@Solvetheriddle Totally agree with your assessment.

@Rick I'm not sure it will be profitable in FY24 but it looks like FY25 should be OK.

I also wanted to correct the opening comment in my Straw earlier today. I said next year EBITDA is forecast to be NZ$0.5m - NZ$2.0m. I didn't read that correctly, as what they've said is they will hit -NZ$2.0m to +NZ$0.5m. (I was fooled because when you show a range the convention is to display the bottom of the range first! My bad.) Hence the use of the work "possiblity" of postive EBITDA, a softening of the rhetoric at the Q4 4C call. But we are splitting hairs here.

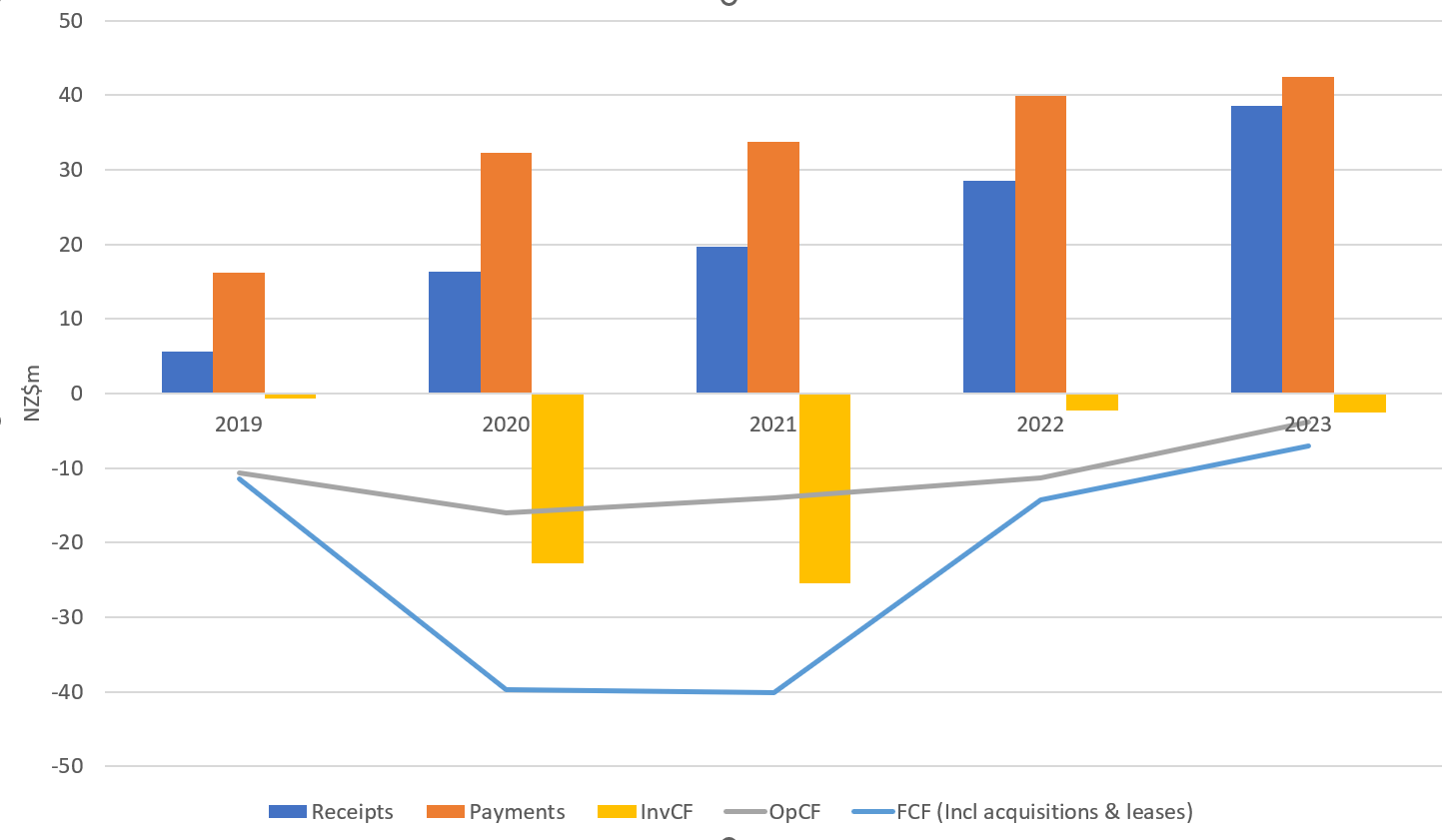

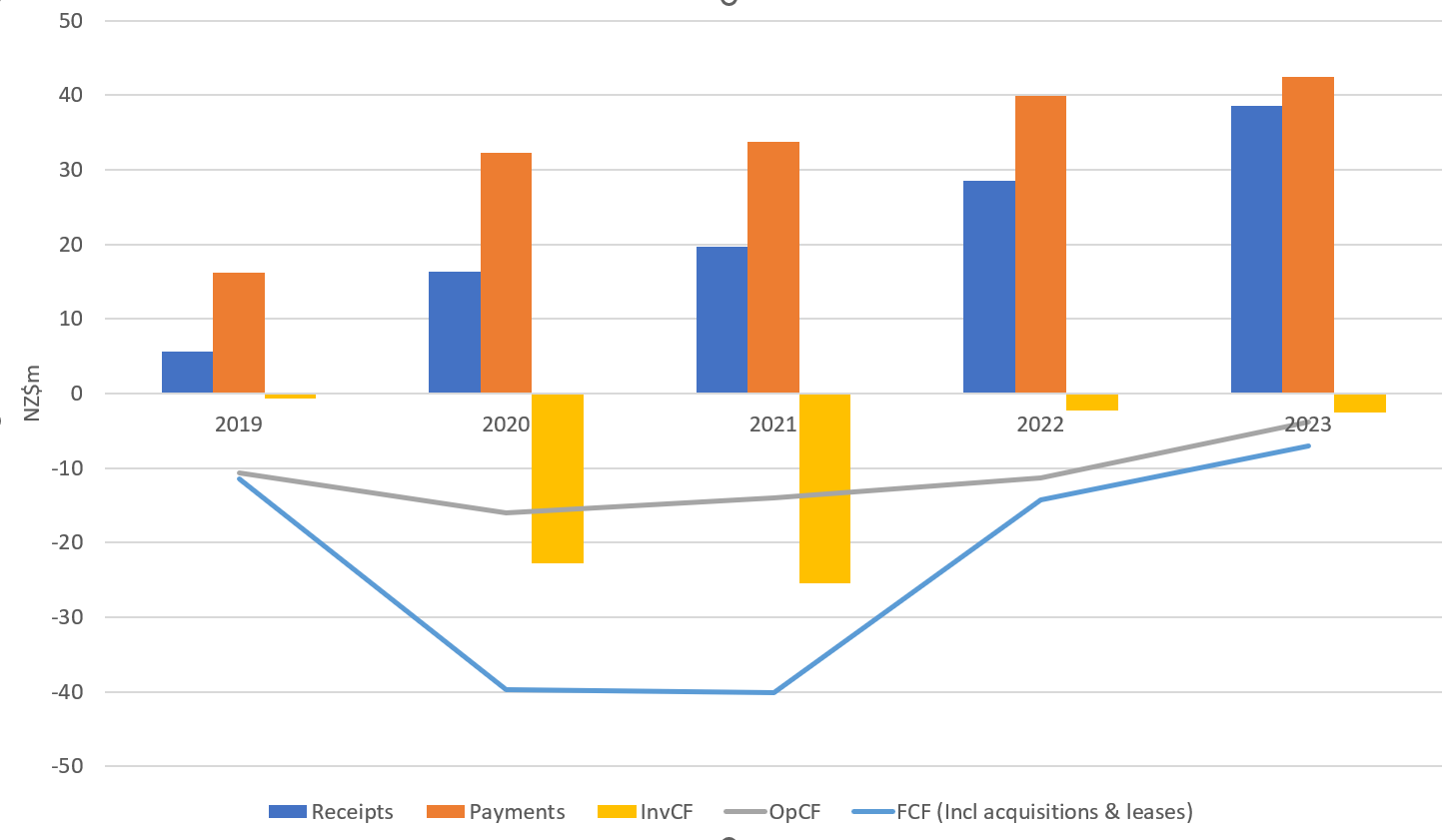

I think it is useful to take a step back and look at the bigger picture, because it takes time to build a successful business. Let's look at the cash flows over 5 years. Because of the way they entered movement in deposits and financial investments in there cashflow line, I have been sure to focus on investments in the business (fixed assets, intangibles and acquired business including transaction costs), and I've also included lease payments in the FCF calculation.

Figure 1: $VHT 5-year Cash Flows

In 2019 we had the business pre-acquisitions. Basically Ralph's and Prof Sir John Brady's breast volume and density algorithm business. 2020 and 2021 saw the acquisitions to bulk up the analytical capability of the software, adding risk assessments, genetics and lung. However, by mid FY2022 it looked like costs were scaling up faster than receipts. (At which point I originally baled out).

Then we have FY2023, Terri resets the cost base and drives for larger accounts.

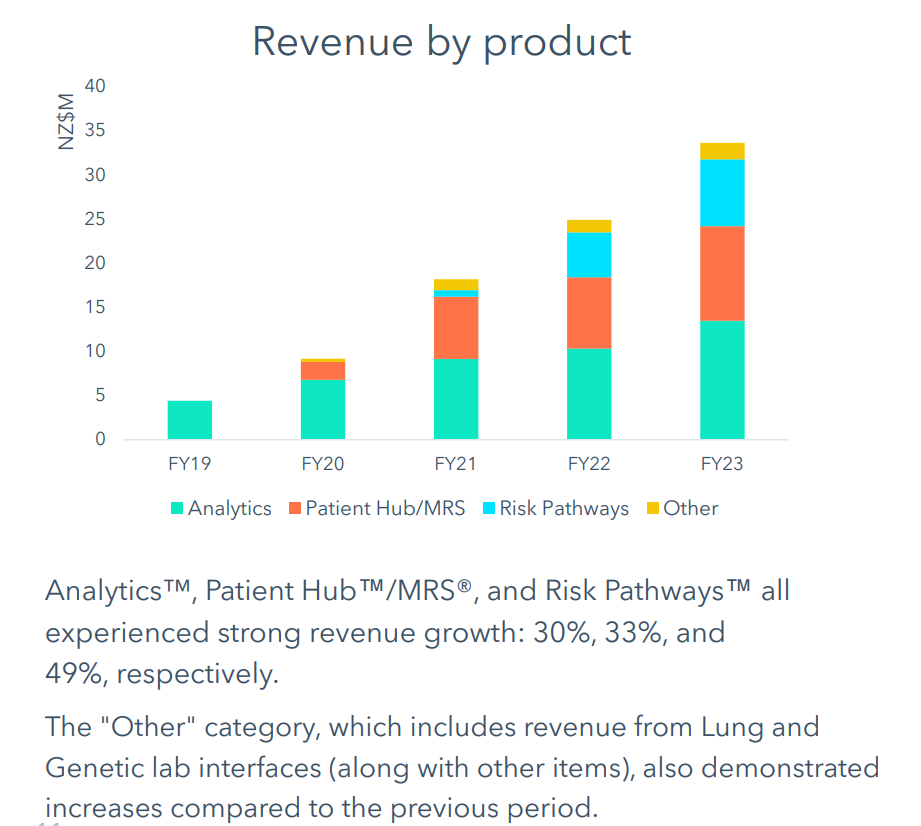

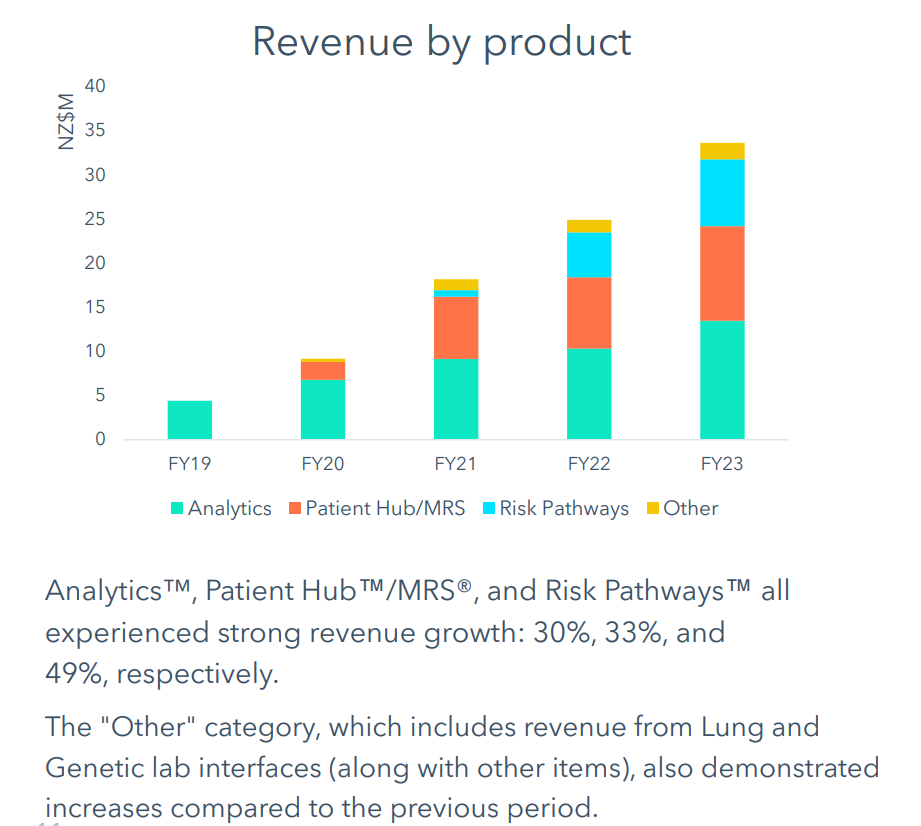

On the acquisitions, I think history is showing these were smart. The extract below from slide 11 shows how strongly Patient UB/MRS and Risk Pathways are growing. Without these acquisition, the original $VHT (mostly the green bit) might still be struggling to cover its costs. And it looks like there is still a very large cross-selling opportunity ahead of them.

So the real question now is, what is the slope of the grey and blue lines in Figure 1? H2FY23 indicates that it looks pretty good and, of course on a cash basis, the payments are still a bit high because of the severance costs incurred during the half.

Provided they run the business organically, the next two halves will give us a first clear read on the underlying economics. While, given industry tailwinds and Terri's leadership, it should trend positively into profitability and FCF generation, it remains an open question whether the economics are strong enough. But is does take time to achieve overnight success!

Listening to today's call, I observed Terri to say that in the past $VHT has focused on the mammography specialist centres, whereas she is taking them further into the big hospital and imaging networks (where you find the elephants.) They've probably got a lot of running room there. Also, they don't necessariy compete with the other imaging (PACS, viewer) providers, because their USP is the analystics and risk assessment.As I understand it, $VHT has the largest body of clinical peer reviewed research supporting their breast density assessment, and because their contracts are modest (compared for example to a $PME full suite purchase), I believe they have every chance to sustaining a reasonable annual revenue growth (c. 20% cc basis per annum.) The can also run in concert with the software used by the imaging hardware providers, so they are not in competition with that. In additonal, their huge cloud-based databank of breast images is a major asset for application of ML/AI, where it sounds like they've made progress with the Microsoft collaboration.

If the recent rulings in the US on breast density and lowering of recommended age limits provide significant tailwinds, then we could even see revenue growth pick up. Again, FY24 should give us a good read on this, given the September 2024 FDA deadline.

As to acquisitions, I hope they don't. It would put us back to square one. And besides, they don't have the balance sheet to do anything significant. However, we have to remember that $PME is what it is today because of one very smart acquisition made around the GFC, I think. So let's hope Terri is smart! (And credit to Ralph, his acquisitions seem to be turning out OK, although I haven't done an ROI assessment.)

Of course, $VHT is itself now an attractive target, and it is probably most vulnerable over the next year as it sits on a reasonable multiple (alebit not cheap at 5.3x EV/Revenue, compared with 3.08 for M7T) while hovering just below breakeven.

Finally, I liked the additional reported metrics added today, e.g., NRR, CARR, TCV and % Revenue in Top 10 Customers. It just makes the business more transparent.

In summary, we'll learn a lot over the next 12 months, but the direction of travel looks positive, even if the market hasn't picked up on it yet.