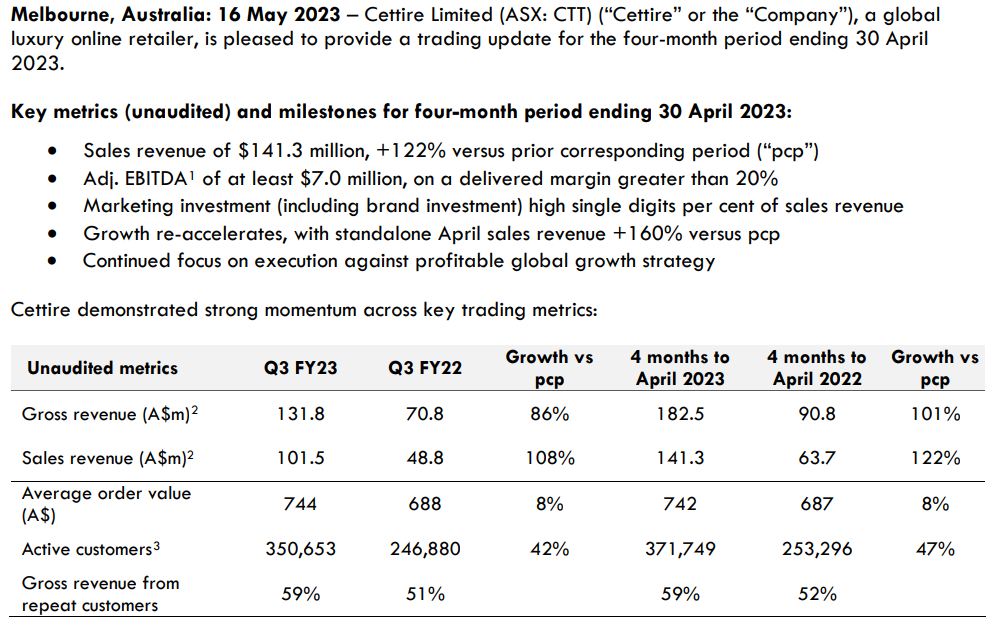

2 months on since my #3Q23 Trading Update straw and my conclusion that the valuation isn't yet what I would consider to be insane is being stretched... ok ok, heaved into a dumpster, doused in petrol and set on fire.

On it's upward march towards the $2.50 level, I saw a reference to CTT on a Livewire Markets "Charts of the Week" story which stated:

It’s the steady climb that we’re interested in and highlighted on the chart above. It’s a solid uptrend, where the dips have been met with support, whilst average volume has been picking up through the most recent part of the rally. The $2 round number has been tested and confirmed multiple times and it seems the bulls are now clear of this level.

I have devoted zero energy to learning about trading and charting (as opposed to valuation and the psychology of investing), but gee whiz do the traders move the SP, which today closed at $3.11 - more than double in 2 months. We're well into irrational SP territory to my mind, and the recent daily swings of typically double-digit percentage SP movement for a discretionary retail stock on no news defy belief to me as a non-trader.

Per my previous straw, I don't hold because of a high degree of conviction in the long term outlook and I'm most certainly not a fashionista who fully appreciates the range of products sold on the platform, yet the business metrics are all good so I don't think it makes sense to sell out entirely.

To my mind, the $3+ SP represents significant downside valuation risk, so I'm planning to trim somewhere between a quarter and a third of my position to recoup invested capital + some profit to reinvest in the wide range of interesting alternative options that exist currently after all the tax loss selling.