Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

ASX Sector performance in 2025 year-to-date (Source: Market Index)

An excerpt from a Livewire article this morning. Another down day, hoping the new year brings a change of fortune for tech and healthcare as my portfolio is heavily biased that way

~ $100k purchase from Director Dr. Brian Daniels.

Encouraging to see, apart from the ongoing buy-back, which is all suggestive of the value on offer.

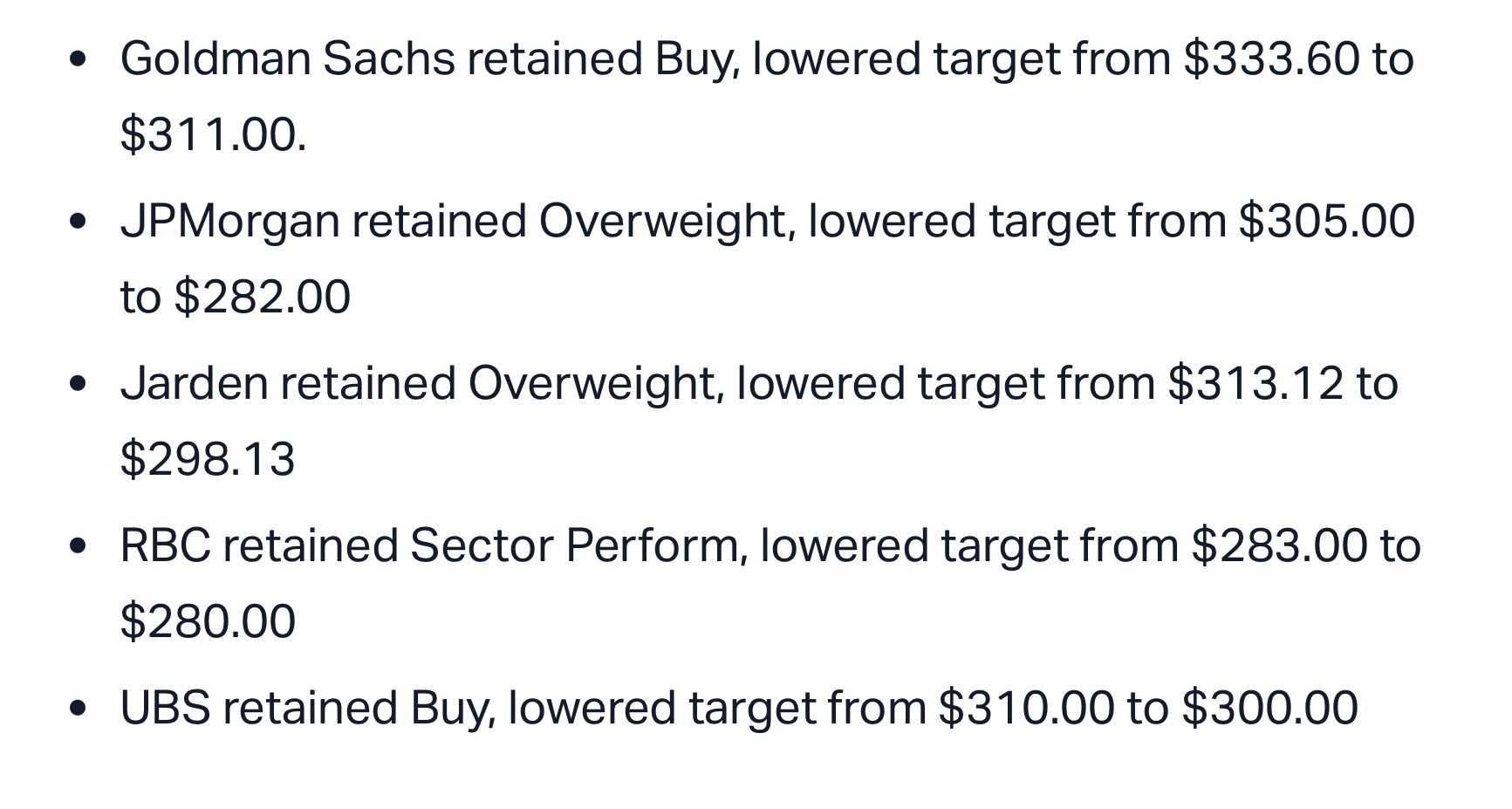

Revised broker targets off the back of the AGM downgrade today -

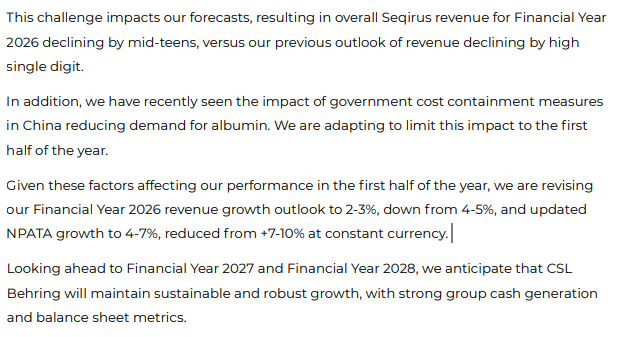

Downgraded earnings for FY26 and future to high single digit from double digit. Postponed Seqirus.

I wondered whether yesterday's announcement from $CSL marked the first sign of the change in R&D Stratgey, following on from the recent shake-up.

Having read @Jimmy's daily newsfeed, it seems I am not the only one: the relevant extract follows, with emphasis added by me.

2248 GMT - CSL's collaboration agreement with closely held VarmX to advance a blood-coagulation treatment signals the start of a new R&D philosophy for the Australian company, according to Jefferies. CSL aims to focus on development by buying assets into its pipeline. VarmX owns the VMX-C001 treatment that aims to restore blood coagulation in patients taking a FXa inhibitor. "We believe this could be an adjunct to CSL's Kcentra franchise, and if successful will compete with Andexxa," analyst David Stanton says. Jefferies estimates annual peak sales for VMX-C001 of some US$240 million. It retains a "buy" call on CSL. ([email protected]; @dwinningWSJ)

Looking back over the last 10-15 years, the lion's share of $CSL's innovation capital has either been organic R&D or buying entire businesses/platforms (think Sequirus and Vifor).

Of course, there are exceptions. For example, Hemegnix is an example of successfully licensed molecule. And there are others.

But on balance, I think it is fair to say that $CSL has been lighter on licensing than industry peers, where (if I recall correctly) something like one-third of NDA candidates are brought through the pipeline from origins in licensing or single molecule acquisitions.

With its now narrowed therapy area focus, it makes sense to me that $CSL allocates more capital to licensing or acquiring the most promising molecules wherever they come from. Such a more balanced approach is also reasonable given some of the recent failures of late stage organically-developed candidates(e.g., CSL112). However, that said, even for a licensed product, $CSL management will need to make the key decision on whether to advance the product through the later and most expensive stages so, while interesting and while licensing can augment the organic pipeline, it doesn't change the importance of effective decision-making along the development funnel.

Beyond that, it is hard to read much into yesterday's announcement, apart from the clear fit of VMX-C001 into the $CSL portfolio.

As might have been predicted, $CSL's SP has continued to fall about 10% since I took my initial modest stake. The set-up is looking good for R&D Day in November, after which I will decide whether to take a bigger bite. The hurdle is getting lower!

Disc: Held in RL and SM

CSL has always seemed like a black box to me as I couldn’t really properly connect with its business and economics, beyond amazing performance metrics. Just started looking into it and look forward to reading all your reviews. What’s simplifying the early analysis is that whilst there are different divisions doing different things some beyond my capacity to understand, most of CSLs business is collecting blood and selling the stuff they make from it. Maybe it can be thought of as a vertically integrated wholesaler. I took a bit of a look at the prices they charge for what they make from the blood they collect. For example a single dose of certain treatments can cost hundreds of dollars and some patients need them regularly. That simple realisation has me interested in the economics. The contrarian in me is keen to understand it further given the loss of interest in it in the market. It’s currently priced more like an industrial than the high margin seemingly moaty company that it is.

Other straw members have covered CAL in better depth than I can (thank you) but one interesting snippet I found that points to a brighter future was this:

One tailwind here has been the Rika plasma collection system, which was developed by the Japanese firm Terumo and CSL has exclusive rights to. This machine makes donations 30% faster on average versus the previous standard.

Not only that, Terumo and CSL’s iNomi platform arrives at a safe amount of plasma to take from each donor individually – as opposed to taking the same amount from everybody. This has increased the average plasma donation by 10%.

As CSL completed rolling out Rika and iNomi across its network in June 2025, it is enjoying faster and larger collections. But as there is a lag of up to a year between plasma collections and sales, Shane says the full benefits aren’t showing yet

Management reiterated its expectation for plasma gross margins to recover by 600 basis points from the 51% achieved in fiscal 2025. A lift to pre-pandemic levels of 57% on $11 billion plus of sales could deliver strong earnings growth, even if revenue growth slips.

These efficiency gains have also allowed CSL to press on with reducing its number of collection centres by 7%. Shane says that the fixed costs saved by doing this can be used to fuel further innovation and fund shareholder returns through buybacks

HELD

Yes, I know it's a big company rather than a typical Strawman pick!

Valuation in Aug 2025 based on $9.10 EPS for FY25 and 10% p.a. growth rate for next 5 years (two thirds of FY25 result) with PE of 25 (bottom of 10 year history). I get an expected return of around 10% p.a. for the next 5 years at the current share price of $240. With a lot less downside / risk than some of my other holdings and twice the return of cash.

It won't all work out exactly like that of course but solid margin of safety built in based on what's known today.

Why do I own it?

# Market leader in blood products and vaccines, with huge global operations/scale and multi decade history of success.

# Growth had slowed post COVID however significant restructuring planned from FY26. Reduction in staff and plasma centers where returns were low - total annual costs to be reduced by around $500 million from FY27 which will boost EPS by around 10% alone. Plus $750 million in buybacks planned, reducing share count by around 1%.

# Very strong IP, Patents and Regulatory approvals

# Significant annual spend on R&D to hopefully develop new growth pipelines. This is being restructured somewhat in FY26 so hopefully can improve outcomes moving forward.

# Business is well diversified geographically and likely to avoid negative tariff impacts with a good spread across the US, Europe and Australia. They expect minimal impact from known tariffs as of FY26 based on their domestic capabilities in the US.

# Very strong reputation and relationships with research institutions and industry.

# Capable Board of experienced Directors. Particularly important is Chair Brian McNamee who is past successful CEO with significant skin in the game.

# Solid balance sheet with debt to equity ratio steadily improving and now at 59%. ROE / ROC are improving again and now sit around 15%.

# Net margins are also improving again and now sit around 20%.

# Management are incentivised to grow NPAT for the short term incentive. The long term incentive pays out in full when ROIC is at 12% or better and EPS growth is 13% or better, so management are working towards higher growth than my valuation requires.

# Acceptable MOS at current price of $240 in Aug 2025 at two thirds of the recent growth rate and the lowest multiple for 10 years.

# They can deliver high single digit revenue growth and low double digit earnings growth for 5 + years so the return should meet my 10% p.a. + target.

# This holding is predominantly to reduce risk in my portfolio rather than maximise for the highest possible return. I do expect a market beating return though.

What to watch

# Need to watch the revised R&D strategy and outcomes closely. May boost short term results but still need to be creating new pathways for growth.

# Need to watch prices being paid for the buyback. Want to see capital deployed at historical lows rather than highs.

# Need to watch regulatory changes and tariffs closely - minimal impact expected in Aug 2025.

# Not expecting much growth from vaccine business so this could surprise to the upside if illnesses ramp up again. Or might be one to exit when spin off takes place.

# Management state that the rationale for FY26 changes are to -

- Accelerate clinical pipeline and priority programs

- Be lean and agile

- Streamline corporate functions and drive additional revenue growth opportunities

- Simplify decision making

so important to follow these goals and hold them accountable.

Gosh, CSL is taking a hammering with shares are down around 10% (wiping about $13b from its market value) despite reporting a 14% lift in profit, right at the top of guidance. Management also expects up to 10% underlying profit growth in the year ahead.

So what gives? The restructure and Seqirus demerger come with one-off costs of up to $1b, with a cash hit of about $600m. The market seems more focused on those near-term costs and the risks of execution rather than the longer-term benefits. That's just a guess though.

I do not think it is a stretch to say CSL is one of the best companies on the ASX, yet its shares have gone nowhere since 2019. That is despite revenue nearly doubling, operating profit more than doubling, and margins improving over that time.

The lesson is that you can still do poorly in a great company that is growing strongly if you pay too much. Back in late 2019 CSL was on a PE of about 47 times. Sure, profits have since grown, but that's been offset by the multiple contraction.

https://www.morningstar.com.au/stocks/unconventional-wisdom-should-i-sell-this-underperforming-asx-share

Mark LaMonica follows up on his initial CSL purchase (linked in my former straw).

Disc. : Held IRL

https://www.morningstar.com.au/insights/stocks/260474/unconventional-wisdom-a-controversial-income-pick

CSL as a "dividend growth" investment. An interesting take from Mark LaMonica of Morningstar.

Chris Leithner, who I note has a mostly bearish slant on the topics he writes on from what I have seen, with a rather eye-catching headline on Livewire.

https://www.livewiremarkets.com/wires/why-csl-will-likely-underperform-term-deposits

I don't follow CSL but the below news just in is going to impact it, so for those who do have a read:

Wonder if something caused this...

"AMERICA IS IN the throes of its worst flu season in at least seven years. The Centres for Disease Control and Prevention estimates that some 29m Americans have been infected since October—20% more than at the same point last year. For the first time since 2020, the flu is leading to more hospitalisations and deaths than covid-19."

Global plasma products leader $CSL announced their HY results today.

Their Headlines

- Revenue $8.48 billion, up 5% at CC

- NPAT $2.01 billion1 , up 6% – NPAT $2.04 billion1 at CC, up 7%

- NPATA $2.07 billion, up 3% – NPATA $2.11 billion at CC, up 5%

- NPATA earnings per share $4.292 , up 3% – NPATA earnings per share $4.36 at CC up 4%

- Interim dividend of US$1.30 per share – Converted to Australian currency, the interim dividend is approximately A$2.08 per share, up 16%

- Guidance reaffirmed – FY25 NPATA anticipated to be in the range of approximately $3.2 billion to $3.3 billion at CC, up approximately 10-13%.

My Quick Analysis

Having exited $CSL last year, today's result confirms my thesis - strong Behring (+10%) already baked into the SP, lack lustre Sequirus (-9%), and only modest growth in Vifor (+6%)- an acquisition that was overpaid for.

Vaccinations in the US were a big driver of the weakness in Sequirus.

Top line performance wasn't helped by cost management. While R&D was lowever (given the end of the 112 program; but committed to spend normal levels of R&D as % revenue for FY), G&A blew up by 27% (driven by "one off projects") and even sales and marketing at +7% grew faster than revenue (+5%).

Behring continues to do the heavy lifting and I think we just aren't seeing the weight of growth from new products sufficient to meet the maturing portfolio and competitive/business environment headwinds in Vifor and Sequirus, respectively.

Going into today's results, most analysts had a very different view to me, with the TP consensus some +20% ahead of the SP. The gap seems to be widening, with the SP down -4% at time of writing.

$CSL's lacklustre performance is starting to challenge the notion of value even at the declining P/E of 25. While FY guidance is being held to (due to approvals, expected launches, and some material vaccine orders which should help H2), even at sub-$260, I don't necessarily see value here.

Are the analysts just seeing what they want to see here (driven by memories of glory days), or will we now start to see some PT downgrades drive by reality?

Glad to have called this one early, and it will be interesting to see if the R&D pipeline is sparking back to life at the R&D day later this year. Don't get me wrong, even as a maturing business, Behring is a powerful engine, and at some point $CSL could present value again. So I continue to watch.

Disc Not Held

Good results from CSL with the unit that made CSL great - Behring - continuing to do all the heavy lifting - Vifor was definitely diworsefication...

Some interesting insight into CSL, the competition and the CSL Behring golden goose.

ADMA Biologics

A fascinating vertically integrated plasma pharma company

background

ADMA Biologics was started back in 2004 by Jerrold and Adam Grossman, a father/son team that had deep expertise in plasma donation and pharma. The company has evolved over the nearly 2 decades but now is a vertically integrated pharma business. ADMA owns 10 plasma donation centers and a manufacturing facility to make its three IVIG drugs. IVIG stands for “Intravenous Immunoglobulin”, which is a category of biologic drugs composed from plasma. Before getting too far, plasma is the liquid component of blood that is actually yellow in color and accounts for about half of its volume. Plasma, itself, is about 90% water but it is a rich source of proteins, which are great for clotting and fighting infection.

Most healthy people can sign up to donate plasma. It takes about an hour and you can get paid between $50-70. Some people actually donate twice a week, which can lead to anemia but it’s not guaranteed – patients just have to be very mindful of that. Donation centers also include incentives for regular donors so some folks make about $500/month by donating plasma.

Last year, in the US, there were 39 million liters of source plasma collected. ADMA made up a very small percentage of that total but it is one of 4 main companies in the world that does plasma donation. However, it is the only US-based company that is vertically integrated. Once the plasma is collected, ADMA sends it to the manufacturing facility in Boca Raton, Florida, where it will be centrifuged and turned into one of its three IVIG products.

The first IVIG that was approved was BIVIGAM in 2012 for immunodeficiencies. Then, it acquired Nabi-HB for Hepatitis B in 2017 when it bought BioTest’s assets out of bankruptcy. And lastly, in 2019, ASCENIV was approved.

The Numbers

ADMA is a rare bird in that it is a fully vertically integrated biopharma company that has GAAP profits. The company’s 4,400 liter fully-ramped facility in Florida has really proven to have economies of scale. Further, there were quite a few start-up costs to get all 10 plasma centers operational. For example, plasma center operating expenses dropped from $18 million last year to just $4 million this year as the company could capitalize those costs into inventory. Meanwhile, gross margins expanded from 23% to 35% as high-margin, ASCENIV took off. So GAAP EBIT margins improved YoY from -25% to 8% and FCF margins went from -48% to 1%.

The company also provides two years of guidance. At the end of Q4, 2024 growth was expected to be 28% and then for 2025, management estimates 15%. However, last year, the company beat its original guide by $48 million or 23%. If that magnitude of a beat happens again, revenue growth would be over 60%. But if the beat is similar in absolute dollars, growth could be more like 46%. Somewhere between this number and 28% is probably a good estimate based on management’s track record but what’s crazy is that after Q1, the revenue guidance already increased to 38%!

Further, management has also provided net income and EBITDA guidance for the next two years. The EBITDA guides imply margins of 27% and 36% for the next two years.

Once the company can get rid of its $90 million in debt, then FCF will track much more closely to EBITDA. I do think it’s possible that the company eats into a good chunk of the debt this upcoming year as FCF really ramps up. As more insurance companies cover ADMA’s IVIGs and the manufacturing economies of scale accelerate, the company should be quite profitable. In fact, ADMA’s net income guidance for 2025 implies 30% net margins. That probably includes lower interest expenses but even at 5% of revenue and some tax expenses, EBIT margins could easily reach 35-40% over the next two years. And the company should still be growing 20% at that point so 40% isn’t even fully mature. That just goes to show how profitable this business really could be. The plasma donation piece of the business typical runs at breakeven – made possible by selling plasma to other companies that need it. And then really good batches of IVIG are incredibly high margin – ASCENIV fully-ramped could probably reach 90% gross margins.

Market Size

The company pegs the US market at $10 billion, growing to $20 billion over the next 5-7ish years as IVIG biologics take share. If you tally up the global revenue from the top 3 competitors, the cumulative immunoglobulin revenue is nearly $11 billion, but it grew 27%! This is quite a tailwind as biologics have quite a bit of optionality. For instance, IVIGs typically can address various immune diseases rather than one pharmaceutical drug.

Right now, ADMA only has three approved drugs but it would be great to see them get more label expansions and even get more drugs approved to widen its revenue opportunity. However, at $260 million in TTM revenue, the company has a long way to go. Globally, the market is probably already about $20 billion so they are just a drop in the bucket at this point.

Moat/Competition

The three main competitors to keep an eye on are all international pharma companies – Takeda from Japan, Grifols from Spain, and CSL Behring is HQ’d in Australia.

Takeda got into the IVIG space from its $62 billion acquisition of Shire, the maker of Adderall. Grifols runs a pretty extensive plasma donation network and this is who ADMA actually bought plasma from before it ramped its own network. And CSL Behring has traditionally been the leader in IVIG, getting its first approval all the way back in 2005.

Like I mentioned, between the three companies, global immunoglobulin revenue was roughly $11 billion but they grew 27% annually. Anecdotally, and it certainly bears out in the numbers, there have been extreme shortages of IVIGs since COVID. It’s not easy to make this stuff – it typically takes between 7-9 months to fully produce a batch and there has been a lot of demand from hospitals and infusion centers. This has led to some price increases and a bit of backlash from insurance companies. But as ADMA has ramped its facility and gotten some recent approvals to store IVIG at room temperature, I think supply could catch up to demand here fairly soon.

ADMA’s competitive advantage mainly consists of its vertical integration. It owns 10 FDA-approved plasma donation centers that it then sends to its manufacturing facility to turn into high margin drugs. So it pays $40-50 per sample (maybe 500 mL) and then turns that same plasma into a small vial that may cost insurance companies $850 for 50 mL. Sure, there are quite a few steps in-between but there are many more people that can give plasma than can manufacture IVIG’s. ADMA captures this spread.

The moat also lies in regulation. It takes an awfully long time to get a drug approved and get FDA-approval for donation centers. Add to this creating your own manufacturing facility and you see why ADMA has almost gone bankrupt a handful of times. It would be very tough for another upstart company to replicate the journey of ADMA, especially with interest rates much higher now. It is possible for a large company to do this but the market is just small enough right now that it probably wouldn’t make sense for them. Eventually, as the market grows, we may see large companies jump in but ADMA’s footing should be much more solid by then.

Risks

The first risk is insurance coverage. IVIGs are expensive and there are several approved for similar purposes. For example, United HealthCare (UHC) stopped covering ASCENIV in November of 2023, essentially because it was too expensive. The nuance here is that ASCENIV is not a first-line treatment, meaning it’s not a doctor’s first choice to prescribe due to the price tag. However, as alternatives don’t get the job done, physicians resort to prescribing this because of its quality. ADMA actually screens plasma donation patients for specific antibodies that contribute to how well the drug works. This is very rare for competitors to do this. And this is one example of why the company’s vertical integration is so important. If ADMA didn’t have complete control over the value chain, they likely wouldn’t be able to do particular screens like this.

The point still remains, though, that if insurance companies don’t cover ASCENIV, then growth could slow down. If Medicare stopped covering ASCENIV, then I would be worried. For now, while UHC makes up a large portion of the market, the actual financial impacts haven’t manifested yet and it has already been about 6 months since it went off the formulary.

Second, competition is fairly tough. The large players have a lot of approvals and educating physicians about all of the different IVIGs takes resources. Further, there is no guarantee that ADMA is able to get any other drugs approved in the future. Without any optionality, I’d be less sure of a huge outcome here. If we see inventory continue to build up on ADMA’s balance sheet, I’d be worried that supply has corrected in the industry and the company’s sell-through has slowed down. I would ideally not like to see inventory grow all that much faster than revenue but the 7-9 months lead times make that difficult for the company to predict. The fact that the company has to tie up rather large chunks of cash in inventory is something to keep an eye on here. If the product is selling very quickly and helping patients, then it’s not something to worry about but we do have to keep in mind the hit to free cash flow conversion resulting from this dynamic.

Management

The Grossman father/son duo is notoriously private. I could barely find a single public interview, other than, of course, earnings calls. Jerrold, the father, is Chairman now and owns less than 1% of outstanding shares. Adam, the son, owns a bit over 2% of shares as the company had to dilute so much just to stay alive. His stake is worth more than $40 million so it’s certainly not nothing but fairly small in percentage terms for a founder.

Adam Grossman seems to have done an incredible job getting the company to this point. I can’t overemphasize how difficult this journey has been so to even survive is impressive.

Conclusion

ADMA is a very interesting vertically integrated company. While it does face risks like insurance companies not covering its drugs and not getting new drugs approved, the company has faced many challenges in the past and has come out the other side. As profitability inflects and the balance sheet strengthens, the story gets even more de-risked, especially with the founders still involved and the industry tailwinds.

CSL Have announced their 1H results with conference call later this morning.

Their Highlights

• Revenue $8.05 billion, up 11% at CC3

• NPAT $1.90 billion, up 17%

• NPAT $1.94 billion1 at CC, up 20%

• NPATA $2.02 billion, up 11%

• NPATA $2.06 billion at CC, up 13%

• NPATA earnings per share $4.182 , up 11%

• NPATA earnings per share $4.26 at CC up 13%

• Interim dividend5 of US$1.19 per share (Converted to Australian currency, the interim dividend is approximately A$1.81 per share, up 12%)

• Guidance reaffirmed – FY24 NPATA2,4 anticipated to be in the range of approximately $2.9 billion to $3.0 billion at CC

My Analysis

Pretty good results, which as far as I can see are broadly in-line with consensus. $CSL are sticking to FY guidance of 13%-17% NPATA Growth, and 9-11% CC revenue growth.

The stand out is Behring where revenue grew 14%, while Seqirus experienced a "challenging season" with only 2% growth. There's no PCP comparison for Vifor, so need to look at that.

There will be a short update on R&D. Key milestones ahead in the short terms are HIZENTRA (3Q - first phase 3 data) and Garadacimab (4Q first approval expected)

Disc: Held

Arcturus, CSL win approval for world’s first self-amplifying mRNA vaccine in Japan

Not exactly "small cap" news but I hadn't seen it come up anywhere else ...

Arcturus Therapeutics (NASDAQ:ARCT) and its partner CSL announced Tuesday that Japan's Ministry of Health had approved their ARCT-154 COVID-19 vaccine, marking the world's first regulatory clearance of a self-amplifying mRNA (sa-mRNA) vaccine

Accordingly, in Japan, ARCT-154 will be indicated for initial and booster vaccinations in adults aged 18 years and older

Compared to conventional mRNA technology used by leading COVID-19 vaccine makers such as Pfizer (PFE)/ BioNTech (BNTX), and Moderna (MRNA), self-amplifying mRNA technology is associated with an enhanced immune response at lower vaccine doses

"Self-amplifying mRNA technology has the potential to be an enduring vaccine option," said Nobel laureate Dr. Drew Weissman, "I look forward to seeing this next generation mRNA technology protect many from COVID-19 and possibly other harmful infectious diseases."

"Today's approval marks a historic and exciting milestone as the first sa-mRNA vaccine in the world to be registered," Jonathan Edelman, Senior Vice President of the Vaccines Innovation Unit at Australian biotech CSL (CSLLLY), said

The decision is based on data from multiple clinical studies for ARCT-154, including a large ongoing trial in Vietnam and a Phase 3 COVID-19 booster trial

About sa-mRNA

Messenger RNA (mRNA) vaccine technology protects against infectious diseases by instructing cells in the body to make a specific protein, stimulating the immune response, and leaving a blueprint to recognize and fight future infection. However, sa-mRNA makes copies of the mRNA which generates the production of more protein compared to an equivalent amount of mRNA in a vaccine. The technology has the potential to create more potent cellular immune responses and increase duration of protection, while using considerably lower doses of mRNA

DISC: Held in RL

I'm just out of $CSL's capital markets day and, as ever, the deep dive into each of the three businesses and the R&D portfolio always leaves me in awe of what a tremendous business this is and the breadth and depth of talent on the management team. There are too many moving parts to summarise the day effectively and, I work on the basis that anyone who was so motivated would have been there anyway. So, instead, I'll pull a few selected slides from the deck with a brief explanation of what they said to me.

My Key Take Aways from the Day

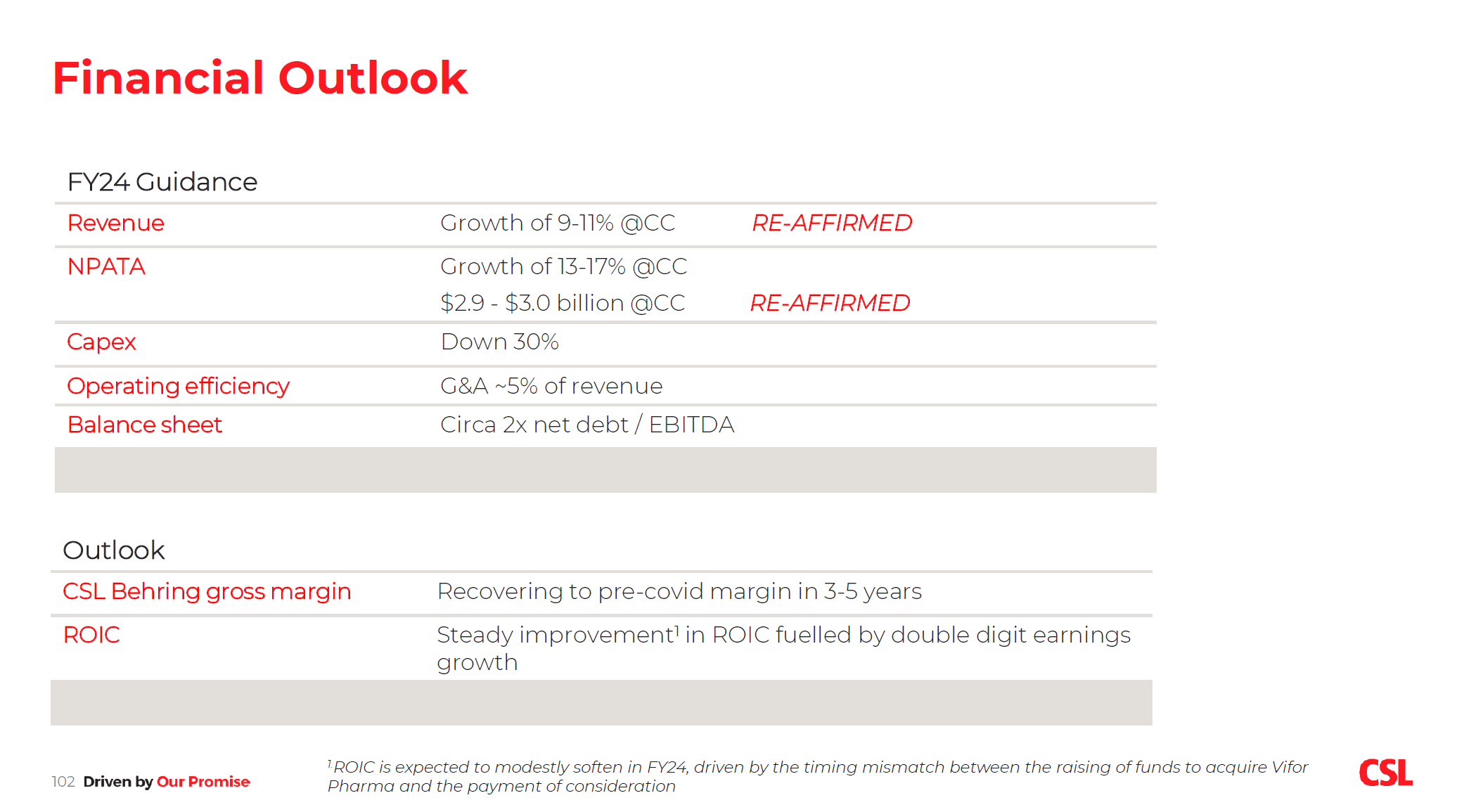

- $CSL will sustainably grow earnings at double digits annually for the foreseeable future. FY24 guidance was re-affirmed.

- It continues to sustain its R&D pipeline with new discoveries, with several exciting near-term, late-stage milestones for FY24

- Gross margin and ROIC will progressively improve year on year over the coming 3-5 years or so, driven by a program of efficiency improvements to drive plasma recovery, a period of 3-years of reduced capex and debt moving back to 2 x EBITDA by EOFY24.

- Overall, revenue will be driven by the tailwind of ageing populations in developed markets; label expansions of the existing portfolio; growth of recently launched products; and new approvals expected.

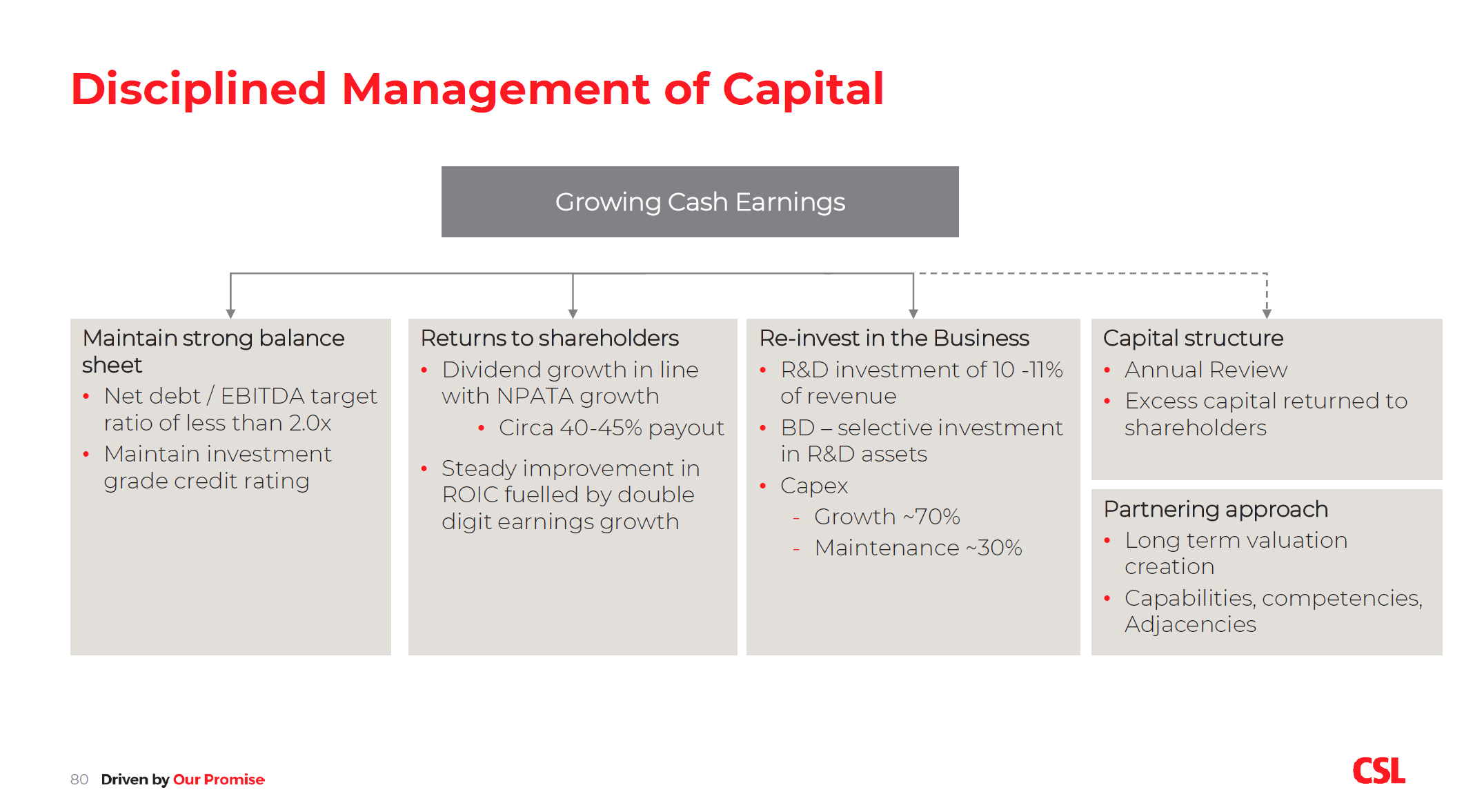

- The company has a framework for disciplined capital allocation, focused on sustaining growth while increasing shareholder returns over time

Today was Paul McKenzie's first outing as CEO for Capital Market's Day. He did a good job topping and tailing the day, supporting his team in the Q&A, and letting the team do the heavy lifting as you'd expect. As far as I am concerned, he did a good job and the first test will be meeting or beating FY24 guidance.

Capital Discipline

I start with Fig.1 the framework for capital discipline presented by CFO Joy Linton.

Figure 1

$CSL continues to invest strongly for growth. The next several years will be some transitionary points:

- A progressive return to pre-COVID %GM in the plasma business, with a promise to grow margins beyond these levels as a result of a range of investment in IT and manufacturing technology to reduce CPL (costs per litre) at the collection stage and increase plasma yield through manufactuing. This isn't something that just happens, and the team outlined some of the details of improvements being made in the collection centres and in the plasma extraction processes.

- A reduction in capex of c. 30% over the next three years. This follows the completion of a major program of new facility investments over recent years

- NPATA growth allowing the debit required for the Vifor acquisition to be reduced back to the target level of < 2 x EBITDA - a conservative position that should retain investment grade credit rating.

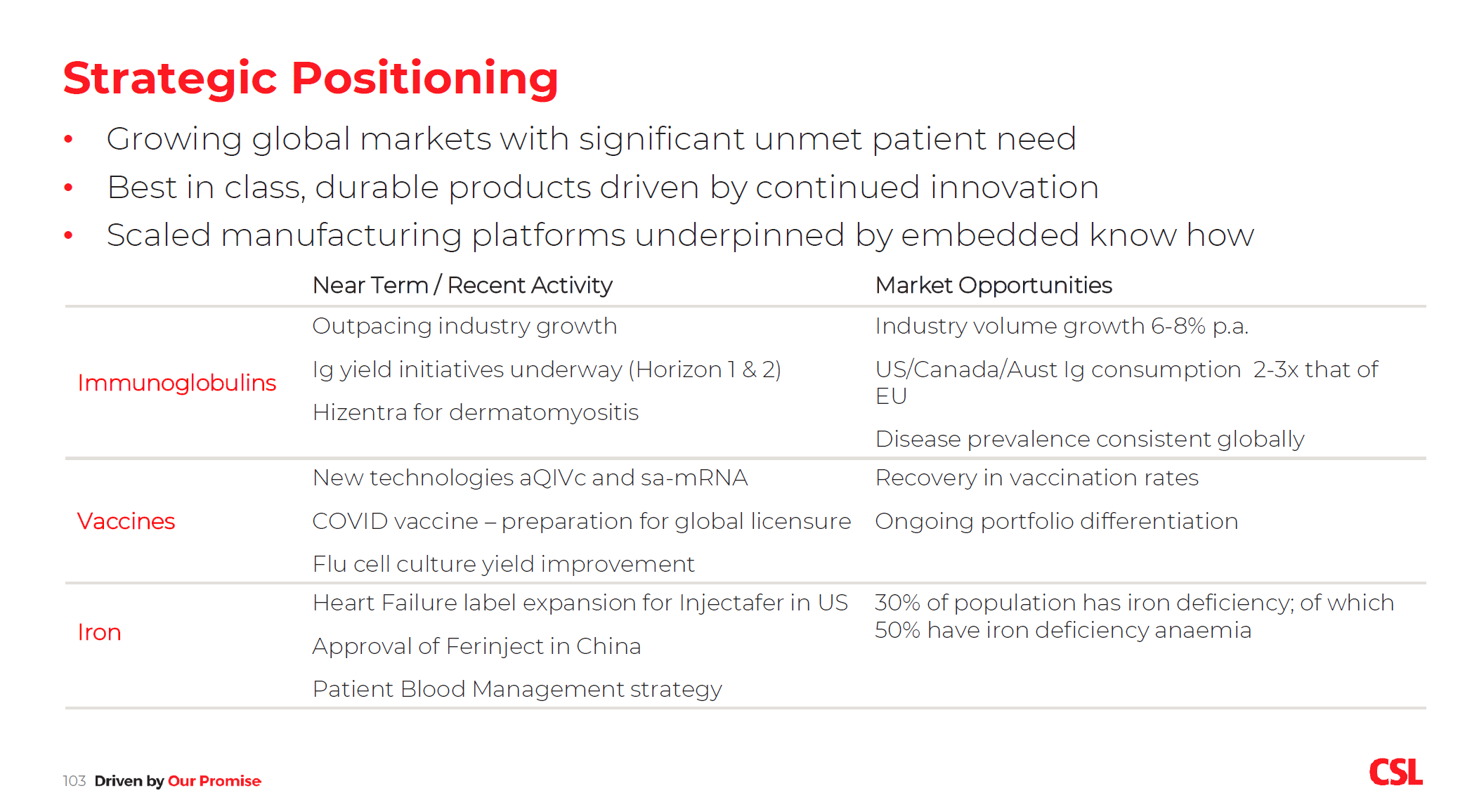

Revenue Growth

$CSL expects to grow strongly across all its businesses. The positioning of each of the three businesses and the market opportunities are summarised in Fig. 2.

Importantly, many of the conditions for $CSLs treatments are related to ageing, so there remains a long-term trend of ageing over the coming decades in developed markets, then to be followed in the future in the middle income countries. Even in developed markets, there is a significant variation in uptake of $CSL products, so there is significant opportunity in driving product use to a more uniform adoption of the standard of care in the most advanced markets. New indications for existing products come on top of that.

In summary, there are many levers for growth offset of course by competition and new tharapies, of which GLP-1s are just one of many.

Figure 2

Although the story for Iron (i.e. Vifor) was perhaps less confident (from my perspective) with indications that progress may be lumpy, this is more down to the uncertainty of how rapidly the growth of Injectafer will take off following approval for Heart Failure in the US and the approval of Ferinject in China, offset by the launch of generic competition from Sandoz (CEO Paul McKenzie emphasised that generic competition was in the acquisition case, but I sense that with the manufacturing challenges of the drug, Sandoz has perhaps been a bit faster out of the blocks than expected).

Of course it is important to remember that adding treatments for renal failure and CKD complements $CSL's other therapy areas, so Vifor is as much about building capability as it is about buying a portfolio of drugs. CFO Joy Linton summed it up when she pointed out that CSL's prior acquisitions have usually taken several years before their promise has materialised, pointing to the 3 years it took for the value of Sequirus (acquired from Novartis) to show through.

We've recently heard how $CSL has been in the gun sights from analysts and commentators from GLP-1 FLOW clinical trial. Head of R&D Bill Mazzanotte addressed this in his opening remarks. He pointed out that cardi-vascular diseases are of a "multi-dimensional and complex nature". By this, he means that there are many diseases within the category, and for each disease there are many indications according to patient profile, disease type and stage of advancement. Reflecting on the hype around GLP-1s, Bill pointed out that 25 years ago Statins were emerging and commentators were saying that would be the end of cardiovascular disease and the existing drugs that treated them. "It didn't happen," he said. He further added that there are many drivers of renal disease, and that weight is not an independent driver (a bit like we've debated here on OSA). While he accepted there will be an impact he considered it to be a small impact on a small part of the portfolio. He summarised by saying "I am proud of the scientists who have done the work. I am grateful that patients have a new opportunity. But I am confident of our product and R&D portfolio."

From that respect, today was good for my general well-being. Having a day immersed in the CSL portfolio reminded me (as a non-clinician) just how complex and multi-faceted disease is, and how vast the array of treatments and modes of action are. It is highly, highly unlikley that any one mode of therapeutic action is going to be a "silver bullet."

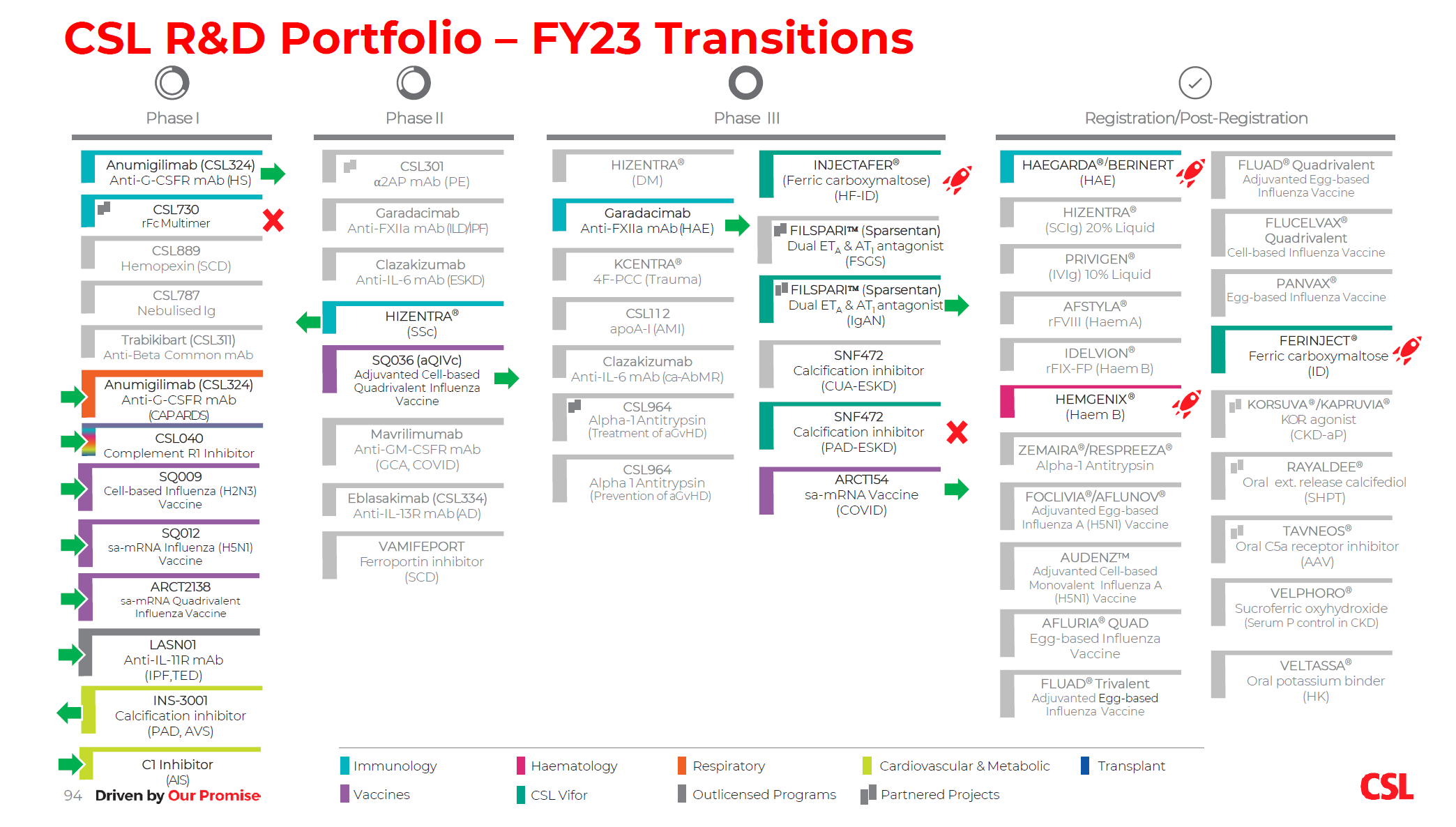

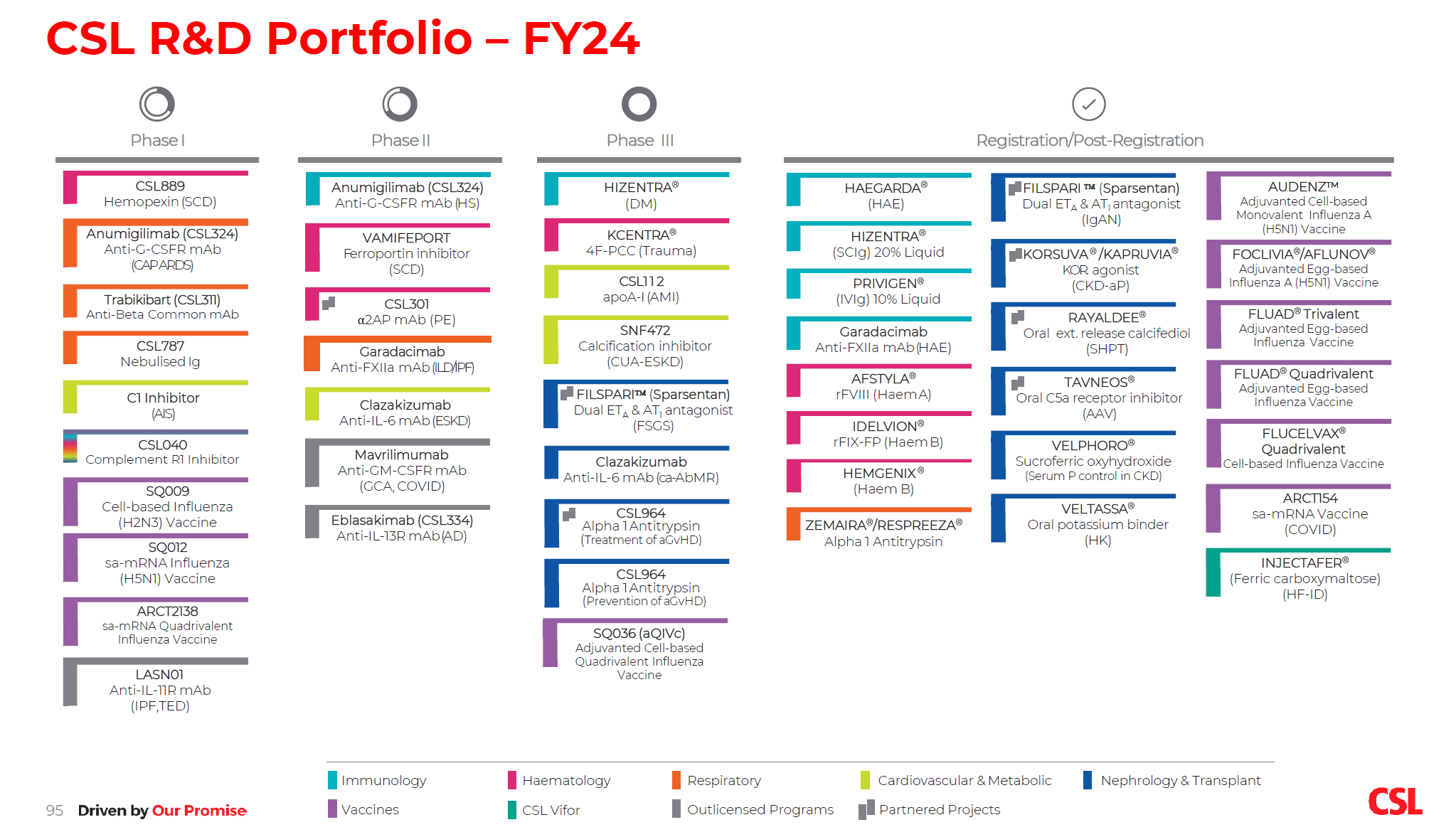

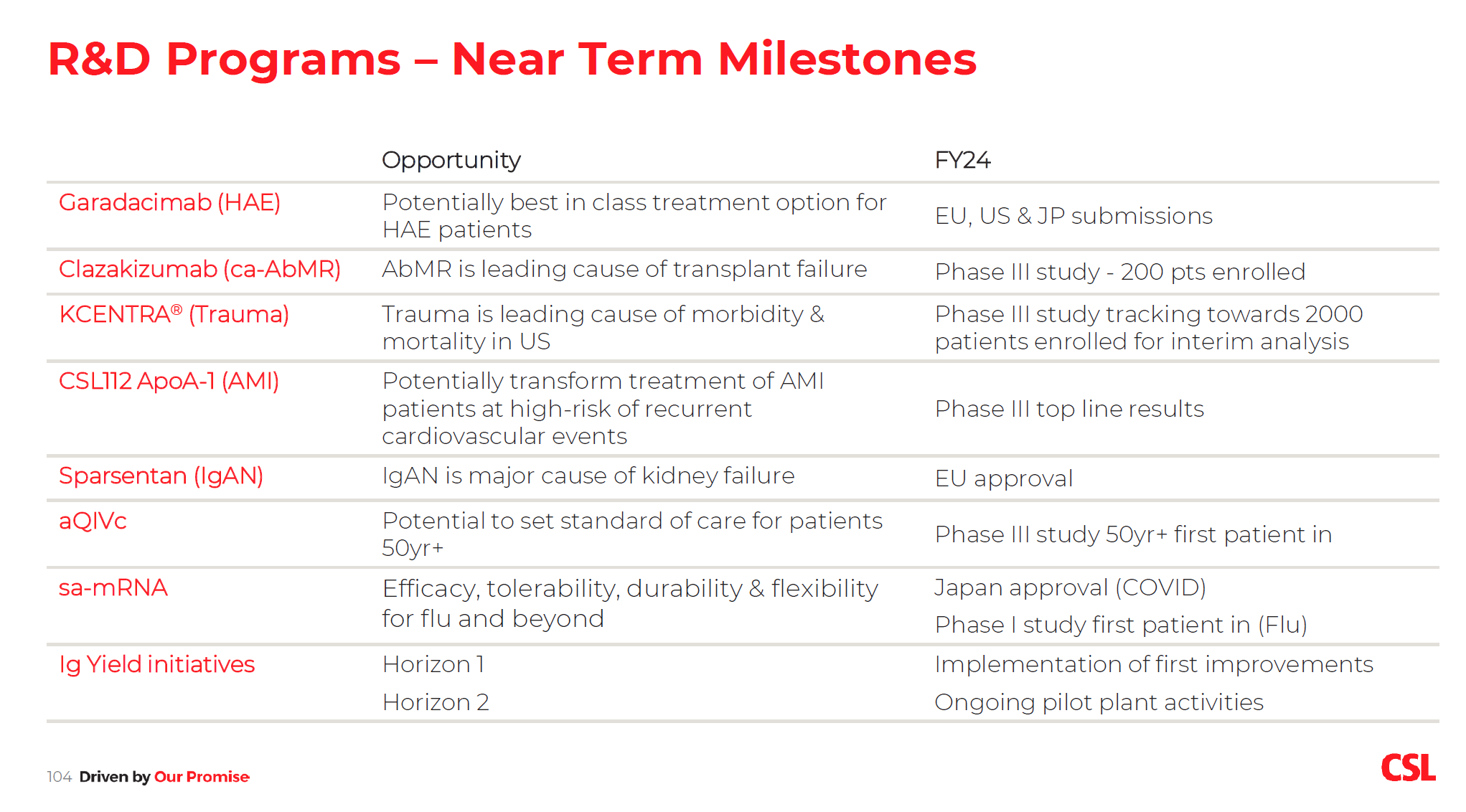

R&D Portfolio

Bill Mazzanotte gave an update on R&D. At the headline level, several new candiates were added to the Phase 1 pipeline from different CSL "platforms" across the therapy areas; several drugs advanced throught the pipeline; and several candidates were dropped. Fig 3 shows the FY23 progress in the R&D portfolio and Fig 4 shows the updated portfolio and fig. 5 shows the key expected milestones for the next three years. (I'll be interested to read some of the broker notes on this, particularly GS, whose global healthcare desk will no doubt do a detailed analysis, considering similar developments across the competition. That's more than I can ever do! Chris Cooper asked several questions during the day, so I am sure there will be an update.)

Figure 3 FY23 Progress

Figure 4

Figure 5 FY24 R&D Milestones

Key milestones are Garadacimab approvals decisions, and Phase III results of CSL112.

Articificial Intelligence and IT Generally

Chief Information and Digital Officer Mark Hill gave a short and interesting presentation of how $CSL is using IT to drive value both in R&D and Operations.

Mark who is a IT veteran of four decades in industry made the following remarks which stood out. First "AI is here to stay, and it is bigger than the internet" and second, it is "difficult to harness because the speed of innovation is faster than anything we have seen."

However, this wasn't a buzzword-hype presentation. On the contrary, Mark gave practical examples of the kind of things that $CSL are applying generative AI to, and they have even built an internal accelerator to innovate, test and then deploy useful applications. ("No one need write meeting minutes again")

I'm calling out this segment because I think across industries, AI - like digital before it and ongoing - will lead to capabilities that the best companies will figure out how to use, and then gain benefits from so doing. Some will succeed, others will be left behind.

And as @Strawman said in the last episode of Baby Giants podcast, if I recall correctly, in quoting Warren Buffet, AI will be like attending a parade, where some stand on a box to get a better view. But eventually, everyone is standing on a box, so no-one has a better view.

From a competitive perspective, however, some get on taller boxes and they get up earlier. From today's presentation it looks like CSL is taking this seriously and is unlikely to be left behind.

Guidance Re-Affirmed

I guess the good news about today is that there was no bad news. Guidance is intact, and the team sounds like they have clear plans in place to drive forward on the margin improvements that are under their control.

Figure 6; Guidance Re-Affirmed

I started my career in industry working in big pharma over 30 years ago, and attended many management updates on the progress of the commercial and R&D portfolios. Today felt strangely familiar. $CSL is a global leader taking stock of where it stands, and laying out its plans to continue to grow more strongly than the industry. I'm pretty confident they will continue to succeed and was impressed by each of the presenters today. This is a business that doesn't depend on single CEO and I've no doubt that anyone of the key executives presenting today could take the ship forward if they needed to. That said, Paul McKenzie did a good job, and came across as a very competent team captain.

Disc: Held in RL and SM

Not much to see here but FWIW Morgan Stanley has just released their first thoughts on CSL's First Capital Markets Day (CMD) today ...

Strategy to manage double-digit earnings growth looks robust; long-term Behring margins "beyond" pre pandemic levels, RIKA (automated plasma technology) could deliver 10% yield improvement:

We gleaned the following for CSL from its CMD presentation: i) It's positioned for double-digit earnings growth and is leading in a market with a large unmet need, yield/capacity is improving and R&D is yielding results; ii) current Ig yield is ~5% ahead of FY19, with ~8-13% likely within 3-5 years and ~16-27% likely by decade-end; iii) CSL expects to outgrow the market - Ig market growth 6-8% pa vs CSL at high-single digits, Hem B market growth 4-6% vs CSL at high-single digits, HAE market growth 4-6% vs CSL at high- single digits; iv) Rika is now in 15 centers with a final roll out timeline to be detailed by end CY23, with individual nomograms to deliver ~10% yield improvement; v) COVID-19 vaccine approvals expected across 2024-26; vi) realization of COGS efficiencies to drive Behring margins to pre-pandemic levels and beyond; vii) CIDP FcRn exposure appears lessened - it now accounts for 19% of IVIg revenue and 8% of SCIg revenue (vs. our estimate of 22-25% of total revenue previously); viii) Patient Blood Management is a key mid-term growth plank for V4; and ix) capex is down 30% from pcp with yield/process improvements delaying the need for expansion

DISC: Held in RL

Could this announcement be to address the very issue we're currently discussing or is just the "norm" for CSL?

Notice of Capital Markets Day

CSL Limited (ASX:CSL; USOTC:CSLLY) will hold a Capital Markets Briefing on Monday 16 October 2023 in Sydney, Australia.

The briefing will commence at approximately 9.00am Australian Eastern Daylight Time and will focus on the Company’s business activities and initiatives for growth.

Presentations will be webcast on the Company website at www.csl.com in the ‘Investors’ section.

An archived copy of the webcast will also be uploaded later that day.

Presentation materials will be available at the commencement of the briefing in the ‘Investors’ section of the Company website at www.csl.com.

Let me start by saying that I think CSL is easily one of the best companies on the ASX. I think the business will survive, and thrive, for many more years to come.

And, as with Resmed, I think any impact from Ozempic and related drugs is likely overstated.

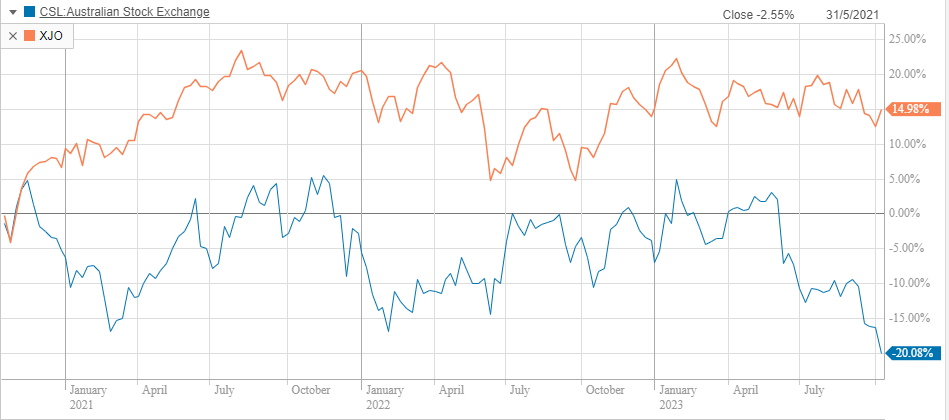

But I do think this is (potentially) a lesson in how you can get fairly ordinary results as an investor even if you buy into a great company. In fact, over the last three years, "ordinary" is putting it mildly when you compare CSL to the wider market:

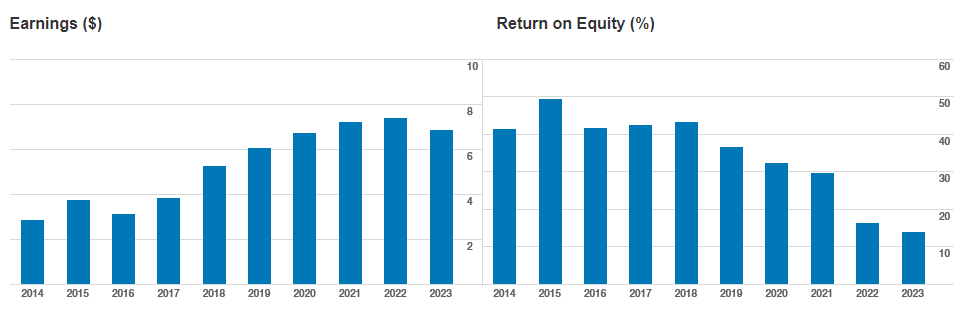

Everything is easy in hindsight, but this is what happens when a company priced for strong growth doesn't deliver. Per share earnings growth and Return on Equity in recent times haven't been great:

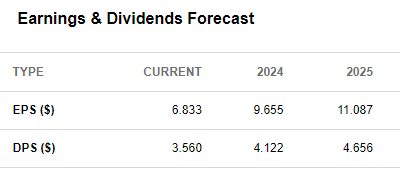

The reasons behind this are far from existential, of course. And it's worth noting that the consensus forecast for FY25 EPS is $11.08 -- 62% higher than FY23! But at the start of 2020 the forward PE was 43x

This was rationalised at the time by:

- Low interest rates

- Strong growth expectations

- High quality

Remember, interest rates (as defined by US 10year treasuries) were 2% and heading lower in early 2020. Things, as we now know, turned out differently. Lower for longer just didn't turn out to be the case...

Likewise, COVID impacted collections and margins, so the growth wasn't as strong as was initially expected.

My point is that at a PE of 42x, there was very little room for error. No one could have predicted covid or what global interest rates were going to do, but the company itself was telling investors in 2020 that they expected 2-7% EPS growth -- which is nothing to sneeze at for $120b company (and they actually beat that guidance!). But a PE of 42x?

This was always my issue. Yes, i'll hasten to add that high quality companies deserve a premium. It's not sensible to expect CSL to trade at a PE of (say) 15. But you are always going to sail into the wind at those kind of multiples -- unless you can realistically expect super strong growth.

Put it this way, to overcome a PE compression of 43 to 35 (and remembering that a PE of 35x aint exactly low!), EPS needs to grow at about 19% just to keep the share price steady.

Anyway, that was then and this is now. And now we (still) have a super high quality company, whose earnings are expected to grow strongly but the PE is now on a forward PE of 25

NOW things are getting interesting!

Thank god the market is anything but rational.

Thought I'd throw this out to the broader and much more informed SM community.

CSL share price is currently trading down at around 2019 levels because.....as I understand.....of weight-loss drug GLP-1 RA?

I'd appreciate views as to whether this "perceived risk" warrants such a dive in s/p?

Top sellers on the register including State Street who lends out shares for shorts and has massive holding.

At 258, CSL is now below the capital raise price for the Vifor takeover. Falling DXY doesn't help.

On the other hand, brokers still putting in high price targets of $300+.

Morgan Stanley’s top healthcare picks for ASX reporting season - TradingView. Com, 11th July 2023.

“Morgan Stanley says the recovery of healthcare earnings to pre-pandemic levels is more challenging than expected. Analysts favour companies that have recently provided guidance on upcoming earnings.

“For most stocks, volume recovery to pre-pandemic levels has been sluggish accompanied by higher cost inflation, yet P/E multiples across the sector are generally inflated,” Morgan Stanley analysts said in a note on Tuesday.

“Staffing shortages have been a major detractor from volume recovery which could be more structural than transient (eg. nurses).”

Heading into August reporting season, the investment bank favours CSL (ASX: CSL) – which recently reset its FY24 expectations – as well as Sonic Healthcare (ASX: SHL) – where volume growth is robust and cost inflation has been contained.

Most preferred large caps: CSL, Ebos and Sonic Healthcare

CSL provided a market update on 14 June, which triggered a sharp 6.9% selloff. The update reaffirmed an FY23 net profit guidance of US$2.7 billion to US$2.8 billion and a first-time FY24 guidance of US$2.88 billion to US$3.01 billion, which missed analyst expectations. The stock has fallen a further 14% since the update and trading at levels not seen since July 2022. Morgan Stanley’s Overweight thesis is based on key points including:

- “Industry data suggest that the trajectory of plasma recovery is accelerating.”

- “CSL's plasma collections are now above pre-pandemic levels with positive momentum.”

- “We don’t see change to the long-term picture despite the downgrade to our forecasts following the market update, but rather a 6-12 month delay in getting there.”

Morgan Stanley is “Overweight” on CSL with a share price target of $325.”

Held: IRL 9.4%, SM 19%

Recently we built up a large sum of cash in our IRL portfolios due to the Blundy-Itaoui acquisition of Best & Less (which has almost reached compulsory acquisition stage now, 90% of ownership).

Looking for somewhere to park the cash, I chose to invest in CSL shares. CSL is now in the Blue Chip dog house, closing at a 12 month low of $266.90. The share price has been going sideways for 3 1/2 years. I thought this might be a reasonably safe place to park a lot of cash with a 12 month horizon in mind. Hopefully I can still extract a bit of cash along the way (if needed) by selling a few shares.

Macquarie thinks CSL is a safe haven according to this article in the AFR from the 19th June - Macquarie’s seven stock picks to ride out weaker earnings - see excerpt below:

Safe havens

“Its advice is to stay defensive, even in the face of the recent downgrades from safe havens such as CSL, Amcor and ASX.

Macquarie’s analysis suggests (perhaps unsurprisingly) that cyclical stocks deliver the most earnings downgrades when forward orders fall and the economy slows. Media, discretionary retail, financial services, insurance and banks all typically experience double-digit falls in EPS when the economy enters a downturn phase.

On the other hand, sectors such as health, telecommunications, consumer staples and utilities experience either earnings upgrades or below-average downgrades.”

Since this article was published on the 19 June, CSL has fallen a further 6 per cent, from $284.44 to $266.90. So NOT so safe in the short term. It might fall further yet! The chartists might be suggesting you to get out of CSL now and buy back in when the share price goes above $320? (That never makes much sense to me).

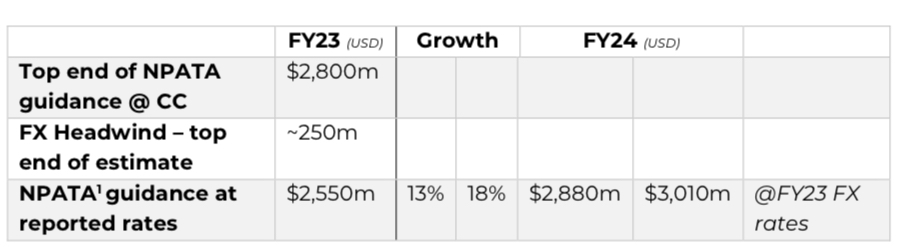

I am reasonably happy with the guidance for 2024 (NAPTA up 13% to 18% on the market update on 14th June) and they haven’t hit their straps yet with the Vifor acquisition.

Most Brokers think there might be some upside to CSL according to the commentary by Bronwyn Allen on The Motley Fool yesterday:

“Macquarie has an outperform rating on CSL shares with a $326 price target.”

“Morgans believes CSL shares are “poised to break out this year“.

The broker has an add rating and a $323 share price target for CSL.

Morgans says:

A key portfolio holding and key sector pick, we believe CSL is poised to break-out this year, a COVID exit trade, offering double-digit recovery in earnings growth as plasma collections increase, new products get approved and influenza vaccine uptake increases around ongoing concerns about respiratory viruses, with shares offering good value trading around its long-term forward multiple of ~30x.”

“The most bullish of the bunch is Citi. It has a buy rating and a 12-month price target of $340. This implies a 27% potential upside on the stock.

This actually represents a cut in Citi’s share price target following CSL’s recent update, which revealed currency headwinds for the company, given it reports its earnings in US dollars.

Citi was previously tipping $350 per share by the end of FY24.

There is still the threat of a US recessionin FY24, which of course, isn’t good for US shares or ASX shares.

But Morgan Stanley points out that US healthcare stocks have outperformed the market by an average of 13% during the past four recessions.”

The consensus share price target from 18 analysts on Simply Wall Street data is $324, which represents an upside of 21%.

Now all the analysts could be wrong. CSL is a complex global roll-up. I’m not even going to attempt to value it given there are hundreds of others who are more skilled than me already doing just that. Most think CSL is worth more than it is selling for now, and I don’t think it is going broke any time soon. So I think it might be a reasonably safe place to park a lot of cash for 12 months or so.

$CSL out today with an adjustment to guidance stating that "currency headwinds" have increased from US$175m estimated at HY to US$230-250m today.

Reiterated their preferred measure of NPATA, stating that results expected to come in towards top end of guidance of $2.7-2.8bn, and that NPATA growth to FY24 would be 13-18% of US$2.9-US$3.0bn cc.

From the wording of the announcement, it looks like they are trying to guide some analysts who have been shooting a bit high.

Listening to the various commentators on CSL there are strong expectations of return to favourable plasma collection dynamics, contributions from Vifor, operational efficiencies, and progress on new products. Some are stating that they believe that after the SP having tracked sideways more or less over the last three years, FY24 is going to be the next "breakout year". So that perhaps explains the negative initial reaction of the market to the result, trading anywhere from down 6-8% this morniing.

Of course, currency headwinds can also turn to tailwinds, and SP of this growth stock has been stifled in the higher interest rate environment. During FY24 and FY25 as we potentially tip into the next phase of the macro cycle, we could indeed see the drag effect of these macro factors reverse and reinforce the underlying operational strength of the business. So there is a logic to being patient.

Based on my model, 3 yr earnings growth of 19% CAGR makes the current forward P/E 40 a bit steep for me to be adding any more, although I always ask the question when the market offers this mini-pullback opportunities.

I didn't make the investor call, but will scruitinize the transcript to see if there is anything else, although I doubt it as they are pretty careful in what goes in the release, and tend not to "freelance" in the Q&A.

Disc: Held in RL only

https://newswire.iguana2.com/af5f4d73c1a54a33/csl.asx/3A604660/CSL_CSL_Vifor_Market_Briefing

This morning CSL held their investor briefing on the $12bn Vifor acquisition, updating their forecasts to now reflect Vifor as a segement within the business. Overall revenue growth guidance was unchanged, with the exception of signalling directional changes for non-US contributions weakening due to US$ strength. There is also a higher cost of debt associated with the acquisition due to rising interest rates.

Overall, while there is the prospect of generic competion for the core iron injectible product, this is offset by the complexity of the manufacturing process and relatively low market penetration, as well as the strong pipeline of recently launched products being rolled out and strong clinical development pipeline.

CFO Joy Linton communicated changes to how CSL will report in the future, reporting GM less sales and marketing at the segment level (Sequirus, Behring and Vifor), with R&D and G&A now to be reported only at Group level.

For me, the value of the briefing was that it explains how the Vifor and CSL combination strengthens capabilities both in therapeutic knowledge, R&D including clinical development and market footprint. On the latter, several of the Vifor products already in the market and in last phase clinical development can expect to experience enhanced growth from the much larger CSL market footprint.

CSL is comprehensively covered by brokers, so it will be interesting to watch the various research notes and updates coming out over the next few days. While I don't have my own CSL model, nothing I heard leads me to expect big swings either way.

At the moment CSL SP appears weighed down by i) impact of higher interest rates ii) expectations of margin pressure iii) weaker contribution from non-US due to currency impacts offset by return to pre-COVID activity and growth in plasma. Re-opening also a positive impact on the dialysis segment which is a value driver for Vifor.

A recording of the webcast will be available later today on www.csl.com. It is about one hour of presentation and an hour of analysis Q&A.

Next stop is the R&D Investor Briefing in November.

Disc. Held in RL (5%), not held in SM

Skipping straight to the outlook from CSL CEO Paul Perreault’s address in the AGM announcement this morning. FY23 Net profit after tax is expected to between $US2.4 billion and $2.5 billion, a growth of 10 - 14% on a “like-for-like” basis. Given the current macro outlook and the weakness in the stock market this week, that is music to my ears!

Disc: Held IRL (7%), SM (18%)

Outlook

Finally, let’s move our attention to the outlook for your business. Looking specifically at CSL Behring:

• We see a continued improvement in plasma collections and that is expected to underpin strong future sales growth for our marginal litre products, IG and Albumin;

• The higher cost of plasma is still evident and expected to prevail in Financial Year 23; and

• We are looking to replenish inventory to a level that gives us more confidence on our ability to meet patient need, and in a more cost-effective way.

For CSL Seqirus:

• Product differentiation will continue to drive strong demand for our influenza vaccines, particularly Flucelvax

Across the enterprise:

• We expect to continue to be faced with challenges in the external cost environment, whether that be inflationary pressures, staffing constraints or the logistics and supply chain challenges

In terms of guidance for Financial Year 23, I am pleased to reaffirm that:

• Revenue growth to be in the range of 7 to 11% over Financial Year 22 at constant currency

• With net profit after tax expected to be approximately in the range of $2.4 to $2.5 billion at constant currency.

• On a like for like basis, this represents a growth of between 10 – 14%.

This excludes CSL Vifor earnings and costs associated with the acquisition, as well as

non-recurring COVID vaccine contribution.

Updated Financial Year 23 guidance, including CSL Vifor, will be provided at the CSL Vifor market briefing on October 17th

As always, our forward-looking statements are subject to the usual disclaimers as mentioned at the start of this presentation.

To close, I am absolutely certain that the fundamentals of our business are strong and the diversity of our pipeline is rich. This really sets up CSL to build on our track record of sustainable growth for years to come.

Looks like SPP offer may come in under $255 barring big spike on Monday

Started looking into CSL to fill the more defensive part of my portfolio. Looking at the historical PE's their 5 year low is 31.1 and 5 year high of 42.9. Current PE of 33.7.

CSL are still spending > $1b on R&D

EPS are forecast to grow 10% this FY but only 2-3% next FY.

For a company that has grown EPS at a CAGR of 15% over the last 5 years and still investing a huge amount of $ in R&D I think the market is looking at the short term and not the opportunity that lies ahead for CSL.

Will continue on this over the weekend, just a few early thoughts.

18-Feb-2021: Half Year Results Announcement plus Half Year Results Investor Presentation

and: Statutory Accounts for the Half Year Ended 31 Dec 2020

CSL Delivers a Strong Half Year Result of $1.8 Billion* Net Profit

- CSL delivered a strong first half result for 2021 with reported net profit after tax of $1,810 million, up 44% at CC** reflecting:

- Solid growth in our core immunoglobulin portfolio led by HIZENTRA®

- Successful transition to own distribution model in China

- Strong growth in the leading HAE product HAEGARDA®

- Exceptionally strong performance by Seqirus

- CSL’s diversified portfolio and resilient business model in the midst of COVID-19 pandemic

- Full financial recognition of contracted income for UQ COVID-19 vaccine in first half, after program termination

- Earnings per share $3.98, up 44% at CC**

- Interim dividend*** of US$1.04 per share, up 9%

- Converted to Australian currency, the interim dividend is approximately A$1.34 per share down 9%

- FY21 net profit after tax is anticipated to be in the range of approximately $2,170 million to $2,265 million at constant currency

Notes:

- (*) All figures are expressed in US dollars unless otherwise stated.

- (**) Constant currency (CC) removes the impact of exchange rate movements, facilitating comparability of operational performance. For further detail please refer to CSL’s Financial Statements for the Half Year ended December 2020 (Directors’ Report).

- (***) For shareholders with an Australian registered address, the interim dividend of US$1.04 per share (approximately A$1.34) will be unfranked for Australian tax purposes and paid on 1 April 2021. For shareholders with a New Zealand registered address, the interim dividend of US$1.04 per share (approximately NZ$1.44) will be paid on 1 April 2021. The exchange rates will be fixed at the record date of 5 March 2021. All other shareholders will be paid in US$. CSL also offers shareholders the opportunity to receive dividend payments in US$ by direct credit to a US bank account.

--- click on links above for more --- [I hold CSL shares and believe they are one of the, if not THE highest quality company on the ASX.]

07-May-2020: New Debt Facilities to Strengthen Maturity Profile

Also (last month): 09-Apr-2020: Company Update on COVID-19 and 08-Apr-2020: Company Update on COVID-19