Pinned straw:

Ouch! BST earlier this week and now DSK. This supports what I have been hearing in personal discussions with different retail operators. Whilst, cafes in shopping centres remain busy with the 40-50-60-70 year olds lucky to own their own homes debt free it’s masking a collapse in general retail. Let’s see who is next? I wonder what, if any influence this has on the RBA? Then again not sure too many of the RBA heavyweights are visiting BST and DSK.

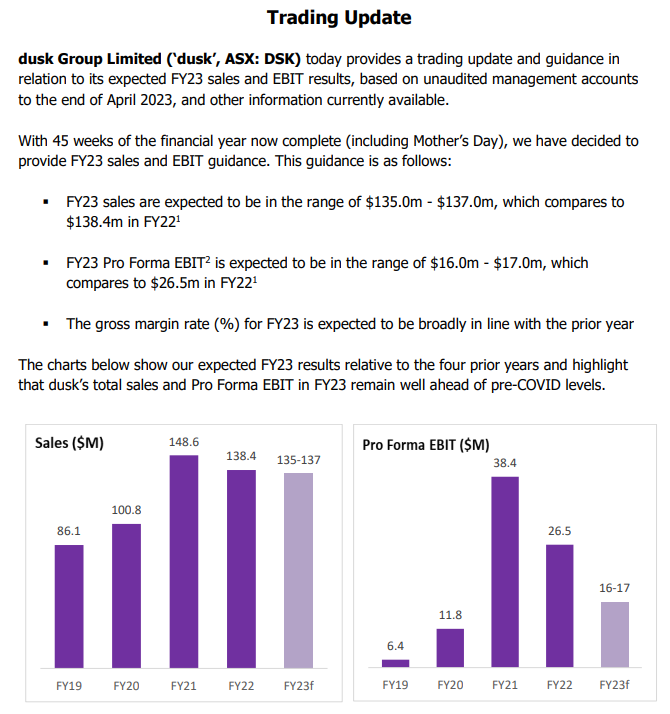

Yeah @Noddy, it has been looking very quiet in the Dusk stores lately. I’ve done some quick and dirty calculations for FY23. Pick me up if it looks whacky!

FY23 EBIT $16 million. After tax $11.2 million NPAT (ignoring depreciation and abnormals, 16 x 0.7) That’s 18cps (11.2 / 62 million shares) per share compared to 31cps last year, down 42%.

ROE will come back to 30% (EPS/BV = 18/59) compared to historical 75% (2021) and 53% (2022). The big question is will ROE continue to decline from here, or is this as bad as it gets?

If you believe this is as bad as it gets and Dusk can maintain ROE at 30% from here, then your future returns could be as high as 19% per year at the current trading price $1.34 (McNiven’s StockVal formula). At $1.34 Dusk is trading at about 7 times estimated FY23 earnings.

As I said, this is a quick and dirty calculation and much depends on whether dusk fragrances will remain ‘on the nose’ over the next few years.