Yes @Valueinvestor0909 , I agree it looks like its strong. My calc. is slightly different from yours (although I've not done the detailed analysis of the buyback**, so I might be in error).

$22.3m Closing Cash 31/12

-$1.5m ** My estimate of shares bought back between 31/12 and 30/4

+$14.5m Net cash flow 31/12 to 30/4

$35.3m Cash at 30/4

They say annual maintenance is invoiced on 1-Jan, so there might be a positive skew of receipts in 1Q, however, I am unsure how much the maintenance element of the perpetual licences is.

On the face of it, with two months to run and "70% of annually recurring subcriptions due in the second half of the year" its looking like H2 will be strong as you say.

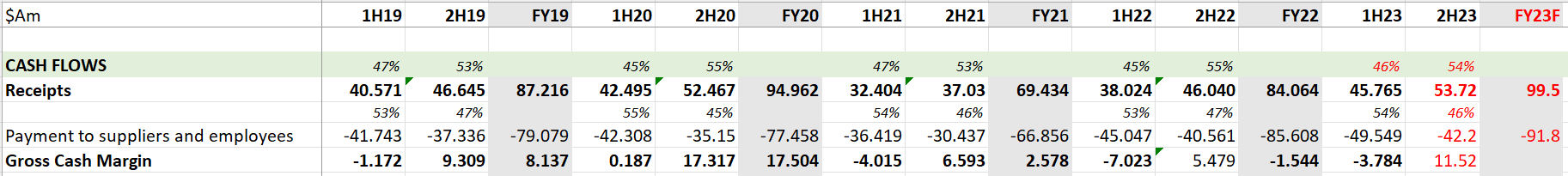

Taking a look at the history, half by half, I have had a go at looking what 2H receipts and payments might look like if the historical ratios between 1H and 2H are continued.

2H is typically 53-55% of receipts, while only 45-47% of payments. So in red I have taken the mid-point. That indeed points to a strong cash result. It would be the strongest half since 2020, and of course it is becoming a higher quality result each time because the proportion of subscription revenue is increasing.

I was a holder of $RUL in 2020 and exited in early 2021, but it has been on my watch list ever since. I almost bought back at the last half, encouraged by the share buyback, but decided to wait until the FY. As @Valueinvestor0909 points out, today's announcement gives an early read on the FY, so I've decided i don't have to wait.

Overall, I am impressed by the steady conversion towards subscription revenue and its growth (up 37% 1H23 over 1H22). Note: the above table is just an illustration, and not a forecast. But it is consistent with the reported cash balance, and consistent that the actual performance could even be stronger.

With the extension of the buyback programme and increasing evidence that it is starting to generate cash, I think that could put a floor under the SP. So, today, I've taken my first "nibble" back in. (0.5%RL and some in SM - leaving room for another nibble or two at the FY result).

If $RUL starts making money (which looks likely), and excess cash is used to buy back shares, then this is eventually going to drive eps and $/share.

Over the last Q, I have exited a few of my high risk micro-caps ($EVS and $3DP) and lowered conviction/weight on others ($ALC and $IKE), so I've been looking at the watchlist to see which potentially can compete for a place in my portfolio. Over recent months, I've acted on $VHT, $DSE, $8CO, $RFT and - today - $RUL. (And I'm looking hard at $CAT.)

Disc: Held in RL and SM