Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

RFT have broken a three month announcement drought with their H1 report for FY2025 this afternoon, albeit after the market had already closed on the very last day they were entitled to lodge it:

28/02/2025 4:10 pm AEDT: Half Yearly Report and Accounts.PDF

The headline numbers seem good, and the NTA of 1.231 cps makes their 0.6 cps ($0.006 cents/share) share price look interesting in terms of a value play, but because of their lack of governance concerns, combined with the current management's recent track record of not caring one bit about ordinary retail shareholders getting screwed, this one is right up there with the worst of them, so I wouldn't go near them with a barge pole of any length.

From the Financial Review about Tritium. Apparently was close to break even in 6 months before the collapse into VA but mostly blamed on the SPAC listing.

Posting late since there is a 3 day hold on AFR articles in the Factiva account

SPAC listing blamed for Tritium fail

Tess Bennett 30 April 2024

Copyright 2024. Fairfax Media Management Pty Limited.

The receivers selling the shell of failed electric vehicle charging company Tritium have blamed its $2 billion listing via the controversial SPAC method for its demise.

The Brisbane-based company, which had been a darling of politicians and big-name investors including sometime coal investor Trevor St Baker, went public when it was acquired by a shell entity in 2022.

As restructuring experts trying to sell Tritium scour reasons for its demise, documents lodged with the corporate regulator show its leaders were preparing for its potential collapse five months before it went under.

Executives and directors from Tritium held 21 teleconferences with restructuring experts from KPMG between November 22 and April 18, when the Brisbane-based company was finally placed into administration.

The SPAC merger tied Tritium to a complicated and expensive capital structure without providing access to capital the company needed to survive, McGrathNicol partner Shaun Fraser told The Australian Financial Review.

"There was no financial benefit for Tritium through the SPAC merger and once it was listed on the Nasdaq the market judged it pretty harshly for a whole range of reasons," Mr Fraser said.

The US listing made the company more expensive to operate while inefficiencies in its production and manufacturing operations also strained its balance sheet.

"The combination of all of those things meant Tritium burnt through the capital it did have quicker than it was able to manage ... It was finding it increasingly difficult to fund the business," Mr Fraser said.

"The shame is it was probably only six to 12 months away from being cash flow break even, but they just needed more money to get there."

McGrathNicol is the receiver of Tritium, while KPMG is administrator. Mr Fraser said he had received significant inquiries, including from big companies that operate in the sector, and from parties interested in participating in an expedited sale process.

US credit funds, which have provided the company with money on a distressed basis since Christmas, have lent cash to pay wages and keep the business running throughout the sale process.

Documents lodged with the Australian Securities and Investments Commission show Tritium chairman Robert Tichio, chief executive Jane Hunter, Chris Hay of St Baker Energy Innovation Fund and others first met with KPMG on November 22.

The initial call came two weeks after the company announced it would close its Brisbane factory before Christmas, in a last-ditch effort to save itself.

The talks with administrators came after requests for a bailout from the Queensland government, the Clean Energy Finance Corporation and the nascent National Reconstruction Fund were rebuffed.

Taiwanese electronics giant Lite-On Technology also considered buying a stake in the embattled charger company, visiting Brisbane in late November to conduct due diligence. The investment did not happen.

With today's announcement, Rectifier has finally requested its shares be reinstated to the ASX.

The announcement was also used to finally express the opposing argument on the recent "Shit Show".

I placed my trust in a company of clevers so keen,

Their promise, it sparkled, like a financial dream.

But now I am bound to shares I can't sell,

In a venture where good luck did not really dwell!

Pretty normal day really, not much to report...

Firstly, great to meet you @BullsWool, luckily we were there with boots on the ground otherwise we would be flying completely blind.

Bear in mind all of this comes from a conversation with Nick Yeoh after the meeting, the actual formal meeting was a shitshow. The company secretary (I think a rep from the registry) had to chair the meeting, he fumbled his way through the resolutions that remained and closed the meeting once votes were cast. No business presentations or questions.

Afterwards, Nick said that earlier this week while checking the incoming votes they noticed a large voting bloc against the resolutions to re-elect Tino and appoint Nick and Jitto to the board. I suspect @Bushmanpat's rough calculations are correct with the shareholdings. It became quite clear what was happening, but no one knew why the Chair and his affiliated votes would drastically and suddenly revolt against fellow board members.

Nick hypothesised that the succession plan that was in place to have Jitto replace Ying Ming sometime next year was potentially the issue, but that is not confirmed. If so, why also vote against Tino and Nick?

The remaining board members met this morning and decided to resign. I don't think that was a good decision, from a corporate point of view I think it would have been better to accept the vote and deal with issues later on, but regardless that was what was decided.

That was really all Nick could share on the board situation. I don't believe anyone had communication with Ying Ming (who was at the meeting, I am not sure if that was a surprise or not) to find out what his intentions were.

Nick gave us an informal operational update. Other employees were there (as dumbfounded as everyone else) to chime in with any comments. Nick said they would "support" Tritium through their restructure, I took that to mean still supplying them but probably on a short rope. The new defence product will soon be released and would have been a focus of the business update plus an update on the megawatt charging with a new 200kw rectifier in early development.

A couple of other points to potentially clear things up:

The directors who resigned from the board have not resigned from the company. They are all still in their operational roles, but don't support the actions of the Chair (labelled hostile in the ASX announcement).

I don't believe Yanbin Wang the CEO is associated with Ying Ming Wang the Chair and these actions. They may have been in the past given Yanbin was appointed shortly after Ying Ming became Chair, but Yanbin remained after the meeting with the other board members and executive staff and has since resigned.

Given the board now doesn't comply with the Corp Act with everyone stepped down except for Ying Ming Wang, this is a probably a nuclear option but it forces a speedy resolution to what could be a long drawn out board spat. Hopefully Ying Ming Wang accepts his move has backfired and steps down from the board.

On top of that, the weather in Melbourne was shit. Got rained on walking to the meeting.

From the announcement:

"Rectifier Technologies Ltd (‘Company’) requests an immediate trading halt pending an announcement regard to the appointment of an additional Australian resident Director."

Curious why this requires a trading halt.

Notice AGM and Agenda >>>2924-02734025-3A629788 (markitdigital.com)

AGM in Melbourne:

See what the board says..

Turning Power Electronic Problems into results....

28/11/2023 share price goes up 14.7%

Return (inc div) 1yr: -7.14% 3yr: 0.00% pa 5yr: 2.08% pa

Rectifier Technologies took a severe hit to the share price today, down 8.3% to 3.3cps in this morning’s trade, a 12 month low.

There’s been no news from RFT, which could be the problem, however it is more likely to be feeling Tritium’s liquidity pain and the sell off may be in response to the AFR article today titled “Tritium asks Queensland Government for up to $90 million Bailout.” I believe RFT relies on Tritium for about half its revenues (stand to be corrected). If Tritium were to fail this would have an immediate impact on RFTs profitability.

The AFR article is copied below:

Embattled Brisbane fast-charging company Tritium has asked the Queensland government for an equity injection of up to $90 million as it tries to deal with its dire liquidity issues.

While the company has warned it may be forced to close its Australian factory and move its headquarters overseas to ensure its financial survival, it is understood the request to the Palaszczuk government is unlikely to be successful.

Tritium chief executive Jane Hunter said she had been in discussions with all tiers of government to try to help the company, which listed on the Nasdaq in the United States in 2021 with a “double unicorn” $2 billion valuation but now has a market capitalisation of $US38 million ($59 million).

“It’s been extremely difficult in Australia to secure sources of capital,” Ms Hunter told The Australian Financial Review.

“To keep sovereign manufacturing capability, Australia will have to put money and legislation into it because just like [funding under America’s Inflation Reduction Act], that’s the only reason people are into factories over there.”

Ms Hunter said the Albanese government’s $3 billion National Reconstruction Fund that will start next year will be too late for Tritium, which has been issued a show-cause notice about its underperformance on the American bourse.

“We’ve had discussions with all levels of government. Unfortunately, the National Reconstruction Fund won’t be ready for us to access it. It will be too late for us,” she said.

“I think there’s a possibility that the CEFC [Clean Energy Finance Corporation] could come in, but we have to have a foundation investor and they have to be Australian.”

ENDS

Disc: Held IRL (0.8%) SM (3.7%)

Rectifier Technologies (RFT) is one of my smaller speculative holdings (IRL), however I’ve been accumulating it at a steady pace this week both IRL and on Strawman.

Here we have a profitable $55 million microcap with EV tailwinds, that in FY23 paid a fully franked dividend of 2.3% (gross 3.3%) while reinvesting 90% of its earnings back into growth. And at least for now, there appears to be significant growth opportunities.

RFT has a history of extremely lumpy earnings as you can see below:

Source: Commsec

FY23 has been an exceptional year for RFT with NPAT of $6.46million and a ROE of 40%.

@Winiworked out in his Quck Maths straw that it is conceivable for FY24 NPAT to be in the vacinity of $5.25 million. This would be down on FY23, but still a solid result! if achieved, this will make today’s share price look extremely cheap.

This would put ROE at c. 32%. If RFT could sustain growth and a ROE of 30%, at the current share price of 3.7 cps the business should return investors 16% per year including the fully franked dividends. If the multiple were to expand from the current 8.5x FY23 earnings, investor returns could be significantly higher than this. This is highly likely if growth is sustained.

It will be some time before we know whether growth can be sustained, however I don’t think this will be a binary outcome. With RFTs technology having superior efficacy to its competitors and less waste heat generated from its units, there should be significant tailwinds for RFT in this thematic. I believe the future is asymmetric in RFT’s favour.

With the current share price under 4 cps (and continuing to weaken), I believe this is a unique opportunity to build a speculative position in a business operating in a forward facing thematic with an asymmetric probabilty for further growth.

Disc: Held SM, accumulating IRL under 4 cps.

2 plus 2 is 4, minus 1 that's 3, quick maths.

The normally tight-lipped RFT management provided some granular detail I didn't expect to receive in the recent annual report by breaking out how much of the contracts received from Tritium and i-charging had been delivered and what was remaining. 75% of Tritium's $20m USD order has been completed, and 37% of i-charging's $22m order has as well. That leaves ~$19m USD to deliver with management stating they were on track to complete by the end of 1H24.

Which gives us a nice platform to work off what the 1H result may look like. At a 65c exchange rate that gives us ~$29m AUD from those two contracts. I expect the remaining business to contribute it's usual $3m plus in FY23 there was $4m in non-Tritium/i-charging EV revenue which I am not sure how to account for looking forward but let's assume that is $1m in the current half.

Tally that all up and it comes to ~$33m revenue in 1H24, compared to $19m last year. EBITDA margins fell half on half last year from 25% to 23% as RFT takes a slight margin haircut on the large volume orders, so let's apply the 23% margin to get $7.5m EBITDA. I see no reason why ITDA would change much from it's ~$500k a half leaving $7m profit before tax. Apply a 25% tax rate and you get $5.25m NPAT for 1H24.

At a current market cap of $65m, $5m+ earnings in the first half would leave the business trading exceptionally cheaply especially given the growth. Of course, the big question is what does the 2H look like as those big contracts roll off. When he presented to Strawman, Exec Director Nick Yeoh noted that once their rectifiers are integrated into a customers product the decision to shift away isn't taken lightly. Given i-charging's Blueberry chargers are so new to market I can't see them shifting away and would expect some commentary on a further commercial relationship with them. Tritium is harder to peg given it's never been disclosed exactly what products RFT's rectifiers are in and there is a chance newer products have been designed without them.

I plan on getting down to the AGM in November and seeing if I can get some light shed on the big question of what does 2H24 and onward look like. Commentary from the annual report was positive, but no doubt the market would like the certainty of renewed contracts or supply agreements.

This was a good meeting, hearing from a board member, long time employee and major shareholder. However, to be honest, I came away with mixed feelings. I need to watch the recording again and do some analysis.

I have little doubt that this firm will be well-managed as a sustainable, profitable business.

My concern is that it might not be well positioned for the massive industry tailwinds that are building up. In the words of Nicholas himself, there is a risk that "we get left behind".

On the one hand, they have matured the RT22 platform relatively recently, and it is well-positioned as a key component in the fast-charging segment.

On the other hand, Nicholas could not clearly articulate who their target customers are, nor their plans to monetise this platform in the next crucial phase of industry development.

I think that in order to understand this company properly and to understand its prospects, we have to understand the competition. I believe (or suspect) that there are a lot of estalished power systems players in the EV charger sector, alreeady making $100s of millions or $bn in annual sales. It is already a major market, and its growing very quickly. As well as the industry leaders, there are doubtless countless component suppliers, who are well-funded given the overall positive vibe for the industry.

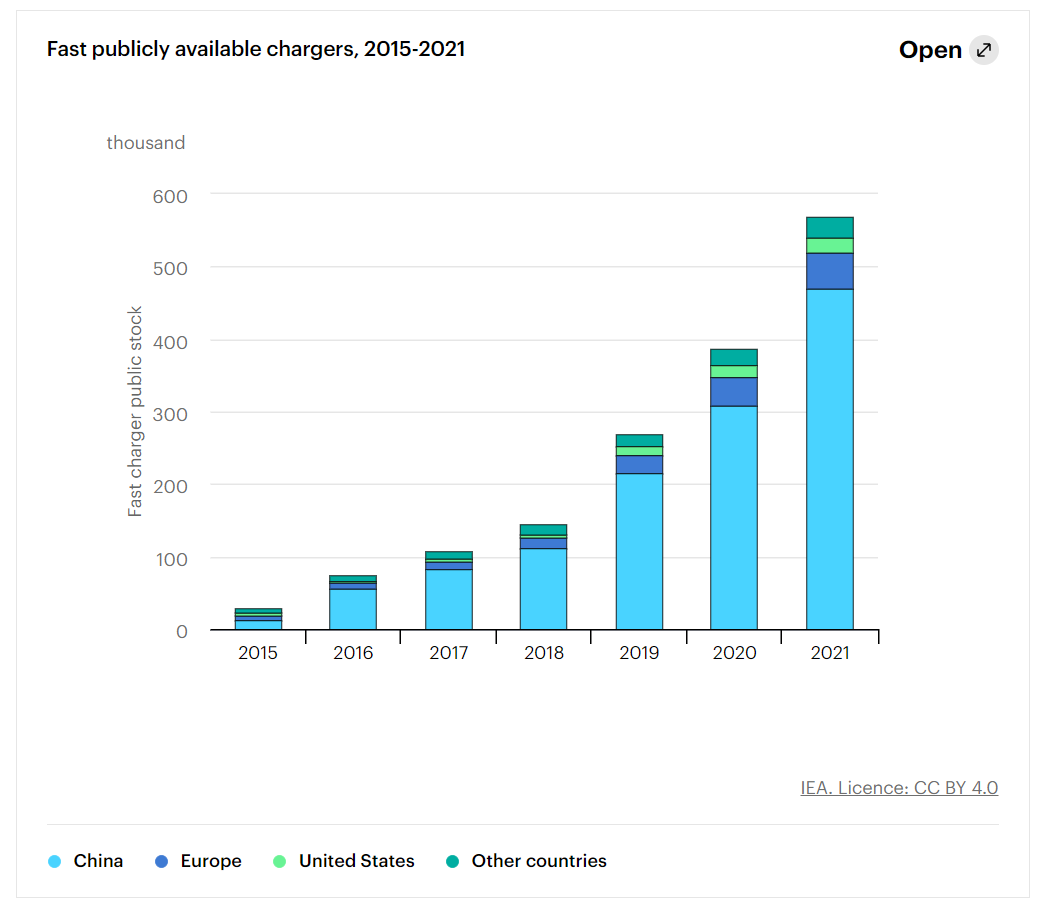

According to the IEA, over 0.5m fast chargers were installed in 2021 - mostly in China. And its growing rapidly. Fast charger networks are being cited by the EU recently as a constraint to achieving EU EV uptake goals. I've seem similar stories in the US, who are much further behind (although not as far behind as Australia!).

With IRA and equivalent legislation in the EU, both are going to be catching up hard in the next few years.

My point it, the explosive growth is happening now, the big players are already there and RFT is talking about going to conferences and discussing standards, and being available to all customers, and questioning whether they might build US capacity to be in the game for IRA deals. It seems to lack conviction, clarity and substance.

I hold a position in RFT as a speculative stock. But I am not convinced.

Source: AFR

@Rick you post has reminded me of an AFR article i read last week around China's rapidly growing ev market. I'm a bull on RFT and chargers but found this swapping concept interesting and one to keep in mind. Not something I'd imagined, but seems obvious in hindsight. Say all batteries were charged this way you'd have much higher utilisation of each charger and in theory need less of them (although still a lot more than we have today)!

Don't have the link but excerpt below.....

The existential threat to Saudi Arabia and the OPEC cartel comes from China, not from net zero or from green deals in theWest. Chinese sales of petrol and diesel cars fell 20 per cent in absolute volume terms in February from a year earlier. Sales of plug-in electric vehicles (EVs) kept rising explosively and reached a record 32 per cent of the market for standard passenger cars. At the current pace, EV sales in China will hit 8 million this year, helped by the proliferation of battery-swapping stations. Rather than charging your own car, you do an instant swap. No need to wait. No need for chargepoints everywhere.

The introduction of Australia’s first emission standard will help to accelerate the uptake of electric vehicles in Australia. More electric vehicles will require more charging stations and Rectifier Technologies is likely to be a beneficiary of the new policy. Subscribers can find the full story in the AFR. I’ve copied part of the story below.

Disc: Held IRL (0.5%)

Labor launches Australia’s first emissions standard to boost EV supply

Jacob Greber, AFR

“Carmakers will be penalised for importing internal combustion engines under a federal plan to drive greater supply of electric vehicles into the Australian market and cut at least 3 million tonnes of carbon by 2030.

Labor on Wednesday morning announced what it described as Australia’s first national electric vehicle strategy to widen the range of electric vehicles available to consumers and encourage greater use of low-emissions models.

“Transport is the third-largest source of emissions in Australia,” the government said in a statement.

“This Strategy will help cut our emissions by at least 3 million tonnes of carbon by 2030, and over 10 million tonnes to 2035.”

The announcement foreshadows the biggest shakeup in Australia’s car market in decades, and will raise concerns motorists will be forced to pay more for some of the biggest selling, but higher emitting, vehicles currently available.

It would also align Australia with the world’s biggest car markets, including Europe, and comes just days after the US Environmental Protection Agency announced pollution limits that would mean EVs account for up to two-thirds of passenger vehicle sales by 2032.

Labor insisted on Wednesday that the strategy would ultimately pave the way for Australians to buy more efficient, low emissions vehicles.

By introducing a fuel efficiency standard, carmakers will need to ensure the average emissions of all the cars they sell in a given period fall below a certain threshold. That would force manufacturers to prioritise sales of EVs and potentially drive up the cost of high-emissions models that dominate the current sales charts.”

I was a little late to this party. I thought I should RECTIFY that, but when I arrived I found @Wini, @shivrak, @Noddy74 , @mikebrisy and a heap of other Straw folk all Fully CHARGED! The Liquid was running low, down to a trickle, and I only managed to pick up a few loose electrons today before the leakage stopped altogether! :)

Seriously, great work to @Wini and other Strawfolk who had the foresight to get in on Rectifier Technologies so early. I hope you are all doing very nicely.

Since reading Wini’s latest straw and valuation, I have taken a closer look at RFT, and I totally support Wini’s valuation of 10 cps.

I also agree that sales and profits should be sustainable following on from the Tritium contract.

I watched the YouTube video @mikebrisy shared about the RT22 50KW EV Charger Module. It would appear that this is ‘state of the art’ technology in an industry with tremendous tailwinds. Looking at the forecasts, we are on the cusp of a five fold increase in EV charging demand over the next 8 years, with growth compounding at 28% per year (Statista.com). I think RFT has a good foot hold in this market.

See the chart below.

“An electric vehicle charging market forecast by Next Move Strategy Consulting projected the market to reach around 128.13 billion U.S. dollars in 2030. EV charging was worth around 14.5 billion U.S. dollars in 2021, and is expected to have a compound annual growth rate of 28.21 percent between 2022 and 2030”

I have added the probable FY23 results to the Commsec chart below to get some perspective on what this looks like in comparison to historical data. I am particularly excited about the return on equity (ROE). Based on the lower end of Wini’s FY23 NPAT expectations of $7 million, the ROE is likely to be upwards of 53% ($7 million NPAT / $13.3 million equity).

Source: modified from Commsec data

I don’t know if RFT can sustain a ROE of 53%, but if they can you could pay 5 cps and expect a 24% annual return with all profits reinvested into growth (McNivens formula). If you paid Wini’s valuation of 10 cps you could still expect a 16% annual return. However, this all depends on whether RFT can continue to win contacts, grow sales, maintain current margins, and reinvest 100% of their earnings back into the business at a 53% ROE. I don’t think I will be chasing RFT up to 10 cps, but I’ll certainly be on the look out for any loose electrons! :)

Disc: Added IRL today

1H23 NPAT of $3.7m. RFT is a manufacturer scaling quickly so I don't expect profit results to be smooth, but getting a glimpse of 20% net margins in this result highlights the potential quality of the business.

$7-8m NPAT is now achievable for FY23 with a strong pipeline underpinning further revenue growth, 10c would be roughly 20x earnings.

27/2/23 Half Yearly Report and Accounts

A fantastic result from RFT, revenue of $19.3m was not only a record for a half year but eclipsed any full year in the company's history. Margins held up better than I expected as well with NPAT of $3.8m leaving the business well placed to smash my $4-5m target going into FY23.

While all segments improved, it was the supply of rectifiers for electric vehicle chargers than drove the result. Revenue in the EV segment grew from $4.5m to $15.7m and EBITDA margin improved from 9.6% to 29.5%.

The big question from this result is whether it is sustainable. As I have outlined before the near future is underpinned by some large EV contracts with Tritium and i-charging for $20m and $22m USD respectively. It is hard to gauge exactly how much of this result came from those contracts (and how much remains in the pipeline) but considering the i-charging contract was only signed in mid-November and in late September RFT updated the market with delays to the Tritium contract with only "part" of the order fulfilled I would think they have yet to contribute meaningfully. Even if the full $15.7m from the EV segment came from those contracts, it would still leave $47m in the pipeline to sustain strong profit results like this for the near future.

No doubt moving forward profit results will be lumpy, there is a lot of operating leverage in the business but I think the pipeline is strong enough to sustain growth moving forward.

Read recent straws by @Noddy74 @shivrak and @Wini for the details leading to my decision today to establish a small position in $RFT. (0.3% RL and 1.5% SM).

With a healthy contract backlog and profitable operations combined with easing supply chain, @Wini called it that FY23 and FY24 could be the breakout for RFT. Today gave support to that heads up.

I've had them on my watch list for 3 years and, although I prefer not to buy on "good news" when the market gets excited, today I dipped my toe in the water. No doubt, there will be plenty of opportunity to add more at cheaper prices, and I would like to get up to my usual position size for a speculative stock of 1.0%.

Just back of envelop, if H2 looks like H1, then the p/e would be about 9. And it generated cash this half! Of course, that is no way to think about this company, as it positions itself to provide "picks and shovels" into the global EV market. There are many competitors for this huge market, but $RFT are in the game with deep capabilities. It has all the credentials for a speculative position in the portfolio.

$RFT has been around for 30 years, and they have deep expertise in power systems engineering. For those intrested in going deeper on the technicals and also seeing and hearing about the RT22 50KW EV Charger Module, have a look at this video.

The whole video is interesting for those with an appetite for getting into some of the electrical engineering details of EV and Battery technology. The R22 bit starts at around 57: 30.

Disc: Held

The half yearly report came out after close and it's a monster. Revenue was up 194% to $19.3m. Profit after Tax up 834% to $3.9m. Free cash flow of 'only' $3.1m as inventory is up - but overall this is the break out result investors have long waited for.

We probably shouldn't have been surprised given the orders the company had previously announced but the lack of shareholder engagement and supply chain delays had meant many weren't going to believe it until they actually saw it. Now that it has come - and given there's still so much of just the existing orders to fulfil - it's going to be very interesting to see what the market thinks of it tomorrow.

For me this is the standout result of an admittedly disappointing reporting season.

@Wini is likely to be sitting back with a brandy in one hand and a pipe in the other tonight!

[Held]

25/11/22 AGM Presentation

Some fantastic details in the RFT AGM presentation from a management team normally light on them. The company now has a tremendous backlog of work to fulfill after winning another $20m+ USD contract from i-Charging, but after delays with servicing the existing Tritium contract the market is wary on the short term outlook.

Management conceded chip supply chain issues remain, but are doing what they can to substitute components and hired a dedicated supply chain manager. However the most important piece of news is how quickly they are ramping up production at their existing facilities. There is 140 current staff members in the manufacturing arm, with plans to grow to 180 by the end of this year and 205 by mid-2023. With no anticipated production capacity constraints it could lead to a very strong FY23.

There was also some great insight into future developments. Megawatt charging is a focus as member of the CharIN industry group. At scale the technology would be a gamechanger delivering 3000kW of power compared to current high powered chargers maxing out at 350kW. Management also committed to V2G technology but conceded it was still too early for commercialisation so the Highbury remains on ice for now. Finally the RT21 was announced with minimal details other than focusing on the defence industry and looking to commercialise next year.

RFT has been a much maligned stock after a few false starts (with the stock price more so than the business) but if they can get a clear runway on the supply chain issues which have hurt them since Covid FY23 could shape up to be a company making year.

Annual Report - Confirms my belief that RFT will have a strong future in our electrification transition

Highlights

- Diversity of EV orders, Driven by RT22 module. Interestingly they are going for further certifications on units ?

- V2G not forgotten about...

- RT21 Commercialization 2023/24

- Megawatt charging system development

- Generally company looking much more transparent than previous reports

- Segment revenue shown

- R&D spend increasing

- Balance sheet stable

Rectifier Technologies Hiring - Great news, especially as there have not been any significant releases lately...

RFT was up 9% today with no official news from the company. The pop appears to relate to Tritium (listed on the NASDAQ) announcing a contract with BP to supply 1000 EV fast chargers across Australia and New Zealand. The market is assuming that RFT, which is a supplier to Tritium, will benefit from this arrangement.

Trading halt - Tritium related ??

Another Contract Extension with Tritium - Encouraging news, Tritium has now listed on the Nasdaq and are expected to announce a USA factory shortly...

I still only see upside in the company with minimal downside .....

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02478804-3A585892?access_token=83ff96335c2d45a094df02a206a39ff4

I used the recent, abrupt spike in the share price to sell my small position. There is still a lack of transparency with regard to the company's strategy, even though they are a good leveraged play on the EV thematic. The recent spike beyond 7c made for a full valuation too.

The Federal Government's announcement for a "Future Fuels" package seems to have lit a fire under the Rectifier Technologies share price (ASX:RFT) -- up 47% at time of writing.

It's a paltry investment from the feds -- about 2.5% of the fossil fuels subsidies paid out last year -- and I'll try to avoid opining on this Government's green credentials (or lack thereof), but it does seem to bode well for a company like Rectifier. It will see approximately 1000 public sites, 400 businesses and 50,000 households fitted with fast chargers under the scheme.

Well done to shareholders, and looks like wini's valuation is well within striking distance!

V2G Podcast - "Trailblazers with Walter Isaacson - 16.The electric grid: keeping the lights on"

Really enlightening podcast on the changing electric grid, touch's on V2G opportunity.

RFT:ASX provides listed Australian opportunity to this market, Im very interested to understand when the RFT solution comes to market

VW to enables bi directional charging on all EV's on MEB platform starting next year

26-Feb-2021 (after market close): Rectifier Technologies Half Yearly Report and Accounts

Not good.

- Revenue down -37.45%

- Profit down -55.26%

- No interim dividend

- NTA down -8.32% from 0.661 cps to 0.606 cps

- Share Price so far steady this morning at 4.0 cps.

One positive is that their gross margin improved from 48% to 54%, however that did not translate into a higher NPAT margin because their NPAT for the 6 months was $593K, being 8.8% of revenue vs $1.326M in the pcp (6 months ending 31-Dec-2019), being 12.3% of revenue, so their NPAT margin has declined by -28.5%, from 12.3% to 8.8% of revenue. That's still a reasonable profit margin, but they do look overpriced when their was no growth in the half, material declines in revenue, profits and NTA, no dividend, and their share price is 6.6 x their NTA.

31-Aug-2020: Rectifier Technologies Announces 0.1c Fully Franked Dividend plus Preliminary Final Report

Recently: 04-Aug-2020: COVID-19 Update

In summary:

- Total revenues decreased by approximately 11.33% to $16.7 million compared to $18.9 million in the previous reporting period.

- The decrease in sales during the year to 30 June 2020 was due to the impact from the COVID-19 pandemic. The Governments in each of our operating jurisdictions have imposed restrictions on movement to protect the safety of the general public, particularly in Malaysia where our factory was shut down in the middle of March, resumed operating with a limited capacity in April, and was fully operating from May onwards.

- The Company reported a profit before tax of $3.1 million compared to a profit of approximate $3.3 million in the previous reporting period - despite the negative global economic impact of COVID-19. The Company was able to report a profit due to support from the Governments in each operating jurisdiction, financial institutions, key stakeholders and our own reserves. The effective plan enables us to mitigate risk exposure.

- The Company expects sales from our legacy market and electric vehicle charging market to continue improving in the 2021 financial year.

--- click on links above for more ---

I've cleaned that up quite a bit - it was clearly written by someone for whom English is not their first language - the original can be read here (first page).

[I don't hold RFT shares. They've been on my Strawman.com scorecard for a trade, but I reckon I might roll that virtual money into something else shortly.]

I think it is very hard for anyone to accurately predict on a macro level how long the current downturn lasts for and the long term effects of it. What we can and should do though is look at individual businesses and assess the impacts to them from the coronavirus, positive or negative.

Unfortunately for RFT it seems as though they will receive the biggest impact from companies in my portfolio, with confirmation that their Malaysian factory was forced to close. The company is trying to seek an exemption to supply products to essential companies (most likely power supply) but are awaiting approval.

The Melbourne (R&D) and Singapore (Sales) offices remain open so hopefully the manufacturing delays can be sorted out in short time and sales quickly picked up.