11/5/23 Xref Product Development Update

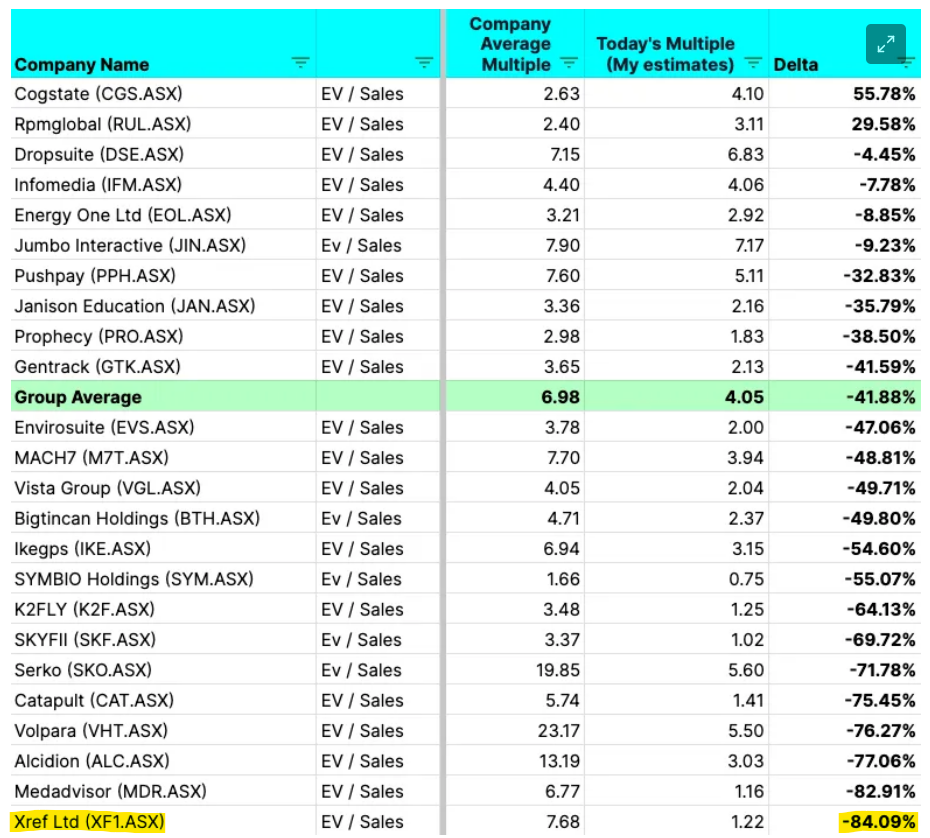

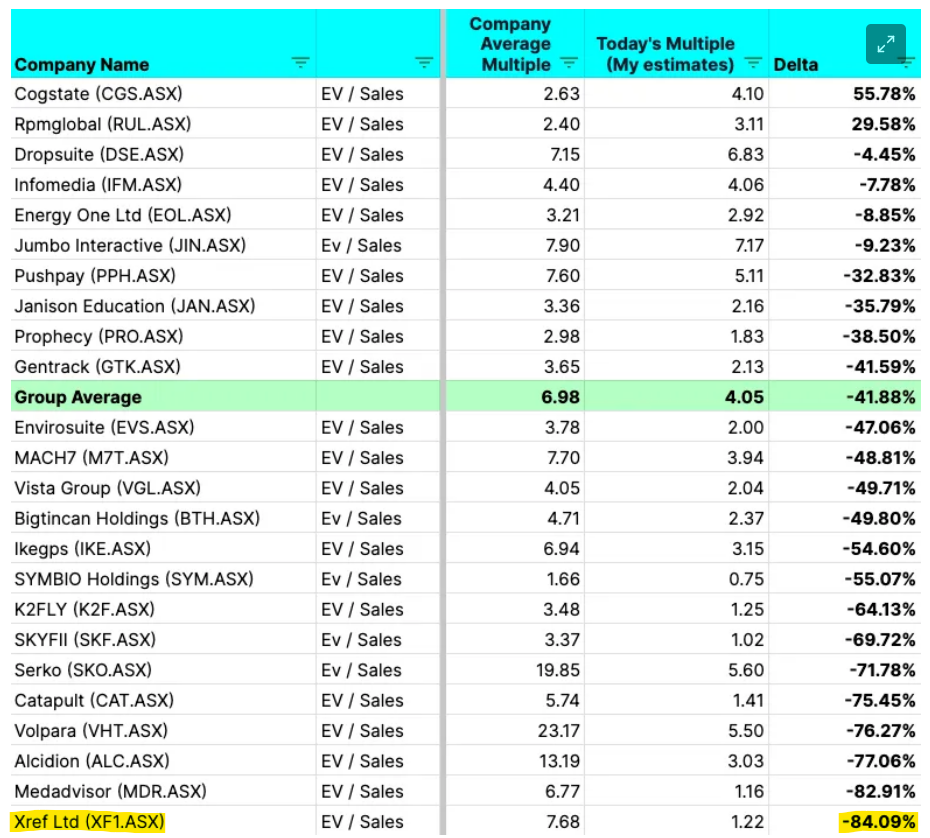

Well, what an annus horribilis for XF1 (or I guess more specifically, the share price). While the business definitely missed the lofty expectations that were set in 2021, it has been one of the worst victims of the massive de-rating for micro cap tech/growth businesses as best highlighted by the great work of @JPPicard in a recent Substack article showing XF1 suffering a multiple de-rate worse than any of it's peers: https://goforgrowthco.substack.com/p/todays-growth-multiples

So where are we today? Financially, the business reported mediocre results at the half year with total revenue growth of 8% through a mix of 15% growth in the core Xref segment and a -17% decline in the Rapid ID segment. It is worth noting that half on half Rapid ID has returned to growth so that headwind will ease moving forward. NPAT fell from roughly breakeven to a $1.5m loss as a higher cost base was put in place to bring forward product development of new modules for the release of their Enterprise subscription model. That said, even accounting for the higher cost base the business still generated over $1m in operating cash flow and breakeven free cash flow due to the working capital model. The business also has net cash of $7m.

The recent Product Development Update was positive, with management confirming they have completed the development of their Pulse Surveys module and it will become the third pillar of the Enterprise offering alongside Reference and Exit Surveys. The Enterprise solutions will also be complemented by the Trust Marketplace (Rapid ID) and Engage (Voice Project).

XF1 began selling the Enterprise platform back in October last year and the migration of existing clients from the transaction based model to the subscription model will ramp up with platform development complete. Currently only 7% of customers are on the subscription pricing however the $300k MRR is roughly 17% of total revenue. This is likely due to migrating large customers first, but the shift to subscription is expected to drive a bigger ARPU as customers can access more modules. Extrapolating the numbers from the update, ARR is $3-4m (depending on whether $0.3m MRR is rounded up from $250k or down from $350k) and implies total Xref revenue of $18-25m (ARR being 17% of total).

Looking forward, the commentary at the first half was for the second half to return to a small net profit which I expect is achievable if the cost base stays relatively flat from the first half. I expect this is likely achieved with $12.5m revenue broken down as $9m from Xref, $1.5m from Trust Marketplace and $2m from Engage with $12m in total expenses up from $10.5m at the half with the contribution from the acquisition of Voice Project.

Long story short, I feel like the multiple de-rate for XF1 has been wildly overdone. The heady days of 8x sales are behind us but XF1 is languishing with cash burning peers who appear reliant on the kindness of capital markets at a time when the markets are taking businesses like that behind the barn like Old Yeller. With XF1 being free cash breakeven and the prospect of growth returning with Enterprise upsell, Voice Project acquisition and easing of crypto-related Rapid ID headwinds I think XF1 deserves a premium to those peers.