Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Ooofff...this update was a bit of a body blow this morning.

The good news first (won’t take long). The migration of customers from an upfront sale per use model to an annual platform subscription is progressing well with more than half of what they call their ‘key customers’ now on the SaaS model. They’ve previously called this their ‘green list’.

Except the numbers have changed. A few months ago Lee said there were 1200 customers on the green list. Now there are 1100, based on extrapolating the figures in the update. So are they bleeding clients? Quite possibly. I’ve heard Lee proudly declare their retention rate is 87%. That doesn’t sound great to me. All else being equal you have to grow your customer base 13% a year just to stand still. In theory, moving customers to a SaaS/platform model should make them stickier but it’s hard to make that case right now. Maybe they redefined the definition of ‘key’, but I don’t love the inconsistency.

There’s other stuff that doesn’t stack up either. According to Lee 271 clients had migrated to SaaS at the end of October, representing $7.6 million of ARR. Now they say 551 clients have migrated (more than double in two months), but ARR is only $10.9 million (only 43% higher). What gives? Ok, you’d likely target your bigger customers first so maybe that accounts for part of the difference, but that’s a big discrepancy. Also, if that’s true what does it say about the remaining clients yet to be targeted?

But I’m kind of nit-picking and in danger of burying the lead. Revenue of $10 million for H1 was pretty bracing. Last we heard from Lee (November), XRef were billing $0.5 million per week so to come in at $10 million for the half is well below expectations. It may be up slightly on pcp but the comparative doesn’t include XRef Engage, which was acquired in January 2023. Back that out and it looks like revenue is down around 20% versus pcp. That’s reasonably close to Seek’s employment index, which showed a 17.4% decline in national job ads from Dec 22 to Dec 23, but again suggests the customer base isn’t growing.

But all that’s in the price now, right? Afterall it’s at 1x revenue, and if you believe them that revenue is largely recurring. I’m a little more cautious. Job ads have certainly rolled over but they remain well above the historical average. Maybe they don’t go back there (unemployment is still low, growing population etc.) but maybe they do and without a growing customer base to offset it, that’s a big risk.

The other announcement the company was ‘pleased’ to make was a refinancing and extension of their debt facility. Given their burn rate they had little choice other than raising at exactly the wrong time but the terms are not exactly borrower friendly:

By my rough workings, assuming they only use the initially drawn amount, at the end of the interest-only period, the financing cost will be $2.7m a year (compared to a financing charge of $0.6m in FY23). Over the course of the loan they’ll repay $9.6m, plus have a $0.5m bubble at the end of 2027. That all assumes exchange rates stay where they are. Maybe they’ve hedged, maybe they haven’t.

They are cutting other costs and their cash flow is better than the P&L would suggest but the thesis no longer stacks up for me and I've sold both here and IRL. I'll keep an eye on it and if things change I might consider buying back in but I can't imagine that is anytime soon.

[No longer held]

Urgh...what do you do when your favourite fast-growing microcap stubbornly refuses to grow?

XRef's FY23 results were nothing short of underwhelming. After initially guiding to a small profit, they later downgraded that to a loss, which ended up being a greater than I expected $(3.4)m loss. What made this worse was they capitalised $2.5m in development costs, most of which appears to be headcount that will be ongoing (opex or capex - doesn't really matter). This resulted in their traditional strength - strong free cash flow - being an outflow of more than $2m. Add in the acquisition of Voice Project and other costs, the overall cash outflow was $4.8m. One thing I didn't think I'd be saying about them was that the balance sheet was looking stressed, but with that level of outflow it is now the case that you need to think about the balance sheet carefully.

It wasn't all doom and gloom. Voice Project (now XRef Engage) delivered $1.8m revenue since January 2023 and what's really impressive added 57 clients to the existing 212 they had at acquisition. That 27% increase in just 6 months demonstrates how valuable the opportunity to cross-sell a premium product to XRef's existing 1300 customer base is. Annualising that and assuming a similar level of growth (but let's say over 12 months rather than 6), would result in Voice Project providing a really meaningful contribution to XRef in FY24. If Voice Project's founder were here right now I'd be shaking his hand because without him things really would be bleak!

Also, while organically XRef's revenue was basically flat year on year, the quality of their revenue has increased. Since rolling out the subscription model in October 2022, ARR has grown to $5.5m as at 30 Jun. That's actually reasonably impressive given that they didn't have Pulse Surveys as part of the platform until May and so were selling the Hire to Retire story without a big chunk of value in the middle. It's conceivable that ARR could represent half their revenue by the end FY24.

Having said that, you can't ignore one of their key disclosures - that the investment in headcount is expected to result in employee costs of $16m in FY24 (it was $11.8m plus whatever they capitalised in FY23). That's a big gap to fill in addition to the $3.4m loss before you even break even.

So back to the original question, what do you do when your favourite fast-growing microcap stubbornly refuses to grow? I can't tell you what you should do but I lightened on the result and belatedly reflected that in SM early this week. Hopefully I get to regret it.

From the comment in their annual report

I think their cash generation ability in advance and good cash balance currently will make sure they are fine. However, to get share price momentum, revenue needs to catch up with the cost increase - which I think will be a little difficult in FY24 based on economic conditions as well if they are migrating to a subscription-based model - that will hide their revenue. so I think the long-term story is intact but I wouldn't be very hopeful in the near term.

I originally forecast $5m FCF for FY23, with a breakeven result in the first half even with the seasonally stronger second half the business won't get close to that.

However a platform has literally been set for XF1 into FY24 as the business scaled up development costs to complete the Enterprise subscription platform in May. The key focus for the business will be migrating the majority of their transaction based customers to the subscription platform which should help growth as it drives a higher ARPU with two new modules (Exit and Pulse) available on Enterprise.

On rough numbers I think XF1 can do $27m revenue in FY24 with $20m from Xref, $3m from Trust Marketplace and $4m from Engage. If costs stabilise after the ramp up in FY23 to $25m it would leave the business doing $2m in operating profit. However if the business gets traction with the Enterprise model through existing and new customers I would not be surprised if costs rise again.

But using $2m profit a 20x multiple would be roughly 21c.

11/5/23 Xref Product Development Update

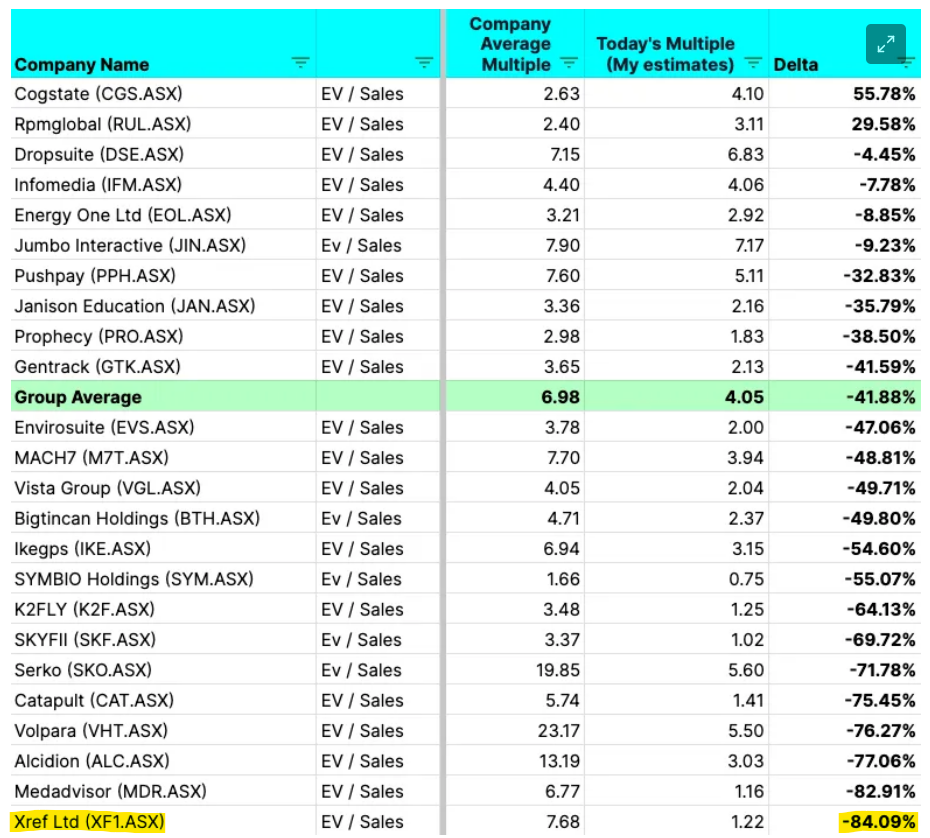

Well, what an annus horribilis for XF1 (or I guess more specifically, the share price). While the business definitely missed the lofty expectations that were set in 2021, it has been one of the worst victims of the massive de-rating for micro cap tech/growth businesses as best highlighted by the great work of @JPPicard in a recent Substack article showing XF1 suffering a multiple de-rate worse than any of it's peers: https://goforgrowthco.substack.com/p/todays-growth-multiples

So where are we today? Financially, the business reported mediocre results at the half year with total revenue growth of 8% through a mix of 15% growth in the core Xref segment and a -17% decline in the Rapid ID segment. It is worth noting that half on half Rapid ID has returned to growth so that headwind will ease moving forward. NPAT fell from roughly breakeven to a $1.5m loss as a higher cost base was put in place to bring forward product development of new modules for the release of their Enterprise subscription model. That said, even accounting for the higher cost base the business still generated over $1m in operating cash flow and breakeven free cash flow due to the working capital model. The business also has net cash of $7m.

The recent Product Development Update was positive, with management confirming they have completed the development of their Pulse Surveys module and it will become the third pillar of the Enterprise offering alongside Reference and Exit Surveys. The Enterprise solutions will also be complemented by the Trust Marketplace (Rapid ID) and Engage (Voice Project).

XF1 began selling the Enterprise platform back in October last year and the migration of existing clients from the transaction based model to the subscription model will ramp up with platform development complete. Currently only 7% of customers are on the subscription pricing however the $300k MRR is roughly 17% of total revenue. This is likely due to migrating large customers first, but the shift to subscription is expected to drive a bigger ARPU as customers can access more modules. Extrapolating the numbers from the update, ARR is $3-4m (depending on whether $0.3m MRR is rounded up from $250k or down from $350k) and implies total Xref revenue of $18-25m (ARR being 17% of total).

Looking forward, the commentary at the first half was for the second half to return to a small net profit which I expect is achievable if the cost base stays relatively flat from the first half. I expect this is likely achieved with $12.5m revenue broken down as $9m from Xref, $1.5m from Trust Marketplace and $2m from Engage with $12m in total expenses up from $10.5m at the half with the contribution from the acquisition of Voice Project.

Long story short, I feel like the multiple de-rate for XF1 has been wildly overdone. The heady days of 8x sales are behind us but XF1 is languishing with cash burning peers who appear reliant on the kindness of capital markets at a time when the markets are taking businesses like that behind the barn like Old Yeller. With XF1 being free cash breakeven and the prospect of growth returning with Enterprise upsell, Voice Project acquisition and easing of crypto-related Rapid ID headwinds I think XF1 deserves a premium to those peers.

29/11/22 Xref 2022 AGM Presentation and Address

@Noddy74 has already done a great job covering the AGM in a prior straw so I will just tack on a few notes:

- Update on the new financial year was the first four months overall sales are "in line" with the corresponding period last year. At face value this is weak but it should be noted they are cycling a tough comp from 1Q22. I was actually expecting sales to go slightly backwards just based on the comp.

- More concerning for me is the guidance for the first half is also forecast to be in line. Given the comp in 2Q22 is much easier I would expect some growth after matching the first quarter, but commentary from management is that macro is starting to bite. XF1's sales model is tied to recruitment which is slowing, but also customers are more cautious on pre-purchasing lumps of credits up front.

- Commentary was that sales activity is high with strong lead flow. On the call Lee did say that December was shaping up to be a strong month but the team needs to execute prior to Christmas/New Year breaks. Perhaps management have learned a lesson and are being conservative with 1H sales guidance but let's wait and see.

- I've updated my historical sales graph below with 1Q23 and 2Q23 on rough numbers provided by management:

- The main positive is that even with flat sales growth the business will remain cash flow positive and likely profitable as revenue (based on usage) continues to grow. The Voice Project will help on that front and the little overlap between the client bases is a big positive for cross sell.

EDIT: My graph titled XF1 Sales ex-RapidID didn't exclude RapidID in 2Q22. Wouldn't have thought it would be that difficult given it's in the title, but here we are...

My thoughts below are a mix of the AGM held yesterday (and subsequent chat with @Wini), my own thoughts and a chat with the CEO today:

- Sales (not revenue) are in line with pcp. On face value this is a minor disaster for a company in growth mode but the reality is sales will become increasingly less of a key metric given the company's move from sales of individual credits in advance to platform-style annuity billing. A similar but more pronounced dynamic occurs when companies move from perpetual to annual recurring licenses.

- Revenue for 1H FY23 to be 10% up on pcp:

- core business up 18%; offset by,

- RapidID down 16%. This is mainly due a drop off in crypto account signup but partially offset by new revenue from Coles and H&R Block.

- Again, on face value this is underwhelming but they are cycling an extremely strong pcp and the extent to which RapidID was benefitting from the crypto signup boom wasn't apparent until it was no longer there.

- In regards to the Voice Project acquisition:

- Lee clarified that the deal of $2m cash and up to $2m of scrip total at next two anniversaries meant $2m+$1m+$1m, not $2m+$2m+$2m. This represents 1x FY22 revenue. The company is profitable and milestones are based on personnel retention and productivity.

- Rationale includes:

- IP - Significant IP originally out of Macquarie University

- Data - Bought 20 years of data, which represents a significant 'time hack'

- Opportunity - Voice Project have 1000 clients (XRef has about 1300) with little overlap. Their biggest clients include Hungry Jacks, Downer EDI, Spotless, Higher Ed and local governments - lots of non-cyclical stuff. They've done this without sales and marketing employees, which XRef can bring.

- Analytics Engine - Voice Project spent two years building this and it's something XRef don't have but need as they move towards being an end-to-end platform that need to be able to mesh data together and deliver insight to clients.

- I still have some question marks over the acquisition. One of the things that has attracted me to them has been the fact they've grown largely organically so far and so I can hardly turn around and applaud an acquisition now. I also question why global searches so often end up finding up ideal candidates in the company's jurisdiction, but they're not Robinson Crusoe when it comes to this. Given their history and the success they had with RapidID I think they deserve the benefit of the doubt for now.

- Revenue from the Coles and H&R Block deals is flowing (utilizing RapidID)

- The Graduate Verification Scheme is live but will take time to onboard significant numbers of higher ed institutions (utilising RapidID)

- The move to become a Hire-to-Retire survey platform will move them from one competitive space into another competitive space. Key competitors will include Qualtrics and Culture Amp. Until recently Peakon was another competitor but this was acquired by Workday for US$700m last year.

Evidently the market didn't like the update but you honestly could of swung a cat in the AGMs zoom call and not hit anything, which is a pity because I'm more of a dog person and wouldn't mourn the loss of a cat, but it also represents part of the opportunity in that there is so little coverage of this company. I am questioning whether I'm becoming a happy clapper and I don't think I am, but time will tell.

[Held]

It seems like the price paid is very reasonable

As much as I like seeing organic developments of modules for software - this acquisition looks complementary to Xref's offering. The question would be how different the tech stack is for both platforms from an integration perspective and how incentivized incoming founders and employees to grow the business.

Although Job ads are going downhill month over month -- it is still above last year.

One sunny day in October 2019 XF1 co-founder Tim Griffiths walks into the CFO's office and says he need them to do him a solid. He needs the company to spot them $135,000, which he will then immediately repay. The CFO has a brain fart and agrees to this. The 'loan' is paid and as promised immediately returned. It is not disclosed how this came to light, however, it does and in March 2021 at the conclusion of an investigation the CFO gets a sizable wrist slapping and co-founder Tim Griffiths is exited ('resigned') as an employee and director.

None of this is contested and it's kind of ancient history now, except for one thing. On the way out Tim Griffiths agreed to put his shares into voluntary escrow for 12 months. That escrow period expires at the end of this month. Should holders be worried? Dunno but it's definitely a risk. Tim owns around 31m shares and that's a lot of capital to be tied up into an enterprise you are no longer a part of. If he decides to significantly lighten or liquidate it would put significant downward pressure on the share price. Hopefully the company is working with Tim and other holders like Australian Ethical and Merewether Capital to ensure if there is a sale it is done in an orderly fashion.

Xref (XF1) - market cap 110m

FCF history

- FY18: -6.6m (CapEx -188k)

- FY19: -5.1m (-115k)

- FY20: -8m (-630k)

- FY21: 1.9m (-331k)

I have projected FY22 FCF of 2.6m, with CapEx hopefully steady around the -250k mark. Thereafter I have projected consistent 1m FCF increases. Revenue has been growing nicely in recent years -- with the exception of a blip between FY19 and FY20. I anticipate we will again see a steady revenue increase in FY22, forecasting around the 20m mark. Yes, my FCF estimates might be considered conservative by some but I would rather underdo it and leave some wriggle room on my valuation.

XF1 has been well covered by @Wini, @Noddy74 and others. I had another listen to your stock pitch too @Noddy74 – I was amazed at the different things I picked up on my second listen when I was a little more familiar with the business. This has made my research easier, so thanks all.

Using the above key metrics in my DCF with a four-year forecast, I reach a company value of 90m -- divide this by shares outstanding (185m) and I arrive at a valuation of 0.50c.

Investment thesis

XF1 is growing nicely in a niche market, with favourable tailwinds buoyed by Covid impacts (the 'great resignation' etc.). There are many similarities here to my investments in SPZ and MSL – XF1 has cash on hand, no debt concerns and shouldn’t need to tap shareholders on the shoulder for more funds (unless they want to make a sizeable acquisition). They will hopefully be able to sustain reasonably high growth levels by investing FCF back into the business. I agree completely with @Noddy74 too: I am not interested in profits, but I want to see healthy gross profit margins and steady FCF – with inflows being used to grow and capitalise on their attractive market position. I think disruption/competition is the big risk to watch here so I would much rather XF1 delayed impending profitability to capture more market share -- but those are just my thoughts.

XRef was the last of the company's in my portfolio to report on half year results today and largely it was per previous guidance. Highlights included:

- Sales - a record first-half sales result of $10 million, up 95% from H1 FY21

- Revenue - a record first-half revenue result of $8.9 million, up 73% from H1 FY21

- Cash Surplus - $2.3 million generated during H1 FY22 ($1.6m after deducting capex)

Despite this the SP suffered some weakness and I think that was because costs were higher than some expected resulting in a really marginal net loss for the half. The company has guided to a net profit for the full year.

I have a couple of thoughts in regards to those costs. First, I think the investment to grow the top line is the right thing to do. It is a land grab and where this company is at they need to be spending in order to capture as much of the market as possible. However, the second thing I would say is that the divergence between the expectation and the reality when it came to spend was a problem of the company's making in that they haven't been entirely consistent with their messaging in regards to costs. I think I mentioned when I pitched this stock that I could point to occasions when they were pretty unequivical that the cost base was largely fixed. However, at other times they did suggest that significant investment was taking place and that maximising profit wasn't the objective. So they're doing the right thing but they're not always saying the right thing...not good but could be a lot worse...

The other thing I'd say is I don't really care about profit (well...I do, but not alot). I'm much more interested in seeing the cash come in. With the highly cash generative Q4 to come I'd expect the cash surplus to be at least $5-6m for the year. If you 20x that (even with lower multiples going forwards that seems a bit light on for a business growing this quickly) you more than justify the current market cap.

[Held]

I won't re-hash the great work @Noddy74 did at the Stock Pitch night on XF1 so encourage people to go back and watch that for an overview of the business.

In the 1Q21 report, XF1 broke out a cohort analysis for the first time. This is helpful but admittedly the data could be presented in a better way (I prefer the line graph used by WSP in their presentations). Nonetheless, compiling this data shows why I am so bullish on XF1 in the short/medium term:

Hopefully the table is easy enough to understand, and it shows how well XF1 is scaling up within their existing customer base. I believe this is largely due to the land and expand strategy of winning a multinational enterprise customer in one region and over time rolling out the Xref to other geographies.

FY19 and FY20 customers are the key customers in my opinion because the business/product has improved since the early years and you are getting clean analysis across the 1Q21/1Q22 comparison (all the customers for those years transacted in both periods). Even if 1Q21 was Covid affected, 100%+ growth from these clients is fantastic. If that momentum can continue I think it is possible that XF1 can probably do 30-40% organic growth in FY22 simply from growing sales through their existing client base.

The other thing this analysis highlights is XF1's pricing model does allow for large fluctuations in sales. Be wary annualising any one quarter, analysis like this above is necessary to remove the lumpiness (which 4Q21 may have been, it's the main thing I am watching).

Nov-21 update

I've been slack in updating this one. Have put a new target on it of 90 cents, which reflects what I had on it at the stock pitch night. This assumes 40% growth in revenue in FY22 and terminal revenue of $100m in ten years (I know, but you've got to assume something...). In the short term they may be beneficiaries of both reopening and the Great Resignation. Web traffic seems to back that up and is something I keep a close eye on with them. One positive development I didn't flag in my presentation was that they recently attracted Thomas Stianos as their new Chairman. He is the Chairman of Empired (EPD - being acquired by Capgemini) and a director of Gale Pacific (GAP - although he might want to leave that one of the resume after Tuesday's market update).

***

May-21 update Am continuing to remain bullish on XRef. I think some of the risk has come out of this as what were previously management aspirations for cashflow breakeven by year end are now being achieved (per last 4C and today's update). Despite this the SP hasn't moved significantly higher since I first posted on this company, probably reflecting market sentiment on the sector and market generally. I've, therefore, been adding to my RL position. Today's update gave a good overview of the company's product suite and revenue sources. It also gave a more detailed insight into new products being rolled out the FY22 that appear to be complementary to its existing suite and will be able to market to existing customer base. Overall I think the scalability of this business model and undemanding valuation are pretty compelling. *** XRef's primary business is providing a platform for employers to reference check prospective employees. The reference check is done online so referees can complete it when it suits them, there's potentially less delivery/interpretation bias and its easier to get references from overseas employers. I suppose the downside for employers is there's less opportunity to 'look them in the eye' or drill down further on an answer. They seem to be well liked by their customers (https://www.capterra.com.au/software/157672/xref and https://www.g2.com/products/xref-xref/reviews) and with that positive sentiment I can see how they could get network effects from users from one company moving to another employer and how referees themselves could see the benefit of the product. Having said that it's growing sales but only at a modest rate. I think you have to come to a decision about the extent to which covid is hurting its sales and if you feel it is you could then see how those might accelerate after the global economy recovers. The second half of this Coffee Microcaps meeting is worth looking at. https://youtu.be/GT93XJg5XK8 The good: - Potential for revenues to sharply benefit from global recovery - Steep reduction in cost base with management targeting Q4 21 breakeven . I think that is likely to be a catalyst for SP inflection. - Cashflows should lead revenues given their model is to sell 'credits' to companies, which then don't get recognised as revenue until they're utilised i.e. a prospective employee is reference checked. - State they are developing and implementing new products at a faster rate than any time in their history. The bad: - Is the board sacrificing long term growth for short term incentives? There are a lot of options expiring over the next few years at around 70 cents and the question has to be asked whether the focus on cost reduction is having a longer term impact on sales. - Have adopted a per use model, which will expose them to cyclicality and is going against the current trend towards maximising ARR. Of course that works both ways and if you accept the global recovery argument their model could work to their advantage over the next couple of years. The ugly: - SP - the technicals are horrible. It's been sold off on low volumes for the last couple of months and many would advise waiting, accepting you'll miss the bottom but buying with confidence that you have volume and momentum on your side. The SP outcomes for this one are diverse and depending on how bullish or bearish I'm feeling I can get a DCF to give me a SP anywhere between something (not a given for all companies) and $1. Overall I'm confident enough that it has a feasible product, is very near being cashflow positive and that the risk/reward ratio is skewed such that the downside is limited and the upside is significant. I've taken a position at 24 cents.

Like DrPete here is the XRef deck from last night.

Just a quick word to recommend pitching a stock (or an expertise or megatrend you are seeing) to anyone who might be considering it. Yes, it takes a little bit of time (although maybe not as much as you might think and certainly not as much as you've already spent researching it). And, yes, you are opening yourself up to whatever may come your way. But it's not an altruistic exercise that you get no benefit from. The process of preparation really helps you retest some of the assumptions you've previously made and reach a decision on the level of conviction you do (or now don't) hold...at least until the company next makes an announcement...

Haven't figured out how to attatch a chart screen shot on here, so I will just say XF1 looks great here for anyone who cares to take a look.

https://twitter.com/ArrowInvestor/status/1441172804301307907/photo/1