Recently we built up a large sum of cash in our IRL portfolios due to the Blundy-Itaoui acquisition of Best & Less (which has almost reached compulsory acquisition stage now, 90% of ownership).

Looking for somewhere to park the cash, I chose to invest in CSL shares. CSL is now in the Blue Chip dog house, closing at a 12 month low of $266.90. The share price has been going sideways for 3 1/2 years. I thought this might be a reasonably safe place to park a lot of cash with a 12 month horizon in mind. Hopefully I can still extract a bit of cash along the way (if needed) by selling a few shares.

Macquarie thinks CSL is a safe haven according to this article in the AFR from the 19th June - Macquarie’s seven stock picks to ride out weaker earnings - see excerpt below:

Safe havens

“Its advice is to stay defensive, even in the face of the recent downgrades from safe havens such as CSL, Amcor and ASX.

Macquarie’s analysis suggests (perhaps unsurprisingly) that cyclical stocks deliver the most earnings downgrades when forward orders fall and the economy slows. Media, discretionary retail, financial services, insurance and banks all typically experience double-digit falls in EPS when the economy enters a downturn phase.

On the other hand, sectors such as health, telecommunications, consumer staples and utilities experience either earnings upgrades or below-average downgrades.”

Since this article was published on the 19 June, CSL has fallen a further 6 per cent, from $284.44 to $266.90. So NOT so safe in the short term. It might fall further yet! The chartists might be suggesting you to get out of CSL now and buy back in when the share price goes above $320? (That never makes much sense to me).

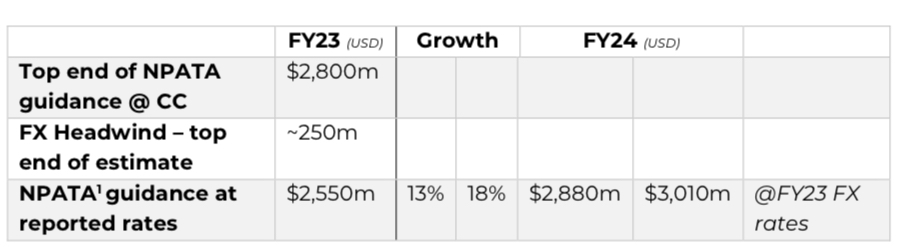

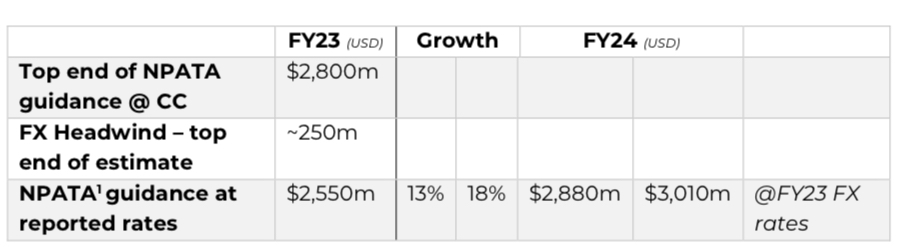

I am reasonably happy with the guidance for 2024 (NAPTA up 13% to 18% on the market update on 14th June) and they haven’t hit their straps yet with the Vifor acquisition.

Most Brokers think there might be some upside to CSL according to the commentary by Bronwyn Allen on The Motley Fool yesterday:

“Macquarie has an outperform rating on CSL shares with a $326 price target.”

“Morgans believes CSL shares are “poised to break out this year“.

The broker has an add rating and a $323 share price target for CSL.

Morgans says:

A key portfolio holding and key sector pick, we believe CSL is poised to break-out this year, a COVID exit trade, offering double-digit recovery in earnings growth as plasma collections increase, new products get approved and influenza vaccine uptake increases around ongoing concerns about respiratory viruses, with shares offering good value trading around its long-term forward multiple of ~30x.”

“The most bullish of the bunch is Citi. It has a buy rating and a 12-month price target of $340. This implies a 27% potential upside on the stock.

This actually represents a cut in Citi’s share price target following CSL’s recent update, which revealed currency headwinds for the company, given it reports its earnings in US dollars.

Citi was previously tipping $350 per share by the end of FY24.

There is still the threat of a US recessionin FY24, which of course, isn’t good for US shares or ASX shares.

But Morgan Stanley points out that US healthcare stocks have outperformed the market by an average of 13% during the past four recessions.”

The consensus share price target from 18 analysts on Simply Wall Street data is $324, which represents an upside of 21%.

Now all the analysts could be wrong. CSL is a complex global roll-up. I’m not even going to attempt to value it given there are hundreds of others who are more skilled than me already doing just that. Most think CSL is worth more than it is selling for now, and I don’t think it is going broke any time soon. So I think it might be a reasonably safe place to park a lot of cash for 12 months or so.