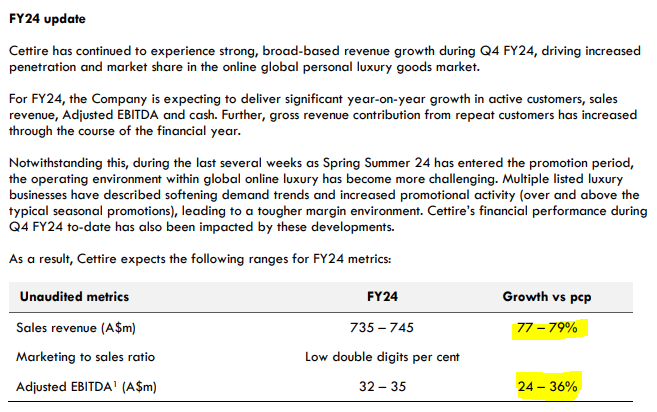

Here's what they said (full announcement here)

Pretty good growth right? Well, it looks like the current Q4 is a shocker when you realize that Cettire was reporting EBITDA of $32.1m in April for the first 9 months of the year, and $545m in revenue.

So they are expecting a further ~$200m in revenue this quarter, but virtually no more operating profit. So they seem to be only able to move inventory by selling it for cost, and some impact from added costs perhaps associated with the China Launch.

Anyway, given today's drop shares are on a EV/EBITDA of ~12x

Doesnt seem too expensive, but only if you expect profit growth to return. Which maybe it will when competitors stop heavily discounting?

I dunno, but a reminder of how much and how quickly things can change in retail.