Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

I wondered whether yesterday's announcement from $CSL marked the first sign of the change in R&D Stratgey, following on from the recent shake-up.

Having read @Jimmy's daily newsfeed, it seems I am not the only one: the relevant extract follows, with emphasis added by me.

2248 GMT - CSL's collaboration agreement with closely held VarmX to advance a blood-coagulation treatment signals the start of a new R&D philosophy for the Australian company, according to Jefferies. CSL aims to focus on development by buying assets into its pipeline. VarmX owns the VMX-C001 treatment that aims to restore blood coagulation in patients taking a FXa inhibitor. "We believe this could be an adjunct to CSL's Kcentra franchise, and if successful will compete with Andexxa," analyst David Stanton says. Jefferies estimates annual peak sales for VMX-C001 of some US$240 million. It retains a "buy" call on CSL. ([email protected]; @dwinningWSJ)

Looking back over the last 10-15 years, the lion's share of $CSL's innovation capital has either been organic R&D or buying entire businesses/platforms (think Sequirus and Vifor).

Of course, there are exceptions. For example, Hemegnix is an example of successfully licensed molecule. And there are others.

But on balance, I think it is fair to say that $CSL has been lighter on licensing than industry peers, where (if I recall correctly) something like one-third of NDA candidates are brought through the pipeline from origins in licensing or single molecule acquisitions.

With its now narrowed therapy area focus, it makes sense to me that $CSL allocates more capital to licensing or acquiring the most promising molecules wherever they come from. Such a more balanced approach is also reasonable given some of the recent failures of late stage organically-developed candidates(e.g., CSL112). However, that said, even for a licensed product, $CSL management will need to make the key decision on whether to advance the product through the later and most expensive stages so, while interesting and while licensing can augment the organic pipeline, it doesn't change the importance of effective decision-making along the development funnel.

Beyond that, it is hard to read much into yesterday's announcement, apart from the clear fit of VMX-C001 into the $CSL portfolio.

As might have been predicted, $CSL's SP has continued to fall about 10% since I took my initial modest stake. The set-up is looking good for R&D Day in November, after which I will decide whether to take a bigger bite. The hurdle is getting lower!

Disc: Held in RL and SM

Global plasma products leader $CSL announced their HY results today.

Their Headlines

- Revenue $8.48 billion, up 5% at CC

- NPAT $2.01 billion1 , up 6% – NPAT $2.04 billion1 at CC, up 7%

- NPATA $2.07 billion, up 3% – NPATA $2.11 billion at CC, up 5%

- NPATA earnings per share $4.292 , up 3% – NPATA earnings per share $4.36 at CC up 4%

- Interim dividend of US$1.30 per share – Converted to Australian currency, the interim dividend is approximately A$2.08 per share, up 16%

- Guidance reaffirmed – FY25 NPATA anticipated to be in the range of approximately $3.2 billion to $3.3 billion at CC, up approximately 10-13%.

My Quick Analysis

Having exited $CSL last year, today's result confirms my thesis - strong Behring (+10%) already baked into the SP, lack lustre Sequirus (-9%), and only modest growth in Vifor (+6%)- an acquisition that was overpaid for.

Vaccinations in the US were a big driver of the weakness in Sequirus.

Top line performance wasn't helped by cost management. While R&D was lowever (given the end of the 112 program; but committed to spend normal levels of R&D as % revenue for FY), G&A blew up by 27% (driven by "one off projects") and even sales and marketing at +7% grew faster than revenue (+5%).

Behring continues to do the heavy lifting and I think we just aren't seeing the weight of growth from new products sufficient to meet the maturing portfolio and competitive/business environment headwinds in Vifor and Sequirus, respectively.

Going into today's results, most analysts had a very different view to me, with the TP consensus some +20% ahead of the SP. The gap seems to be widening, with the SP down -4% at time of writing.

$CSL's lacklustre performance is starting to challenge the notion of value even at the declining P/E of 25. While FY guidance is being held to (due to approvals, expected launches, and some material vaccine orders which should help H2), even at sub-$260, I don't necessarily see value here.

Are the analysts just seeing what they want to see here (driven by memories of glory days), or will we now start to see some PT downgrades drive by reality?

Glad to have called this one early, and it will be interesting to see if the R&D pipeline is sparking back to life at the R&D day later this year. Don't get me wrong, even as a maturing business, Behring is a powerful engine, and at some point $CSL could present value again. So I continue to watch.

Disc Not Held

CSL Have announced their 1H results with conference call later this morning.

Their Highlights

• Revenue $8.05 billion, up 11% at CC3

• NPAT $1.90 billion, up 17%

• NPAT $1.94 billion1 at CC, up 20%

• NPATA $2.02 billion, up 11%

• NPATA $2.06 billion at CC, up 13%

• NPATA earnings per share $4.182 , up 11%

• NPATA earnings per share $4.26 at CC up 13%

• Interim dividend5 of US$1.19 per share (Converted to Australian currency, the interim dividend is approximately A$1.81 per share, up 12%)

• Guidance reaffirmed – FY24 NPATA2,4 anticipated to be in the range of approximately $2.9 billion to $3.0 billion at CC

My Analysis

Pretty good results, which as far as I can see are broadly in-line with consensus. $CSL are sticking to FY guidance of 13%-17% NPATA Growth, and 9-11% CC revenue growth.

The stand out is Behring where revenue grew 14%, while Seqirus experienced a "challenging season" with only 2% growth. There's no PCP comparison for Vifor, so need to look at that.

There will be a short update on R&D. Key milestones ahead in the short terms are HIZENTRA (3Q - first phase 3 data) and Garadacimab (4Q first approval expected)

Disc: Held

I'm just out of $CSL's capital markets day and, as ever, the deep dive into each of the three businesses and the R&D portfolio always leaves me in awe of what a tremendous business this is and the breadth and depth of talent on the management team. There are too many moving parts to summarise the day effectively and, I work on the basis that anyone who was so motivated would have been there anyway. So, instead, I'll pull a few selected slides from the deck with a brief explanation of what they said to me.

My Key Take Aways from the Day

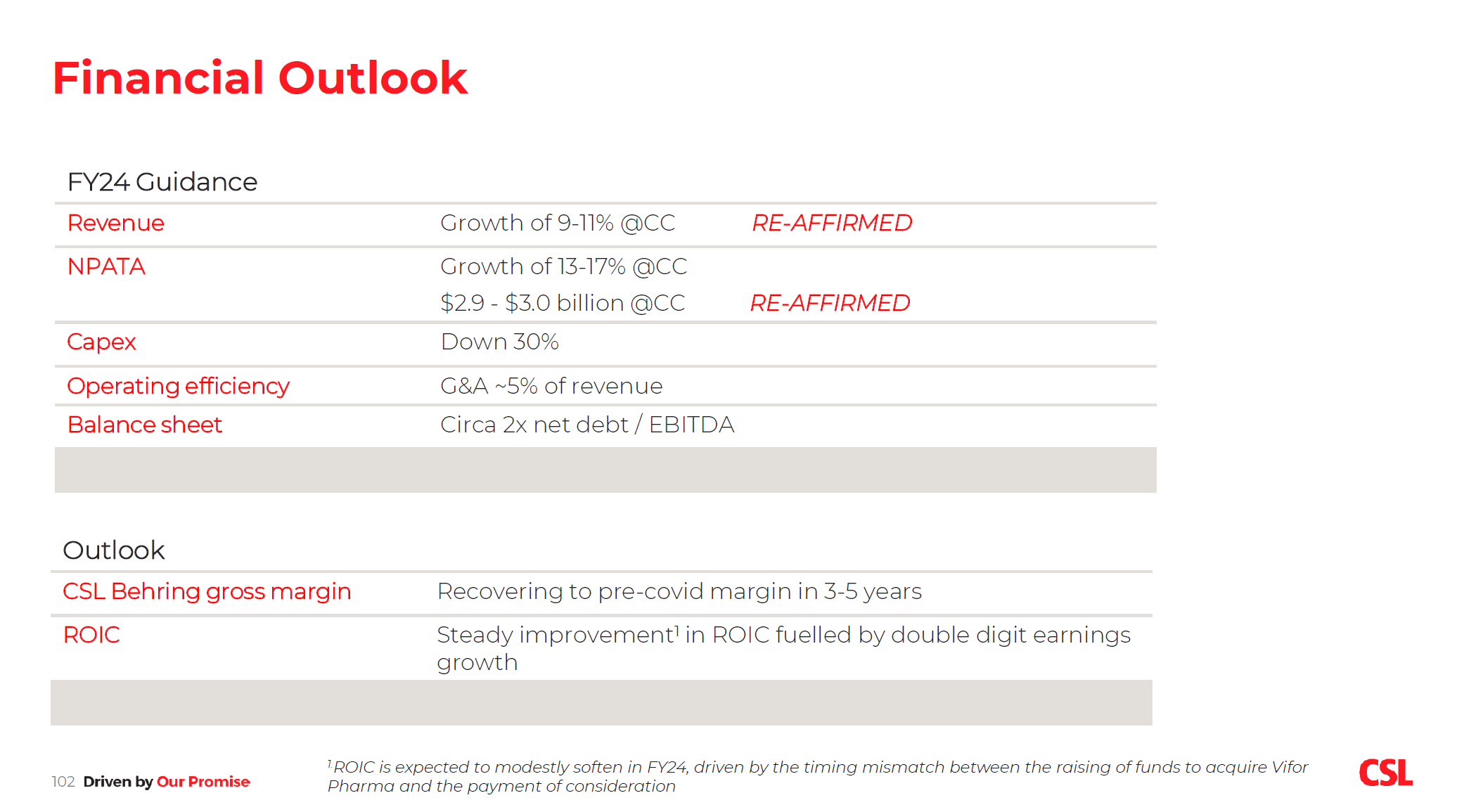

- $CSL will sustainably grow earnings at double digits annually for the foreseeable future. FY24 guidance was re-affirmed.

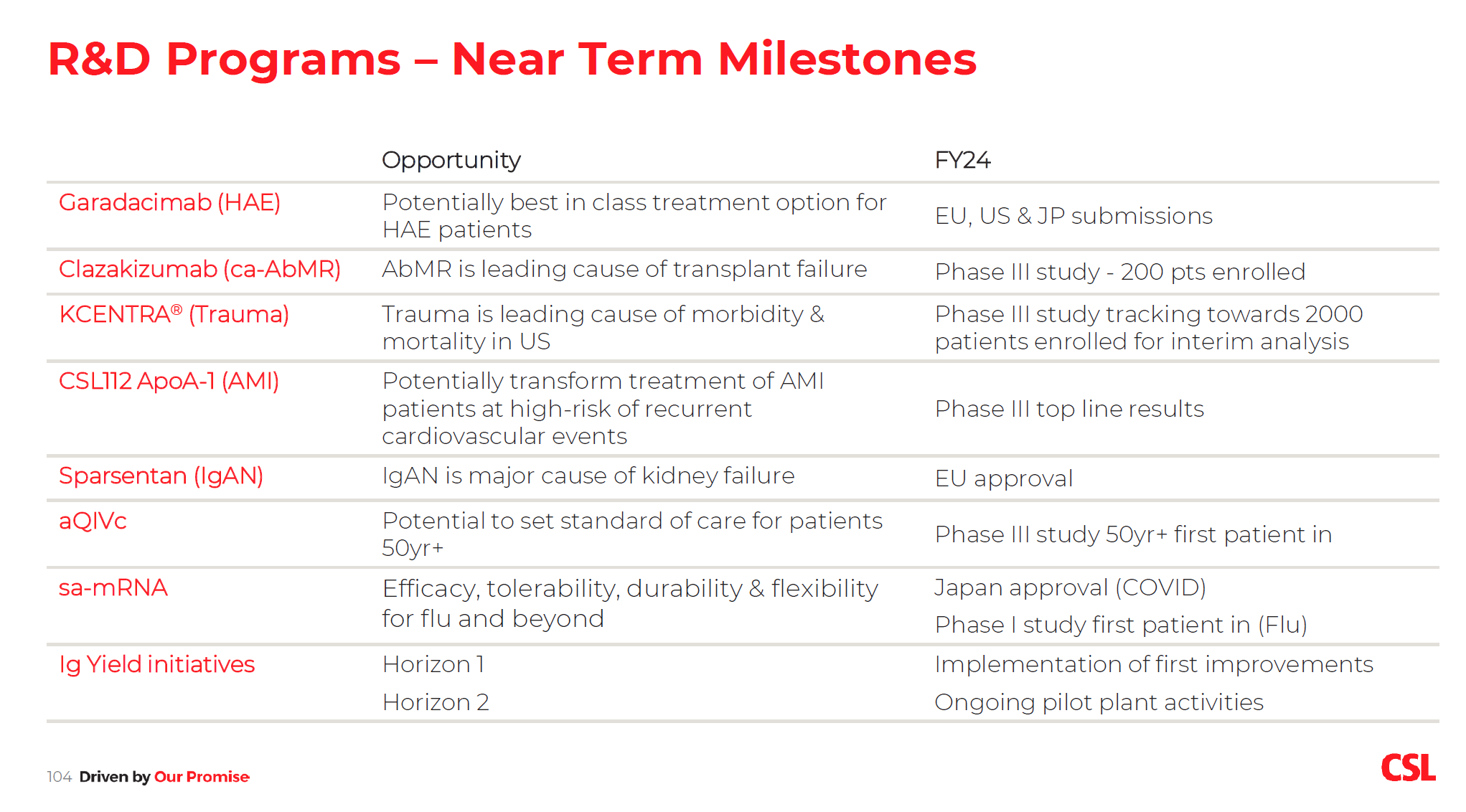

- It continues to sustain its R&D pipeline with new discoveries, with several exciting near-term, late-stage milestones for FY24

- Gross margin and ROIC will progressively improve year on year over the coming 3-5 years or so, driven by a program of efficiency improvements to drive plasma recovery, a period of 3-years of reduced capex and debt moving back to 2 x EBITDA by EOFY24.

- Overall, revenue will be driven by the tailwind of ageing populations in developed markets; label expansions of the existing portfolio; growth of recently launched products; and new approvals expected.

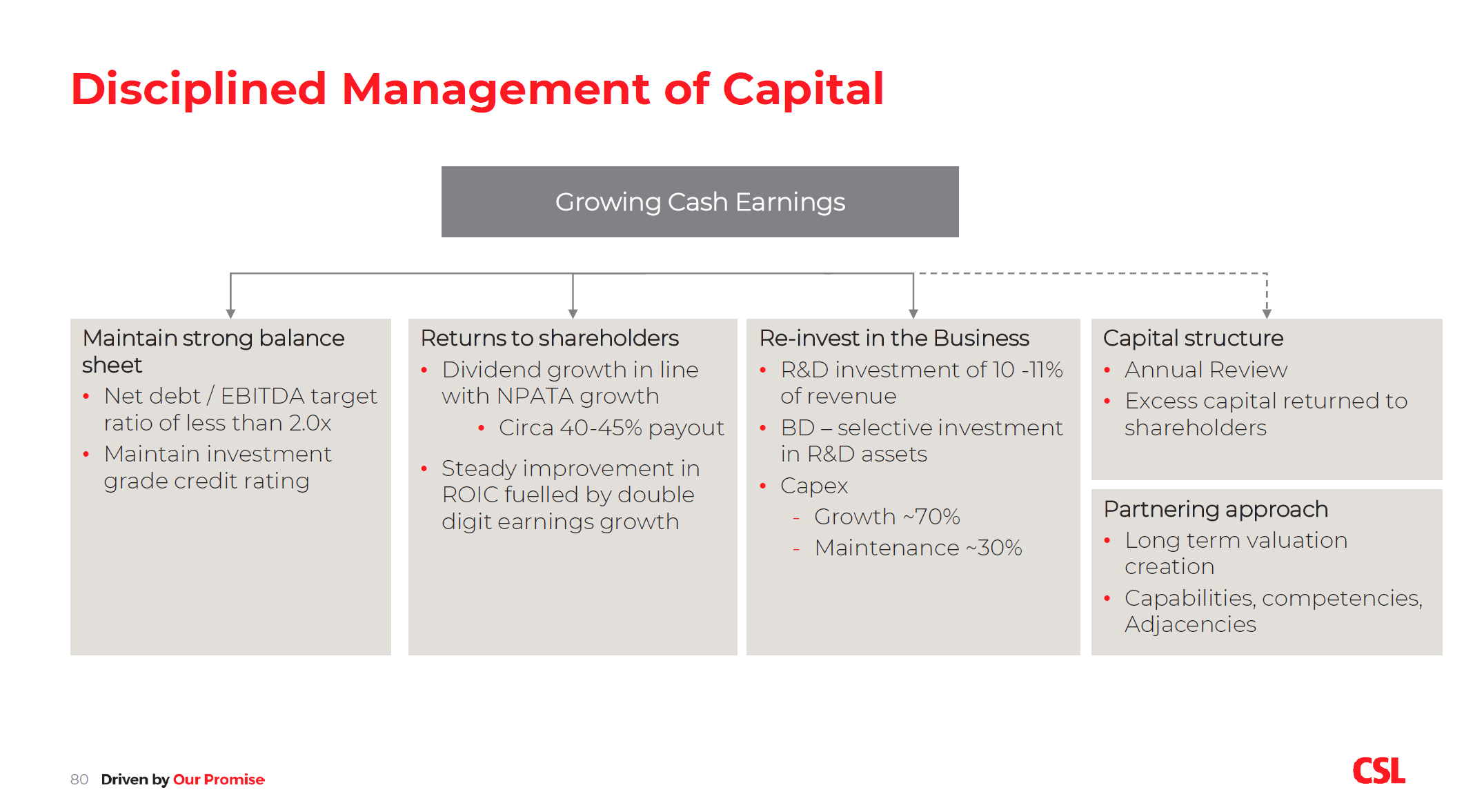

- The company has a framework for disciplined capital allocation, focused on sustaining growth while increasing shareholder returns over time

Today was Paul McKenzie's first outing as CEO for Capital Market's Day. He did a good job topping and tailing the day, supporting his team in the Q&A, and letting the team do the heavy lifting as you'd expect. As far as I am concerned, he did a good job and the first test will be meeting or beating FY24 guidance.

Capital Discipline

I start with Fig.1 the framework for capital discipline presented by CFO Joy Linton.

Figure 1

$CSL continues to invest strongly for growth. The next several years will be some transitionary points:

- A progressive return to pre-COVID %GM in the plasma business, with a promise to grow margins beyond these levels as a result of a range of investment in IT and manufacturing technology to reduce CPL (costs per litre) at the collection stage and increase plasma yield through manufactuing. This isn't something that just happens, and the team outlined some of the details of improvements being made in the collection centres and in the plasma extraction processes.

- A reduction in capex of c. 30% over the next three years. This follows the completion of a major program of new facility investments over recent years

- NPATA growth allowing the debit required for the Vifor acquisition to be reduced back to the target level of < 2 x EBITDA - a conservative position that should retain investment grade credit rating.

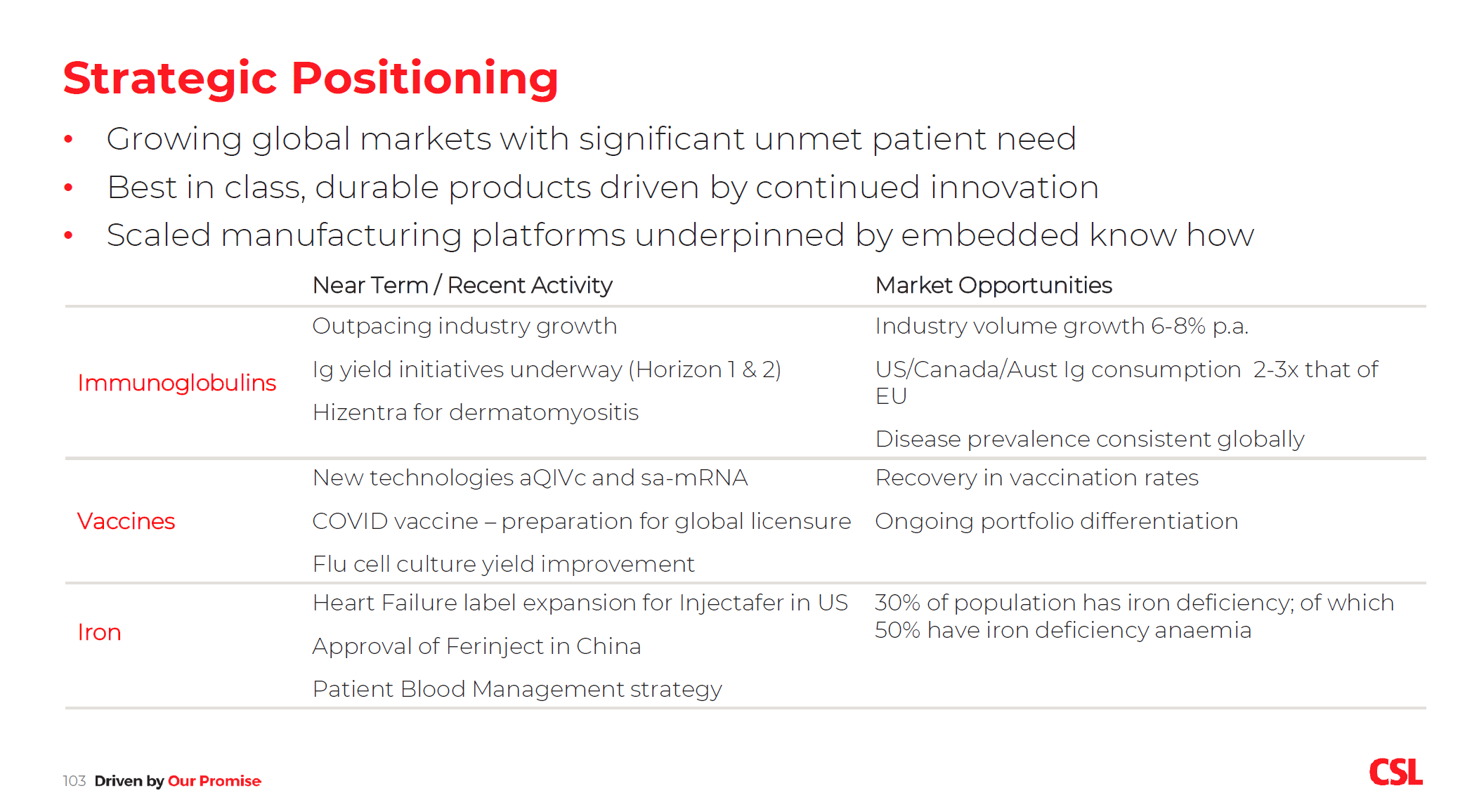

Revenue Growth

$CSL expects to grow strongly across all its businesses. The positioning of each of the three businesses and the market opportunities are summarised in Fig. 2.

Importantly, many of the conditions for $CSLs treatments are related to ageing, so there remains a long-term trend of ageing over the coming decades in developed markets, then to be followed in the future in the middle income countries. Even in developed markets, there is a significant variation in uptake of $CSL products, so there is significant opportunity in driving product use to a more uniform adoption of the standard of care in the most advanced markets. New indications for existing products come on top of that.

In summary, there are many levers for growth offset of course by competition and new tharapies, of which GLP-1s are just one of many.

Figure 2

Although the story for Iron (i.e. Vifor) was perhaps less confident (from my perspective) with indications that progress may be lumpy, this is more down to the uncertainty of how rapidly the growth of Injectafer will take off following approval for Heart Failure in the US and the approval of Ferinject in China, offset by the launch of generic competition from Sandoz (CEO Paul McKenzie emphasised that generic competition was in the acquisition case, but I sense that with the manufacturing challenges of the drug, Sandoz has perhaps been a bit faster out of the blocks than expected).

Of course it is important to remember that adding treatments for renal failure and CKD complements $CSL's other therapy areas, so Vifor is as much about building capability as it is about buying a portfolio of drugs. CFO Joy Linton summed it up when she pointed out that CSL's prior acquisitions have usually taken several years before their promise has materialised, pointing to the 3 years it took for the value of Sequirus (acquired from Novartis) to show through.

We've recently heard how $CSL has been in the gun sights from analysts and commentators from GLP-1 FLOW clinical trial. Head of R&D Bill Mazzanotte addressed this in his opening remarks. He pointed out that cardi-vascular diseases are of a "multi-dimensional and complex nature". By this, he means that there are many diseases within the category, and for each disease there are many indications according to patient profile, disease type and stage of advancement. Reflecting on the hype around GLP-1s, Bill pointed out that 25 years ago Statins were emerging and commentators were saying that would be the end of cardiovascular disease and the existing drugs that treated them. "It didn't happen," he said. He further added that there are many drivers of renal disease, and that weight is not an independent driver (a bit like we've debated here on OSA). While he accepted there will be an impact he considered it to be a small impact on a small part of the portfolio. He summarised by saying "I am proud of the scientists who have done the work. I am grateful that patients have a new opportunity. But I am confident of our product and R&D portfolio."

From that respect, today was good for my general well-being. Having a day immersed in the CSL portfolio reminded me (as a non-clinician) just how complex and multi-faceted disease is, and how vast the array of treatments and modes of action are. It is highly, highly unlikley that any one mode of therapeutic action is going to be a "silver bullet."

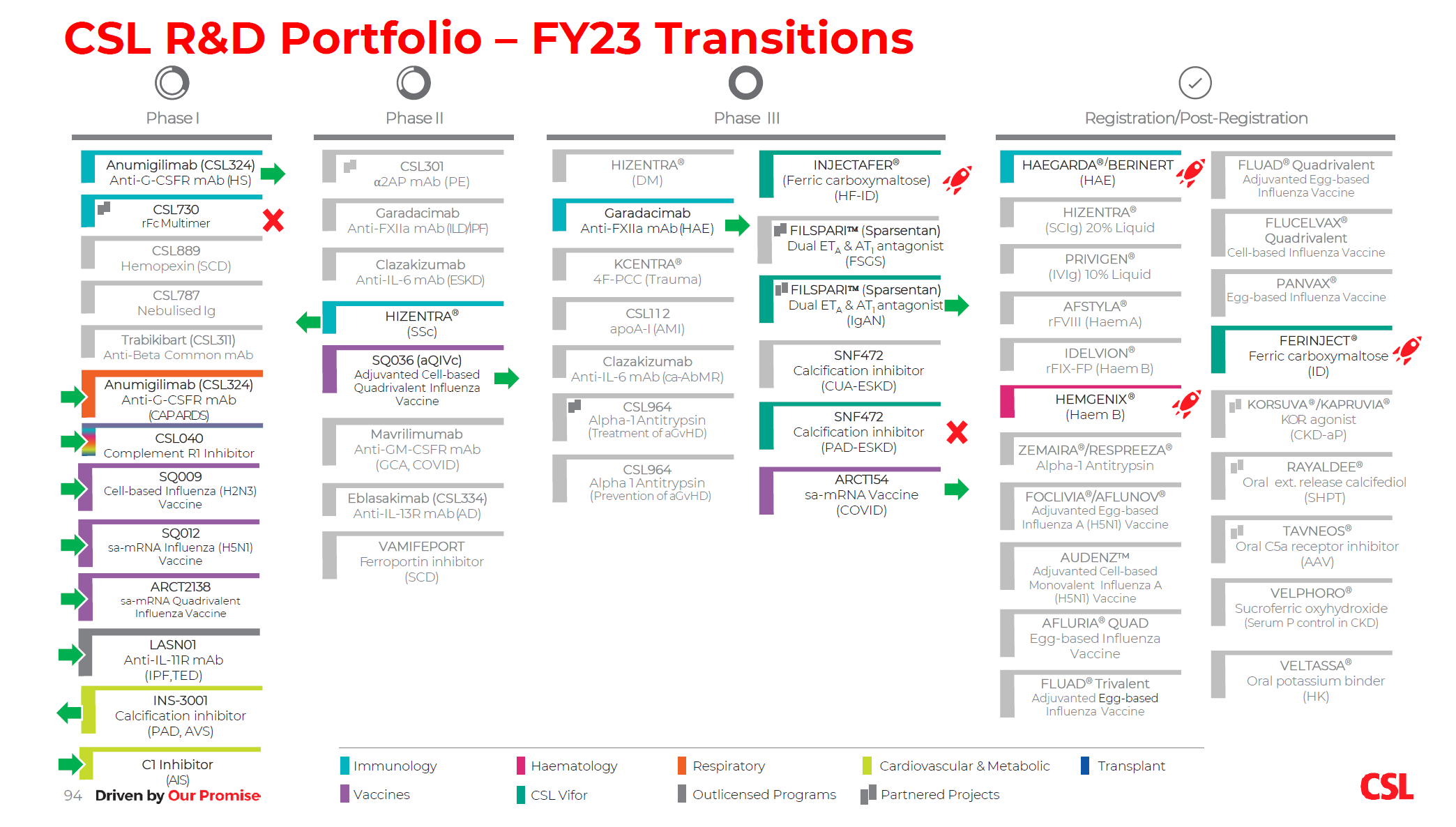

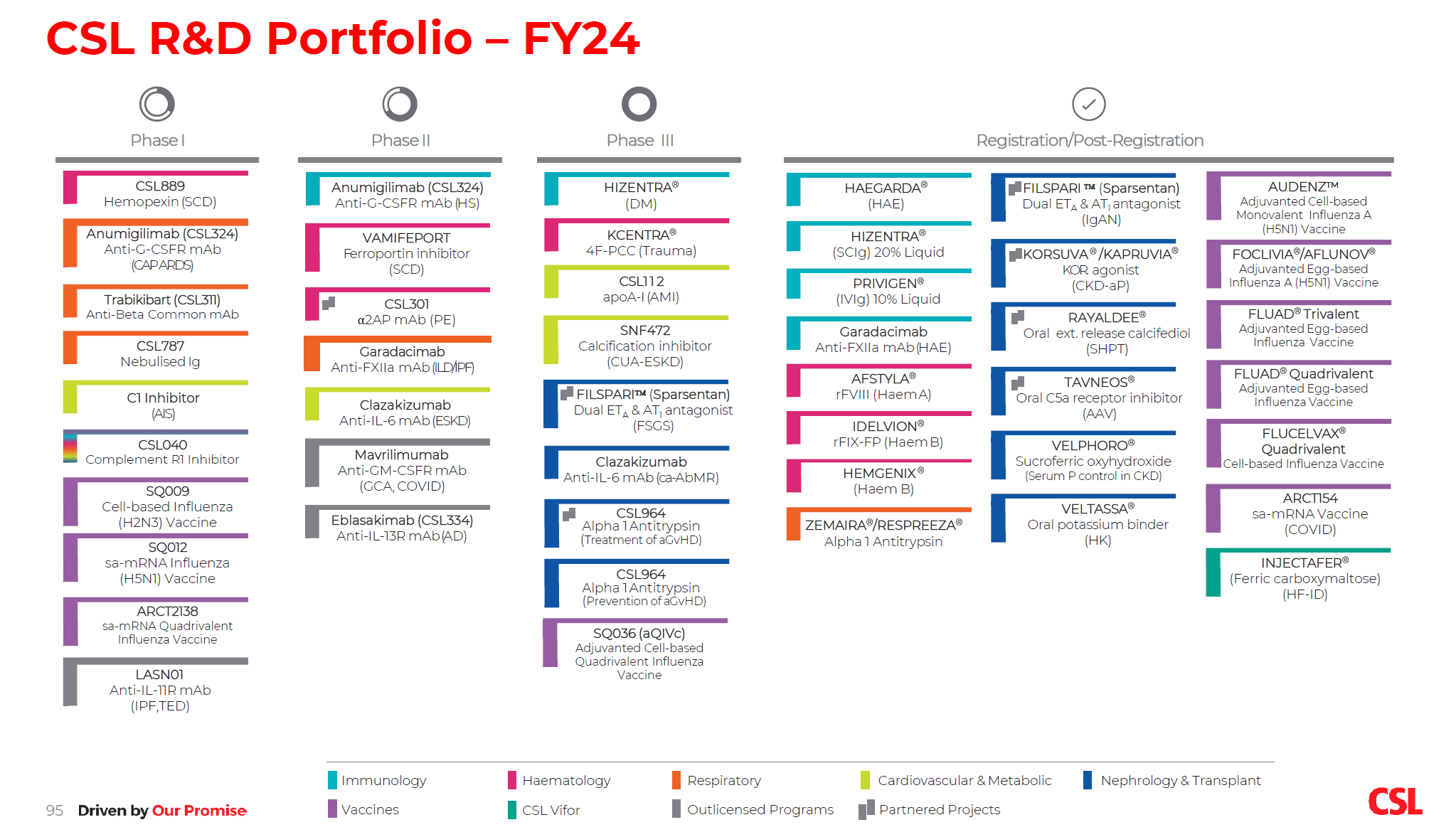

R&D Portfolio

Bill Mazzanotte gave an update on R&D. At the headline level, several new candiates were added to the Phase 1 pipeline from different CSL "platforms" across the therapy areas; several drugs advanced throught the pipeline; and several candidates were dropped. Fig 3 shows the FY23 progress in the R&D portfolio and Fig 4 shows the updated portfolio and fig. 5 shows the key expected milestones for the next three years. (I'll be interested to read some of the broker notes on this, particularly GS, whose global healthcare desk will no doubt do a detailed analysis, considering similar developments across the competition. That's more than I can ever do! Chris Cooper asked several questions during the day, so I am sure there will be an update.)

Figure 3 FY23 Progress

Figure 4

Figure 5 FY24 R&D Milestones

Key milestones are Garadacimab approvals decisions, and Phase III results of CSL112.

Articificial Intelligence and IT Generally

Chief Information and Digital Officer Mark Hill gave a short and interesting presentation of how $CSL is using IT to drive value both in R&D and Operations.

Mark who is a IT veteran of four decades in industry made the following remarks which stood out. First "AI is here to stay, and it is bigger than the internet" and second, it is "difficult to harness because the speed of innovation is faster than anything we have seen."

However, this wasn't a buzzword-hype presentation. On the contrary, Mark gave practical examples of the kind of things that $CSL are applying generative AI to, and they have even built an internal accelerator to innovate, test and then deploy useful applications. ("No one need write meeting minutes again")

I'm calling out this segment because I think across industries, AI - like digital before it and ongoing - will lead to capabilities that the best companies will figure out how to use, and then gain benefits from so doing. Some will succeed, others will be left behind.

And as @Strawman said in the last episode of Baby Giants podcast, if I recall correctly, in quoting Warren Buffet, AI will be like attending a parade, where some stand on a box to get a better view. But eventually, everyone is standing on a box, so no-one has a better view.

From a competitive perspective, however, some get on taller boxes and they get up earlier. From today's presentation it looks like CSL is taking this seriously and is unlikely to be left behind.

Guidance Re-Affirmed

I guess the good news about today is that there was no bad news. Guidance is intact, and the team sounds like they have clear plans in place to drive forward on the margin improvements that are under their control.

Figure 6; Guidance Re-Affirmed

I started my career in industry working in big pharma over 30 years ago, and attended many management updates on the progress of the commercial and R&D portfolios. Today felt strangely familiar. $CSL is a global leader taking stock of where it stands, and laying out its plans to continue to grow more strongly than the industry. I'm pretty confident they will continue to succeed and was impressed by each of the presenters today. This is a business that doesn't depend on single CEO and I've no doubt that anyone of the key executives presenting today could take the ship forward if they needed to. That said, Paul McKenzie did a good job, and came across as a very competent team captain.

Disc: Held in RL and SM

$CSL out today with an adjustment to guidance stating that "currency headwinds" have increased from US$175m estimated at HY to US$230-250m today.

Reiterated their preferred measure of NPATA, stating that results expected to come in towards top end of guidance of $2.7-2.8bn, and that NPATA growth to FY24 would be 13-18% of US$2.9-US$3.0bn cc.

From the wording of the announcement, it looks like they are trying to guide some analysts who have been shooting a bit high.

Listening to the various commentators on CSL there are strong expectations of return to favourable plasma collection dynamics, contributions from Vifor, operational efficiencies, and progress on new products. Some are stating that they believe that after the SP having tracked sideways more or less over the last three years, FY24 is going to be the next "breakout year". So that perhaps explains the negative initial reaction of the market to the result, trading anywhere from down 6-8% this morniing.

Of course, currency headwinds can also turn to tailwinds, and SP of this growth stock has been stifled in the higher interest rate environment. During FY24 and FY25 as we potentially tip into the next phase of the macro cycle, we could indeed see the drag effect of these macro factors reverse and reinforce the underlying operational strength of the business. So there is a logic to being patient.

Based on my model, 3 yr earnings growth of 19% CAGR makes the current forward P/E 40 a bit steep for me to be adding any more, although I always ask the question when the market offers this mini-pullback opportunities.

I didn't make the investor call, but will scruitinize the transcript to see if there is anything else, although I doubt it as they are pretty careful in what goes in the release, and tend not to "freelance" in the Q&A.

Disc: Held in RL only

Yesterday I gave a brief report on the $CSL Vifor briefing, concluding that overall the information shared did not significantly impact my view on valuation. https://strawman.com/reports/CSL/mikebrisy?view-straw=20145

Overnight, it appears the analysts largely agree, based on their target price adjustments:

- Goldman Sachs unchanged at $291 (Neutral)

- Citi unchanged at $340 (Buy)

- Credit Suisse unchanged at $304 (Neutral)

- Macquarie unchanged at $329.50 (Outperform)

- Morgans reducing to $312.20 from $321.30 (Add)

All but GS are from the FNArena Broker Database.

Looking at market consensus = $328 (n=16, range $281 - $376), the discount of current SP of $276 to consensus is -16%. (Source: marketscreener.com)

$CSL is one firm where I don't think I can get a better handle on valuation than the big investment houses. The biggest research teams are well-resourced, read across competitors, study clinical trials reports and regulatory approvals, analyse pricing and reimbursement. For me, investing in a company like $CSL is about picking the right time to add a long term growth stocktaking into account all views.

$CSL rarely trades at this discount to consensus. Given the re-opening of both plasma collection and dialysis cycling through the next round of results, there will likely be upward pressure on share price to close gaps to targets. This will particularly be true if we start to see a moderating of inflation over next 6 months. Of course, some of the higher targets may be moderated over time if results don't shoot the lights out. So arguably, there is room for disappointment. Even so, this looks like a very good entry point.

Personally, I'm not buying more $CSL as it is at 5% of my RL portfolio. Happy to keep it there, and will revisit this based on the the R&D Investor Day in November.

https://newswire.iguana2.com/af5f4d73c1a54a33/csl.asx/3A604660/CSL_CSL_Vifor_Market_Briefing

This morning CSL held their investor briefing on the $12bn Vifor acquisition, updating their forecasts to now reflect Vifor as a segement within the business. Overall revenue growth guidance was unchanged, with the exception of signalling directional changes for non-US contributions weakening due to US$ strength. There is also a higher cost of debt associated with the acquisition due to rising interest rates.

Overall, while there is the prospect of generic competion for the core iron injectible product, this is offset by the complexity of the manufacturing process and relatively low market penetration, as well as the strong pipeline of recently launched products being rolled out and strong clinical development pipeline.

CFO Joy Linton communicated changes to how CSL will report in the future, reporting GM less sales and marketing at the segment level (Sequirus, Behring and Vifor), with R&D and G&A now to be reported only at Group level.

For me, the value of the briefing was that it explains how the Vifor and CSL combination strengthens capabilities both in therapeutic knowledge, R&D including clinical development and market footprint. On the latter, several of the Vifor products already in the market and in last phase clinical development can expect to experience enhanced growth from the much larger CSL market footprint.

CSL is comprehensively covered by brokers, so it will be interesting to watch the various research notes and updates coming out over the next few days. While I don't have my own CSL model, nothing I heard leads me to expect big swings either way.

At the moment CSL SP appears weighed down by i) impact of higher interest rates ii) expectations of margin pressure iii) weaker contribution from non-US due to currency impacts offset by return to pre-COVID activity and growth in plasma. Re-opening also a positive impact on the dialysis segment which is a value driver for Vifor.

A recording of the webcast will be available later today on www.csl.com. It is about one hour of presentation and an hour of analysis Q&A.

Next stop is the R&D Investor Briefing in November.

Disc. Held in RL (5%), not held in SM

Post a valuation or endorse another member's valuation.