Here you go.

=============

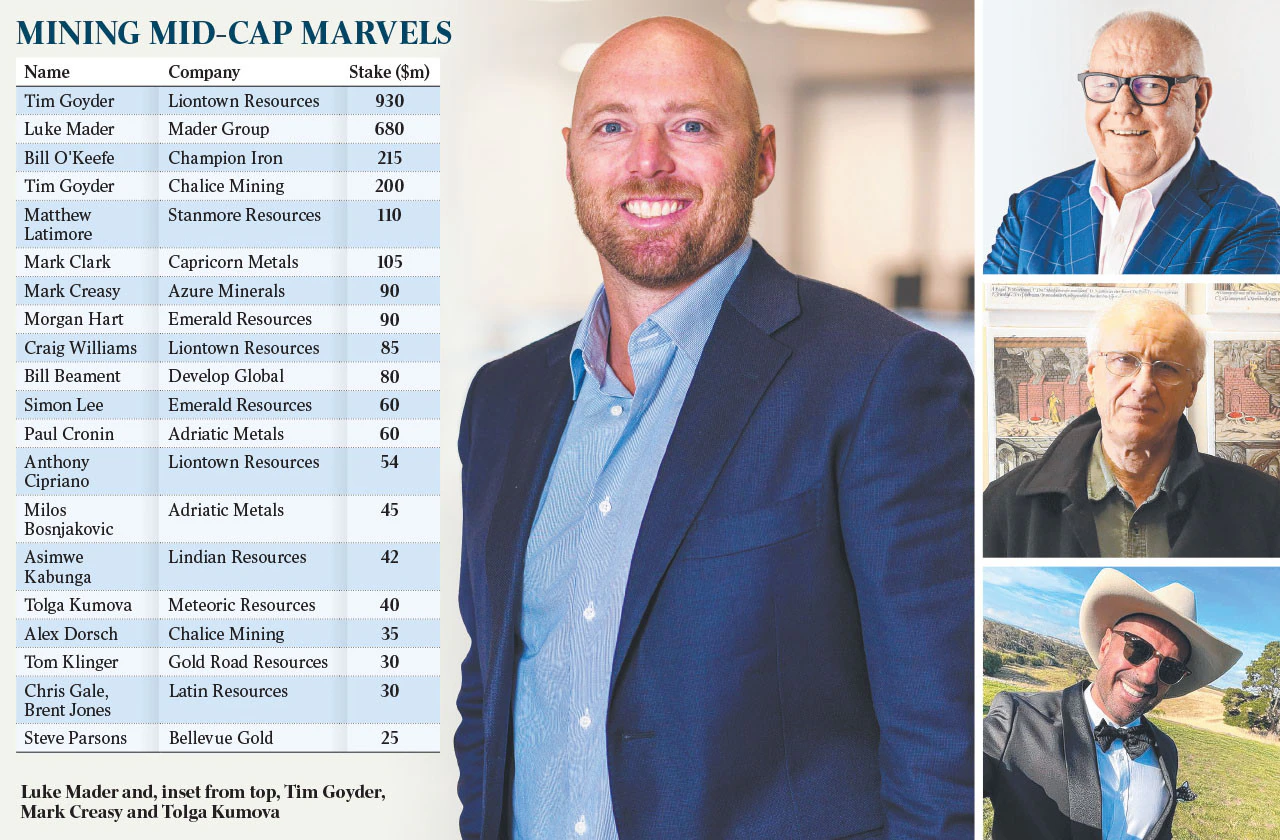

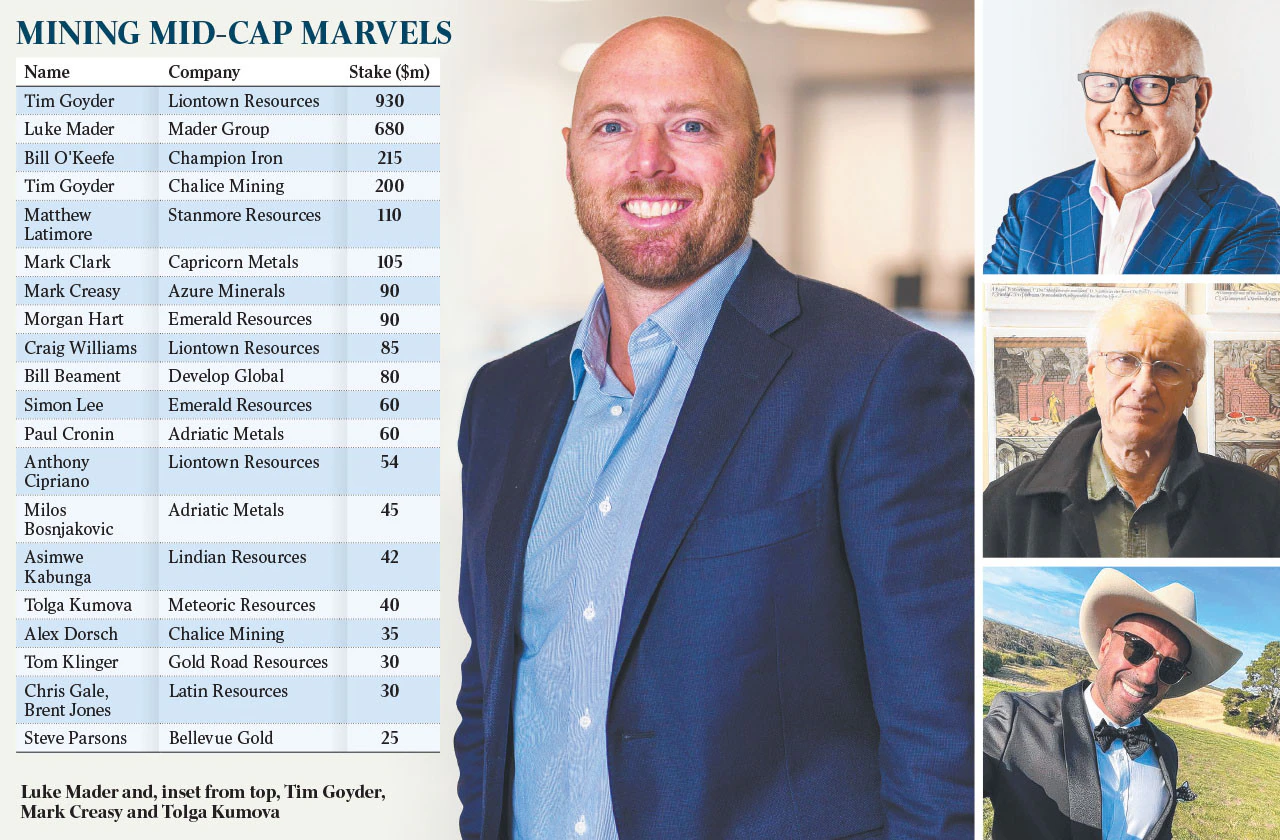

Australia’s newest mining magnate is a little-known 42-year-old former apprentice diesel mechanic who has quietly overseen one of the most successful ASX floats in recent years.

Luke Mader, the founder and executive chairman of mining services company Mader Group, runs one of the hottest mining stocks in a sector that has performed spectacularly for investors this year.

Shares in Mader Group, which floated on the ASX in late 2019, are up almost 70 per cent since January 1 and have surged 154 per cent in the past 12 months alone.

Mader holds more than 50 per cent of his company’s stock and now has a stake worth about $680m on paper – which would be easily enough for him to debut on the next edition of The List – Australia’s Richest 250, published by The Australian.

Mader Group shares are worth more than six times the $1 listing price when it hit the ASX in September 2019, when Mader and his non-executive director Craig Burton raised $50m from investors in what was a $200m float.

The business is on track for $580m revenue and at least $37m in net profit for the 2023 financial year, with 2500 employees in eight countries servicing heavy mining equipment and providing other services to customers such as BHP, Rio Tinto, Fortescue Metals Group, CITIC Pacific and other big names.

All of which is a far cry from when Mader was an apprentice with WesTrac servicing Caterpillar trucks, diggers and tractors across northwest Western Australia. He launched his own business in 2005 in the Kimberley with a ute, tools and $20,000 in savings.

“As a young bloke, I thought it was just a big adventure; we got to go to a lot of different sites, meet a lot of people and fix their gear. It was a good job,” Mader told The West in 2019 before Mader Group floated.

The group has recorded 11 consecutive quarters of record revenue growth, most recently announcing $155m revenue in the March quarter and earnings before interest, tax, depreciation and amortisation of $17.7m.

“Each quarter I am continually impressed with the group’s ability to achieve compounding financial results whilst remaining laser-focused on safety and culture. The group’s revenue growth of 59 per cent versus the (previous corresponding period) is exceptional and a testament to our strong, culture-led business,” Mader Group chief executive Justin Nuich said in April.

When it comes the ranks of Australia’s wealthy elite, the mining industry has long been represented by the likes of Gina Rinehart and Andrew Forrest (and more recently his wife Nicola Forrest), and their fellow billionaires such as Mineral Resources boss Chris Ellison and Liontown Resources chairman Tim Goyder.

But Mader is just one of dozens of executives and shareholders of mid-cap mining marvels that have struck paydirt in the past year. In particular, lithium, rare earths and gold stocks have surged in value and have their bosses and board members suddenly sitting on huge paper fortunes in companies that have had little mainstream attention.

Take rare earths explorer Meteoric Resources, which has a project in Brazil and counts Gerry Harvey, the billionaire proprietor of retail giant Harvey Norman, and mining identity Tolga Kumova among its major shareholders.

Meteoric shares are up about 340 per cent this year, and up from about 1c last year to about 23c now, thanks to its push into critical minerals exploration in Brazil where its Calderia project has a high-class rare earths deposit.

Kumova is the company’s biggest shareholder and has a paper fortune of more than $40m, while Harvey is the fifth biggest individual shareholder with a stake worth about $7m.

Lindian Resources is another rapidly rising rare earths stock. It recently raised $35m from investors, with the strong interest in the placement reflecting the potential of its Kangankunde rare earths project in Malawi.

Tanzanian-born Perth entrepreneur Asimwe Kabunga is Lindian’s chairman and major shareholder. Lindian shares are up 125 per cent since January 1 and have increased 218 per cent in value in the past year. Kabunga has a stake worth about $42m.

Lithium is another hot sector.

Goyder now has more than $930m worth of shares in Liontown Resources, which rejected a series of takeover offers from Albemarle earlier this year.

Liontown says its project at Kathleen Valley in WA will be one of the world’s largest lithium mines when it comes into production mid-2024.

Non-executive director Craig Williams, a geologist with more than 40 years experience, has a stake in Liontown worth about $85m, while one-time Deloitte national tax leader in the energy and resources sector Anthony Cipriano holds shares with a paper value of $54m.

Meanwhile, billionaire prospector Mark Creasy is benefiting from the surging share price of Azure Minerals thanks to its 40 per cent holding in the Andover lithium project in WA.

Creasy owns the other 60 per cent of Andover, of which Azure has spruiked the great potential.

Azure shares have trebled since the beginning of June, giving Creasy – the company’s biggest shareholder – a stake of more than $90m.

Other big lithium movers include Latin Resources, which has trebled since May given interest in its hard rock lithium project in Brazil, giving managing director Chris Gale and non-executive director Brent Jones a combined stake of about $30m.

Big paper fortunes are also being made in gold stocks, including WA producer Capricorn Metals where executive chairman Mark Clark now has shares worth about $105m, with its share price up 50 per cent since January 1.

Emerald Resources has a gold project in Cambodia and its shares have almost doubled this year. Managing director Morgan Hart has a $90m shareholding and chairman Simon Lee a stake worth about $60m on paper.

Non-executive director Steve Parsons has a $25m stake in Bellevue Gold after selling about $17m worth of stock earlier this year, while Queensland investor Tom Klinger has a stake worth about $30m in Gold Road Resources.

Meanwhile, investor and non-executive director Matthew Latimore has a $110m stake in coal miner Stanmore Resources after selling $40m in stock last year, and CEO Alex Dorsch has about $35m shares in nickel and copper explorer Chalice Mining. (Goyder has almost $200m shares in Chalice).

Champion Iron executive chairman Bill O’Keefe has about $215m shares in the iron ore miner that has a big project in Canada’s Quebec province, while Bill Beament has about $80m shares in copper and zinc explorer Develop Global.

Then there is Adriatic Metals, which owns the Vares silver project in Bosnia and Herzegovina. Adriatic shares are up almost 90 per cent in the past 12 months, giving CEO Paul Cronin a shareholding of almost $60m and investor Milos Bosnjakovic a stake of about $45m.

JOHN STENSHOLT

EDITOR, THE LIST