$DTC annoucemed their 4C report this mornings.

Their Highlights

Cash Highlights

• Free cash flow $0.51 m vs pcp negative ($1.6m);

• Operating cashflow of $3m vs up 131% on pcp basis of $1.3m;

• 5th consecutive quarter of positive operating cashflow.

Financial Highlights

• Quarterly Revenue of $7.4m, same as prior quarter;

• EBITDA of $2.72 m, up 145% on pcp basis of $1.1m;

• EBITDA Margin of 37%, up 164% of pcp basis of 14%;

• Q4 Gross Margin 79%;

• Client churn 1.8%;

• Refinanced existing debt facilities, providing investor certainty

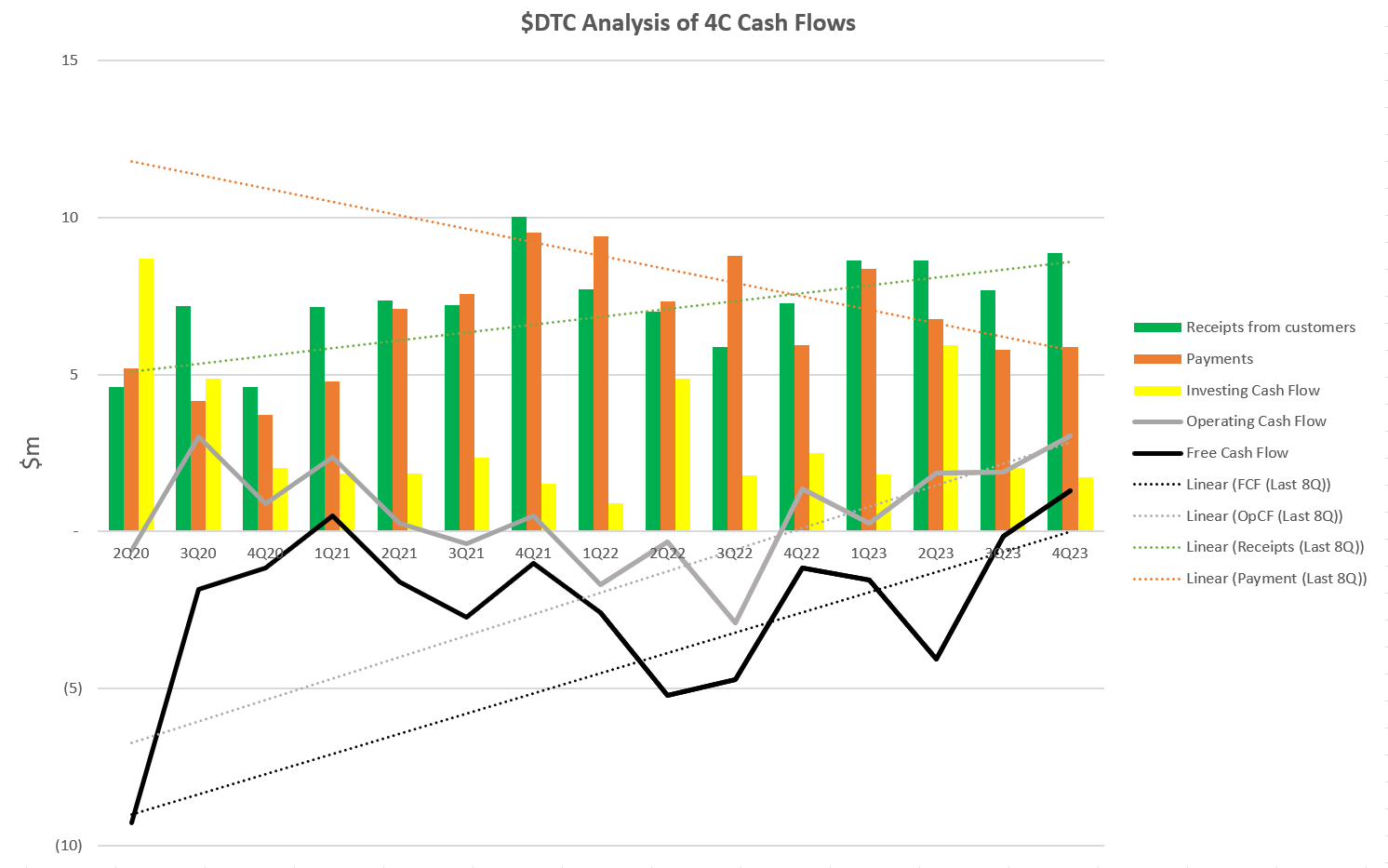

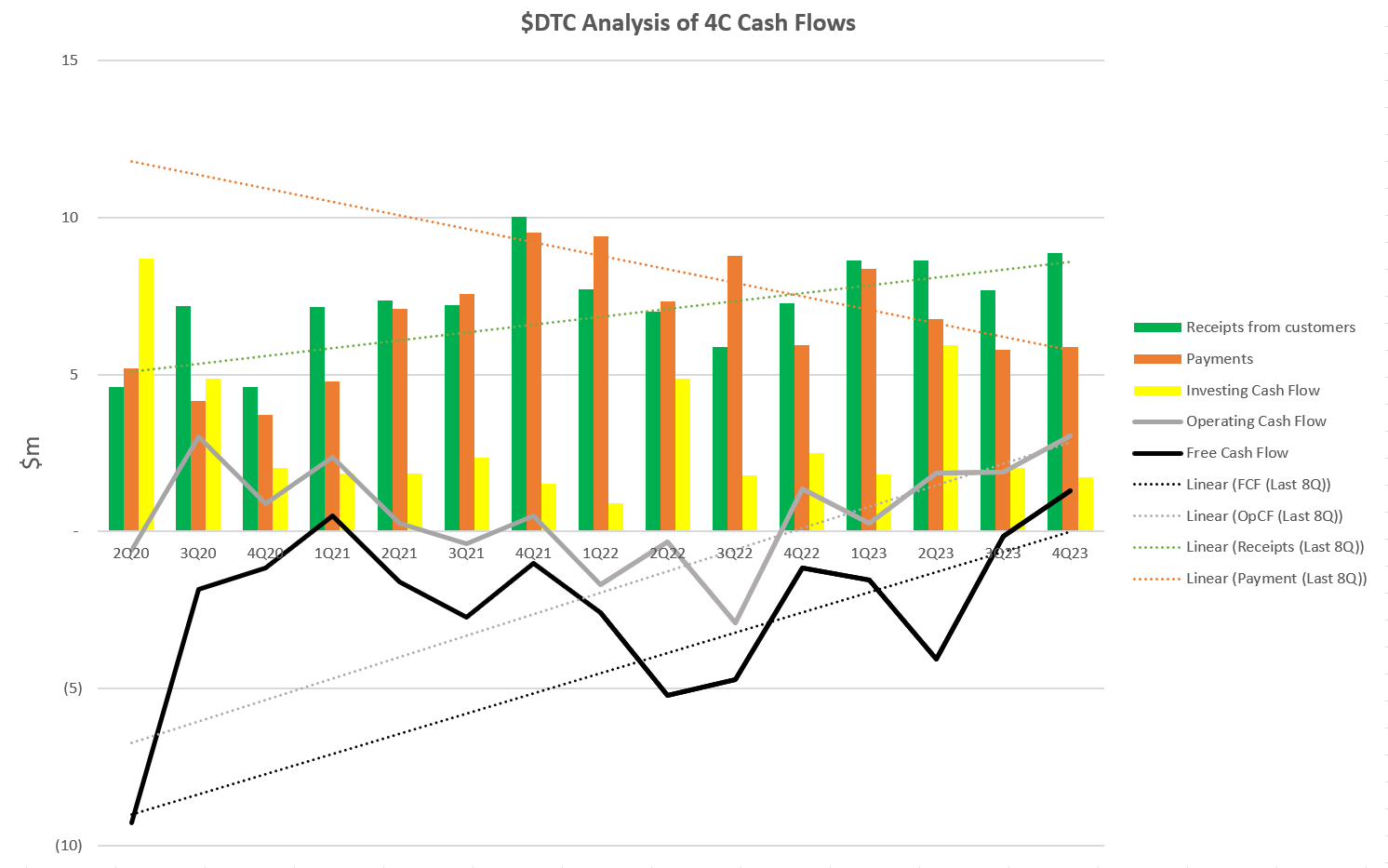

CF Trend Analysis

Below is my standard CF trend analysis. Note that the trendlines are plotted for the last 8Q only.

This is another former cash burner which has now successfully tackled costs to generate consistent positive Operating CF. However, the expense has been a slowing revenue growth.

My Key Takeways

$DTC appears to have succeeded in using the imperative of the changing market environment to turn from a cash burner to a cash generator. Certainly, on an operating cashflow basis, this is looking sustainable, with the 5th consecutive quarter of positive OpCF.

Topline growth is still there, looking at the 8Q trend, albeit slower than historically, and it remains to be seen what the continuing growth trajectory looks like.

Positively, churn was low, and a historical large churn event (which management excluded from their churn reporting to my irritation) is now outside the window, and so once again reported churn is a clean result.

I've historically criticised $DTC from being insufficiently focused "too many modules, too many verticals". That too seems to be improving with a reported focus on mining and civil construction.

On valuation, $DTC is on a modest 1.2 EV/EBITDA. Recently SP has been knocked down as it began to take on debt to see it through the "transformation" without having to raise cash.

If the market believes that the reported strong prospects ahead of it will convert into contracts, we could see $DTC re-rate quite quickly, now that it truly is at the inflection point.

I'm more sceptical, and want to see continued movement on the top line, while costs and investment levels are contained. I've no doubt I'll miss some of the re-rate, but Im not a trader and the long term thesis sin't yet restored.

All credit to management - they've done what I criticised them for not doing before - getting the firm to proftable growth.

Disc: Not held in RL and SM (formerly held)