Based upon a quick review of results and announcements of sales orders, Rectifier (RFT) seems to have two large EV charger customers

i-Charging (Blueberry chargers) - purchasing the RT22 50Kw module with announcement of USD22m PO 16 November to be fulfilled through 2023 … that’s AUD30m give or take. Presumably a meaningful chunk of RFTs $39m FY23 revenue.

• Its pretty hard to find out much more about iCharging as they seem to be privately held and according to Pitchbook were founded 2019 with Early Stage VC money.

Tritium - (the focus of my analysis)

- 28 April 21 - Exclusive arrangement with Tritium to End March 2022

- 25 Jan 22 - Continued arrangement with Tritium to End March 2023

- 9 Feb 22 - $20m USD Purchase order for a 35Kw rectifier (another AUD 30m give or take)

- 28 Sept 22 - Delays in shipping expect PO to be fully fulfilled by End of CY2023

Given the timing here, this could represent at least AUD$15-20m of the RFT revenue recognised in FY23.

These 35Kw rectifiers presumably would have been for the PK350 product line which is a Tritium product for Europe (https://www.tritiumcharging.com/product/pk-350/) and not available for sale in North America. Hence, presumably not going to take advantage of Tritium's big ramp up into NEVI manufacturing with its new Lebanon Tennessee factory. I suspect the big 20m purchase order announced in Feb 22 could have been associated with this product line.

*** Tritium seems to have moved on beyond a 35Kw rectifier to a 50Kw module as they are rationalising their manufacturing to the new modular line ***

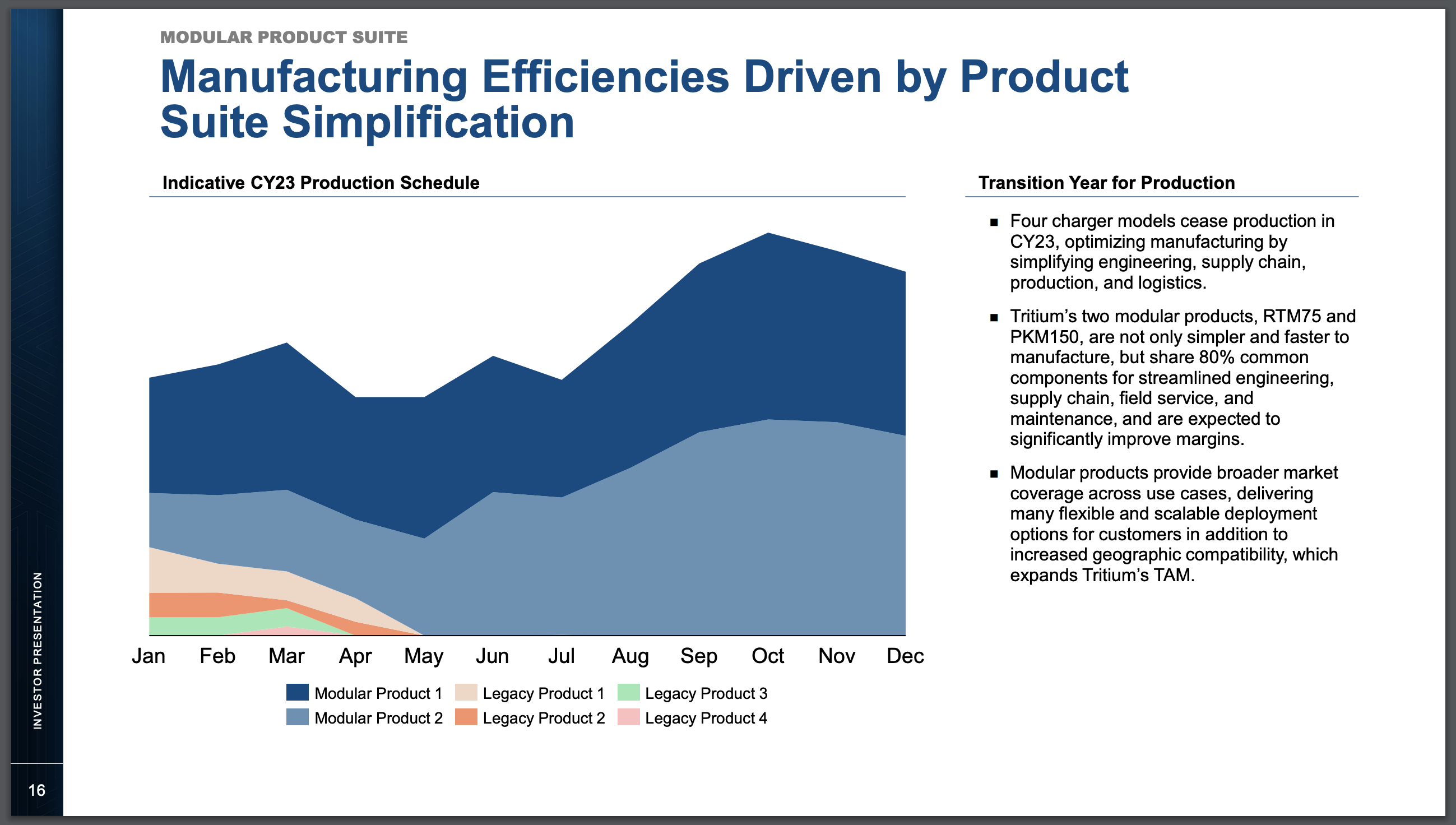

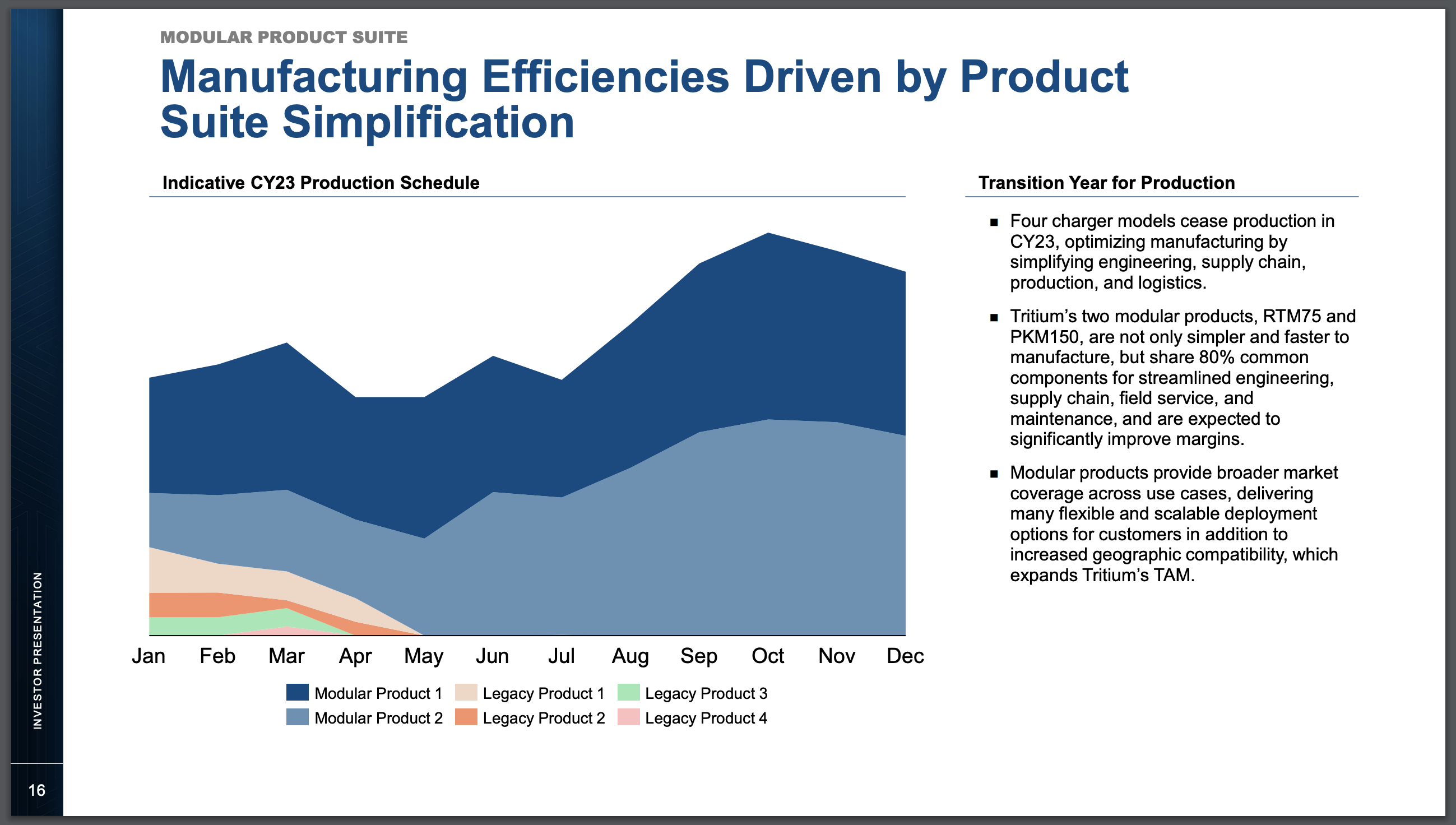

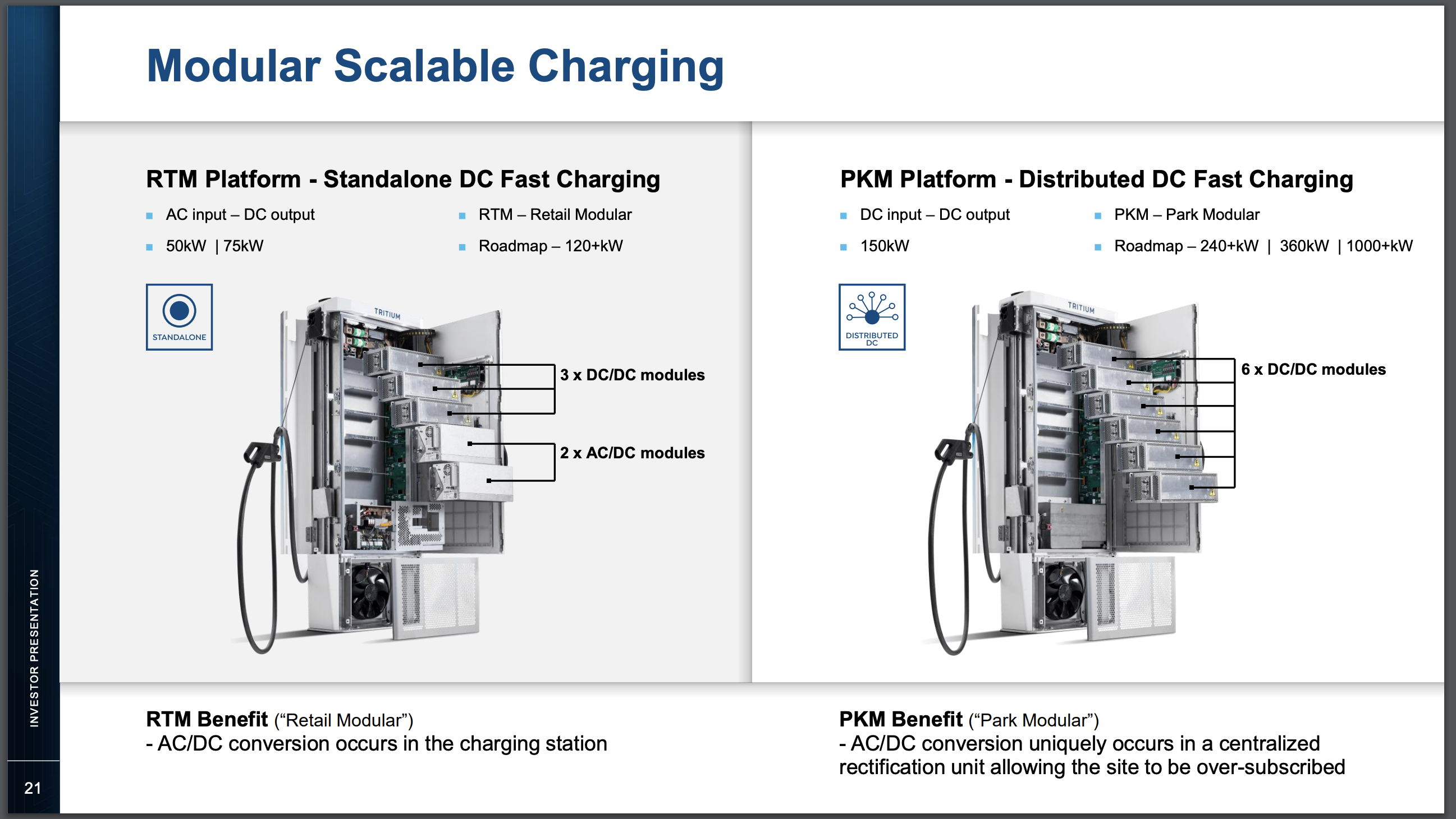

Tritium rationalising its Product Suite into two modular products RTM75 and PKM150 - January 2023 Investor presentation https://investors.tritiumcharging.com/static-files/c360767c-4c45-442d-bc81-a479179ba7e1

This could signal a sweet spot for the Rectifier RT22 50Kw module.

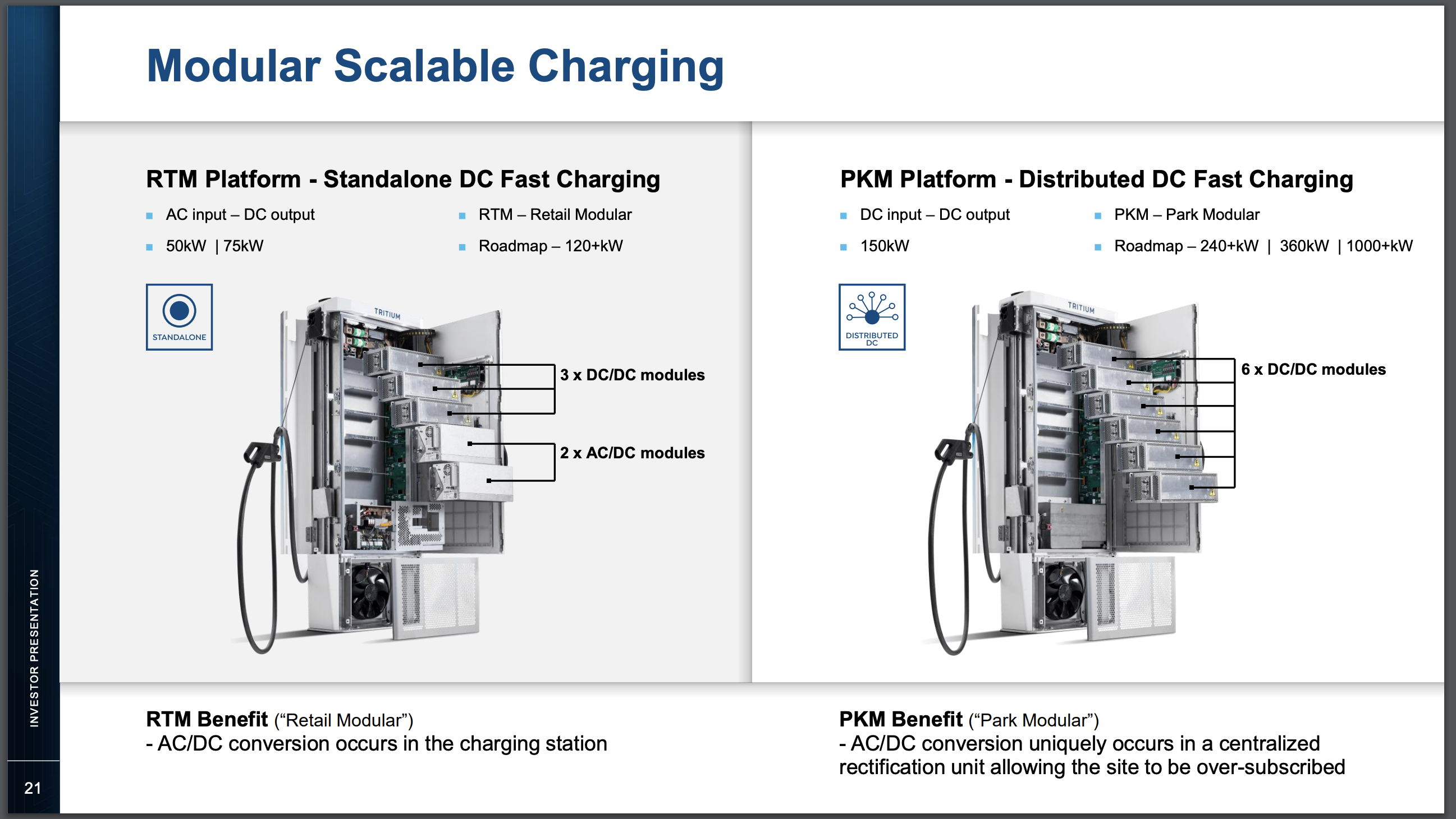

The RTM platform (stand alone chargers with 50Kw/75Kw) has two slots for rectifier modules which could indicate 1 x Rectifier RT22 50Kw module or some combo of smaller rectifier modules (but that would seem to defeat the purpose of standardising on a reduced set of component parts)

According to spec sheet the. PKM150 (charger cluster) has got 100/150 KW per charger with a standalone rectifier with up to 300Kw total (i.e. 6 x 50Kw Rectifier RT22's if that's what they are using). The PKM is for a cluster of chargers all running off a single rectifier cabinet.

There is also a NEVI version of the PKM150 https://tritiumcharging.com/wp-content/uploads/2023/06/23-202-NEVI-brochure-v3.pdf being marketed for the US which just seems to be a bundle of 4 x chargers + 2 x rectifier units with 12 x 50Kw Rectifer modules. I'm guessing this is what Tritium is going to be manufacturing in its new American factory (no point tooling up the new factory to manufacture the legacy product lines)

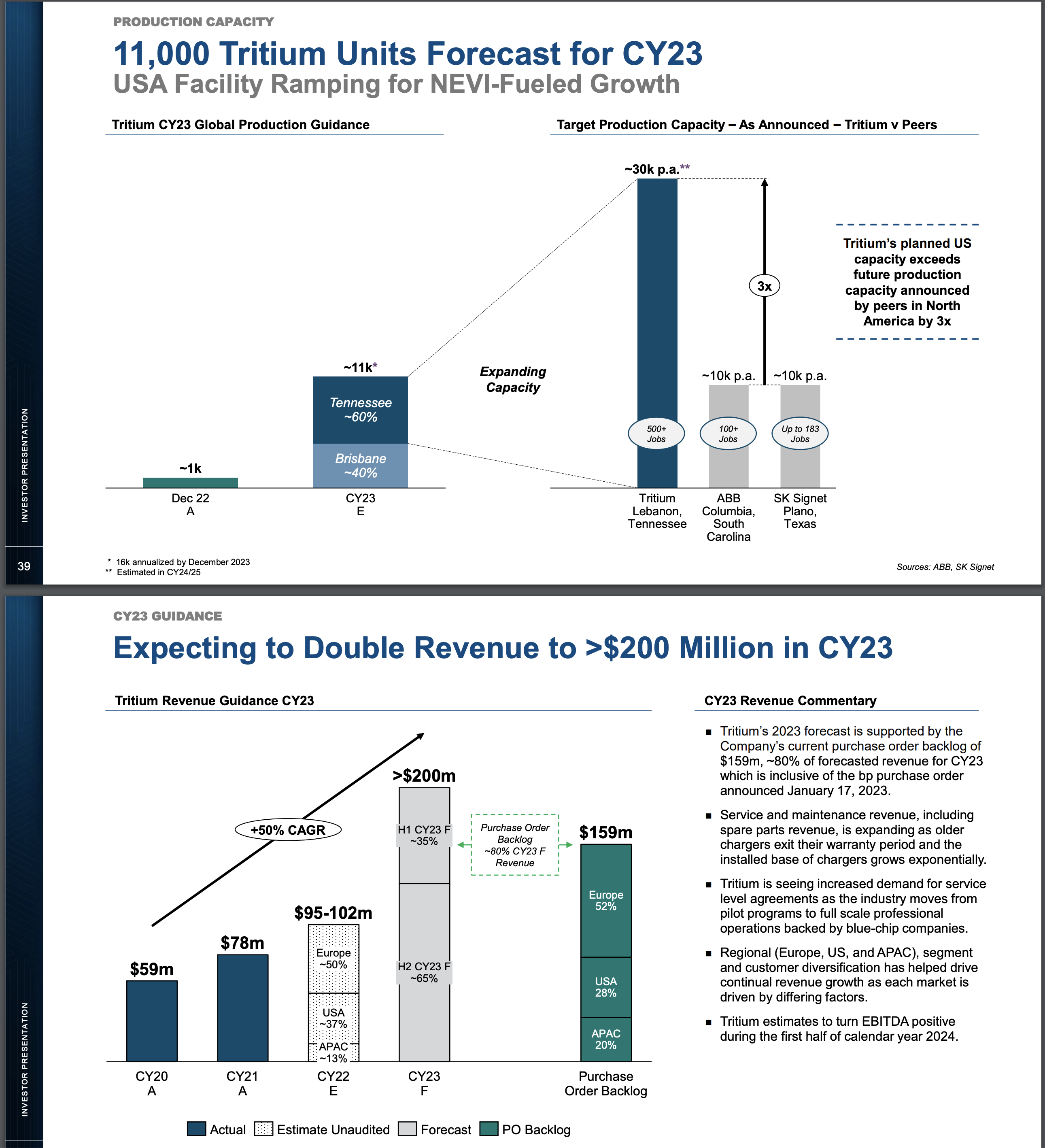

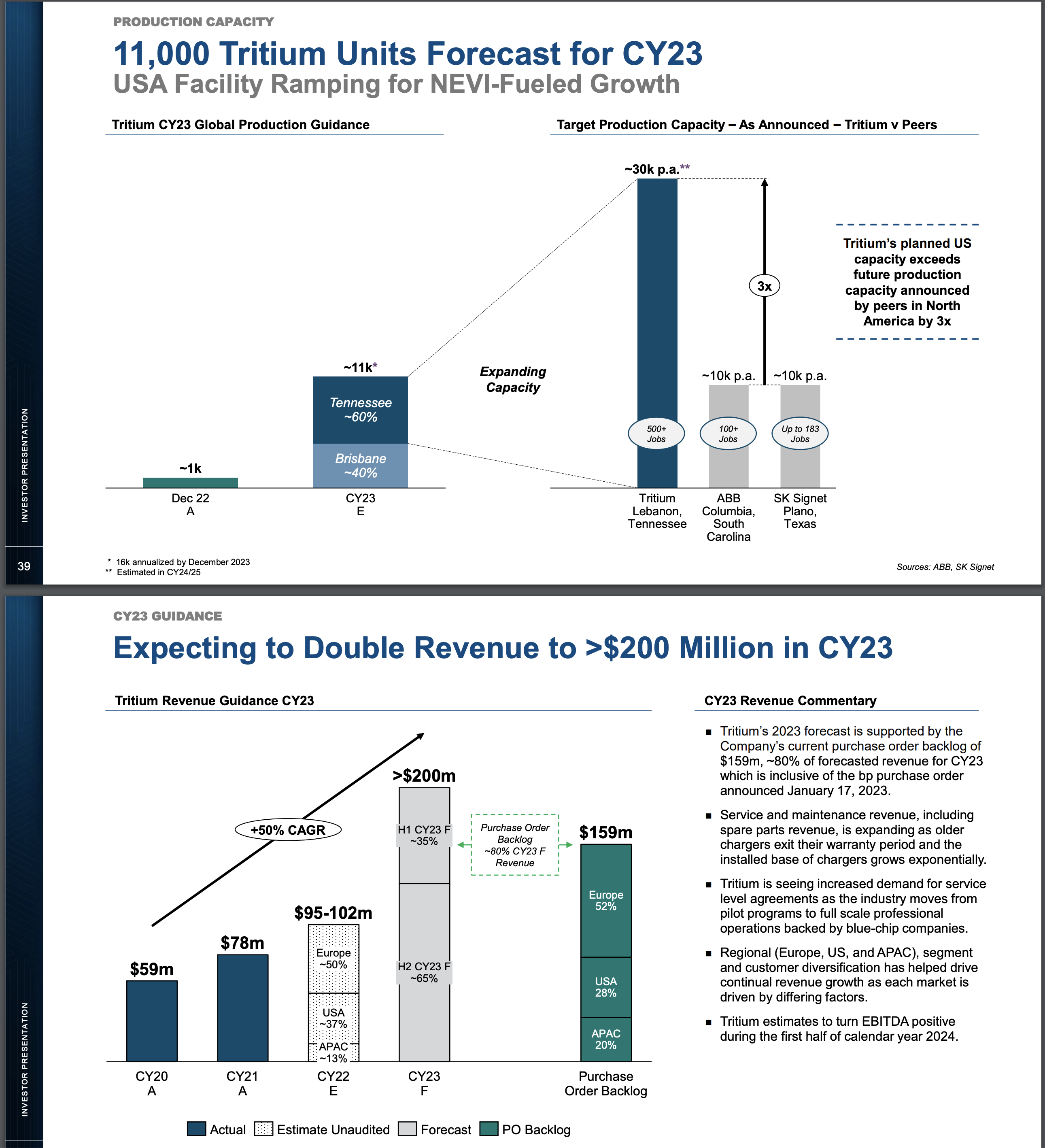

According to Tritium's February 2023 Investor presentation https://investors.tritiumcharging.com/static-files/c360767c-4c45-442d-bc81-a479179ba7e1, they are gearing up for 11,000 total units for CY23 with the new factory in Tennessee eventually of scaling to 30,000 units per year in addition to the 5000 unit capacity they have in Brisbane.

However, Here is my concern

Are the Rectifier RT22's what Tritium is using moving forward?

- If they are, then I can see a rosy future for RFT. Tritium's plans for ramp up in production should indicate a healthy pipeline for RFT and the build up of RFT's inventory could indicate they are gearing up towards this and I think can justify the RFT growth projections for the next few years (if they are the Tritium supplier).

- If they are NOT. Then I can't see how RFT can match this years revenue let alone deliver growth projections. Conspicuous in its absence are any announcements about renewal of Tritium/RFT arrangements beyond March 2023 and no mentions of any further purchase orders. These arrangements seemed to be preferred supplier arrangements all the way back to 2018 and exclusive supplier arrangements for the last couple of years … NOW CRICKETS.

Can anyone cast light on this?

DISC: Hold DCFC IRL (not on Strawman since its US listed) and seriously considering RFT.