Pinned straw:

@Rick @mikebrisy and everyone else.

firstly i have zero tolerance for holding stocks as a cash proxy, just dont want to take that risk. SWAN.

on CSL, i got to know mgt quite well when i covered the company for an institution about 10 years ago but first met mcnamee on the ipo roadshow in 1995ish.

the positives, to summarise, the culture is quite considered and conservative, they have achieved best practice in manufacturing and have a disciplined and judicious approach to R&D and capex. i suspect their reliance on moon shots and "hail mary"s is extremely low versus peers, they have had no significant stuff ups, same as MQG, which differentiates them from peers and part justifies their premium.

now the negative which i will concentrate on here. firstly their PE premium is now full. those lucky enough to hold for the rerating, several years ago, of course did well and it is a lesson to look at global peer multiples not domestic to gauge where the PE ends up. however a further rerating is very unlikely, imo, but possibly leads to room for a modest compression in the multiple.

with ratings done it falls to earnings to drive the SP, (dividends not big). i think the impacts of C19 have obviously been under estimated for CSL, firstly the volume drop in collections and then the higher price to be paid for them. given the very long inventory cycles at CSL the uncertainty of when that rectifies has given cause to overly optimistic expectations, in hindsight. maybe the company could have been more active in hosing down expectations, maybe they didnt know themselves, given it was an unusual circumstance.

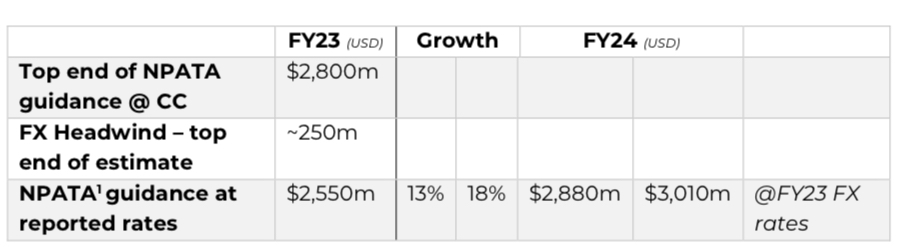

earnings have been impacted by FX and other smaller issues but hardly a thesis breaker. the unexpected and sustained grwoth in the uses of IG has been the driver, imo.

the Vifor acquisiton obviously needs to deliver and it si too early to make that call, imo. the company is right in CSL's wheelhouse where manufacturing expertise and distribution can add value in an "unsexy" part of the industry, where CSl resides. they can be given the benefit of the doubt at this stage, imo.

in summary at 35X earnings need to grow and that has not happened as consistently as one would have wished but most everything that has driven that has been outside mgt control. no own goals.

one other area that sits uncomfortably with me is that CSL is extremely well held. plus there has been a recent large equity raise that adds more stock to already well held positions. almost every serious investor in Australia holds CSL, for retail punters it is rusted on , a "no brainer", that is uncomfortable for me. even in institutional land it is very well held and not only by the grwoth managers who have to hold a lot of it. value guys would hold CSL as a growth proxy given its size in the index, its great record, and as a growth hedge. given the great reputation of CSL, it si a case of nobody gets sacked holding CSL. that sits uncomfortably with me as well. if our best decisions come with a certain amount of discomfort, it is not there with CSL.

what doese this mean for the share price? to me it means there are many holders with more than full allocations or are holding without conviction. that is stock indigestion, when downgrades appear they get flushed out and this takes time to work through. for the long term 3-5 year holders maybe not an issue but for momentum/ST guys it is an issue.

this disequilibrium needs to balance out imo, of course determining the length of this is almost impossible , when it ends it ends. the stock needs to find its way to natural holders whoa re already full is the issue to me. just takes time.

may the IG cycle continue to surprise to the upsidde! thats all i have, could be wrong

disc held (like everyone else)

Like you, @Rick, I use my shares in CSL as my emergency cash fund. Financial advisors often recommend keeping 6-12 months or up to 3 years of living expenses in cash, depending on one’s life stage and risk tolerance. They also suggest keeping this money in cash rather than equities. However, with low interest rates (until recently) and now inflation, this approach doesn’t make much sense to me.

I mentally allocate a third of my CSL holdings as my emergency fund, which I can easily liquidate if needed. Although CSL’s share price hasn’t changed much in the past 3 years, it’s no worse than holding cash long-term and I expect it will return capital growth at some stage.

Source: Marketscreener.com

Source: Marketscreener.com