Let me start by saying that I think CSL is easily one of the best companies on the ASX. I think the business will survive, and thrive, for many more years to come.

And, as with Resmed, I think any impact from Ozempic and related drugs is likely overstated.

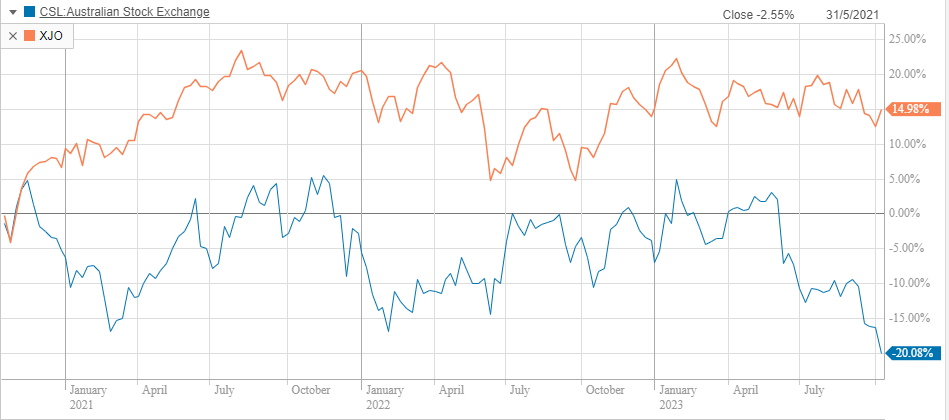

But I do think this is (potentially) a lesson in how you can get fairly ordinary results as an investor even if you buy into a great company. In fact, over the last three years, "ordinary" is putting it mildly when you compare CSL to the wider market:

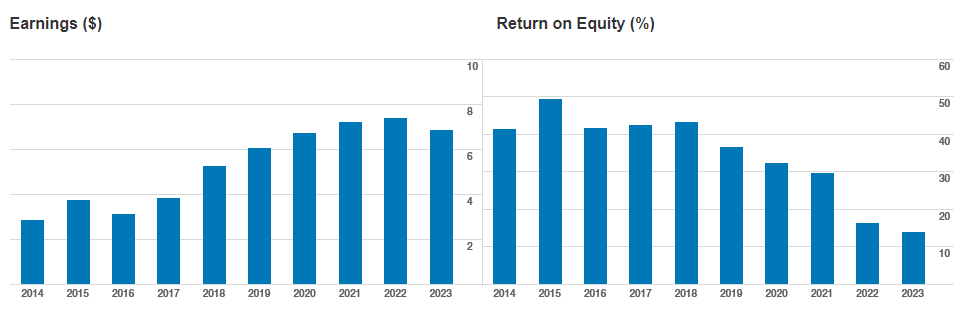

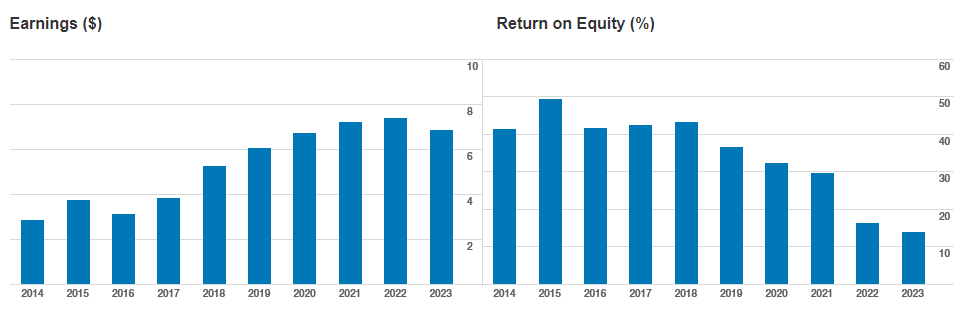

Everything is easy in hindsight, but this is what happens when a company priced for strong growth doesn't deliver. Per share earnings growth and Return on Equity in recent times haven't been great:

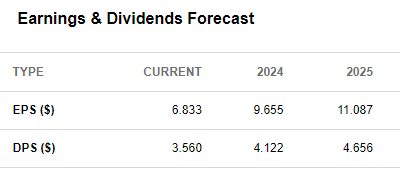

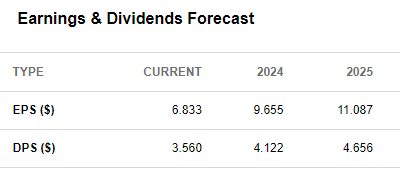

The reasons behind this are far from existential, of course. And it's worth noting that the consensus forecast for FY25 EPS is $11.08 -- 62% higher than FY23! But at the start of 2020 the forward PE was 43x

This was rationalised at the time by:

- Low interest rates

- Strong growth expectations

- High quality

Remember, interest rates (as defined by US 10year treasuries) were 2% and heading lower in early 2020. Things, as we now know, turned out differently. Lower for longer just didn't turn out to be the case...

Likewise, COVID impacted collections and margins, so the growth wasn't as strong as was initially expected.

My point is that at a PE of 42x, there was very little room for error. No one could have predicted covid or what global interest rates were going to do, but the company itself was telling investors in 2020 that they expected 2-7% EPS growth -- which is nothing to sneeze at for $120b company (and they actually beat that guidance!). But a PE of 42x?

This was always my issue. Yes, i'll hasten to add that high quality companies deserve a premium. It's not sensible to expect CSL to trade at a PE of (say) 15. But you are always going to sail into the wind at those kind of multiples -- unless you can realistically expect super strong growth.

Put it this way, to overcome a PE compression of 43 to 35 (and remembering that a PE of 35x aint exactly low!), EPS needs to grow at about 19% just to keep the share price steady.

Anyway, that was then and this is now. And now we (still) have a super high quality company, whose earnings are expected to grow strongly but the PE is now on a forward PE of 25

NOW things are getting interesting!

Thank god the market is anything but rational.