Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Dusk's result out this morning, overall not bad (market reaction was good too).

This is a $75m market cap company, so if you remove cash, you're essentially paying $37m for a company that just produced NPAT of $9.6m for the 1st half and free cash flow of c. $20m. Makes it interesting from a value perspective. Only cloud was probably the membership program which now appears to be in long term decline. That and it's still candles and smell nice oils, and my wife still hates the business....

Held IRL & SM.

Update from the AGM this morning - some recovery in sales YTD...still a long way back from its peak and coming of a lower base so to be read with caution. But at least it's starting to show signs of recovery...

Membership $10 (was$15) Transformational year with new management team and new strategy in place. dusk delivered quarter on quarter improvements in sales trends as FY24 progressed (CEO has been with DSK for 1 yr)

Return (inc div) 1yr: 31.03% 3yr: -21.93% pa 5yr: N/A

(07/2024)

Any one else still holding a candle (boom-tish), or should I say bag, for dusk?

Some great posts before from @Rick and @Dominator and others on reasons for selling. I've been a little too stubborn to sell at these prices, so while I've been too shy to add more, I've held on.

The recent update on the second half looks encouraging based on just the cash and inventory position. Over the last 12 months, which have not been good for discretionary retail, the business has added ~A$4m to its cash position (~20.8m) and paid out about A$3.4m in dividends.

The market cap at ~80c is near enough A$50m, so assuming no other significant balance sheet items occurred during the year (there may have been some cash costs for store closures etc that I'm simplifying) the business is trading on a price to free cash flow (after tax) of about 7 times. If you do it on an EV its only about 3x.

I was nervous about the change in management, but so far, Vlad and the new team seem to have navigated the tough environment well - and he even bought a few (5k shares - so few is generous) on market recently. There is no sign of heroics, which is not what the business needs at the moment.

I've updated my DCF and lowered the price target - which in hindsight was wrong (they all are - but this one more than I'd like!). I've lowered the long term NPAT margins to 6%, which is a little higher than this year but I don't think unattainable. I've reduced the revenue growth over the long term slightly. I think my biggest mistake previously in putting a valuation of 2.60 on dusk (see below) when a recession was likely coming was to think that it could survive the downturn and get back to realising full long term value without a takeover. I think now that its shown it will survive through this downturn, PE will try take it out - and get it. I take the point about PE avoiding due to limited growth, but they don't have to flip it, they might choose to hold it as a cash cow even without much growth. There's not a lot of risk if run conservatively if you can pick it up for A$100m or less, with such a clean balance sheet and no committed investments.

My revised DCF valuation target comes out at $1.78 per share, I'm valuing it at $1.40 because I think it will get taken out about there.

------------------------------------------------------------------------------------------------

(2022)

Valuation of $165m from DCF, which off a base of 63m shares gives a per share valuation of $2.60.

I have allowed for some revenue and margin erosion in the coming years due to the economic outlook and the fact that despite being an "affordable luxury" and well managed (IMO) dusk would likely be impacted.

I take revenue down by 10% each of the next 2 x years and then hold it flat until 2026. It resumes growing at 10% pa from 2027 for a few more years but reaches a terminal revenue of about $180m by 2031. I think this is conservative given the history of growth, long term expansion plans in NZ/UK and the fact that it could easily fund that growth via cashflows and its current cash hoard (which is approaching 20% of Market cap at 21.5m).

I've assumed that margins are squeezed over the near term too but particularly in 2024/25. If this happens it might fall further and will require some fortitude to hold. From 2027 NPAT margins are back around 13% where they were for FY22 (19% in FY21, but that was a boom year with COVID).

I've valued the cash at face value, I think that's conservative given I've only factored in limited growth.

I've used a 10% discount factor

Disc: I hold this in real life, am sitting on a loss and plan to buy more.

Unfortunately I bought into Dusk a few years ago when candles were popular during the pandemic. Now I think the well-being community are steering clear of artificial fragrances and sweet smelling fragrance are now on the nose! My wife warned me about this and I should have listened!

I managed to offload some of our holding before the latest spiral downwards, at a significant loss. Today, Dusk is trading at 78cps, cum a 2.3cps fully franked dividend (goes ex dividend this Monday, 11th March).

I feel like just biting the bullet and selling it so I can wipe the red off my screen. However, the business is debt free and holds 50cps in cash. The businesses is now trading at just over its equity value. All it needs to do now is run at a profit and return 10% return on equity to make future returns look reasonable. The big question here is will Dusk continue to run at a profit?

Providing they don’t squander their cash away by rolling out loss making stores, and they can turn a reasonable profit, the business looks too cheap to sell at today’s price. I might live to regret this, and my wife will continue to remind me of it too!

Worst Investment Ever! :(

24 Feb 24

Updating based on expectation of $6m NPAT.

- PE target = 10

- Profit = $6m

- Cash = $30m

- Market value = $90m

- Valuation per share = $1.45

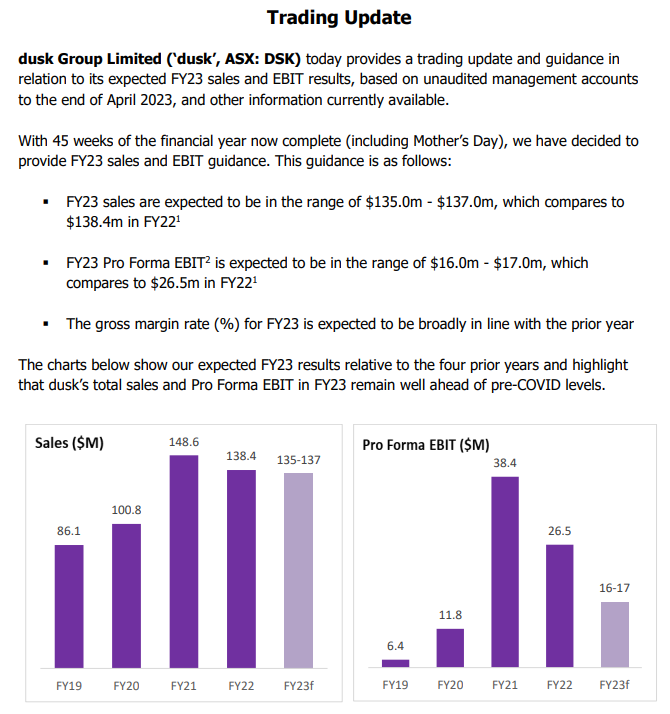

19 May 23

Updating based on weak trading update:

- PE target = 10

- Profit = $10m

- Cash = $30m

- Market value = $130 mil

- Valuation per share = $2.09

Feb 23

Updating based on shorter-term expectations being weaker.

- PE target = 12

- Profit = $16 mil

- Cash = $33 mil

- Market value = (12 x 16) + 33 = $261 mil

- Valuation per share = $3.61

Sep 22

Update of valuation due previous valuation becoming stale. Still a target PE of 12 and an expected NPAT of $20 mil after FY22 results. Cash updated to $20mil. Short term price target only. There is still potential for growth through the opening of more stores which over time will increase Dusk's valuation.

Valuation figures:

- PE target = 12

- Profit = $20 mil

- Cash = $21 mil

- Market value = (12 x 20) + 21 = $261 mil

- Valuation per share = $4.19

Overview Comment:

Overall, a negative result but about what I expected (actually slightly better). I am expecting profitability to be around $5-6m for this FY so 1H NPAT of $8.1m should allow that exception to remain (2H is always weaker). Without the strong cash backing I would definitely be out due to risk of failure. The current valuation on an EV/E with my assumption of $5-6m FY24 profit is approximately 4-8x (depending on low/high cash figures between halves) so not a demanding multiple and probably the only thing keeping me from selling. I am well aware I could be stuck in a value trap here so needs constant monitoring. At this point continued holding requires that current conditions are nearing the bottom of the cycle and as consumer confidence returns Dusk's operating leverage will return.

General notes:

- Dividend of 2.5c

- NPAT $8.1m, about where I expected it to be, with H2 I would expect NPAT to be negative due to the usual seasonality. EPS 12.9c.

- Store network up to 151 stores. 2H will be see 4 store openings with 5 store closures of underperforming stores.

- Not expanding NZ offering until conditions improve.

- Improving rate of total sales decline compared to PCP for FY23 as FY24 progresses, first 7 weeks -15.6%, first 20 weeks -11.3%, 1H -9.7% and first 7 weeks of 2H -7.8% with December 8%. However, consumer was starting to weaken at this point last year.

- Sales conversion rate remains stable.

- Multiple notes about continued focus on maintaining costs.

- CFO leaving not long after new CEO started. Don't know if good or bad? Gives a potential for a fresh start but also is there internal issues with new CEO? Not much information on changes CEO intends to make.

- Amazon store opened in the half.

- No outlook provided; however, this is normal for Dusk.

Positives:

- Maintained gross margin at 64.5%.

- Net cash $31.1m.

- Invenvtory managed well with figure flat at $17.6m even though number of stores up by 10.

- CEO appears to want to attract new younger customers.

Negatives:

- Sales $77.8m down 9.7% on total or 15.8% LFL. LFL very troubling.

- CODB up 5.9%. Due to wage increase of 6.25%.

- Online sales still struggling at 5.3% of sales or $4.1m. Website redesign coming.

- Membership numbers down 703k from 735k at FY23 year-end (1HFY23 end was 722k). Price increase to $15 hasn't worked so going back to $10.

- Membership ATV has decreased from $64 in 1HFY22 to $57 1HFY24. Membership makes up 56% of sales.

Has the thesis been broken?

- No, but remains on a very close watch with a sell if there is any sign that Dusk won't improve performance when the consumer confidence returns. Still has a strong cash backing so can't see financial stress as such in the next year or so.

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- That conditions don't continue to deteriorate. Expecting that we are nearing the bottom of the cycle over the next year or so.

- Will the CEO start to make visible changes to improve results?

- Continued focus on controlling costs and maintaining gross margins.

- Continue using statutory figures rather than proforma numbers.

- Company "on watch".

- FY24 NPAT of $5-6m and sales ending the FY down around 5-8% compared to FY23.

In an ASX announcement this morning Dusk were quick to advise “it has not been approached by any prospective buyer or advisor in relation to a privatisation or takeover. Dusk said Ord Minnett are acting on their own initiative and do not have a mandate or arrangement with dusk in relation to this matter. We have not seen or contributed to the content of any document purported to have been prepared by Ord Minnett.”

The ASX announcement was in response to an AFR Street Talk story published yesterday (and copied below). I haven’t come across this approach before (ie. an instruction booklet on how to takeover over a company) but it probably happens all the time? I’m curious to see if anything develops from here.

Project Dawn: A flyer, a banker and a candlestick maker

“Dusk’s bombed-out share price is attracting attention.

Street Talk understands stockbroker Ord Minnett is shopping around the ASX-listed candle and diffuser retailer, putting an investment opportunity flyer in front of potential acquirers.

The 43-page deck, dubbed “Project Dawn”, outlines the business’ financial performance, its abysmal trading performance since December 2021, the make-up of its register and how best to mount a takeover.

Ords recommends a scheme of arrangement via a full cash offer, which it calls a “friendly approach”, because of the strong representation of the board and management on the register.

“Early engagement with board and management who together own around 9.6 per cent of Rusk will be critical,” Ords argues.

“Board and management have a modest but important combined stake and may be influential on top institutional shareholders’ views. We believe the remaining major institutional shareholders may be open to an initial approach, and suggest early engagement to ensure alignment of interests with key shareholders.”

Ords’ friendly approach recipe aptly starts with a “fireside chat” with Dusk chairman John Joyce, followed by a formal written and verbal approach. The aim is to secure an agreed solution and receive a board recommendation.

Its alternative approach is securing a prebid stake from Dusk shareholders, including early engagement with its largest intuitional shareholder, Regal, which has a near 5 per cent stake, which it says would be considered “quasi-aggressive”. Then, it would put forward a scheme of arrangement or an off-market takeover.

It’s not surprising to see a document like this circulating. This is what bankers such as Ords’ Steve Boggiano and Sam Robinson do for a crust – try to get people to buy something and make a fat fee off the back of it. Whether it results in a transaction is another question altogether.

Still, Ords corporate finance team knows its target better than most, having advised Dusk on its $124 million initial public offering in October 2020. The company listed at $2 per share and has been trending down since December 2021, last trading at 94¢. Ords points out this means a reasonable cash offer would “likely gain board and shareholder attention”.

Dusk has 145 stores across Australia and New Zealand, selling candles, perfumes, oils and new lines such as personal fragrance ranges. Sales are under pressure given a broader slowdown in consumption as interest rates rise, but the company finished last financial year with $19.7 million EBITDA and an $11.6 million net profit.

To ward off any interlopers, Ords recommends getting on the front foot, doing “early engagement with the target and key shareholders”.

ENDS

Disc: Held IRL and SM

This story came from ‘Street Talk’ in the AFR on Friday morning:

Barrenjoey trades 4pc of Dusk Group; offshore fund sells

“Barrenjoey’s equities desk crossed 2.46 million shares in Dusk Ltd, representing 4 per cent of the company shortly after market open on Friday.

Sources said the seller was an overseas institutional investor, while the buyers were spread across a couple of local funds including Regal. The trade was done at 82.5¢ a share and totalled just $2 million, but its timing is interesting.

It comes after an obscure Thai hedge fund, BNG Special Situations, built a 3.5 per cent stake and began agitating for a buyback as reported by The Australian Financial Review on Monday. BNG did not buy any shares in Friday morning’s trade.

Dusk, which makes candles and diffusers, is down 52.6 per cent over the past 12 months. BNG has argued Dusk has strong cash flow, high margins and a loyal customer base but is being undervalued by the market.

The fund’s assistant managing director, Vikram Sachatheva, has said Dusk shares should be worth $3 to $4 and the company should buy back shares at anything below the $1.50 levels. It is currently trading at 92¢ a share and listed in 2020 at $2 a share.”

Disc: Held IRL and SM

- First 20 weeks sales of $38.8m down 11.3% on PCP. Only positive was online sales which were up 8% compared to PCP.

- "Slight improvement since October". With "encouraging Christmas early response".

- 6 new stores have opened in the current FY and 3 pop-up stores have been opened for Christmas. Pop up stores allow Dusk to test centres that do not have a store or expand an existing footprint. Net 3 new stores expected in 2H.

- Will be launching Amazon marketplace store in December.

- Strategy to expand into regional centres is working well according to new MD. Recently opened Mildura store recorded the highest opening day of trade in the companies history.

- New sales incentives for staff over the Christmas period.

- 500 casuals have been onboarded for the Christmas period.

- Will continue with "collaborations" such as Streets Ice Cream collaboration which was very successful. The trailed perfume range was successful.

General notes:

- Revenue = $137.6m (-0.6%).

- Statutory EBIT = $18.0m

- Dividend of 3c per share. Not cut but not as big as I expected. I think it is about right in terms of size given results.

- Introduction of click and collect and redesigned website due 2HFY24.

- 6 stores expected to be opened in 1HFY24.

- New CEO to start in October.

- Still 24 stores to be updated to Glow 2.0 format which has a proven ROI.

- Trial stores in NZ are in line with expectations. However, rollout will only occur once economic outlook improves.

- Compared other years of first 7/8 weeks. Even the non-covid FY20 doesn't provide a decent indicator to the final sales. Ie not consistent and this isnt a major trading period for Dusk.

Positives:

- NPAT $11.6m. Higher than my expectations of $7-10m. Though 1st half wasn't to bad. Economic conditions only hit hard in the second half.

- ROE = 31.6% (with 43.5% of equity being cash with no debt).

- Inventory levels dropped slightly even with the addition of 13 stores. Dusk has not mismanaged its inventory like other retails over the past year or so.

- Management have already implemented a $2m CODB reduction program. Majority of this was in relation to staff wages so will have an ongoing impact.

- Net cash $16m.

- Membership slightly down to 735k from 755k at the end of FY23. However, I was expecting a much bigger drop off from the sign ups during FY21 when Dusk was booming. This is actually an improvement from 1HFY23 and signups and renewals up 9.8% compared to previous year.

- 4% increase in sales conversion when customers enter the store.

- Looking to expand perfume range prior to Christmas after fast sell out of trial range.

Negatives:

- First 7 weeks FY24 total sales down 15.6% compared to FY23. For contrast this is still 29.2% above FY20 (pre-covid) sales. Generally outlook still looks poor due to macroeconomic factors. It was noted in the call that this number is cycling the "Streets" product launch which was extremely popular and sold out quickly.

- ATV decreased 5.7% to $51 showing the consumer is a lot more cost coconscious

- Gross profit margin down 160bps to 64.1%.

- CODB up 11%. To $67.8m from $61.1m. This flows through the financial statements. Mainly impacted by wage increases and some stood down periods in the previous year. 6.6% increase on a like for like basis if staff wont stood down.

- Online sales down 35.2% and below management expectations. Idon'tt see this as core to the business.

- LFL store sales down 11.1%. With foot traffic down 10.2%.

Has the thesis been broken?

- No, but on watch, mainly because the core of the business model hasn't change. Key metrics such as ROE still very high (espically considering a large portion of the equity is cash). This is a cyclical company, while I never expected profitability to be maintained at the highs of COVID, I did underestimate the drop off. The company will need to be on watch.

- While the current outlook isn't positive, I can see Dusk making its way through the current environment given the strong net cash position of the balance sheet. I would be much more worried if it was net debt. There is still growth potential long term. There is a clear operating leverage effect on this business which at the moment is a weakness. For a profitable return from here, I will need to see the operating leverage effect work again. Running some numbers based on FY23 results $5m NPAT in FY24 will be achievable with 5% drop in revenue and a 5% increase in CODB. This is my minimum expectation.

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- Is this the new normal or just the current economic conditions are hurting Dusk?

- I think statutory numbers can be used for comparison moving forward given post covid impacts and listing costs are no longer relevant. Proforma numbers were actually worse than statutory this FY so management isn't being funny with these numbers.

- Is foot traffic a potential indictor of sales? Matched pretty closely?

- Profitability in the first half needs to be in a range that enables a $5-10m FY24 NPAT.

- Company on watch. Will need to get out with further deterioration.

$DSK announced their FY23 results. NPAT down -37.3% on flat revenue y-o-y (-0.6%)

LFL sales down -13.2% (stores -11%; online - 35%), so overall revenues held up by store openings.

The outlook is interesting, with one of the heavier YTD FY24 revenue declines reported this season.

Unsurprising, as this might be one of the more discretionary sectors.

Disc: Not held ... but tracking the retail sector more generally.

Expectations:

- Gross margin maintained around the normal level for the business.

- Expecting NPAT $7-10mil

- How are LFL sales going for start of this FY? Are revenues down more than 2HFY23? Hoping they match the 2HFY23 percentage change at worst.

- I won't be surprised if the dividend been cut to help protect the cash buffer. I expect a dividend of around 5c or better otherwise I don't think the market will be happy.

- Have membership numbers been maintained now that they are rolling of COVID windfalls? Expecting a fall, maybe up to 10%? Membership numbers were at 720k at 1HFY23.

Questions to Answer:

- Determine the reason for the negative EBIT margin impacts. Trading update looked like loss in profit attributable to below the gross margin line. Can the EBIT margin changes be reversed easily?

- Any direction on where the new CEO is going to take the business?

- How is the NZ rollout going?

- What is the cash balance and what are the boards plans reference the previously high cash balance?

- What is the outlook going forward? More pain to come or is this the worst of it?

We hold Dusk and now have the quandary of what to do with it. Is Dusk a Buy, Hold or Sell?

One thing that is now clear is that Dusk floated at a very opportune time on 2nd November 2020. COVID 19 meant that lots of people were stuck at home and at the same time goverments were propping up the economy with cash injections and interest rates were low. Things that made your home more comfortable, appealing and entertaining were very popular with consumers.

Shopping centres reduced rents to retain tenants and the goverment compensated retailers to keep people employed during lost trading days. Online sales increased because customers couldn’t go to the shopping centres. Interest rates were low and people felt rich as equities and property prices started to soar when it became apparent COVID 19 was not going to end the world or the economy.

Discretionary homemaker retail did exceptionally well and Dusk’s fortunes peaked in FY21 with NPAT of $21.9 million and ROE at 75%.

In FY22 things came of the boil for homemaking discretionary retailers as people got tired of being couped up at home and things started to normalise. Despite this COVID 19 shutdowns we’re sporadic. Dusk’s NPAT dropped back to $18.5 million and ROE dropped to 53.6%.

FY23 is a very different year to the previous two years. COVID 19 has dropped in severity. People are living normal lives, albeit more people are now working from home.

Inflation is high (c. 7%) and interest rates are the highest we’ve seen since the 1990s.

https://themortgagereports.com/61853/30-year-mortgage-rates-chart

People are starting to feel poorer and are spending less. Foot traffic in shopping centres is lower than previous years.

The costs of doing business (CODB) for retailers is rising. Wages are higher. The award wage for the retail industry increased 5.2% last year. Shopping centres are charging more fo rent. Power costs are increasing, but shipping costs have normalised after COVID.

Dusk is feeling the squeeze on margins from both ends. Sales have fallen more per store than the results indicate. Dusk has increased the number of stores from 132 to 145 (10% more stores) yet sales have declined by 2%. 2HFY23 will see an EBIT loss of about $3million for the half (1H23 EBIT $19.1 - FY23 EBIT $16).

Gross margins have remained similar at 67% however CODB has been increasing (Could be close to 50% of sales now) Dusk now has 10% more stores to run and 10% more rent to pay (About 25% of CDOB). Wages will increase by 15% due to the 5.2% award increase and 10% more stores (about 50% of CODB). There are 10% more stores to stock at inflated prices and more stores to fit out in the new Glow 2 format. The Glow 2 format looks smart, stylish…and very expensive!

So what does this mean for Dusk going forward. I can’t see sales magically increasing as interest rates rise and people feel poorer. I can’t see rent reducing, especially if dusk rolls out more stores, I can’t see wages going down…EVER, and inflation is proving to be stubborn.

All we can conclude from this is that FY23 net profit margins of approx 8% (NPAT $11/ Sales $135), down from 11.5% in FY22, might be as good as it gets for a few years to come. It might even go slightly lower if sales go down and costs continue to go up).

If we work on a ‘new normal’ of 8% net profit margin, that puts Dusk on a ‘new normal’ ROE of 26% (NPAT 18cps / Book Value 70cps).

Valuation

When it comes to making a Buy, Hold or Sell decision I like to use valuation as my guide.

Because ROE has fallen from 75% (FY21) to 54% (FY22) to 26% (forecast FY23) you can’t use historic PE as a valuation tool. Historical PE is now a nonsense for Dusk. In fact PE is never a great valuation tool because it has no relation to business performance.

For the sake of valuation I’m going a little more cautious and using a ‘new normal’ ROE of 25%. Dusk has a strong balance sheet with net cash close to $30 million and current book value of 70 cps. Dusk historically pays out 70% of earnings as dividends, reinvesting the other 30%. It should pay out about 12cps fully franked dividends this year unless the board decides to do something radical (18 x 70%), 8cps has already been paid. You could expect 4 cps to be declared for 2H2023. That’s a total 11% fully franked at the current price of $1.10 per share.

To value the business I’m going to use a required return (RR) of 15% allowing a higher margin of safety for the uncertainty.

Using McNivens StockVal formula, my updated ‘new normal’ valuation (including franking credits as part of future earnings) is $1.75, close to my previous valuation of $1.80.

What will I do with Dusk? I will hold what we’ve got and watch the share price momentum looking for a possible entry point to add more. It can be a very painful experience trying to catch a falling knife so I don’t see any rush today.

Disc: IRL (3.6%) It used to be much higher! :(

Overview Comment:

The trading update released today was overwhelmingly negative. The attribution towards slower consumer spending was a risk I was aware of but wasn't expecting the EBIT margin decrease as much as stated. The question is how long will this last for? Is it just a temporary blip caused by the interest rate hikes or is weak consumer confidence going to be a theme of the next 1-2 years. This question is key as to whether to continue to hold Dusk as if this is more than just a temporary decrease in EBIT/NPAT margins then more bad news can be expected.

General notes:

- Sales slightly below FY22.

- Management blames strains on household budget/interest rate hikes.

- I am estimating a NPAT of $10m for FY23 as a result of the announcement.

Positives:

- Gross margins have been maintained.

- Still high sales conversion rates according to management.

Negatives:

- Pro forma EBIT for FY23 forecast = $16-17 mil. Implying a $2-3mil loss for 2H, 2H is normally weaker but hasn't been a negative result in recent times.

- Market didn't like the news. Down 28c or 19% to $1.28.

- Mother's Day sales were weak. This is normally a major trading period for Dusk.

- The downgrade in profitability is below the gross margin part of the P&L. What has increased costs so much?

- Was expecting revenues to grow at least on a LFL basis. Given flat revenues, and an increase of 14 stores. LFL basis is definitely down.

- EBIT margin has moved from 19.1% in FY22 to 12% for FY23f.

- Is there a potential of a dividend cut? Given the loss in 2H. Heaps of cash but does management want to preserve this given the negative outlook?

Has the thesis been broken?

- Maybe, conviction has been lowered significantly. Dusk is still cheap, but can it get cheaper? Is it a value trap? Something is causing reduced EBIT and NPAT margins which is of concern (especially given gross margin is reported to be maintained). Normally more unwelcome news comes after the first downgrade so is it better to sell (potentially at the bottom) or is this as bad as it gets? My valuation has basically halved in less than a year. Not a good sign for the position. Company definitely #OnWatch and #Nobuy, potentially looking to sell all or part of the holding. Having a think over the next week or two.

Valuation:

See valuation straw for updated valuation.

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- Must meet expectations set out in the trading update.

- Are weaker results going to be a one off or continue?

- Maintain membership numbers.

- Understand the impact new CEO will have.

- Determine the reason for the negative EBIT margin impacts.

Well I guess that answers the question about whether scented candles are a discretionary purchase. Dusk's trading update today may even be worse than some were thinking. The second half of the financial year is always a much quieter period for them but with consumers keeping wallets shut, it's actually going to be a loss making half this year.

Having said that, underneath is a business that does make good money under normal circumstances and is maintaining its gross margin at close to 70%. If the economy were to go to hell in a handbasket you might pick this up for a steal in the next 12 months. The big BUT though is a pending CEO transition and it might be worth waiting to see what the new dude is bringing to the table.

[on watchlist only]

Dusk has announced Vlad Yakubson as the next CEO and MD of Dusk. Vlad is currently the general manager of yd. Previously, he has worked for Mad Mex and Glue Store. Vlad will begin working for Dusk by no later than the end of October.

Peter King has run the business very well so I am disappointed to see him go, however, pleased there is going to be a well-planned transition. From a quick search on the net, Vlad appears to be a good candidate. All the brands he has worked for previously have been growing retail businesses with a narrow segment focus much like Dusk.

Looking to add to position after a bounce of recent bottom. Quick review of key points to remember before moving forward purchase.

Positives:

- Note the following values: EV = $67mil and MC = $97m, ($30m cash). Note FY22 E = $18m. This gives the following implied valuations:

- If E = $10m then EV/E = 6.7x or P/E = 9.7x

- If E = $13m then EV/E = 5.2x or P/E = 7.5x

- If E = $15m then EV/E = 4.5x or P/E = 6.5x

- Given above the market is pricing in profitability to decline strongly.

- No balance sheet issues. Strongly cash backed.

- No change to the core of the business:

- Gross margin around 67%.

- Only run profitable shops on a local store basis.

- Expanding into NZ, continued Aus store rollout and 24 stores still to remodel providing growth.

- Paid membership program to engage with repeat customers.

- First 7 weeks of 2H matched FY22 approximately.

Negatives:

- CEO resigning. Will the changes the new CEO makes be positive or negative? The current CEO has done a very good job and created a very sustainably profitable retail business.

- Macro outlook not great for consumer discretionary. Market is not going to price this highly anytime soon.

Overall, I see a good opportunity to buy at the current price. The fundamentals of the business haven't changed. Bounced off the recent lows. This has often happened with Dusk, share price craters well below $2, then bounces back to around the $2 mark. Looking at the implied valuation it is very cheap, the numbers above imply the company goes backwards from FY22 and doesnt make a profit in 2nd half, you still can buy for a PE of well under 10x and much lower when you consider the EV. As a result, adding to my position, don't see much potential downside on a risk adjusted basis.

On the rare occasion I visit the main shopping centre in Toowoomba I try to fit in a quick visit to each of the retailers we own shares in. Sometimes I’ll have a chat to the manager about how business is going.

Last week I went to visit Dusk and found it all boarded up!

I thought, this doesn’t look good!

I sent an email off to Dusk and was relieved to find out the store was undergoing an upgrade to the new Glow 2.0 format, and will be reopening this week.

In their 1H23 presentation Dusk said they would be focusing on converting the remaining 24 legacy stores to the new Glow 2 format. It was good to see this is underway. Dusk has probably picked a good time to do the upgrade with foot traffic in the centre much lighter than usual. I’ll be keen to see how the new format goes on my next visit.

Disc: Held IRL (5%)

Overview Comment:

The consumer pull back in discretionary spending and inflation effects are evident in the Dusk results with flat sales and increases in CODB. The business still has maintained a very strong balance sheet backed by cash to weather any issues that may occur in the current environment. Every store operating on a profitable basis and a continued high ROE are good indicators that Dusk is continuing to be well run by management, however, the CEO transition will be important to watch to ensure this continues into the longer term. Over the shorter term I expect subdued results, however, over the longer term I see no signs of a poor return on investment especially considering the dividend income and ability to continue to expand the business through store openings.

General notes:

- Financials:

- Dividend = 8c (fully franked)

- Sales = $86.1m (+7.6% vs pcp)

- Total LFL sales = -10.4%

- Gross margin rate 67.0%

- EBIT = $19.1m

- NPAT = $13.3m

- EPS = 21.4c

- Net cash = $32.9m

- Inventory = $17.6m down from $19.6m in PCP

- NTA per share = 66.53c

- 9 new stores opened in 1H finishing with a total of 141. 6 new stores expected in 2HFY23.

- 722k members vs 718k at end of pcp. Membership appears to be flatlining. Always expected at some point. For reference:

- 1 in 28 (3.5%) of adult Australian's have a Dusk membership ($10 fee every two years).

- 1 in 5.4 (18.5%) of adult Australia's have an active Myer one membership which is free.

- Still 24 stores to update to latest format which has a very good ROI historically.

- No guidance given.

Positives:

- Inventory down on same period even with a higher store count. Dusk has managed inventory well.

- Sales conversion was 70% vs 57% in pcp.

- Foot traffic outside of stores was -29% vs pcp. Therefore, Dusk potentially did relatively well.

- NZ in line with expectations.

- All stores profitable.

- Balance sheet is still very strong, net cash approx $33m, with a closing price of $1.84 a share this net cash figure represents around 28% of market capitalisation ($116m).

Negatives:

- Sales down for first 7 weeks of 2HFY23 by 3%. Store based sales down 1%, however, note this would be on a higher number of stores, therefore, LFL down further.

- CODB up 8% vs pcp on an adjusted basis for 1HFY22 store closures. This is driven by "new store, increased wages and inflation".

- Online business is struggling. Only $4.8m in sales. Is this even worth maintaining? Presentation notes company has identified multiple improvements that need to be made to the website and platform.

- Gross margin down slightly due to "increased promotional intensity and AUD vs USD".

- ATV down 5.7% "driven by a more cost-conscious customer".

Has the thesis been broken?

- No, valuation does need updating to cover the shorter-term impacts of inflation and lower than forecast profits. The fact management states that every store is profitable shows the underlying format of Dusk works and is profitable.

- Previously I had been worried about the profit to cash conversion. This half has greater "cash profits" than P&L profits therefore this has reversed and therefore not an issue going forward.

Valuation:

Updating based on shorter-term expectations being weaker.

- PE target = 12

- Profit = $16 mil

- Cash = $33 mil

- Market value = (12 x 16) + 33 = $261 mil

- Valuation per share = $3.61

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- CEO transition period will require watching. Do results continue? Are the changes the new CEO makes positive or negative?

- Watching effect of sales and lower NPAT on longer term thesis.

- Membership numbers to remain around 720k. Not expecting any significant drop off or improvement.

Dusk released its 1H23 results and presentation today.

1H FY23 Overview

• Total sales of $86.1m, +7.6% vs pcp1 (1H FY22: $80.0m); +47.0% vs 1H FY20

• Total Like for like sales (LFL)2 was -10.4%

- Stores -6.9%

- Online -37.8%

• Gross margin of $57.7m, +6.1% vs pcp

• Gross margin rate of 67.0% compared to 68.0% in pcp

• Pro forma EBIT4 of $19.1m, -10.2% vs pcp; +98% vs 1H FY20

• Net cash of $32.9m at period end and no debt (1H FY22: $33.3m)

• 141 stores (including online) at period end, an increase of 9 new stores

• Inventory of $17.6m at period end (1H FY22: $19.6m)

• dusk Rewards active members of 722,000 (1H FY22: 718,000)

• Interim fully franked dividend of 8 cents per share

Expectations

Overall the results were better than I was expecting, and are ahead of what analysts were forecasting for FY23 (S&P Global data on Simply Wall Street). Prior to the results announcement the average analyst earnings forecast for FY23 was $13.5 million. Dusk has already achieved NPAT of $13.3 million in the first half (down 9.5% on pcp). Before you get too excited you need to know Dusk earnings are heavily skewed to the first half. Last year 80% of the earnings came from the first half. If this repeats we could expect FY23 earnings to be c. $16.6 million compared to $18.5 million last year.

1H23 Profit & Loss Summary

Sales were up 7.6% on pcp, however you need to consider there were 9 new stores (141 in total). Like-for-like sales were down 10.4% on pcp.

Gross Margins slightly lower

Gross margins were down slightly (98 bps) to 67% driven by increased promotional activity and AUD deterioration versus USD. On the conference call CEO, Peter King said 2H23 gross margins should stabilise at 67%.

Cost of doing Business Higher

The biggest impact on earnings was increased cost of doing business (CODB), increasing 16.3% to $36.7 million. This is due to higher employment costs (13 additional stores open and a 5.2% award wage increase), higher store rent (more stores plus CPI).

Strong Balance Sheet

Solid cash conversion of earnings.Net Cash $32.9 million. Net assets up 11.5% to $43.7 million.

Outlook

Dusk didn’t provide full year guidance. Total sales for the first 7 weeks are 3% down on pcp, but 29.3% higher than preCOVID levels. 6 new stores will be opened in 2H.

Valuation

A number of assumptions are required for the valuation. I will assume earnings in H223 will make up 20% of FY23, a similar weighting to FY22. I’ll work on FY23 earnings of c. $16.6 million. I expect gross margins and CODB to stabilise at current levels and future ROE to pull back to current levels of c. 27%.

Using McNiven’s StockVal formula and assuming normalised ROE of 27% going forward, dividend payout ratio of 70% (historical), franking of 100% and a required annual return of 14%, I get a valuation of $1.80 (close to the current share price). If you were happy with a 12% required annual return you could pay up to $2.20 per share.

Given the current pressure on household budgets and the risks for discretionary retailers going forward I’m going with a valuation to $1.80. Assuming FY23 earnings of $16.6 million or 26.8 cps, that’s a very undemanding forward PE ratio of 6.7x.

Disc: Held IRL (5%), SM (3%)

Dusk could face further challenges convincing a skeptical share market of its merits following the resignation of long time CEO/MD Peter King. Trading on a trailing EV/Earnings under 6x, the market seemed doubtful candles and diffusers were a non-discretionary purchase. That view is likely to harden until new management can prove otherwise.

There appears to be nothing untoward with Peter King's decision given his intention to stay at the helm until mid year and provide a thorough handover to his successor. An update on the recruitment progress will be given at the 1H result in Feb.

[not held]

Perhaps it’s not a discretionary spend after all:

https://www.economist.com/1843/2022/12/14/the-rise-of-the-scented-candle-industrial-complexThe rise of the scented-candle industrial complex from TheEconomist

Hi @PeregrineCapital i am a holder and have grappled with the risk and the fact “DUSK” is labelled discretionary.

So my question is can that 11.2% dividend be maintained?

Sometimes I think the historical definition of a discretionary item has not kept up with todays norms. What someone born in the 50-60-70s consider as a want is most likely influenced by what they needed (could afford) to get by and function in the 80-90-00s.

Today the quality of life and what’s important as a result of a trend or life-work balance pushes so called wants into the necessity basket in order for this better life balance. So I suppose the word “discretionary” on a whole is dependant on whom / what generation you ask and what they feel is required to negotiate society in 2022 both from an lifestyle capacity.

For me I suppose the concern I have is what are normal operating levels?

Having a relatively short history as a listed company and benefitting from the stay at home covid bump I am waiting to see what normalised revenue and profit levels will be.

As such, I am less concerned with the impact on a reduction in discretionary spending as I think the DUSK products fall in that affordable luxury zone that allow for a semblance of normality even when times are tough.

In saying that I have a margin of error (25% reduction) that I have factored in and so am assuming a dividend of 15c (still 8.4% at its current price of 1.78). Should the dividend remain at 20c then I consider this a bonus.

Should this be it’s new normal baseline payout from where it then slowly builds then I think this is still a significant and well above market average dividend returns. Even if there is little to no CG, at 8.4% you are probably beating most people in the market over the next few years. That’s nothing to sneeze at.

Late this afternoon Regal Funds Management lodged an initial notice of substantial holdings in Dusk. In two tranches on the 8th September and the 29th November, Regal Funds bought 4,470,932 shares averaging $1.89 per share, total $8,468,395. According to the notice Regal Funds held 3,872,447 or 6.22% of Dusk shares on 29 November. The first tranche averaged $2.05 per share, and the second tranche averaged $1.80 per share.

I couldn’t find anything in the media about the transactions. However, my guess is that Regal Funds has bought almost all the shares held by Capital Investments, each tranche at a significant discount to market value (c. 12% discount to the previous days of trading). On the 6th September Dusk was trading at $2.38 per share and within a week the share price had fallen to Regal Funds buy price of $2.05, and it kept falling due to the momentum. On the 24th November Dusk was trading at $2.14 per share, and once again within a week it had fallen as low as Regal Funds buy price of $1.80.

This might also explain the mysterious volatility in the Dusk share price as Regal Funds has taken advantage of the arbitrage on 589,486 of the shares it has just bought, but aren’t included in the 6.22% share holding on the notice on the 29th November.

I’m hoping the selling will ease up now the price is close to Regal’s average cost price of $1.89 per share. In fact, now Regal is the largest shareholder it will be in their interests to see the majority of their holdings appreciate in value. Perhaps we will see something in the media over the next few days.

Disc: I have shared my thoughts on what I suspect might be happening with Dusk trading lately. Much of this is highly speculative in nature and not based on fact. Held IRL and SM.

Yesterday (30/11/22) independent non-executive director Tracey Mellor added 8900 shares on-market at $2.14, totalling $19,038, Announcement.

I bought more Dusk shares myself yesterday on a mystery 8% fall in the share price. This might be a result of Dusk’s largest shareholder, Catalyst Investments (holds 7%), dumping more shares on the market. Last time Tracey Mellor bought shares it was followed by a sell down by Catalyst Investments.

The share price dropped to $1.81 at one stage yesterday. I didn’t see the the shares trading as high as $2.14 during the day which makes the director buying price a bit of an anomaly.

I have added more shares today. I think the value and dividend Dusk offers is too good to be ignored. I’ve also worked out that Dusk have about 34 cps sitting in cash alone.

At least for now they are cashed up, highly profitable and run a high margin, high ROE business that pays a dividend c. 10% FF (14% grossed up with franking credits).

Even if the share price stays flat for 5 years, Dusk should return about 14% per year in dividends, in which time the shares should pay for themselves (The Rule of 72). I’d be happy with that for an outcome.

Risks - The looming risk for Dusk is the possibility of a recession, in which case fragrances might get a bit on the nose!

Disc: Accumulating IRL and SM.

Dusk has traded reasonably well for the first 19 weeks of FY23, and I think should be ahead of analyst expectations for FY23.

Total sales are up 23.9% pcp on FY22 and down 4.5% on record FY21. Although, Dusk CEO Peter King, said “Like-for-like sales are not considered a useful measure in the first half of FY23 given the extent of store closures in the prior corresponding period.” - Chairman and CEO Addresses

While it would be easy to extrapolate the strong sales result from the first 19 weeks of FY23 forward, Peter King warns “it is prudent to reinforce the importance of December trade to dusk’s full year results.”

So we need to be cautious about what might happen from here. However, Dusk is well ahead of FY22 sales and only 4.5% behind Dusk’s record FY21 year. Anything is possible from here.

If Dusk has a good Christmas trading period, FY23 sales should be at least somewhere between FY21 ($148.6 million) and FY22 ($138.4 million). Currently analysts are forecasting FY23 sales to be c. $134.9 million, or 2.5% lower than last year (4 analysts, S&P Global data).

Dusk has opened five new stores in Australia in time for Christmas and have refurbished a further four legacy stores to the Glow 2.0 fit out. Dusk has also entered the New Zealand market and early indications are positive.

Even though it’s still very early into FY23, I’m feeling positive about the prospects for Dusk this year and it is still possible for Dusk to surprise the market to the upside.

Disc: Held IRL and SM.

Collection of bearish points - view with my valuation and bull points for balance.

Economic downturn due to interest rates likely to impact dusk. As discretionary homewares they're connected to the housing market and rates cycle. I think this is factored in the price (they're trading on trailing PE of 6 and that's in the 5's if you use enterprise value), however if they have a bad year in the coming few the price could still go lower and I'll have bought too early.

Candles are not sexy for investors and whilst dusk point out they're not just candles, I think they will struggle to attract a premium and they could just go out of fashion.

Catalyst are selling out and still have more to go.

The eroma thing was disturbing, however I like it that they can back out of something that isn't right. Management are prepared to look silly to do the right thing for the company - this doesn't always happen.

It wont be a ten bagger in the foreseeable future.

Disc: I hold this in real life, am sitting on a loss and plan to buy more.

Peter King, Dusk's CEO presented at the ASX Small and Mid-Cap Conference this morning. Below are my notes from the presentation:

- Dusk doesn't employ any buyers. All stock is developed in-house with the help of long-term suppliers. Good product development example - latest product range sold out early.

- Only a small change in gross margin in FY22 compared to bumper FY21. CEO very pleased with this.

- Very slight inventory build is explained by increase in store numbers and opening of new stores.

- As ultrasonic diffusers are bought or gifted, they are creating a reoccurring revenue stream through the consumables used, which are sold at higher margin than other products.

- Membership program is very important to the business model. The pay-to-play model shows intent of customers to make repurchases. "I pay $10, get $6 off this time then need to come back again to make back my membership fee". Then customer keeps coming back for 10% off. Dusk and customers are both winners.

- Online penetration overseas of products that Dusk sells is much lower than other retail segments. Customers like to come into the store due to the tactile nature of the product and the experience.

- Expansion:

- No store target in Australia.

- First store in NZ opening in Auckland on 15th September 2022.

- NZ market looks very positive for Dusk. CEO expects it to be more profitable and the product is cheaper compared to the local competition.

- International expansion beyond NZ would likely be the UK. Not the right time though. CEO was there in June 2022.

- Eroma deal didn't go ahead because management didnt think it was the right fit after completing due diligence. CEO said M&A will not occur if it is not earnings accretive. Still looking for M&A opportunities.

- No more shares in escrow and main holder has been able to sell shares for a while now.

- No store is unprofitable. Store fitouts normally subsidised by landlords. Payoff for new stores normally within the year and opened at the right time of year to ensure this occurs.

- Peter King has been CEO since 2014, the company has grown significantly during this time. Adding to thesis that he is key personnel. You could tell he knows the detail of the business very well.

I also like that their Free cash flow is close to net profit and that they have a strong ROE (just under 50%). Add that to a net cash balance sheet and single digit PE and there’s not much not to like. It is just selling candles though…

This contrasts with ADH which has some of these characteristics but had a significant Free cash flow drop this year.

Disc - I own DSK personally not in SM. Have ADH in SM only.

PS is everyone else hating that this new(ish) lease standard now just makes it harder to calculate FCF - it was easier when an operating lease was just an expense…or is this just me?

Below are some general comments based on additional information provided by the results release compared to the recent trading update (see previous straw for those details) that was released on 20th July.

Positives:

- Membership numbers continue to rise to 755k. Sign-ups and renewals were 358k, down from 413k in FY21 but still up on FY20 figure of 278k.Cycling this was still an increase from 688k same time last year (membership period is two years).

- 67% of sales are non-candle sales. Proving Dusk isn't just a candle shop but a fragrances and homewares store.

- Store network up to 132 stores (net +10 for FY). Entry into NZ in 1HFY23. International expansion is a great growth opportunity. 5 new stores in Australia by Christmas.

- 'Repeat customer visits driven by high margin scented consumables.'

- COVID lockdowns had a material impact on sales results for FY22, therefore for Dusk to make my thesis NPAT of $20m should be much easier this coming FY. Potential to do much better.

- Still 27 stores to update to latest store format which has a proven ROI.

- No inventory blow out like has been occurring with other retailers.

- Final dividend of 10c, fully franked. At a share price of $2.41 and a total dividend of 20c for the FY, this gives a yield of 8.3% or gross yield of 11.9%. It seems like the board is paying out 100% of cash earnings.

- Sales for start of FY23 look positive. DSK actually provided figures for comparison to FY20 which is a non-COVID period and sales were up 53.5%. Other retailers have only been given this figure for FY22 which is hard to provide any context to. Sales were up 33.2% on FY22 where COVID lockdowns were in place but slightly down on FY21 which was the COVID bumper year. Positive overall, for the FY23 result if the non-lockdown period results can be maintained.

- Management is executing well. If you look at the graphs in @Rick's straw the track record shows a very good CAGR result over the last 5 years for key metrics.

- I like that Dusk releases key figures early (on 20th July for FY end of 3rd July). Though would be good if they released the official results a bit earlier than the 2-month rule so it doesn't look like they are holding off to the market.

Negatives:

- Cost of doing business up 6.6% while revenues were slightly down.

- Online not getting traction, however, again part of the thesis that this is the case.

- Didn't provide guidance due to macro-environment. Not a big deal, guidance for a retailer really is just a guessing game in my opinion.

- Terminated Eroma acquisition cost $1.06m.

What I would like to see/expecting to see over the next financial year:

- Would like to see the FY22 total membership number maintained. The membership is a big driver of sales (approx. 62% of all sales) and members spend more per transaction.

- Need to watch cash compared to income statement, this appears to be just differences in timing but something to check over a few FYs.

- Expecting an increase in sales over FY23 thanks to cycling period of lockdowns in FY22 and as a result, improved profitability over FY22.

Overall Comment:

Dusk released its FY22 trading update with unaudited figures. Overall, positive for the thesis as the results were all as I expected with no surprises. Nice to see the overseas expansion starting in the next half, I see this as the future growth driver of the business if they can get it right.

General Notes:

- Total sales of $138.3 mil down 6.9% from FY21. LFL sales down 10.5% compared to FY21. This is flat compared to the LFL from 1HFY22. Sales being down on the COVID boom was always expected. LFL accounts for COVID related store closures, 1HFY22 saw a loss of approximately 24% of store trading days.

- Net cash $21.3 mil. Inventory at $15.4m. Similar to this time last year.

- Management is happy with inventory position and made Christmas orders with no expectation of delays.

Positives:

- Proforma EBIT (excludes IPO costs and benefits of JobKeeper and rental concessions etc) expected in the range of $26.3-26.8 mil. Therefore, NPAT will likely be around $18.5 mil. Within my expected range of $17-20 mil.

- 10 new stores were opened in FY22 in Australia. 5 stores expected to be opened in Australia before Christmas.

- NZ expansion to begin with 3 stores opening in September/October.

Negatives:

- Online traction is still weak. Especially given the membership program. Only up 2.9% compared to FY21. However, thesis is based on the fact that Dusk sells products that consumers want to be there to physically touch and smell before buying so not a deal breaker.

Has the thesis been broken?

- No, results are all as expected. Sales seem to be stabilising after the COVID boom around where I expected. Overseas expansion is about to begin which was an expected avenue for growth, new stores are continuing to be rolled out as well.

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- Expecting the same results as this year or slightly better. On the positive side the negative impacts of store closures in 1HFY22 should not be felt in 1HFY23, however, lower consumer confidence and higher costs will be a negative factor on next FY results.

- Continued store and overseas expansion.

- Maintain or grow the number of members. This may be hard given the 2-year cycling that might start to occur from the COVID boom.

General Notes

- Key financials:

- Sales down 12% to $80m. LFL sales down 10%. LFL excludes the effect of closed stores.

- Proforma gross margin of 68%, slightly up from 67.7%.

- Proforma EBIT of $21.3m. Down from 1HFY21 ($28m) but up from 1HFY20 ($9.6m). While proforma EBIT is down this was expected as part of the thesis. FY21 was a COVID boosted year, I never expected this to be beaten. Still significant improvement on FY20.

- NPAT = $14.7

- Net cash $33.3m.

- Fully franked dividend of 10c declared.

- Dusk is preparing to commence operations in New Zealand. Expected in Q2FY23.

- Acquisition of Eroma announced within the reporting period. Transaction consisting of $15 in cash payment and a placement of $13m of Dusk shares (4.496m shares @ $2.89). Transaction to be completed in 2HFY22. New $10m debt facility will be used for part of the cash component.

- First 8 weeks trading update sales:

- Total sales down 11.8% (matching 1HFY22 approximately)

- Sales LFL down 14.8%.

- Online sales up 19.4%.

- Foot traffic down sharply.

- There were distribution disruptions during the 1H but inventory for 2H reported as "healthy".

- 6 new stores opened during the period with 4 new stores expected by Mother's day.

- CEO bought shares on market at around a price of $2.50 this replaces most of the shares sold in August at around $3.05. CEO holds 2.26m shares and chairman 2.275m shares so both significantly invested in the company.

Positives

- Average transaction value increased 5.8% to $57. Strategy to higher prices is showing through in ATV. ATV of members was $64.

- Membership program continued to grow to 718k members. This program produces 62% of total sales up from 59% in 1HFY21. HFY22 had more sign ups and renewals of membership that 1HFY20, very positive.

- Trading update noted freight costs are elevated but not as high as 1H. Good sign for margins in 2H.

- 66% of sales were non-candle sales. Dusk isn't just a candle store.

- Fully franked dividend of 10c. Based on $2.70 share price and annualised this give a yield of 7.4% or grossed up yield of 10.6%.

Negatives

- Total sales and LFL sales down but expected.

- Online sales only up 2.8% (cycling 120% from FY20) to $7.7m. Not impressive given the amount of time NSW/VIC were in lockdown during the period. However, thesis is based on the idea that customers actually want to go to the store to buy Dusk's products. Fragrances are physical so require the physical presence of the customer.

- Store days lost were around 24%.

- Shares from IPO come out of escrow on 3rd March. Potential for share price weakness.

Has the thesis been broken?

- No, thesis is playing out as predicted. While results won't hitting it out of the park, my thesis is based on $20m NPAT annually. This was a reduction from the COVID boosted FY21. Membership numbers continue to increase which is very positive and a key driver of growth. The Eroma purchase is very logical and will be earnings accretive. Based on my expectation of NPAT, DSK has an ROE of 50%, very high thanks to very good capital management by the board. High convection maintained.

Valuation

- Valuation remains with factors target PE = 12 and NPAT =$20m as yearly price target.

What are you expecting and what do you need to see over the next reporting season or generally into the future?

- Expecting profit for FY22 to come in around $20m as per thesis. 1H NPAT of $15 makes this likely. 2H is always lower due to Christmas sales boost.

- Cycling of membership program will start to show through in next half for the next two years. Maintaining membership will be important but will not be surprised if membership drops somewhat (but not dramatically) given members that signed up during COVID peak might not renew or have moved on. 1HFY22 had more sign ups and renewals of membership that 1HFY20 which is a particularly good sign.

- Per share earnings/results will be important to compare over the next few years due to the Eroma transaction which will issue 4.496m shares (6.7% of shares after offer).

Must be contender for acquisition of the year @ ~20% EPS accretion from Year 1 before synergies. Company call today reaffirmed these targets!

Dusk has announced the purchase of 100% of Eroma shares. Eroma is a supplier of candle making, soap and home fragrance supplies (see attached presentation image). They are only a supplies business with over 900 fragrance formulations, therefore, Eroma works in a related but different segment of the market. The deal will transact on 31 January.

The enterprise value acquisition is $28 million, which equates to an EV/FY21 EBIT of around 5x. This is funded though $13m in DSK shares, $10m in new term debt with CBA and $7m from existing cash. Management believes the acquisition should be highly earnings accretive from year one adding to pro forma EPS by over 20% (before any synergies). No change to DSK dividend payout policy is expected as a result of the acquisition. The shares issued will be held in escrow with 25% released after each HY financial result, with first released after FY22 result.

Summary of benefits listed by management:

- Increases TAM.

- Increases the scale of DSK online operations.

- New specialised segment for DSK.

- Geographic and range expansion through the used of shared facilities, knowledge and relationships.

- Increased buying power of overlapping input costs.

- Eroma owns over 900 fragrances, this gives DSK a large range of new formulations to use in the creation of their own products.

- Improved distribution through the use of shared facilities.

- Highly EPS accretive.

- Some Australian based manufacturing capability.

- Potential for synergies.

Personal Notes on Acquisition:

Overall, this is a very good acquisition for DSK shareholders especially due to the instant EPS accretion from year one. The potential for synergies is clear and all numbers presented are on a pre-synergy basis. The fragrance IP will be valuable for DSK given they create their own fragrances.

The purchase price seems like a great deal for both parties. I like the structure of the deal especially the use of shares given the slightly lower relative EV/EBIT purchase price. Only question is why they didn't use cash given the previously high amount of cash on the balance sheet. My thoughts here are that DSK has had to pay for its Christmas stock and/or trying to keep cash for dividends. The term debt adds only a small amount of leverage to the business.

Dusk has launched an online brand called Mihi Home. Looking at the products and prices this is definitely a premium brand compared to the current Dusk offering. Hopefully an even higher margin brand for Dusk. Will be interesting to hear commentary from management on the aspirations for the new brand.

Facebook and Instagram the pages only have a few hundred followers at the moment so a bit of work to do to increase brand awareness (as expected given it is a newly launched brand).

General Notes

- Hit guidance. Could say lower end but on or around is pretty much a rounding error.

- Increase in membership is a very positive sign. This is a number to watch closely. This is a good indicator into the future about the potential future sales and if the COVID profit boost is sustainable. Membership makes up for 60% of total sales.

- 67% of sales were non-candle. Showing DSK isn't just a candle shop. However, most growth was in candles and diffusers so still core business.

- Potential for a subscription model? To jump on the bandwagon, "Fragrances as a service" or "Scents as a service" as the financial analysts will call it... Given the high membership sales to total sales ratio I can see this being quite an interesting opportunity.

- Website was updated recently. Gave it a quick test run. Seems very user friendly. I find many UI's annoying, Dusk's website UI seems quite good. All items seem well organised into categories and the right number of items in each category, you are not overloaded or underloaded with items.

- Still 35 stores (out of 122) to update to latest fit out which has a proven high ROI.

- Final dividend of 10c. 25c total dividend YTD. Fully franked. This equates to a 35.7c grossed up dividend. Giving a yield of 7.6% or gross yield of 10.8% based on opening price.

- Proforma numbers appear fair to use given IPO costs, Jobkeeper repayments and rental concessions. No clear manipulation of the numbers for gain by management in the use of this metric.

- General figures:

- NTA = 45.65c per share.

- Total sales = $148.6 mil

- Statutory NPAT = $21.9 mil

- Proforma NPAT = $26.8 mil

- Total costs without IPO = Approximately $60 mil vs $52 mil for FY20. Approximately +15%.

- Diluted EPS = 34.6c (statutory).

- Net cash = $24.1 mil

- Operating cash flow = $35 mil

Positives

- Great growth numbers:

- Total sales +47.4%

- LFL sales + 32.7% (excludes stores closed for refurbishment or COVID-19 related closures.

- Online sales + 27.0%

- LFL sales increase 2/3rds due to increasing transaction numbers the other 1/3rd an increase in transaction value.

- Membership up +31% to 688k.

- General figures look very good (proforma figures used):

- ROE: 98%

- P/E: 7.6 (based on $3.28 a share)

- EV/EBIT: 4.75

- Gross profit: 68.1% (vs 65.1% FY20)

Negatives

- Weak outlook for 1HFY2022 until opening up of NSW and VIC.

- FY YTD LFL sales down 11% is very concerning. Is this due to the strong reopening effect of PCP in FY21? Good online figures at least. 1H earnings are mostly generated in Nov/Dec so if closed stores have reopened by then the sales in that period will show the prevailing conditions.

- Concerning Q4 FY21. While high growth numbers were not expected given the significant growth in PCP, I would have liked to see this a bit flatter at least. Thesis based on there being some retraction from COVID reopening sales so not overly concerned considering the FY22 YTD figure is less of a decrease at 11% and impacted by Sydney and Melbourne lockdowns. However, YTD total sales are down 28%, which equates to a $4.4 mil impact on sales over 7 weeks. For those interested see LFL sales performance chart in presentation.

- Some margin pressures in the second half. Likely to continue IMO. Pressures were input costs, FX hedging and rising freight costs.

- Dividend did not equal 1H. Board quotes current COVID related issues. Seems prudent, however, also an indicator of potential struggles at the moment.

- Movement into NZ market has been delayed due to COVID.

Has the thesis been broken?

- No. Thesis was a P/E play. P/E and EV/EBIT still low but normalising over my holding period.

- Weaker Q4 and current FY YTD sales are concerning but expected. Thesis was based on ongoing NPAT of $20 mil when COVID growth subsides. Proforma profit is well above this figure (by more than 30%) so there is a margin of safety. Target P/E of 15, high target PE because of the quality of management and the multiple potential growth opportunities though online, Australian store number increases (+30% more than current) and international expansion. This PE target may be a bit high but I am using the conservative NPAT figure. Either way I get a EV of around $300 mil.

- I feel happy to hold given the decent dividend yield, low multiples (PE + EV/EBIT) and great ROE figures the company produces. I think these factors provide decent protection from a significant share price decrease. The uncertainty over the next few months about sales will likely be reflected in weak share price growth over that period.

- What to watch to for:

- Maintaining and increasing membership will be critical. Will members renew?

- Sales for Q2 will be very important and a good indicator to the ongoing business post COVID.

- FY20 to FY21 shows the impact of operating leverage. Revenues can not reduce significantly from FY21 and profitability be maintained.

Valuation

- Maintaining PE target of 15 with NPAT $20 mil plus cash. Market cap = $324 mil. Valuation per share = 5.20.

- Q3 sales of $27.7M up 50% on PCP.

- EBIT margin up -17.6% for Q3.

- Gross margins up 4% for Q3.

- Guidance for FY 2021 upgraded to $147-151 M revenue, and $38-40 M normalised EBIT.

Will this strong growth hold in a post-COVID world?

DISC - HELD.

Management performance hurdles of interest are:

50% of LTI is vested according to Total Shareholder Return to end of FY2023:

- If 4% achieved, 20% of LTI is awarded

- If 4-15% is achieved, a percentage, in linear relationship of 20-100% to TSR range of 4-15%.

- If >15% TSR, 100% of LTI awarded.

Simply put, management are incetivised to achieve TSR of 15% pa to FY2023. Basecase if IPO price of $2.00 per share.

50% of LTI is vested according to EPS growth to end of FY2023:

- If 4% achieved, 20% of LTI is awarded

- If 4-15% is achieved, a percentage, in linear relationship of 20-100% to TSR range of 4-15%.

- If >15% TSR, 100% of LTI awarded.

Simply put, management are incetivised to achieve EPS growth of 15% pa to FY2023. Base case is EPS of 14 cents in FY2020.

The EPS hurdle for management is 22 cents per share.

Fragrance specialty retailer, Dusk announced a significant upgrade in results. Key takeaways:

1) Like-for-like sales growth of 49% on pcp.

2) Sales of $90 M for the HY, an increase of 53% on pcp.

3) EBIT of $25-27 million forecast, an increase of 168% on pcp.

4) Cash on hand of $33.5 million, or 54 cents per share.

Based solely on the number, Dusk looks cheap IMO.

DISC - I HOLD.