This was a good meeting, hearing from a board member, long time employee and major shareholder. However, to be honest, I came away with mixed feelings. I need to watch the recording again and do some analysis.

I have little doubt that this firm will be well-managed as a sustainable, profitable business.

My concern is that it might not be well positioned for the massive industry tailwinds that are building up. In the words of Nicholas himself, there is a risk that "we get left behind".

On the one hand, they have matured the RT22 platform relatively recently, and it is well-positioned as a key component in the fast-charging segment.

On the other hand, Nicholas could not clearly articulate who their target customers are, nor their plans to monetise this platform in the next crucial phase of industry development.

I think that in order to understand this company properly and to understand its prospects, we have to understand the competition. I believe (or suspect) that there are a lot of estalished power systems players in the EV charger sector, alreeady making $100s of millions or $bn in annual sales. It is already a major market, and its growing very quickly. As well as the industry leaders, there are doubtless countless component suppliers, who are well-funded given the overall positive vibe for the industry.

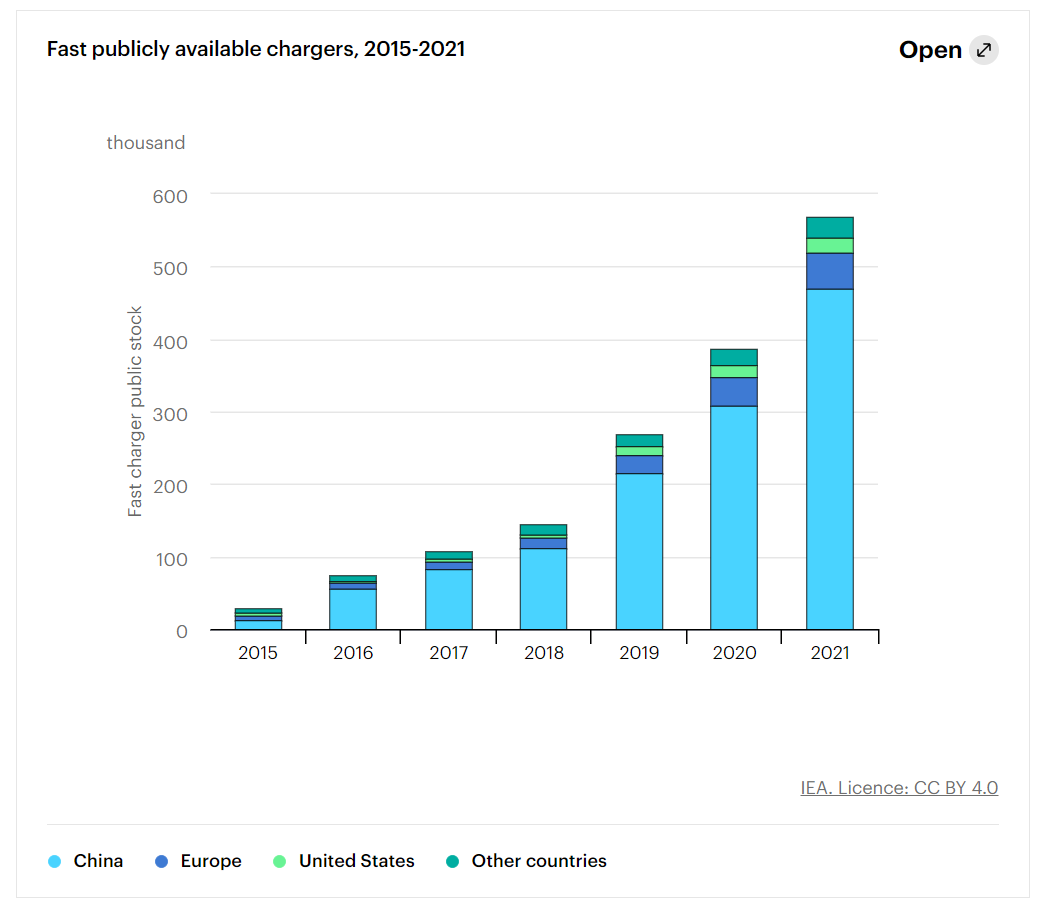

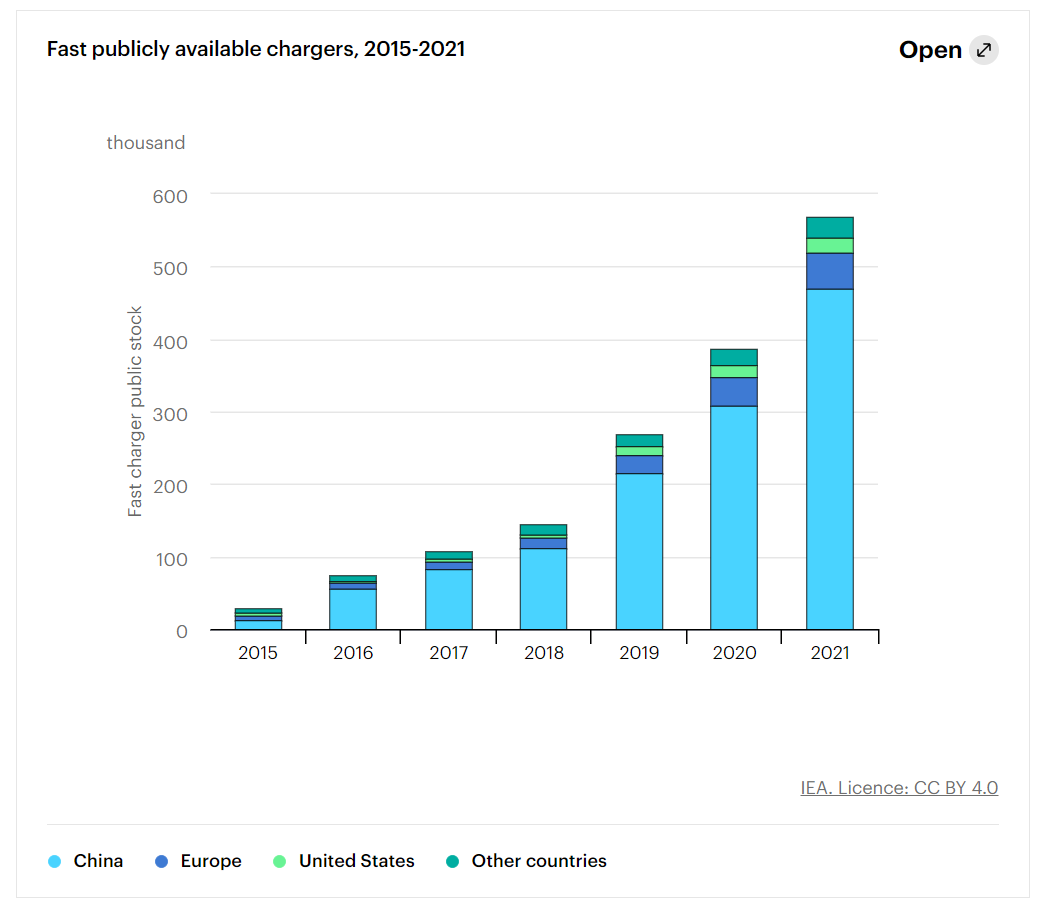

According to the IEA, over 0.5m fast chargers were installed in 2021 - mostly in China. And its growing rapidly. Fast charger networks are being cited by the EU recently as a constraint to achieving EU EV uptake goals. I've seem similar stories in the US, who are much further behind (although not as far behind as Australia!).

With IRA and equivalent legislation in the EU, both are going to be catching up hard in the next few years.

My point it, the explosive growth is happening now, the big players are already there and RFT is talking about going to conferences and discussing standards, and being available to all customers, and questioning whether they might build US capacity to be in the game for IRA deals. It seems to lack conviction, clarity and substance.

I hold a position in RFT as a speculative stock. But I am not convinced.