Pinned straw:

This was a good meeting, hearing from a board member, long time employee and major shareholder. However, to be honest, I came away with mixed feelings. I need to watch the recording again and do some analysis.

I have little doubt that this firm will be well-managed as a sustainable, profitable business.

My concern is that it might not be well positioned for the massive industry tailwinds that are building up. In the words of Nicholas himself, there is a risk that "we get left behind".

On the one hand, they have matured the RT22 platform relatively recently, and it is well-positioned as a key component in the fast-charging segment.

On the other hand, Nicholas could not clearly articulate who their target customers are, nor their plans to monetise this platform in the next crucial phase of industry development.

I think that in order to understand this company properly and to understand its prospects, we have to understand the competition. I believe (or suspect) that there are a lot of estalished power systems players in the EV charger sector, alreeady making $100s of millions or $bn in annual sales. It is already a major market, and its growing very quickly. As well as the industry leaders, there are doubtless countless component suppliers, who are well-funded given the overall positive vibe for the industry.

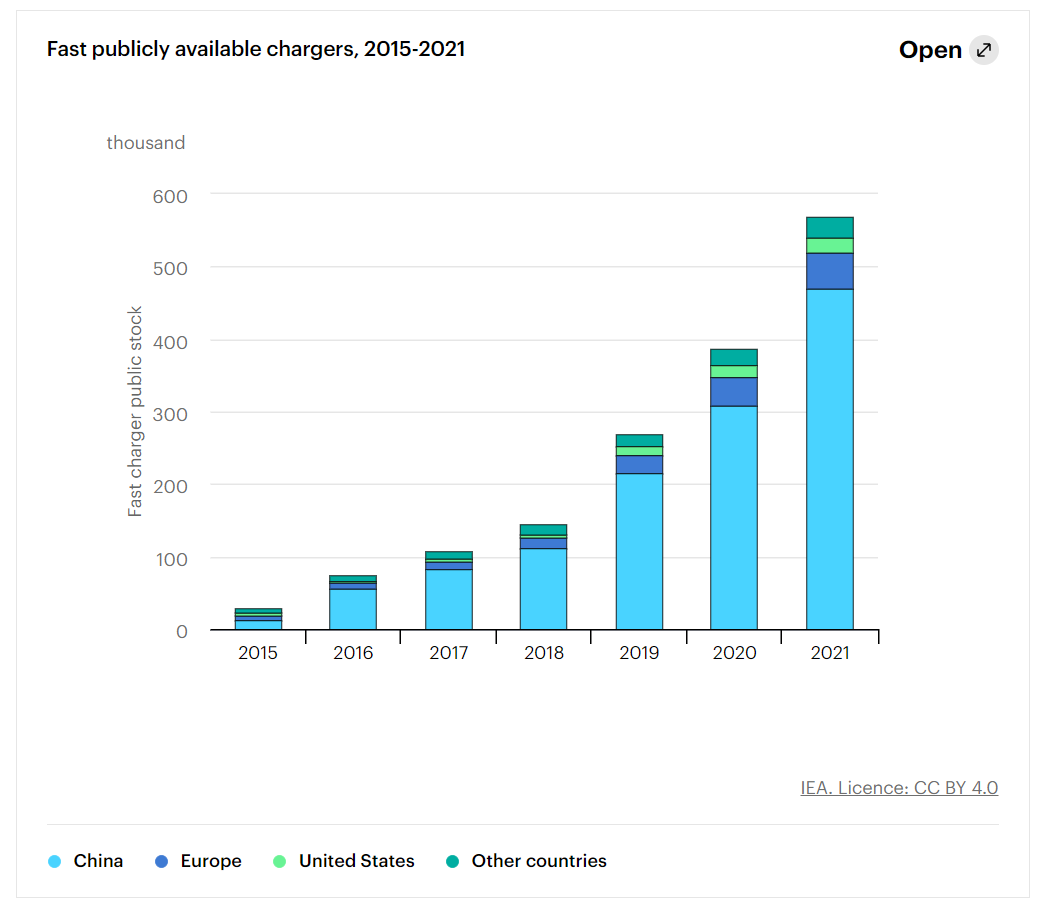

According to the IEA, over 0.5m fast chargers were installed in 2021 - mostly in China. And its growing rapidly. Fast charger networks are being cited by the EU recently as a constraint to achieving EU EV uptake goals. I've seem similar stories in the US, who are much further behind (although not as far behind as Australia!).

With IRA and equivalent legislation in the EU, both are going to be catching up hard in the next few years.

My point it, the explosive growth is happening now, the big players are already there and RFT is talking about going to conferences and discussing standards, and being available to all customers, and questioning whether they might build US capacity to be in the game for IRA deals. It seems to lack conviction, clarity and substance.

I hold a position in RFT as a speculative stock. But I am not convinced.

Strawman

Good observation @mikebrisy

I'm no expert about power rectifiers, but it does seem like a commodity product to some extent. I'm sure quality and reputation really do matter in the industry, as Nicholas said, and more custom builds are obviously better differentiated. But the operating margins and some of his comments do suggest there's not a huge amount of pricing power.

Still, the argument could be that the pie itself is growing fast enough that they could do well without any material gain in market share. As volumes climb higher they could even wear lower gross margins and still sustain reasonable growth. And while it could be argued they are too conservative in terms of growth ambitions (or more specifically the pace of growth), we've also seen what happens when companies become too ambitious on that front, and become reliant on friendly capital markets.

No position held, but I do think it's an interesting company -- especially if you're bullish on electrification.

mikebrisy

These are all excellent points @Strawman and they get to the heart of my thesis:

- Profitable company with evidence of disciplined management

- Long track record of technical capability in power rectification, including innovation (unclear to me how differentiated this is)

- Established material (in context of $RFT) orders from two EV mobility players (i-Charging and Tritium)

- Right sector, right time (yes, I am definitely a bull on EV mobility charging infrastructure for the next decade +)

Some further thoughts (as I went to bed in a bearish mood last night, but things can seem different after a night's sleep.)

I hold a small position (0.6% RL) which I believe over the long term can do well exposed to this sector. A conservatively run company can still quietly compound year on year and deliver long term success ($LBL is another like this.) As the company progresses I'll consider adding a little more each time. Just as I am happy for the company to scale progressively, so I hope to be able to scale my exposure progressively. My horizon is 10 years+. This actually suits my investing temperament better than firms that hit the hype cycle, have the SP rocket, and have you buckle in for a rollercoaster ride (like $PNV).

My pause for thought yesterday was more because this was my first exposure to management and I wasn't convinced by everything Nicholas said - or rather it wasn't all clear to me. However, I also considered that just as $RFT doesn't spend a lot of time talking to investors, so too the key messages aren't honed to an inch of their life and, therefore, we were probably getting a more unvarnished/raw (dare I say, honest) set of insights into the comany.

I did like what he said about "holding on to existing customers", proving themselves to be a reliable partner with a quality product. Each new EV mobility customer can be material to $RFT at this stage in its life. So if existing customers grow strongly with the market, then $RFT grows. Each new customer is a leg up on that. So you maybe don't need to see more than one new customer each year or so. It is a different cycle of newsflow.

Given the significant contracts $RFT has from existing customers, it is clear that supply chain challenges are impacting their ability to deliver volumes to initially expected times. As a relatively small player in the sector, I guess it has been a challenge for them to get to the front of the queue of their suppliers. As Nicholas said, if you have 300 components in a product and one is not available, then you can't deliver anything. ("The weakest link.") This is where larger scale competitors will have advantages as they are better able to multi-sourcing strategies, as well as having greater leverage with suppliers. Potential $RFT customers will potentially consider this in their buying decisions, and so I wonder to what extent $RFT's lack of scale puts them at a disadvantage.

Overall, time will tell, and I am happy to be patient.

Wini

As always, kicking off the conversation very well @mikebrisy.

I have done a fair bit of work into the industry. First of all, your suspicion is of course correct, RFT is butting heads against massive industry players. ABB, Siemens, Scheider, Eaton, Delta, etc. Any time you have a small fish in a massive pond the risk of obsolescence is high. But I think history can be a guide here, RFT have demonstrated they can bring products to market, win very large contracts with customers and establish themselves in industry thinktanks (CharIn which Nick spoke about).

I can go down a very deep rabbit hole, but to keep it simple I would suggest separating the industry in two segments: at home AC slow charging and out of home DC fast charging. RFT doesn't compete in the first segment and that is where products are commoditised, low margin and winners basically came about through established scale and distribution (ABB dominates that space).

DC fast charging is a completely different beast. Now we are talking about a space where even a percentage point or two in efficiency makes a huge difference, multiple rectifiers are used in a modular state and heat dissipation and noise can vastly change the size and form factor of the overall charger. This is where RFT competes and are doing a great job.

Efficiency is not the be all and end all, but all others things equal you would want a more power efficient charger. Looking at the various competitors I listed above, here are the power efficiencies of their highest end fast chargers:

ABB: Terra HP Gen III 94% full load

Siemens: SICHARGE D 95% rated, 96% full load

Scheider: No fast charger, only slow AC

Eaton: Power Xpert EVX 95% full load

Delta: City Charger >96%

RFT: RT22 >96%

To be honest when I think about the risks to the RFT thesis I have technological obsolescence well below the risk of being squeezed out by vertically integrated players. Even if ABB has a technically poorer charger, they manufacture their own internal power components so the likelihood of switching to RFT is low (could they just acquire though?). So to "win" RFT needs players like Tritium and iCharging to succeed. Industry players who aren't vertically integrated and their only motivation for building their products is sourcing the best supply which RFT can offer.

But to go back to your point: "I have little doubt that this firm will be well-managed as a sustainable, profitable business."

I agree with this, and importantly I think at today's valuation you are only paying for this. While @Strawman didn't focus on it (and rightfully so, digging into the EV opportunity much more important) but RFT has an established core business in telco, defence and power generation. In the past these segments alone have generated a few million in NPAT and give us a free shot at further execution in the EV space.

mikebrisy

That's really clear @Wini - thanks!

Your comment really help clarify for me "who the customers are" - and its not "everyone". iCharging and Tritium are relative new entrants (compared with the industry behemoths you've listed) and are not vertically integrated. And I can see that in a huge global market there will be many firms of different scales having a go. So the "niche" of vertically non-integrated players could be very material indeed, over time in the context of $RFT. As you say, the question is can these players ($RFT's customers) be profitable against the economies of scale of the giants? Or do they get squezed out?

So in terms of industry tracking, its probably worth following the fortunes of players in the segment of $RFT's customers. If they grow strongly with sustaniable margins, that's an indicator that there is running room for $RFT.

You also raise the question of M&A. For example, if $ABB takes a liking to RT22 96% versus 94% efficiency, they could acquire $RFT in a heartbeat, and tech transfer the manufacturing into their own supply chain. Equally, one of $RFT's customers could acquire them, if they wanted to become more vertically integrated.

I'm not trying to predict what's going to happen. But you are right to raise M&A, because with all the new entrants and innovation taking place driven by the industry tailwinds in mobility EV, consolidation over time is an inevitable as night follows days.

Strawman

Great points @mikebrisy & @Wini

The industry tailwind is a big part of the thesis, and not an unreasonable one. And definitely not a bad thing in having a team that is financially conservative (which as Nicholas said was a stance learnt the hard way).

Remorhaz

I havn't watched the RFT meeting playback yet (and I havn't even looked at the company) but something you mentioned @Wini in your post invites me to mention ...

As a relatively recent EV driver I've ended up doing a lot of research into charging, public charging infrastructure, brands and so on. From what I can see - whilst there appears to be some international (e.g. UK/Europe) love for the Tritium brand and their chargers - there's almost universal hate from Australian EV drivers

Essentially here in Australia the Tritium chargers are viewed as the most unreliable PoS around (these are heavily used for example by the free NRMA charging network for instance but MANY of them are invariably down because the Tritium units are broken)

One could theorise that the units in places like UK/Europe are in cooler/cold climates and thus don't overheat and break down but those in Australia are just not standing up to our harsher warmer climates

Another factor is that most overseas countries (like Australia) have government (state and federal) incentives for groups to roll out charging infrastructure which heavily subsidises them (especially in the early phases of EV adoption). The difference however is that most overseas countries also tie in a mandate of a minimum uptime (e.g. 99.9% or whatever) as part of that incentive and penalise you if you don't meet them (i.e. it's not just about rolling out the infrastructure it's about supporting and maintaining it). We don't appear to have that here in Australia, and many Tritium chargers are left languishing for months in a broken state (and thus local EV users hate the brand - even though it is a local Australian company)

mikebrisy

For the record, I don’t yet drive an EV. However, I understand the issue with charging station reliability is not confined to Australian. Here’s a post complaining about the problem in the UK. UK EV Charging Reliability

@Remorhaz , I couldn’t find anything about specific manufacturers in the UK. Did you have a source about the Australian / Tritium problems you reported? I guess I’m not plugged into the EV user community like you. I do have contacts here in Brisbane at Tritium, so potentially could follow up.

Wini

@Remorhaz Yep, or as the local EV owners call them, "Shitium" chargers!

There are a few factors involved. I think the environmental factor is quite low, your second factor is much more applicable. Whenever you have a rapidly emerging industry it can often be a case of "move fast and break things" (literally in this case). For large scale charging networks you can have many parties involved. At the very least you have the EV charger manufacturers, but distribution is generally though a different company (such as NRMA) and sometimes rolled out through a corporate customers footprint (such as Tritium supplying BP). Of course the Government is also involved when you need to put charging infrastructure along highways and main roads. Better legislation is definitely needed to ensure that all parties understand their roles for maintenance and upkeep.

But for Australia in particular, don't discount the fact that the majority of Tritium chargers here are their old legacy models. I think all of the NRMA network are the original Veefil 50kW models. I think they still sell them (rebranded to RT50), but it is now their lowest end charger with the 75kW model the one that would be rolled out to a similar network to the current NRMA one if it was to be done today.

Also bringing it back to RFT, it is worth noting that RFT doesn't supply the 50kW model, their exclusive supply agreement is for 75kW and up (see image below). So the third factor why the 50kW "Shitium" chargers don't work is they don't have world class rectifiers!

Slideup

Some really great information in this thread and video thanks everyone.

Another potential tailwind for rectifier if it builds a reputation as having higher quality/faster or more efficient chargers is that they can position themselves (or their rectifiers) as the sortafter charger for the mining sector, where I imagine cost comes second to performance and reliability.

As it looks to me like the miners main response to decarbonisation is moving to electrification of their truck fleets. I would expect that a mine and mine fleet would need to have larger capacity batteries and faster charge times to minimise the time their assists are sitting idle.

Just thinking that the niches for the higher quality gear might be seperate from the light vehicle chargers market.

mikebrisy

Spot on @Slideup - I have contacts in my network who are very active advising mining cos. on electrification as part of their net zero plans. There is a lot of focus and investment going into it. Here is a summary of the opportunity: Electrifying Mines Could Double Their Demand

In an more detailed study for the QLD Government, Accenture estimate that the opportunity for mining electrification in Australia alone to be 3.3GWh by 2030. (In context: the entire Australian electricity market in 2021 was c. 270GWh.)

Their assumption was based on "20% of Australian mines electrifying, with an average of 15 haulers per mine with a 2MWh battery per hauler and a battery replacement after 2.5 years as well as a 50MWh battery per mine electrifying". So, its real finger in the air stuff, but it indicates the order of magnitude. But you are right - the big driver of demand is the replacement of diesel powered mobile plant with battery powered.

Of course, any mine will require a mix of DC and AC, some will access off-grid and some on-grid wind and solar generation captured in grid-scale batteries (xx MWh capacities). Rectification will be part of the infrastructure mix, but its not clear to me how much of the incremental electricity demand will need to be rectified. If much of the on-mine demand is met by storage in a large, local battery, then mobile plant batteries could be recharged via DC-to-DC charging, which doesn't require rectification. I don't know this for a fact, just using my Yr12 physics to guess, here. Rectification would be used when AC from the grid is used directly for DC charging. If you had a large onsite battery, it wouldn't make sense to go from DC to AC back to DC, because of the losses incurred at each change. (OK, I'll stop here because maybe other StrawPeople actually know what they are talking about on this.)

Anywway, this rapdily growing market segment is already served by the integrated giants that @Wini listed yesterday (e.g., ABB, Siemens, etc.). However,, the products are lower volume, higher duty (hundreds of kW and even MW) with potentially more exacting and tailored specifications (efficiency, reliability, robustness). So it probably is a significant global market where $RFT could play (if it is not already) and its probably a higher margin market than the more competitive mass-market passenger EV charging.

Overall, demand in mining will be a subset of the "Offgrid-ESS" and "Commercial EVs" buckets shown in the slide below from the Accenture study. While smaller than the Passenger EV market, it is certaintly still significant by comparison.

This is why I was keen to understand who $RFT perceive their main customers to be and how they can differentiate themselves to win them.

Source: Accenture (2023) Battery Industry Opportunities for Queensland

Remorhaz

@mikebrisy I don't have any direct experience myself (I've not actually needed to use one of the faster DC chargers yet - but will do when we go away mid year). Most of what I've heard is from numerous posts in some EV "forums" (Whirlpool, Facebook, Reddit, etc) that I'm a member of or from some mainstream news articles or local EV web sites covering the frustrations - like:

https://thedriven.io/2023/02/16/broken-ev-chargers-australia-urged-to-follow-new-us-reliability-standard/

https://thedriven.io/2022/05/05/beyond-a-joke-number-of-busted-ev-chargers-causes-concern-as-ev-uptake-jumps/

https://www.bhatt.id.au/blog/its-not-all-tritiums-fault-how-aussie-electric-car-dc-fast-charging-network-can-more-resilient/

https://www.theage.com.au/national/victoria/broken-chargers-a-headache-for-electric-vehicle-owners-20220329-p5a8ye.html

The other place you see the frustration is on services like PlugShare (which is essentially an app with crowd sourced data on EV chargers worldwide (where they are, photographs, what provider they are on and how to access/use them, what they cost or if they are free, whether they are working, for some even whether they are in use or available, user checkin reports, and so on))

@Wini I'd say you're correct that the older 50kW DC chargers have more reliability issues (and reports) - but anecdotally they aren't the only ones seeing issues - I read frustrations with broken DC chargers all the way up to the 350kW models

Obviously it's possible that it's just a vocal minority that are actually having problems and ranting online, and even if there is a real EV charger reliability problem in Australia it's possible the Tritium chargers aren't the problem (or the only problem)

edgescape

I also haven't seen the recording, but I can already see most of the comments about RFT being in a market swamped with many competitors reflect my views as well as I suspected. It is probably why I went for IPD Group instead for the electrification theme (sorry don't mean to cross post).

Having said that, if they sell their value proposition and competitive advantage well enough on their chargers and rectifiers then that could put some wind in the sales for the company. Plus owning their own IP on their products does have advantages over something like IPD Group. However, being a small company that is still trying to make themselves heard, I think there could be a possibility they could get acquired by one of the larger companies.

Just my thoughts but definitely one for the watchlist.

lyndonator

Great meeting and discussion here. My key takeaways largely align:

- I appreciated his honesty - all business is uncertain, and I think it demonstrates his faith in their product and his team that he is so open about the uncertainty

- Sounds like they are trying find their exact niche in the electrification transition and have the brains (in the tech) and business acumen to make something work. They aren't trying to become the supplier for EV chargers worldwide, go for broke and either 1000X their market cap or die - but are looking for opportunities to continue to grow substantially and manageably from here.

- They have an established business they want to keep and could fall back on. I think this, as our trusty overlord likes to say, offers an asymmetry in the potential outcome and is why I have started a small position

Couple of other related things:

- The term 'Shitium' could also apply to their financials and balance sheet. In their last report Tritium has both negative equity and cashflow. I suspect the only way they'll stay in business is from the corporate welfare offered by governments to accelerate electrification. I wouldn't be surprised if Rectifier don't get any more orders from Tritium...

- Both Ford and GM have announced they are moving to using Tesla's super chargers which will further increase their dominance in this space and make it harder for the other EV chargers. Based on their level of vertical integration everywhere else I'm pretty certain Tesla make their own rectifiers so probably won't be a potential customer, however could easily buy RTF if they liked their tech.

Shapeshifter

Just to clarify a point @lyndonator

- Ford and GM have agreed to transition to Tesla's charging standard called the North America Charging Standard (NACS) by 2025.

- Tesla have agreed to allow Ford and GM to utilise the Tesla supercharging network

- Already Flo Stations (which has about 90,000 charging stations in the US) has agreed to adopt the NACS standard

- In effect this means Tesla has won the EV charging standard war that was happening in North America

- This is like USB-C becoming the universal standard (even Apple is being dragged into this standard!)

- Both Tesla's supercharging network and other non-supercharging networks will still exist together in the US

lyndonator

Thanks - I hadn't really considered the effect of the NACS becoming the standard

In fact, you could argue that having (effectively) one standard might actually make it easier for the other EV changing companies as they can now cater for all EVs without an adaptor.

One more point, Tesla is giving Ford and GM API access to use in their phone apps - their customers, in theory, would get the same experience at the Tesla super chargers as Tesla owners. Which is why I stated the deal would further increase Tesla's dominance in charging as GM and Ford customers would take preference to Tesla and encourage further investment by Tesla to build chargers.

However maybe the 2 effects net out - hard to know.

Similar to petrol stations I'm sure this space will end up with a number of winners, but I'd take the bet that there much greater number of companies that fail

Shapeshifter

A technical point I found interesting (this is not something I understand so take this with a grain of salt) there is a barrier to Europe adopting the NACS standard which would require a rectifier (the comment was at this link)

mikebrisy

On the announcement by Ford and GM to move to the NACS standard, Tritium have issued an announcement which provides further clarity. (Tritium are a key customer of $RFT).

Tritium Announces Support for NACS Connector It makes clear that NACS is a US standard, and it implies that making the charger compatible relates only to fitting the NACS plug, which they are going to do. So, overall, this is a positive for EV adoption, easing customer access to standard charging infrastruture.

Further updates from the Reuters newswires:

First, some pushback from the industry body behind the CCS alternative, arguing NACS is not the standard yet and secondly, responses from other fast-charging providers.

Just on the economics of the fast-charging sector, here are the operating results from Tritium over the last 3 years:

So, it is not scaling favourably yet.

But is it early days yet, as they are guiding to FY23 revenue of $200m from 11,000 units. Note: thestated combined capacity of Brisbane and Tennessee is 5,000 + 30,000 units per year. So the financials are likely reflecting a high fixed cost from lost asset utilisation at this stage.

Given that there are quite a lot of fast-charger manufacturers and despite the growth, competition will challenge the margins, I am happy to be invested in a supplier to the fast chargers, and not the fast charger makers themselve.

Having said that, Tritium share price has been absolutely smashed as they burn through cash, take on debt, and likely have to issue more capital. The SP is currently at $1.13, with the consensus at $4.83 (n=6). So if they can hit profitability in FY25 (which is the consensus), then there is a big potential upside from here assuming they've done the heavy lifting for now in investing in plant.