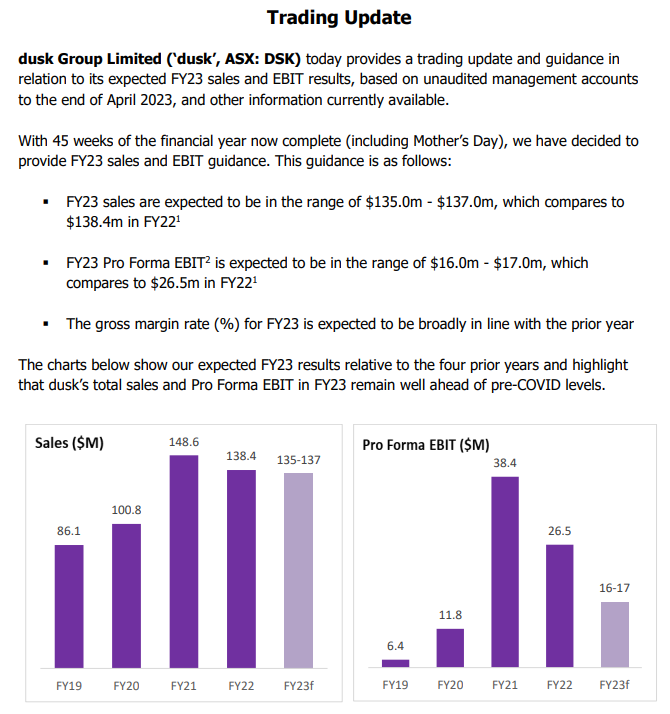

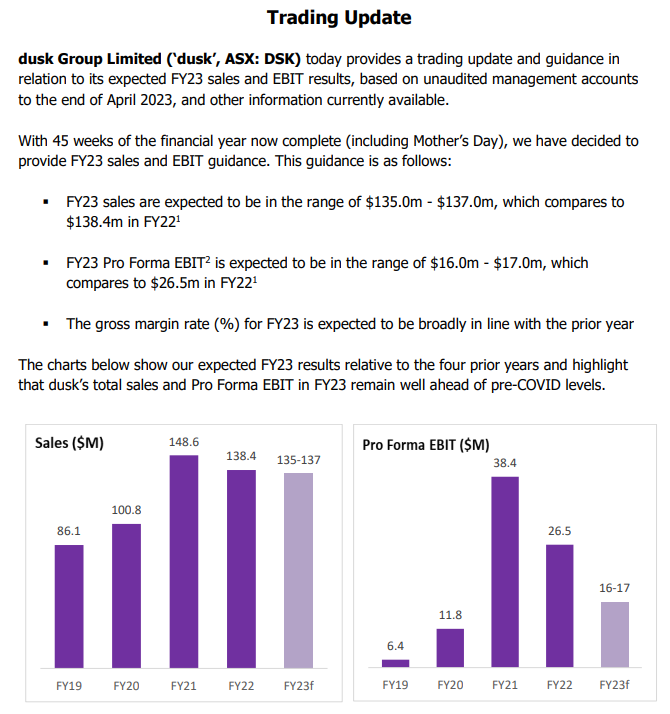

Well I guess that answers the question about whether scented candles are a discretionary purchase. Dusk's trading update today may even be worse than some were thinking. The second half of the financial year is always a much quieter period for them but with consumers keeping wallets shut, it's actually going to be a loss making half this year.

Having said that, underneath is a business that does make good money under normal circumstances and is maintaining its gross margin at close to 70%. If the economy were to go to hell in a handbasket you might pick this up for a steal in the next 12 months. The big BUT though is a pending CEO transition and it might be worth waiting to see what the new dude is bringing to the table.

[on watchlist only]